DPC Old Absinthe House, bar, New Orleans 1906

A gutted society.

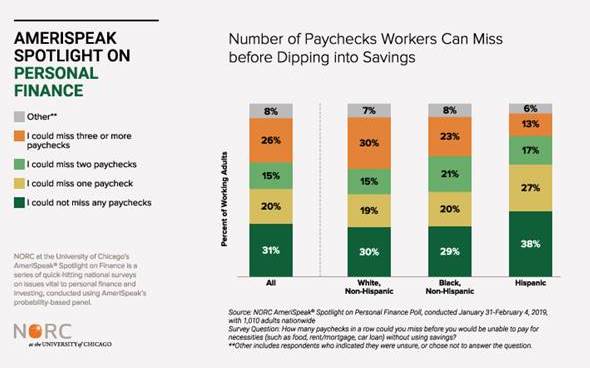

• Most Americans Are One Paycheck Away From The Street (MarketWatch)

Americans are feeling better about their job security and the economy, but most are theoretically only one paycheck away from the street. Approximately 62% of Americans have no emergency savings for things such as a $1,000 emergency room visit or a $500 car repair, according to a new survey of 1,000 adults by personal finance website Bankrate.com. Faced with an emergency, they say they would raise the money by reducing spending elsewhere (26%), borrowing from family and/or friends (16%) or using credit cards (12%). “Emergency savings are not just critical for weathering an emergency, they’re also important for successful homeownership and retirement saving,” says Signe-Mary McKernan, senior fellow and economist at the Urban Institute, a nonprofit organization that focuses on social and economic policy.

The findings are strikingly similar to a U.S. Federal Reserve survey of more than 4,000 adults released last year. “Savings are depleted for many households after the recession,” it found. Among those who had savings prior to 2008, 57% said they’d used up some or all of their savings in the Great Recession and its aftermath. What’s more, only 39% of respondents reported having a “rainy day” fund adequate to cover three months of expenses and only 48% of respondents said that they would completely cover a hypothetical emergency expense costing $400 without selling something or borrowing money. Why aren’t people saving? “A lot of people are in debt,” says Andrew Meadows, producer of “Broken Eggs,” a documentary about retirement. “Probably the most common types of debt are student loans and costs related to medical issues.”

He spent seven weeks traveling around the U.S. and interviewed over 100 people about why they haven’t saved enough money. “People are still feeling the heat from the Great Recession.” Some 44% of senior citizens have enough savings to cover unexpected expenses versus 33% of millennials, Bankrate.com found. On the upside, the Bankrate survey found that 82% of Americans keep a household budget, up from 60% in 2012. Even in the age of the smartphone, most people keep a budget the old-fashioned way, either with a pen and paper (36%) or in their heads (18%). Just 26% of those surveyed say they use a computer program or smartphone app.

Read more …

That’s exactly what I said yesterday in I Follow Charlie.

• Ron Paul On Paris Attack: Bad Foreign Policy ‘Invites Retaliation’ (Breitbart)

On Wednesday’s “The Steve Malzberg Show” on NewsMax TV, former Rep. Ron Paul (R-TX) tied the Paris shooting, along with other Western domestic terrorist attacks to the bad foreign policies of those countries. “Partially what the Secretary of State said is true,” Paul said. “This is pretty obscene, when it comes to violence, and libertarians are pretty annoyed by anybody who initiates violence. “The context of things, France has been a target for many, many years, because they’ve been involved in foreign affairs in Libya, and they really prodded us along in — recently in Libya, but they’ve been involved in Algeria, so they’ve had attacks like this, you know, not infrequently,” he added.

“So, it does involve, you know, their foreign policy as well. When people do this, you know, the rejection of the violence has to be made, and with that I agree. I put blame on bad policy that we don’t fully understand, and we don’t understand what they’re doing because the people who are objecting to the foreign policy that we pursue, they do it from a different perspective. They see us as attacking them, and killing innocent people, so yes, they, they have — this doesn’t justify, so don’t put those words in my mouth — it doesn’t justify, but it explains it.” Paul cited U.S. involvement in the Middle East that helped to inspire the rise of ISIS.

“And this is why we say if we had somebody do to us what we have done to so many countries in the Middle East, and how many people we’ve killed, and sending over drones, and bombing, being involved in all these wars, and supporting dictators one week, and taking away the support — and the stupidity of us sending all those weapons into Syria, ending up in the hands of ISIS — and right now we’re even sending more weapons. You know, because ISIS took all the American weapons. It’s that overall policy which invites retaliation, and they see us as intruders. But it’s a little bit more complex, you know, when they hit us, either here at home, and hit civilians, and what’s happening in France. But I don’t think you can divorce these instances from the overall foreign policy.”

Read more …

“The median estimate of more than 30 forecasters in a Bloomberg survey is $1.15 by the end of 2016.”

• World’s Best Forecaster Targets Euro-Dollar Parity (Bloomberg)

Being more bearish on the euro than the consensus helped ING become the world’s most accurate currency forecaster in 2014. The Dutch bank sees no reason to change its strategy now, breaking from the pack to predict a drop to parity with the dollar within two years. After watching the 19-nation currency slide as low as $1.1792 today from last year’s high of $1.3993 in May, ING sees it continuing to weaken all the way to $1, a level last seen in 2002. The median estimate of more than 30 forecasters in a Bloomberg survey is $1.15 by the end of 2016. ING expects measures by the European Central Bank to boost the euro zone’s flagging economy and avoid deflation will have direr consequences for the currency than most other firms. Few investors will want the euro as policy makers expand the money supply, especially as the Federal Reserve makes dollar assets more attractive by raising interest rates.

“We are one of the most bearish houses on euro-dollar,” Petr Krpata, a foreign-exchange strategist at ING in London, said yesterday by phone. “It looks as if the Fed will start hiking rates sooner rather than later, potentially even late in the second quarter, and this will further fuel the divergence on policy.” ING topped Bloomberg’s rankings of foreign-exchange analysts for the four quarters ended Dec. 31, rising from second place previously and supplanting German lender Landesbank Baden-Wuerttemberg in the No. 1 slot. In one of its best calls, ING predicted at the start of 2014 the euro would fall 13% to $1.20 by Dec. 31, compared with a median estimate in a Bloomberg survey of $1.28 at the time. The shared currency ended the year at $1.2098, and traded at $1.1798 as of 9:39 a.m. in London.

Read more …

Or is it a loss of sanity signal?

• Are Bond Yields Flashing A Panic Signal? (CNBC)

Government bond yields in the U.S., Europe and Japan are plumbing lows, suggesting a flight to safety, but analysts aren’t ready to hit the panic button. “This is the first time ever that rates are this low, as even during the 1930s rates were well above current levels,” Steven Englander, head of G-10 foreign-exchange strategy at Citigroup, said in a note this week, noting the average G-3 10-year government bond yield is below 1%. The 10-year U.S. Treasury yield was trading around 1.98% late Tuesday in the U.S. after starting the year around 2.17%. Germany’s 10-year bund was around 0.47%, around all-time lows, after ending 2014 around 0.54%, while the Japanese government bond (JGB) was around 0.30%, a tad up from the record low 0.265% touched earlier this week. Bond prices move inversely to yields.

“This is not happening during the panic phase of a crisis, but after the panic is over and we have had significant recoveries in asset prices globally,” he said. But rather than a panic signal, he calls it “more a sign that investors think we are going nowhere for a long time.” Others are also disregarding the idea that declines in already low bond yields may be a warning signal. “The markets seem to be suggesting that you have perhaps even a recessionary environment, not dissimilar to an emerging market crisis, an Asian crisis or even the GFC (global financial crisis),” Piyush Gupta, CEO of DBS, said at a presentation for the bank’s private banking clients. He cited the 30-year U.S. Treasury’s around 40 basis point drop in yield in the first three trading days of this year, saying it may be the biggest drop in the 30-year’s yield since records began.

Read more …

“U.S. oil production rose again—to 9.132 million barrels a day, on par with the largest output in more than three decades.”

• Why Oil Will Go Even Lower (CNBC)

New data showing a surge in U.S. gasoline and diesel fuel supplies spell more trouble for oil prices but is good news for consumers. The Energy Information Administration on Wednesday reported that U.S. gasoline stocks rose by 8.1 million barrels last week, compared with expectations for a 3.4 million barrel build. Distillate stocks, including diesel fuel and heating oil, rose by 11.2 million barrels, more than five times the amount expected. Gasoline futures for February slumped more than 2% on the Nymex to $1.32 per gallon, but West Texas Intermediate oil futures rose slightly to $48.62 per barrel even though the large supply of refined products means lower demand for oil in coming weeks.

The data showed a bigger-than-expected drop of 3.1 million barrels in crude inventories last week, but it also showed that U.S. oil production rose again—to 9.132 million barrels a day, on par with the largest output in more than three decades. Production was at 9.12 million barrels a day last week, and has been above 9 million barrels daily since early November. The surge in U.S. production, largely from shale drilling, is what set off a price war between OPEC and other producers as U.S. crude displaced that of other competitors. OPEC, at its last meeting on Thanksgiving, adopted a strategy of standing back and letting the market determine price. That has helped drive oil down further and faster than many analysts had expected.

Analysts see oil prices weakening further through the second quarter before leveling off and rising in the fourth quarter. “Despite the falling rig count, we tend to hover near 30-year highs in output,” said John Kilduff of Again Capital. He said Wednesday’s weekly data reaffirmed his negative outlook for oil prices. U.S. oil production is expected to continue to grow over the next several months, as producers pump at current levels and some even more, particularly if they are cash strapped. Analyst say it will be several months before cutbacks in capital spending start to show up in decreased oil output. “My outlook’s pretty bearish. I don’t know if it can possibly get more bearish,” Kilduff said. “I still think we’re going to punch the clock on $33 and see what happens from there.”

Read more …

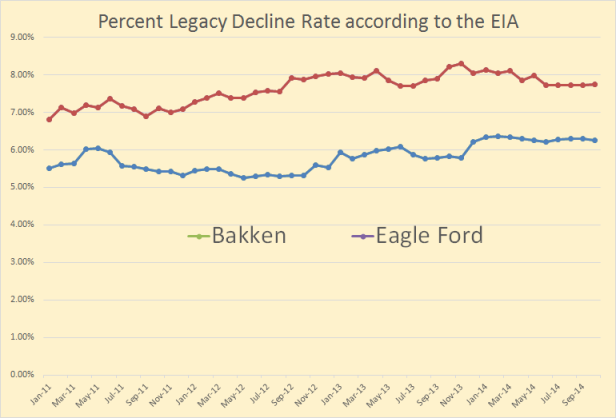

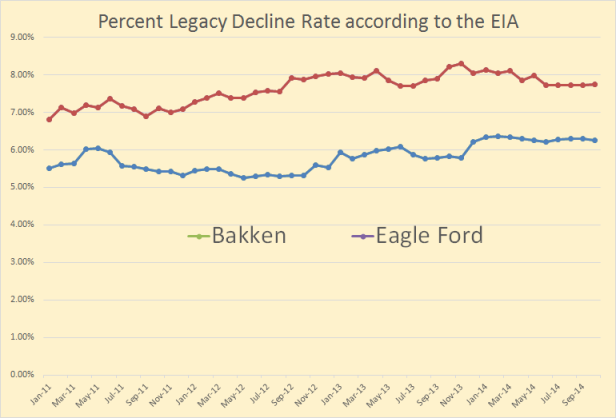

Decline rates even worse than thought.

• The Worrying Math From US Shale Plays (Ron Patterson)

There has been considerable dispute over how many new wells required to keep production flat in the Bakken and Eagle Ford. One college professor posted, over on Seeking Alpha, figures that it would take 114 rigs in the Bakken and 175 in Eagle Ford to keep production flat. He bases his analysis on David Hughes’ estimate that the legacy decline rate for Bakken wells is 45% and 35% for Eagle Ford wells. And he says a rig can drill 18 wells a year, or about one well every 20.3 days. The EIA has come up with different numbers. The data for the chart below was taken from the EIA’s Drilling Productivity Report. The EIA has current legacy decline at about 6.3% per month for Bakken wells and about 7.7% per month for Eagle Ford wells. That works out to be about 54% per year for the Bakken and 62% per year for Eagle Ford. I believe the EIA’s estimate of legacy decline, in this case, is fairly accurate.

Read more …

“If you look at what’s going on in the market and actions that the Department took, I think that … there’s not a lot of pressure to do more.”

• White House Doesn’t Feel Pressure To Expand US Crude Exports (Reuters)

The White House does not feel pressure to loosen restrictions on U.S. oil exports further and views debate over the issue as resolved for now, John Podesta, a top aide to President Barack Obama, told Reuters in an interview. The drop in oil prices and the Commerce Department’s move to allow companies to ship as much as a million barrels per day of ultra-light U.S. crude to the rest of the world has taken pressure off the administration to do more. “At this stage, I think that what the Commerce Department did in December sort of resolves the debate. We felt comfortable with where they went,” Podesta said from his West Wing office in the most substantive comments yet from a White House official on the contentious issue of exporting abundant U.S. shale oil. “If you look at what’s going on in the market and actions that the Department took, I think that … there’s not a lot of pressure to do more.”

His comments may disappoint some Republicans and energy companies such as Hess Corp. which have lobbied for more relief from a ban they view as a relic of the 1970s Arab oil embargo. While few analysts expected Obama to make a serious effort to repeal the ban – a delicate political topic due to widespread fears among Americans that doing so could inflate gasoline prices – some had hoped that further modest measures to ease its impact might emerge this year. By standing pat, however, Obama may avoid clashing with his environmentalist supporters who have begun to campaign against lifting the restrictions, hoping that might keep a lid on domestic oil drilling by depressing local prices. Some refiners such as PBF Energy, which have benefited from the abundance of U.S. shale oil, also oppose easing the ban. Podesta, who plans to leave the administration in early February and help Hillary Clinton if she decides to run for president, has played a critical role on energy and climate policy during his one-year tenure with Obama.

Read more …

Well, if you need to gamble ..

• Oil Investors Pour Most Money Into Funds in 4 Years (Bloomberg)

Investors betting oil will rebound from the lowest prices in 5 1/2-years poured the most money in more than four years into funds that track crude. The four biggest oil exchange-traded products listed in the U.S. received a combined $1.23 billion in December, the most since May 2010, according to data compiled by Bloomberg. Another $109.9 million was added this month through Jan. 5. Investors are piling into oil ETFs even after West Texas Intermediate crude tumbled the most since 2008 last year amid signs of rising supply and weak demand. Shares outstanding of the four funds surged to the highest since 2009. “Commodity investors can be contrarian investors,” said Matt Hougan, president of research firm ETF.com. “There are a lot of true believers in the commodity space. A lot of people are attached to the idea that oil’s natural price should be $100, not $50.”

The U.S. Oil Fund (USO), the biggest oil ETF, attracted $629.9 million in December and $100.4 million so far this month. The fund (DBO), which follows WTI prices, added 1.8% to $18.369 yesterday on the New York Stock Exchange. The number of U.S. Oil Fund shares on loan to short sellers was 3.93 million on Jan. 5, down from as high as 9.53 million last month, data compiled by Markit and Bloomberg show. Money is pouring into oil ETFs even as commodity-linked index liquidations surged to a record $17 billion in the first 11 months of last year, Barclays said in a report yesterday. Total commodity assets under management fell to $276 billion in November, the lowest since early 2010, according to the bank.

Read more …

“There is a risk of a real economic vicious cycle: less investment, which in turn reduces potential growth, the future becomes even grimmer and investment is reduced even further ..”

• Eurozone Deflation Is The Final Betrayal Of Southern Europe (AEP)

The eurozone has let it happen. Europe’s authorities have so mismanaged monetary and fiscal strategy that the whole currency bloc has tipped into deflation. The drop in the eurozone’s headline price index to -0.2% in December scarcely captures the significance of what is happening. Deflationary forces have been gaining a grip on all the crisis states of the South for 18 months. A chorus of economists began warning two years ago that the region was sailing close to the wind by letting inflation drift ever lower, leaving itself one shock away from a loss of policy traction. That shock is now hitting in successive waves: the Russia crisis; China’s over-investment glut; and now the collapse of oil prices. Textbook theory suggests that a halving of energy costs should be cause for celebration, a tax cut for consumers. It is very different calculus when inflation is already zero, bond yields are plummeting to 14th century lows across the world, and market psychology is becoming “unhinged” – to use central banking vernacular.

“Normally, any central bank would prefer to look through a positive supply shock,” said Peter Praet, the European Central Bank’s chief economist. “But we may not have that luxury at present. Shocks can change: in certain circumstances supply shocks can morph into demand shocks via second-round effects.” Mr Praet said families and firms are already adapting pre-emptively to the new order, describing what amounts to a classic deflation trap. “There is a risk of a real economic vicious cycle: less investment, which in turn reduces potential growth, the future becomes even grimmer and investment is reduced even further,” he told Börsen-Zeitung. Mr Praet warned that an “underemployment equilibrium” is setting in, invoking the term used by Keynes in the 1930s. He exhorted “all the authorities”, including governments, to step up to their responsibilities and take “urgent action”. This is a man who knows that monetary union is in deep crisis.

His boss, Mario Draghi, has been bending every sinew for a long time to head off this awful moment. He went to Berlin as far back as November 2013 to plead for understanding from Germany’s economic elites, warning even then that radical measures were needed to secure a “safety margin against deflationary risks”. He feared that the downward slide was pushing EMU crisis countries into a deeper rut as they tried to claw back competitiveness. “Real debt burdens rise,” he said. Mr Draghi did not invoke Irving Fisher’s classic text published in 1933 – Debt-Deflation Theory of Great Depressions – but his message was the same. Falling prices are not benign in highly-leveraged economies. There comes a point when the sailing ship does not right itself by the normal swing of the cycle. It tips too far and capsizes. Try to right it then. The Japanese are still trying 15 years later.

Read more …

Zero Hedge noticed the same phenomenon I did earlier in yesterday’s I Follow Charlie. As I said: “If the European economy doesn’t magically recover, the north will – continue to – save its economies by strangling the south.”

• A Tale Of Two Record Unemployments: Italy vs Germany (Zero Hedge)

For the first time ever, Italy’s unemployment rate is more than twice that of its European Union (one region, one monetary policy) neighbor Germany. As Germany’s jobless rate fell for the 3rd month in a row to 6.5% (the lowest level in records going back more than two decades), Italian unemployment unexpectedly rose to a record high at 13.4% (well above the euro-region rate of 11.5%). Of course, while these two nations ‘economic’ state diverges by the most on record, bond yields are at record lows in both – leaving us (and everyone else) questioning, just what it is that ECB QE will do to help Europe’s economies?

Read more …

Here’s the German part:

German Unemployment Falls to Record Low on Strengthening Economic Recovery (Bloomberg)

German unemployment fell for a third month in December to a record low, signaling that growth in Europe’s largest economy will accelerate in 2015. The number of people out of work fell a seasonally adjusted 27,000 to 2.841 million in December, the Federal Labor Agency in Nuremberg said today. The adjusted jobless rate dropped to 6.5%, the lowest level in records going back more than two decades.

The rest of that article is just a whole load of nonsense, hubris and whale blubber. But then you contrast it with this:

Italy Jobless Rate Rises to Record Amid Growth Outlook Concerns (Bloomberg)

Italy’s unemployment rate increased more than forecast to a new high of 13.4% in November as companies failed to hire on concern the country’s longest recession on record isn’t about to end. The jobless rate rose from a revised 13.3% in October, the Rome-based national statistics office Istat said in a preliminary report today. The November reading is the highest since the quarterly series began in 1977.

Two more weeks of this endless discussion …

• Greek Crisis Jolts QE Juggernaut as ECB Ponders Deflation (Bloomberg)

Mario Draghi has more evidence than ever to start quantitative easing as soon as this month – if only he can find a way to deal with Greece. Two weeks before the first monetary-policy meeting of the year on Jan. 22, governors gathered yesterday and discussed the decision over dinner. Hours earlier, data showed the first annual drop in consumer prices since 2009 and stubbornly high unemployment, handing the European Central Bank president a stronger case for buying government bonds. Overshadowing their meal was the return of Greek tensions, with the prospect that elections three days after the meeting will bring a party to power that wants to restructure the nation’s debt. That threat adds a new dimension to the argument for Draghi, whose chief challenge in convincing opponents of quantitative easing is to show it won’t turn into a bailout for recalcitrant governments.

“The case for further ECB action is strong and the negative rates of inflation will provide great mood music for Draghi to push QE through the Governing Council,” said Nick Kounis, head of macro research at ABN Amro Bank NV in Amsterdam. “The Greek issue could complicate the announcement and the ECB may well hold off from providing the details until March, giving it a chance to see how the situation turns out.” Euro-area consumer prices dropped an annual 0.2% in December as oil costs plunged, and November unemployment remained near a record at 11.5%. Draghi has argued that slumping energy prices may worsen inflation expectations, a development the ECB won’t be able to ignore. A decision in favor of large-scale government-bond purchases still has hurdles to overcome.

Policy makers including Bundesbank President Jens Weidmann have spoken publicly against them, citing legal risks and the likelihood that a program would reduce the incentive for governments to reform their economies. The treatment of Greek bonds, which are rated junk by the three major credit-rating companies, demands particular attention by officials. The ECB already owns 8% of the nation’s debt, and has committed to accept it as collateral in refinancing operations as long as the country stays in a program to ensure its reform efforts stay on track. Greek opposition party Syriza, which leads in opinion polls, has campaigned on an anti-austerity platform that includes relief on the nation’s debt. That leaves the ECB facing a dilemma over whether to buy the bonds.

Read more …

Greece can get anything it wants, as long as Germany’s interests are secured. And that’s the whole problem.

• German Lawmakers Say Greek Debt Talks Possible After Vote (Bloomberg)

Germany is leaving the door open to discussing debt relief with Greece’s next government, lawmakers in Chancellor Angela Merkel’s coalition said, signaling a more flexible stance than her administration has taken publicly. While writing off Greek debt isn’t on the table, talks on easing the repayment terms on aid that Greece received from European governments are possible after the country’s parliamentary elections on Jan. 25, the lawmakers from Germany’s two biggest governing parties said. The condition is that Greece sticks to its austerity commitments, they said.

The potential opening reflects scenarios under discussion in Merkel’s coalition for how to respond if Greek voters oust Prime Minister Antonis Samaras, a Merkel ally who has enforced German-led demands for austerity, and elect anti-austerity leader Alexis Tsipras’s Syriza party. “There should be talks with any government that emerges from the election,” Ingrid Arndt-Brauer, a Social Democrat who chairs the lower house’s finance committee, said in an interview. “You can talk about extending maturities and easing the interest rate on loans with a left-wing government, too.” A senior lawmaker from Merkel’s Christian Democratic Union said Germany will talk with any elected Greek government, including about an easing of aid conditions, as long as Greece doesn’t renege on its austerity commitments.

Read more …

If the creditors are willing to forgive enough debt, this shouldn’t be a problem. 😉

• ECB Wants New Greek Government To Quickly Reach Deal With Creditors (Reuters)

The European Central Bank wants Greece’s new government to soon reach an agreement with its European partners to enable the country’s banks to continue to have access to funding, Greek newspaper Kathimerini reported on Thursday. “The ECB sent clear and stern messages to Athens yesterday through Bank of Greece Governor Yannis Stournaras asking for an agreement with European partners soon after the election so that liquidity access to banks can continue,” the paper said. ECB funding to Greek banks rose 2.3% to €44.85 billion in November. Banks have reduced their exposure but still depend on ECB funding for liquidity.

Citing the country’s central banker, the paper said the ECB will maintain its funding access to the nation’s lenders as long as Athens remains under a bailout program and continues to meet its obligations. “As regards the upcoming election, the ECB is not taking any side but wants whatever government emerges to be formed soon and complete negotiations with the (EU/IMF/ECB) troika so that there is agreement on the day after,” Kathimerini said. The paper said business and household deposits dropped by about €2.5 billion in December, according to estimates by bankers who do not see the situation as a cause for concern.

Read more …

“.. preparations must be made in secret by a small group of officials and then acted on more or less straightaway ..”

• Here’s One Road Map For A Greek Eurozone Exit (MarketWatch)

Remember Grexit? Looming elections in Greece have people again talking about the possibility of a country leaving the euro. If it were to come to that, it wouldn’t be a simple task. And some economists fear the turmoil that would surround a breakup could trigger another global financial crisis. While financial markets aren’t exactly up in arms over the prospect, it’s worth a closer look at exactly how a Greek exit might play out. One possible path was detailed by economist Roger Bootle, the founder of London-based research firm Capital Economics. In fact, the plan won the 2012 Wolfson Economics Prize, which was a contest for proposals on how to dismantle the eurozone. Here are some of the plan’s highlights:

Secret preparations, capital controls: This would be necessary because word of an exit would prompt a run on the banks. After all, who would want to leave their euros parked in a Greek bank to see them converted overnight into drachmas? “Accordingly, preparations must be made in secret by a small group of officials and then acted on more or less straightaway,” wrote Bootle and his associates. Temporary capital controls, including temporary closure of the banks, would be essential just before departure. Parity with the euro (at first): In order to maintain price transparency and boost confidence, it would be best to introduce the new currency at parity with the euro. In other words, if the price of an item was €1.35, it would now be 1.35 drachmas. They note that the drachma would, of course, be free to fall on foreign exchange markets and that it is actually crucial that it does so.

Redenominated debt, substantial default: The government should redenominate its debt in the new currency and make clear it plans to renegotiate the terms, which would likely include a “substantial default,” they wrote, while also making clear the intention to resume servicing remaining debt as soon as possible. Bootle and his team offered several other recommendations, including a call for the national central bank of an exiting country to implement inflation-targeting and stand ready to inject liquidity into its own banking system, using quantitative easing, if necessary. They must also make clear they’re ready to recapitalize banks, the plan recommends.

Read more …

“.. the idea that such things can happen despite a consensus of social and geopolitical health does not seemed to have soaked into the thick skulls of average people.”

• We Are Entering An Era Of Shattered Illusions (Alt-Market)

The structure of history is held together by two essential and distinct kinds of links, two moments in time to which no one is immune: moments of epiphany, and moments of catastrophe. Sometimes, both elements intermingle at the birth of a singular epoch. Men often awaken to understanding in the midst of great crisis; and, invariably, great crises can erupt when men awaken. These are the moments when social gravity vanishes, when the kinetic glue of normalcy melts away, and we begin to see the true foundations of our world, if a foundation exists at all. Catastrophe occurs when too many people refuse to accept that around us always are two universes at work. There is the cold, hard reality that underlies everything. And on the surface is a veil of deceit and compromise. The more humanity compromises vital truths in order to enjoy the comfort of illusions, the more mind-shattering it will be when those illusions fall away. These two worlds can coexist only for short periods of time, and they will always and eventually collide. There is no other possible outcome.

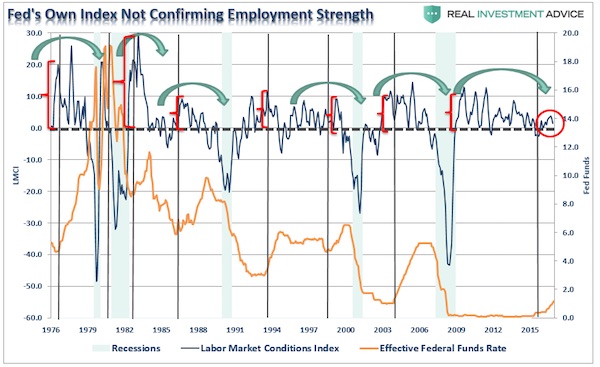

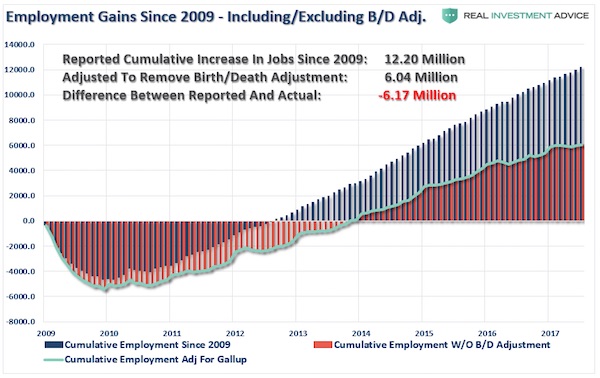

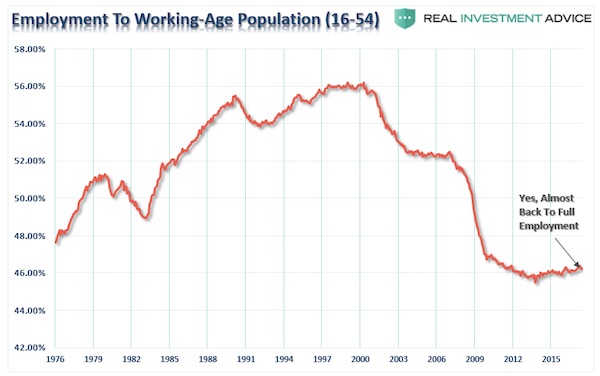

I think it could be said that the more polarized our realities become, the more explosive and disastrous the reaction will be when the separation is removed. I feel it absolutely necessary to relate this danger because today humanity is living so historically far from the bedrock of reality, political reality, social reality and economic reality that the stage has been set for a kind of full spectrum destabilization that has never been seen before. Though my analysis tends to lean toward the economic side of things, I am not only speaking of shattered illusions in the financial realm. In my next article, one last time I plan to go over nearly every mainstream economic statistic used today to misdirect the public (from national debt to unemployment to inflation to retail sales and corporate profits) and expose why they are false while giving you the real numbers. For now, I want to discuss the core problem of self-deception, the problem that makes all the rest of our problems possible.

When the initial phase of the global collapse was triggered in 2007 and 2008, there was a substantial explosion in interest and education in terms of liberty issues and alternative economic awareness. I remember back in 2006 when I had just begun writing for the movement that the ratio of people on any given Web forum or in any given public discussion was vastly opposed to alternative viewpoints and information — at least 50-1 by my observations. We were at the height of the real estate frenzy; everyone was buying houses with money they didn’t have and borrowing on their mortgages to purchase stuff they didn’t need. Life was good. The shock of the credit crisis came quickly and abruptly for most people, and there has been a considerable shift in the kinds of discussions many are willing to entertain about our future. Yet the idea that such things can happen despite a consensus of social and geopolitical health does not seemed to have soaked into the thick skulls of average people.

Read more …

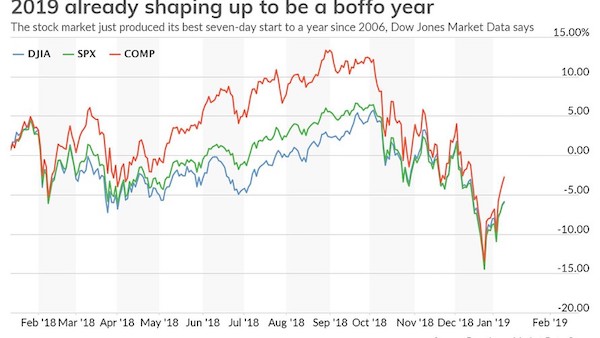

Setting the stage for rate hikes.

• Fed Bullish On US Recovery (Reuters)

U.S. central bankers have looked beyond a global deflation threat, fear of energy-sector bond defaults, and a surge of oil patch layoffs to reach what appears to be a firm conclusion: the U.S. recovery is here to stay. New trade data released on Wednesday and signs of ever-stronger consumer spending confirmed the United States remains the bright spot in a global economy plagued by uncertainty. The trade deficit shrank in November to less than $40 billion, providing a boost to growth as Americans spent less on imported oil. Meanwhile, the first corporate reports from the Christmas season showed at least some of that money trickling into stores as J.C. Penney said same-store sales rose 3.7% in November and December, pushing the company’s stock up nearly 20%.

At its December policy-setting meeting, according to minutes released on Wednesday, the Federal Reserve took close stock of plunging world oil prices and turmoil in Europe and decided that those negative trends would not undo that underlying strength. “Several participants … suggested that the real economy may end up showing more momentum than anticipated, while a few others thought that the boost to domestic spending coming from lower energy prices could turn out to be quite large.” The minutes set the stage for what could be a key economic theme this year: how the global system will react as Fed policy diverges from that of other major central banks. The European Central Bank and the Bank of Japan are expected to further loosen monetary conditions in coming weeks or months, while the luster has fallen from emerging markets that had been attracting record levels of investment in recent years.

“These minutes defined the environment post-tapering,” said Robert Tipp, chief investment strategist at Prudential Fixed Income in New Jersey. “If the Fed moves aggressively it would suck up capital from emerging markets.” Global conditions have arguably weakened since the Fed’s Dec. 16-17 meeting, and the minutes note that the United States would not be immune if the world economy turns sharply down. There is already fallout. Credit analysts have honed in on the debts of companies involved in oil and gas exploration and production, with Standard & Poor’s downgrading half a dozen firms at the end of 2014 and concluding the entire sector will be under pressure if prices remain so low.

Read more …

Abecomics has been far worse than a mere failure.

• Japan Household Mood Worsens To Levels Before ‘Abenomics’ (Reuters)

Japanese households’ sentiment worsened in December to levels last seen before premier Shinzo Abe unleashed radical stimulus policies two years ago, a central bank survey showed, underscoring the challenges he faces reviving the economy. The diffusion index measuring how households felt about the current state of the economy stood at minus 32.9 in December, down 12.5 points from September, the Bank of Japan’s quarterly survey on people’s livelihood showed on Thursday. Abe’s ruling party won a landslide victory in a snap poll in December last year, giving the premier a fresh mandate to proceed with his “Abenomics” mix of massive fiscal, monetary stimulus and structural reforms dubbed “Abenomics.”

That is the lowest level since December 2012, when Abe won the previous election and launched his radical program aimed at breaking the economy free of a long deflationary phase. While the policies helped weaken the yen and boost stock prices, the effect on the economy has been disappointing as companies remain hesitant over boosting wages and capital spending. Another index gauging households’ livelihood fell 3.1 points to minus 47.2, the worst level since 2011, the survey showed. A negative reading means respondents who feel they are worse off than three months ago exceed those who fell better off.

Many of those who replied that they are worse off complained of rising costs of living and stagnant wage growth, a sign households are feeling the pinch from a sales tax hike in April 2014 and rising import costs due to the weak yen. The weak reading suggests Abe’s decision last November to delay a second sales tax hike, initially planned for October 2015, did little to brighten sentiment. It also highlights the dilemma of the BOJ, which is printing money aggressively to achieve its 2% inflation target sometime during the fiscal year beginning in April. More than 80% of respondents expect prices to rise a year from now, roughly unchanged from September. But 83.8% of households consider rising prices as undesirable, up from 78.8% in September, the survey showed.

Read more …

More than happy to.

• China Steps In To Support Venezuela, Ecuador As Oil Prices Tumble

China stepped up its courtship of Latin American countries Thursday, promising to double trade with the region by 2025 and offering fresh loans to support left-wing governments in Venezuela and Ecuador. At a meeting in Beijing with the Community of Latin American and Caribbean States, or CELAC, President Xi Jinping said that annual bilateral trade would rise to $500 billion over the next 10 years, and that China would invest some $250 billion in the region in that period. That would threaten the U.S.’s traditional pre-eminence as the region’s biggest trading partner, inevitably diluting its political clout there. However, it’s not clear quite how Xi arrived at his figures. Although trade and investment have rocketed in the last 20 years as China has sucked up natural resources from around the world to fuel its industrialization, growth slowed sharply in the first 11 months of last year, as China refocused its economy on domestic demand.

According to CELAC figures, trade volumes grew only 1.3% year-on-year in the first 11 months of 2014. Despite that, China remains the biggest buyer for Venezuelan oil, Chilean copper and Argentinian soybeans, among other things. Of more immediate impact than Xi’s promises Thursday were agreements to bankroll the governments of Venezuela and Ecuador, two of the most viscerally anti-U.S. regimes in the region and two oil exporters who are struggling with the consequences of the 60% drop in oil prices since the start of last year. Venezuelan President Nicolas Maduro was reported as saying that he had secured over $20 billion in investment from the state-owned institutions Bank of China and China Development Bank, adding to over $45 billion in the last 10 years. He didn’t give details of the loans’ terms. Ecuador, meanwhile, said it had agreed a new $5.3 billion credit line with China’s Export-Import Bank and $2.2 billion in other funding.

Read more …

Saudi involvement in the attacks.

• Lawmakers Up Pressure On Obama To Release Secret 9/11 Documents (Fox)

Congressional lawmakers on Wednesday ramped up efforts to get President Obama to release 28 top-secret pages from a 9/11 report that allegedly detail Saudi Arabia’s involvement in the terror attacks. Lawmakers and advocacy groups have pushed for the declassification for years. The effort already had bipartisan House support but now has the backing of retired Florida Democratic Sen. Bob Graham, a former Senate Intelligence Committee chairman whom supporters hope will help garner enough congressional backing to pressure Obama into releasing the confidential information. “The American people have been denied enough,” North Carolina GOP Rep. Walter Jones said on Capitol Hill. “It’s time for the truth to come out.”

Jones has led the effort with Massachusetts Democratic Rep. Stephen Lynch, among the few members of Congress who have read the 28 redacted pages of the joint House and Senate “Inquiry into Intelligence Activities Before and After the Terror Attacks,” initially classified by President George W. Bush. They introduced a new resolution on Wednesday urging Obama to declassify the pages. Jones and other lawmakers have described the documents’ contents as shocking. That 15 of the 19 hijackers were Saudi Arabian citizens is already known. But Graham and the congressmen suggested the documents point to Saudi government ties and repeatedly said Wednesday that the U.S. continues to deny the truth about who principally financed the attacks – covering up for Saudi Arabia, a wealthy Middle East ally.

Read more …

Don’t be surprised if France moves quickly on this.

• ‘France Wants To Mend Ties With Russia’ (RT)

France intends to take a lead in de-escalating the confrontation with Russia as a face-saving measure while the EU is facing big economic challenges, John Laughland, Director of studies at the Institute of Democracy and Cooperation in Paris, told RT.

RT: Francois Hollande on Monday said that sanctions against Russia “must stop now.” What does this statement from the French leader mean for the upcoming talks?

John Laughland: I think that means that France is intending to take a lead in deescalating the confrontation with Russia and in seeing an end to sanctions, in seeing the sale of the Mistral helicopter carrier ships and also in seeing a de facto – at least – recognition of the annexation of Crimea. I said this back in December when Francois Hollande, the French president visited Vladimir Putin on the way back from Kazakhstan. It was clear that he was taking the lead then, taking a lead against Germany and against Mrs. Merkel of who many people thought that she would be pro-Russian force in Europe. She’s turned out to be very opposite. And we are seeing France assuming a relatively traditional position now in foreign policy and reassuming and reasserting its traditional friendship with Russia. So I’m relatively optimistic about these latest statements.

RT: Hollande added that progress has to be made at the talks. Moscow has been actively engaged in the peace process in eastern Ukraine. The latest talks saw hundreds of prisoners returned by both Kiev and eastern militias, but the sanctions still remain. So what exactly constitutes progress?

JL: He is saying that he wants to sell the Mistral, he wants to get rid of the problem, he would like, as he said, the end of the sanctions and so on. He assured himself, extremely understanding for the Russian position. He didn’t mention Crimea. He implied that Crimean annexation would be accepted, and he showed understanding as well for Russian opposition to NATO membership for Ukraine. When he says “progress” I regard that as purely a face-saving phrase. The fact is that Ukraine is off the headlines now. We haven’t had much news from Ukraine for many weeks now in the Western media. Quite frankly it is off people’s radar screen. Providing it stays off the radar screen, providing it stays off headlines it would be a good time – if that is indeed his intention – to move on from this unfortunate episode.

Read more …

As I said: why bother?

• Fight Over Keystone Pipeline is Completely Divorced From Reality (Bloomberg)

In the six years since TransCanada Corp. first sought U.S. approval to build the pipeline, the debate over Keystone XL pipeline has, somewhat strangely, become one of the central fights in U.S. politics. It’s about to get even bigger. On Wednesday, Republicans will inaugurate the new Congress by taking up a Senate bill to approve the Keystone XL pipeline that would connect oil producers in Western Canada to U.S. refineries on the Gulf Coast. The House will vote on the measure on Friday. Several years ago, liberals looking for a cause to rally around settled on Keystone because the oil it would transport, extracted from tar sands, is especially damaging to the environment. James Hansen, then the director of NASA’s Goddard Institute for Space Studies, famously declared that if the pipeline goes forward and Canada develops its oil sands “it will be game over for the planet.”

Conservatives seized on Keystone because it offered a clear example of liberals prioritizing the environment over the jobs the pipeline’s construction would create, an effective political attack in a lousy economy. President Obama’s anguish over whether or not to approve it only added to the appeal. As a result, Keystone has attained tremendous symbolic importance for both Democrats and Republicans. But this is the opposite of how it should be — the political fight has become completely divorced from reality. The pipeline’s actual importance to oil markets, the economy and the environment has steadily diminished. Whoever wins, the “victory” will be pointless and hollow. The liberal claim that blocking Keystone would limit Canadian oil sands development, or even slow Canadian oil exports to the United States, has turned out to be wrong.

Over the last four years, Canadian exports to the Gulf Coast have risen 83%. Last year, U.S. oil imports from Canada hit a record. This year, Canadian oil producers expect shipments to double. One way producers achieved this is by building new pipelines, such as the Flanagan South pipeline, which can transport 600,000 barrels a day of heavy crude, and expanding old ones. At the same time, the Canadian government has approved two new lines as a fallback to Keystone—one running east to Quebec, the other west to the Pacific—that avoid the U.S. entirely. Collectively, these projects dwarf Keystone’s 800,000 barrel-a-day capacity. “Keystone is kind of old news,” Sandy Fielden, director of energy analytics at Austin, Texas-based RBN Energy, told Bloomberg News. “Producers have moved on and are looking for new capacity from other pipelines.”

Read more …

“Policy makers must realise that their instincts to completely use the fossil fuels within their countries are wholly incompatible with their commitments to the 2C goal.”

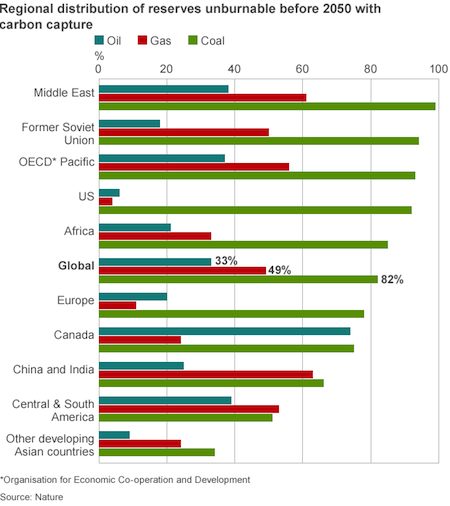

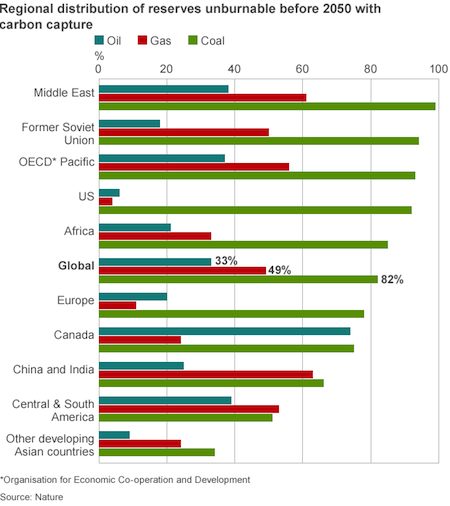

• Most Fossil Fuels Are ‘Unburnable’ (BBC)

Most of the world’s fossil fuel reserves will need to stay in the ground if dangerous global warming is to be avoided, modelling work suggests. Over 80% of coal, 50% of gas and 30% of oil reserves are “unburnable” under the goal to limit global warming to no more than 2C, say scientists. University College London research, published in Nature journal, rules out drilling in the Arctic. And it points to heavy restrictions on coal to limit temperature rises. “We’ve now got tangible figures of the quantities and locations of fossil fuels that should remain unused in trying to keep within the 2C temperature limit,” said lead researcher Dr Christophe McGlade, of the UCL Institute for Sustainable Resources.

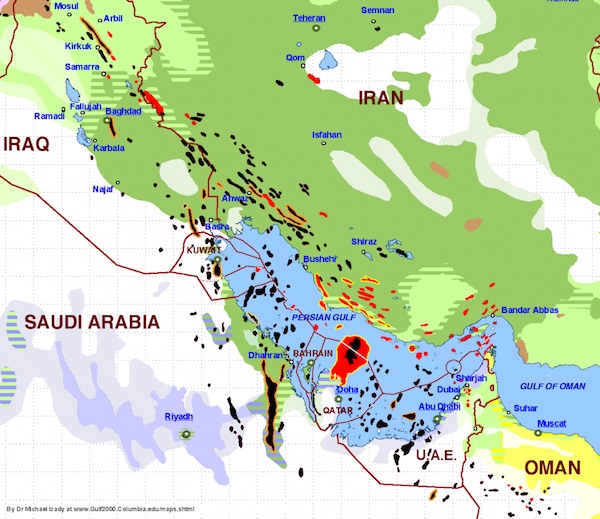

“Policy makers must realise that their instincts to completely use the fossil fuels within their countries are wholly incompatible with their commitments to the 2C goal.” Past research has found that burning all of the world’s fossil fuel resources would release three times more carbon than that required to keep warming to no more than 2C. The new study uses models to estimate how much coal, oil and gas must go unburned up to 2050 and where it can be extracted to stay within the 2C target regarded as the threshold for dangerous climate change. The uneven distribution of resources raises huge dilemmas for countries seeking to exploit their natural resources amid attempts to strike a global deal on climate change:

• The Middle East would need to leave about 40% of its oil and 60% of its gas underground

• The majority of the huge coal reserves in China, Russia and the United States would have to remain unused

• Undeveloped resources of unconventional gas, such as shale gas, would be off limits in Africa and the Middle East, and very little could be exploited in India and China

• Unconventional oil, such as Canada’s tar sands, would be unviable.

The research also raises questions for fossil fuel companies about investment in future exploration, given there is more in the ground than “we can afford to burn”, say the UCL scientists. “We shouldn’t waste a lot of money trying to find fossil fuels which we think are going to be more expensive,” co-researcher Prof Paul Ekins told the BBC. “That almost certainly includes Arctic resources. It will certainly include a lot of the shale gas resources in Europe, which have not really been explored or exploited at all.”

Read more …

Different take on same story.

• The ‘Untouchable Reserves’ (BBC)

Is the “carbon bubble” wobbling in the face of a new assault? A paper in the journal Nature has lent support to the notion that combating climate change and developing more fossil fuels are mutually contradictory. Its key message is that keeping global temperature rise within 2C means leaving in the ground 80% of known coal reserves, 50% of gas and 30% of oil. The University College London authors invite investors to ponder whether $670bn, the amount they say was spent last year on seeking and developing fossil fuels, is a wise use of money if we can’t burn all the fuel we’ve already found.

The movement to divest from fossil fuel companies is being prompted by the small but increasingly influential NGO Carbon Tracker, which argues that investment has created a carbon bubble of fossil fuel assets that will be worthless if climate change is taken seriously. The managers of the Rockefeller fortune have heard its message and already divested from coal. The University of Glasgow’s investment fund will avoid fossil fuels altogether. NGO 350.org is gathering support for a similar campaign in the US, and Norway’s vast government pension fund is seeking to pressure companies to take their climate responsibilities more seriously.

Surprisingly, the Bank of England has also chipped in. It is conducting an enquiry into the risk of an economic crash if future climate change rules render coal, oil and gas assets worthless. The findings will be interesting; even if the enquiry team are alarmed by the potential extent of stranded assets, they can hardly make their case bluntly for fear of creating a stampede. To heap on the pressure, the talks leading to the prospective climate deal in Paris in December will debate whether fossil fuels can be completely phased out by 2050. Oil firms like Shell have stated their confidence in the energy status quo that has formed the economic bedrock of modern society and helped billions out of poverty. They say they see no risk to their business model (because executives privately do not believe that politicians will keep their promises on carbon limits). And they have hopes that technology to capture and store carbon will give their products a new lease of life.

Read more …

This would save a lot of lives in the future. Then again, we’d start feeing them to farm animals, and restart the whole cycle.

• US Antibiotics Discovery Labelled ‘Game Changer’ For Medicine (BBC)

The decades-long drought in antibiotic discovery could be over after a breakthrough by US scientists. Their novel method for growing bacteria has yielded 25 new antibiotics, with one deemed “very promising”. The last new class of antibiotics to make it to clinic was discovered nearly three decades ago. The study, in the journal Nature, has been described as a “game-changer” and experts believe the antibiotic haul is just the “tip of the iceberg”. The heyday of antibiotic discovery was in the 1950s and 1960s, but nothing found since 1987 has made it into doctor’s hands. Since then microbes have become incredibly resistant. Extensively drug-resistant tuberculosis ignores nearly everything medicine can throw at it. The researchers, at the Northeastern University in Boston, Massachusetts, turned to the source of nearly all antibiotics – soil. This is teeming with microbes, but only 1% can be grown in the laboratory.

The team created a “subterranean hotel” for bacteria. One bacterium was placed in each “room” and the whole device was buried in soil. It allowed the unique chemistry of soil to permeate the room, but kept the bacteria in place for study. The scientists involved believe they can grow nearly half of all soil bacteria. Chemicals produced by the microbes, dug up from one researcher’s back yard, were then tested for antimicrobial properties. The lead scientist, Prof Kim Lewis, said: “So far 25 new antibiotics have been discovered using this method and teixobactin is the latest and most promising one. “[The study shows] uncultured bacteria do harbour novel chemistry that we have not seen before. That is a promising source of new antimicrobials and will hopefully help revive the field of antibiotic discovery.”

Read more …