NPC O Street Market, Washington DC 1925

“Once contagion spreads from Italy to Germany and then to the UK, we will have a new banking crisis but on a much grander scale than 2007-08.”

• Bank Shares Plunge Across Europe As Stress Tests Warn Of Contagion (G.)

Bank shares across Europe have slumped, as investors digested the results of health checks on major lenders and the impact of low interest rates on their long-term health. Shares in Germany’s Commerzbank hit record lows after a warning that profits would be down this year. This compounded the findings of stress tests by the European Banking Authority watchdog last week, which left the Frankfurt-based institution in the bottom half of the results from health checks on 51 major lenders. The worst performer in the stress tests, Italy’s Banca Monte dei Paschi di Siena (MPS), suffered a 16% in its shares on Tuesday and Italy’s biggest bank Unicredit fell 7% after heavy losses the day before.

The pan-European bank stock index was down 3.5% as the prospect of prolonged period of low interest rates makes it more difficult for banks to make profits. The Bank of England will conduct a bank industry assessment this year, which prompted the Adam Smith Institute – a leading thinktank – to publish a report calling for the abandonment of the “worse than useless” stress tests unless changes can be made. Kevin Dowd, professor of finance and economics at Durham University, and author of the report, said: “As the EU banking system goes into a renewed crisis, the UK banking system is in no fit state to withstand the storm. Once contagion spreads from Italy to Germany and then to the UK, we will have a new banking crisis but on a much grander scale than 2007-08.

“The Bank of England is asleep at the wheel again, and we will be back to beleaguered banksters begging for bailouts – and the taxpayer will be ripped off yet again, but bigger this time.”

Stress tests are meant to be useless. Pure lipstick.

• Bank of England’s Stress Tests ‘Worse Than Useless’ (Ind.)

The Bank of England’s annual stress tests of the UK’s banks, designed to ensure Britain’s lenders will not be at the heart of another destructive financial crisis, have been branded “worse than useless”, by a new report. Kevin Dowd, professor of finance and economics at Durham University, argues in a paper published today by the Adam Smith Institute that the Bank’s tests, which model various adverse economic scenarios each year such as a major fall in UK house prices or a Chinese property crash, have a series of “fatal flaws” and that the central bank is “asleep at the wheel”. “The purpose of the stress-testing programme should be to highlight the vulnerability of our banking system and the need to rebuild it. Instead, it has achieved the exact opposite, portraying a weak banking system as strong”.

Professor Dowd warns that the eurozone banking system is on the precipice of another crisis, which will also engulf the UK’s major lenders. “Once contagion spreads from Italy to Germany and then to the UK, we will have a new banking crisis but on a much grander scale than 2007-08” he said. “The Bank of England is asleep at the wheel again, and we will be back to beleaguered banksters begging for bailouts – and the taxpayer will be ripped off yet again, but bigger this time.” Among the flaws in the Bank’s testing exercise identified by Professor Dowd are the fact that the stress tests rely on analytical “risk weights” for banks’ assets, which have been much criticised for potentially underplaying the true riskiness of various assets such as mortgages and sovereign debt.

A potential global earthquake.

• Global Bond Market Rally Unravels as Japan Shows Limit to Demand (BBG)

The record-setting global bond market rally is coming undone. Bonds in Bank of America’s G-7 Government Index yielded 0.58% on average, the highest level in five weeks. The move is a rebound from the record low of 0.45% set in July. Japan led the selloff, and yields are rising from Australia to Germany. Global bonds surged from the end of June as the U.K.’s vote to leave the EU drove expectations the global economy would slow enough to keep the Federal Reserve from raising interest rates. Now investors and analysts are questioning whether yields dropped too far. Donald Trump said U.S. interest rates are artificially low, while Bill Gross said record-low yields aren’t worth the risk. A rally in long-term Japanese government bonds is probably over, according to PIMCO.

BBG: “Pretax earnings fell 45% to $3.61 billion from a year earlier..”

• HSBC Reports 29% First-Half Profit Slump (G.)

HSBC has admitted it is breaching a US regulator’s order to bolster its defences against financial crime as it announced a slump in first-half profits. The UK’s biggest bank also announced a $2.5bn share buyback following the sale of its Brazilian business in a move intended to demonstrate its financial strength. As the bank reported a 29% fall in first-half profits to $9.7bn, it also made a series of legal disclosures that confirmed it had received requests for information from various regulatory and law enforcement authorities around the world in relation to Mossack Fonseca, the Panama law firm linked to tax-haven companies.

Among the legal disclosures is a reference to an order agreed in October 2010 with the US Office of the Comptroller of the Currency which required the bank to “establish an effective compliance risk management programme across HSBC’s US businesses”. “HSBC Bank USA is not currently in compliance with the OCC order. Steps are being taken to address the requirements of the orders,” HSBC said, without providing details. In February the bank had revealed an official monitor it installed after a $1.9bn fine over money laundering four years ago had raised “significant concerns” about the slow pace of change to its procedures to combat crime. “Through his country-level reviews the monitor identified potential anti-money laundering and sanctions compliance issues that the [department of justice] and HSBC are reviewing further.”

Bitcoin has turned into a Chinese bubble machine. “Chinese exchange OKCoin was the largest overall bourse for trading in the digital currency, over 90% of which is denominated in the Chinese yuan.”

• Bitcoin Sinks After Hackers Steal $65 Million From Exchange (BBG)

Bitcoin plunged after one of the largest exchanges halted trading because hackers stole about $65 million of the digital currency. Bitcoin slumped 5.3% against the dollar as of 10:17 a.m. on Wednesday in Tokyo, bringing its two-day drop to 13%. Prices also sank 6.2% on Monday, although it was not clear if that initial move was related to the hack. Hong Kong-based exchange Bitfinex said on Tuesday that it halted trading, withdrawals and deposits after discovering the security breach. The exchange said it was still investigating details and cooperating with law enforcement, but acknowledged that some bitcoin have been stolen from its users.

“Yes – it is a large breach,” Fred Ehrsam, co-founder of Coinbase, a cryptocurrency wallet and trading platform, wrote in an e-mail. “Bitfinex is a large exchange, so it is a significant short term event, although Bitcoin has shown its resiliency to these sorts of events in the past.” Bitfinex confirmed in a message to Bloomberg News on Wednesday that the hackers took 119,756 bitcoin, or about $65 million at current prices. More than $1.5 billion has been wiped out from bitcoin’s market capitalization this week, according to research from CoinDesk. “We will look at various options to address customer losses later in the investigation,” Bitfinex wrote in a blog post. “We ask for the community’s patience as we unravel the causes and consequences of this breach.”

The Hong Kong exchange was the largest for U.S. dollar-denominated transactions over the past month, according to bitcoincharts.com. Chinese exchange OKCoin was the largest overall bourse for trading in the digital currency, over 90% of which is denominated in the Chinese yuan.

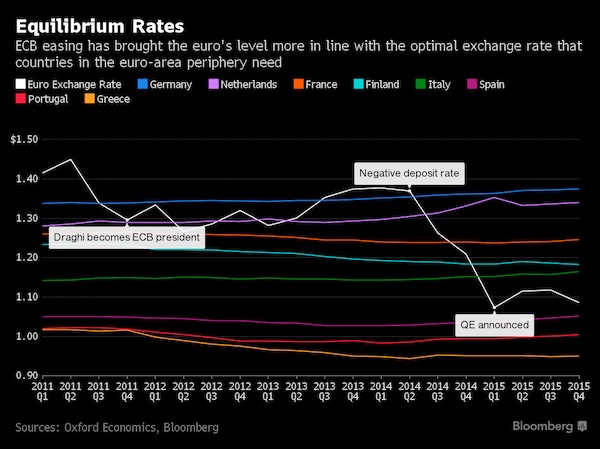

Between the lines you can see just how faulty the design of the euro is. It makes the rich countries much richer, but the poor so much poorer that the system MUST collapse. Greed is blind.

• The One-Size Euro Might Not Be So Tight After All (BBG)

It’s a given that the euro can’t have the right exchange rate for all of its 19 diverse members, all of the time. Yet at the helm of the ECB, Mario Draghi may be making it a closer fit for more countries, more of the time. Angel Talavera, an economist at Oxford Economics in London, has calculated for Bloomberg Benchmark what would have been the equilibrium exchange rate for 8 euro-area economies between 2011 and 2015 ” the rate that would be best suited to an economy’s domestic and external profiles. Germany’s economic strength and positive balance of payments would warrant the euro trading at around $1.40, while Greece’s woes would require it to be below parity with the dollar.

At the beginning of Draghi’s term, the euro was too strong for pretty much everyone, and has typically aligned itself more to the needs of “core” economies, Germany included. That hasn’t been helpful. “What would normally happen with a country that has its own currency is that the currency will appreciate or depreciate over time to help correct those imbalances,” Talavera said. “In the case of the Eurozone obviously you can’t have both things happening, so those imbalances are not correcting, but rather amplifying most of the time.” His calculations bear this out. At the height of the sovereign-debt crisis in 2011 the spread between the optimal rate for Germany and Greece was $0.32. By the end of last year the gap had widened to $0.42.

Given the structure of the euro, though, there may be only so much that the current set of policies can do. According to Talavera’s Oxford Economics study, the ECB’s monetary policy has always been plagued by a paradox: while it has has been “generally right for the common currency area as a whole, it has proven to be wrong for most of its individual members most of the time.”

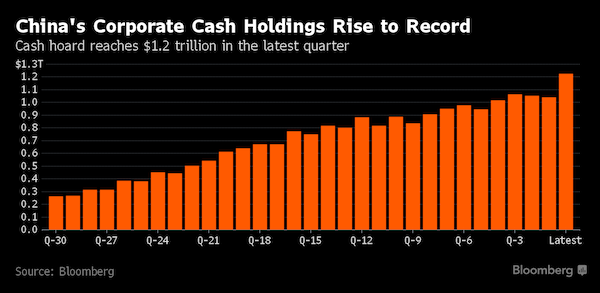

Really? So what are their debts at the same time?

• China Inc. Has $1 Trillion in Cash That It’s Too Scared to Spend (BBG)

Never before have China’s companies had so much cash and so little to spend it on. With investment opportunities sparse amid the country’s weakest economic expansion in a quarter century, Chinese firms reported an 18% jump in cash holdings during their latest quarter, the biggest increase in six years. The $1.2 trillion stockpile – which excludes banks and brokerages – grew at a faster pace than in the U.S., Europe and Japan, according to data compiled by Bloomberg. While there are worse problems than having too much cash, China Inc.’s unprecedented hoard is frustrating both policy makers and investors. Because companies lack the confidence to spend on new projects, government attempts to boost growth by pumping money into the financial system are falling short.

Stockholders, meanwhile, would rather see bigger dividends or share buybacks than a buildup of idle cash on corporate balance sheets. “This is actually becoming a bigger and bigger issue,” said Herald van der Linde at HSBC. “Cash is becoming a point of debate.” The impulse to hoard instead of invest is relatively new for a country where corporate risk-taking has been rewarded for much of the past 25 years. But as economic growth moves deeper below 7% from double-digit levels just a few years ago, the change in mindset has been stark. Growth in China’s private spending on fixed assets, which topped 10% last year, slowed to 2.8% in the six months through June, the weakest level on record. “The drivers aren’t there” for Chinese firms to invest, said Sean Taylor at Deutsche Asset Management in Hong Kong.

Moving into ever more and newer bubbles is the only thing that keeps China going.

• China’s Trouble With Bubbles (BBG)

The collapse of China’s stock markets a year ago was eye-catching, but in the end, hardly earth-shattering. Despite the pain for millions of retail investors, the fact is that stocks remain a small part of the financial system in China. Their brief, giddy rise and spectacular collapse never really threatened the wider Chinese economy, let alone the global financial system. That doesn’t mean the rest of the world should rest easy, however. While equities remain subdued, bubbles are growing in bonds and real estate – two markets that play a much bigger role in the mainland economy. The question is whether Chinese regulators can handle a new crisis any better than the old one.

Faith that China can safely manage fast-growing, debt-fueled bubbles assumes its regulators aren’t just as good as their peers in the rest of the world, they’re better. Last year’s events should call that confidence into question. Throughout the first half of 2015, policymakers allowed leverage to grow unchecked. When the market peaked and margin calls accelerated the decline, the combined force of financial regulators, public security officials and the state press were powerless to stop the slide. The situation places a premium on policies, rather than personalities, that can prevent things from unraveling. China needs to find a way to tap the brakes on credit without sending the markets into a downward spiral. Tighter rules and larger capital requirements for wealth management products – a key source of risk – are a start.

But as long as loan growth continues to accelerate faster than GDP, it’s hard to argue that a true basis for stability has been established. For evidence the underlying problems remain unsolved, look no further than China’s other asset markets. One might’ve expected that after the trauma of the stock crash, Chinese investors would become a shade more cautious. Nothing could be further from the truth. The equity boom-and-bust was followed almost immediately by a similar cycle in the metal market, which saw steel prices surge almost 80%. Property prices in Shenzhen are up 64% in the last nine months. Leveraged bets in the fixed income market mean yields continue to creep down, even as default risks grow.

Thank the IMF for this.

• Investment In Greek Economy Fell 66% Between 2007 And 2015 (Kath.)

Investment in the Greek economy plummeted more than 60% between 2007 and 2015, according to data published in Eurobank’s weekly bulletin on Tuesday. According to the lender’s economists, fixed capital investment declined by €40 billion or 66.1% during the period in question. At the same time, Greece’s GDP fell €56.7 billion. The Eurobank document described the drop in investment since 2007 as “deep and prolonged.” The reduction in investment was mainly felt in the housing market (€23.8 billion euros), followed by machinery and equipment (€12.1 billion) and other types of construction (€2.3 billion).

Eurobank said some of the key reasons for the dramatic slide in the amount of capital being invested in the Greek economy were the increases and frequent changes in taxation, the rising cost of capital, the reduction in lending by banks, the rise of uncertainty, an inability to create an investor-friendly environment despite some progress in this area, and expectations of weak economic activity. The lender also notes that net fixed capital formation, which measures gross investment minus depreciation, has been in negative territory since the end of 2010. The most recent data show that the annual shortfall is close to €11 billion.

To underline how damaging the last few years, and the collapse in investment described earlier, have been for the Greek economy, Eurobank’s weekly report pointed out that unemployment in December 2007 was at 8.1%, meaning there were just 403,000 people out of work. By the end of 2015, the jobless rate had risen to 24.2%, with 1.1 million people without work. During this eight-year spell, 860,000 jobs disappeared.

Time for Fonterra to collapse. It’s too big for its own good.

• Pay Time: The Big Squeeze On Small Business (West)

US cereal giant Kellogg’s and New Zealand milk multinational Fonterra have put the squeeze on local suppliers by stretching their payment terms out to a crushing 120 days. Along with other multinationals such as Unilever and Nestle, Kellogg’s and Fonterra already had their suppliers on 90-day terms, a punishing delay for family businesses who have to pay staff and a slew of other costs within the month. The move to 120 days does not bode well for small business, already fed up with “being used as a bank”, as one framed it. “Small business is the engine room of the economy,” he said, declining to be named for fear of reprisals, “And we are bankrolling these multinationals. I’ve got staff, super, rent and electricity to pay: and GST and payroll tax to collect. I can’t tell my staff to wait for 120 days to be paid”.

Kellogg’s was ducking for cover when rung for comment, its media team refusing to return calls. Fonterra issued this statement via a spokesperson: “In 2011, we identified that international best practice was to pay vendors supplying goods and services on a 60 day global standard payment from the end of the month in which the invoice was received. Part of our 2015 business transformation was to speed up compliance to this global standard term. We have 20,000 vendors globally and 16,000 or 80% of them have had no change to their payment terms.” According to a Fonterra document seen by this reporter, however, the new terms are “1st of the month, 3 months following invoice date”.

As for Fonterra’s claim of “international best practice”, payment terms in Europe have been moving the other way, by law. Since March 2013, the maximum delay for companies in the EU to for pay for goods and services is 30 days, unless agreed by both parties in writing, in which case it may be 60 days.

Get ready for the NAFTA law suits.

• Vancouver Enacts 15% Property Tax To Stave Off Chinese Investment Surge (AFR)

As of Tuesday, foreign buyers of property in Vancouver, which like Sydney is one of the world’s hottest real estate markets, will have to pay a 15% transaction tax. Property prices in Vancouver trail only Sydney and Hong Kong on the list of the world’s least-affordable housing markets, a Demographia survey shows. Trying to correct that, the NSW government said two months ago that it would levy a 4% stamp-duty surcharge on foreign buyers beginning next year and also charge an extra 0.75% land-tax surcharge on residential real estate, where prices are buoyed by incoming investment from mainland China. British Columbia legislators passed the new law on Friday going into a three-day holiday weekend even as local property agents called for exemptions for deals made to buy but not yet complete.

The new tax means non-Canadian residents buying a $2 million home will have to pay an additional $300,000 in tax. “While investment from outside Canada is only one factor driving price increases, it represents an additional source of pressure,” British Columbia Finance Minister Michael de Jong said in a statement. “This additional tax on foreign purchases will help manage foreign demand while new homes are built to meet local needs. A surge in purchases by Chinese property buyers has resulted in driving up the value of more than 90% of detached homes in Vancouver to more than C$1 million ($1.04 million), compared with 19% 10 years ago. Vancouver’s average home price is Canada’s highest, at $1.2 million, the Royal Bank of Canada estimates.

“Should you be asked what does matter to you, concentrate on such issues as the candidates’ body language, fashion sense and demeanor.”

• Furious Sheep (Dmitry Orlov)

you have to understand the way the electoral game is played. It is played with money—very large sums of money—with votes being quite secondary. In mathematical terms, money is the independent variable and votes are the dependent variable, but the relationship between money and votes is nonlinear and time-variant. In the opening round, the moneyed interests throw huge sums of money at both of the major parties—not because elections have to be, by their nature, ridiculously expensive, but to erect an insurmountable barrier to entry for average citizens. But the final decision is made on a relatively thin margin of victory, in order to make the electoral process appear genuine rather than staged, and to generate excitement.

After all, if the moneyed interests just threw all their money at their favorite candidate, making that candidate’s victory a foregone conclusion, that wouldn’t look sufficiently democratic. And so they use large sums to separate themselves from you the great unwashed, but much smaller sums to tip the scales. When calculating how to tip the scales, the political experts employed by the moneyed interests rely on information on party affiliation, polling data and historical voting patterns. To change the outcome from a “lose-win” to a “lose-lose,” you need to invalidate all three of these:

• The proper choice of party affiliation is “none,” which, for some bizarre reason, is commonly labeled as “independent,” (and watch out for American Independent Party, which is a minor right-wing party in California that has successfully trolled people into joining it by mistake). Be that as it may; let the Furious Sheep call themselves the “dependent” ones. In any case, the two major parties are dying, and the number of non-party members is now almost the same as the number of Democrats and Republicans put together.

• When responding to a poll, the category you should always opt for is “undecided,” up to and including the moment when you walk into the voting booth. When questioned about your stands on various issues, you need to remember that the interest in your opinion is disingenuous: your stand on issues matters not a whit (see study above) except as part of an effort to herd you, a Furious Sheep, into a particular political paddock. Therefore, when talking to pollsters, be vaguely on both sides of every issue while stressing that it plays no role in your decision-making. Should you be asked what does matter to you, concentrate on such issues as the candidates’ body language, fashion sense and demeanor.

This reviewer misses the point entirely, as evidenced by stupid things like “A cheerful worker is as much as 12% more productive.”

• Why Capitalism Has Turned Us Into Narcissists (G.)

It is no wonder that the notion of happiness has been taken into public ownership, given the remarkable spread of spiritual malaise around the globe. Around a third of American adults and close to half in Britain believe that they are sometimes depressed. Even so, more than half a century after the discovery of antidepressants, nobody really knows how they function. Work over which individuals have little control can heighten the risk of heart disease. (Co-operatives, by contrast, are apparently good for your health.) So-called austerity has made people sicker and driven some to death. Vastly unequal nations such as the UK and the US breed mental health problems far more than more egalitarian ones such as Sweden.

Illness, absenteeism and “presenteeism” (coming into work purely to be physically present) are estimated to cost the US economy as much as $550bn (£417bn) a year. There is evidence that a competitive ethos can trigger mental illness among the winners as well as the losers, not least in the case of sport stars. Despite the living disproof known as Donald Trump, the more you chase after money, status and power, the lower your sense of worth is likely to be. Given their pathologically upbeat culture, Americans tend to downplay their dejectedness, while the French, with their suspicion that happiness is unsophisticated, are more likely to under-report it. It is the kind of thing that cavorts at the end of piers wearing a striped jacket and red plastic nose.

Happiness is excellent for business. A cheerful worker is as much as 12% more productive. A science of human sentiments – what Davies calls “the surveillance, management and government of our feelings” – is thus one of the fastest growing forms of manipulative knowledge. So is market research into shopping, which now uses extensive face-scanning programmes in order to reveal customers’ emotional states. The more bright-eyed neuroscientists claim they are close to discovering a “buy button” in the brain.

if you’re still wondering why Brexit happened after reading this, good luck and good night. Britain is a thoroughly sick nation. Not saying it’s unique in that. But…

• What Kind Of School Punishes A Hungry Child? (G.)

Michaela community school in Wembley was widely criticised last week for placing children in “isolation” because their parents were late with lunch payments. The lunches are compulsory, with parents being charged £75 upfront for each six-week period. Fall even a week behind, and you may be warned that your child faces “lunch isolation”, where “they will receive a sandwich and a piece of fruit only”. That’s not counting the side order of segregation and humiliation. The child will spend the whole 60 minutes away from their friends, and “only when the entire outstanding amount is paid in full will they be allowed into ‘family lunch’ with their classmates”.

“A sandwich is fine – at least the child is being fed,” you might think. But a sandwich is not “fine”. The School Food Plan, by Leon founders Henry Dimbleby and John Vincent, states that only 1% of packed lunches, which typically comprise a sandwich and snacks, meet the nutritional requirements for school meals. It is easier to get nutrients into a hot meal. After the story broke, Michaela’s headteacher, Katharine Birbalsingh, insisted she was not punishing children for being poor: the sanction didn’t apply to pupils receiving free school meals (more than one in five of those at the school) or whose families had money problems. The problem was the small number of families who were “playing the system”, “trying to get other poor families to pay for their child’s food” and “betraying their children”.

We have heard these accusations before. Back in 2013, Lord Freud claimed that food bank users were simply abusing a free facility, thus demonstrating his lack of understanding of the obstacles between a hungry mother and a food bank parcel. A willingness to seek help, for example. Swallowed pride. A referral from a doctor or social worker. Perhaps the bus fare to the nearest centre, with children in tow.

The.Beat.Goes.On.

• Bodies Of 120 Migrants Washed Up On Libya Shores In Past 10 Days (R.)

The bodies of 120 migrants have washed up on the shores of Libya in the past 10 days, not from previously known shipwrecks in the Mediterranean, the International Organization for Migration (IOM) said on Tuesday. A total of 4,027 migrants or refugees have died worldwide so far this year, three-quarters of them in the Mediterranean while trying to reach Europe, IOM spokesman Joel Millman told a briefing. That represents a 35% increase on the global toll during the first seven months of 2015, he said.