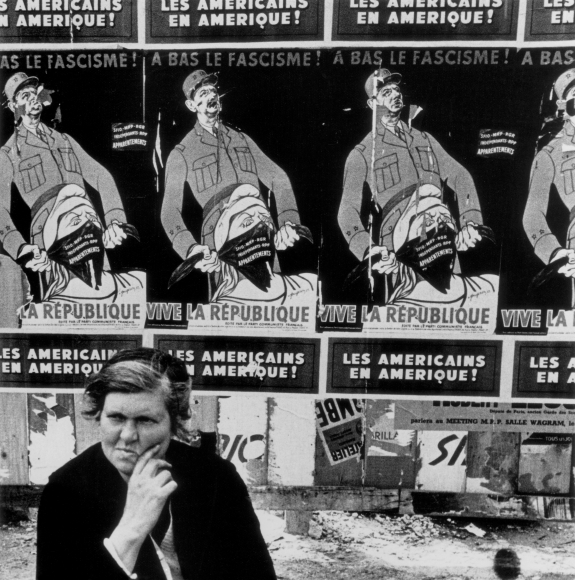

GordonParks Untitled, Paris, France 1951

UPDATE: There is a problem with our Paypal widget/account that makes donating hard for some people. What happens is that for some a message pops up that says “This recipient does not accept payments denominated in USD”. This is nonsense, we do.

We have no idea how many people have simply given up on donating, but we can suggest a workaround (works like a charm):

Through Paypal.com, you can simply donate to an email address. In our case that is recedinghorizons *at* gmail *com*. Use that, and your donations will arrive where they belong. Sorry for the inconvenience.

The Automatic Earth and its readers have been supporting refugees and homeless in Greece since June 2015. It has been an at times difficult and at all times expensive endeavor. Not at least because the problems do not just not get solved, they actually get worse. Because the people of Greece and the refugees that land on their shores increasingly find themselves pawns in political games.

Therefore, even if the generosity of our readership has been nothing short of miraculous, we must continue to humbly ask you for more support. Because our work is not done. Our latest essay on this is here: The Automatic Earth for Athens Fund – Christmas and 2018 . It contains links to all 14 previous articles on the situation.

Here’s how you can help:

For donations to Konstantinos and O Allos Anthropos, the Automatic Earth has a Paypal widget on our front page, top left hand corner. On our Sales and Donations page, there is an address to send money orders and checks if you don’t like Paypal. Our Bitcoin address is 1HYLLUR2JFs24X1zTS4XbNJidGo2XNHiTT. For other forms of payment, drop us a line at Contact • at • TheAutomaticEarth • com.

To tell donations for Kostantinos apart from those for the Automatic Earth (which badly needs them too!), any amounts that come in ending in either $0.99 or $0.37, will go to O Allos Anthropos.

Please give generously.

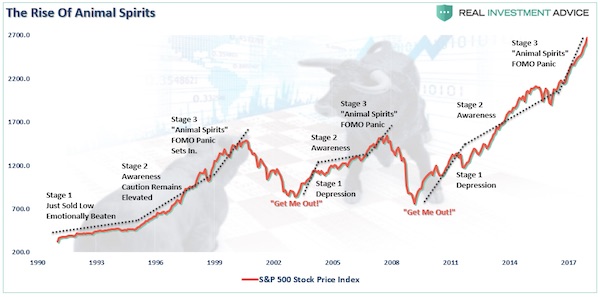

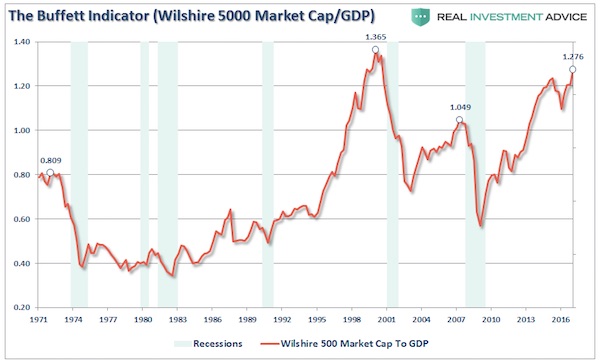

Thsis is what people tend to forget. Things look normal. But the more normal they look, the more risk there is.

• Financial Markets Are No Longer A Mechanism For Price Discovery (Guinn)

This Time It’s Different. It’s not different because people really got it right this time (in ways they missed every other time) about some new technology that’s going to Change The World! Electric cars, cryptocurrency, AI and automation, these may all be fabulous things, and they may well prove to be game-changers for productivity and returns on capital down the line, but if you think any of those things explain current valuations, you’re nuts. You’re also wrong. It’s different because financial markets are no longer a mechanism for price discovery and the pricing of risk of capital allocation decisions. Markets have been made into a utility. More to the point, they have been made into a political utility, a tool for ensuring wealth and stability of our political structures.

The easing tools we dabbled in to stabilize prior business cycles were brought to bear instead as tools for propping up and expanding financial asset prices. Beyond the direct marginal price impact of the easing itself, central bankers tailored communications policies to create Pavlovian responses to every narrative. Our President tweets about the policy implications when the S&P 500 hits new highs, for God’s sake. This isn’t a secret, y’all. The singular intent of every central banker in the world is to keep the prices of financial assets from going down, and the singular intent of every government that puts those central bankers in power is to ensure that they do so, in order to retain social stability.

Sure, there’s a dual mandate. But the mandates aren’t employment and price stability. They’re (1) expanding financial asset prices and (2) effectively marketing the idea of corresponding wealth effects to the public. Markets have also rapidly become a social utility, an inextricable part of every contract between governments and the governed. Underfunded pensions and undersized boomer 401(k) accounts mean that ownership of risky assets is not a choice driven by diversification or relative return expectations, but by the fact that it is the only asset they can buy that has any potential of meeting the returns they would need to be adequately funded.

Let’s say that you are running a state pension plan that is 65% funded. Your legislature is telling you that no help is coming from the state budget. You and every member of your agency will be fired if you even suggest cutting benefits, if you even have that authority. Your consultant or internal staff just did their new mean reversion-based capital markets return projections, and higher valuations mean projected returns on everything are lower. What’s worse, your funded status assumes returns that are higher than anything on their sheet. You are being presented with a Hobson’s Choice — behind Door #1, you get fired, and behind Door #2, you lever up your stock exposure with an increased private equity allocation. This a brutal position to be in.

While you were sleeping.

• Stocks Start 2018 On Positive Note But Investor Confidence Keeps Falling (BBG)

Stocks kicked off 2018 on a positive note, as U.S. equities led the MSCI All-Country World Index to its best start since 2013. To the bears, every move higher only serves to underscore a growing divergence between stocks and sentiment. State Street Global Markets’ index of institutional investor confidence, which differs from survey-based measures in that it is based on the actual trades, as opposed to opinions, fell for a fifth straight month in December, the firm said last week. What’s jarring is how the measure has fallen as the MSCI index of stocks has soared, after largely moving in line with the benchmark in the first half of 2017.

The latest reading of 94.8 puts State Street’s the index further below 100, which is “neutral,” or where investors are neither increasing nor decreasing their long-term allocations to risky assets. By region, sentiment fell in both North America and Asia, but rose strongly in Europe in what State Street said is a sign that that European-based investors are becoming less concerned that political risks could derail the strong economic performance in that region.

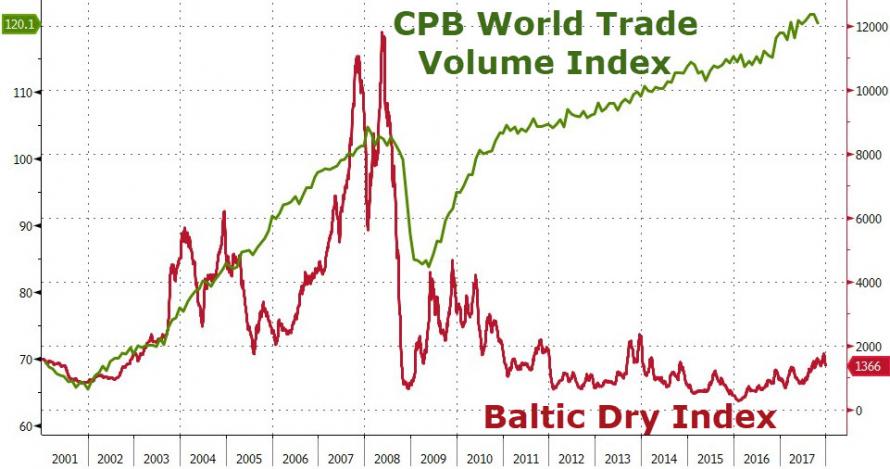

Our old friend the Baltic has a say as well.

• Baltic Dry Index Plunges Most In 2 Years (ZH)

The last six months have seen an almost unprecedented surge in world macro-economic data upside-beats as the so-called ‘global coordinated growth’ narrative surprised more dismal economists. Until recently, The Baltic Dry shipping index had confirmed that narrative… But The Baltic Dry Index has dropped for 8 straight days, tumbling over 21% – the biggest drop since Jan 2015…

While there is seasonality in the index, this is a notable decoupling… (as Bloomberg notes, peak season typically boosts trade volume and pricing, benefiting liners. The industry’s slack capacity remains a drag on rate increases.) But in a longer-term context, the decoupling between global trade volumes and the Baltic Dry Index is vast…

As the overbuilding of vessels in previous credit-fueled bubblicious malinvestment booms continues to ripple through markets still.

Good risk overview by Nomi.

• The Next Financial Crisis Will Be Worse Than the Last One (Nomi Prins)

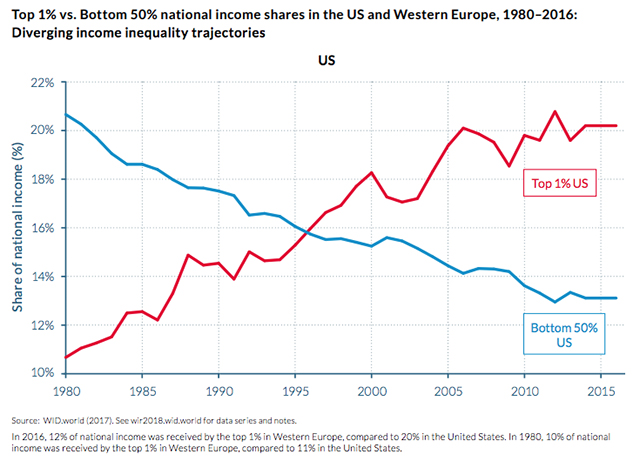

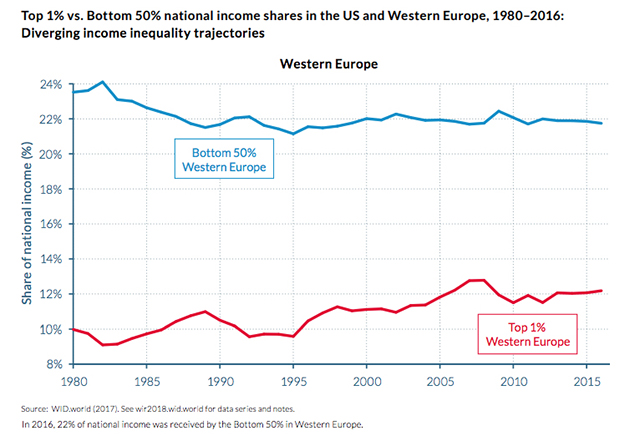

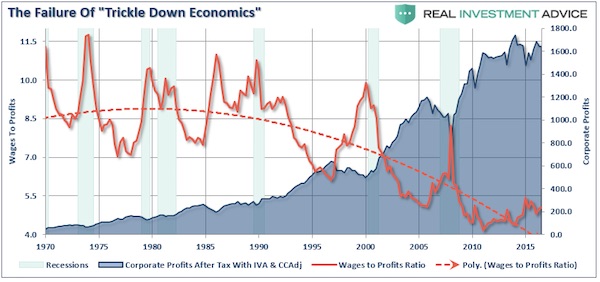

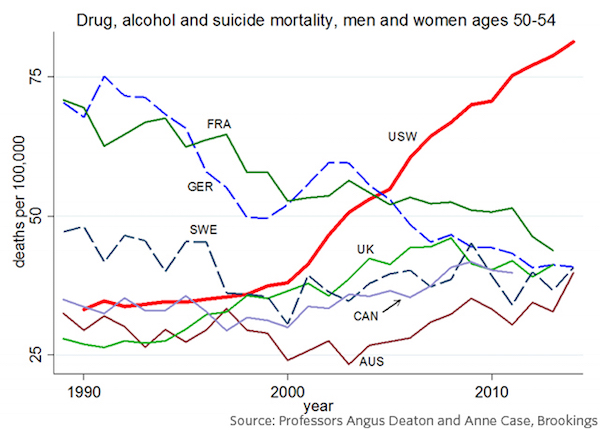

If you look at the stock and asset markets, as Donald Trump tends to do (and as Barack Obama did, too), you’d think all is fine with the world. The Dow Jones Industrial Average rose about 24% this year. The Dow Jones U.S. Real Estate Index rose 6.20%. The price of one Bitcoin rose about 1,646%. On the flip side of that euphoria however, is the fact that the median wage rose just 2.4% and has remained effectively stagnant relative to inflation.

And although the unemployment rate fell to a 17-year low of 4.1%, the labor force participation rate dropped to 62.7%, its lowest level in nearly four decades—particularly difficult for new entrants to the workforce, such as students graduating under a $1.3 trillion pile of unrepayable or very challenging student loan debt. (Not to worry though: Goldman Sachs is on that, promoting a way to profit from this debt by stuffing it into other assets and selling those off to investors, a la shades of the subprime mortgage crisis.)

Those of us living in the actual world without billionaire family pedigrees possess a healthy dose of skepticism over the “Make America Great Again” sect that believes Trump has transformed America “hugely,” for record-setting markets don’t imply economic stability, nor do 40% corporate tax cuts translate into 40% wage growth. We can march forward into 2018 carrying that knowledge with us.

Can consolidation save the system?

• China’s Small Banks Dumped on Signs of More Policy Pain in 2018 (BBG)

China’s smaller banks started the New Year with a double whammy from regulators and investors, and more pain may be looming. Bank of Tianjin tumbled by as much as 12% in the first two trading days, the biggest two-day decline since its Hong Kong listing in March 2016, after rallying at the end of last year. Bank of Jinzhou, Bank of Qingdao, and Huishang Bank fell by more than 3%. In contrast, bigger rivals have rallied. A policy announcement on Friday highlighted China’s tough stance toward smaller banks, which are already a target of government efforts to reduce leverage in the financial system. The People’s Bank of China said it will set up a mechanism for lowering banks’ reserve requirements as needed during the Lunar New Year festival next month, letting national lenders use as much as 2 %age points of reserves to meet liquidity needs for 30 days. The small banks, which are often the most cash-strapped, were excluded.

“This shows regulators are unrelenting in deleveraging efforts,” said Richard Cao at Guotai Junan Securities. Small banks seeking liquidity will have to borrow from bigger banks at higher costs, he added. China’s smaller banks have borne the brunt of a deleveraging campaign since April last year which has pushed up their borrowing costs, weakened profit growth and increased solvency risks, Natixis said in a December report. Funding for smaller banks “has clearly worsened” because they lack large deposit bases, said Alicia Garcia Herrero, the firm’s chief economist for Asia Pacific. The extensive branch networks of larger lenders lure deposits that act as a buffer as policy makers push ahead with deleveraging. Regulators ramped up financial supervision last year, targeting excessive interbank lending as well as the shadow financing that has helped some smaller lenders expand aggressively.

it’s still Thatcher time in Britain. Never went away. She’s supposed to have said: A man who, beyond the age of 26, finds himself on a bus can count himself as a failure.

• Brits Spend 5 Times More Of Their Pay On Rail Fares Than EU Commuters (Mirror)

Millions of British commuters are having a miserable morning as rail fares go up by 3.4%. The eye-watering above inflation hike is the biggest for five years. So just wait until you compare it to what some commutes cost on the continent. New research by the Trades Union Congress (TUC) shows Brits spend up to five times as much of their salary than some of their counterparts in Europe. An average worker travelling from Chelmsford, Essex, to central London will have to pay 13% of their salary for a £381 monthly season ticket, the TUC said. That compares with 2% for similar-length commute in France (£66), 3% in Italy (£65), 4% in Germany (£118) and 5% in Spain (£108) and Belgium (£144). Season tickets will increase a third faster than wages in 2018, the TUC warned.

TUC general secretary Frances O’Grady said: “Many commuters will look with envy to their continental cousins, who enjoy reasonably priced journeys to work.” Mick Cash, general secretary of the Rail, Maritime and Transport union, added: “While the British passenger is being pumped for cash, the same private companies are axing safety-critical staff and security on our trains and stations. “It’s a national scandal that private profit comes before public safety on our rail network. “Even worse, with 75% of Britain’s railways in overseas hands, it is the British people who are subsidising state-run rail operations across the continent. The Department for Transport today insisted 97% fares go back to the railways and will help fund the biggest modernisation since Victorian times, including Thameslink, Crossrail and the Great North Rail project.

Too close to banking.

• US Blocks MoneyGram Sale To China’s Ant Financial (R.)

A U.S. government panel rejected Ant Financial’s acquisition of U.S. money transfer company MoneyGram International over national security concerns, the companies said on Tuesday, the most high-profile Chinese deal to be torpedoed under the administration of U.S. President Donald Trump. The $1.2 billion deal’s collapse represents a blow for Jack Ma, the executive chairman of Chinese internet conglomerate Alibaba Group, who owns Ant Financial together with Alibaba executives. He was looking to expand Ant Financial’s footprint amid fierce domestic competition from Chinese rival Tencent’s WeChat payment platform.

Ma, a Chinese citizen who appears frequently with leaders from the highest echelons of the Communist Party, had promised Trump in a meeting a year ago that he would create 1 million U.S. jobs. MoneyGram shares were down 8.5% at $12.06 in after-market trading. The companies decided to terminate their deal after the Committee on Foreign Investment in the United States (CFIUS) rejected their proposals to mitigate concerns over the safety of data that can be used to identify U.S. citizens, according to sources familiar with the confidential discussions. “Despite our best efforts to work cooperatively with the U.S. government, it has now become clear that CFIUS will not approve this merger,” MoneyGram Chief Executive Alex Holmes said in a statement.

Really? It’s hard to say if there’s a bubble?

• Australia Property Market Is Repeating US Mortgage Mistakes (AFR)

For all the endless discussion of housing prices in Australia, it is very hard to tell if there is a bubble. Sydney price-to-income ratios are the second highest in the world—above London and New York—but hey, Sydney is a great place to live. Supply is constrained by zoning laws, two national parks, a mountain range, and an ocean. Yet demand continues to grow, so prices tend to rise. I don’t know if there’s a bubble in the Australian housing market, but there are some very troubling markers that suggest impudent borrowing and lending. Just the sort of things that preceded the US housing implosion nearly a decade ago. And I worry that bankers, borrowers, and regulators seem not to have learned the lessons of that very painful piece of economic history.

First, the markers. Australia lenders will let you borrow a lot compared to your income. If one adjusts for tax and exchange rates and uses an online mortgage calculator, it is easy to see than a major Australian bank will lend about 25% more for the same income level compared with what a major US bank will now lend. Not only can one borrow a lot, the structure of the loans is often very risk. A staggering 35.4% of home loans in Australia are interest only, according to recent APRA figures. That has dropped from above 40% thanks to APRA’s recent 30% cap on the amount of new loans that can be interest only. Don’t forget that a key trigger of the US housing meltdown was when five-year adjustable rate mortgages could not be refinanced, and borrowers faced steep upticks every quarter in their interest rates.

Interest-only loans in Australia typically have a five-year horizon and to date have often been refinanced. If this stops then repayments will soar, adding to mortgage stress, delinquencies, and eventually foreclosures. So-called “liar loans”, where borrowers provide inaccurate information about their income, assets, or expenses to lenders seem both prevalent and on the rise. A UBS survey in late 2017 found that approximately 30% of home loans, or $500 billion worth could be affected.

Oh well, the idea I guess is commendable.

• Bankers Work Around The Clock To Iron Out EU Finance Reforms (R.)

Bankers will work through the night to iron out last-minute hitches before Wednesday’s launch of a major change to European Union financial markets that aims to apply lessons from the financial crisis nearly a decade ago. The new rules are already a year late due to their complexity, with regulators having to issue 11th-hour guidance to banks and financial firms to avoid freezing up trades as well as calming nerves of those not yet fully compliant. The new regime shines a spotlight on the innards of stock, bond, commodity and derivatives markets by forcing banks, asset managers and traders to report detailed information on trillions of euros in transactions. Banks and trading firms have spent millions of euros getting ready for the big day.

A report from Expand, part of the Boston Consulting Group and IHS Markit, has estimated that top global banks and asset managers will have spent £1.5bn ($2.1bn) this year to comply with the rules. Royal Bank of Scotland’s NatWest Markets has conducted a “soft launch”. From 2 January to 4 January, some of its staff will work through the night. “Day one will hopefully go smoothly and we are as ready as we can be,” Giovanni Mazzocchi, head of macro distribution in Europe for Barclays, said. “There are a few overnighters going on to make sure everything will work on the day.”

Credit rating agency Standard & Poor’s said there would likely be more losers than winners from the changes. The aim is to boost transparency and strengthen investor protection to avoid some of the problems of the 2007-2009 financial crisis. Stock, bond, derivatives, commodity and other trades must all be reported to a repository, giving regulators a trove of data to track trades and try to spot bubbles early after failing to see the last crisis coming. When the rules go live on Wednesday, fund managers and others must for the first time fill in a transaction report with up to 65 bits of data within 15 minutes of a trade – or risk being fined.

I wish I could share Mike Krieger’s optimist visions of internet and social media. I can’t. I see them divide people at least as much as bringing them together.

• Welcome to 2018 – We Are All Connected (Krieger)

Over the course of 2017, I spent a lot of time detailing where we stand as a species and where I think we’re going. To summarize, I think the positive impact of the internet and social media on humanity is still very much in its infancy. The more connected we become to one another across the planet, the more we’ll realize we have far more in common with one another than we do with the sociopathic oligarchs and politicians in charge of our respective nation-states.

Much of the 20th century was defined by unimaginable human conflict and terror, unleashed upon the public by crazed elites and rulers who were able to successfully manipulate large populations. The key to preventing a repeat of this sort of thing in the 21st century is billions of human beings across the planet communicating and sharing friendship with one another to the point we can no longer be tricked in killing each other. We need to learn to see “the other” in ourselves and voluntarily collaborate with our fellow humans on the challenges that face us in order to bring our species to the next level. This isn’t just a pipe-dream or insane utopian ramblings, I think it’s entirely possible.

[..] When I think about 2018 and beyond, I see a species in the early stages of a historic transformation. We are moving away from hierarchies and into networks. Away from centralization and into decentralization. From the unconscious to the conscious. That said, the old system isn’t gone just yet. It remains a dangerous zombie, and its benefactors will fight to keep their schemes alive. The years ahead will be characterized by increased tension between the old and the new. What comes next is up to us. Never forget that we are all connected. That you have tremendous power to impact the world based on your everyday thoughts and actions. Understand that we don’t have to live this way. Fill your heart with love, not hate. Stay true to your higher nature. If enough of us do this, the future is unimaginably bright.

As Berlin and Brussels deck it out with Erdogan, they force Greece to consider an approach.

• Athens To Propose Transfer Of Migrants To Ankara (K.)

In a bid to reduce overcrowding at migrant reception centers on the Aegean islands, the government is to propose to Turkey that asylum seekers who are not high on the list of eligibility for protection be transferred to camps on the mainland and subsequently to Turkey, Kathimerini understands. “We are asking that we be allowed to conduct returns either directly from the islands or from the mainland in the context of the EU-Turkey joint statement,” a government official told Kathimerini, referring to a deal between Brussels and Ankara signed in March 2016 aimed at curbing migrant smuggling across the Aegean. According to sources, Turkish government officials have indicated that Ankara will respond to Greece’s request in the first half of January.

During a landmark visit to Greece last month, the first by a Turkish head of state in 65 years, President Recep Tayyip Erdogan and Greek Prime Minister Alexis Tsipras agreed to cooperate more closely in tackling the refugee crisis. According to sources, Erdogan accepted Tsipras’s request that Turkey take back migrants from the Greek mainland as well as the islands. It remains unclear, however, whether officials in Brussels approve of the deal. Tsipras’s government is keen to ease pressure on reception centers by jumpstarting the return of migrants to Turkey, a process that has largely halted as new arrivals often lodge applications for asylum. By ensuring that those being returned are not refugees from war zones such as Syria, authorities believe they will overcome the objections of some within leftist SYRIZA who have taken a tough stance against returns to Turkey.

To make a prairie it takes a clover and one bee,

One clover, and a bee.

And revery.

The revery alone will do,

If bees are few.

– “To make a prairie”, Emily Dickinson