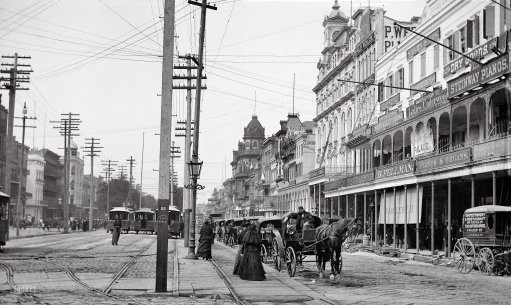

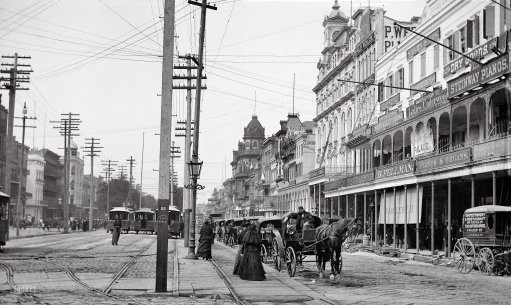

William Henry Jackson New Orleans, “Canal Street from the Clay monument” 1890

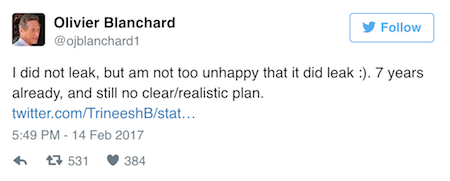

How and why could this surprise people? Of course he steps down. Fantastic interview on Bloomberg. Said he’d cut his arm off before signing a deal without debt restructuring.

• Varoufakis Says He Won’t Be Finance Minister After a ‘Yes’ Vote

Greek Finance Minister Yanis Varoufakis said he would resign if Greece votes to accept European Union bailout proposals. In the event of a “yes” vote in Sunday’s referendum, “I will not” be finance minister on Monday evening, Varoufakis said in an interview in Athens with Bloomberg Television. “But I will help whoever is.” Varoufakis said that he expects Greeks to reject the bailout proposals.

Read more …

Straightforward. No use getting scared now.

• Why We Recommend A NO In The Referendum – In 6 Short Bullet Points (Varoufakis)

1) Negotiations have stalled because Greece’s creditors (a) refused to reduce our un-payable public debt and (b) insisted that it should be repaid ‘parametrically’ by the weakest members of our society, their children and their grandchildren

2) The IMF, the United States’ government, many other governments around the globe, and most independent economists believe — along with us — that the debt must be restructured.

3) The Eurogroup had previously (November 2012) conceded that the debt ought to be restructured but is refusing to commit to a debt restructure

4) Since the announcement of the referendum, official Europe has sent signals that they are ready to discuss debt restructuring. These signals show that official Europe too would vote NO on its own ‘final’ offer.

5) Greece will stay in the euro. Deposits in Greece’s banks are safe. Creditors have chosen the strategy of blackmail based on bank closures. The current impasse is due to this choice by the creditors and not by the Greek government discontinuing the negotiations or any Greek thoughts of Grexit and devaluation. Greece’s place in the Eurozone and in the European Union is non-negotiable.

6) The future demands a proud Greece within the Eurozone and at the heart of Europe. This future demands that Greeks say a big NO on Sunday, that we stay in the Euro Area, and that, with the power vested upon us by that NO, we renegotiate Greece’s public debt as well as the distribution of burdens between the haves and the have nots.

Read more …

And this is from the Conservative side in the US..

• Juncker, Draghi and Lagarde Should Hang Their Heads In Shame (Davis)

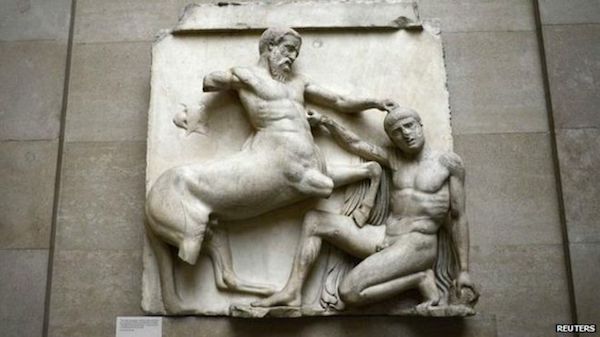

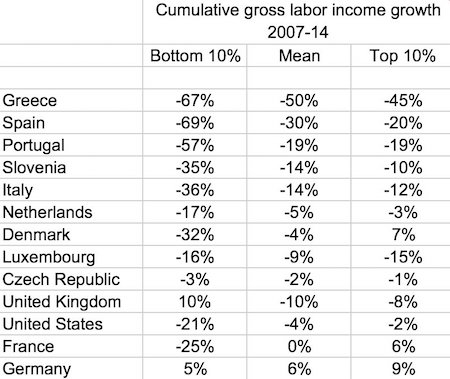

The Euro-clique that is the Troika should be ashamed of itself. This organisation, comprising the European Commission, the ECB, and the IMF run by yet another member of the cold-hearted Euro-elite, Christine Lagarde, is inflicting on the Greek people a policy that is little short of barbarism. They have only themselves to blame if the Greeks reject their latest demands in the upcoming referendum. Not only is unemployment running at 25%, and at nearly 60% amongst the under 25s, but the Greek lower middle class, the traders that make any economy run, has been decimated. Suicide is up 45%. 30% of the Greek people are living in poverty. Nearly one in five of the population does not have enough to eat, with food purchases having fallen by 28.5%.

Pensioners, now the bread-winners in many households (pensions are now the main – and often only – source of income for almost half of Greek families), have seen a 61% fall in their pension payments. Greek pensions were, pre-crisis, extremely generous, sometimes ridiculously so. In some sectors pensions could be more than 100% of final salaries, with some public sector workers taking retirement in their early 50’. Coupled with an aging population – 20% of Greeks are over age 65, one of the highest%ages in the Eurozone – this was a major factor in Greece’s problems. But Greek pensions are no longer so generous. On top of the cut to monthly payments, the standard retirement age for men is being lifted to 67, one of the highest in Europe.

Almost half of pensioners live on less than the poverty line of €665 per month. Food poverty is worsening people’s health. The stillbirth rate is up by 21% and infant mortality rose by 40% between 2008 and 2011. TB rates have doubled. HIV infection is up. Malaria has re-emerged after nearly half a century. Health care is funded by insurance, so when people lose their jobs they lose their health care. Along with cuts in state funding and the subsequent hospital closures, the economy of the health service is being destroyed. Thousands of doctors have left the country. Those that remain work for about €12,000 a year. Some clinics now depend upon volunteers and doctors who work for nothing.

This destruction is repeated throughout Greece’s public sector. There is little doubt that it needed reform. It was rotten, with overpaid jobs and excessive pensions allocated by rousfeti (political patronage) and the distribution of its services often lubricated by fakelaki (bribes). But what was needed was modernising rationalisation, not the fit of devastation that has left much of Greece dependent on soup kitchens and charity clinics.

Read more …

“This is, after all, a system where unelected institutions and other states have the power to override elected governments..”

• Syriza Can’t Just Cave In. Europe’s Elites Want Regime Change In Greece (Milne)

It’s now clear that Germany and Europe’s powers that be don’t just want the Greek government to bend the knee. They want regime change. Not by military force, of course – this operation is being directed from Berlin and Brussels, rather than Washington. But that the German chancellor Angela Merkel and the troika of Greece’s European and IMF creditors are out to remove the elected government in Athens now seems beyond serious doubt. Everything they have done in recent weeks in relation to the leftist Syriza administraton, elected to turn the tide of austerity, appears designed to divide or discredit Alexis Tsipras’s government. They were at it again today, when Tsipras offered what looked like almost complete acceptance of the austerity package he had called a referendum on this Sunday.

There could be no talks, Merkel responded, until the ballot had taken place. There’s no suggestion of genuine compromise. The aim is apparently to humiliate Tsipras and his government in preparation for its early replacement with a more pliable administration. We know from the IMF documents prepared for last week’s “final proposals” and reported in the Guardian that the creditors were fully aware they meant unsustainable levels of debt and self-defeating austerity for Greece until at least 2030, even on the most fancifully optimistic scenario. That’s because, just as the earlier bailouts went to the banks not the country, and troika-imposed austerity has brought penury and a debt explosion, these demands are really about power, not money.

If they are successful in forcing Tsipras out of office, a slightly less destructive package could then be offered to a more house-trained Greek leader who replaced him. Hence the ECB’s decision to switch off emergency funding of Greece’s banks after Tsipras called the referendum on an austerity scheme he had described as blackmail. That was what triggered the bank closures and capital controls, which have taken Greece’s crisis to a new level this week as it became the first developed country to default on an IMF loan. The EU authorities have a deep aversion to referendums, and countries are routinely persuaded to hold them again if they give the wrong answer. The vote planned in Greece is no exception. A barrage of threats and scaremongering was unleashed as soon as it was called.[..]

This is, after all, a system where unelected institutions and other states have the power to override elected governments – in fact to impose not only policies but effectively governments too, as we may be about to see in Greece. Anti-democratic firewalls are built into Europe’s institutions.

Read more …

Great angle. Nobody talks about Obama’s silence.

• “US Should Have Stopped IMF From Sending Redlined Document To Greece” (HuffPo)

The United States should have intervened a week ago when the latest talks between Greece and its creditors began to fall apart, a former senior IMF official told The Huffington Post on Tuesday. Appeals for compromise over the Greek debt crisis come too late now, economist Peter Doyle said. [..] To really help the situation, Doyle, the former IMF senior manager, said the U.S. needed to step into the negotiations between Greece and its creditors at a crucial moment a week ago. As the largest single contributor to the IMF, the U.S. has the greatest say over its policies. Specifically, Doyle argues that the U.S. should have stopped the creditors from sending back Greece’s latest proposal covered with redlined changes on June 24 and then leaking it to the media.

The way the counterproposal was made was widely seen as humiliating to Greece. Moreover, it did not offer any new concessions on debt relief, pension reforms or increases in the value-added tax. Greece reacted furiously to the counterproposal, beginning a downward turn that culminated Saturday in Greece’s withdrawal from the talks and announcement of the referendum. “I was truly amazed that the U.S. allowed the IMF to send back to Greece that redlined document,” Doyle said. “It must have slipped through the cracks in the White House,” he added. “That redlined document was completely humiliating, and it says nothing about debt relief.”

Read more …

If Obama won’t speak, someone else will have to do it.

• Bernie Sanders Blasts Greece’s Creditors (HuffPo)

Sen. Bernie Sanders (I-Vt.) attacked the IMF and European authorities on Wednesday for imposing what he called excessive austerity measures on Greece in negotiations over the country’s debt payments. “It is unacceptable that the IMF and European policymakers have refused to work with the Greek government on a sensible plan to improve its economy and pay back its debt,” Sanders said in an exclusive statement to The Huffington Post. “At a time of grotesque wealth inequality, the pensions of the people in Greece should not be cut even further to pay back some of the largest banks and wealthiest financiers in the world.”

Sanders, a 2016 Democratic presidential candidate and veteran progressive lawmaker, called the loans-for-austerity policies that the IMF and eurozone nations have imposed on Greece an “abysmal failure,” and demanded that the United States and other world powers grant Greece new debt-repayment terms that would allow its economy to recover from the damage it has sustained since 2008. “Instead of trying to force the Greek government and its people into even more economic pain and suffering, international leaders throughout the world, including the United States, should enable Greece to enact pro-growth policies that improve the lives of all of its people, not just the wealthy few,” Sanders said.

Sanders appeared to single out the IMF, the creditor over which the United States has the most direct influence. The U.S. controls more votes in IMF decisions than any other nation. “If Greece’s economy is going to succeed, these austerity policies must end,” Sanders said. “The IMF must give the Greek government the flexibility and time that it needs to grow its economy in a fair way.”[..]

It’s not clear what impact, if any, Sanders’ statement will have on the Greek crisis, since the United States – notwithstanding its controlling votes at the IMF – has remained largely on the sidelines during the current impasse. Treasury Secretary Jack Lew has been in close consultation with his eurozone and Greek counterparts throughout negotiations, but he’s refrained from specific prescriptions, instead making broad appeals for both sides to compromise. Peter Doyle, a former senior manager at the IMF, criticized the approach in an interview with HuffPost on Wednesday, arguing that the Obama administration should have vetoed a redlined document the creditors presented to Greece on June 26 that was viewed as especially humiliating.

Read more …

There’s more to this.

• Europe Wants to Punish Greece With Exit (Crook)

In my more than 30 years writing about politics and economics, I have never before witnessed such an episode of sustained, self-righteous, ruinous and dissembling incompetence –and I’m not talking about Alexis Tsipras and Syriza. As the damage mounts, the effort to rewrite the history of the European Union’s abject failure over Greece is already underway. Pending a fuller postmortem, a little clarity on the immediate issues is in order. On Monday, European Commission President Jean-Claude Juncker said at a news conference that he’d been betrayed by the Greek government. The creditor institutions, he said, had shown flexibility and sought compromise. Their most recent offer involved no wage cuts, he emphasized, and no pension cuts; it was a package that created “more social fairness.”

Tsipras had misled Greeks about what the creditors were asking. The talks were getting somewhere. Agreement on this package could have been reached “easily” if Tsipras hadn’t collapsed the process early Saturday by calling a referendum. What an outrageous passel of distortion. Since these talks began five months ago, both sides have budged, but Tsipras has given vastly more ground than the creditors. In particular, he was ready to accede to more fiscal austerity — a huge climbdown on his part. True, the last offer requires a slightly milder profile of primary budget surpluses than the creditors initially demanded; nonetheless, it still calls for severely (and irrationally) tight fiscal policy. In contrast, the creditors have refused to climb down on the question of including debt relief in the current talks, absurdly insisting that this is an issue for later.

On Tuesday, Tsipras made his most desperate attempt yet to bring the issue forward. Far from expressing any desire to compromise, dominant voices among the creditors – notably German Finance Minister Wolfgang Schaeuble, who often seemed to be calling the shots – have maintained throughout that there is nothing to discuss. The program already in place had to be completed, and that was that. Yes, the program had failed. No, it wouldn’t achieve debt sustainability. Absolutely, it was pointlessly grinding down Greek living standards even further. What did that have to do with it? Juncker says the last offer made no demand for wage cuts. Really? The offer says the “wage grid” should be modernized, including “decompressing the [public sector] wage distribution.”

On the face of it, decompressing involves cuts. If the creditors were calling for public-sector wages to be decompressed upward perhaps they should have made this clear. Regardless, the increases in value-added taxes demanded by the creditors mean lower real wages, public and private alike. As for no pension cuts, the creditors called for phasing out new early-retirement penalties and the so-called social solidarity payment for the poorest pensioners. Those are cuts. The creditors called for a lot else, too. Remember that the Greek economy is on its knees. Living standards have collapsed and the unemployment rate is 25%. Now read the offer document, and see if you think the advance in “social fairness” that Juncker stressed at his news conference shines through.

Read more …

“..democracies are already well under way to be made “market conforming..”

• Democracy And Monetary Union: How Not To Do It (Janssen)

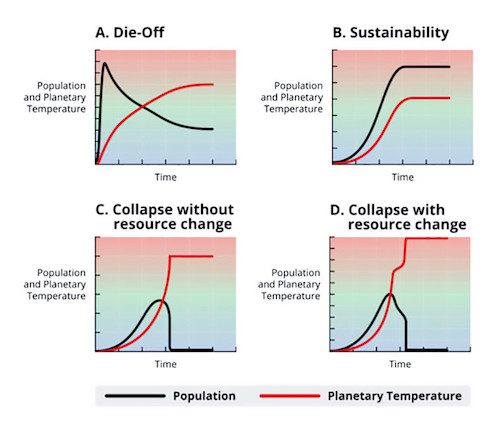

There is not a shadow of a doubt that EMU is incomplete. The key problem is that sovereign debt of individual euro area member states is no longer backed by a central bank of their own. Indeed, when adopting the single currency, member states not only become members of EMU, they are also divorcing in some way from their national central bank. The Banca d’ Espana (just to name one) continues to exist but with its competence on monetary policy transferred to Frankfurt, the government in Madrid can no longer call upon the assistance of a money-creating institution in case of emergency. This peculiar combination of one supranational central bank together with 19 different sovereign debt stocks has made euro area member states extremely vulnerable in the event of a run on the bond market for their sovereign debt.

No longer able to resort to their own national central bank as a lender of last resort, governments inside EMU have no other choice but to adopt brutal austerity – or else default – in dealing with any liquidity crisis. In a sense, Eurozone member states can be compared to emerging economies that are issuing debt in a (foreign) currency they have no control over and get into serious trouble when market momentum changes and access to finance is completely cut off. Until 2010, this gap in the construction of monetary union in Europe went completely unnoticed. However, when the crisis in Greek public finances erupted back in 2009 and with central bankers openly declaring their increasing unwillingness to accept Greek debt as collateral, the fault-line in monetary union became painfully clear.

Financial markets reacted in a predictable way, by panicking and staging a self-fulfilling prophecy. Realising that, in the absence of the ECB backing up Spanish, Italian, French, or Belgium sovereign debt, a run on these bonds could trigger default, markets started running for the exit by massively dumping them. The rest of the story is well-known. Euro Area Member states, trying to calm down markets, embarked on the experiment of highly pro-cyclical austerity and topped this up with wage devaluation. Their hopes soon turned out to be vain as austerity and internal devaluation triggered a double dip recession, thus even stoking markets’ worst fears of default and/or the break-up of monetary union.

This vicious circle was only broken some years later (2012) when the ECB’s president, Mario Draghi, finally addressed market concerns about the absence of a lender of last resort by orally promising to do “anything it takes” to save the single currency. Europe has paid a high price for this. The price does not simply come in the form of economic stagnation, record high unemployment and rising inequalities. An even more worrying issue is that the principle of democracy is being hollowed out. Elected governments have repeatedly found themselves confronted with little choice but to abide by what the markets seem to be demanding or, alternatively, to obey the detailed “diktats” prescribed by the ECB in – not so – secret letters. [..]

A couple of years ago, at the height of the euro crisis, Chancellor Angela Merkel publicly stated that democracies in Europe needed to “conform to the markets”. With monetary policy in the hands of a supranational central bank, with fiscal policy enchained by the Stability Pact and the Fiscal Compact with its Fiscal Councils, democracies are already well under way to be made “market conforming” under the tutelage of these gatherings of independent professionals. The next step seems to be to also bring wages and wage bargaining under the discipline of experts’ councils and to do this on the basis of rules forcing workers across the Euro Area to compete with each other in poaching each other’s jobs. It is not a prospect that augurs well for a democratic Europe.

Read more …

“If you were of a suspicious mind, you might wonder whether Mr Tsipras has not in fact lured European leaders and officials into a legal trap..”

• Europe Has Suffered A Reputational Catastrophe In Greece (AEP)

Oxi Day has totemic significance in Greece. It commemorates the defiant Greek “No” to Mussolini’s ultimatum in October 1940, and the heroic acceptance of war against a vastly bigger military machine. It is the same word that will top the ballot sheet when Greeks vote in a snap referendum this Sunday on creditor demands, and prime minister Alexis Tsipras is not shy in evoking the same spirit of wartime resistance. His speech to the nation on Wednesday night was peppered with talk of ultimata. He accused “extreme Right-wing circles” of forcing the closure of the Greek banks and the imposition of capital controls through liquidity asphyxiation. He lashed out at “authoritarians” in charge of the IMF and EU institutions. He spoke of attempts to blackmail the Greek people.

And he vowed to campaign against the creditor package – which, strictly speaking, is no longer on offer – deeming it the “destruction of Europe”. Where this will take him, and take Greece, is anybody’s guess. The latest Efimerida ton Syntakton poll shows the “No” side leading by 54pc against 33pc for “yes”. But that lead – if it really exists – may evaporate as the ghastly consequences of financial collapse become clearer by the day. Distraught pensioners have been gathering in small, tense crowds outside banks trying to withdraw their weekly allowance of €120 (£85). Many have not been paid. A throng of veterans protested outside the finance ministry on Wednesday morning, denouncing EU “dictatorship” and Mr Tsipras with equal fury.

Ambulances in parts of northern Greece have run out of fuel. The Greek Chamber of Commerce warns of “serious shortages” of basic goods and pharmaceutical supplies within days. The radical-Left Syriza government is skating on very thin ice. If Europe’s creditor powers have succeeded in bringing Greece to its knees, they have paid a fearful price themselves. As Pyrrhus said after the battle of Asculum: “Another such victory, and we will be utterly ruined.” We can already see that the EU itself has suffered a reputational catastrophe on several fronts. This is of far greater importance in the sweep of events than daily twists and turns in Athens. It has brought about a state of affairs where a member of its own eurozone family has become the first developed country in history to default to the IMF.

Let us be clear what this means. The currency union itself is delinquent. The rich countries of northern Europe are refusing to pay African, Asian and Latin American states. Blaming it on Greece alone does not wash. The eurozone has shown itself unable to manage its basic moral responsibilities. Russian president Vladimir Putin could hardly resist his own wicked dig, professing “great concern” over the EU’s vanishing credibility. This default is doubly shameful given that the original IMF-Troika loan in 2010 was not intended to save Greece. The extra debt was imposed on an already bankrupt Greek state to buy time for the euro, against Greek interests.

Read more …

And all the other stuff yesterday was just gossip.

• Tsipras Refuses To Bow To Threats To Greek Banking System (Telegraph)

Greece’s embattled prime minister has refused to back down over a referendum on the country’s bail-out future, despite being threatened with imminent financial ruin and a banking collapse as early as Monday if he chooses to press ahead with the vote. In his third address on national television in the past five days, a defiant Alexis Tsipras vowed to let the Greek people have their say on the austerity terms they will need to sign up to in order to retain their 14-year membership of the single currency. Mr Tsipras is backing a “No” vote, a move that has drawn opprobrium from across the continent and been described as “dumb” by a senior ally of Germany’s Angela Merkel. “Come Monday, the Greek government will be at the negotiating table after the referendum, with better terms for the Greek people,” said Mr Tsipras.

Wednesday was the first day in five years that Greece has not been subject to a bail-out programme, freezing the bankrupt country out of €15bn in rescue funds. The government has been forced to impose draconian controls on cash withdrawals and shut down the banks for more than a week to prevent a devastating bank run. Branches are due to open again on July 7 after the referendum vote is held. But creditor powers are now threatening the country with the threat of an imminent financial collapse unless Mr Tsipras calls off the plebiscite. Slovakia’s finance minister, Peter Kazimir, made clear the ultimatum that was now facing Athens: “I’m afraid that Greece’s banks might not reopen with the euro as the currency in case the referendum on Sunday ends with a No,” he said.

The ECB decided to maintain the current €89bn cap on emergency funding that it is providing to keep the banking system afloat. The show of bullish resistance from Mr Tsipras is likely to further anger European leaders, who spent their third consecutive day refusing any dialogue with his government, pushing the country to the brink of a disorderly ejection from the eurozone. “We see no grounds for further talks at this point,” said Jeroen Dijsselbloem, the president of the Eurogroup of finance ministers. Greece became the first country since Robert Mugabe’s Zimbabwe to default to the International Monetary Fund on Tuesday night. The non-payment now places the country’s future in the hands of its creditors.

Read more …

Stunning how little intellectual progress has been made in 5 months. We leave it all up to the nutcases in charge: “The world will be a better place when Germans know their history – all of it.”

• In Greek Crisis, Germany Should Learn From Its Fiscal Past (WaPo, Jan 28)

If you made a list of countries you hope have learned from their past hundred years of mistakes, Germany would have to be at the top. Happily, the staunch opposition to a nativist fringe that the nation’s government and citizenry have shown in recent weeks makes it clear, again, that Germany understands the costs of bigotry and the virtues of tolerance. Unhappily, it has not learned the costs of a mad adherence to fiscal orthodoxy, despite the fact that its prosperity is rooted in the decision of its World War II adversaries to allow West Germany’s postwar government to write off half of its debts. Indeed, the policies that Angela Merkel’s government have inflicted on the nations of Southern Europe could not be more different from those that European leaders and the United States devised in the early 1950s to enable West Germany to rebuild its damaged economy.

Since the crash of 2008, Germany, as Europe’s dominant economy and leading creditor, has compelled Mediterranean Europe, and Greece in particular, to sack their own economies to repay their debts. Germany’s insistence has reduced Greece to a condition like that of the United States at the bottom of the Great Depression. Unemployment has soared to 25%, and youth unemployment to more than 50% ; the economy has shrunk by 26% and consumption by 40%. Debt has risen to 175% of the nation’s gross domestic product. And the funds from the loans that Germany and other nations have extended to Greece have gone almost entirely either to cover interest payments or repay past loans; only 11% has actually gone to Greece’s government.

Stuck on a treadmill of debt repayment and anemic economic activity, Greece, as the Financial Times noted, has been reduced to a “quasi-slave economy” run “purely for the benefit of foreign creditors.”Not surprisingly, when Greek voters went to the polls Sunday, they elected a new government that is demanding a renegotiation of its debt. German and European Union officials have responded with adamant opposition to any such changes.

Fortunately for Germany, its own creditors took quite a different stance after World War II. In the London Debt Agreement of 1953, the 20 nations — including Greece — that had loaned money to Germany during the pre-Nazi Weimar Republic and in the years since 1945 agreed to reduce West Germany’s debts by half. Moreover, they agreed that its repayments could not come out of the government’s spending but only and explicitly from export income. They further agreed to undervalue the German mark, so that German export income could grow. By the consent of all parties, the London Agreement, and subsequent modifications, were crafted in proceedings that made West Germany an equal party to its creditors: It could, and sometimes did, reject the creditors’ terms and insist on new negotiations.

Read more …

The morally bankrput union.

• In Athens, Scavenging From Bins Has Become A Way To Survive (Telegraph)

Piled high with rubbish congealing in the summer heat, municipal dustbin R21 on Athens’ Sofokleous Street does not look or smell like a treasure trove. But for Greece’s growing army of dustbin scavengers, its deposits of rubbish from nearby stores and grocery shops make it a regular point of call. “Sometimes I’ll find scrap metal that I can sell, although if I see something that looks reasonably safe to eat, I’ll take it,” said Nikos Polonos, 55, as he sifted through R21’s contents on Tuesday morning. “Other times you might find paper, cans, and bottles that you can get money for if you take them back to the shops for recycling.” One reason for R21’s popularity is because it is just down the road from a church soup kitchen, where the drug-addicted, the poor and homeless queue up for meals three times daily.

But many of those who now forage in such dustbins each day are simply ordinary working people – or were, at least, until Greece’s economic meltdown shot unemployment up to 25%. Mr Polonos, a quietly spoken man of 55, is typical of the new class of respectably destitute. He lost his job as a construction worker three years ago, when Greece’s building boom dried up, and in the current climate, cannot see himself finding paid work in the foreseeable future. Yet he dresses as smartly as he can in second-hand trousers and shirt, and does not see himself as any kind of vagrant. “I don’t want to ever look like him,” he said, gesturing to a tousle-haired drug addict slumped in a doorway near the soup kitchen.

“I never believed I would end up like this, but as long as Greece is in this terrible situation, my construction skills are not in demand. A lot of my friends are doing what I do now, and some people I know are even worse off. They have turned to drugs and have no hope at all.” The exact numbers of people who now scrape a living by rummaging through Athens’ bins is hard to estimate, since many only operate at night when their friends and neighbours will not see them. But according to Panos Karamanlikis, a volunteer at the soup kitchen, the numbers have increased by two or three times since 2011 alone. “A lot of them are normal people from normal homes,” said Mr Karamanlikis, who lost his job himself back in 2006 when the insurance company he worked for shed 60% of its work force. “They will go out and look for cigarette stubs on the streets, tin cans to recycle, anything.”

Stephen Graham, an anti-austerity campaigner from England who has spent the last three months travelling through Greece to study its economic problems, said that well-to-do scavengers were a common sight in the Athens suburb where he lived. “These are people who still have trappings of their old way of life, who still have clothes for work and smartphone contracts they can’t get out of,” he said. “They go to different neighbourhoods to scavenge so that people they know don’t see them. Seeing them is something I’ll never forget.”

Read more …

Schäuble’s been preparing this for years.

• The Hard Line on Greece (Sorkin)

In July 2012, Timothy F. Geithner, the United States Treasury secretary at the time, traveled to Sylt, an island off Germany in the North Sea. Mr. Geithner was there for a meeting with Wolfgang Schäuble, Germany’s finance minister, who would spend his summers at his vacation home on the tiny island. The topic was Greece. In the home’s library, the two men spoke about Greece’s prospects and begun discussing ways for the European Union to keep the country in the eurozone. To Mr. Geithner’s dismay, however, Mr. Schäuble took the conversation in a different direction. “He told me there were many in Europe who still thought kicking the Greeks out of the eurozone was a plausible — even desirable — strategy,” Mr. Geithner later recounted in his memoir, “Stress Test: Reflections on Financial Crises.”

“The idea was that with Greece out, Germany would be more likely to provide the financial support the eurozone needed because the German people would no longer perceive aid to Europe as a bailout for the Greeks,” he says in the memoir. “At the same time, a Grexit would be traumatic enough that it would help scare the rest of Europe into giving up more sovereignty to a stronger banking and fiscal union,” Mr. Geithner wrote. “The argument was that letting Greece burn would make it easier to build a stronger Europe with a more credible firewall.” Fast-forward three years. What Mr. Schäuble articulated that summer afternoon to Mr. Geithner is finally taking shape.

Greece is in a harrowing last-minute standoff with the European Union over whether it will remain part of the eurozone, and Greek citizens are set to make the decision in a referendum vote on Sunday. That vote is happening against a backdrop of bank runs; citizens are camped outside of banks, where capital controls now restrict the amount of money that can be removed. Politicians and investors have been trying to “war game” the outcome. Who is bluffing? The Greeks or the European Union. The conversation between Mr. Geithner and Mr. Schäuble gives a strong indication. As Mr. Geithner said of another conversation he had with Mr. Schäuble: “He has a clear view: Greece had binged, so it needed to go on a strict diet.” [..]

It may seem counterintuitive, but rather than make a Greece exit easy and seamless to avoid dislocations in financial markets, the E.C.B. has the perverse incentive to make it messy and difficult to deter others.

Read more …

“Though Germany was allowed to grow its way out of recession in 1953, it will not let Greece do this, because it would set “a bad example””

• Fear-Mongering Is The Enemy Of Democracy (Suzanne Moore)

Project Fear stalks Europe. In suits and ties and chaffeur-driven cars, in hurried meetings, in corridors blaring with strip lights, around the cabinet tables, in meetings where strategy is scrawled on whiteboards, in advertising agencies where earnest young people compete to unsettle us in the most effective ways. Perhaps I am too old and dreamy to think that politics was ever about anything other than fear; that hope is a necessity not a luxury. Surely I know, really, that when you want someone to vote a certain way you have to frighten them into thinking that any alternative is worse. We may not know what we like, but we sure as hell as know what we don’t like. Project Fear is not a paranoid delusion of mine. This phrase was used by the Conservatives in the last election and the pro-UK Better Together campaign. [..]

Of course, Project Fear reaches its apotheosis in Greece. If there is a referendum, the Greek people will be asked to vote for a hell they already know or one they can only imagine. They will continue to be lectured on profligacy and infantilised as lazy children, while their hospitals are running out of supplies, people are sleeping on the streets and unemployment soars. Those who stand in ATM queues are fearful, and who wouldn’t be? But from my last couple of visits to Greece, I would say that when a crisis is everyday, when you live on the brink, a strange calm sets in, a resilience that I can only compare to what I have seen in war zones, in that the need to get on with living overrides fear. No one can panic 24/7. “We will grow potatoes,” one man said to me. “We all watch out for each other,” said a woman.

For the thing about Project Fear is that when it becomes the weather, one learns to ignore it. As the Eurocrats huddle and speak of Greece, and then Spain and Italy, as some kind of totemic ethnic “other”, we should be disturbed. Does this huge south need to be dealt with differently? Is this all a place of unpaid tax and bribery and siestas? Be fearful of this. “They will take what is ours” is the subtext here. There is no respect for seasonal economies like Greece’s, but the fear is myopic. How can we not see that all of Europe will lose, too, if it continues to impoverish these places?

With migrants arriving in Kos and hordes of the dispossessed massing in Libya, why would we want to alienate a nation just one country away from Isis? Greece spends a lot on defence, this is true. Can we not see why? But the troika are the agents of Project Fear. Though Germany was allowed to grow its way out of recession in 1953, it will not let Greece do this, because it would set “a bad example”. The aim of all these dealings becomes clearer. It is to remove the democratic challenge of Syriza to these huge, undemocratic institutions of the EU and IMF. Even many rightwing economists argue that the conditional loans given to Greece have only enriched the financial intuitions. The aim is not growth but punishment.

Read more …

Berlin turns out to be even crazier than he thought.

• How Varoufakis Saw The “Worst Case Scenario” Over A Year Ago (Zero Hedge)

Over a year ago, and long before he became the mascot for fraught negotiations between Greece and its creditors, Yanis Varoufakis penned a lengthy essay on what might happen should the Greek government decide to stand firm in the face of pressure from Brussels, Frankfurt, and Berlin. Earlier today we learned that in fact, Greece will stick to its negotiating position even in default and will remain defiant to the end, or at least until the voters who swept PM Tsipras and Varoufakis into office indicate at the ballot box that concedeing the Syriza campaign mandate is an acceptable outcome. With the government urging Greeks to vote “no”, the Tsipras and Varoufakis’ gambit will be put to the test next week, or perhaps even as early as this afternoon when the ECB could decide to effectively bring the Greek banking sector to its knees.

In this context, we bring you Yanis Varoufakis’ vision of the endgame, straight from the embattled FinMin himself:

That Greece has the right and the opportunity to deploy these bargaining cards there is no doubt. The important question is this: What if Berlin and Frankfurt do not budge? What if they tell Athens to ‘go jump of the tallest cliff’? The Greek government currently claims that it has a budget surplus. While I strongly doubt this claim, I suspect that a small primary surplus can be concocted through some additional cost cutting and a leximin squeeze of top public sector incomes downwards (without affecting the lowest incomes, pensions and benefits). That should suffice to allow the Athens government to meet its needs during any medium term standoff with Berlin and Frankfurt, as the Greek state will need no financing either from the official sector or from the money markets. In short, the answer to a German “Go jump” can be: “We shall not jump but we shall stay rock solid within the Eurozone and behind our demand for a debt conference. Just watch us.”

Berlin and Frankfurt will, undoubtedly, be furious. They will issue a variety of threats, including the suspension of structural fund flows from Brussels. But the real battleground will be the banks. As they did with Cyprus, where they threatened the government with an immediate suspension of the island nation’s ELA, so too in the case of Greece they will threaten to pull the plug on the Greek banks. Two points need to be made here. First, the Greek banks no longer hold any Greek government debt, which means that their collateral with the European System of Central Banks cannot be downgraded legally. Secondly, Frankfurt will have to think twice before it issues the threat of bending its own rules to close down Greek banks – since doing this would threaten to engulf the whole of the Periphery’s banking system into another cascading panic.

Confronted with such a reality, I have good cause to hope that Berlin will prefer to accommodate the Greek government and to look with a great deal more ‘kindness’ the ‘request’ for a debt relief conference. And if it does not, and wishes to bring the Eurozone down with it, let it do its worst, I say.

Read more …

What’s creeping into the discussion is a sense that it’s normal and legit for Berlin to move for regime change in a sovereign nation. That’s scary.

• Berlin Accuses Tsipras Of Seeking Scapegoats Outside Own Ranks (Guardian)

Berlin has delivered a blistering attack on Greece’s beleaguered radical prime minister, Alexis Tsipras, accusing him of lying to his own people and seeking scapegoats for the country’s misery everywhere but in his own ranks. The German government dismissed desperate attempts by Athens to salvage some form of bailout, prompting Tsipras to hit back, accusing the country’s creditors of trying to “blackmail” Greek voters with dire warnings that a vote against austerity in this weekend’s referendum would be a vote to leave the euro. Tsipras referred to leaders of other eurozone nations as “extremist conservative forces” and blamed them for the capital controls that have forced the banks to shut down and ration cash.

With relations between Greece and Germany now at their lowest point in the crisis, divisions have also opened up among the main EU powers over what to do about Greece after five years of bailout closed down on Tuesday and the country became the EU’s first to default on loans to the IMF. The trenchant criticism of Tsipras from Berlin reinforced the view that the German government might refuse to negotiate with the leftwing Syriza administration on any new rescue package after Sunday’s referendum in Greece – which Berlin insists is a vote on whether to stay in the euro. The validity of the vote is now also being questioned. The Council of Europe said one week’s notice fell short of international standards and the wording was unclear, while Greece’s highest court has been asked to cancel the plebiscite on constitutional grounds.

A judgement will not be made until Friday. Syriza’s allies in the German parliament – die Linke, or the Left – accused the chancellor, Angela Merkel, of seeking to topple the Greek prime minister. It is an open secret in Berlin that Merkel, and especially her hawkish finance minister, Wolfgang Schäuble, would be happy to see Tsipras fall as a consequence of Sunday’s vote. At the very least, German government sources say privately, Berlin wants Greece’s flamboyant finance minister, Yanis Varoufakis, replaced. The rising tension over the Greek debacle surfaced at the very top of the EU on Wednesday when Schäuble rejected the latest Tsipras letter to his creditors accepting most of the austerity terms that last Saturday he had described as “humiliation” and “extortion”, while arguing for much more generous rescue funding over two years and including debt relief.

Read more …

Insult and injury.

• Greek Tourism Bookings Are Nosediving (Kathimerini)

The government’s decision to call a referendum, shut banks and default on its payment to the International Monetary Fund are taking a toll on Greek tourism, professionals warned on Wednesday. Andreas Andreadis, the head of the Association of Hellenic Tourism Enterprises (SETE), said that hotel bookings are down 50,000 a day due to the recent developments in the country. Given that last-minute bookings account for 20% of the year’s tourism traffic, the blow is expected to be severe for Greek tourism, with knock-on effects on employment if those bookings are lost for good. Furthermore, there is a growing wave of cancellations at Athens hotels, while bookings from Greeks have dropped to almost zero.

Andreadis said the activation of Target 2 – an interbank payment system for the real-time processing of cross-border transfers throughout the EU – would be vital as it would facilitate transactions with other countries and allow for essential imports, meaning that catering facilities at accommodation units would be able to operate. He went on to warn that food and drink stocks will only suffice to cover hotels’ needs for one more week. Data released on Wednesday by the Travelplanet 24 and Airtickets websites showed that air ticket bookings by Greek travelers for the July-September period showed a decline of up to 50%. Air ticket cancellations rose from an average rate of 1.05% to 7.2% in the period from June 27 to yesterday. This peaked on Monday, when the cancellation rate amounted to 22%.

Similarly, ferry ticket bookings had posted an annual increase of 10% up until June 25, but since Prime Minister Alexis Tsipras called a referendum there has been a dip of 60%. Meanwhile, SETE informed the US Embassy in Athens that a major US-based tour operator had told the association that it had received orders to withhold money owed to Greek hoteliers from bookings last month. The embassy is investigating the claims, while the IMF yesterday issued a statement denying that it had given any such order.

Read more …

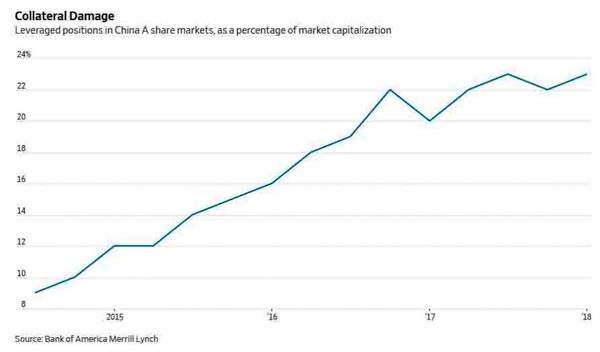

Use your home as collateral to buy hugely leveraged stocks. Yeah, that sounds good…

• China Eases Margin Lending Rules to Support Flagging Stock Market (FT)

China’s securities regulator has moved to curb downward pressure on the country’s tumbling stock market by relaxing collateral rules on margin loans, in a bid to prevent a vicious cycle of price falls and forced selling. Margin finance has been a major driver of the rally that propelled China’s main stock index to a seven-year high on June 12, but the market has since tumbled more than 20% due in part to worries about a clampdown on leveraged bets. The China Securities Regulatory Commission said late on Wednesday that brokerages are free to set their own rules for demanding more collateral from clients when stocks bought with borrowed money fall in value. Previous rules required clients to add assets to their accounts when their collateral ratio dropped below 130%, or else liquidate their positions.

“The new CSRC rules to stop forced liquidation have hit the nail on the head and will calm the market for now,” Hao Hong, research director at Bocom International, wrote in a note. Nevertheless, the Shanghai Composite Index was down 0.9% in early trading on Thursday, deepening Wednesday’s 5.3% decline. Shenzhen was down 1.5%. Stock exchange data show that after surging to a high of Rmb2.27tn ($366bn) on June 18 — from Rmb401bn a year earlier — outstanding margin loans have fallen Rmb236bn. But Mr Hao also warned that the relaxation may sow the seeds for a future crisis.

“Beyond the short term, we believe margin call is a necessary risk management mechanism for brokers. The premise of margin trades is that asset prices will rise perpetually. It simply cannot be true,” he said. In addition to loosening collateral requirements, the new rules allow margin loans to be extended for longer than the previous six-month limit, and eliminate the requirement that margin clients must have assets in their securities account worth at least Rmb500,000. The CSRC first proposed the changes on June 12 in the form of draft rules open for a month-long public comment period. But in its statement on Wednesday the regulator said that “because the situation is special” the rules would now take effect immediately.

Read more …

Please borrow more!

• China’s Fix for a Margin-Debt Boom Roiling Stocks? More Leverage (Bloomberg)

As China’s stock-market slump spurs margin traders to unwind record bullish bets, authorities have responded with a policy that analysts say could exacerbate the problem: make it easier to take on even more leverage. Hours after a one-day tumble of 5.2% in the Shanghai Composite Index, China’s securities regulator eased collateral requirements for leveraged investors and allowed brokerages to securitize margin loans – a move that frees up room to extend credit after a nine-fold surge in outstanding margin debt in two years. Brokerages have leeway to boost lending by about $300 billion, based on regulatory caps announced Wednesday.

While a surge in leverage helped fuel the longest-ever bull market in Chinese stocks, traders have been closing out those positions for a record eight straight days as the Shanghai Composite tumbled more than 20% from this year’s high. Even if relaxed rules help prevent a free-fall in share prices, the risk is that more leverage will expose amateur investors to even greater losses later and spur bigger price swings in the world’s most-volatile market. “Beyond the short term, risk taking with leverage underwritten by the state plants seeds for even greater market peril in the future,” Hao Hong, a China strategist at Bocom International, wrote in an e-mailed note.

The China Securities Regulatory Commission will allow brokerages to accept new forms of collateral, including real estate, from clients with insufficient value in their stock accounts. The regulator, which cut short a public consultation on the rules due to “market conditions,” said investors no longer need to supply extra collateral within two days when it falls below 1.3 times the amount of borrowed money. The new guidelines let brokerages give six-month extensions to clients’ margin trading and short selling contracts, instead of liquidating the positions.

Read more …

At home as in China.

• Normal Banks Are Helping Shadow Banks Grow, a Lot (Bloomberg)

It’s no secret that financial companies without government-backed deposits—often dubbed shadow banks—have been growing as a result of post-financial crisis regulations imposed on actual banks. But what’s often overlooked is just how much the “normal” kind of banks are helping to power that growth. U.S. banks’ loans to nondepository financial companies, or shadow banks, have jumped more than 230% over the past three years, according to the semiannual risk perspective report released by the Office of the Comptroller of the Currency on Tuesday. They were the fifth-largest category of commercial-loan holdings at banks at the end of last year, up from the 11th spot at the end of 2011.

To be sure, banks being involved with shadow banks isn’t new. During the crisis, loans to subprime mortgage lenders, managers of collateralized debt obligations, and hedge funds created all sorts of trouble for banks, along with the sort of softer relationships they had with such things as the mortgage-backed securities they issued and SIVs. Yet banks never really backed away from being a key cog in the shadow-banking system, as Bloomberg News reporter Donal Griffin laid out in an article in 2012 about how Citigroup was involved with collateralized loan obligations, money-market funds, and mortgage real estate investment trusts, even as the bank’s then-chief executive officer, Vikram Pandit, was vocally criticizing how regulations were shifting risk toward exactly such things.

It’s not just banks that are offering nonbanks a helping hand. Another report released Tuesday, from the overseer of Fannie Mae and Freddie Mac, shows that those companies may also be playing a role, as they increase the fees they charge lenders to guarantee mortgages. Over the past two years, the mortgage giants have been charging small lenders less (on a risk-adjusted basis) to guarantee loans than they charge large ones, in a switch from the past, according to the report. And many of those small lenders are nonbanks.

Read more …

Abe should go.

• Reaganomics Won’t Save Japan (Pesek)

Can Ronald Reagan save Japan from a debt crisis? We’re about to find out as Prime Minister Shinzo Abe bets the remaining years of his mandate on the former U.S. president’s economic philosophy. Abe’s new plan to curb Japan’s debt burden, the world’s heaviest at almost 250% of GDP, doesn’t mention Reagan. But it’s impossible not to notice the influence of his widely-touted theory that healthy government finances require, above all, a thriving corporate sector. That should worry investors, credit rating companies and the Japanese people alike. Abe did announce some vague intentions to cap spending and reach a budget surplus in fiscal 2020. But the heart of his strategy for dealing with government debt is stoking broader economic growth.

It’s a questionable strategy, one that’s even more dubious because of where Abe expects this debt-erasing output to come from: giant companies profiting from a weaker yen and a “productivity revolution.” Unfortunately, Abe’s plan is based on the discredited notion that more money for companies and the wealthy will mean more money for government coffers. Japanese companies have been earning more money since at least 2012, when the yen began dropping to the benefit of exports. But instead of sharing the wealth by fattening paychecks, executives hoarded it. The amount of cash and deposits corporate Japan has on hand jumped 3.6% in March to a record $1.96 trillion. In 26 of the 30 months Abe has been in office, CEOs have chosen to save extra cash rather than deploy it.

Abe shouldn’t expect much growth to trickle down from productivity gains either. Japan’s insular and outdated business practices have long made it a laggard among developed nations. That was less problematic before China’s ascendance in the region. Japan is now an aging, inefficient and wildly expensive property in a cheap neighborhood. In order to sustain its living standards, Japan needs to innovate and develop new job-creating industries (think renewable energy, not cars and televisions). But as Georges Desvaux of McKinsey argues in a recent report, Abe has done very little since taking office to invest in Japan’s vast human capital. [..] The bottom line is that there’s little “new” about a plan that relies on growth to pay down debt. Reagan never managed to pull it off in the 1980s – U.S. debt actually rose, belying the theory that tax cuts pay for themselves.

Read more …

All of Europe should.

• Belgium Adopts Law Against ‘Vulture Funds’ (AFP)

Belgium has passed a law to cap how much so-called “vulture funds” can recoup from government debt bought at rock-bottom prices from countries teetering on the brink of default. Under the new law, approved overwhelmingly by the country’s main political parties, if a Belgian judge determines a fund is acting as a “vulture,” then it cannot claim more than the discounted price paid for the bonds, rather than their face value. The move comes after Belgium was dragged into a more than decade-long battle between a group of US hedge funds led by NML Capital Management and Argentina over some $1.3 billion of defaulted debt. In May, NML demanded Argentinian accounts be frozen in Brussels – a move no longer allowed under the new law, which means a Belgian judge can refuse legal decisions made in other countries.

The decision is particularly important as Belgium is home to giant clearing house Euroclear, which processes vast numbers of global financial transactions. In March, a US judge ordered Euroclear to block any payments concerning Argentine bonds and notify the hedge funds that are claiming the debt. Ahmed Laaouej, the Socialist MP who first put forward the law, hailed its passing as a “victory over the vultures of finance” that came about “despite strong pressure from several national and international lobby groups”. “These pressures came from representatives of American finance and law firms operating in Europe and defending the interests of some clients, in this case vulture funds,” he said to AFP. “This law is a strong signal to unscrupulous investment funds which speculate in a shameful manner on the back of people in difficulty,” he added.

Read more …

Not for environmental reasons.

• China’s May Thermal Coal Imports Collapse 41% On-Year (HSN)

China’s thermal coal imports, including bituminous and sub-bituminous coal, dropped 41% on the year and were down 26% on the month in May at 6.48 million mt, according to the latest data from Beijing’s General Administration of Customs (GAC). Australia exported 3.8 million mt of bituminous and sub-bituminous coal to China in May, down 18% on month, and down 21% on the year. China’s imports of Indonesian thermal coal fell 40% from April and were down also 40% from a year ago at 1.84 million mt in May. Thermal coal imports from Russia slumped 52% on year and down 16% on month at 0.78 million mt last month.

Over January-May, China imported a total of 36.14 million mt of bituminous and sub-bituminous coal and down 44% from the corresponding five-month period last year, data showed. Top supplier Australia exported a total 18.61 million mt of thermal coal to China during January-May this year, down 22% from the year before. Meanwhile, total imports of lignite dropped 32% from the previous year to 20.85 million mt during the same period, with May imports decreasing 29% on month to 3.54 million mt. Imports from China’s top lignite coal supplier — Indonesia — stood at 19.48 million mt between January and May, down 32% on year.

Read more …