Ansel Adams Evening at McDonald Lake, Glacier National Park 1942

UPDATE: There is a problem with our Paypal widget/account that makes donating hard for some people, but that Paypal apparently can’t be bothered to fix. At least not over the past 2 weeks. What happens is that for some a message pops up that says “This recipient does not accept payments denominated in USD”. This is nonsense, we do.

We have no idea how many people have simply given up on donating, but we can suggest a workaround (works like a charm):

Through Paypal.com, you can simply donate to an email address. In our case that is recedinghorizons *at* gmail *com*. Use that, and your donations will arrive where they belong. Sorry for the inconvenience.

The Automatic Earth and its readers have been supporting refugees and homeless in Greece since June 2015. It has been and at times difficult and at all times expensive endeavor. Not at least because the problems do not just not get solved, they actually get worse. Because the people of Greece and the refugees that land on their shores increasingly find themselves pawns in political games.

Therefore, even if the generosity of our readership has been nothing short of miraculous, we must continue to humbly ask you for more support. Because our work is not done. Our latest essay on this is here: The Automatic Earth for Athens Fund – Christmas and 2018 . It contains links to all 14 previous articles on the situation.

Here’s how you can help:

For donations to Konstantinos and O Allos Anthropos, the Automatic Earth has a Paypal widget on our front page, top left hand corner. On our Sales and Donations page, there is an address to send money orders and checks if you don’t like Paypal. Our Bitcoin address is 1HYLLUR2JFs24X1zTS4XbNJidGo2XNHiTT. For other forms of payment, drop us a line at Contact • at • TheAutomaticEarth • com.

To tell donations for Kostantinos apart from those for the Automatic Earth (which badly needs them too!), any amounts that come in ending in either $0.99 or $0.37, will go to O Allos Anthropos.

Please give generously.

No, this is not actual value, this is just another bubble in a system built exclusively on bubbles.

• Global Markets End On Record High After Adding $9 Triilion In 2017 (G.)

Global stock markets have ended 2017 on record highs, gaining $9tn in value over the year due to a strong worldwide economy, President Donald Trump’s tax cuts and central banks’ go-slow approach to easing financial support. The FTSE 100 hit a new peak in London, with an all-time closing high of 7687.77, having earlier hit a new all-time peak of 7697.62. The leading UK index was boosted by a late surge in mining stocks as commodity prices rose against a weaker dollar and optimism grew about the Chinese economy, leaving the index up 7.6% over the year. In global terms, the MSCI all-country world index gained 22% or $9tn on the year to an all-time high of 514.53.

Even the rival attractions of bitcoin, up nearly 14 times over the year, and concerns about war with North Korea, political upheaval in Europe with the Catalan separatist movement in Spain and an inconclusive German election failed to dampen the party mood. Craig James, chief economist at Sydney-based fund manager CommSec, said that of the 73 bourses it tracks globally, all but nine have recorded gains in local currency terms this year. The key for 2018 will be whether central banks maintain a benign approach to reducing their financial support, he added, with the Federal Reserve and Bank of England raising borrowing costs only gradually this year. Low interest rates and quantitative easing, where central banks buy bonds from financial institutions, have been a major support for investors and asset prices in recent years.

“For the outlook, the key issue is whether the low growth rates of prices and wages will continue, thus prompting central banks to remain on the monetary policy sidelines,” said James. “Globalisation and technological change have been influential in keeping inflation low. In short, consumers can buy goods whenever they want and wherever they are.”

And here’s your next bubble. Now, remember, the Fed is set to tighten, taking the fuel for the bubble away with it.

• Value Of US Housing Market Climbs To Record $31.8 Trillion (HW)

The total value of all homes in the U.S. increased in 2017 to a total $31.8 trillion, according to the latest report from Zillow. This is up from last year’s record high of $29.6 trillion, data from 2016 shows. This is so high, that total homes in Los Angeles and New York City metro areas are worth $2.7 trillion and $2.6 trillion, respectively, the size of the U.K. and French economies. To put it in perspective, the total value of the housing market is 1.5 times greater than the GDP of the U.S., and nearly three times that of China. This is an increase of $1.95 trillion over the past year, more than all of Canada’s GDP or two companies the size of Apple, Zillow’s report showed. And renters are also now spending more money than ever before on housing, spending a record $485.6 billion in 2017.

This is an increase of $4.9 billion from 2016. Renting in San Francisco is especially expensive as renters collectively paid $616 million more than renters in Chicago, despite having 467,000 fewer renters in San Francisco. Of the 35 largest U.S. markets, most home value growth occurred in Columbus, Ohio, which saw an increase of 15.1% to $152.3 billion in 2017. But home prices continue to increase, fueling the housing market’s value growth. Home prices recently increased in October, and experts are beginning to fear 2018 could lock many potential buyers out of the housing market, forcing them to rent, according to the latest report released by S&P Dow Jones Indices and CoreLogic.

Stating the obvious.

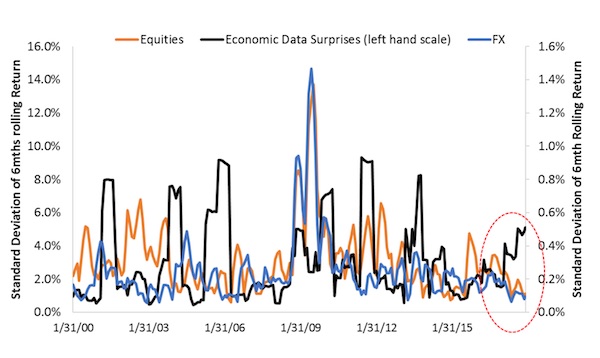

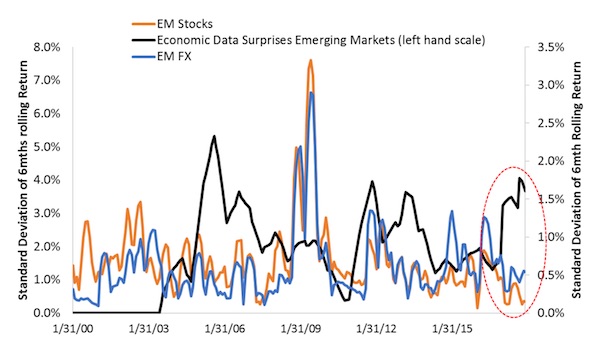

• Return of Volatility Foreshadowed In Economic Data (BBG)

If financial market volatility was given up for dead in 2017, then get ready for a resurrection. To understand why, take a look at the incoming economic data. When the underlying dynamics of the economy change, the data tend to become more volatile before markets react. Economic volatility as expressed by the standard deviation of changes in the monthly data has been on the rise since the summer as the global economy gained strength. Financial market volatility, though, has fallen amid a lack a surprises in central bank policies, receding geopolitical tensions and upbeat corporate earnings. But as history shows, such divergences between economic and financial market volatility only last for brief periods. As such, a rebound in market volatility has the potential to be a key driver of risk premiums, bond yields and valuations in 2018.

Volatility is also linked to “financial vulnerability,” which is an aggregate of indicators such as fiscal and current-account balances, the share of local currency bonds held by nonresidents, and short-term external debt as a percentage of currency reserves. Such vulnerabilities picked up in 2017 as portfolio flows into local emerging-market bond and currency funds swelled by $7.5 billion to 15% of local GDP with the growing popularity of exchange-traded funds. And although the data coming from emerging-market economies have been solid, it’s become more volatile, which contrasts with the drop in financial market volatility brought on by large portfolio flows. Countries such as South Africa and Turkey that are political hot spots have seen portfolio flows increase even though their current-account balances have deteriorated. Historically, market volatility has closely tracked economic volatility in emerging markets.

$2.5 trillion coming back home?

• Trump’s Tax Changes To Blow A $5 Billion Hole In Goldman Sachs Profits (G.)

Goldman Sachs has said Donald Trump’s radical US tax changes will knock about $5bn (£3.7bn) off its profits this year. The investment bank said most of the cost would come from Trump’s “repatriation tax” designed to encourage multinationals to bring back the trillions of dollars they hold overseas to avoid tax. Goldman, which made profits of $7.4bn last year, said: “The enactment of the tax legislation will result in a reduction of approximately $5bn in the firm’s earnings for the fourth quarter and year ending 31 December 2017, approximately two-thirds of which is due to the repatriation tax. “The remainder includes the effects of the implementation of the territorial tax system and the remeasurement of US deferred tax assets at lower enacted corporate tax rates,” the bank said in a filing with the Securities and Exchange Commission on Friday.

Last week Congress approved the biggest tax overhaul in 30 years, which includes big tax cuts for companies and wealthy people. The reduction in corporation tax – from 35% to 21% – is designed in part to encourage multinational to repatriate cash from overseas. US companies were estimated, by Citigroup, to hold $2.5tn of capital overseas. Companies had previously explained that they had a duty to shareholders to keep the money abroad, rather than bring it back to the US and pay large tax bills. The tax overhaul will allow Apple to bring back its $252.3bn foreign cash mountain without a major tax hit. The huge amount of untaxed profits Apple holds overseas has become a major political football and a headache for the world’s most valuable company. Drugmaker Amgen said last week that it expected to pay $6bn to $6.5bn repatriating its cash to the US.

More of the obvious, in a long article: “I don’t care that some university gave her a Ph.D., and some politicians made her Fed Chair ..”

• Doug Casey on the Coming Financial Crisis (CR)

Justin’s note: Earlier this year, Fed Chair Janet Yellen explained how she doesn’t think we’ll have another financial crisis “in our lifetimes.” It’s a crazy idea. After all, it feels like the U.S. is long overdue for a major crisis. Below, Doug Casey shares his take on this. It’s one of the most important discussions we’ve had all year. Justin: Doug, I know you disagree with Yellen. But I’m wondering why she would even say this? Has she lost her mind?

Doug: Listening to the silly woman say that made me think we’re truly living in Bizarro World. It’s identical in tone to what stock junkies said in 1999 just before the tech bubble burst. She’s going to go down in history as the modern equivalent of Irving Fisher, who said “we’ve reached a permanent plateau of prosperity,” in 1929, just before the Great Depression started. I don’t care that some university gave her a Ph.D., and some politicians made her Fed Chair, possibly the second most powerful person in the world. She’s ignorant of economics, ignorant of history, and clearly has no judgment about what she says for the record. Why would she say such a thing? I guess because since she really believes throwing trillions of dollars at the banking system will create prosperity.

It started with the $750 billion bailout at the beginning of the last crisis. They’ve since thrown another $4 trillion at the financial system. All of that money has flowed into the banking system. So, the banking system has a lot of liquidity at the moment, and she thinks that means the economy is going to be fine. [..] The whole banking system is screwed-up and unstable. It’s a gigantic accident waiting to happen. People forgot that we now have a fractional reserve banking system. It’s very different from a classical banking system. I suspect not one person in 1,000 understands the difference… Modern banking emerged from the goldsmithing trade of the Middle Ages. Being a goldsmith required a working inventory of precious metal, and managing that inventory profitably required expertise in buying and selling metal and storing it securely.

Those capacities segued easily into the business of lending and borrowing gold, which is to say the business of lending and borrowing money. Most people today are only dimly aware that until the early 1930s, gold coins were used in everyday commerce by the general public. In addition, gold backed most national currencies at a fixed rate of convertibility. Banks were just another business—nothing special. They were distinguished from other enterprises only by the fact they stored, lent, and borrowed gold coins, not as a sideline but as a primary business. Bankers had become goldsmiths without the hammers.

“..we’re more likely to land in a return to something more like 1834, with scant central heating, and a lot of suspense about getting a hot meal at sundown. I want a mule…”

• The Year in Trump (Jim Kunstler)

There he is, our president, both immovable object and irresistible force, unsmiling with slitty eyes beneath that car-hood of a hair-doo, lumbering from one presidential prerogative to the next through squalls of opprobrium, perplexing leaders from foreign lands, punking congressmen and senators, inducing swoons of un-safeness among the zhes, theys, and thems on campus, provoking the op-ed bards of The Times to mouth-foaming hysterics, tweeting any old thing that flies through the interstices of his brain-pan, our Golden Golem of Greatness, MAGA sword in smallish hand against a swirling red sky. Well, he made it through the year. I thought the fucker would be sandbagged by a claque of Pentagon patriots inside of three months, but I was wrong, wrong, wrong.

What seems to be forgotten is that Donald Trump brought his own swamp to Washington, as in a history of hinky real-estate wheelings-and-dealings, stiffed vendors, bankruptcies, lowbrow TV hijinks, and dark adventures in the Manhattan nightlife of the late 20th century. So, it’s swamp versus swamp. You may detect that I’m not exactly a fan of the president, but I rather admire his standing up to the permanent bureaucracy that we call the Deep State, and especially its elite poobahs, who have driven this polity into a deeper ditch than the voters realize. The Mueller investigation hangs over Trump’s head like a piñata filled with dog-shit, but he soldiers on.

After more than a year, the RussiaGate narrative is looking like something fished out of the Goodwill Industries dumpster, its chief sponsor, the FBI, riddled with conflicts-of-interest, suspicious political motivations, and flat-out partisan animosity. Right now, there’s more reason to suppose Mueller will have to start asking some hard questions about Russia collusion among the Hillary cohort —and don’t forget, there’s that stinky business featuring ex-DNC-Chief Debbie Wasserman-Schultz and her mysterious Pakistani IT go-fer, Imran Awan, waiting in the wings.

[..] I’m skeptical of Trump’s MAGA program. We’re not going to replay the industrial age in North America, and we’re for sure not going to return to the life-ways of 1962. I also doubt that we are heading into a Silicon Valley inspired robotic A-I nirvana of “creative” weenies in flying, pilotless Ubers. Rather, I think we’re more likely to land in a return to something more like 1834, with scant central heating, and a lot of suspense about getting a hot meal at sundown. I want a mule.

Pay people for work in non-profit-oriented jobs. Education, health care etc. Good for society, and the only way to save these fields.

We define poverty, I suppose, as that living condition which is unable to acquire enough dollars to purchase some, or most, of the basic necessities of life. It also seems to be an accepted notion that a certain amount of “poverty” is a necessary condition of our modern market economy—that a certain segment of the population will always be “unemployable” by the profit-oriented business community, either because they lack skills or because the business community simply does not need their services in order to generate its profits. Nobody really knows what to do with these “unneeded” people. We talk about “retraining” them—but there is no guarantee the profit-seeking business community will need them even with their newly acquired skills. In the meantime, these “unneeded” people don’t know what do with themselves either.

This is, perhaps, the biggest problem of all—though I will not, in this short essay, go into the details of that (except to say that it is contributing to a tragedy that is now disrupting the lives of too many of us). The point is this: It is time to begin imagining specific, concrete solutions to what is becoming a fundamental dilemma of our time. Imagine, for example, that every American citizen over the age of 16 can choose to earn a living-wage in exchange for providing a useful service to their local or regional community. Imagine that every local community has a free health and pharmacy clinic (in conjunction with a free methadone and counseling center)—where some of the employees are the living-wage earners. Imagine further that every local community has a housing co-op system (built in part by some of the living-wage earners) that makes available—to every family that needs it—a basic dwelling unit that is warm, dry, well-ventilated, and which provides for cooking, bathing, sleeping, and family gathering.

Imagine that every local community has at least one community garden and rookery (managed by some of the living-wage earners) which grows, harvests, and processes vegetables, fruits, eggs, cheese—and perhaps fish—for local consumption. Imagine that every local community has at least one pre-school day-care (manned at least in part by some of the living-wage earners) which provides, free of charge, a safe, early child-hood learning environment between the hours of 6 A.M. and 6 P.M. Imagine that every local community has a system of retirement co-housing villages (built and staffed, in part, by the living-wage earners). Imagine, in other words, replacing what we now define as “poverty” with another kind of living condition—we might call it “community subsistence.”

If he feels so strongly anti-Brexit, why did he agree to be part of May’s government?

• Theresa May’s Infrastructure Czar Quits, Lashing Out at Brexit (BBG)

Andrew Adonis quit as Theresa May’s infrastructure czar, but not before delivering a blistering verdict on the Brexit policy being pursued by the U.K. prime minister and her Conservative Party. The Labour peer and former transport secretary described Brexit as a “populist and nationalist spasm worthy of Donald Trump” in a resignation letter published by the Guardian that he confirmed as “accurate” on Twitter. As for May’s flagship piece of Brexit legislation, which cleared the House of Commons in December, Adonis described it as “the worst legislation of my lifetime,” and indicated he’ll oppose it when the House of Lords debates it. “I feel duty bound to oppose it relentlessly from the Labour benches,” Adonis wrote.

“You are pursuing a course fraught with danger…If Brexit happens, taking us back into Europe will become the mission of our children’s generation, who will marvel at your acts of destruction.” Adonis was appointed to the National Infrastructure Commission in 2015 by then Chancellor of the Exchequer George Osborne, to push cross-party consensus over long-term decisions to invest in infrastructure. His departure and pledge to oppose May’s Brexit strategy is another sign that even as Britain leaves the EU, divisions permeate throughout the political establishment.

His departure means 2017 is bookended by resignations for May. Three days into the year, her EU envoy Ivan Rogers unexpectedly quit, depriving her of a key figure in dealing with EU negotiators. And now, days from the end of the year, Adonis is departing with an excoriating verdict on the country’s direction. “Brexit is causing a nervous breakdown across Whitehall,” Adonis wrote. “The government is hurtling towards the EU’s emergency exit with no credible plan for the future of British trade and European cooperation, all the while ignoring – beyond sound-bites and inadequate programs – the crises of housing, education, the NHS and social and regional inequality which are undermining the fabric of our nation and feeding a populist surge.”

Rajoy calls an election, tries to influence it be jailing some opponents and making sure others remain in exile, then loses anayway and starts blabbing about extortion. Who’s blackmailing who?

• Rajoy Says Spain Won’t Yield to Blackmail by Catalan Separatists (BBG)

Spanish Prime Minister Mariano Rajoy set in motion the process for convening a new Catalan parliament and said he wouldn’t allow a new separatist administration to blackmail his government. A session to swear in lawmakers in Barcelona will take place on Jan. 17 before a vote days later to appoint a new regional president if there is a candidate, Rajoy said in an end-of-year news conference in Madrid. Rajoy dissolved the Catalan parliament in October after drawing on emergency constitutional powers to respond to a unilateral declaration of independence from Spain. Elections held last week in the region produced a majority for parties that support independence in a result that threatens to prolong a secession crisis that is damaging Spain’s economy.

“I hope that very soon in Catalonia we can count on a government dedicated to reversing the grave social and economic effects of the crisis of recent months,” Rajoy said. “There’s no room for more appeals for rupture or illegality because the law will not allow it.” Choosing a president for Catalonia won’t be easy for the pro-independence parties with former President Carles Puigdemont in Brussels avoiding arrest and his former deputy, Oriol Junqueras, already in jail. A Supreme Court judge is investigating whether the campaign to split from Spain amounted to a rebellion against the government. Rajoy said his most pressing task for the start of the year would be the need to build consensus for his minority government to pass a budget for 2018.

Syria is no-go for the US and its allies. Leave it alone. Let them rebuild.

• Putin Tells Assad Russia Will Help Defend Syrian Sovereignty (R.)

Russian President Vladimir Putin told his Syrian counterpart Bashar al-Assad in a new year’s greeting that Russia will continue supporting Syria’s efforts to defend its sovereignty, the Kremlin said on Saturday. Earlier this month Putin ordered the Russian forces in Syria to start withdrawing from the country, but said Russia would keep its Hmeymim air base in Syria’s Latakia Province as well as its naval facility at Tartous “on a permanent basis”.

The Troika will use this to come up with additional demands.

• Greek Banks Offer Borrowers Haircuts Of Up To 90% (K.)

Greek lenders are proposing huge haircuts, ranging from 70% to 90%, for borrowers with debts from consumer loans, credit cards or small business loans without collateral. In the context of the sale of a €2.5 billion bad-loan portfolio named Venus, Alpha Bank is using the incentive of major haircuts in letters it has sent to some 156,000 debtors. The fact that this concerns some 240,000 bad loans means that some debtors may have two or three overdue loans. Eurobank is employing the same strategy for a set of loans adding up to €350 million. Most of them range between €5,000 and €7,000 each and have been overdue for over a decade. This means that the banks are expecting to collect a small amount of those debts, coming to €250 million for Alpha and €35 million for Eurobank – in effect accepting that the rest of the debt is uncollectible.

Man happened.

• How Did Half Of The Great Florida Coral Reef System Disappear? (G.)

The great Florida coral reef system stretches hundreds of miles down the eastern seaboard of the US. It is the world’s third largest, and nearly 1,400 species of plants and animals and 500 species of fish have been recorded there. But last year marine scientists found nearly half the reef was missing. They took the latest satellite images, compared them with precisely drawn 250-year-old British admiralty charts and found them nearly identical. But where the historic charts showed there had been extensive coral reefs close to the shore in the 1760s, the satellite maps revealed just sea grasses and mud. Only those reefs far from the shore were still intact and alive with fish and plants. So when and why did so much of the world’s third largest reef system just disappear?

Natural forces like spells of extreme rainfall and heatwaves may have played some part, but it is more likely that man was responsible. In those 250 years, fishing off the Florida Keys intensified, causeways and cities were built, pollution increased and the flow of freshwater, sediments and nutrients from the land all changed. Any of these factors could have led to the stress and decline of the reef, but it probably took a combination to kill off half the corals. Something similar to what took place over 250 years off the Florida coast is now accelerating across reefs around the world as natural and new anthropogenic threats emerge and combine with deadly effect.

Corals are intolerant both of temperature and salinity change and it just takes a rise of 1C for a few weeks or extreme rainfall for them to begin to die. In the past 20 years, extreme weather linked to El Niño events and climate change has hit the world’s shallow reefs hard. Abnormally warm water caused the world’s first recorded widespread coral bleaching in 1998. Stretches of the Great Barrier Reef off Australia, and other reefs off Madagascar, Belize and the Maldives, were left white and seemingly dead. Most recovered because corals survive if conditions return to normal. But since then, widespread bleaching and other events have occurred nearly every year, leaving many of the world’s reefs stressed and vulnerable to disease.