Mondriaan Amaryllis 1910

A huge difference from the overarching narrative.

• US Weeks Away From A Recession According To Latest Loan Data (ZH)

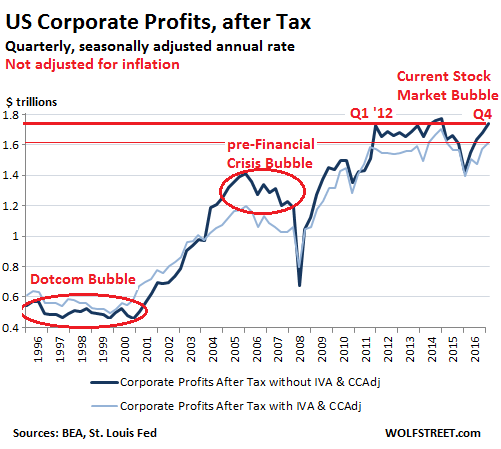

While many “conventional” indicators of US economic vibrancy and strength have lost their informational and predictive value over the past decade (GDP fluctuates erratically especially in Q1, employment is the lowest this century yet real wage growth is non-existent, inflation remains under the Fed’s target despite its $4.5 trillion balance sheet and so on), one indicator has remained a stubbornly fail-safe marker of economic contraction: since the 1960, every time Commercial & Industrial loan balances have declined (or simply stopped growing), whether due to tighter loan supply or declining demand, a recession was already either in progress or would start soon. This can be seen on both the linked chart, and the one zoomed in below, which shows the uncanny correlation between loan growth and economic recession.

And while we have repeatedly documented the sharp decline in US Commercial and Industrial loan growth over the past few months (most recently in “We Now Know “Who Hit The Brakes” As Loan Creation Crashes To Six Year Low“) as US loans have failed to post any material increase in over 30 consecutive weeks, suddenly the US finds itself on the verge of an ominous inflection point. After growing at a 7% Y/Y pace at the start of the year, which declined to 3% at the end of March and 2.6% at the end of April, the latest bank loan update from the Fed showed that the annual rate of increase in C&A loans is now down to just 1.6%, – the lowest since 2011 – after slowing to 2.3% and 1.8% in the previous two weeks.

Should the current rate of loan growth deceleration persist – and there is nothing to suggest otherwise – the US will post its first negative loan growth, or rather loan contraction since the financial crisis, in roughly 4 to 6 weeks. An interesting point on loan dynamics here from Wolf Richter, who recently wrote that a while after the 1990/1991 recession was over, the NBER determined that the recession began in July 1990, eight month after C&I loans began to stall. “As such, the current seven-month stall is a big red flag. These stalling C&I loans don’t fit at all into the rosy credit scenario. Something is seriously wrong.”

However, it wasn’t until loan growth actually contracted, that the 1990 recession was validated. Well, the US economy is almost there again. And this time it’s not just C&I loan growth, or lack thereof, there is troubling. As the chart below shows, after peaking in late 2016, real-estate loan growth has also decelerated by nearly half, to 4.6%.

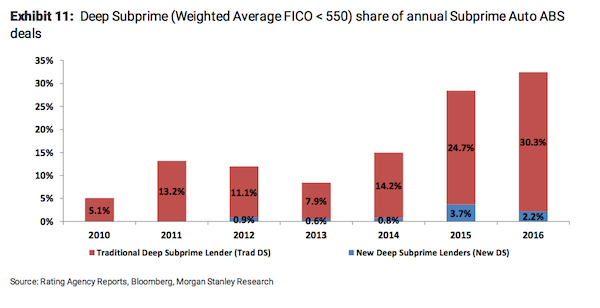

More troubling still, after flatlining at nearly double digit growth for much of 2016, starting last September there has been a sharp slowdown in commercial auto loans, whose growth is now down to just a third, or 3%, of what it was a year ago.

While it remains to be seen if C&I loans have preserved their uncanny “recession predictiveness” for yet another turn of the business cycle, the charts above confirm that the US economy is rapidly slowing, and validating the poor Q1 GDP print. Furthermore, one thing is clear: absent a substantial rebound in loan growth, whether for commercial, residential or auto loans, there is no reason to expect an imminent uptick in the US economy. We only note this, because next week the Fed plans to hike rates again. If it does so just as US loan growth contracts, it may be doing so smack in the middle of a recession.

Read more …

It’s more of a series of bubbles. But yes, Germany’s needs and demands are set to prevail over everyone else’s yet again. The EU’s inherent flaws will do it in.

• This Super Bubble Is About to Pop (IM)

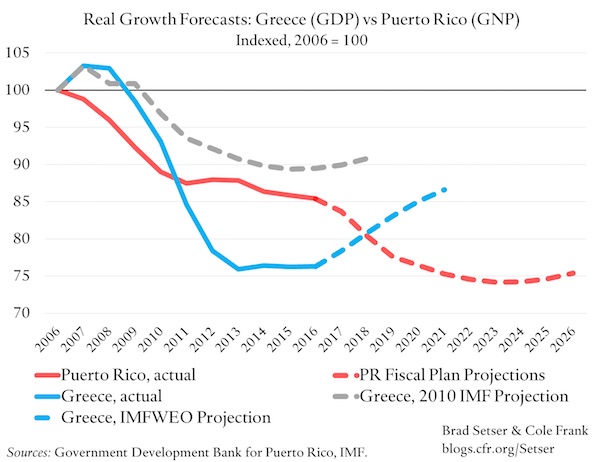

Right now, Italy is Europe’s weakest link. Italy has one of the most indebted governments in the world. It’s borrowed over $2.4 trillion. Its debt-to-GDP ratio is north of 130%. (For comparison, the US debt-to-GDP ratio is 104%.) But the situation is actually much worse. GDP measures a country’s economic output. However, it’s highly misleading. Mainstream economists count government spending as a positive when calculating GDP. A more honest approach would count it as a big negative. In Italy, government spending accounts for a whopping 50%-plus of GDP. Remove that from the calculation, and I suspect we’d see how hopelessly insolvent the Italian government truly is. In other words, Italy is flat broke. I don’t see how the Italian government could possibly extract enough in taxes from the productive part of the economy to ever pay back what it’s borrowed.

Meanwhile, Italian government bonds are in a super bubble. They’re currently trading near record-low yields. (When bond prices go up, bond yields do down.) Over $1 trillion worth of Italian bonds actually have negative yields. It’s a bizarre and perverse situation. Lending money to the bankrupt Italian government carries huge risks. So the yields on Italian government bonds should be near record highs, not record lows. Negative yields could not exist in a free market. They’re only possible in the current “Alice in Wonderland” economy created by central bankers. You see, the ECBhas been printing money to buy Italian government bonds hand over fist. Since 2008, the ECB and Italian banks have bought over 88% of Italian government debt, according to a recent study. This is stunning.

It means that Italy’s financial system depends completely on ECB money printing. Italian government bonds are, without a doubt, in super-bubble territory. It won’t be long before a pin pricks this bubble and… pop. That could happen soon. Earlier this month, the credit rating agency Fitch downgraded Italy’s credit rating from BBB+ to BBB. And Mario Draghi, the head of the ECB, recently announced that after five years of manic money printing, he’s finally achieved his wrongheaded goal of 2% inflation. [..] Now that the ECB has reached its 2% inflation target, Germany and other EU countries are pushing the central bank to stop printing so much money. This is the last thing the Italian government wants. Remember, the ECB buys a lot of Italian government bonds with those freshly printed euros.

If the ECB stops buying Italian government bonds, who will step up? The answer is nobody. Italian banks are already completely saturated with government bonds. Germany wants the money printing to stop. Italy wants it to continue. But, since the ECB has reached its stated inflation target and Germany has crucial elections later this year, I think Germany will get its way. This is very bad news for Italy’s government and banking system. Once the ECB—the only large buyer—steps away, Italian government bonds will crash and rates will soar. Soon it will be impossible for the Italian government to finance itself. Italian banks—which are already insolvent—will be decimated. They hold an estimated €235 billion worth of Italian government bonds. So the coming bond crash will pummel their balance sheets.

Read more …

Multiple banks. Zombies and dominoes.

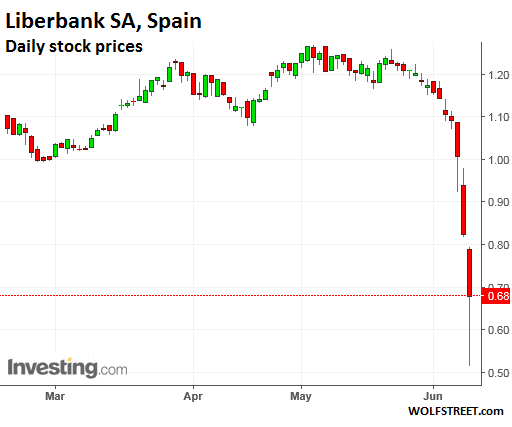

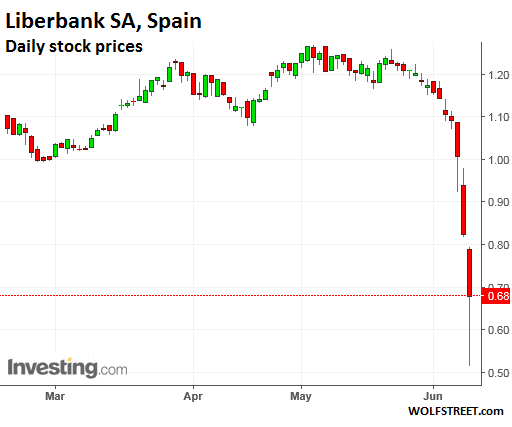

• Another Spanish Bank about to Bite the Dust (DQ)

After its most tumultuous week since the bailout days of 2012, Spain’s banking system is gripped by a climate of fear, uncertainty and distrust. Rather than allaying investor nerves, the shotgun bail-in and sale of Banco Popular to Santander on Tuesday has merely intensified them. For the first time since the Global Financial Crisis, shareholders and subordinate bondholders of a failing Spanish bank were not bailed out by taxpayers; they took risks in order to make a buck, and they bore the consequences. That’s how it should be. But bank investors don’t like not getting bailed out. Now they’re worrying it could happen again. As Popular’s final days showed, once confidence and trust in a bank vanishes, it’s almost impossible to restore them.

The fear has now spread to Spain’s eighth largest lender, Liberbank, a mini-Bankia that was spawned in 2011 from the forced marriage of three failed cajas (savings banks), Cajastur, Caja de Extremadura and Caja Cantabria. This creature’s shares were sold to the public in May 2013 at an IPO price of €0.40. By April 2014, they were trading above €2, a massive 400% gain. But by April 2015, shares started sinking. By May 2017, they were trading at around €1.20. But since the bail-in of Popular, Liberbank’s shares have seriously crashed as panicked investors fled. Scenting fresh blood, short sellers were piling in. On Friday alone, shares plunged another 17%. At one point, they were down 38% before bouncing at the close of trading, much of it driven by the bank’s own share buybacks:

In the last three weeks a whole year’s worth of steadily rising gains on the stock market have been completely wiped out. The main causes of concern are the bank’s high risk profile and low coverage rate. By the close of the first quarter of 2017, Liberbank’s default rate had reached 13%, over three%age points higher than the national average (9.8%), while its unproductive asset coverage rate was just 42.1%, compared to 47% for Banco Sabadell, 48% for Bankia, 50% for CaixaBank and 55% for Unicaja. Worse still, the vast bulk of the bank’s unproductive assets are real estate investments. After Popular, it is the Spanish entity with most exposure to toxic real estate assets, according to the financial daily El Confidencial — a remarkable feat given the bank already had the lion’s share of its impaired real estate assets transferred onto the balance sheets of Spain’s “bad bank,” Sareb.

[..] Banco Popular’s demise is a stark reminder that Europe’s banking woes are far from resolved, despite the trillions of euros thrown at them. “The message the market is sending is that you have to buy solvent banks and stay away from those that pose high risks,” said Rafael Alonso, an analyst at Bankinter, one of Spain’s more solvent banks. Another Spanish bank that could be considered to pose high risks is Unicaja, the product of another merger of failed cajas that is (or at least was) scheduled to launch its IPO some time in June or July. As things currently stand, the timing could not be worse. The greater the uncertainty over Liberbank’s future, the lower the projected valuation of Unicaja’s IPO falls. Before Popular’s forced bail-in and acquisition, the Unicaja was valued at around €2.3 billion; now, just days later, it’s valued at less than €1.9 billion. If the trend continues, the IPO will almost certainly be shelved.

Read more …

From literally zero to a comfortable majority in just weeks. Maybe someday we’ll learn how it was done. We may not like it. Follow the money.

• “Macron Is Shaping Up As Hyper-Presidency” (BBG)

Polling stations opened across France on Sunday as voters begin electing a parliament that will determine how much power recently elected President Emmanuel Macron will actually have. If polls are to be believed, it will be a lot. The latest surveys suggest Macron’s Republic on the Move movement, or REM, will win a comfortable majority in the 577-seat National Assembly, allowing him to push through his plans to loosen French labor laws and simplify its tax system. The 39-year-old Macron was elected in May after creating a centrist political movement that took millions of votes away from the two parties that have dominated French politics for decades. During one month in office, he’s further weakened the Socialist Party and the center-right Republicans by poaching some of their leading members for cabinet positions.

“Macron is shaping up as hyper-presidency, with a very strong central authority,” said Dominique Reynie, a politics professor at Sciences Po institute in Paris. “He’s got a party that he founded and fully controls. He’s got opposition parties that risk fragmenting.” Sunday’s ballot is for 539 seats in France. Voting has already closed in 27 constituencies for France’s overseas territories and another 11 to represent French expats. Voting started at 8 a.m. Paris time and most polling booths will close at 6 p.m., though local prefects can allow voting to continue until 8 p.m. The interior ministry will release turnout figures at noon and at again at 5 p.m. In 2012, about 59% of registered voters went to the polls. Little will be settled Sunday night. Under France’s two-round system for the parliamentary elections, any candidate with more than 12.5% of the registered voters goes through to runoffs on June 18, so long as no one gets 50% on Sunday. In the previous election five years ago, only 36, or about 6%, of the constituencies were settled in the first round.

Read more …

And he’s right. I wrote that even before the election. But Osborne and Cameron have been as disastrous for the UK as May now is.

A new poll shows that elections today would see Labour at 45% and Tories at 39%.

When will people fully appreciate that Jeremy Corbyn is the one person around who does not smear and gossip and play personal petty politics?

• George Osborne Says Theresa May Is A ‘Dead Woman Walking’ (G.)

George Osborne has called Theresa May “a dead woman walking” and suggested the prime minister would be forced to resign imminently. The former chancellor said the campaign had undone the work of himself and former prime minister David Cameron in winning socially liberal seats such as a Bath, Brighton Kemptown and Oxford East, now lost to Labour and the Lib Dems. “She is a dead woman walking and the only question is how long she remains on death row,” the editor of the Evening Standard said, defending his paper’s attacks on May as speaking from a “socially liberal, pro-business, economically liberal position” that he said had been consistent as editor and chancellor. Speaking on the BBC’s Andrew Marr show, Osborne said he and Cameron had spent “years getting back to office, winning in seats like Bath and Brighton and Oxford and I am angry when we go backwards and I am not afraid to say that”.

Political strategist Lynton Crosby, blamed by May’s advisers for an overly negative, presidential-style campaign with robotic slogans, had been undermined by the prime minister’s own flaws, Osborne said. “They are professionals,” he said, blaming May’s “failure to communicate and a disastrous manifesto”. Osborne said blame should be on the shoulders of May, though her advisers Nick Timothy and Fiona Hill resigned on Saturday. “You can’t just blame the advisers. The only person who decides to have an election is the prime minister, the person who decides what’s in the manifesto is the prime minister.” He said the party had been furious with May on her return to Downing Street when she gave a speech that failed to acknowledge party colleagues who had lost their seats, including ministers. “The Tory party was absolutely furious that Theresa May failed to acknowledge the loss and suffering of many MPs,” he said.

Read more …

The DUP is a fatally flawed option. May has signed her own political death warrant. Bloomberg: “Theresa May could reportedly face a leadership challenge as soon as Tuesday”

• Theresa May’s Premiership In Peril As Loose Alliance Agreed With DUP (G.)

Theresa May’s plan for a loose alliance with the Democratic Unionists to prop up her government was thrown into confusion last night after the Northern Ireland party contradicted a No 10 announcement that a deal had been reached. A Downing Street statement on Saturday said a “confidence and supply” agreement had been reached with the DUP and would be put to the cabinet on Monday. But the DUP last night put the brakes on that announcement, saying talks were continuing, not finalised. The DUP leader, Arlene Foster, said “discussions will continue next week to work on the details and to reach agreement on arrangements for the new parliament”. Following talks between May and the DUP last night, a second statement from No 10 clarified that no final deal had been reached.

[..] The Observer has learned that the DUP was planning to dodge a row when negotiations began by avoiding the inclusion of any controversial social policies, such as opposition to gay marriage or abortion, in its so-called “shopping list” of demands to the Tories. Party sources said it would be seeking commitments from May that there would be no Irish unity referendum and no hard border imposed on the island of Ireland. However, some Tories remained concerned that a pact would damage a brand they have spent years trying to detoxify. “More and more colleagues are becoming distinctly uneasy about the idea of a formal pact with the DUP,” said one senior Conservative. “It is up to the DUP if they want to support a Conservative government and vote for various measures that we put through, but there is a feeling that we are damaged if we are seen to be entering into a formal agreement with a party whose views on a number of things we just don’t share.

“Why should we damage what we painstakingly built up through David Cameron’s work on personal issues, and indeed what the prime minister’s own instincts are, with any form of formal linkage with people who plainly have some views that the vast majority of Conservative MPs would not share?” Nicky Morgan, an education secretary under David Cameron, said: “As a former minister for women and equalities, any notion that the price for a deal with the DUP is to water down our equalities policies is a non-starter.” An online petition calling for May to resign rather than form a coalition with the DUP had attracted more than 500,000 signatures Saturday night. The DUP is opposed to abortion and same-sex marriage. It has also appointed climate change sceptics to senior posts within the party.

Read more …

The Tories need internal cleansing even more than Labour.

• UK’s May Isolated Ahead Of Brexit Talks As Key Aides Quit (R.)

British Prime Minister Theresa May secured a deal on Saturday to prop up her minority government but looked increasingly isolated after a botched election gamble plunged Britain into crisis days before the start of talks on leaving the EU. Her Conservatives struck an outline deal with Northern Ireland’s Democratic Unionist Party (DUP) for support on key legislation. It was a humiliating outcome after an election that May had intended to strengthen her ahead of the Brexit push. Instead, voters stripped the Conservatives of their parliamentary majority. As May struggled to contain the fallout, her two closest aides resigned. Newspapers said foreign minister Boris Johnson and other leading party members were weighing leadership challenges. But Johnson said he backed May.

May called the early election in April, when opinion polls suggested she was set for a sweeping win. May’s aides, Nick Timothy and Fiona Hill quit on Saturday following sustained criticism within the party of the campaign. Gavin Barwell was named new chief of staff. The Conservative lawmaker who lost his seat on Thursday and has experience working as a party enforcer in parliament. The change was unlikely to significantly quell unrest within the party. Most of May’s cabinet members have kept quiet on the issue of her future, adding to speculation that her days as prime minister are numbered. A YouGov poll for the Sunday Times newspaper found 48% of people felt May should quit while 38% thought she should stay. [..] Britain’s largely pro-Conservative press questioned whether May could remain in power.

The Sun newspaper said senior members of the party had vowed to get rid of May, but would wait at least six months because they feared a leadership contest could propel the Labour party into power under Jeremy Corbyn, who supports renationalization of key industries and higher taxes for business and top earners. Survation, the opinion polling firm that came closest to predicting correctly the election’s outcome, said a new poll it conducted for the Mail on Sunday newspaper showed support for Labour now 6%age points ahead of the Conservatives. “She’s staying, for now,” one Conservative Party source told Reuters. Former Conservative cabinet minister Owen Paterson, asked about her future, said: “Let’s see how it pans out.”

Read more …

“Sometime between now and Armageddon, interest rates will go up..”

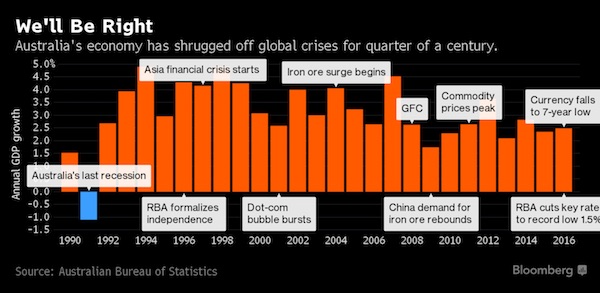

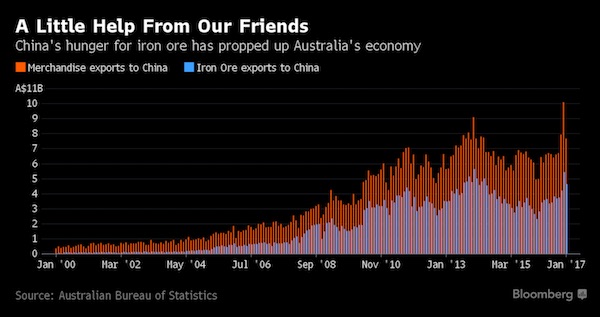

• The Inconvenient Truth of Consumer Debt (DDMB)

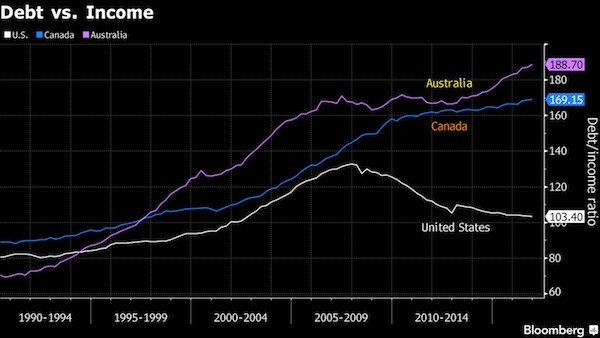

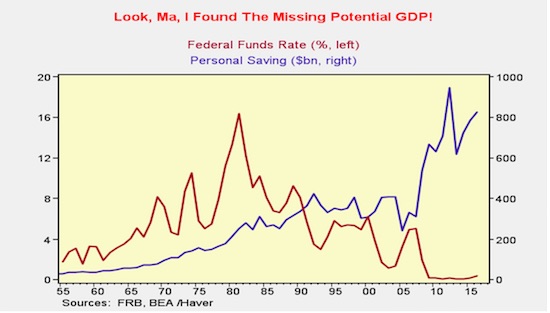

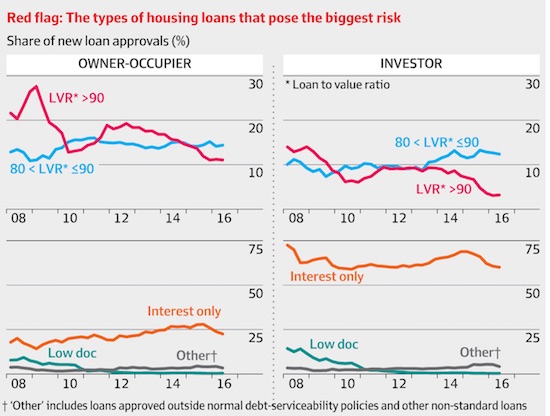

Oh, but for the days the hawks had a hero in Sydney. Against the backdrop of a de facto currency war, the Reserve Bank of Australia stood as a steady pillar of strength. The RBA held the line on interest rates, maintaining a floor of 2.5%, even as its global central bank peers drove rates to the zero bound and beyond into negative territory. The abrupt end to the commodities supercycle drove the RBA to join the global currency war. The mining-dependent nation’s economy was so debilitated that policy makers felt they had no choice but to ease financial conditions. In February 2015, after an 18-month honeymoon, the RBA reduced its official rate to 2.25%, marking the start of a cycle that ended last August with the fourth cut to a record low of 1.5%. The Bank of Canada has taken a similar journey in recent years.

It embarked upon a mild tightening campaign in 2010 that raised the overnight loan rate from a record low of 0.25% to 1% in September 2010. The bank maintained that level until early 2015. Two weeks before the RBA’s first cut, the Bank of Canada lowered rates to 0.75%. The January move, which shocked the markets, was followed in July 2015 with an additional ease to 0.5%, where it remains today. Bank of Canada Governor Stephen Poloz, who replaced Mark Carney after he departed to head the Bank of England, explained the moves as necessary to counter the downside risks to inflation emanating from the oil price shock to the country’s economy. Two resource-rich economies reacting similarly to body blows is intuitive enough. They eased the pressure on their given economies. How they’ve landed in their current predicaments is less easy to explain.

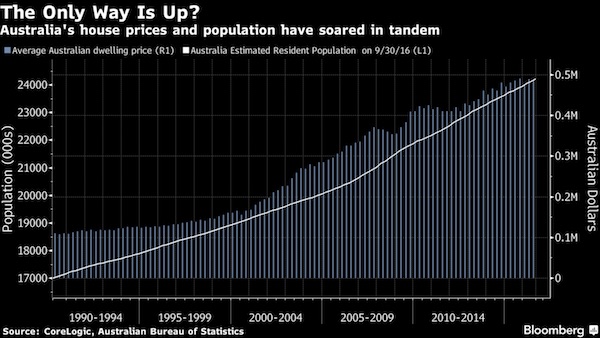

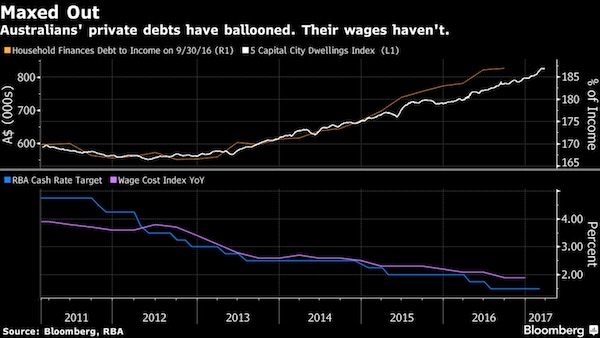

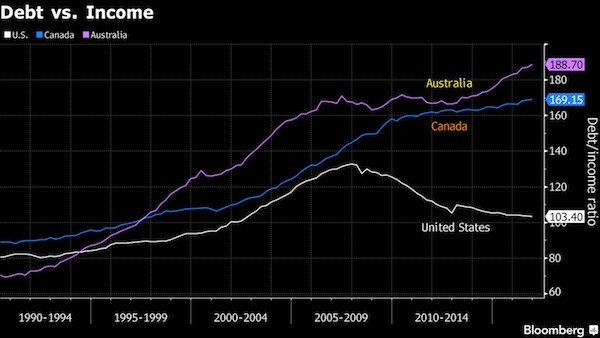

Propelled by soaring home prices from Sydney to Toronto to Melbourne to Vancouver, Australia’s household debt-to-income has hit a record 190%, the highest among developed nations; it is trailed closely by Canada, which has a 167% ratio. To put this in perspective, at the peak of the housing bubble, debt-to-income in the U.S. peaked at 130%. Then, economists took perverse pleasure in squelching the alarm these frightening figures elicited. “It’s not the level of debt that matters, it’s the cost to service that debt.” Is it a surprise that economists today are equally dismissive of households’ heavy debt burdens? Mortgages take a lifetime to expunge; incomes flow in every year. That myopic mindset best captures the shackles that bind today’s global economy. Of course it’s acceptable to build infinitely high levels of debt – as long as rates never rise.

But then there’s the inconvenient truth that when the price of the collateral backing those millions of subprime mortgages cratered, those irrelevant debt loads became relevant overnight. The same can be said of today’s delicate dynamic. Australia and Canada will be just fine so long as they don’t suffer a shock in any form to their respective economies. Some policy makers have begun to push back against the conventional stupidity. “Sometime between now and Armageddon, interest rates will go up,” warned Australia’s Treasury Secretary John Fraser on May 30. “That’s something people need to be mindful of.” Bear in mind that household debt has been growing at multiples of income, a disconnect that can only exist in a wonderland of permanently low interest rates.

Read more …

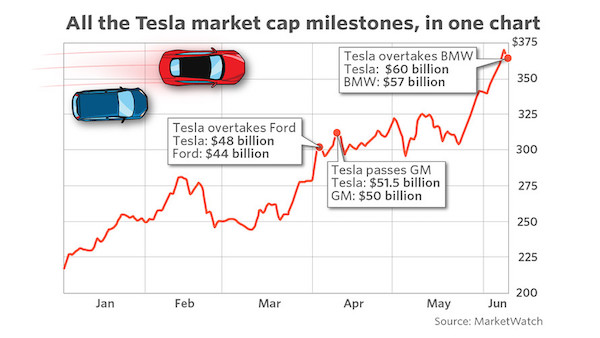

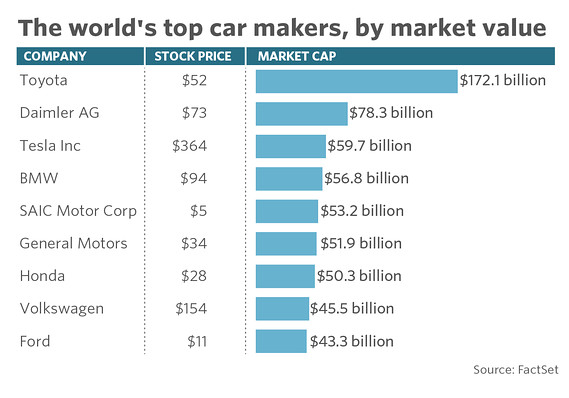

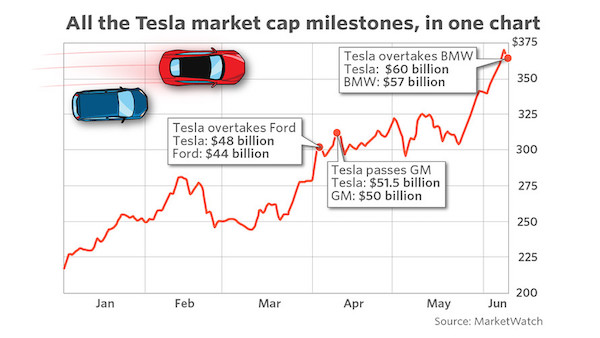

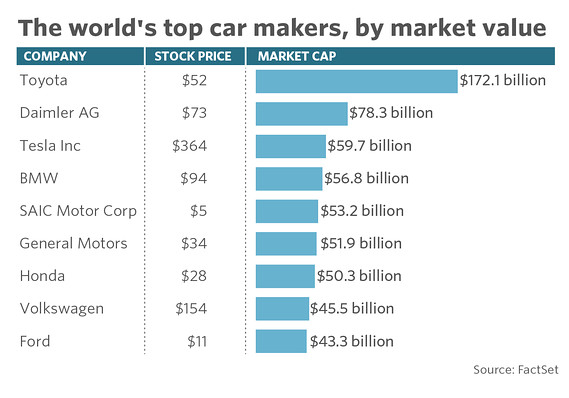

Tesla sold less than 84,000 cars in 2016. VW sold 10 million. Guess which is worth more? Time to get free money out of the way, because it only serves to distort valuation, economies and societies.

• Tesla’s Market Value Zooms Past Another Car Maker (MW)

Tesla on Friday became the world’s No. 3 car maker by market capitalization, surpassing Germany’s BMW and getting further ahead of U.S. competitors General Motors and Ford. Tesla’s market value now stands at $59.7 billion. The two car makers it has yet to surpass are Toyota, which is still a ways off at $172 billion, and Daimler at $78 billion. Tesla stock has hit a string of records in the past two months, and was slated to hit another closing all-time high on Friday. It reached a closing record of $370 on Thursday, and traded as high as $376.87 on Friday.

The meteoric stock rise pushed Tesla’s market cap to surpass Ford’s and GM’s in April. Tesla sold nearly 84,000 cars in 2016, up 64% from the previous year. The company has set a goal to be able to make cars at an annual rate of 500,000 a year by the end of 2018. The top auto makers by vehicles produced are Volkswagen and Toyota, each of which make about 10 million of the 90 million vehicles produced world-wide, according to the International Organization of Motor Vehicles Manufacturers. Tesla shares are up more than 73% so far this year. That compares with gains of approximately 9% for the S&P 500. The stock has gained more than 62% over the past 12 months, more than four times the gains for the benchmark.

Read more …

This is a history lesson that’s part of a longer piece on neo-liberalism and the Shock Doctrine.

• The Actual Lizard People (Connelly)

The Mont Pelerin Society was created on 10 April 1947 at a conference organised by the economist Friedrich von Hayek and Swiss businessman Albert Hunold. (By the end of the conference, Hunold would be appointed secretary. He also became editor-in-chief of The Mont Pelerin Quarterly magazine). The Society was basically a union for the rich and powerful, which boasted Prime Ministers and Presidents, journalists, European and American aristocracy, economists, business people, authors and academics. It was backed and funded by The (New York) Foundation for Economic Education, and the William Volker Fund based in Kansas City which provided subsidies. Credit Suisse, then known as The Schweizerische Kreditanstalt, paid for almost all the conference costs.

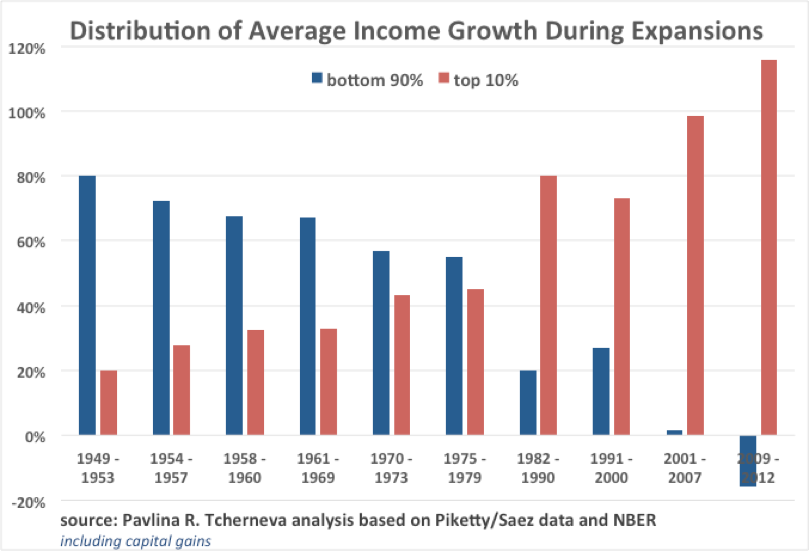

As the cigar-smoke, whiskey and heady self-righteousness swilled around the ballroom lights, Hayek joined with Milton Friedman and their luminaries, including Austrian-American economist, Ludvig von Mises and noted Austrian-British philosopher, Karl Popper to form a small, exclusive club of free-marketeers, devoted to remaking the world in its image. That night began the systematic deconstruction of Roosevelt’s New Deal which, ironically, was responsible for the greatest expansion of the American middle class up until that point, according to historian Jason A Schwarz which in turn helped bolster middle-class wealth in allied nations. The wealth created during the New Deal endowed three generations with financial and social mobility, the riches that were still being spent and created in the 60s, 70s and 80s, at the cost of a fraction of the wealth of the world’s millionaires and billionaires.

The infrastructure built during the New Deal, cracking and creaking, is in use to this day. The Mont Pelerin group would draft a ten-point statement of aims which claimed “independent freedom can be preserved only in a society in which an effective competitive market is the main agency for the direction of economic activity.” The 10 point statement of aims concludes with: “Complete intellectual freedom is so essential to the fulfillment of our aims that no consideration of social expediency must ever be allowed to impair it”. The decisions made in that Swiss Hotel in 1947 was the formalisation of a long running class war that is still being fought today. Initially their progress was slow. They were in such a defensive mode, they achieved little that was tangible during the 50s and 60s, beyond an attack on the then dominant Neo-Keynesian economic management.

Their first opportunity to take back real power, and shift the world towards the capitalism of the 1920s and earlier decades, came with the US-inspired overthrow of the Allende Government in Chile on September 11th, 1973 which saw hundreds killed, 200,000 people exiled, and many more tortured, kidnapped and disappeared. It is often referred to as the first 9/11. It is estimated more than 10,000 people were killed under Pinochet’s regime. Mass Chilean unemployment persisted for years after Pinochet cut government spending by 27%, with education and health hit hardest, while adopting a “pro-business package” and a move towards “complete free trade” which removed “as many obstacles as possible that now hinder the private market”.

Read more …

Another crazy narrative that must be halted. The blame lies in Brussels, not with people trying to prevent other people from drowning.

• Refugee Rescue Ships Not ‘Colluding With People Smugglers’ (Ind.)

Humanitarian ships rescuing refugees in the Mediterranean Sea are not acting as a “pull factor” driving increasing refugee boat crossings or “colluding” with smugglers, research has found. A report by the Forensic Oceanography department at Goldsmiths, University of London, rejected a “toxic narrative” seeking to blame NGOs for the worsening crisis. Experts dismantled allegations made by agencies such as Frontex and leading European politicians, who claimed charities were encouraging smugglers to use more dangerous tactics on the treacherous passage between Libya and Italy. The Blaming the Rescuers report’s author, Lorenzo Pezzani, said: “The evidence simply does not support the idea that rescues by NGOs are to blame for an increase in migrants crossing.

“The argument against NGOs deliberately ignores the worsening economic and political crisis across several regions in Africa that has driven up the numbers of crossings in 2016. “The violence against migrants in Libya is so extreme that they attempt the sea crossing with or without search and rescue being available.” The United Nations has documented “slave auctions” where African migrants are openly bought and sold in the war-torn country, as well as endemic rates of rape, abuse, torture and forced labour. Despite the dire situation, the EU has been giving funding, training and equipment to the Libyan coastguard in efforts to turn back migrant boats and prevent the crossings. Humanitarian groups, which have documented the coastguard abusing migrants and attacking their ships, say forcing refugees from international waters back into Libya is a violation of international law.

[..] The Goldsmiths report also placed partial blame on the EU’s Operation Sophia mission, which had a “major impact on smugglers’ tactics” by intercepting and destroying larger and safer wooden boats. “The Libyan coastguard’s use of violence when intercepting vessels also affected smugglers’ tactics and at times led to boats capsizing, endangering everyone on board,” it added. It concluded that those blaming NGOs are choosing to ignore the role other actors, including EU agencies and national governments, have played in making migrant crossings more dangerous. “We believe that the toxic narrative falsely claiming that NGO search and rescue is to blame for the migrant crossing situation is part of a worrying tendency to criminalise solidarity initiatives towards migrants,” Mr Pezzani said.

Read more …

Wonderful. I think, however, that saying it contradicts the Tragedy of the Commons is a bridge too far. Because these people do choose what’s best for themselves.

• Fractal Planting Patterns Yield Optimal Harvests, No Central Control (PhysOrg)

Bali’s famous rice terraces, when seen from above, look like colorful mosaics because some farmers plant synchronously, while others plant at different times. The resulting fractal patterns are rare for man-made systems and lead to optimal harvests without global planning. To understand how Balinese rice farmers make their decisions for planting, a team of scientists led by Stephen Lansing (Nanyang Technological University) and Stefan Thurner (Medical University of Vienna, Complexity Science Hub Vienna, IIASA, SFI), both external faculty at the Santa Fe Institute, modeled two variables: water availability and pest damage. Farmers that live upstream have the advantage of always having water; while those downstream have to adapt their planning on the schedules of the upstream farmers.

Here, pests enter the scene. When farmers are planting at different times, pests can move from one field to another, but when farmers plant in synchrony, pests drown and the pest load is reduced. So upstream farmers have an incentive to share water so that synchronous planting can happen. However, water resources are limited and there is not enough water for everybody to plant at the same time. As a result of this constraint, fractal planting patterns emerge, which yield close to maximal harvests. “The remarkable finding is that this optimal situation arises without central planners or coordination. Farmers interact locally and take local individual free decisions, which they believe will optimize their own harvest. And yet the global system works optimally,” says Lansing.

“What is exciting scientifically is that this is in contrast to the tragedy of the commons, where the global optimum is not reached because everyone is maximizing his individual profit. This is what we are experiencing typically when egoistic people are using a limited resource on the planet, everyone optimizes the individual payoff and never reach an optimum for all,” he says. The scientists find that under these assumptions, the planting patterns become fractal, which is indeed the case as they confirm with satellite imagery. “Fractal patterns are abundant in natural systems but are relatively rare in man-made systems,” explains Thurner. These fractal patterns make the system more resilient than it would otherwise be. “The system becomes remarkably stable, again without any planning—stability is the outcome of a remarkably simple but efficient self-organized process. And it happens extremely fast. In reality, it does not even take ten years for the system to reach this state,” Thurner says.

Read more …