Pieter Bruegel the Younger St. George’s Kermis with the Dance Around the Maypole 1634

Alexandra Herion-Caude, geneticist

Alexandra Henrion Caude, French geneticist – appaling if true pic.twitter.com/QXkRSKhesg

— Heidegger (@heidegger79) June 5, 2021

Nurse willing to lose her job not to get vaxxed.

Nurse is willing to lose her job to avoid getting vaccine. pic.twitter.com/fR851uusmf

— Heidegger (@heidegger79) June 5, 2021

This is really good.

The way out is to allow people to make decisions and choices on their own. This therapy is used with victims of learned helplessness such as hostages .

• COVID, Learned Helplessness, and Control (WeMeantWell)

Learned helplessness is well-documented. It takes place when an individual believes he continuously faces a negative, uncontrollable situation and stops trying to improve his circumstances, even when he has the ability to do so. Discovering the loss of control elicits a passive reaction to a harmful situation. Psychologists call this a maladaptive response, characterized by avoidance of challenges and the collapse of problem-solving when obstacles arise. You give up trying to fight back. An example may help: you must keep up with ever-changing mask and other hygiene theatre rules, many of which make no sense (mask in the gym, but not the pool; mask when going to the restaurant toilet but not at your table, NYC hotels are closed while Vegas casinos are open, Disney California closed while Disney Florida was open) and comply.

You could push back, but you have been made afraid at a core level (forget about yourself rascal, you’re going to kill grandma if you don’t do what we say) and so you just give in. Once upon a time we were told a vaccine would end it all, yet the restrictions remain largely in place. You’re left believing nothing will fix this. Helpless to resist, you comply “out of an abundance of caution.” American psychologists Martin Seligman and Steven Maier created the term “learned helplessness” in 1967. They were studying animal behavior by delivering electric shocks to dogs (it was a simpler time.) Dogs who learned they couldn’t escape the shock simply stopped trying, even after the scientists removed a barrier and the dog could have jumped away.

Learned helplessness has three main features: a passive response to trauma, not believing that trauma can be controlled, and stress. Example: you are being stalked by a killer disease which often has no outward symptoms. There is nothing you can do but hide inside and buy things from Amazon. The government failed to stop the virus initially, failed to warn you, failed to supply ventilators and PPE gear, and failed to produce a vaccine quick enough. You may die. You may kill your family members along the way. You have lost your job by government decree and are forced to survive on unemployment and odd stimulus check, manufactured dependence. It is all very real: WebMD saw a 251 percent increase in searches for anxiety this April. Americans, with their cult-like devotion to victimhood, are primed for learned helplessness. Your problems are because you’re a POC, or fat, or on some spectrum.

You are not responsible, can’t fix something so systemic, and best do what you are told. The way out is to allow people to make decisions and choices on their own. This therapy is used with victims of learned helplessness such as hostages . During their confinement all the important decisions of their life, and most of the minor ones, were made by their captors. Upon release, many hostages fear things as simple as a meal choice and need to be coaxed out of helplessness one micro-choice at a time. Example: you cannot choose where to stand, so follow the marks on the floor. Ignore the research saying three feet apart is as useful/useless as six feet apart. Don’t think about why the rules are the same inside a narrow hallway and outside in the fresh air but don’t apply at all on airplanes.

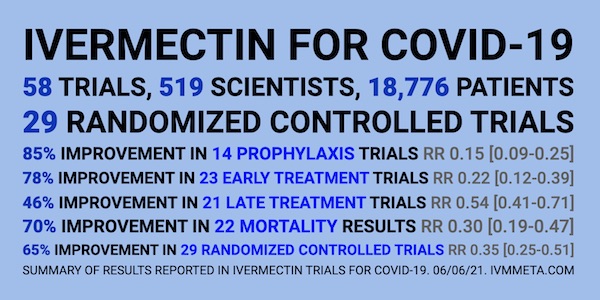

“Would you even want a jab if that debate had played out and 90+% of the time as soon as you got sick you used $30 worth of cheap, off-patent medication and never went to the hospital at all?”

• You Hated Grandma, Right? (Denninger)

The article goes on to talk about whole areas of research that are considered “off limits.” Where have we seen that in the last year and change? Oh, fraudulent studies, like the retracted one in The Lancet that condemned hundreds of thousands of Americans to die? It slammed HCQ as worthless and even dangerous when in fact it was not. Henry Ford Hospital System, a huge and highly-respected medical group in SE Michigan, came under attack for developing and successfully using a HCQ-based protocol for Covid-19. They reported their results and were instantly slammed by the woke Orange-Man-Bad mob, issuing a press release shortly thereafter saying they would have no further public comment on treatment protocols.

How many died in Michigan because of that? How many died elsewhere in the nation because of it? Did Henry Ford look further and use Ivermectin as it became known as both useful and then superior to HCQ, or perhaps investigate synergy between the two? I have no idea; they never, as far I know, registered or ran another trial, nor publicly reported further results. HENRY FORD HAS OVER 1,500 PHYSICIANS; the “woke mob” silenced the professional opinions of each and every one of them and almost-certainly led to the deaths of thousands in Michigan alone. How many of the 175 dead in this county would be alive had that not happened and this debate played out in the medical sphere over the last 15 months? Would you even want a jab if that debate had played out and 90+% of the time as soon as you got sick you used $30 worth of cheap, off-patent medication and never went to the hospital at all?

We don’t know — but I assure you some of them would be, because that’s what the data tells us. How scared would you have been all last year and would you line up to roll up your sleeve if almost nobody had died? If, when you started feeling like crap you got a handful of cheap pills and a steroid inhaler at the Urgent Care or doctor’s office along with a few pills for everyone in your household, you went home and in a couple of days everything was fine — and none of your family members got it? If the care-givers in the nursing homes used same as a preventative, never got it and thus never transmitted it? If all the old people used it as a preventative and nearly all of them never got sick?

Where was the professional debate on everything in c19early.com? NOWHERE! You can’t speak of any of that on Facebook, Instragram or Twitter nor on any of the other social media outlets such as Youtube. You in fact can’t cite medical studies on any of these drugs nor can a physician speak to any of it, including their experience with them, either. Dr. Kory, an actual front-line physician treating patients, had his Senate Testimony removed by Youtube. But you can sure talk about and advocate Remdesivir, a $3,000 drug which has been shown worthless in a random controlled trial!

Strong pattern. India daily new cases went from over 400,000 a month ago to 120,000 yesterday. And their ivermectin campaign is just picking up speed.

• Covid Deaths Plunge After Mexico City Introduces Ivermectin (WND)

A citywide initiative in Mexico City to prescribe ivermectin to COVID-19 patients resulted in a plunge in hospitalizations and deaths, two studies found. Hospitalizations were down by as much as 76%, according to research by the Mexican Digital Agency for Public Innovation, Mexico’s Ministry of Health and the Mexican Social Security Institute, according to a TrialSiteNews report highlighted by LifeSiteNews. Earlier this month, as WND reported, a significant decrease in cases in India coincided with the national health ministry’s promotion of ivermectin and hydroxychloroquine treatments. In Mexico City, after a spike in cases in December, the city’s Ministry of Health created a home-treatment kit for residents. The city’s metro population is 22 million.

At the time, the head of the Mexico City Ministry of Health, Oliva López, said told reporters her agency had determined “that there is enough evidence to use in people positive for SARS-CoV-2, even without symptoms, some drugs such as ivermectin and azithromycin.” Beginning Dec. 29, people who tested positive for COVID from an antigen test and who were experiencing at least mild symptoms began receiving one of the government’s ivermectin-based treatment kits, TrialSiteNews reported. The Mexican government then began a study to track the impact of the early treatment of COVID with ivermectin on the city’s population.

The study tracked 200,000 people, dividing in two cohorts — those who received ivermectin and those who did not. Through a phone-call-based monitoring system and hospital data on admissions for COVID-19, the researchers found a reduction of between 52% and 76% in hospitalizations for those who took ivermectin compared to those who did not. The government’s findings were corroborated by Dr. Juan J. Chamie-Quintero, a senior data analyst at private Colombian university EAFIT. He found that excess deaths in the city dropped sharply only a few weeks after the ivermectin treatments began.

They don’t appear to have looked at mRNA at all yet.

• “We Usually Don’t Use Vaccines With Lethal Side Effects” (SNN)

The AstraZeneca and Johnson & Johnson adenoviral vector vaccines have both been removed from the coronavirus immunisation programme in Norway. However, the government has decided to offer the Johnson & Johnson vaccine to those who may wish to take it, despite warnings from health authorities and experts. This appears to be easier said than done. “We are trying to see if it is possible within todays legal framework to let people decide for themselves to have a vaccine – or whether the law actually demands that a doctor has evaluated the risk-benefit in advance”, Sigurd Hortemo says to newspaper VG (link in Norwegian). He is a senior medical consultant at the Norwegian Medicines Agency.

The Norwegian Medicines Agency is working with the health authorities to find out how to offer the vaccine. One survey done for a newspaper, found that one in five were positive to taking the vaccine. As sciencenorway.no recently reported, the National Institute of Public Health and the Norwegian Directorate of Health do not advise people to get vaccinated with Johnson & Johnson. The Norwegian Medical Association has advised its members not to participate in administering the vaccine. Hortemo says to VG that he believes there is no legal framework in Norway which allows people to waive risks and get vaccinated voluntarily. “There may be a need for a legal change of some sort”, he says.

[..] Given the low levels of infection rates in Norway at the moment, and the availability of mRNA vaccines, the National Institute of Public Health have said that for women in Norway aged 18-50, it would be more risky to get vaccinated with the Johnson & Johnson vaccine, compared to waiting for an mRNA shot. According to Hortemo, legally speaking this is unchartered waters. “This is something completely new, because we usually do not use vaccines with lethal side effects. One exception is the vaccine against yellow fever which in rare cases may cause death”, he says to VG.

Believe it or not, this is meant to comfort you.

• Any Menstrual Changes After Covid Jab Would Be Short-Lived – Experts (G.)

Researchers exploring whether Covid vaccines may disrupt menstrual cycles have said any potential changes to periods are short-term and do not affect fertility. Though any link between the jab and changes in periods is yet to be proven, anecdotal accounts have been highlighted in blogs and on social media. Speaking to the Guardian’s Science Weekly podcast, Dr Kate Clancy, an associate professor at the University of Illinois, and Dr Katharine Lee, a postdoctoral researcher at Washington University School of Medicine, said they both experienced temporary changes to their menstrual cycles after receiving Covid vaccinations, leading them to start a survey to explore whether others had similar stories. The results, they say, suggest the experience is highly variable.

“[Among those reporting changes] people on long-acting hormonal contraceptives, people on gender-affirming hormones and post-menopausal people were all reporting effectively surprise periods or breakthrough bleeding,” said Clancy. “And then of people who currently have periods, some of them were reporting earlier and heavier periods – but I will also say that some were also reporting later and lighter periods. And there definitely is a very large number of people who have reported that they have really experienced no changes at all.” Clancy, whose research focuses on understanding the impact of environmental stresses on menstrual cycles, added that the changes did not appear to affect a large number of people, or last for long. “This is not a universal experience,” she said. “I would say this also appears to be something that is very short-lived – it is one to two cycles, max, of changes.”

However, the potential link is not clearcut: many people experience variations to their cycles from month to month, and patterns of menstruation can be influenced by factors including stress. What is more, because of the nature of the pandemic, researchers cannot now track people’s periods before and after vaccination in a controlled way – although Clancy notes that would have been possible during the vaccine trials. Dr Sue Ward, a vice-president at the Royal College of Obstetricians and Gynaecologists (RCOG), said something as all-consuming and life-changing as a global pandemic could result in women experiencing their periods differently. But she added: “Anecdotally some women seem to be reporting heavier periods after receiving the Covid-19 vaccine and we would support more data collection in this area to understand why this might be the case.”

“A lot of disturbing information has surfaced since the Lancet letter I signed, so I want to see answers covering all questions.”

Covering questions, or covering your a$$?

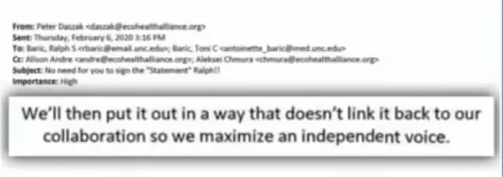

• Scientists Backtrack After Quashing Covid-19 Lab-leak Theory (RT)

A microbiologist who helped quash claims that Covid-19 leaked from a lab at the start of the pandemic has said “disturbing information” that has since emerged led him to backtrack on insisting the virus started naturally. Peter Palese, who runs a lab named in his honor at New York’s Icahn School of Medicine at Mount Sinai, was among 27 scientists who signed an influential statement in February 2020 blasting suggestions that Covid-19 may have leaked from China’s Wuhan Institute of Virology. “We stand together to strongly condemn conspiracy theories suggesting that Covid-19 does not have a natural origin,” the lab-leak deniers said in their statement, which was published in The Lancet, a prestigious British medical journal.

That view became the official Covid-19 doctrine for mainstream media outlets and social media platforms, which censored dissenting speech. But with reports surfacing in recent weeks regarding Wuhan lab staffers taking ill with Covid-like symptoms in the fall of 2019, even the likes of the Washington Post, which previously mocked lab-leak speculation, has said that it was not a “debunked conspiracy,” but one of the options. “I believe a thorough investigation about the origin of the Covid-19 virus is needed,” Palese, 77, told the UK Daily Mail on Friday. “A lot of disturbing information has surfaced since the Lancet letter I signed, so I want to see answers covering all questions.”

Many such questions were declared forbidden in The Lancet statement, which said scientists who analyzed genomes of the virus “overwhelmingly conclude” that Covid-19 had to have originated in wildlife. Palese and the other signatories went on to praise China for its “rapid, open and transparent sharing of data” and called for others to “stand with our colleagues on the frontline” in Wuhan. They added, “Conspiracy theories do nothing but create fear, rumors and prejudice that jeopardize our global collaboration in the fight against the virus.”

UK medical researcher Jeremy Farrar, who also signed the letter, is sounding a different tone as well. He told the Daily Mail that he still favors the theory that the virus originated in a wild animal, but “there are other possibilities which cannot be completely ruled out, and retaining an open mind is critical.” Peter Daszak, president of the EcoHealth Alliance, which sent $600,000 in US taxpayer money to help fund research at the Wuhan lab, orchestrated the statement in The Lancet. He was also part of a World Health Organization team that investigated the origins of Wuhan. The probe consisted of a three-hour visit to the Wuhan lab. Daszak faced some criticism that he had a conflict of interest as both a financial backer and an investigator of the lab. Ironically, he is also part of a “task force” formed last November by The Lancet to investigate how the pandemic began.

“But then the noose tightens as people start to realize how inconvenient life can quickly become if you aren’t connected to the Matrix.”

• Will EU ‘Digital Identity Wallet’ Be Used To Control People Like China? (RT)

There are now two types of people: Loyalists, who meekly obey all the new rules being brought in under the cover of Covid, and Resisters, who don’t. Our freedom rests on more people realising the truth of what is happening. The European Union’s executive commission has just announced the introduction of a pan-EU digital identification that citizens of member states can use across the entire bloc that will store important identification and official documents, like a driver’s license, prescriptions, diplomas, and presumably Covid-19 test and vaccination certificates. It will also be linked to an e-wallet, which large online platforms will be required to accept. It’s easy enough to imagine how this can get out of hand.

At first, it’s a soft sell, and we’re told that there’s no pressure to participate in what is essentially a government-created digital dragnet. But then the noose tightens as people start to realize how inconvenient life can quickly become if you aren’t connected to the Matrix. We’ve seen the same phenomenon recently with vaccinations – which are still technically optional, but to which many are now simply succumbing if only to avoid the hassles and hoop-jumping that risk becoming the norm for those who aren’t vaccinated and want to travel and live like they did pre-Covid. Is there any doubt that governments – including supranational ones like the EU – have no interest in simply allowing people to get back to their normal lives? They’re treating the crisis like an opportunity to foist onto citizens whatever weird dystopian fever dreams have been lurking in the back of their warped minds.

Sure, it’s entirely possible that the EU wants to just make our lives easier by creating their own platform that allows us to upload everything related to our identity, along with our money, which can then feasibly be cross-referenced with many of our daily activities as we merrily scan our way through life. But you’d have to be pretty naïve to believe that they’d bother doing anything that didn’t have some kind of major payback for them. It’s hard not to think of the similarities with China’s social credit system, first introduced in 2014 and consisting of a similar digital ID and e-wallet, that has evolved to control and deny access to everything from travel, high-speed internet and university access for individuals based on “violations” like playing too many video games, making posts that the government doesn’t like on social media, wasting money on things that the government considers junk, or generally not behaving in a government-approved way in your daily life.

“Joe Biden must try to find a grimace useful for sweeping this under the carpet.”

• US Spying On “Allies” Spoils Biden’s Set-Piece Visit To Europe (ZH)

American President Joe Biden flies to Europe next week for a series of major summits in what was being billed as a happy revival for the transatlantic alliance. Four years of bitter and divisive chaos under Trump were supposed to be sutured by the new president declaring the importance of a strong U.S.-European partnership and “shared values”. Unfortunately for Biden, the scandal over U.S. spying on European governments looks like casting a shadow on the “happy family reunion”. What’s more, this American president is fully implicated in the illicit snooping. The timing also upsets Biden’s attempt to burnish America’s image as a defender of “rules-based order” and “shared Western values” when he meets Russian leader Vladimir Putin in Geneva for their first face-to-face presidential summit.

Several European media outlets published reports last week on how Denmark’s intelligence services were spying on European neighbors on behalf of the American National Security Agency. The illegal surveillance is said to date back to 2013 when Barack Obama was in the White House and Joe Biden was his vice president. Whistleblower Edward Snowden, who formerly worked as a contractor for the NSA and who is now in exile in Russia to avoid persecution in the United States, claims that Biden was closely involved in the surveillance operations. There was stunned silence among the European governments last week when the reports emerged.

However, this week several leaders, including Germany’s Chancellor Angela Merkel and French President Emmanuel Macron, have become more vocal in denouncing the reports of American spying as “outrageous” and “unacceptable”. When Biden attends the G7 summit in England on June 11-13 and the NATO meeting in Brussels on June 14, his first in-person encounter with allies since becoming president will be strained by awkward questions about the reported U.S. tapping of private communications. As Danish defense analyst Peter Viggo Jakobsen drily observed: “This is an embarrassing matter for the Americans. Joe Biden must try to find a grimace useful for sweeping this under the carpet.”

They better hope more countries will follow soon, and the pressure is not only on them.

• El Salvador Aims To Become First Nation To Adopt Bitcoin As Legal Tender (RT)

El Salvador is taking steps to become the first sovereign nation to adopt bitcoin as legal tender, alongside the US dollar, potentially setting the stage for other nations to reduce central-bank influence over their economies. A bill enabling El Salvador to recognize bitcoin as legal tender will be submitted to the country’s Legislative Assembly next week, President Nayib Bukele said in a video message that was shown on Saturday at the Bitcoin 2021 conference in Miami. Bukele’s political party has firm control of the assembly. “In the short term this will generate jobs and help provide financial inclusion to thousands outside the formal economy,” Bukele said.

Strike, a Bitcoin Lightning Network payment application, is working with Bukele’s administration to implement the cryptocurrency plan. “This is the shot heard ’round the world for bitcoin,” Strike founder Jack Mallers said in a statement. “What’s transformative here is that bitcoin is both the greatest reserve asset ever created and a superior monetary network.” Holding bitcoin can help protect a developing nation’s economy from fiat currency inflation, Mallers said. Central banks also have manipulated money supplies to trigger recessions.

About 70% of El Salvadorans don’t have a bank account, according to Strike. El Salvador is the smallest country in Central America and one of the poorest nations in the western hemisphere. Use of bitcoin will make the country’s financial system more inclusive and allow people to send money home without remittance services taking out fees, Strike said. “We want to make cross-border payments free,” Mallers said in a speech at Bitcoin 2021. “We want to solve the remittance problem for places that need it the most.” He added: “In real time, we’re improving the GDP of the country.”

“In a twist of irony, the decision was announced on Twitter..”

• Nigeria Teaches US Lesson In How To Handle Big Tech Tyranny (Malic)

Nigeria is a far more serious and “based” country than the US, at least if President Muhammadu Buhari’s response to Twitter censorship – compared to that of Donald Trump’s – is anything to go by. The government in Abuja announced on Friday it had “indefinitely suspended” the US-based platform, following Twitter’s censorship of Buhari. The move was made because of “the persistent use of the platform for activities that are capable of undermining Nigeria’s corporate existence,” said Information Minister Lai Mohammed. Nigeria’s TV and press regulator, the National Broadcasting Commission (NBC), will also start the process of “licensing” all social media platforms in the country, the government said. In a twist of irony, the decision was announced on Twitter.

Also, the ban doesn’t appear to have gone into effect just yet, and Nigerians are reportedly flocking to virtual private networks to circumvent it. The Nigerian government also missed an easy opportunity to clobber Twitter with its own wokeness cudgel and accuse CEO Jack Dorsey of being racist and Islamophobic – considering Buhari is both African and Muslim. All that aside, however, Abuja’s response stands in stark contrast to that of official Washington from a year ago, when Twitter censored then-US President Donald Trump – and then the White House account – citing the same pretext of “glorifying violence” or “threatening harm” to individuals or groups. Trump responded by signing an executive order intended to crack down on social media censorship… and nothing happened. The career bureaucrats in DC simply ignored the president’s orders and stood by while Twitter, Facebook and YouTube helped ‘fortify’ the 2020 elections in favor of Democrat Joe Biden – who revoked Trump’s order last month, without bothering to offer an explanation.

“The warning is the last one before the social media giant will be held accountable of its behavior and face penalties.”

• India Issues ‘Last Notice’ To Twitter (RT)

New Delhi has issued “one last notice” to Twitter, accusing the social media giant of non-compliance with the country’s new information laws. Failure to comply would result in penalties for the company. The notice was issued by India’s ministry of electronics and information technology on Saturday. The ministry told Twitter that it was “dismayed to note that your responses to the Ministry’s letters neither address the clarifications sought by this Ministry nor indicate full compliance with the Rules.” “The refusal to comply demonstrates Twitter’s lack of commitment and efforts towards providing a safe experience for the people of India on its platform.” The warning is the last one before the social media giant will be held accountable of its behavior and face penalties.

The ministry also threatened to revoke Twitter’s indemnity as a social media platform. According to India’s laws, social media are considered to be intermediaries that are not held responsible for illegal content posted by users. “As gesture of goodwill, Twitter is hereby given one last notice to immediately comply with the Rules, failing which the exemption from liability available… shall stand withdrawn and Twitter shall be liable for consequences as per the IT Act and other penal laws of India,” the ministry’s statement reads. India has been wrestling with social media platforms for quite a time already, with the standoff getting even more heated after the new information technology rules came into force this February. As the rules came into force, Twitter got involved in a spat with New Delhi over posts concerning farmers’ protests in the country, which the government deemed to be illegal.

Gee, what a surprise.

• EVs May Offer A “Negligible” CO2 Difference From ICE Vehicles (ZH)

Are the carbon footprints of EVs really as drastically lower than that of internal combustion engine vehicles? When considering the amount of carbon and CO2 created from assembling lithium ion batteries, one firm thinks the difference could be “negligible”. Such was the topic of a new blog post by natural resource investors Goehring & Rozencwajg (G&R), a “fundamental research firm focused exclusively on contrarian natural resource investments with a team with over 30 years of dedicated resource experience.” The firm, established in 2015, posted a blog entry entitled “Exploring Lithium-ion Electric Vehicles’ Carbon Footprint” this week, where they call into question a former ICE vs. EV comparison performed by the Wall Street Journal and, while citing work performed by Jefferies, argue that there could literally be “no reduction in CO2 output” in some EV vs. ICE comparisons.

Their analysis “details the tremendous amount of energy (and by extension CO2) needed to manufacture a lithium-ion battery.” Because a typical EV is on average 50% heavier than a similar internal combustion engine, the analysis notes that the “embedded carbon” in an EV (i.e., when it rolls off the lot) is therefore 20–50% more than an internal combustion engine. The report notes: “Our analysis suggests a modern lithium-ion battery has approximately 135,000 miles of range before it degrades to the point of becoming unusable. An extended-range Tesla Model 3 has an 82 kWh battery and consumes approximately 29 kWh per 100 miles. Assuming each charge cycle has a ~95% round-trip efficiency and a battery can achieve 500 cycles before starting to degrade, we conclude a Model 3 can drive 134,310 miles before dramatically losing range.

Incidentally, Tesla’s Model 3 warranty covers the battery for the lesser of eight years or 120,000 miles and does not apply until the battery has degraded by at least 30%. If the Jefferies analysis is correct (and we believe it is), then an EV will reach carbon-emission parity with an internal-combustion vehicle just as its battery requires replacement. This will come as a huge disappointment for those believing that EV adoption will have significant impacts on CO2 reduction.”

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Does she really jump twice her own height?

Simone Biles, in extreme slow motion. pic.twitter.com/d43PPTg87O

— Timothy Burke (@bubbaprog) June 5, 2021

Support the Automatic Earth in virustime. Click at the top of the sidebars to donate with Paypal and Patreon.