Vasily Polenov Moscow courtyard 1878

$15 billion is chump change.

• Turkish Lira Rallies As Qatar Makes $15bn Loan Pledge (G.)

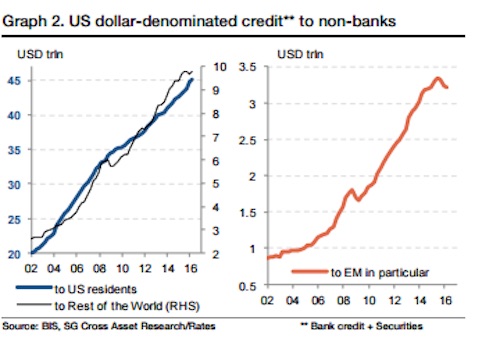

Turkey’s beleagured currency has bounced back from record lows after Qatar pledged to shore up the banking sector’s shaky finances with loans worth $15bn. A week after a diplomatic spat with the US sent the lira into a tailspin, the agreement with Qatar was calculated to help Turkey avoid having to ask the IMF for emergency funding. Officials in Ankara said the Qatari money would be “channeled into Turkey’s financial markets and banks”, with the implication that the investment would be enough to head off a banking collapse. However, while the investment gave the Turkish lira much-needed respite, the US president Donald Trump’s announcement of further trade sanctions against Ankara, along with concerns about the rising value of the dollar and weak profits in Chinese tech firms, sent global financial markets into reverse.

[..] Mohamed A El-Erian, the chief economic adviser at the German insurer Allianz, tweeted that Erdogan’s policies, including the Qatari investment, would act like sticking plaster, leaving the possibility open for an IMF rescue. He said: “This is part of the Turkish government’s strategy to avoid the IMF by finding alternative external support. To be a sustainable stabilizer, funding needs to be larger and reach the central bank.” However, the lira rallied by 6% after the Qatari pledge and a separate move by Turkey’s central bank to boost the finances of the country’s banks. In an effort to defend the lira, Turkey’s central bank tightened its rules on currency swaps and other foreign exchange transactions, limiting the ability of banks to supply lira to foreign financial companies.

It’s hardly ever a good sign when short sellers are curtailed. Question is why are they shorting?

• Turkey Slashes Capacity Of Banks To Bet Against Struggling Lira (CNBC)

Action by Turkey’s banking regulator has stymied investor ability to buy and short the lira, helping the currency to gain value in overnight trade. The Banking Regulation and Supervision Agency (BRSA) has reduced the amount of swap market contracts that offshore banks can undertake, reducing their access to the beleaguered currency. A swap is where on flow of cash income, usually a fixed or steady rate, is swapped for a typically riskier flow of income. The derivative contract is set for a fixed period. The BRSA has stipulated that banks now cannot run swap contracts for no more than 25% of the equity that they hold. The figure was previously 50%.

BlueBay Asset Management strategist Timothy Ash said in a note Wednesday that Turkey’s central bankers had finally taken action to restrict international access to lira. “They are killing offshore TRY (lira) liquidity to stop foreigners shorting the lira,” he said before adding “why did they not do all this much earlier?” [..] This year the dollar has gained more than 60% in value versus the lira, and the Turkish currency has become the world’s worst performer this year.

Maybe Turkey simply needs the money?!

• Turkey Joins Russia In Liquidating US Treasuries (ZH)

Last month, when we reported that Russia had liquidated the bulk of its US Treasury holdings in just two months, we said that “we can’t help but wonder – as the Yuan-denominated oil futures were launched, trade wars were threatened, and as more sanctions were unleashed on Russia – if this wasn’t a dress-rehearsal, carefully coordinated with Beijing to field test what would happen if/when China also starts to liquidate its own Treasury holdings.” As it turns out, Russia did lead the way, but not for China. Instead, another recent US foreign nemesis, Turkey, was set to follow in Putin’s footsteps of “diversifying away from the dollar”, and in the June Treasury International Capital, Turkey completely dropped off the list of major holders of US Treasurys, which has a $30 billion floor to be classified as a “major holder.”

According to the US Treasury, Turkey’s holdings of bonds, bills and notes tumbled by 52% since the end of 2017, dropping to $28.8 billion in June from $32.6 billion in May and $61.2 billion at the recent high of November of 2016. [..] The selloffs took place well before a diplomatic fallout between the US and both Turkey and Russia resulted in new sets of sanctions and tariffs imposed on both nations. The Trump administration last week imposed new sanctions against Russia in response to the nerve agent poisoning in the U.K. of a former Russian spy and his daughter. Meanwhile, the Turkish selloff certainly continued into July and August as U.S. relations with Turkey deteriorated this week

It‘s in Putin’s hands.

• Turkey Wants Its Share Of Syria’s Reconstruction (AlM)

Although Turkey publicly appears to sustain its anti-Bashar al-Assad stance on Syria, it is actually getting ready for a new Syria that will allow Assad to stay on as the country’s president. While a termination of the de facto Kurdish autonomy in northern Syria seems to be the first precondition for a possible normalization between Ankara and Damascus, there is another unspoken condition as well: the allotment of a share in Syria’s reconstruction. Naturally, the Assad administration does not have the intention to allot any share to Turkey, which is accused of supporting anti-regime military groups that have destroyed the country and looted Aleppo’s industrial zones. However, Turkey’s control of a sizable territory in northern Syria and its cooperation with Russia make it difficult for Damascus to exclude Turkey from these calculations.

Turkey’s influence over opposition groups that could have a bearing on the Geneva process can not be dismissed. Turkey has been able to preserve its most important trading partner position with Syria despite the seven-year-old conflict. Its geographical proximity to Syria, logistical superiority and advanced capacity of its construction sector encourages Turkey to obtain a substantial part in the reconstruction process. Moreover, Turkey is currently organizing local entities in al-Bab, Jarablus, Azaz, Cobanbey and Afrin that are de facto under its control. It is also setting up systems for security, education, religion and even issuing ID cards to residents. In addition it has started building a road network.

“The issues in Italy… in the next three months are going to dictate the whole European banking narrative for the next three to five years,”

• Italy, Not Turkey, Is The Biggest Threat To European Banks (CNBC)

The European Central Bank (ECB) was reported Friday to be concerned that the ongoing currency crisis in Turkey could result in problems for the continent’s banks. However, the real problem for Europe’s banking industry is Italy and what happens in that country in the coming months, an analyst said Tuesday. “The issues in Italy… in the next three months are going to dictate the whole European banking narrative for the next three to five years,” Tom Kinmonth, fixed income strategist at ABN Amro, told CNBC’s “Squawk Box Europe.” Italy’s economy is the third largest in the European Union and the country’s new coalition government is currently working on next year’s budget.

Its financial plan will be closely scrutinized by European authorities and, more importantly, by market players, following promises to increase public spending. Investors are wary of rises in pensions and state benefits, given that Italy already has a significantly high public debt pile — the second largest in the euro zone, at about 130% of GDP. If market players do not approve of the next budget, due around October, then borrowing costs for Italy are likely to go up, which in turn could affect neighboring European countries. It could also create problems for certain European banks that hold Italian debt.

And they’re still in business.

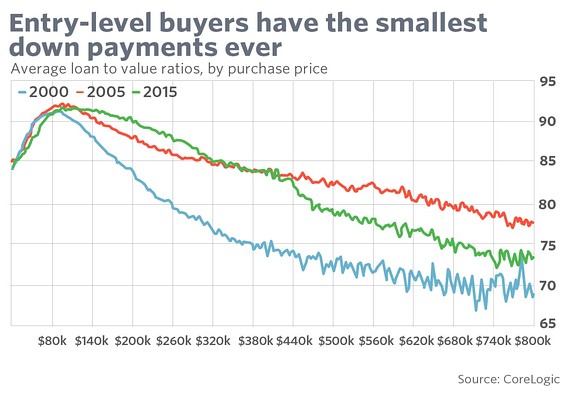

• RBS Bankers Joked About Destroying The US Housing Market (G.)

RBS bankers joked about destroying the US housing market after making millions by trading loans that staff described as “total fucking garbage”, according to transcripts released as part of a $4.9bn (£3.8bn) settlement with US prosecutors. Details of internal conversations at the bank emerged just weeks before the 10-year anniversary of the financial crisis, which saw RBS rescued with a £45bn bailout from the UK government. The US Department of Justice (DoJ) criticised RBS over its trade in residential mortgage backed securities (RMBS) – financial instruments underwritten by risky home loans that are cited as pivotal in the global banking crash. It said the bank made “false and misleading representations” to investors in order to sell more of the RMBS, which are forecast to result in losses of $55bn to investors.

Transcripts published alongside the settlement reveal the attitude among senior bankers at RBS towards some of the products they sold. The bank’s chief credit officer in the US referred to selling investors products backed by “total fucking garbage” loans with “fraud [that] was so rampant … [and] all random”. He added that “the loans are all disguised to, you know, look okay kind of … in a data file.” The DoJ said senior RBS executives “showed little regard for their misconduct and, internally, made light of it”. In one exchange, as the extent of the contagion in the banking industry was becoming clear, RBS’ head trader received a call from a friend who said: “[I’m] sure your parents never imagine[d] they’d raise a son who [would] destroy the housing market in the richest nation on the planet.” He responded: “I take exception to the word ‘destroy.’ I am more comfortable with ‘severely damage.’”

No chance until the whole thing collapses.

• Elizabeth Warren Unveils Bold New Plan To Reshape American Capitalism (G.)

Elizabeth Warren, the Massachusetts senator tipped as a Democratic presidential candidate in 2020, has unveiled new plans for legislation aimed at reining in big corporations, redistributing wealth, and giving workers and local communities a bigger say. Warren will introduce the bill dubbed the Accountable Capitalism Act on Wednesday. The proposal aims to alter a model she says has caused corporations to chase profits for shareholders to the detriment of workers. Under the legislation, corporations with more than $1bn in annual revenue would be required to obtain a corporate charter from the federal government – and the document would mandate that companies not just consider the financial interests of shareholders.

Instead, businesses would have to consider all major corporate stakeholders – which could include workers, customers, and the cities and towns where those corporations operate. Anyone who owns shares in the company could sue if they believed corporate directors were not meeting their obligations. Employees at large corporations would be able to elect at least 40% of the board of directors. An estimated 3,500 public US companies and hundreds of other private companies would be covered by the mandates. [..] Large companies dedicated 93% of their earnings to shareholders between 2007 and 2016 – a shift from the early 1980s, when they sent less than half their revenue to shareholders and spent the rest on employees and other priorities, Warren said.

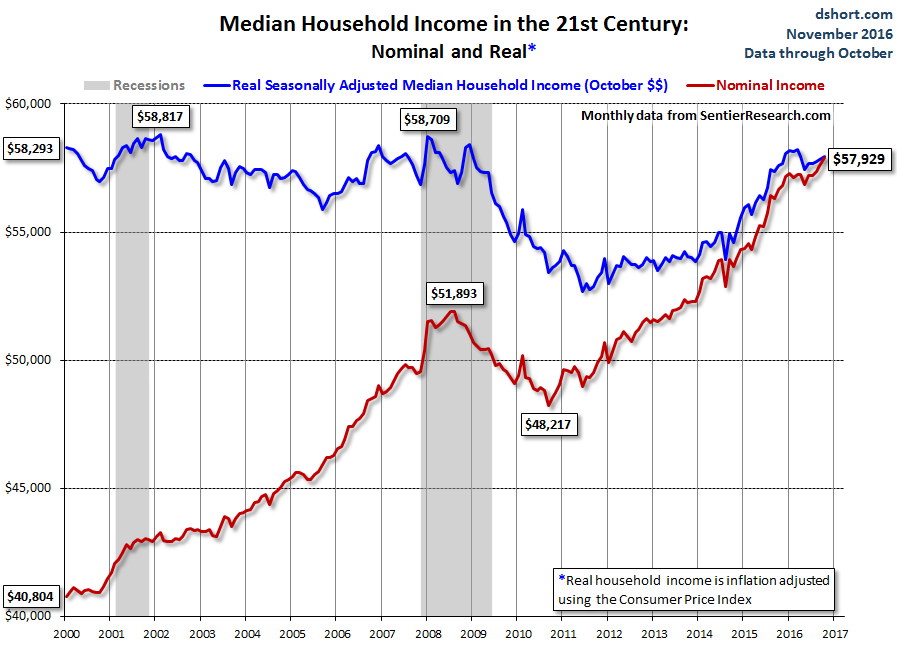

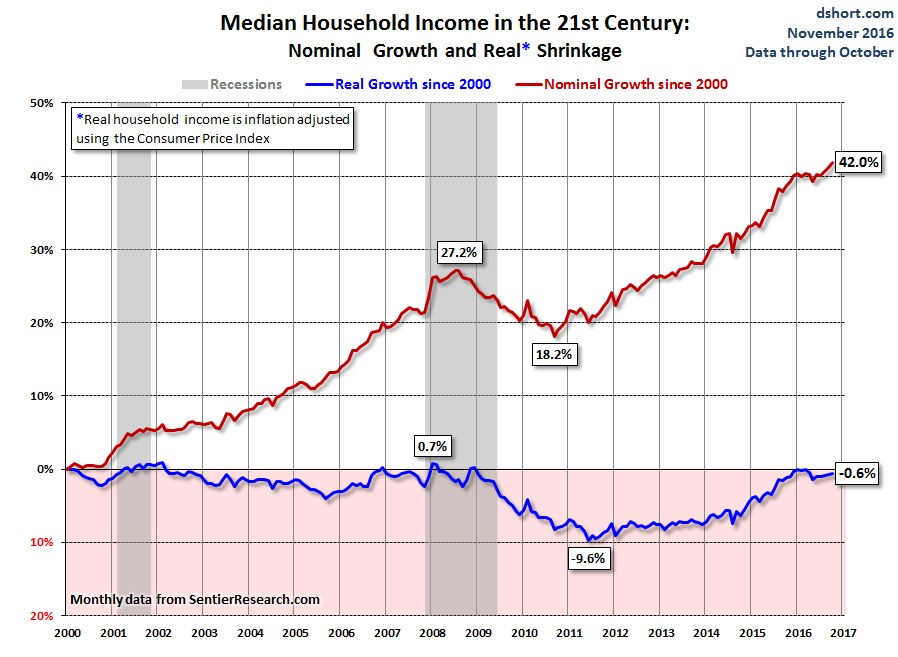

Here’s what Warren wants to change.

• Our “Prosperity” Is Now Dependent on Predatory Globalization (CHS)

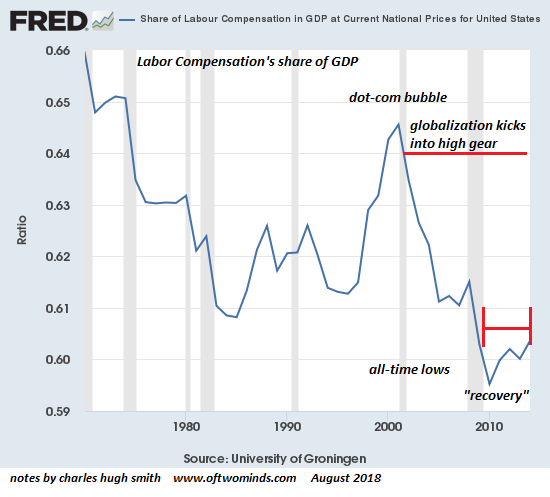

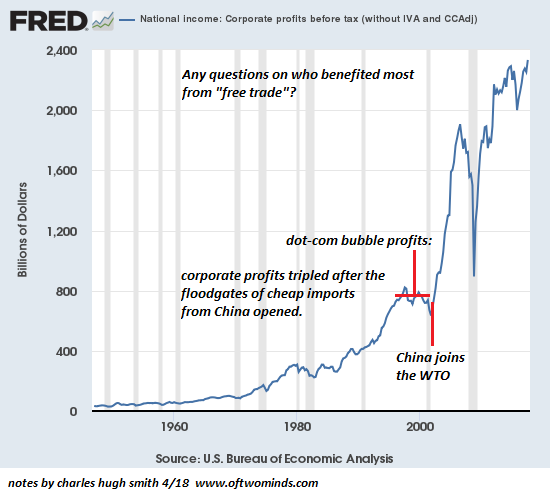

So here’s the story explaining why “free” trade and globalization create so much wonderful prosperity for all of us: I find a nation with cheap labor and no environmental laws anxious to give me cheap land and tax credits, so I move my factory from my high-cost, highly regulated nation to the low-cost nation, and keep all the profits I reap from the move for myself. Yea for free trade, I’m now far wealthier than I was before. That’s the story. Feel better about “free” trade and globalization now? Oh wait a minute, there’s something missing–the part about “prosperity for all of us.” Here’s labor’s share of U.S. GDP, which includes imports and exports, i.e. trade:

Notice how labor’s share of the economy tanked once globalization / offshoring kicked into high gear? Now let’s see what happened to corporate profits at that same point in time:

Imagine that–corporate profits skyrocketed once globalization / offshoring kicked into high gear. Explain that part about “makes us all prosperous” again, because there’s no data to support that narrative. What’s interesting about all this is the way that politicians are openly threatening voters with recession if they vote against globalization. In other words, whatever “prosperity” is still being distributed to the bottom 80% is now dependent on a predatory version of globalization.

Britain simply refuses to understand what the EU is. May can only get what she wants if the EU bends itself out of shape. Not going to happen.

• EU Rebuffs Idea Of Escalating Brexit Talks To Leaders’ Summit (G.)

European officials have poured cold water on hopes that Theresa May could negotiate Brexit with other EU leaders in September to break the deadlock over Britain’s departure. Diplomatic sources have rejected suggestions that May could hold direct talks on Brexit with the 27 other EU heads of state and government at a summit in Salzburg next month. “That is completely ridiculous, that is complete overspin of Salzburg,” one senior source told the Guardian. “It would mean that we would ditch our negotiating approach of the last two years and discuss at 28 instead of 27 to one, and I don’t see why this would happen.” Brexit talks are due to resume in Brussels on Thursday and Friday, the start of a new intense phase of negotiations, with the aim of reaching a deal in the autumn.

Since the referendum, the EU has insisted that all formal talks are led by the chief negotiator, Michel Barnier. May is allowed to update EU leaders on her plans at quarterly EU summits but is not in the room for discussions. Officials expect this approach to be continued at Salzburg, an informal summit on 20 September officially dedicated to migration. The meeting has been organised by Austria, which currently holds the EU rotating presidency, but it will be for the European council president, Donald Tusk, to decide whether to add Brexit to the agenda. The Salzburg gathering comes four weeks before an EU summit in Brussels, pencilled in by Barnier as the moment to strike a deal. Many in Brussels expect the deadline to slip to November or even December, squeezing the time available to ratify the text ahead of the UK’s departure on 29 March 2019.

The view of a CIA veteran.

• Trump Strikes Back at ‘Ringleader’ Brennan (Ray McGovern)

There’s more than meets the eye to President Donald Trump’s decision to revoke the security clearances that ex-CIA Director John Brennan enjoyed as a courtesy customarily afforded former directors. The President’s move is the second major sign that Brennan is about to be hoist on his own petard. It is one embroidered with rhetoric charging Trump with treason and, far more important, with documents now in the hands of congressional investigators showing Brennan’s ringleader role in the so-far unsuccessful attempts to derail Trump both before and after the 2016 election.

Brennan will fight hard to avoid being put on trial but will need united support from from his Deep State co-conspirators — a dubious proposition. One of Brennan’s major concerns at this point has to be whether the “honor-among-thieves” ethos will prevail, or whether some or all of his former partners in crime will latch onto the opportunity to “confess” to investigators: “Brennan made me do it.” Well before Monday night, when Trump lawyer Rudy Giuliani let a small bomb drop on Brennan, there was strong evidence that Brennan had been quarterbacking illegal operations against Trump. Giuliani added fuel to the fire when he told Sean Hannity of Fox news:

“I’m going to tell you who orchestrated, who was the quarterback for all this … The guy running it is Brennan, and he should be in front of a grand jury. Brennan took … a dossier that, unless he’s the biggest idiot intelligence agent that ever lived … it’s false; you can look at it and laugh at it. And he peddled it to [then Senate Majority Leader] Harry Reid, and that led to the request for the investigation. So you take a false dossier, get Senators involved, and you get a couple of Republican Senators, and they demand an investigation — a totally phony investigation.”

History lessons always good.

• Trump Is Right: America Was ‘Built On Tariffs’ (MW)

President Trump defended his use of tariffs to force other countries to renegotiate “unfair” trade deals by claiming that “our country was built on tariffs.” He’s right. America was a staunchly protectionist country for most of its history before World War II. One of the very first bills new President George Washington signed, for instance, was the Tariff Act of 1789. He inked the bill on July 4 of that year. The tariff of 1789 was designed to raise money for the new federal government, slash Revolutionary War debt and protect early-stage American industries from foreign competition. Then, as now, some industries sought protection in Congress from a flood of imports. Most goods entering the U.S. were subjected to a 5% tariff, though in a few cases the rates ranged as high as 50%.

It was the first of many tariffs that Congress passed over a century and a half. They generated the vast majority of the federal government’s revenue until the U.S. adopted an income tax in 1913. Tariffs have always been a source of controversy, however, starting with that very first one. Early on, the North preferred higher tariffs to protect infant American industries such as textiles from established English manufacturers. Alexander Hamilton, the nation’s first Treasury secretary, feared the U.S. would remain a weakling unless it built its own industries and became economically independent of the mother country. Over time the arguments on behalf of protectionism became closely tied to the emerging Republican party.

“Give us a protective tariff and we will have the greatest nation on earth,” a young politician named Abraham Lincoln said in 1847. Later, as the country’s 16th president, Lincoln rejected free trade and jacked up tariffs during the Civil War to pay for the North’s military campaigns.

Paul has already topped the Iran regime change cabal. Let’s hope he gets his way again. Assange can be a very important Russiagate witness.

• Rand Paul Thinks Julian Assange Should Be Granted Immunity for Testimony (GP)

Senator Rand Paul believes that WikiLeaks founder Julian Assange should be given immunity in exchange for him testifying before the Senate Intelligence Committee. Speaking to the Gateway Pundit, Senator Paul asserted that Assange likely has important information about the hack and that it’s unlikely he would agree to testify without immunity. “I think that he should be given immunity from prosecution in exchange for coming to the United States and testifying,” Senator Paul told the Gateway Pundit. “I think he’s been someone who has released a lot of information, and you can debate whether or not any of that has caused harm, but I think really he has information that is probably pertinent to the hacking of the Democratic emails that would be nice to hear.” “It’s probably unlikely to happen unless he is given some type of immunity from prosecution,” Senator Paul added.

[..] Christine Assange, Julian’s mother, has a list of things that she would like to see happen before her son agrees to testify. She told the Gateway Pundit that her wishes include an end to the WikiLeaks grand jury, a dismissal of charges against all WikiLeaks staff, safe passage for him to a nation where he can receive medical care and an agreement that there will be no future US extradition requests. She would also like to see the testimony conducted publicly through Skype.

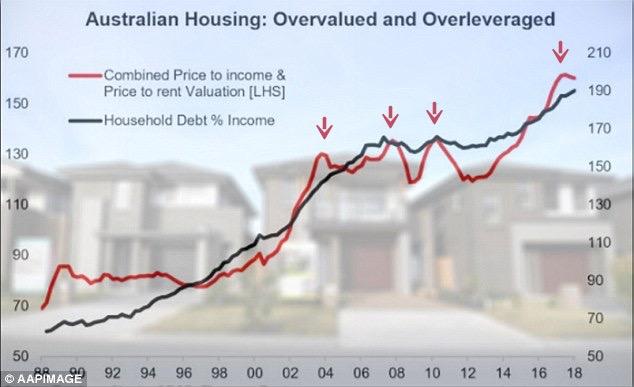

Household debt. Mortal enemy no. 1. Check it where you live.

• Australia’s Record Household Debt Is A Ticking Time Bomb (ZH)

The Australian household debt to income ratio has ballooned to shocking levels over the past three decades as Sydney is ranked as one of the most overvalued cities in the world. According to the Daily Mail Australia, credit card bills, home mortgages, and personal loans now account for 189% of an average Australian household income, compared with just 60% in 1988, as Callus Thomas, Head of Research of Topdown Charts, demonstrates that record high household debt is a ticking time bomb. The average Australian credit card bill is roughly $3,272.70 as average income earners spend at least $2,000 a month on mortgage repayments, which has contributed to the affordability crisis, said the Daily Mail Australia.

The average Australian holds about a $400,000 mortgage after they put down 20% deposit for a $500,000 property. The paper notes that the loan would barely buy a one-bedroom unit in most outer suburbs, as full-time workers take in about $82,000 salary per annum and spend an alarming 40% on mortgage repayments. With household debt at crisis levels, CoreLogic said Australian home prices experienced their sharpest monthly drops in July since late 2011 as declines gathered momentum in Sydney and Melbourne (Sydney and Melbourne cover about 60% of Australia’s housing market by value and 40% by number). Nationally, the index of home prices dropped .60% in July from June, leading to an annual fall of 1.6%.

The board may have to get rid of Musk. But what is Tesla without him?

• SEC Serves Tesla With Subpoena (CNBC)

The Securities and Exchange Commisison has served Tesla with a subpoena after CEO Elon Musk tweeted that he was considering taking the company private and that he had the necessary funding lined up, according to reports from The New York Times and other outlets published Wednesday. Earlier reports said the SEC had intensified scrutiny of the automaker after the controversial tweet. A subpoena would be one of the first steps in a formal inquiry. Shares of Tesla were down 3% in afternoon trading, though they moved only a fraction of 1% following the Times article.

Musk publicly floated the possibility of taking the company private in a tweet that sent shares seesawing and company leadership scrambling. His statement that he had the “funding secured” came under particular scrutiny, as it may have violated an SEC rule that essentially stipulates public statements made by company executives must be true. Musk explained earlier this week that the Saudi Arabia sovereign wealth fund had expressed interest in taking Tesla private.

Will this get the EU to move?

• Monsanto’s Roundup Found In Wide Range Of Cereals Aimed At Children (G.)

Significant levels of the weedkilling chemical glyphosate have been found in an array of popular breakfast cereals, oats and snack bars marketed to US children, a new study has found. Tests revealed glyphosate, the active ingredient in the popular weedkiller brand Roundup, present in all but two of the 45 oat-derived products that were sampled by the Environmental Working Group, a public health organization. Nearly three in four of the products exceeded what the EWG classes safe for children to consume. Products with some of the highest levels of glyphosate include granola, oats and snack bars made by leading industry names Quaker, Kellogg’s and General Mills, which makes Cheerios.

One sample of Quaker Old Fashioned Oats measured at more than 1,000 parts per billion of glyphosate. The Environmental Protection Agency has a range of safe levels for glyphosate on crops such as corn, soybeans, grains and some fruits, spanning 0.1 to 310 parts per million. “I grew up eating Cheerios and Quaker Oats long before they were tainted with glyphosate,” said EWG’s president, Ken Cook. “No one wants to eat a weedkiller for breakfast, and no one should have to do so.” Cook said EWG will urge the EPA to limit the use of glyphosate on food crops but said companies should “step up” because of the “lawless” nature of the regulator under the Trump administration.