Edward S. Curtis Slow Bull Dakota Sioux Medicine Man In Prayer 1907

After a week of senseless violence and rhetoric, we could sure do with a medicine man praying for peace. I know, they say this is what the Fourth Turning looks like. But I don’t have to like it. Seeing some of the pictures of traumatized people in Barcelona I couldn’t help thinking how much they looked like those I’ve seen from Syria and Libya. Senseless violence.

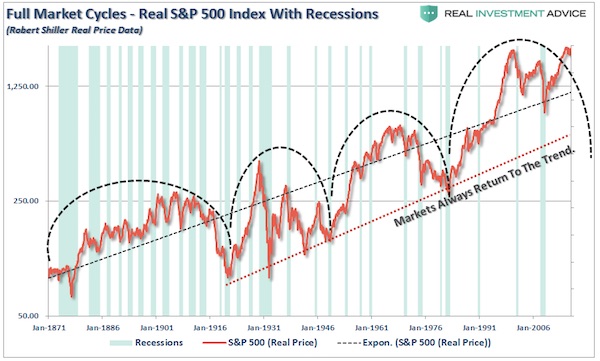

Part of a longer piece on retirement distributions. Very strong graph.

• Never Doubt Regression To The Mean (Rosso)

Since 1877, secular bull years have totaled 80 vs. 52 for bears, which is a 60/40 ratio. Surprised? Bear markets happen more often than investors are led to believe. They usually occur at times of overvaluation which makes recent retirees or those close to retirement at greater risk of experiencing negative or poor future returns. Bad luck or rotten timing. Either way, it’s going to be important to remain cognizant of portfolio distribution rates, place renewed priority on risk management, and adjust spending accordingly perhaps over the next ten years. Those who were proactive to minimize stock and high-yield bond portfolio risk (like several of the writers for Real Investment Advice), and redeployed capital into stocks at 13x earnings in the summer of 2009, helped new retirees at that time meet their retirement objectives. In addition, they have experienced a cyclical tailwind in stocks that has allowed greater distribution rates. Great luck!

Stock market cycles are vast and span decades. Don’t stumble into a Recency Bias trap where you believe current complacent market conditions lay the path to a smooth, high-return future. Markets are mean reverting mechanisms. Cycles indeed change. Usually, markets are more volatile with periods of 5% pullbacks occurring every 3-4 months. As investors, this year we’ve witnessed shallow retracements followed up by buys on the dips. An environment like this fosters overconfidence. Volatility may excite traders and be helpful to those who are seeking lower prices to purchase risk assets. For those in retirement distribution mode, volatility and corrections have potential to place portfolio longevity in jeopardy.

“Remember, we’re talking about the Fed here… a group of people who go above and beyond to ignore risks in order to maintain the status quo…”

• The Stock Market Bubble is So Big Even the Fed’s Talking About It (Phoenix)

The Fed confirmed yesterday that stocks are in a bubble. Lost amidst the usual Fed-speak about inflation and other items were the following nuggets. 1) “Equities” (read: stocks) were the primary reason the Fed discussed financial stability risks. 2) The Fed raised its assessment of financial stability from “notable” to “elevated.” 3) The Fed discussed “stock valuations.” This is simply incredible. Remember, we’re talking about the Fed here… a group of people who go above and beyond to ignore risks in order to maintain the status quo. Put another way, the stock market bubble is now so massive that even THE FED is talking about it. Indeed, the Fed is even openly states that the bubble might cause financial instability (read: a CRASH). It’s not difficult to see what the Fed is talking about. Based on their cyclical adjusted price to earnings ratio (CAPE) stocks are in CLEAR bubble territory.

As you can see, stocks are currently as overpriced as they were at the 1929 peak. Indeed, the only time stocks were MORE expensive was the Tech Bubble: the single largest stock market bubble in history. They say you don’t ring a bell at the top. But what the Fed did yesterday is DARN close. So what happens when the markets wake up to the fact that yet another massive bubble is beginning to burst?

Freeze it before the collapse.

• Ice-Nine: The Plan To Freeze The Financial System (Rickards)

In my book The Road to Ruin, I discuss a phenomenon called “ice-nine.” The name is taken from a novel, Cat’s Cradle, by Kurt Vonnegut. In the novel, a scientist invents a molecule he calls ice-nine, which is like water but with two differences. The melting temperature is 114.4 degrees Fahrenheit (meaning it’s frozen at room temperature), and whenever ice-nine comes in contact with water, the water turns to ice-nine and freezes. The ice-nine is kept in three vials. The plot revolves around the potential release of ice-nine into water, which would eventually freeze the rivers and oceans and end all life on Earth. Cat’s Cradle is darkly comedic, and I highly recommend it. I used ice-nine in my book as a metaphor for financial contagion.

If regulators freeze money market funds in a crisis, depositors will take money from banks. The regulators will then close the banks, but investors will sell stocks and force the exchanges to close and so on. Eventually, the entire financial system will be frozen solid and investors will have no access to their money. Some of my readers were skeptical of this scenario. But I researched it carefully and provided solid evidence that this plan is already in place — it’s just not well understood. But the ice-nine plan is now being put into practice. Consider a recent Reuters article that admitted elites would likely shut down the entire system when the next financial crisis strikes. The article claimed that the EU is considering actions that would temporarily prevent people from withdrawing money from banks to prevent bank runs.

“The desire is to prevent a bank run, so that when a bank is in a critical situation it is not pushed over the edge,” said one source. Very few people are aware of these developments. They get a brief mention in the media, if they get mentioned at all. But people could be in for a shock when they try to get their money out of the bank during the next financial crisis. Think of it as a war on currency or a war on money. Even the skeptics can see how the entire financial system will be frozen solid in the next crisis. The only solution is to have physical gold, silver and bank notes in private storage. The sooner you put your personal ice-nine protection plan in place, the safer you’ll be.

“..the ideal of society as a kind of universal market (and not, for example, a polis, a civil sphere or a kind of family) and of human beings as profit-and-loss calculators (and not bearers of grace, or of inalienable rights and duties)..”

• Neoliberalism: The Idea That Changed The World (G.)

Last summer, researchers at the IMF settled a long and bitter debate over “neoliberalism”: they admitted it exists. Three senior economists at the IMF, an organisation not known for its incaution, published a paper questioning the benefits of neoliberalism. In so doing, they helped put to rest the idea that the word is nothing more than a political slur, or a term without any analytic power. The paper gently called out a “neoliberal agenda” for pushing deregulation on economies around the world, for forcing open national markets to trade and capital, and for demanding that governments shrink themselves via austerity or privatisation. The authors cited statistical evidence for the spread of neoliberal policies since 1980, and their correlation with anaemic growth, boom-and-bust cycles and inequality.

Neoliberalism is an old term, dating back to the 1930s, but it has been revived as a way of describing our current politics – or more precisely, the range of thought allowed by our politics. In the aftermath of the 2008 financial crisis, it was a way of assigning responsibility for the debacle, not to a political party per se, but to an establishment that had conceded its authority to the market. For the Democrats in the US and Labour in the UK, this concession was depicted as a grotesque betrayal of principle. Bill Clinton and Tony Blair, it was said, had abandoned the left’s traditional commitments, especially to workers, in favour of a global financial elite and the self-serving policies that enriched them; and in doing so, had enabled a sickening rise in inequality. Over the past few years, as debates have turned uglier, the word has become a rhetorical weapon, a way for anyone left of centre to incriminate those even an inch to their right. (No wonder centrists say it’s a meaningless insult: they’re the ones most meaningfully insulted by it.)

But “neoliberalism” is more than a gratifyingly righteous jibe. It is also, in its way, a pair of eyeglasses. Peer through the lens of neoliberalism and you see more clearly how the political thinkers most admired by Thatcher and Reagan helped shape the ideal of society as a kind of universal market (and not, for example, a polis, a civil sphere or a kind of family) and of human beings as profit-and-loss calculators (and not bearers of grace, or of inalienable rights and duties). Of course the goal was to weaken the welfare state and any commitment to full employment, and – always – to cut taxes and deregulate. But “neoliberalism” indicates something more than a standard rightwing wish list. It was a way of reordering social reality, and of rethinking our status as individuals.

Still peering through the lens, you see how, no less than the welfare state, the free market is a human invention. You see how pervasively we are now urged to think of ourselves as proprietors of our own talents and initiative, how glibly we are told to compete and adapt. You see the extent to which a language formerly confined to chalkboard simplifications describing commodity markets (competition, perfect information, rational behaviour) has been applied to all of society, until it has invaded the grit of our personal lives, and how the attitude of the salesman has become enmeshed in all modes of self-expression. In short, “neoliberalism” is not simply a name for pro-market policies, or for the compromises with finance capitalism made by failing social democratic parties. It is a name for a premise that, quietly, has come to regulate all we practise and believe: that competition is the only legitimate organising principle for human activity.

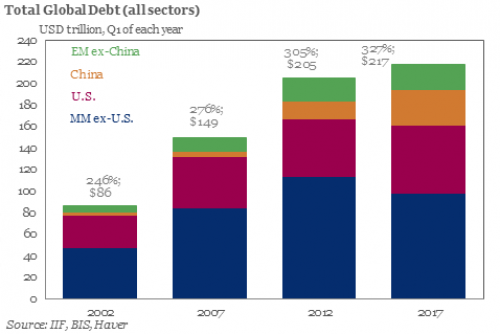

I’m still convinced that people will react shocked if China is the first domino. But though Charlene Chu is right that China controls most of its system, its control over Chinese obligations abroad isn’t nearly that strong. Xi knows this, and that’s why Chinese purchases abroad are shrinking. China has become part of the global financial system with monopoly money. And sure, it has dollars and Treasuries, but they’re neither limitless nor limitlessly fungible. Weakest point? Local governments who have borrowed from foreign sources. Or from domestic ones that get their credit from foreigners. Shadow banks.

• So When Will China’s Debt Bubble Finally Blow Up? (WS)

Corporate debt in China has soared to $18 trillion, or 169% of GDP, the largest pile of corporate debt in the world, according to the worried BIS. The OECD has warned about it earlier this year. The New York Fed warned about this debt boom in February and that it could lead to a “financial crisis,” but that authorities have many tools to control it. The IMF regularly warns about China’s corporate debt, broken-record-like, and did so again a few days ago, lambasting the authorities for their reluctance to tamp down on the growth of debt. The “current trajectory,” it said, “could eventually lead to a sharp adjustment.” The Chinese authorities – the government and the central bank, supported by the state-owned megabanks – have allowed some bonds to default, rather than bail them out, to make some kind of theoretical point, and they have been working furiously on a balancing act, tamping down on the credit growth that fuels the economy and simultaneously stimulating the economy with more credit to keep the debt bubble from imploding.

A misstep could create a global mess. “Everyone knows there’s a credit problem in China, but I find that people often forget about the scale; it’s important in global terms,” Charlene Chu told the FT. Back in 2011, when she was still a China banking analyst at Fitch Ratings, she went out on a limb with her radical estimates that there was much more debt than disclosed by the central bank, particularly in the shadow banking system, that banks were concealing risky loans in off-balance-sheet vehicles, and that this soaring opaque debt could have nasty consequences. Her outlandish views at the time have since then become the consensus. And this pile of debt is in much worse shape than officially acknowledged, she says in her latest report, cited by the FT. She’s now with Autonomous Research.

She figured that by the end of 2017, bad debt in China could hit 51 trillion yuan, or $7.6 trillion. Or about 68% of GDP! It would take the bad-debt ratio to an astronomical 34% of all loans, and way above the 5.3% that the authorities are proffering. And the authorities – the government, the central bank, supported by the state-owned banks – are now pulling all levers to keep this under control. “What I’ve gotten a greater appreciation for is how everything is so orchestrated by the authorities,” she said. “The upside is that it creates stability. The downside is that it can create a problem of proportions that people would think is never possible. We’re moving into that territory.”

More Chu. Remarkable how she says “.. the ability to avoid recognizing losses only delays the inevitable day of reckoning as problems fester for longer, and grow larger than in an economy where actors respond purely to market incentives.” Remarkable because that describes America as much as it does China.

• Charlene Chu Lays Out China’s “Doomsday” Scenario (ZH)

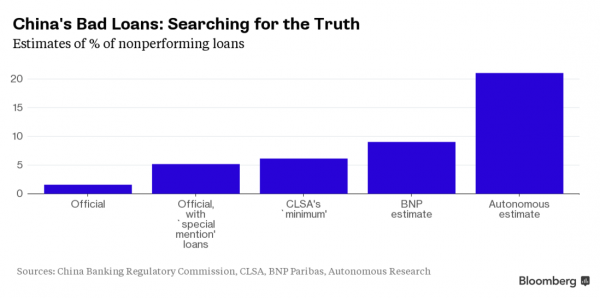

The first time we laid out the dire calculations about what is perhaps the biggest mystery inside China’s financial system, namely the total amount of its non-performing loans, by former Fitch analyst Charlene Chu we called it a “neutron bomb” scenario, because unlike virtually every other rosy forecast the most dire of which topped out at around 8%, Chu argued that the amount of bad debt in China was no less than a whopping 21% of total loans. While traditional bank loans are not Chu’s prime focus – she looks at the wider picture, including shadow banking – she says her work suggests that nonperforming loans may be at 20% to 21%, or even higher. The chart below shows just how much of an outlier Chu’s stark forecast was in comparison to her peers, and especially the grotesquely low and completely fabricated official number released by the banks and the government.

Recall that one of the biggest scandals in China in 2014 was the realization (as many had warned previously) that millions of tons of commodities were rehypothecated countless times, and thus “pledged” as collateral to numerous counterparties, and that as a result these same counterparties were unable to make sense of who owns what at one of China’s largest ports, Qingdao. In this context, it is safe to assume that loss given default rates in China are if not 100% (or more, which is impossible in theoretical terms but in practice is quite possible, as another curious side effect of unlimited collateral rehypothecation), then as close to it as possible.

Fast forward to today, when Charlene Chu, described by the FT as “one of the most influential analysts of China’s financial system” is back with a revised estimate that the bad debt in China has now reached a stunning $6.8 trillion above official figures and warns that the government’s ability to enforce stability has allowed underlying problems to go unchecked. [..] So if Chu held the wildly outlier view nearly two years ago that China’s NPLs amount to 21% of total, what is her latest estimate? The number is a doozy: in her latest report, Chu estimates that bad debt in China’s financial system will reach as much as Rmb51 trillion , or $7.6 trillion, by the end of this year, more than five times the value of bank loans officially classified as either non-performing or one notch above.” That estimate implies a bad-debt ratio of 34%, orders of magnitude above the official 5.3% ratio for those two categories at the end of June.

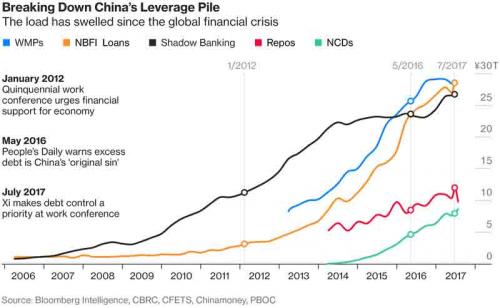

One factor that has foiled countless shorts over the years is that Beijing can simply order state-owned banks to keep lending to a lossmaking zombie company or to a smaller lender that relies on short-term interbank funding to stay liquid, and that’s precisely what has been happening, when looking at the various non-conventional credit pathways in China in recent years, which include Wealth Management Products, Bank Loans to Non-Bank Institutions, Shadow Banking, Repos and Certificates of Deposit.

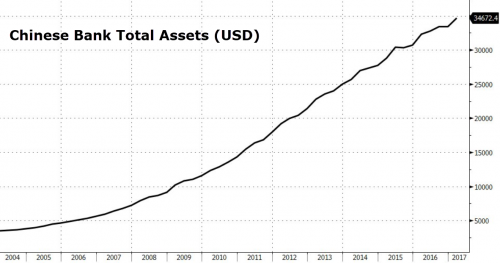

But Chu said the ability to avoid recognizing losses only delays the inevitable day of reckoning as problems fester for longer, and grow larger than in an economy where actors respond purely to market incentives. That said, the recent spike in corporate bankruptcies indicates that even Beijing is slowly shifting to a more “market” driven stance. “What I’ve gotten a greater appreciation for is how everything is so orchestrated by the authorities,” she said. “The upside is that it creates stability. The downside is that it can create a problem of proportions that people would think is never possible. We’re moving into that territory.” Finally, putting it all in context is the following chart showing the total size of China’s financial sector, which as of the latest quarter has grown to $35 trillion, double the size of the US.

Subtle tactics from Xi. Shift the debt but keep it high. What do you think the odds are that after the Party Congress China will withdraw into itself?

• China’s New Problem: Frenzy Of Consumer Lending Creates Debt Explosion (CNBC)

The Chinese government is moving to tackle high debt levels, but the country is still borrowing more, Deutsche Bank said in a report released Thursday. That’s because short-term consumer debt in China has begun to surge as authorities try to alleviate the high levels of corporate indebtedness. The redistribution comes as Beijing is trying to strike a balance between stability and strength in its economy. Household debt in China is growing “very fast” and has accelerated in the last three to four months, according to Deutsche Bank: “If we focus purely on the consumer lending … then China has been undergoing something akin to a consumer lending frenzy.” According to Deutsche Bank, corporate credit has fallen to 45% of net new credit, down from 65% in the last 10 years. Instead, Beijing is allowing households and governments to borrow more to fund growth, which is targeted for around 6.5% in 2017, said the analysts.

Now, short-term consumer credit is growing 35% year-over-year, and may hit about 40% year-over-year by the end of December at the current trend, Deutsche Bank said. The bank said it isn’t yet clear where exactly the short-term consumer credit is being deployed, although 70 to 80% of that debt has historically been credit card-related. Overall household credit growth in China, the analysts noted, is growing around 24% year-over-year. At the end of the first half of 2017, corporate the debt-to-GDP ratio fell to 165% from the peak of 169% in the first quarter of 2016. That was “more of a ‘stabilization’ than a significant reduction,” Deutsche Bank said, calling it an “explosion” of growth. Meanwhile, household and government debt however rose by 8 to 9% of GDP. “So when viewed in aggregate China is still leveraging up apace,” the Deutsche Bank report concluded.

Maybe somoneone should explain to Warren what the Fed is and does. Or Washington for that matter.

• ‘Simply Doesn’t Cut It’: Elizabeth Warren Slams Wells Fargo Board Changes (BI)

Wells Fargo’s effort to turn the page on consumer fraud scandals is falling short. That’s according to Massachusetts senator Elizabeth Warren, who has requested the Federal Reserve remove the bank’s board members who served between May 2011 and July 2015 in response to a series of vast consumer fraud scandals. The bank, already in hot water for creating millions of unauthorized accounts, recently admitted to also selling auto insurance without customers’ knowledge. Wells Fargo’s response? It has promoted an ex-Fed board governor, Elizabeth Duke, to chairwoman of the board. Duke, a champion of community banks while at the Fed, became a Wells Fargo director in 2015 and was named vice chair last year after the first round of scandals broke and led to the resignation of then-CEO John Stumpf.

Business Insider contacted Senator Warren to get her reaction. “Letting a few board members retire early and shuffling around current board members simply doesn’t cut it,” Warren said in an email. “The Fed should remove all remaining board members who served during the fake-accounts scandal.” Warren also renewed her call for board members’ removal with a new letter to Fed chairman Janet Yellen dated August 16, and voicing her dissatisfaction at what she sees as central bank inaction. “Instead of taking steps to remove the responsible Wells Fargo Board members, the Federal Reserve has actually sought to reduce their obligations and the obligations of other directors at the country’s biggest banks,” the letter said. In July, Warren repeatedly pressed Fed Chair Janet Yellen on the issue during recent Congressional testimony but Yellen would only say the central bank had the power to remove the directors — not that it had any inclination to do so.

More free rides for bankers. Warren! Oh wait, your own party takes their contributions.

• Deutsche Bank, Bank of America Settle Agency Bond Rigging Lawsuits (R.)

Deutsche Bank and Bank of America agreed to pay a combined $65.5 million to settle investor litigation accusing large banks of rigging the roughly $9 trillion government agency bond market over a decade. Preliminary settlements totaling $48.5 million for Deutsche Bank and $17 million for Bank of America were filed on Thursday with the U.S. District Court in Manhattan, and require a judge’s approval. Both banks denied wrongdoing. The settlements were the first in litigation accusing 10 banks of engaging in a “brazen conspiracy” to rig the market for U.S. dollar-denominated supranational, sub-sovereign and agency (SSA) bonds, court papers show. The investors are led by the Iron Workers Pension Plan of Western Pennsylvania, KBC Asset Management, and the Sheet Metal Workers Pension Plan of Northern California.

They accused banks of communicating by phone, chatrooms and instant messaging to share pricing data and function as a collective “super-desk,” while letting traders coordinate their strategies, to boost profit. This collusion allegedly ran from 2005 to 2015, and forced customers to accept unfair prices on bonds they bought and sold, court papers show. BNP Paribas, Citigroup, Credit Agricole, Credit Suisse, HSBC, Nomura, Royal Bank of Canada and Toronto-Dominion Bank were also sued, and all sought dismissals. U.S. regulators have also examined possible manipulation in the SSA bond market. The Manhattan court is home to a slew of private litigation accusing big banks of conspiring to rig various financial markets, interest rate benchmarks and commodities. Late Wednesday night, another group of investors sued six banks, claiming they rigged the more than $1 trillion stock lending market.

Simply how all of Washington works.

• Who Is Lobbying Mike Pence And Why? (IBT)

Mike Pence has been among the Trump administration’s most prominent voices pressing to replace the Affordable Care Act, repeal post-crisis financial regulations, privatize American infrastructure and promote fossil fuels. Those positions would benefit the industries that have been directly lobbying Pence since he was elected vice president, according to federal documents reviewed by International Business Times. Amid speculation that Pence could mount his own presidential bid — or replace Trump if he leaves office early — the former Indiana governor and U.S. congressman has been directly lobbied by major health care and drug companies, Wall Street firms, oil and gas interests and industry groups interested in shaping a federal infrastructure privatization initiative.

Pence’s office has also been lobbied by his former congressional chief of staff on behalf of insurance, defense contracting and telecommunications companies — and that lobbying revolved around health care policy, defense spending and net neutrality. Pence has enthusiastically backed the policies by the lobbying firms. While other vice presidents have been the target of lobbying in the past, Pence has been viewed as one of the most powerful vice presidents in recent history. He is a longtime politician serving a president with no experience in elected office, and during his vice-presidential selection process, Trump was reportedly offering potential running mates a vast policy portfolio to oversee. Pence also oversaw Trump’s White House transition, which shaped the administration’s personnel decisions and many of its policy proposals.

Companies that have lobbied the vice president have spent tens of millions of dollars in total federal lobbying so far this year. Here is a deeper look at the major industries lobbying him — and what exactly they have been pushing for in their efforts to influence the vice president. Despite his onetime support for expanding Obamacare subsidies in his home state, Pence has reversed course and led the Trump administration’s legislative bid to repeal the Affordable Care Act — just as health insurers have been lobbying him in 2017.

“If you’re one of those Americans who want to see Obamacare repealed and replaced, we literally are days, or maybe just weeks, away from being able to accomplish that historic objective,” he told conservative talk radio host Rush Limbaugh last month. “We believe if they can’t pass this carefully crafted repeal and replace bill — we do those two things simultaneously — we ought to just repeal only and then have enough time built into that legislation to craft replacement legislation.” The Pence-led repeal effort could be a financial boon to health insurers like Blue Cross and Blue Shield, as well as UnitedHealthcare Group — both which have been in direct contact with Pence, according to records reviewed by IBT.

Libertarian view.

• Mr. President: Close Down More “Advisory Councils” (Rossini)

So President Trump closed down his “Manufacturing Council” and no one cheered? What a shame. Why was there a “Manufacturing Council” to begin with? It’s not the job of the president to meddle with our economy. His job description says nothing about benefitting “manufactures” or “scientists” or “Silicon Valley” or anyone else. These “Councils” are breeding grounds for the cronyism that has virtually destroyed the American Dream. If a CEO has the ear of the president, do you think he’s going to “advise” the president to do anything that will hurt his own business? On the other hand, would the CEO be tempted to advise the president to hurt his competitors, both foreign and domestic? Would the CEO advise the president to make it hard for start-ups and entrepreneurs to compete?

Would he advise for subsidies? Strict licensing laws? The president doesn’t need Advisory Councils, Czars, or any other destroyer of our economic liberties. Let the CEO’s be “counciled” themselves by free market prices. Let them deal with economic reality as it is, not massage the president for unconstitutional interventions. Let them stand on their own. Either satisfy consumers profitably, or fold up so that other people can. The president, at the same time, should stop pretending that he can push buttons and pull levers to make the economy run. Nothing could be further from the truth. Government intervention only stifles the economy.

The economy continues to function despite the political intrusions that exist. Fortunately, entrepreneurs are creative enough to always find ways around so-called government “regulations”. There’s always a loophole somewhere. But why make it hard on entrepreneurs to begin with? Just get the heck out of the way! But alas, the government and multi-national corporations are attached at the hip. One scratches the back of the other. Mr. President, close down all the “Advisory Councils,” and keep your hands off the economy.

Spain’s views on this may have changed last night.

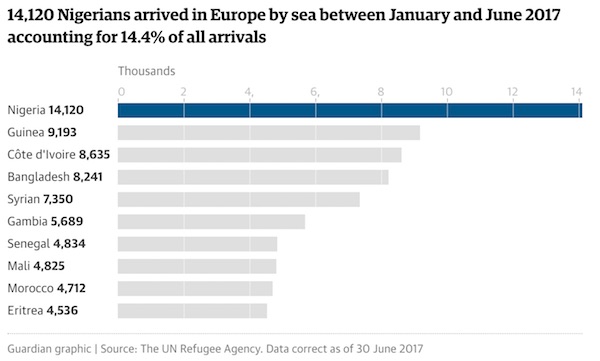

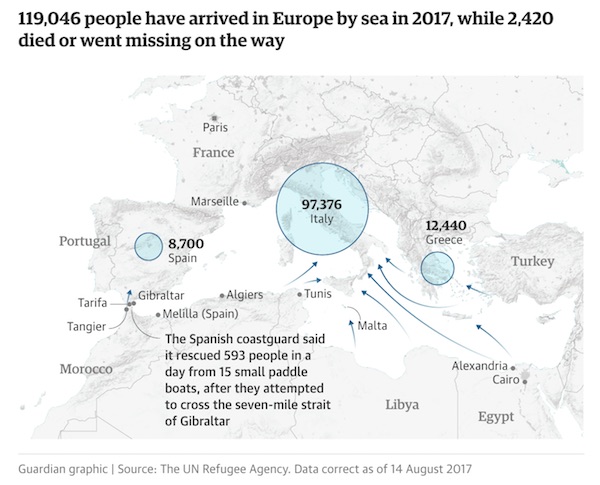

• Spain Lacks Capacity To Handle Migration Surge – UNHCR (G.)

Spain lacks the resources and capacity to protect the rising number of refugees and migrants reaching it by sea, the UN refugee agency has said. The warning from UNHCR comes as the Spanish coastguard said it rescued 593 people in a day from 15 small paddle boats, including 35 children and a baby, after they attempted to cross the seven-mile Strait of Gibraltar. The number of refugees and migrants risking the sea journey between Morocco and Spain has been rising sharply, with the one-day figure the largest since August 2014, when about 1,300 people landed on the Spanish coast in a 24-hour period. About 9,300 migrants have arrived in Spain by sea so far this year, while a further 3,500 have made it to two Spanish enclaves in north Africa, Ceuta and Melilla, the EU’s only land borders with Africa.

María Jesús Vega, a spokeswoman for UNHCR Spain, said police were badly under-resourced and there was a lack of interpreters and a shortage of accommodation for the new arrivals. “The state isn’t prepared and there aren’t even the resources and the means to deal with the usual flow of people arriving by sea,” she said. “Given the current rise, we’re seeing an overflow situation when it comes to local authorities trying to cope at arrival points.” Vega said the agency was seeing a very high number of vulnerable people including women, victims of people-trafficking, and children. “What we’re asking is for there to be the right mechanisms in place to ensure people are treated with dignity when they come,” she said.