Lewis Wickes Hine News of the Titanic and possible survivors 1912

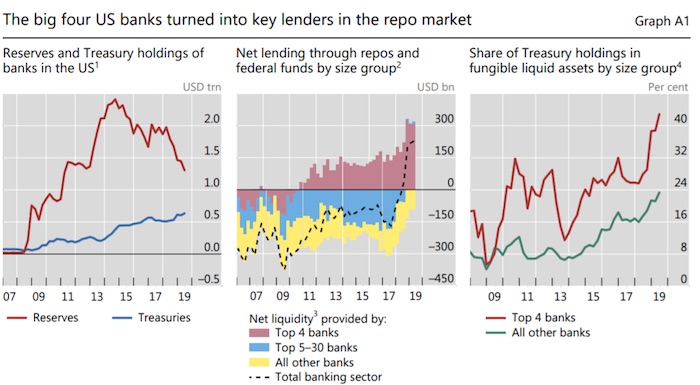

From what I understand, big banks moved from cash to Treasuries, which decreased the amount of cash available for lending. Hedge funds also play a role. Have they become market makers?

• US Banks’ Reluctance To Lend Cash May Have Caused Repo Shock: BIS (R.)

The unwillingness of the top four U.S. banks to lend cash combined with a burst of demand from hedge funds for secured funding could explain a recent spike in U.S. money market rates, the Bank for International Settlements said. Cash available to banks for short-term funding all but dried up in late September, and interest rates deep in the plumbing of U.S. financial markets climbed into double digits. That forced the Fed to make an emergency injection of billions of dollars for the first time since the global financial crisis more than a decade ago.

While the exact cause of the squeeze is unclear – with explanations ranging from large withdrawals for quarterly tax payments to a big settlement of a trade in U.S. Treasuries – BIS analysts said the growing reliance on the biggest U.S. banks to keep the repo market functioning may have been a big factor. The big four banks, which BIS did not name in its report, have become net providers of funds to repo markets as they account for more than half of all Treasuries held by banks in the United States at the Federal Reserve.

The repo market underpins much of the U.S. financial system, helping ensure banks have liquidity to meet their daily operational needs. In a repo trade, Wall Street firms and banks offer U.S. Treasuries and other high-quality securities as collateral to raise cash, often just overnight, to finance their trading and lending. The next day, borrowers repay the loans plus what is typically a nominal rate of interest and get their bonds back. In other words they repurchase, or repo, the bonds.

Did the big banks know the Fed would move in? Were there conversations between JPM and the Fed prior to the move into Treasuries??

• BIS Offers Stunning Explanation Of What Happened On Repocalypse Day (ZH)

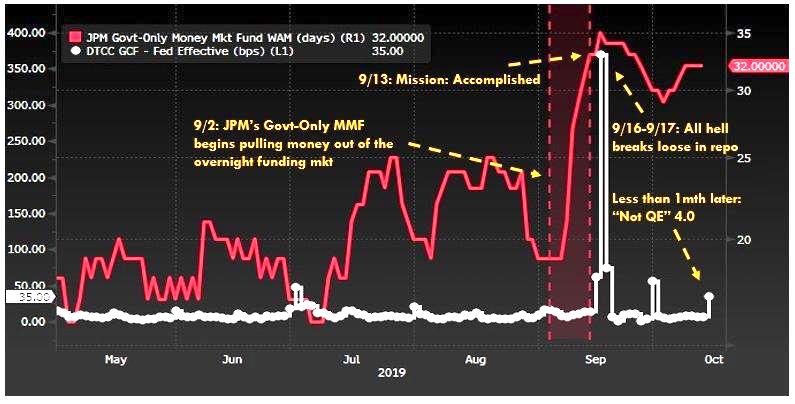

About a month ago, we first laid out how the sequence of liquidity-shrinking events that started about a year ago, and which starred the largest US commercial bank, JPMorgan, ultimately culminated with the mid-September repo explosion. Specifically we showed how JPM’s drain of liquidity via Money Markets and reserves parked at the Fed may have prompted the September repo crisis and subsequent launch of “Not QE” by the Fed in order to reduce its at risk capital and potentially lower its G-SIB charge – currently the highest of all major US banks.

Shortly thereafter, the FT was kind enough to provide confirmation that the biggest US bank had been quietly rotating out of cash, while repositioning its balance sheet in a major way, pushing more than $130bn of excess cash away from reserves in the process significantly tightening overall liquidity in the interbank market. We learned that the bulk of this money was allocated to long-dated bonds while cutting the amount of loans it holds, in what the FT dubbed was a “major shift in how the largest US bank by assets manages its enormous balance sheet.”

The moves saw the bank’s bond portfolio soar by 50%, and were prompted by capital rules that treated loans as riskier than bonds. And since JPM has been aggressively returning billions of dollars to shareholders in dividends and share buybacks each year, JPMorgan had far less room than most rivals to hold riskier assets, explaining its substantially higher G-SIB surcharge, which indicated that the Fed currently perceives JPM as the riskiest US bank for a variety of reasons. An executive at a large institutional investor told the FT that what JPM did “is incredible”, adding that “the scale of what JPMorgan is doing is mind-boggling . . . migrating out of cash into securities while loans are flat.”

The dramatic change, which occurred gradually over the year, and which may have catalyzed the spike in repo rates in September, was first flagged by JPMorgan at an investor event back in February. Then CFO Marianne Lake said that, after years of industry-leading loan growth, “we have to recognize the reality of the capital regime that we live in”. About half a year later, the rest of the world did too when the overnight general collateral rate briefly did something nobody had ever expected it to do, when it exploded from 2% to about 10% in minutes, an absolutely unprecedented move, and certainly one that was seen as impossible in a world with an ocean of roughly $1.3 trillion in reserves floating around.

[..] in a novel twist, the BIS also found that hedge funds exacerbated the turmoil in the repo market with their thirst for borrowing cash to juice up returns on their trades. Here is what the BIS said: “US repo markets currently rely heavily on four banks as marginal lenders. As the composition of their liquid assets became more skewed towards US Treasuries, their ability to supply funding at short notice in repo markets was diminished. At the same time, increased demand for funding from leveraged financial institutions (eg hedge funds) via Treasury repos appears to have compounded the strains of the temporary factors.”

Britain.

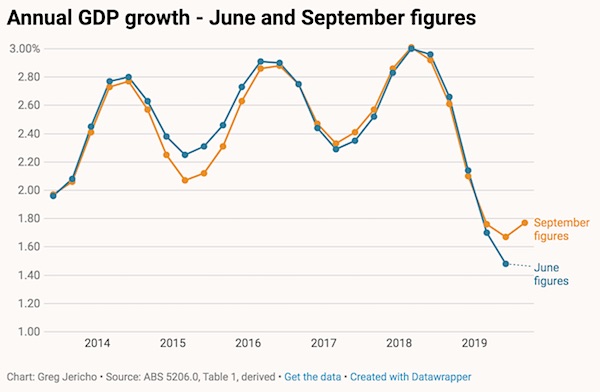

• The Incredible Shrinking Private Sector (G.)

The latest GDP figures released on Wednesday suggest on the surface the overall economy is doing better, but further inspection highlights the underlying weakness. The domestic private sector is in a dire state, having now shrunk for four consecutive quarters – the worst result since the 1990s recession – and the economy is now more dependent on government spending to keep it afloat than at any time since the GFC . First the good news – things are better than we previously thought. The GDP figures contained some fairly significant revisions of past data, based on more accurate underlying data. Whereas in June it appeared the economy grew by just 1.5% – the worst since 2001 – now the ABS estimates in June the economy was growing at an annual rate of 1.7% and is now growing at 1.8% in trend terms:

This is good, and yet it is pretty sad really how low the bar has become to think economic growth can be called “good”. The current growth rate of 1.8% is around 1% point below the long-term trend and well below the old marker of 3% growth that used to be considered average. In the September quarter the economy grew by 0.4% (seasonally adjusted), or 0.5% (trend), still below average, but what is important is where this growth is being generated. The biggest driver was net exports – contributing 0.35% pts of that growth.

They don’t appear to have all the details figured out.

• Northern Ireland Customs Protocol Could Thwart Brexit Plans (G.)

Northern Ireland customs arrangements may thwart Boris Johnson’s plan to leave the EU by December 2020, according to a document said to be leaked from civil servants in the Department for Exiting the EU. In the document, seen by the Financial Times, staff raised concerns about the readiness of the new customs arrangement, calling the protocol to keep part of the EU customs code in Northern Ireland, a “major” obstacle to Brexit delivery. The FT reported that the document was sent to senior Whitehall officials last week and said that implementing the Northern Ireland protocol before next December was a “strategic, political and operational challenge”.

The protocol would implement a form of customs border between Northern Ireland and the rest of the UK – an alternative arrangement to the Northern Irish “backstop” in the withdrawal agreement. Civil servants reportedly highlighted the “legal and political” repercussions both within the UK and Europe of failing to deliver Brexit on time, which Boris Johnson has made it the focal issue of his election campaign. Doubt was also cast on the free-trade agreement that Johnson has pledged to establish with the EU next year, with the document, marked “official sensitive”, reportedly stating that “delivery on the ground would need to commence before we know the outcome of negotiations”.

The government said it did not comment on leaks, but insisted that its deal with the EU would comprehensively withdraw the whole of the UK – including Northern Ireland. It reiterated its commitment to complete the process before December 2020.

“The EU/UK future relationship cannot be settled in 11 months.”

• Boris Johnson’s Promise Of Brexit By End Of 2020 Torpedoed By EU Chief (Mi.)

Michel Barnier has torpedoed Boris Johnson’s promise that Brexit will be done and dusted by the end of next year. The Sunday Mirror has seen minutes of a private meeting between the EU’s chief Brexit negotiator and MEPs which rubbish the PM’s pledge. Mr Johnson has said he will not extend the transition period beyond 2020 – which raises the danger of the UK crashing out with no deal. Trade talks are planned after Britain formally leaves the EU on January 31. But Mr Barnier told EU Employment and Social Affairs Committee MEPs: “The EU/UK future relationship cannot be settled in 11 months.” He added that means prioritising some areas while more time will be needed for other issues such as transport.

Dominic Cummings focuses on social media, not canvassing.

• The Invisible Tories (Craig Murray)

I live in a marginal constituency, where the excellent Joanna Cherry of the SNP has a lead of just over 1,000 over the Tories. If the most recent opinion polls are correct, the parties’ standings at this moment are similar to the result last time, the momentum is with the Tories and this should be a key Tory target. Yet I have not received one single Tory leaflet (and I live on one of the main residential streets) nor have I seen one single Tory campaigner, including when I have been out delivering leaflets for Joanna Cherry myself. Nor have I seen one single Tory poster in a house.

It is not just on TV that the Tories have been skipping interviews and debates, they seem to have eschewed any semblance of a ground campaign too, in what presumably is a key target seat for them. Boris Johnson is not popular with any of the local residents I have spoken to, and there is no enthusiasm at all for Brexit in this part of Edinburgh. In short, I am absolutely unable to square the opinion polls with the evidence of my own eyes and ears.

What is your experience?

Sounds like quite the undertaking.

• China Tells Government Offices To Remove All Foreign Computer Equipment (G.)

China has ordered that all foreign computer equipment and software be removed from government offices and public institutions within three years, the Financial Times reports. The government directive is likely to be a blow to US multinational companies like HP, Dell and Microsoft and mirrors attempts by Washington to limit the use of Chinese technology, as the trade war between the countries turns into a tech cold war. The Trump administration banned US companies from doing business with Chinese Chinese telecommunications company Huawei earlier this year and in May, Google, Intel and Qualcomm announced they would freeze cooperation with Huawei.

By excluding China from western know-how, the Trump administration has made it clear that the real battle is about which of the two economic superpowers has the technological edge for the next two decades. This is the first known public directive from Beijing setting specific targets limiting China’s use of foreign technology, though it is part a wider move within China to increase its reliance on domestic technology.

“We have an answer to all the threats that the Alliance is multiplying in this world.”

• NATO Seeks To “Dominate The World”, Eliminate Competitors: Lavrov (ZH)

Russian Foreign Minister Sergei Lavrov has charged NATO with wanting to “dominate the world” a day after 70th anniversary events of the alliance concluded in London. “We absolutely understand that NATO wants to dominate the world and wants to eliminate any competitors, including resorting to an information war, trying to unbalance us and China,” Lavrov said from Bratislava, the capital of Slovakia, while attending the 26th Ministerial Council of the Organization for Security and Cooperation in Europe (OSCE). He seized upon NATO leaders’ comments this week, specifically Secretary General Jens Stoltenberg, naming China as a new enemy alongside Russia. Stoltenberg declared at the summit that NATO has to “tackle the issue” of China’s growing capabilities.

Lavrov told reporters Thursday: “I think that it is difficult to unbalance us and China. We are well aware of what is happening. We have an answer to all the threats that the Alliance is multiplying in this world.” He also said the West is seeking to dominate the Middle East under the guise of NATO as well. The new accusation of ‘world domination’ comes at a crisis moment of growing and deep divisions over the future of the Cold War era military alliance, including back-and-forth comments on Macron’s “brain death” remarks, and looming questions over Turkey’s fitness to remain in NATO, and the ongoing debate over cost sharing burdens and the scope of the mission.

“Naturally, we cannot but feel worried over what has been happening within NATO,” Lavrov stated. “The problem is NATO positions itself as a source of legitimacy and is adamant to persuade one and all it has no alternatives in this capacity, that only NATO is in the position to assign blame for everything that may be happening around us and what the West dislikes for some reason.”

Who operated each contraption?

• Russian Air Defense System Shot Down US Drone Over Libyan Capital (R.)

The U.S. military believes that an unarmed American drone reported lost near Libya’s capital last month was in fact shot down by Russian air defenses and it is demanding the return of the aircraft’s wreckage, U.S. Africa Command says. Such a shootdown would underscore Moscow’s increasingly muscular role in the energy-rich nation, where Russian mercenaries are reportedly intervening on behalf of east Libya-based commander Khalifa Haftar in Libya’s civil war. Haftar has sought to take the capital Tripoli, now held by Libya’s internationally recognized Government of National Accord (GNA). U.S. Army General Stephen Townsend, who leads Africa command, said he believed the operators of the air defenses at the time “didn’t know it was a U.S. remotely piloted aircraft when they fired on it.”

“But they certainly know who it belongs to now and they are refusing to return it. They say they don’t know where it is but I am not buying it,” Townsend told Reuters in a statement, without elaborating The U.S. assessment, which has not been previously disclosed, concludes that either Russian private military contractors or Haftar’s so-called Libyan National Army were operating the air defenses at the time the drone was reported lost on Nov. 21, said Africa Command spokesman Air Force Colonel Christopher Karns. Karns said the United States believed the air defense operators fired on the U.S. aircraft after “mistaking it for an opposition” drone. An official in Libya’s internationally recognized Government of National Accord (GNA) told Reuters that Russian mercenaries appeared to be responsible.

Please put the Automatic Earth on your Christmas charity donations list. Support us on Paypal and Patreon.

Top of the page, left and right sidebars. Thank you.