René Magritte After the water, the clouds 1926

Both candidates Harris and Trump loose and win the election at the same fime. Schrödinger's election. 🙂 pic.twitter.com/WwK5lUeGfl

— Alex is fine (@Lacertko) October 22, 2024

Elon Musk: “It must reach 69%, as foretold in the prophecy”

Vivek

— Elon Musk (@elonmusk) October 23, 2024

High speed

Apparently, Facebook doesn’t want you to know that VP Kamala Harris’s signature $42 billion effort to extend internet service to millions of Americans has connected 0 people to date.

FCC Commissioner Brendan Carr reveals the shocking details ⬇️ https://t.co/YMOzekq0YQ pic.twitter.com/k1JFeJKfzD

— Oversight Committee (@GOPoversight) October 21, 2024

Election day

https://twitter.com/i/status/1848572247650537955

Count

Yesterday, the Secretaries of State for Michigan, Georgia, and Pennsylvania each went on mainstream media and said they won’t have Election results on Election Night. Clearly coordinated.

Why is it that these key battleground states are the only ones that can’t seem to deliver… pic.twitter.com/oaDH95ROcz

— Patri0tsareinContr0l (@Patri0tContr0l) October 21, 2024

Lara

Lara Trump reveals that before Trump announced he was running for president in 2015, he brought his whole family together and predicted exactly how the media & the deep state would come after them

"They're going to come after us. And it's not just me. It's the whole family."… pic.twitter.com/aDoHltc8av

— George (@BehizyTweets) October 21, 2024

Convicted felon

Every time someone says Trump is a “convicted felon” show them this…….@megynkelly masterfully explains the truth and law. pic.twitter.com/6WLixsikaE

— Spitfire (@DogRightGirl) October 21, 2024

RFK

No matter what state you live in, vote Trump. This may be our last chance to protect our Constitutional rights. America is turning into a one-party state, fast. So far the Supreme Court has restrained the censorship-industrial complex run by the Democrats. But if they win this… pic.twitter.com/mKLLPCLOUn

— Robert F. Kennedy Jr (@RobertKennedyJr) October 22, 2024

Thanks @realDonaldTrump. That's right, we'll get it taken care of when we get you back in the White House and me to DC so we can Make America Healthy Again. #MAHA 🇺🇸 pic.twitter.com/VJUfC2v8tE

— Robert F. Kennedy Jr (@RobertKennedyJr) October 22, 2024

Dana White

DANA WHITE: “The narrative that has been flipped on Donald Trump is one of the craziest things I have ever seen… From 20 years of experience, Donald Trump is a good person. I would never back a guy who is a racist… or someone who wanted to start WW3.”pic.twitter.com/zmKkoIuqde

— KanekoaTheGreat (@KanekoaTheGreat) October 21, 2024

IRS

IRS used AI to spy on American Citizens.

Rep. Harriet Hageman: "What we have learned is that the IRS, in fact, has been using AI to access bank accounts of American citizens without any kind of a search warrant or even without any specific claim that they have committed a crime.… pic.twitter.com/3WLmco37L0— Camus (@newstart_2024) October 21, 2024

Tulsi

Tulsi Gabbard: “I'm excited about Trump winning because of the people that he's chosen to surround himself with.”

“You've got Bobby Kennedy who is sitting in position and already starting to choose people who recognize how broken our healthcare system is and bringing about the… pic.twitter.com/NpFp56FAuK

— End Tribalism in Politics (@EndTribalism) October 22, 2024

Scripted clickbait. “I know this sounds bizarre. If I had said this five years ago, you’d lock me up, but we’ve got to lock him up..”

• Biden Wants Trump ‘Locked Up’ (RT)

US President Joe Biden has claimed that Republican contender Donald Trump wants presidential immunity and powers to kill his opposition, and therefore should be locked up, as he spoke to a Democratic crowd with the election just half a month away. Biden, who stepped aside earlier this year to allow Vice President Kamala Harris to become the Democratic nominee, made the statement at a campaign office in New Hampshire on Tuesday. “He thinks he has a version of the Supreme Court ruling on immunity that allows him, if necessary, to physically eliminate someone he believes is a threat to him,” he said, referring to former President Trump. “I know this sounds bizarre. If I had said this five years ago, you’d lock me up, but we’ve got to lock him up,” Biden stated, drawing applause from the audience.

https://twitter.com/i/status/1848854784054571349

“Politically lock him up,” he clarified amid the crowd noise, seemingly backtracking on his statement. “Lock him out. That’s what we have to do.” Biden has faced scrutiny in the media over numerous gaffes, often misspeaking at similar events. He stepped aside as his party’s contender earlier this year amid concerns about his mental state following a disastrous televised debate against Trump. Last week, Biden suggested that Trump is running for president again “to stay out of jail,” referencing the Republican’s legal troubles.

Earlier this year, a Manhattan jury found Trump guilty on 34 charges related to falsifying business documents to cover up hush money paid to porn star Stormy Daniels. Trump also faces charges related to the January 6, 2021, Capitol riots. He denies any wrongdoing and insists that all of his legal troubles are a political witch hunt by his opponents. After Biden endorsed Harris as his party’s nominee, the Democrats initially enjoyed a honeymoon period with voters, rising in the polls. However, recent averages from the RCP polling data aggregator indicate that Trump is leading in all swing states.

“..British advisors from Labour Together rescuing the distressed political damsel that is the Harris/Walz campaign..”

• “This Is War”: Musk Responds To Bombshell “Kill Twitter” Plot (ZH)

Elon Musk has responded to a bombshell report by journalists Paul Thacker and Matt Taibbi which reveals that a the UK’s Center for Countering Digital Hate – which is advising the Kamala Harris campaign, aims to “kill Musk’s Twitter”. [..] The British are coming, to meddle in our elections! In an explosive leak with ramifications for the upcoming U.S. presidential election, internal documents from the Center for Countering Digital Hate—whose founder is British political operative Morgan McSweeney, now advising the Kamala Harris campaign—show the group plans in writing to “kill Musk’s Twitter” while strengthening ties with the Biden/Harris administration and Democrats like Senator Amy Klobuchar, who has introduced multiple bills to regulate online “misinformation.”

[..] The documents obtained by The DisInformation Chronicle and Racket show CCDH’s hyperfocus on Musk — “Kill Musk’s Twitter” is the first item in the template of its monthly agenda notes dating back to the early months of this year. KILL, KILL, KILL: No matter what else the CCDH talks about, “Kill Musk’s Twitter” is its first item of business. The Center for Countering Digital Hate is the anti-disinformation activist ally of Prime Minister Keir Starmer’s Labour Party, and a messaging vehicle for Labour’s neoliberal think tank, Labour Together. Both the CCDH and Labour Together were founded by Morgan McSweeney, a Svengali credited with piloting Starmer’s rise to Downing Street, much as Karl Rove is credited with guiding George W. Bush to the White House.

The CCDH documents carry particular importance because McSweeney’s Labour Together political operatives have been teaching election strategy to Kamala Harris and Tim Walz, leading Politico to call Labour and the Democrats “sister parties.” CCDH’s focus on “Kill Musk’s Twitter” also adds to legal questions about the nonprofit’s tax-exempt status as a 501(c)(3) organization. According to the IRS, CCDH could lose its special tax status if “a substantial part of its activities is attempting to influence legislation.” Yet, CCDH’s third item on its annual priority list is “Trigger EU and UK regulatory action” and the group previously employed the firm Lot Sixteen to lobby congressional offices on “misinformation” in Washington. Both The DisInformation Chronicle and Racket have sent multiple, extensive questions to CCDH’s current CEO Imran Ahmed, another British political operative tied to McSweeney’s Labour Together. [..]

In the last two months, the Washington Post and Politico, among others, have run a series of features about British advisors from Labour Together rescuing the distressed political damsel that is the Harris/Walz campaign. Politico casts McSweeney as the “election mastermind” who first helped Keir Starmer defeat leftist Jeremy Corbyn to become the head of Labour, all the way to Starmer’s “landslide” win over Conservatives to become Prime Minister this past July, implying that McSweeney and his team can perform a similar miracle for Harris.

“Take the red pill..”

• Musk’s Trump Support Follows Wave Of Government Probes Into His Companies (JTN)

As Elon Musk ramps up his $1 million-a-day support for Donald Trump, what appears to be a record of progressive harassment of his many companies may explain how the world’s richest man went all-in for Republicans. Musk’s transformation from a politically unengaged tech billionaire to mega-donor and avid campaigner has earned him the ire of Democrats who have derided “disinformation” on his X platform and suggest he is violating the law in his support for Trump. Undeterred, Musk, touting his most recent effort over the weekend, announced that his Trump-supporting Save America PAC would give away $1 million a day to people who sign an online petition pledging support for the First and Second Amendments. To date, the multibillionaire has reportedly dumped $75 million of his own cash into the political action committee to support Trump’s third bid for the presidency.

He has also joined the candidate on the campaign trail and is holding events in swing state Pennsylvania, becoming a de facto surrogate for the former president. “Take the red pill,” Elon Musk posted to X, alluding to the famous choice in the cult-classic movie “The Matrix” which has now come to represent a choice between the Red (Republican) and Blue (Democratic) political parties. Musk’s evolution into a fervent Trump supporter comes after years increasingly aggressive probes into his four companies by various agencies of the Biden administration for seemingly frivolous and potentially serious concerns alike. It is likely no accident that Musk now wants to see the government reduced in size and scope after burdensome lawsuits and regulatory actions against his companies, previously saying publicly that bureaucracy is “smothering” large projects in the United States.

Most recently, a California body responsible for managing the coastlines blocked a proposal for the Defense Department on behalf of SpaceX for increasing launches from Vandenberg Space Force Base in the state. Musk’s SpaceX has raked in billions from contracts primarily with DOD and NASA. The California Coastal Commission drew scrutiny after its members voiced criticisms of Musk’s political leanings during a meeting about whether to approve more frequent launches by the company in addition to other concerns, like the environment. “We’re dealing with a company, the head of which has aggressively injected himself into the presidential race and he’s managed a company in a way … that I find to be very disturbing,” said agency chair Caryl Hart. “The Coastal Commission has one job — take care of the California coast,” Musk shot back on X Tuesday before SpaceX filed a lawsuit against the commission.

“It is illegal for them to make decisions based on what they (mostly wrongly) think are my politics.” “Rarely has a government agency made so clear that it was exceeding its authorized mandate to punish a company for the political views and statements of its largest shareholder and CEO,” SpaceX alleged in the 45-page lawsuit. This is not the first time Musk’s SpaceX has been the target of government action. Last August, the Department of Justice announced a high profile lawsuit against the space exploration company for allegedly discriminating against asylum claimants and refugees in its hiring process. The suit alleged Musk’s company “routinely discouraged asylees and refugees from applying and refused to hire or consider them, because of their citizenship status,” according to the DOJ press release.

“SpaceX was told repeatedly that hiring anyone who was not a permanent resident of the United States would violate international arms trafficking law, which would be a criminal offense,” Musk said in post to X, which he acquired in a $44 billion deal in 2022. “We couldn’t even hire Canadian citizens, despite Canada being part of NORAD! This is yet another case of weaponization of the DOJ for political purposes.” Several months later, a federal judge in Texas blocked the administrative case against the company from proceeding while it challenged the specific internal adjudication process. In a preliminary ruling earlier this year, a Texas judge ruled that the internal DOJ administrative panel process was unconstitutional, though the decision is not binding on the federal government.

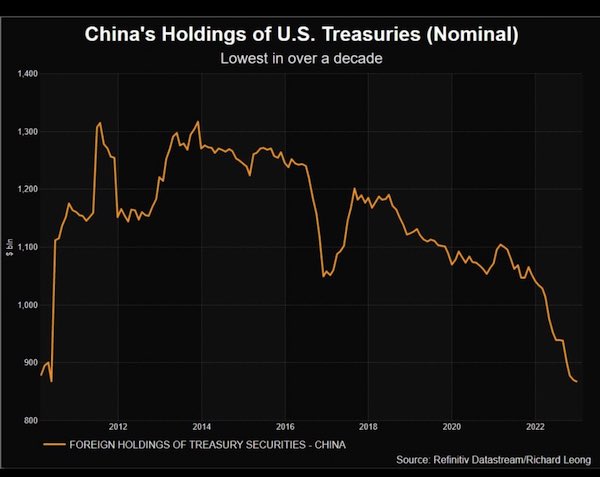

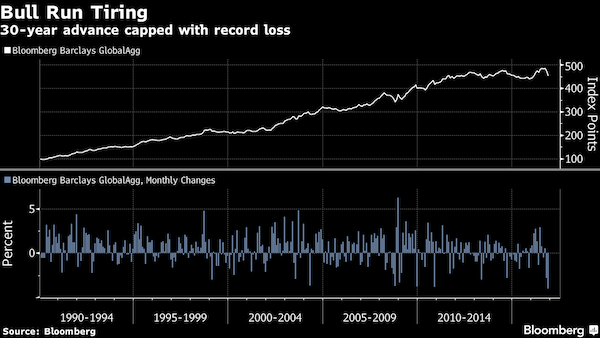

“..both Treasuries and the Mexican peso appear to be pricing in a rising probability of Donald Trump winning..”

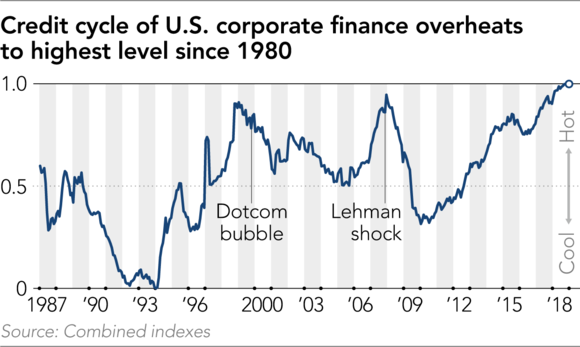

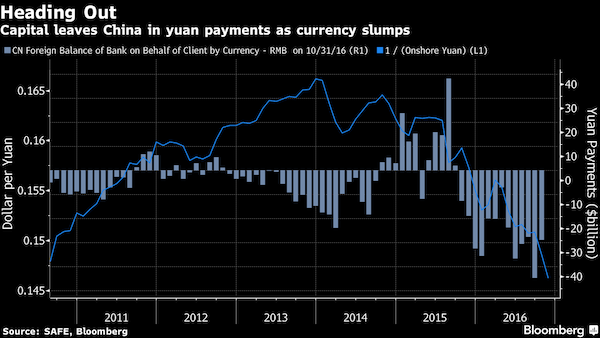

• Polymarket Is Singlehandedly Moving The Entire US Bond Market (ZH)

Online betting exchange Polymarket has not only taken the attention space by storm, rapidly becoming one of the most downloaded Apple apps… it is also quickly becoming a key driver behind the world’s largest and most liquid bond market. According to Bloomberg’s Masaki Kondo writes, Polymarket has become instrumental in setting at least the near-term price signals not only for the $28 trillion marketable US Treasury markets, but also for FX markets: that’s because both Treasuries and the Mexican peso appear to be pricing in a rising probability of Donald Trump winning the US presidential election, as indicated by Polymarket, while ignoring traditional polls which for the most part still show Kamala in the lead.

As this Bloomberg chart shows, the benchmark 10Y yield has been closely tracking the spread in the perceived odds of a vote victory between Trump and Kamala Harris. This difference has reached almost 30% points, according to data from Polymarket, with Trump seen leading the race, and where competitors such as Kalshi and PredictIt now show the same odds with a notable delay behind Polymarket which has emerged as the undisputed leader in the online betting space. Even such Bloomberg luminaries as John Authers admit Polymarket’s role in setting bond prices: “In the last few months, it’s striking that the 10-year yield has traced the Trump odds according to Polymarket — an offshore market that may be over-influenced by a few large bettors, but which seems to be driving opinion on Wall Street.”

Of course, Polymarket is just the starting signal: the actual driver behind the blowout move in yields, which as we noted earlier have surged by a whopping 50bps since the Fed’s very unironic 50bps rate cut one month ago…is because memory is still be fresh among bond traders that the 10-year yield soared almost 80bps in about a month after Trump’s last victory in November 2016. Granted, one can argue this time may be different, as the jump in yields back then was in part driven by the start of the Federal Reserve’s tightening cycle while the direction of Fed policy is the opposite now, but the kneejerk reaction to a market that is now is now aggressively pricing in a Trump presidency is there.

“Motor Voter Law..”

• Biden Admin Under Fire Over Virginia Non-Citizen Voter Removals (Turley)

Call it the Mark of Kaine. The heated dispute between the Biden Administration and the State of Virginia just took a curious turn after Virginia lawyers released support for the effort to remove alleged noncitizens from the voting rolls ahead of the presidential election. The main witness against the Biden Administration may prove to be Sen. Tim Kaine (D., Va.) who is on the ballot this election. The Biden Administration sued to stop the removal of 6,303 alleged noncitizens from Virginia’s voter rolls before the election, which is expected to be close in the state. It relies on the National Voter Registration Act (NVRA), or the “Motor Voter Law,” which bars “systemic” removals for voters from the rolls less than 90 days before an election. Youngkin ordered compliance with existing laws, citing Virginia code 24.2-439, requiring the removal of noncitizens whose names were added under false pretenses. It also cited Virginia Code 24.2-1019, requiring registrars to immediately notify their county or city prosecutor of such situations.

The NVRA has exceptions for removals within what the Justice Department calls the “quiet” period before an election, including the removal of individuals who are “ineligible to vote because of a criminal conviction or mental incapacity, or for “correction of registration records pursuant to this chapter.” However, the state argues as a threshold matter that these are not systemic removals. The state argues that these are individual actions triggered automatically by citizens identifying themselves as noncitizens but then joining the voting rolls. It is a crime for a noncitizen to vote in the election. The state notes that the voter is notified of the problem and allowed to correct any errors to remain on the rolls. If they do not correct the problem, they are removed from the rolls. However, they can still vote on election day with a “provisional” ballot to challenge any removal.

Virginia is not targeting any group and does not know how these voters might vote. It is responding to a notice coming from the Department of Motor Vehicle of a possible ineligibility and potential criminal act if they person actually votes, which is admittedly rare for noncitizens. While the Justice Department insists that some of these individuals are actually citizens, the system allows for those citizens to remain on the rolls by simply correcting the DMV record. I understand concerns over changes close to the election, but there seemed to be a host of options for the Justice Department short of this lawsuit, including working with the state to be sure that this relatively small number of voters are given ample opportunity to correct their records. This weekend, Virginia added a new wrinkle in the litigation. The Virginia law has been on the books since 2006.

The bipartisan legislation was signed into law by then Virginia Gov. Tim Kaine. It has been used without any objection for all those years. However, it now appears that Kaine’s administration specifically asked the Justice Department to determine if the law was compliant with federal laws, including an express inquiry about the NVRA. On December 16, 2006, the Justice Department completed its review and found no objections to the Virginia law though it added that it reserves the right to object in the future to any such laws. Gov. Glenn Youngkin further told Fox News that past governors continued to use the law within the 90 days period without a peep of objection from the Justice Department. These facts distinguish the Virginia case from the Alabama case where a court enjoined removal of names of suspected non-citizens.

“..a red, white and blue cap inscribed with “TUSA,” short for “Told U So America!”

• Two Weeks Before the Meltdown Begins (Miele)

I wouldn’t be much of a political pundit if I weren’t willing to share my prediction for what will happen in 15 days when one of the most important presidential elections in history is decided. So here goes: Donald Trump will win, and he will win convincingly. But that doesn’t mean the progressive left won’t have a meltdown. Just as in 2016, when Trump was first elected president, the media will be dismayed, the Democrats will be shocked, and there will be protests in the streets, possibly violent. Congressional Democrats such as Jamie Raskin will try to prevent Trump from being sworn in by declaring him an insurrectionist. Seven so-called battleground states are supposed to decide the election: Pennsylvania, Michigan, Wisconsin, North Carolina, Georgia, Nevada, and Arizona. But even more important will be the experience of the American people, who in large measure have come to regret the election that put Joe Biden in the White House four years ago.

That is the underlying story that the media will never acknowledge. Polling within the last year shows that less than one-third of Republicans believe Biden is the legitimate president, and 36% of all Americans have doubts about the 2020 election. That is only a feeling, not a fact, but feelings decide presidential elections, and the almost gleeful anti-American thrust of Biden’s presidency has given more than 60% of potential voters a feeling that we are on the wrong track as a nation. Five days before the 2020 election, I published a spoof that proved modestly prophetic as a warning about the pitfalls of a Democratic victory. Called “The Short Happy Presidency of Joe Biden,” it predicted that Kamala Harris would invoke the 25th Amendment immediately after Biden’s inauguration in order to seize power in a bureaucratic coup. It didn’t quite happen that way, of course, but 3 1/2 disastrous years later, Kamala along with Chuck Schumer and Nancy Pelosi seemingly used the specter of the 25th Amendment to force Biden to end his reelection bid. Life imitating art.

In my pastiche, President Trump had appeared close to sealing his victory in the 2020 election, thanks to late mail-in votes in Pennsylvania. But “in an emergency session, the Pennsylvania Supreme Court convenes and reverses its earlier ruling that late votes could be counted for up to three days. The new ruling asserts that late voting amounts to election interference ‘on account of Trump winning,’ thus handing the state and the Electoral College victory to Biden.” Exaggerated, yes, but prescient in regard to how courts across the country would eventually rule in Biden’s favor on almost every issue, refusing to look at the evidence of fraud or unconstitutional irregularities. Perhaps the most prophetic aspect of my column four years ago was how I depicted the reaction of Trump to losing a disputed election. Just two days after the inauguration of first Biden and then Harris:

“Former President Donald Trump announces that he is running for re-election in 2024 after taking a four-year rest to catch up on his golf and make a few billion dollars. Trump says his new role model will be Grover Cleveland, the only president to serve non-consecutive terms. “If it’s good enough for Grover, it’s good enough for me!” Trump also tries out a new campaign slogan, as he takes a swing at Biden voters with a red, white and blue cap inscribed with “TUSA,” short for “Told U So America!” When you think about it, that really is the underlying message that Trump has been sharing for the past four years. And Americans got the message – because it matched their lived experience. They saw with their own eyes that the wide-open Biden border was being called secure by Biden, Harris, and Homeland Security Secretary Alejandro Mayorkas. They saw that Biden’s Supreme Court nominee couldn’t say for sure what makes a woman a woman, and then they watched as boys began to dominate girls’ sports. They watched prices on the rise and safety in decline.

Worst of all, they stood helpless as the world seemed to be rushing headlong toward World War III, first in Ukraine, then the Middle East, all the while as China has been threatening to cripple the world economy by attacking Taiwan. So, yes, Trump will be elected as the 47th president of the United States, and the liberal talking heads will melt down just as they did in 2016. But what matters most is what happens after the election, and whether the experience of Americans will reflect renewed prosperity, a safer world, and respect for tradition and common sense. Many will try to prevent that, but making America great again should be a unifying goal. “Ask not what your country can do for you – ask what you can do for your country.” And if I am wrong and Kamala Harris becomes the 47th president, I pray that divine providence takes hold of her and guides her to protect, defend, and strengthen these United States and their Constitution. Seems like a long shot, but without Trump, prayer is all we got.

“..hopefully I will be able to ask some questions that will be in your head..”

• Questions Are All “Pre Determined” At Kamala’s FAKE Town Hall (MN)

Kamala Harris held a “town hall” meeting Monday, giving those in attendance a chance to ask questions and testing her mettle when it comes to being put on the spot. Not really. It was all fake and scripted. The reality of the situation was unintentionally exposed by Maria Shriver, the moderator of the event in Royal Oak, Michigan. Shriver had to inform an audience member that they couldn’t actually ask any real questions at Kamala’s town hall because they were all scripted and handed to Harris beforehand. “We have some pre-determined questions and hopefully I will be able to ask some questions that will be in your head,” Shriver told the person. The thing was full of her own supporters and an anchor who was never going to challenge her on anything.

Word Salads By Kamala™ pic.twitter.com/nU4BciywSM

— Trump War Room (@TrumpWarRoom) October 22, 2024

Why did it still have to be fake? What does this tell you about her if she were to become president? Even the press conference for the event was fake with Harris’ handler directing pre selected reporters with pre screened questions. The rest of the fake event was just word salads and empty platitudes as usual. It’s so hard to watch without grinding one’s teeth to pulp from cringing. Enough already. To top it all off they sat war obsessed RINO Liz Cheney next to her. Why can’t she do the fake Q&A on her own?

Kamala is so desperate — now taking issue with President Trump being "humorous."

Then she laughs about trying to put President Trump in jail.

She's a sick, sick person. pic.twitter.com/j9EnjkYK44

— Trump War Room (@TrumpWarRoom) October 21, 2024

“..the two have had a complicated relationship..”

• Trump-Rogan Interview Set For Friday: Politico (ZH)

Former President Donald Trump is set to record an interview with podcasting king Joe Rogan on Friday at Rogan’s studio in Austin, Texas. According to Politico, Rogan – who has over 14 million followers on Spotify, continues to dominate national podcast ratings. Trump’s appearance is expected to help Trump win young male voters – after appearing on such podcasts as “This Week w/ Theo Vaughn” and “Full Send.” Trump has never appeared on Rogan’s podcast and the two have had a complicated relationship. In August, Trump called out Rogan after the podcaster claimed that politicians on both sides are manipulative except for Robert Kennedy Jr., who at the time was running for president. -Politico

Reactions have been mixed – with some suggesting this is “incredible news,” and others suggesting this might not go well for the former president. Meanwhile, after rumors first emerged of a Trump appearance on Rogan, Reuters reported that Vice President Kamala Harris ‘could’ also sit down for an interview. (lol)

ActBlue.

• Texas AG Demands FEC Action Over ‘Suspicious Donations’ To Democrats (ZH)

Texas Attorney General Ken Paxton says he has evidence that the Democrat fundraising platform ActBlue is interfering in the 2024 US election by allowing straw donors to mask “bad actors” donating to candidates “Our investigation into ActBlue has uncovered facts indicating that bad actors can illegally interfere in American elections by disguising political donations,” Paxton said in a statement on X. “It is imperative that the FEC close off the avenues we have identified by which foreign contributions or contributions in excess of legal limits could be unlawfully funneled to political campaigns, bypassing campaign finance regulations and compromising our electoral system.”

In a Monday press release, Paxton says he sent a Petition for Rulemaking to the Federal Election Commission (FEC) detailing how “suspicious actors appear to be using ActBlue’s political fundraising platform to make a large number of straw political donations.” “Our investigation into ActBlue has uncovered facts indicating that bad actors can illegally interfere in American elections by disguising political donations.” Last December, Paxton launched an investigation into ActBlue. In August, of this year he said that “straw donations” were systematically being made using false identities through untraceable payment methods. “I am calling on the FEC to immediately begin rulemaking to secure our elections from any criminal actors exploiting these vulnerabilities,” said Paxton. As Fox News reports further;

“ActBlue targets small-dollar donations, the Hill first reported, and has been an integral part of the Democratic fundraising structure, collecting an estimated $1.5 billion from about 7 million donors. While that influx of cash was split among nearly 19,000 campaigns, an excessive amount has gone to the highest profile races. In just the first few days of the Harris campaign, for example, donors gave her $200 million through the platform, per ActBlue’s account on the social platform X, the Hill reported. In September, Rep. Bryan Steil (R-Wis.) introduced a bill that would require political committees to collect CVVs — the three- or four-digit “card verification value” on the back of a credit card — along with political donations.

Steil, who chairs the Committee on House Administration, sent a letter to top FEC officials urging them to “immediately initiate an emergency rulemaking to require political campaigns to verify the card verification value (‘CVV’) of donors who contribute online using a credit or debit card, and to prohibit political campaigns from accepting online contributions from a gift card or other prepaid credit cards.” The Aug. 5 request came in response to accusations that ActBlue is skirting campaign donation laws that allow for rampant fraud on the site. Paxton’s office has said previously that “secure elections are the cornerstone of our republic.”

“He fought the entire war on the front line, in Robotino, Soledar, Kherson… He was exhausted, he couldn’t take it anymore and the commanders didn’t give him a break. A few days ago he left, just like that..”

• Ukrainian Troops Increasingly Refusing Orders – El Pais (RT)

Ukrainian servicemen are increasingly refusing to follow orders and fleeing their positions, accusing their leadership of assigning them suicide missions, the Spanish newspaper El Pais reported on Monday, citing several Ukrainian officers. The outlet claimed that soldiers from four brigades fighting near the besieged settlement of Kurakhovo in Russia’s Donetsk People’s Republic have claimed that “the future of the war is bleak for their interests because there are not enough replacements.” “Why are we retreating? Because we have no rotations, we don’t rest, we are demoralized,” one officer told the outlet, adding that there is a growing problem of Ukrainian soldiers fleeing their positions. “I had a friend, we called him England. He fought the entire war on the front line, in Robotino, Soledar, Kherson… He was exhausted, he couldn’t take it anymore and the commanders didn’t give him a break. A few days ago he left, just like that,” the officer said.

A Ukrainian sergeant who goes by Churbanov also told the Spanish outlet that the shortage of soldiers had become the biggest problem facing the Ukrainian military, noting that servicemen often have to spend three months in their positions without rest or rotation. Another serviceman, identified as Alexander, who serves in the Territorial Defense Forces (TRO), also told El Pais that at one point the 116th TRO brigade near Kurakhovo staged a mass rebellion and refused to follow orders. After that, the whole brigade was supposedly transferred to Sumy Region, from where Kiev launched its incursion into Russia’s Kursk Region, according to the officer. A source within Russia’s security services has also confirmed to the TASS news agency that Ukraine’s 116th TRO brigade had indeed been transferred to participate in the Kursk incursion as punishment for its mutiny.

According to a source cited by the outlet, Kiev was trying to “somehow correct the situation in Kursk Region at the expense of the already demoralized Ukrainian Armed Forces soldiers.” Alexander also told El Pais that there had been a high-profile case earlier this month where 100 soldiers of the 123rd TRO Brigade abandoned their positions near Ugledar several days before the city was captured by Russian forces. The officer explained that they did this to “announce that without sufficient training and weapons they were being assigned to a suicidal defense,” according to El Pais. Moscow has long characterized the hostilities in Ukraine as a US-initiated proxy war against Russia in which Ukrainian soldiers were being expended as “cannon fodder” with the complicity of their government.

“..helps to keep economic development free from politics as far as possible in the context of today’s world.”

• Dumping US Dollar ‘Keeps Politics Out Of Economic Development’ – Putin (RT)

Boosting trade settlements in national currencies between members of the BRICS group is a strategic necessity, Russian President Vladimir Putin has said, adding that a shift from the US dollar would strengthen financial independence and reduce geopolitical risks. Russia is currently hosting the 16th annual BRICS Summit in the city of Kazan. The group comprises Brazil, Russia, India, China, and South Africa, as well as new members Iran, Egypt, Ethiopia, and the UAE, which joined in January. Speaking on Tuesday with the president of the BRICS New Development Bank, Dilma Rousseff, Putin emphasized that the use of local currencies instead of the dollar or euro “helps to keep economic development free from politics as far as possible in the context of today’s world.”

The unprecedented US-led sanctions campaign against Moscow due to the Ukraine conflict has forced Russia and other BRICS members to seek alternative ways to pursue trade. Russia’s leading banks were banned outright from the SWIFT international payment system back in 2022 as part of the restrictions. Last month, Putin said that Russia was already actively switching to the use of national currencies in cross-border trade with its BRICS partners, and that the group’s members were jointly developing a payment and settlement framework to be used in trading. In August, Russian Prime Minister Mikhail Mishustin said that over 95% of mutual settlements between Russia and its biggest trading partner, China, are carried out using the ruble or yuan. Earlier this month, Indian Foreign Minister Subrahmanyam Jaishankar said New Delhi was looking to secure its interests and find “workarounds” in settlements with global partners, including Russia.

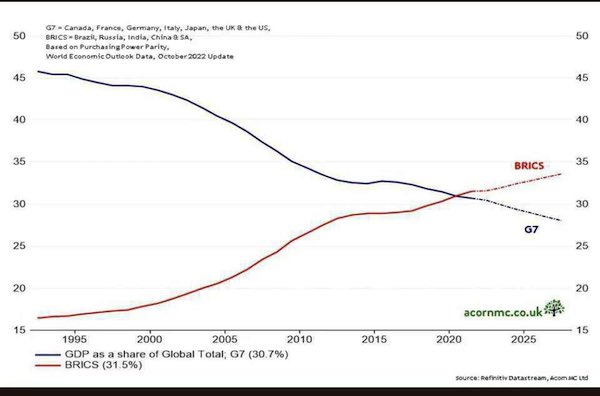

“Other economies have to improve to a point where the relative US domination declines further, and in that case the alternative system will easily emerge.”

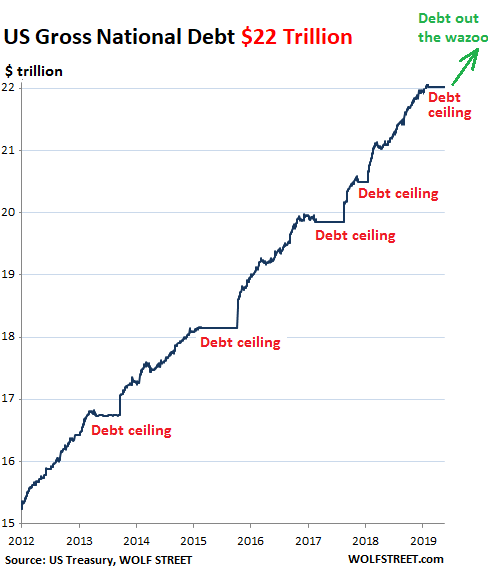

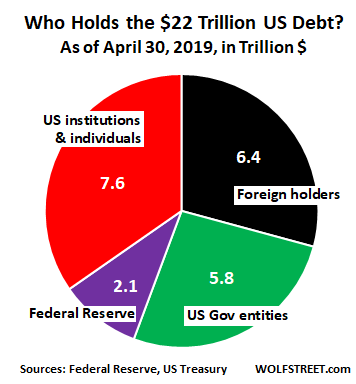

• Dollar’s Diktat Will Prove Its Downfall Once Emerging Powers Unite (Sp.)

The annual meetings of the International Monetary Fund and the World Bank kicked off in Washington, DC on Monday, with the gatherings, set to run through Saturday, expected to focus on the global debt crisis and ways to save the US-led international financial order. Here’s what will need to happen for the dollar’s dominance to fade into history. The US accounts for over a third of the skyrocketing $100 trillion in global public debt, with the country’s $35.75 trillion in borrowing (and climbing) gradually putting the economic behemoth in jeopardy as its share of global GDP by PPP sinks to below 15% – its lowest showing since the Great Depression of the 1930s, and down from a historic high of as much as 50% (in nominal terms) in the mid-1940s and the creation of the Bretton Woods System of international exchange.

“Countries are seeking ways and means of conducting trade and business outside the US-dominated financial architecture, because they are fed up with the US dictating terms to multiple countries, especially by preventing countries from doing business with countries under US sanctions,” Chintamani Mahapatra, founder and chairman of the Kalinga Institute of Indo-Pacific Studies, told Sputnik, commenting on the US’s relative decline against the backdrop of this week’s IMF/World Bank Group meetings. There is essentially no other option for many countries at the moment “to conduct business with countries under US sanctions, even if they do not support US sanctions,” Mahapatra stressed, pointing out that the rising Chinese yuan has a way to go before it can “emerge as a credible international currency,” and that US-led institutions like the IMF, World Bank and WTO will be certain to do their best to “ensure that the US and its allies maintain their dominance in the global financial ecosystem.”

“The combined West will try not to allow an alternative system from rising. And the non-West is hardly united. Countries have complex interdependence,” the observer said. “Thus, one cannot write the obituary of the dollar-dominated system at the moment. Other economies have to improve to a point where the relative US domination declines further, and in that case the alternative system will easily emerge.” “The first step should be to attempt to create an alternative financial system for global trade, so that the payment system can be other than the current financial architecture dominated by the United States. However, de-dollarization is not easy. The emerging economies will have to resolve their bilateral political and security differences before seeking to create a de-dollarized order based on non-discrimination, equity and justness,” Mahapatra emphasized.

For now, “the US, and not many other countries, are benefiting a great deal from the current war in Europe and the West Asian region. Thus, expecting other economies to perform better now is not appropriate,” Mahapatra added. As far as the IMF/World Bank agenda’s focus on debt is concerned, the observer stressed that so long as the dollar’s hegemony is maintained, growing debt in the US will create major risks for the global economy. “Although the US, the largest global economy, is facing huge public debt, the US economy is unlikely to suffer much. After all, the US Federal Reserve prints dollars and not any other country. But decline or turbulence in the US economy due to huge and unsustainable debt will have global ramifications and thus countries are trying to avoid shocks as a natural reaction,” Mahapatra said.

“Our allies have taken advantage of us. More so than our enemies..”

“To me, the most beautiful word in the dictionary is ‘tariffs’..”

• EU Bracing For Trade War With Trump – Politico (RT)

The EU is bracing for a massive trade war with Donald Trump if he wins the US presidential race in November and erects new barriers to commerce with Europe, Politico reported on Monday, citing senior diplomats and EU officials. Concerns are mounting in EU capitals since the former US president has pledged to target the bloc with a slew of new punitive trade measures in a bid to address what he says are serious imbalances in imports and exports, the outlet said. Washington and Brussels have been at odds over the issue since Trump imposed 25% tariffs on imports of European steel and 10% on aluminum in 2018 in his first term as president, arguing EU competition was endangering US national security. The EU retaliated, imposing duties on companies including motorcycles produced by Harley-Davidson Inc. and Levi Strauss & Co jeans.

Trump went even further however, and threatened to impose tariffs on EU car exports. Although the threatened duties never took effect, Brussels “was shocked” by Trump’s willingness to overhaul supply chains. “Last time we didn’t believe how far Trump would actually go,” one of the diplomats told Politico. “This time we’ve had time to prepare. Europe has changed a lot, and we will be ready to act.” Trump has previously said that as president, he may also introduce counter-measures against EU digital services taxes that implicitly target US technology leaders. “Our allies have taken advantage of us. More so than our enemies,” Trump said last week in an interview with Bloomberg News Editor-in-Chief John Micklethwait. “Our allies are the European Union. We have a trade deficit of $300 billion with the European Union.”

The EU is preparing a coordinated impact assessment of a potential Trump victory with the European Commission overseeing the process, and is determined to retaliate and “hit back hard,” one diplomat told Politico. According a second diplomat, the bloc is confident it can “win this trade war.” The EU should aggressively retaliate given that Trump uses trade and tariffs as a negotiating tactic to force countries to act in the interest of the US, the report said. At his rallies, Trump has vowed to impose a 10% baseline duty on imports from other countries. “To me, the most beautiful word in the dictionary is ‘tariffs’,” he said. “It’s my favorite word.” He also took aim at German car producers last week, pledging to slap high levies on imported cars. According to Trump, such duties targeting EU industry would force producers in the bloc to move their factories to the US, boosting its long-term global manufacturing position.

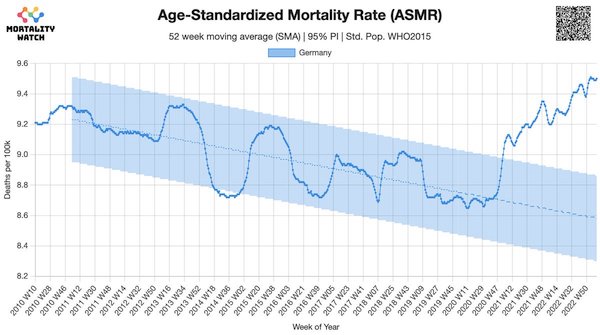

”There is no growth in Germany, there is growth in other countries, and the tax situation is not particularly good either..”

• Sharp Rise In Russia’s Share Of EU LNG Market (RT)

The share of Russian liquified natural gas (LNG) in the EU market has reached 20% this year, the bloc’s energy watchdog reported in a quarterly review released on Tuesday. In 2023, the share of Russian-sourced tanker-movable fuel was 14%, according to statistics cited by the Agency for the Cooperation of Energy Regulators (ACER). The shift came as supplies from Qatar, Nigeria, and minor suppliers declined. The US remains the biggest source of LNG, accounting for 45% of EU imports. The total flow as well as the EU’s share in the global LNG market have both shrunk this year. The bloc now accounts for 18% of all imports, down from 24% last year, the ACER report estimated. Roughly a third of all EU gas imports come in the form of LNG, with the rest being delivered via pipelines, according to the report.

Russian pipeline supplies grew from 7.9 billion cubic meters in Q3 of 2023 to 8.6 billion cubic meters this year. Commenting on the findings, Bloomberg said it highlighted challenges in implementing the EU’s policy of reducing reliance on Russian supplies. This summer, Brussels banned investment in LNG projects in Russia and targeted the transshipment of Russian gas by third nations with a port access ban. Qatar, a major natural gas producer, has been diverting shipments to Asian markets, in part due to the worsening security situation in the route through the Red Sea, Bloomberg said, explaining why its presence in the EU market has declined. The Yemeni-based Houthi rebels have been targeting commercial ships which they believe to be linked to Israel, in a campaign to pressure West Jerusalem to end its military action in Gaza.

The EU declared the intention wean itself off Russian supplies in its economy, particularly in the energy sector, following the outbreak of the Ukraine conflict in February 2022. Supplies of expensive US fuel have replaced much of the cheap pipeline gas that was previously delivered by Russia. The change contributed to a drop in the competitiveness of Western Europe, which was highlighted last week by an executive from German industrial giant Siemens. Speaking at a public hearing of the Bundestag’s Financial Committee, Christian Kaeser, the company’s head of global taxation, said it no longer invests at home due to the poor business climate. ”There is no growth in Germany, there is growth in other countries, and the tax situation is not particularly good either,” he stated.

“..each one of them “treated pre-teen children who were shot in the head or chest on a regular or even a daily basis.”

• Harris Denies Israel Is Committing Genocide in Gaza – Campaign (Antiwar)

Vice President Kamala Harris’s presidential campaign has clarified that she does not believe Israel is committing genocide in Gaza after an incident at a rally suggested that she did. At a campaign event at the University of Wisconsin-Milwaukee, a protester interrupted Harris and said she invested “billions of dollars in genocide” and pressed her about the massive child casualties in Gaza, repeatedly describing the Israeli onslaught as a genocide. Addressing the students, Harris said, “What he’s talking about, it’s real. That’s not the subject that I came to discuss today, but it’s real, and I respect his voice.”

A spokesperson for Harris’s campaign said Sunday that the comments made by the protester “don’t reflect the position of the Biden-Harris administration or the vice president’s stance.” The spokesperson added that Harris “didn’t agree with defining the war as a genocide, and she has not expressed such a stance in the past, as this is not her position.” The International Court of Justice (ICJ) has ruled that its “plausible” Israel is committing genocide against the Palestinian population of Gaza. There have been massive civilian casualties in the onslaught, and Israeli forces have purposely targeted children.

A group of 99 American healthcare workers who volunteered in Gaza said in an open letter to Harris and President Biden that each one of them “treated pre-teen children who were shot in the head or chest on a regular or even a daily basis.” The American healthcare workers also estimated that over 118,000 Palestinians had been killed in Gaza, or about 5% of the population. Despite the mass slaughter, the Biden administration maintains Israel is not committing genocide since that would mean US officials are supporting genocide. Harris also angered pro-Palestine groups over the weekend when discussing the situation in Gaza by labeling the October 7 Hamas attack on southern Israel the “most tragic” part of the conflict.

This is good. And long.

• Biblical Cruelty Took Power In Israel: “Mein Kampf In Reverse” (José Goulão)

The founding fallacy of Zionism has survived many decades since the establishment of the State while the continued colonization of Arab territories was developing, an illegal process only possible thanks to the tolerance and complicity of the UN, the United States and the countries involved in European integration: first in the territories allocated to the Arab population through the sharing agreement approved in 1948 by the United Nations; from 1967 and the so-called Six-Day War, in the Palestinian regions of Gaza, the West Bank and East Jerusalem occupied at that time, allowing the installation of settlements in vast areas stolen by the Zionist regime from the original population. They are now home to almost 700,000 fanatical fundamentalist Jews from all over the world, the overwhelming majority without any ethnic roots in Palestine.

This brutal and massive demographic violence, always with the character of ethnic cleansing, as it was written, mortally wounded the fallacy of secular Zionism. Real, fascist, fiercely racist and segregationist Zionism, which has the expulsion of all Palestinians on the horizon, has taken power over the most recent decades and intends to remain there eternally “by the will of God”, respected and fulfilled through “prophets ” self-taught and terrorists who consider themselves mandated by him to guarantee their vigilante role on Earth by applying the terrifying mythology of the Old Testament to the letter. Netanyahu is just another leader in this process of transforming the character of the State, even though the role of head of government played almost exclusively over the last 30 years has given him a natural prominence, although overestimated in relation to his real weight in the fundamentalist environment.

He inherited the mission from his father, Benzion Netanyahu, in turn personal secretary and one of the main ideological disciples of Volodymir Jabotinsky, the Ukrainian who was a collaborator of Mussolini and in 1925 had caused the great schism between the secular Zionism opportunistically proclaimed at birth and that designated “ revisionist Zionism” founded by him. This variant of extremist colonialism under “Hebrew” cover inspires the political-religious fanaticism that prevails in the current government and aims to create a theocracy – the primacy of the “Law of God”. Maintaining, of course, the mission of defending Western civilization in the Middle East. It is no small matter that this fanatical tendency has enormous representation within the World Jewish Congress and is supported without practical restrictions by the United States regime and the non-democratic bodies that define European Union policies.

Ehud Barak, one of the most experienced Israeli politicians, prime minister of a government at the beginning of the century that practiced a savage repression of the so-called Second Palestinian Intifada and was the last head of the Labor Party as an influential political organization, has a relevant opinion about the ongoing events. “Under the cover of war,” he says, “a governmental and constitutional coup is taking place without a shot being fired; If the coup is not stopped it will turn Israel into a dictatorship within weeks – Netanyahu and his government are murdering democracy.” The path proposed by the now “centrist” leader is to “close the country through large-scale civil disobedience 24 hours a day, seven days a week”.

A much more incisive and advanced opinion, and also alarming, comes from General Moshe Yalon, former Chief of Staff of the Armed Forces and former Minister of Defense: “An angry, eschatological cult is laying down the law in Tel Aviv, the headquarters of the genocidal and colonial construction of the settler community; This process is completed with a huge vigilante militia, or interconnected militias of hundreds of thousands of colonists armed to the teeth, uncontrollable and prepared for anything, even attacking the military and the State.” A “former Mossad director” quoted by the newspaper “Haaretz” even questions the future of the so-called “Jewish State” saying that if it takes the form of “a racist and violent State it will not be able to survive; and it’s probably already too late.”

When following the globalist media network, it will be said that the current Israeli government is made up only of Prime Minister Netanyahu and the Minister of Finance, Bezalel Smotrich, and the Minister of Security, Itamar Ben-Gvir, these two benevolently considered as “ far-right” when, in practice, they are nothing more than Nazi terrorists. Smotrich is a settler head of the National Religious Party who denies the existence of the Palestinian people, “composed of sub-humans”. On his record he has several accusations of terrorist attacks, including against Zionist authorities.

Itamar Ben-Gvir is the son of an Iraqi Kurdish Jew who was part of the terrorist group Irgun, a founding branch of the Israeli army born in the ranks of Mussolini and historically led by former prime minister Menahem Begin. He heads the Otzmar Yehdiut organization, equally “extreme right” and heir to the banned Kach movement of the fascist icon Meir Kahane, an American terrorist born in New York, where he committed several attacks for which he was sentenced to one year in prison, which he served in a hotel. He then settled in Israel to fight for the expulsion of all Palestinians from Palestine, was arrested at least 60 times for terrorist attacks and was elected a member of the Knesset (Parliament).

Bike lock

https://twitter.com/i/status/1848688384392171691

Baby dog

Friends! As you know, Baby Dog has his Funny Routines and Funny Ways. Like when he comes in from his Walk, he has to rub himself all over the furniture and also lick various parts of himself! Trouble is, he’s not used to doing it with an AUDIENCE who are questioning his every… pic.twitter.com/k2Wud7YQup

— Malcolm & Baby Dog (@Malcolm_theCat) October 22, 2024

Kiss

https://twitter.com/i/status/1848765037688557721

Pineapple

https://twitter.com/i/status/1848612938208215460

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.