Harris & Ewing Staircase in the Capitol, Albany, New York 1905

So PIMCO was going to fire Bill Gross over the weekend, and he chose to leave on his own accord and work for Janus. So what? Gross is 70 years old and still joins another firm geared towards making money, and nothing else at all. As if making money, and nothing else, is a valid goal in a human life.

As if someone who’s done nothing else his entire life, and who’s richer than Croesus, should have nothing else to do with the times that remains him, and is somehow right and justified about not being able to find anything more worthwhile.

As if that singular focus does not make his life a useless one, or the man an empty shell. And yeah, I’m sure he gives away some cash from time to time to make himself feel even better. Though I doubt he ever feels truly fine. Perhaps the disappointment of being a billionaire and still feel like he’s wasted his life is what drives him on. Or maybe his wife beats him. And he enjoys it.

And it’s not just Bill Gross, it’s just as much the way the mainstream press covers the ‘event’ of Gross’ departure, the fact that they bother to cover it in the first place, and the details they focus on, that shine a chillingly clear cold and revealing light on what we have become, as individuals and as societies.

The hollow single-minded worshipping of money, which Gross can be said to embody, is the single biggest scourge on each and every one of us, on all the bonds we form between each other, on the communities and nations we live in, and the planet they’re located on. The bible is full of allusions to this, and the world is full of people who call themselves Christians, but the twain are like ships passing in the night.

if you would want to prevent a war, or you want to stop the destruction of rivers and seas through pollution, or for the earth’s climate from entering a cycle that neither we nor the climate itself can control, would you think first of people like Bill Gross when you’re looking for support? If you do, that would not be wise. Nevertheless, at every single climate conference it’s people just like him, such as Bill Clinton and Bill Gates, who made sure they’re in the spotlight.

People who’ve never done anything in their lives that was not directed at self-gratification. People who cause, not prevent, the mayhem. Even the big demonstrations last week were shrouded in a veil of corporatism, not unlike the one Greenpeace has been enveloped in for many years.

And of course you can argue that it serves a purpose, because it’s the only way to get people pout on to the street. But still, if millions of dollars have to be spent to make a few hundred thousand people in New York leave their homes, what exactly are we doing?

Where does that money come from? Does anyone want to deny that in general the richer people in the world are the ones responsible for the destruction? That we ourselves cause more damage than the average Bangla Deshi or Senegalese, and that the richest and most powerful people in our own societies do more harm than the poorset?

If you don’t want to deny that, why do you walk in a heavily sponsored protest march? Or does anyone think those marches are spontaneous eruptions of people’s true feelings anymore? Why then do they feel scripted, in a way the anti-globalization ones (Seattle) absolutely did not?

There is no doubt that there are well-meaning people involved, and a lot of grass-roots identity, but isn’t there something wrong the very moment money becomes a factor, if and when we can agree that the pursuit of money is the 8 million ton culprit in the room in the first place? Do we really feel like we can’t achieve anything without money anymore? And moreover, shouldn’t we, as soon as we feel that way, start doing something about it?

There’s a nice interview in Slate with Naomi Klein, who says capitalism is the bogey man. I find that a little easy; in the end man him/herself is the bogey man. Klein sits on the board of Bill McKibben’s 350.org, which I have no doubt is full of people full of best intentions, but which also sees money as way to achieve things:

Naomi Klein Says We Must Slay Capitalism to Fight Climate Change

Everybody that’s trying to get anything progressive done in this country knows that the biggest barrier is getting money out of politics. Climate can be a shot of adrenaline in the pre-existing movement to get money out of politics. So, it’s not a brand-new movement. [..] All these new reports say that the transition to that next economy will be cheap. So why isn’t it happening? Elites like to think of everything as a win-win, but it’s not true.* It’s the wealthiest corporations on the planet that will win; everyone else will lose. No number of reports is going to change that. You actually need a counter-power.

[..] we need to finance this transition somehow. I think it needs to be a polluter-pays principle. It’s not that we’re broke, it’s just that the money is in the wrong place. The divestment movement is a start at challenging the excesses of capitalism. It’s working to delegitimize fossil fuels, and showing that they’re just as unethical as profits from the tobacco industry. Even the heirs to the Rockefeller fortune are now recognizing this. The next step is, how do we harness these profits and use them to help us get off fossil fuels?

Exxon needs to pay—it’s the most profitable company on the planet. It’s also the descendent of Standard Oil. In the book, I talk a lot about Richard Branson’s pledge to donate all the profits from his airline to fight climate change. When he made that announcement, it was extraordinary. The problem is, no one held him accountable—well, besides me and my underpaid researcher. But at least Branson’s heart was in the right place. These profits are not legitimate in an era of climate change. We can’t leave this problem to benevolent billionaires.

‘Getting money out of politics’, but ‘we need to finance this transition somehow’. There’s a grand contradiction in there somewhere. Now, I’m a big admirer of Naomi, her Shock Doctrine is one of the greatest books in the past 25 years or so. But I have my questions here.

I don’t think you can argue that capitalism itself is the issue. This is about the erosion of checks and balances, laws and regulations, the erosion of a society’s ability to hold people responsible for what they do, whether they operate in the political field or in private business.

And those same issues are just as relevant in any communist or socialist society. Unless you’re very careful day after 24/7 day, all political systems tend towards ceding control to ever more psychopatic individuals. In the exact same way that bad money drives out good. In short, it’s not about ‘them’, it’s about us. It’s the psychos who want that power and that money more than anyone else, but it’s us who let them have it. While we’re watching some screen or another.

It’s about how we can keep the most money- and power hungry individuals amongst us from ruling over us. An obviously daunting task if you look at most countries, corporations and organizations today. I mentioned the three Bills already, Bill Gross, Bill Clinton and Bill Gates, and they epitomize as fittingly as any threesome where and how we go wrong, and how hard it is to keep ourselves from doing that.

If you want a better world, A) stop listening to the crazy clowns, and B) stop telling yourself you care and then just keep doing what you always did. Get real. Pursue truth, not money.

• Bonds Worldwide Pull Out of Tailspin This Week on Growth Concern (Bloomberg)

Bonds worldwide pulled out of a tailspin this week as a surging dollar sparked warnings from Federal Reserve officials that the stronger currency may hamper the U.S. recovery. The Bloomberg Global Developed Sovereign Bond Index (BGSV) headed for its first weekly gain this month, buoyed by speculation weak economic growth in Europe and Japan will spur policy makers there to maintain stimulative monetary policy. The gauge advanced 0.2%, trimming September’s decline to 2.7%. Yields attracted investors after climbing last week when Fed policy makers increased their estimate for how far they’ll raise borrowing costs next year.

“The speed in the rise of interest rates in response to the Federal Reserve, and also gains in the U.S. dollar, have had an impact on demand for Treasuries,” said Tony Morriss, an interest-rate strategist at Bank of America Merrill Lynch in Sydney. While the stronger dollar may damp U.S. growth, unprecedented easing in Japan and Europe have also “served to reverse some of the sharp rise in yields that we saw earlier.” The company’s Merrill Lynch unit is one of the 22 primary dealers that trade directly with the Fed. The U.S. 10-year yield was little changed at 2.50% at 6:56 a.m. in London, according to Bloomberg Bond Trader data. The price of the 2.375% note due August 2024 was 98 29/32. The yield rose to 2.65% on Sept. 19, the highest since July 7. It has dropped eight basis points this week. The Bloomberg Dollar Spot Index, which tracks the U.S. currency against 10 of its major counterparts, rose to a four-year high yesterday.

Oh, you real man.

• Bank of England’s Carney: Rate Rise ‘Getting Close’ (Reuters)

The Bank of England is getting nearer to raising interest rates, but the exact date will depend on economic data, Governor Mark Carney said in a speech on Thursday. Carney stuck close to previous remarks on monetary policy in his address to actuaries, much of which focused on the BoE’s plans for further regulating insurers. Britain’s economic outlook was much improved, and a rate rise was only a matter of time, Carney said. “The point at which interest rates … begin to normalise is getting closer,” he said. “In recent months the judgement about precisely when to raise Bank Rate has become more balanced. While there is always uncertainty about the future, you can expect interest rates to begin to increase.”Most economists expect the Bank of England to raise rates early next year, though a minority see a chance of an increase in November. Two members of the BoE’s Monetary Policy Committee voted for a rate rise this month.

Britain’s economy looks set to grow by more than 3% this year – faster than any other big, advanced economy – and unemployment has fallen to its lowest level since 2008. But inflation of 1.5% is well below the BoE’s 2% target, and wages are growing even more slowly – something the BoE has cited as a reason to keep rates on hold. Carney said that when rate rises did come, he expected them to be gradual, and for rates to peak below pre-crisis levels. “Headwinds facing the economy are likely to take some time to die down,” he said. “Demand in our major export markets remains muted. Public balance sheet repair is ongoing. And a highly indebted private sector is likely to be particularly sensitive to changes in interest rates.”

This is the reality of Europe (and the US, Japan): you can’t force people to borrow. Therefore, you will have deflation. If people don’t spend, it’s inevitable.

• Draghi’s Trillion-Euro Pump Finds Blockage in Spain (Bloomberg)

Mario Draghi’s plan to channel as much as €1 trillion ($1.3 trillion) into the euro region’s economy is running into a blockage: some companies in the countries hardest hit by the debt crisis don’t want the money. “We’re getting calls from lenders every day,” said Miquel Fabre, 34, whose family-run beauty products firm Fama Fabre employs 43 people in Barcelona. “They can see that they’ll benefit from a loan because we’re doing good business and will return the money. Whether it’s in our interest as well is a different question.” Many small and medium-sized businesses are wary of the offers from banks as European Central Bank President Draghi prepares to pump more cash into the financial system to boost prices and spur growth. The reticence in Spain suggests demand for credit may be as much of a problem as the supply. The monthly flow of new loans of as much as €1 million for as much as a year – a type of credit typically used by small and medium-sized companies – is still down by two-thirds in Spain from a 2007 peak, according to Bank of Spain data.

The total stock of loans is almost 470 billion euros below the 2008 record of €1.87 trillion, the figures show. Spanish bonds rose for a third day yesterday, with 10-year yields dropping to 2.11%, after further evidence that Draghi may have to resort to buying government debt to get cash into the economy. The ECB’s latest attempt to funnel money through the financial system with a targeted-loans offer, known as TLTRO, was shunned by banks on Sept. 18. That’s not to say banks aren’t making an effort to attract borrowers. Banco Popular Espanol SA (POP), a Spanish lender that borrowed €2.85 billion from the TLTRO, started an advertising campaign this month using Spanish NBA basketball star Pau Gasol to target smaller companies. In the first six months, Popular boosted lending to that group by 6% and is aiming for a 10% increase for all of 2014. Across the economy, small business loans at 12.9 billion euros in July were the highest in more than two years, while still just a third of the peak volume.

Make that ‘will’.

• Draghi May Discover Weaker Euro Doesn’t Buy Enough Recovery (Bloomberg)

Mario Draghi may find a falling currency can’t buy much of an economic recovery. The euro has dropped toward a two-year low against the dollar since the European Central Bank president boosted stimulus earlier this month. Economics textbooks say that should lift Europe’s struggling growth rate by boosting exports and speed inflation by raising import prices. Such effects will be more welcome if falling commodities deal a disinflationary blow. It’s time for those textbooks to be revised, according to economists at Societe Generale SA led by Michala Marcussen, who reckon a devaluation of the euro will not be as stimulatory as it once was and perhaps as much as the ECB is hoping. For one thing, the single currency may not be that weak yet. While it has fallen 7.5% against the dollar this year, it has slipped just 4% on a trade-weighted basis.

A deep decline may be hard to achieve. While the euro should keep falling against the dollar and sterling as the Federal Reserve and Bank of England shift toward higher interest rates, those currencies account for only about a third of the trade-weighted index. The monetary policies of Japan and China are almost just as important, with the yen and yuan accounting for a quarter of the euro’s value, according to Marcussen. With their central banks also dovish, the euro may have less far to fall against those currencies, meaning a 10% decline on a trade-weighted basis would require the single currency to drop below $1.15 and 70 pence. It was at $1.28 and 0.78 pence today. Another brake on any descent is that the euro’s long-term rate may actually have risen since the global financial crisis to $1.35 from $1.31, Societe Generale calculates. That’s because in aggregate the euro area is running a current-account surplus and its budget deficit and debt are lower than in other major economies.

But won’t.

• Debt Forgiveness Could Ease Eurozone Woes (Guardian)

The eurozone debt crisis never went away. It merely acquired a misleading veneer of resolution, thanks to grand promises, political chest-thumping and frazzled financial markets that were desperate to believe in happily ever after. Today, there is an accentuated sense of deja vu (all over again, as Yogi Berra would concur). Europe faces the spectre of deflation. Some members, such as Italy, have toppled over the edge for the first time in more than half a century; Germany threatens recession; France is a basket case. Wages are in decline across club Med: real hourly wages in Greece, Spain and Ireland recently fell for the fourth year in succession. Meanwhile, bank lending is an aspiration and Banco Espirito Santo is an ugly reminder of the iceberg of bad debts lurking. Good Europeans are in decline while populism, nationalism and jingoism are les belles du jour.

Enter quantitative easing (QE) as the white knight, as envisaged by the European central bank. This is fast becoming a modern-day rain dance. QE is not a cure. It is a shot of morphine that sedates an ailing patient while doctors figure out what to do in the long term. Like most opiates, the patient is elated and euphoric. Leaving aside “niggles” like the Germans and the moral hazard of whose sovereign bonds to buy, there is no reason why financial markets should not rally if QE proceeds. Our limited sample over the past few years proves this. But asset-price inflation and falling bond yields are poor substitutes for long-run economic growth and, arguably, even antithetical, thanks to the punishing bubbles they risk creating.

Europe has a singular problem – it has far too much debt. And in a globalised world, much of this debt is bound in a complex web, particularly among the weaker economies – namely Portugal, Ireland, Italy, Greece and Spain – and their main creditors: France, Germany, the UK and the US. For example, more than half of Portugal’s foreign debt claims are held by Spain, while Italy owes French banks about $373bn – almost a seventh of France’s GDP. And, lest we forget, Italy also has the third-largest sovereign bond market in the world. This is a game of dominoes. Any solution that does not involve large-scale debt forgiveness is doomed to failure. In the 1920s, an ambitious scheme of credit easing – the Dawes plan – to tackle the intractable debts left by the first world war fuelled an enormous bubble that ended in the great depression, as the underlying reality of sovereign insolvency became clear. It also created a fertile political climate for the nationalism that ended so disastrously more than a decade later. Money is divisive when things turn sour.

Hmmm.

• “The Fed Gig Is Up” (Scotiabank)

In a switch from what are typically only one-sidedly dovish comments, NY Fed President Dudley was balanced this week, even citing reasons for why the Fed would want to hike rates. Dudley stated that “being at the zero-lower-bound is not a very comfortable place to be”, because it “limits” flexibility and has “consequences for the economy”. He said it “hurts savers”, and while acknowledging “what is happening” to financial markets, he avoided directly citing risks to financial stability. Anxiety-riddled conversations about financial instability are probably implicitly restricted to a ‘behind-closed-doors-only’ rule. FOMC members are slowly and carefully trying to change the conversation. Yellen completely diluted away any meaning behind “considerable period” to make it all but meaningless. Bullard said to that he still “sees the first tightening at the end of the first quarter”.

A March 18th hike seems reasonable to me, since US economic improvement appears to remain on track (at least for the moment) and since the FOMC seems more anxious to begin the normalization process. Actually though, by waiting even until March, it is possible that the FOMC risks missing its window of opportunity in terms of using US economic momentum as its cover (what irony). Financial markets are becoming agitated and disturbed by shifting government and central bank policies, mounting geo-political tensions, and rising nationalist fervor. QE has not yet ended and the Fed is likely still months away from hiking for the first time, but markets are using these factors to adjust portfolio exposures. These are hints that a larger market reaction is likely to unfold as the Fed’s policy transition approaches.

Macro signs are currently evident with steep commodity price declines, rising FX volatility, rallying global bond markets (long end), and sagging prices for low quality credits. Some investors are clearly getting out of the Fed-generated “herd” trades of recent years and saying that they are doing so because “the Fed’s balance sheet is set to stop expanding next month”. The strengthening dollar is one consequence and it has already had an impact on commodities and Emerging Markets. In turn, weakening currencies in EM countries are starting to trigger capital outflows. It may lead toward domestic central bank hikes (again) which weaken those economies and cause second-order effects.

• 5 US Banks Each Have More Than $40 Trillion Exposure To Derivatives (Snyder)

When is the U.S. banking system going to crash? I can sum it up in three words. Watch the derivatives. It used to be only four, but now there are five “too big to fail” banks in the United States that each have more than $40 trillion in exposure to derivatives. Today, the U.S. national debt is sitting at a grand total of about $17.7 trillion, so when we are talking about $40 trillion we are talking about an amount of money that is almost unimaginable. And unlike stocks and bonds, these derivatives do not represent “investments” in anything. They can be incredibly complex, but essentially they are just paper wagers about what will happen in the future. The truth is that derivatives trading is not too different from betting on baseball or football games.

Trading in derivatives is basically just a form of legalized gambling, and the “too big to fail” banks have transformed Wall Street into the largest casino in the history of the planet. When this derivatives bubble bursts (and as surely as I am writing this it will), the pain that it will cause the global economy will be greater than words can describe. If derivatives trading is so risky, then why do our big banks do it? The answer to that question comes down to just one thing. Greed. The “too big to fail” banks run up enormous profits from their derivatives trading. According to the New York Times, U.S. banks “have nearly $280 trillion of derivatives on their books” even though the financial crisis of 2008 demonstrated how dangerous they could be…

Problem, not solution.

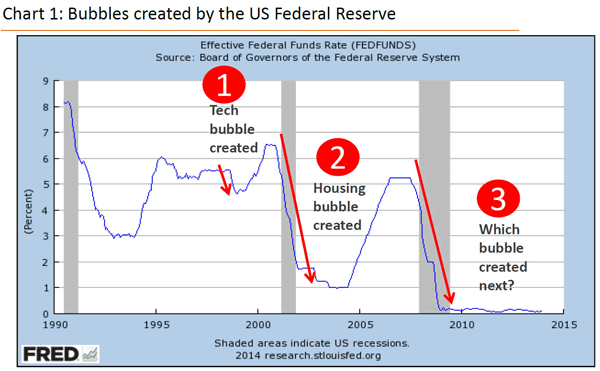

• Federal Reserve Policies Cause Booms and Busts (Mises.org)

Since the economic crisis of 2008-2009, the Federal Reserve — America’s central bank — has expanded the money supply in the banking system by over $4 trillion, and has manipulated key interest rates to keep them so artificially low that when adjusted for price inflation, several of them have been actually negative. We should not be surprised if this is setting the stage for another serious economic crisis down the road. Back on December 16, 2009, the Federal Reserve Open Market Committee announced that it was planning to maintain the Federal Funds rate — the rate of interest at which banks lend to each other for short periods of time — between zero and a quarter of a%age point.

The Committee said that it would keep interest rates “exceptionally low” for an “extended period of time,” which has continued up to the present. Beginning in late 2012, the then-Fed Chairman, Ben Bernanke, announced that the Federal Reserve would continue buying US government securities and mortgage-backed securities, but at the rate of an enlarged $85 billion per month, a policy that continued until early 2014. Since then, under the new Federal Reserve chair, Janet Yellen, the Federal Reserve has been “tapering” off its securities purchases until in July of 2014, it was reduced to a “mere” $35 billion a month.

In her recent statements, Yellen has insisted that she and the other members of the Federal Reserve Board of Governors, who serve as America’s monetary central planners, are watching carefully macro-economic indicators to know how to manage the money supply and interest rates to keep the slowing general economic recovery continuing without fear of price inflation. Some of the significant economic gyrations on the stock markets over the past couple of months have reflected concerns and uncertainties about whether the Fed’s flood of paper money and near zero or negative real interest rates might be coming to an end. In other words, borrowing money to undertake investment projects or to fund stock purchases might actually cost something, rather than seeming to be free.

• Pimco ETF Probe Spotlights $270 Billion Market Vexing Regulators (Bloomberg)

The U.S. regulatory probe into Bill Gross’s Pimco Total Return ETF is highlighting an industry that supervisors say may pose an increasing risk to the stability of the bond market. The assets held by bond exchange-traded funds have ballooned to more than $270 billion from about $57 billion at the end of 2008 as hedge funds to retirees sought quick and easy access to debt markets, according to data compiled by the Investment Company Institute. While the amount is still a pittance compared to the $38 trillion U.S. bond market, trading in ETFs is fueling price swings that may become more severe in a downturn — particularly for the most illiquid markets, like speculative-grade debt. Regulators are examining the danger it will be more difficult than investors expect to get out of the funds in a falling market.

“The ETF market will be the tail that wags the dog,” said Mark Pibl, head of research and fixed-income strategy at Canaccord Genuity in New York. As assets managed by ETFs of all types more than tripled since 2008 to $1.8 trillion, the fastest-growing product in the money-management industry is drawing scrutiny from regulators. While ETFs have shares that trade like stocks on exchanges, bonds often trade in transactions that are negotiated by telephone and through e-mails.

How is this a question?

• Is Big Business Too Influential? (CNBC)

People from emerging economies are much more comfortable in strong corporations having influence over government than in developed nations, a CNBC/Bursen-Marsteller poll survey has found. Most emerging markets’ respondents –whether from the public or executives – surveyed in the CNBC/Bursen-Marsteller poll on the Global Corporate Compass viewed strong and influential corporations as engines for innovation and economic growth. However, in the developed world, opinion was split. Indeed, in seven out of the 13 developed nations included in the survey, the public believe that strong and influential corporations “rig the system so that they do not have to act responsibly,” the survey reported. These include economic powerhouses such as the U.S., U.K., Germany and Hong Kong. Surprisingly, people in France and Italy sided with emerging markets in their belief that strong and influential businesses can boost the economy.

For Tamsin Cave, director of Spinwatch and author of “A quiet Word: Lobbying, Crony Capitalism and Broken Politics in Britain”, there’s now a “growing disquiet among the public (in the developed world) about this relationship between government and big business”. The public in the U.K., she added, feels that there is a disconnect between politicians and the public. “The public voice isn’t heard because of the enormity of what is a corporate lobbying industry – worth something like £2 billion ($3.2 billion) in the country,” she said. Even executives across the developed world were of two minds with C-suite respondents in Germany, Italy, Singapore and Australia describing strong and influential corporations as bad. “I have a saying”, said Gary Greenberg, head of emerging markets at Hermes. “The way you can tell the difference between emerging markets and developed markets is that in emerging markets the government controls the banks whereas in developed markets it is the opposite!”

Chiecken and the egg.

• Australia Kills Civil Liberties with Draconian New Anti-Terror Law (Krieger)

Understanding how the power structure thinks, and how it intentionally manipulates the emotions of the masses, is key to overcoming and rolling back totalitarian ambitions. I have spent the last few posts talking about how instilling fear throughout the general populace is one of their primary tactics. Indeed, to borrow a term from Glenn Greenwald, “fear-manufacturing” has been in overdrive across the Five Eyes nations over the past several weeks. In the UK, we saw it used to convince elderly Scots to overwhelming vote against independence, thus swaying the result decisively to the NO side. In the USA, we have seen it used to drum up support for another pointless war in the Middle East, which will benefit nobody except for the military/intelligence-industrial complex. While these examples are bad enough, nowhere is fear being used in a more clownish and absurd manner to strip the local citizenry of its civil liberties than in Australia. This should come as no surprise, considering that nation’s Prime Minister is a certified raging lunatic.

“National home prices rose an annualized 16.8% in the three months to August”. Not a bubble, right? That doubles ± every 4.5 years.

• Is Australian Housing Facing A Repeat Of 2003? (CNBC)

Australia’s property market is approaching the bubble extremes seen a decade ago, an analyst told CNBC, after the Reserve Bank of Australia (RBA) warned this week that the market looks ‘unbalanced’. “There was an intense bubble in the property market a decade ago. There were property ‘spruikers’ out there encouraging people to buy five properties at a time – everyone was buying property magazines and all the top rated shows on TV were property related,” Shane Oliver, head of investment strategy and chief economist at AMP Capital, told CNBC. “We haven’t quite returned to the extremes we had back then but we’re getting close and that’s why the RBA is getting concerned,” he said. “Danger signs are emerging.”

A low interest rate environment and strong price competition among lenders have led to a surge in investment property, raising the risk of a repricing, the RBA said in its Financial Stability Review on Wednesday. National home prices rose an annualized 16.8% in the three months to August after a cooler period in the first half of the year. Meanwhile, prices in Sydney and Melbourne rose 16 and 11%, respectively, over the past 12 months according to RP data. As a result, the RBA said it is considering measures to cool property investment that could include macro-prudential controls or credit restrictions designed to reinforce sound lending practices.

Provocation.

• Ukraine Pushes for NATO Membership as Gas Talks Commence (Bloomberg)

Ukraine kick-started the process to strengthen its ties with NATO and will strive to join the alliance in the “short term,” its government said, a day after its president declared the worst of its separatist war was over. The country of more than 40 million people is scheduled to hold talks today in Berlin to resolve a dispute over natural gas supply before the onset of winter. Russia stopped selling the fuel to Ukraine in June without pre-payment after raising the price 81%, which has prompted officials in Kiev to urge companies and households to cut consumption. Russian gas exporter OAO Gazprom (GAZP) says Ukraine owes it $5.3 billion.

Ukraine’s push to end its neutral status and join the North Atlantic Treaty Organization will probably exacerbate the worst standoff between Russia and its former Cold War foes since the fall of the Iron Curtain. Sporadic fighting between pro-Russian rebels and government troops in the eastern Donetsk region of the former Soviet Republic is threatening a shaky cease-fire reached three weeks ago. “The cabinet has submitted a draft law to parliament that envisages the cancellation of our non-aligned status and ensuring a European integration course to create grounds for Ukraine’s integration into the Euro-Atlantic security space,” the administration in Kiev said in an e-mailed statement today. “Ukraine’s government underlines that Ukraine’s aim is to receive special partner status with NATO now and membership in the short term.”

Because it would force him to drive Kiev, which can’t survive without Moscow, into the ground, by cutting trade even more..

• Putin Demands Reopening Of EU Trade Pact With Ukraine (FT)

)Vladimir Putin has demanded a reopening of the EU’s recently-ratified trade pact with Ukraine and has threatened “immediate and appropriate retaliatory measures” if Kiev moves to implement any parts of the deal. The demand, made in a letter to European Commission President José Manuel Barroso, reflects Russia’s determination to put a brake on Ukraine’s integration into Europe and other Euro-Atlantic organisations such as Nato, even after annexing Crimea and creating a pro-Russian separatist entity in the east of the country. It also comes amid a fresh crackdown on Russia’s oligarchs, exemplified by the recent house arrest of billionaire businessman Vladimir Yevtushenkov, which was extended by a court on Thursday.

The integration treaty was the spark that set off the 10-month Ukraine crisis after the country’s then-president, Viktor Yanukovich, backed out of the deal. Petro Poroshenko, the new Ukrainian president, has made integration with the EU a key objective of his presidency. But this is strongly opposed by Moscow, which is determined to keep Ukraine within its own economic sphere of influence. Mr Putin’s letter argues that a 15-month delay in implementing part of the deal – which Kiev and the EU agreed to earlier this month – should be used to “establish negotiating teams” to make wholesale changes to the deal.

1+1=2.

• Russia Mulls Draft Law To Allow Seizure Of Foreign Assets (Reuters)

Russian courts could get the green light to seize foreign assets on Russian territory under a draft law intended as a response to Western sanctions over the Ukraine crisis. The draft, which was submitted to parliament on Wednesday by a pro-Kremlin deputy, would also allow state compensation for an individual whose property is seized in foreign jurisdictions. Italian authorities this week seized property worth about 30 million euros ($40 million) belonging to companies controlled by Arkady Rotenberg, an ally of President Vladimir Putin targeted by the U.S. and European Union sanctions. The draft law, published on a parliamentary database, would allow for compensation for Russian citizens who suffer because of an “unlawful court act” in a foreign jurisdiction and clear the way to foreign state assets in Russia being seized, even if they are subject to international immunity.

Don’t think he’s far off.

• Iran’s Rouhani Blames Intelligence Agencies For Rise In Extremism (RT)

The rise of violent extremism around the world is the fault of “certain states” and “intelligence agencies” that have helped to create it and are failing to withstand it, Iranian President Hassan Rouhani said in an address to the UN General Assembly. Speaking at the 69th session of the UN General Assembly on Thursday, Rouhani stressed that extremism is not a regional but a global issue, and called on states worldwide to unite against the extremists. “Certain states have helped to create it, and are now failing to withstand it. Currently our peoples are paying the price,” he said. “Certain intelligence agencies have put blades in the hand of the madmen, who now spare no one.” Rouhani also said the current anti-Western sentiment in certain parts of the world was “the offspring of yesterday’s colonialism. Today’s anti-Westernism is a reaction to yesterday’s racism.”

The Iranian president urged “all those who have played a role in founding and supporting these terror groups” to acknowledge their mistake. Rouhani also blamed “strategic blunders of the West in the Middle East, Central Asia and the Caucasus” for inciting violence in these regions and creating a “haven for terrorists and extremists.” “Military aggression against Afghanistan and Iraq and improper interference in the developments in Syria are clear examples of this erroneous strategic approach in the Middle East.” Warning that “if the right approach is not undertaken in dealing with the issue at hand” the Middle East risks turning into “a turbulent and tumultuous region with repercussions for the whole world.” “The right solution to this quandary comes from within the region and regionally provided solution with international support and not from the outside the region,” he said.

Chasing money.

• How Australia Became The Dirtiest Polluter In The Developed World (Slate)

Australians like to think of themselves as green. Their island country boasts some 3 million square miles of breathtaking landscape. They were an early global leader in solar power. They’ve had environmental regulations on the books since colonial times. And in 2007 they elected a party and a prime minister running on a “pro-climate” platform, with promises to sign the Kyoto Protocol and pass sweeping environmental reforms. All of which makes sense for a country that is already suffering the early effects of global warming. And yet, seven years later, Australia has thrown its environmentalism out the window—and into the landfill. The climate-conscious Labor Party is out, felled by infighting and a bloodthirsty, Rupert Murdoch–dominated press that sows conspiracy theories about climate science.

In its place, Australians elected the conservative Liberal Party, led by a prime minister who once declared that “the climate argument is absolute crap.” In the year since they took office, Prime Minister Tony Abbott and his Liberal-led coalition have already dismantled the country’s key environmental policies. Now they’ve begun systematically ransacking its natural resources. In the process, they’ve transformed Australia from an international innovator on environmental issues into quite possibly the dirtiest country in the developed world. And in a masterful whirl of the spin machine, they’ve managed to upend public debate by painting climate science as superstition and superstition as climate science. (We should note here that one of us grew up in Australia.)

The country’s landmark carbon tax has been repealed. The position of science minister has been eliminated. A man who warns of “global cooling” is now the country’s top business adviser. In November, Australia will host the G-20 economic summit; it plans to use its power as host to keep climate change off the official agenda. If the environment has become Australia’s enemy, fossil fuels are its best friend once again. Two months after it struck down the carbon tax, the government forged a deal with a fringe party led by a mining tycoon to repeal a tax on mining profits. It appointed a noted climate-change skeptic—yes, another one—to review its renewable energy targets.

I wrote many years ago that is the only way. Not that communism or socialism is any better. Any system aimed at growth will do it.

• Naomi Klein Says We Must Slay Capitalism to Fight Climate Change (Slate)

Q: On Sunday, more than 300,000 people were in the streets in New York. In stark contrast, Tuesday’s U.N. Climate Summit didn’t accomplish much. How do you feel about “progress” toward a climate treaty through official U.N. channels?

A: It’s been quite an amazing week. [Sunday’s march] was, I think, a real turning point. A lot of debates have sharpened up a bit. I’m excited. After the march, it was kind of jarring to go to the U.N. I definitely did not get the feeling that they were even managing to convince themselves. Some shit-disturber decided it would be a good idea to invite me into the private-sector portion of the U.N. summit Tuesday, which had unprecedented participation from CEOs. It was definitely the highest net-worth room I’ve ever been in. They were conducting what amounted to a telethon for the Earth. It was pretty unimpressive.

Q: I think U.N. countries officially pledged a little more than $1 billion to the fund designed to help low-income nations adapt.

A: Yes, and I think almost all of it was from France. At one point in that room, there was a debate over whether France’s pledge was in euros or dollars. Yeah. It was in dollars.

Q: So what’s the next step in terms of climate action? How do we get from 300,000 in the streets to 30 million?

A: Everybody that’s trying to get anything progressive done in this country knows that the biggest barrier is getting money out of politics. Climate can be a shot of adrenaline in the pre-existing movement to get money out of politics. So, it’s not a brand-new movement. What excited me about Sunday is the huge participation from labor. People in that movement clearly see that a climate-justice agenda would be a serious benefit to their members. The post-carbon economy we can build will have to be better designed.