Richard Oelze The expectation 1936

Speaker

https://twitter.com/i/status/1869414683054346727

People call me "NostraThomas" for accurately predicting @SpeakerJohnson would use the Christmas recess to force a massive spending bill through Congress.

After claiming he would not, Johnson is embracing a D.C. tradition that's nearly as old as decorating Christmas trees. pic.twitter.com/TRd1ZiCXtc

— Thomas Massie (@RepThomasMassie) December 18, 2024

Call your elected representatives today to stop the steal of your tax dollars!

pic.twitter.com/6suIuQMcO4— Elon Musk (@elonmusk) December 18, 2024

Congress is racing to force through a massive amount of wasteful spending in the next three days.

President Trump’s hands will be tied by the Impoundment Control Act, passed in 1974 to sabotage Richard Nixon from cutting spending.

I want to repeal it. pic.twitter.com/L13MBKVpn5

— Mike Lee (@SenMikeLee) December 17, 2024

Eric Adams

https://twitter.com/i/status/1869155321987358803

Revenge

https://twitter.com/i/status/1869198929667014946

Rogan

NEW: Joe Rogan GOES OFF on Democrats, the legacy media, FBI, and DOJ for using the judicial system as a weapon against Trump!

Rod Blagojevich says "dirty cops" need to be held accountable for framing an innocent man:

• Jack Smith

• Alvin Bragg

• Letitia James

• Fani Willis… pic.twitter.com/y4KQh72qLM— KanekoaTheGreat (@KanekoaTheGreat) December 18, 2024

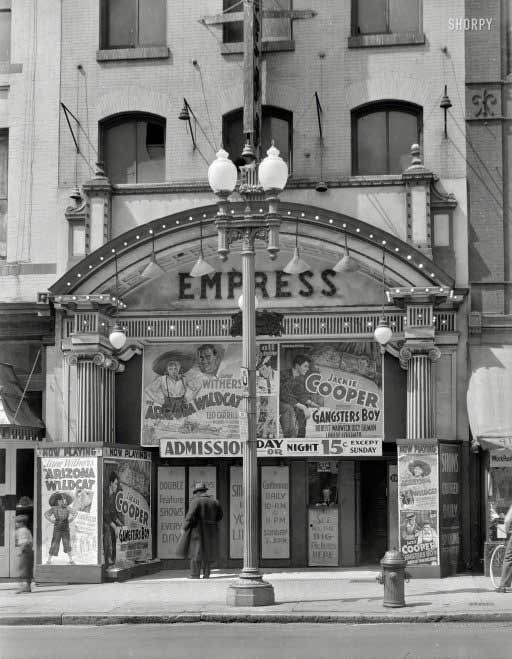

“Speaker Johnson Tries To Ram Through Insane Funding Package..”

“Sen. Rand Paul (R-KY) said he had “hoped to see @SpeakerJohnson grow a spine,” but “this bill full of pork shows he is a weak, weak man.”

• ‘CALL THEIR BLUFF’: Trump And Vance Slam Pork-Filled House Bill (ZH)

Speaker Mike Johnson, (R-LA), has unveiled a 1,547-page government funding bill that has Republicans seeing red – and not just because of the looming Friday midnight shutdown deadline. Packed with disaster relief, farmer aid, and a Christmas stocking full of legislative surprises, the short-term spending bill has set off a firestorm within Johnson’s own party. The bill, known as a continuing resolution (CR), keeps the federal government funded through March 14, buying Congress a little breathing room. But in classic Capitol Hill fashion, the measure is loaded with provisions unrelated to basic spending – and House conservatives are furious, according to Punchbowl News.

[..] They’ve also given themselves a pay raise: “It’s complicated, but Congress has proactively blocked lawmakers from getting a cost-of-living adjustment (COLA) since 2009. This was done by including language in spending bills specifically preventing such pay increases, although other federal employees get them. However, the new CR includes a provision (page 15) that amends language in a previous CR that incorporated a provision from an earlier omnibus blocking any member COLA. Yes, that’s how it was done. Nothing as simple as “Members and senators will get a pay raise.” -Punchbowl

NOW – House Speaker Mike Johnson said he was texting with Elon and Vivek about CR spending bill; "Well I was communicating Elon last night. Elon and Vivek and I are on a text chain together. And I was explaining to them the background of this." pic.twitter.com/1eNRqe3Eaf

— Overton (@overton_news) December 18, 2024

Johnson’s problems began Tuesday, when he sounded out hardliners on the House Rules Committee – Reps. Chip Roy (TX), Thomas Massie (KY), and Ralph Norman (SC) – to gauge their support for the bill. Unsurprisingly, the trio demanded a price for their cooperation:

• Adherence to the 72-hour rule to review the bill before voting.

• Spending offsets to counter the new funding.

• Restrictions on selling off border wall materials.

Johnson hasn’t agreed to these conditions, leaving him with little choice but to bring the CR to the floor under suspension of the rules, which requires a two-thirds majority for passage. A floor vote is expected Thursday, giving the Senate barely 24 hours to clear the bill before the clock strikes midnight Friday. Sen. Rand Paul (R-KY) said he had “hoped to see @SpeakerJohnson grow a spine,” but “this bill full of pork shows he is a weak, weak man.” “It’s silly to pretend this is just a skinny CR,” one GOP staffer told Punchbowl News. “It’s a three-month spending bill with ornaments hanging all over it.”Meanwhile, conservatives in the House Freedom Caucus (HFC) are fuming at the bill’s scope and the speaker’s handling of the process. And GOP moderates are frustrated by the party’s inability to settle on a clean solution. Johnson, for his part, has no easy out – having opted for neither a clean CR nor a comprehensive omnibus spending package, and instead delivering a stopgap bill stuffed with unrelated provisions. Some hardliners are already withholding public support for Johnson ahead of his January 3 re-election bid for speaker, signaling that his light-handed leadership style may be backfiring.

This bill should not pass https://t.co/eccQ6COZJ4

— Elon Musk (@elonmusk) December 18, 2024

[..] Trump and Vance just came out against the pork too… A statement from President Donald J. Trump and Vice President-Elect JD Vance: The most foolish and inept thing ever done by Congressional Republicans was allowing our country to hit the debt ceiling in 2025. It was a mistake and is now something that must be addressed. Meanwhile, Congress is considering a spending bill that would give sweetheart provisions for government censors and for Liz Cheney. The bill would make it easier to hide the records of the corrupt January 6 committee—which accomplished nothing for the American people and hid security failures that happened that day. This bill would also give Congress a pay increase while many Americans are struggling this Christmas. Increasing the debt ceiling is not great but we’d rather do it on Biden’s watch. If Democrats won’t cooperate on the debt ceiling now, what makes anyone think they would do it in June during our administration?

Let’s have this debate now. And we should pass a streamlined spending bill that doesn’t give Chuck Schumer and the Democrats everything they want. Republicans want to support our farmers, pay for disaster relief, and set our country up for success in 2025. The only way to do that is with a temporary funding bill WITHOUT DEMOCRAT GIVEAWAYS combined with an increase in the debt ceiling. Anything else is a betrayal of our country. Republicans must GET SMART and TOUGH. If Democrats threaten to shut down the government unless we give them everything they want, then CALL THEIR BLUFF. It is Schumer and Biden who are holding up aid to our farmers and disaster relief. THIS CHAOS WOULD NOT BE HAPPENING IF WE HAD A REAL PRESIDENT. WE WILL IN 32 DAYS!

CR BS: On the heels of the report that the DOJ obtained the emails of Schiff and Swalwell proving they leaked classified documents to the media, Congress has inserted language into the continuing resolution allowing it to quash any subpoena @Kash_Patel or @PamBondi might issue… pic.twitter.com/dq5XagDMqQ

— @amuse (@amuse) December 18, 2024

[..] Vivek Ramaswamy, who will be in charge of the new Department of Government Efficiency (DOGE) along with Elon Musk, has analyzed the bill. Via X: “I wanted to read the full 1,500+ page bill & speak with key leaders before forming an opinion. Having done that, here’s my view: it’s full of excessive spending, special interest giveaways & pork barrel politics. If Congress wants to get serious about government efficiency, they should VOTE NO. Keeping the government open until March 14 will cost ~$380BN by itself, but the true cost of this omnibus CR is far greater due to new spending. Renewing the Farm Bill for an extra year: ~$130BN. Disaster relief: $100BN. Stimulus for farmers: $10BN. The Francis Scott Key Bridge replacement: $8BN. The proposal adds at least 65 cents of new spending for every dollar of continued discretionary spending.

The legislation will end up hurting many of the people it purports to help. Debt-fueled spending sprees may “feel good” today, but it’s like showering cocaine on an addict: it’s not compassion, it’s cruelty. Farmers will see more land sold to foreign buyers when taxes inevitably rise to meet our obligations. Our children will be saddled with crippling debt. Interest payments will be the largest item in our national budget. Congress has known about this deadline since they created it in late September. There’s no reason why this couldn’t have gone through the standard process, instead of being rushed to a vote right before Congressmen want to go home for the holidays. The urgency is 100% manufactured & designed to avoid serious public debate.

The bill could have easily been under 20 pages. Instead, there are dozens of unrelated policy items crammed into the 1,547 pages of this bill. There’s no legitimate reason for them to be voted on as a package deal by a lame-duck Congress. 72 pages worth of “Pandemic Preparedness and Response” policy; renewal of the much-criticized “Global Engagement Center,” a key player in the federal censorship state; 17 different pieces of Commerce legislation; paving the way for a new football stadium in D.C.; a pay raise for Congressmen & Senators and making them eligible for Federal Employee Health Benefits. It’s indefensible to ram these measures through at the last second without debate. We’re grateful for DOGE’s warm reception on Capitol Hill. Nearly everyone agrees we need a smaller & more streamlined federal government, but actions speak louder than words. This is an early test. The bill should fail.

“We have to remove a clear majority of the people who snuck in here during the four years.”

• Congress’s First Gift To Trump Could Be Legislative ‘Kitchen Sink’ (JTN)

As Trump moves to implement his many campaign promises, some lawmakers hope to bundle a litany of conservative agenda items in a sort of “kitchen sink” legislative package early in his term. “We don’t have a lot of wiggle room. That’s why we have to get everybody on board with everything,” said Rep. Glenn Grothman, R-Wis., on the “Just the News, No Noise” television show. “You’ve got to remember, we can only afford to lose one person in the House. You know, we can only afford to lose, what about four people in the U.S. Senate? So we’ve got to get everything that we need to make America great again in that first big bill that is going to be passed in, presumably, February or March.”

The Trump White House and Congress have been negotiating over their approach to key legislative priorities, notably the pairing of immigration and border security with extending the 2017 Trump tax cuts. While the Senate and White House appear on the same page with a two-step approach of passing separate legislation, House conservatives on key committees have called for a single mega-bill, citing concerns that the administration could chicken out on immigration if the bill does not include it. “It’s important that the Trump administration does not cave in to the more weak-kneed open borders Republicans who say, ‘Well, you know, why don’t you kick out the murderers and the rapists, but otherwise we can let the 10 million people stay here,’” Grothman added. “No, no, no. We have to remove a clear majority of the people who snuck in here during the four years.”

Grothman is not alone in that sentiment. Rep. Ralph Norman, R-S.C., a key member of the House Rules Committee, said Tuesday on the “Just the News, No Noise” television show that Congress ought to prioritize the border efforts “because I think the American people are going to demand it, and that has got to be done early on.” “Now it’s got to be handled,” he added. “And I think the tax cuts that Trump did a great job on, we take that up in the second reconciliation. But you’d handle first things first, and that’s one of them that’s leading the pack. And it would be, I think, Well, I would say easy to pass, but in Congress, I don’t think anything’s easy.”

“..deep state traitors are coming after me, using their paid shills in legacy media.”

• Musk Brands Reuters ‘Paid Propaganda’ (RT)

US billionaire Elon Musk has expressed support for an online theory that links the Reuters international news agency with investigations into his businesses by the current administration of US President Joe Biden. Musk, a close ally of US president-elect Donald Trump, has called the purported connection “insane” and claimed it “explains a lot.” Reuters is “paid propaganda” that should be ashamed, he added. The connection was suggested by Mike Benz, who heads the self-described pro-free speech website Foundation For Freedom Online. On Tuesday, he alleged in a post on X that the outgoing Biden administration “paid Reuters over $300 million in government contracts” while simultaneously 11 US government agencies “targeted Elon’s businesses.”

Benz cited public records reported by the database usaspending.gov as evidence of his claim, as well as a series of reports by Reuters about the entrepreneur that won a Pulitzer Prize in May. The series on ‘The Musk Industrial Complex’ focused on “grave harms to consumers, workers and laboratory animals across Elon Musk’s manufacturing empire.” The billionaire emerged as a close ally of Trump after endorsing his candidacy in mid-July. He is slated to become a senior member of the incoming US administration responsible for cutting government inefficiency. Prior to picking a side in the US race, Musk was heavily criticized by left-leading public figures and media outlets for his management of X, formerly known as Twitter, which he purchased in 2022. The stated objective of his multibillion-dollar acquisition was to eradicate censorship on the platform, which he claimed was silencing pro-conservative voices.

Critics claim that Musk has turned X into a hotbed of right-wing extremism, while failing to live up to the promise of free speech. The EU has threatened the platform with legal penalties for allegedly failing to tackle “disinformation.” Last week, the Musk Foundation was accused of failing to meet US requirements for charitable organizations, based on its latest tax returns submitted to the Internal Revenue Service (IRS). The New York Times has since reported that the billionaire and his firm SpaceX are being investigated for compliance with US rules on classified information. Musk responded to the report by stating that “deep state traitors are coming after me, using their paid shills in legacy media.” In March, Musk stated that “The legacy media lies as easy as breathing,” and that “Reuters is the worst right now.”

Hold on, Ursula would like to have a word. And Annalena Baerbock too. They can’t all be queens.

• Kaja Kallas, Queen of Russophobia (RT)

Since assuming the role of EU high representative for foreign affairs and security policy on December 1, 2024, Kaja Kallas has swiftly implemented policies reflecting her firm anti-Russia stance and commitment to supporting Ukraine in its conflict with Moscow. Her policies with regard to Russia have long been harsh, and a number of media outlets have labeled her as a ‘Russophobe’. On her first day in office, Kallas visited Kiev alongside European Council President Antonio Costa, signaling the EU’s unwavering support for Ukraine amid the ongoing conflict. During the visit, she highlighted the EU’s commitment to bolstering Ukraine’s defense capabilities, announcing a substantial investment of €400 million ($420 million) for the current year and an additional €1.9 billion for the following year to enhance Ukraine’s defense industry.

Kallas praised the EU’s anti-Russia sanctions and has been a vocal advocate for utilizing frozen Russian state assets within the EU to aid Ukraine. She stated that these funds should be used to cover the damages inflicted by Russia, viewing them as a strategic tool to pressure Moscow. She expressed confidence that, despite certain sensitivities, progress would be made toward this objective. Moscow has called the freezing of its funds blatant theft and announced that there would be consequences. In February 2024, as prime minister of Estonia, Kallas was placed on a Russian wanted list due to her government’s efforts to remove Soviet-era World War II monuments. Russian officials accused her of “falsification of history,” viewing the removal of these monuments as a desecration of the memory of Soviet soldiers who fought against Nazi Germany.

In 2023, Kallas spoke at the first in-person meeting of the pro-Kiev online group ‘NAFO’ on Saturday, praising their efforts in the ‘information war’ against Russia. NAFO, founded by Kamil Dyszewski – who is known for having anti-Semitic and white supremacist views – has celebrated Russian civilian deaths and raised funds for individuals accused of war crimes. He has made numerous posts praising Nazi Germany and denying the Holocaust. ‘NAFO’ stands for the ‘North Atlantic Fellas Organization’ and consists of internet users known for their ‘Shiba Inu’ avatars and strong support for the Ukrainian military. Members – known as ‘Fellas’ – actively promote Ukraine’s messages on social media, pressure platforms to censor pro-Moscow accounts, and solicit donations for the Georgian Legion, a mercenary group led by an individual who has admitted to committing war crimes in Ukraine.

Critics have also scrutinized Kallas’ family history, alleging connections to nationalist movements during the early 20th century. Several researchers have highlighted her grandfather’s alleged role in the Estonian police and nationalist militia during the 1920s and 1930s. In August 2023, reports emerged that Stark Logistics, a transportation company in which Kallas’ husband Arvo Hallik held a 24.9% stake, continued operations involving Russia following the escalation of the Ukraine conflict in early 2022. This revelation was particularly striking given Kallas’ strong public stance urging Estonian companies to cease all business activities with Russia in response to the conflict.

Stark Logistics was found to be facilitating the transportation of goods for AS Metaprint, an Estonian company with ongoing operations in Russia. Between February and November 2022, Metaprint reportedly sold approximately €17 million worth of goods to Russia. In response to the public outcry, Hallik announced he would divest his shares in Stark Logistics and resign from all positions within the company. Kallas addressed the situation by highlighting her commitment to transparency and denying any prior knowledge of her husband’s business dealings related to Russia.

NATO bioweapons.

• Kiev Regime Kills Russian General To Hide The Truth About Bioweapons (SCF)

In a bold and lethal move, a terrorist attack carried out by Ukrainian intelligence operatives in Moscow killed Igor Kirillov, head of the Russian Federation’s Chemical, Biological, Radiological, and Nuclear Defense Forces, along with his main advisor. Kirillov, one of the most important figures in Russian national security, became a strategic target due to his investigations revealing the complex and shadowy ties between the West, Ukraine, and the bioweapons research laboratories. His death is not only a blow against Russia but also a critical turning point in international relations, involving the controversy surrounding biological laboratories, the pharmaceutical industry lobby, and, inevitably, Kiev’s connections to U.S. politics.

Since the beginning of Russia’s Special Military Operation in Ukraine in 2022, Igor Kirillov had been denouncing the existence of bioweapons research laboratories in Ukrainian territory. These laboratories, operating under the guise of “scientific research” and funded by global actors such as the Soros Foundation, Big Pharma companies, and even influential members of the Biden family, have been accused of developing biological weapons aimed at Russia.In public statements, Kirillov warned of the growing risk posed by these biolaboratories, pointing out that their goal was to create a “universal package” of genetically modified biological pathogens to target Russian people, cattle, and crops simultaneously. The development of such weapons could potentially cause a catastrophe of epic proportions, destroying Russian food production and decimating the population. Once Russia became aware of these activities, it had no choice but to launch a military operation to dismantle these dangerous research centers.

Moscow also raised suspicions that, without early intervention, Ukraine, with U.S. support, could have launched a large-scale biological attack against Russia. This attack would target Russian public health by releasing multiple lethal viruses and bacteria simultaneously, with the aim of creating catastrophic chaos. The greatest obstacle Russia faced in exposing these threats was the absolute silence of the Western media. In the European Union, the United States, and even the Global South, an iron curtain was raised on the subject, with most media outlets ignoring or discrediting Kirillov’s revelations. However, Russia believed that without its military operation and the dismantling of bioweapons laboratories in the early days of the conflict, the country would have been vulnerable to a biological attack of catastrophic magnitude.

Furthermore, during the eight years following the Euromaidan coup, citizens of Russian-majority regions in Ukraine were subjected to a series of biological experiments. These included tests of new chemical and biological substances, some of which were administered under the guise of “voluntary treatments” or even by force, as in the case of prisoners or ethnic Russian low-ranking soldiers. The ultimate goal of these experiments was to understand the genetic characteristics of Russians in order to develop even more lethal and ethnically targeted pathogens, thus creating ethnically directed mass destruction biological weapons.

In addition to the evidence of involvement by organizations such as the Soros Foundation, another crucial point in Kirillov’s reports was the connection with Big Pharma companies. He spared no effort in revealing the role of pharmaceutical giants such as Pfizer and Moderna in financing bioweapons research in Ukraine. The claim that these corporations were associated with the development of biological weapons was not merely speculative, having several captured documents proved the whole truth. In the same vein, the involvement of influential members of the U.S. government and their families, including Hunter Biden, in contracts and initiatives related to Ukrainian biolabs was a central issue in his revelations.

The U.S. president’s son was of the main financial supporters of the biolabs, which were part of his corruption schemes in Ukraine. Kirillov’s death, therefore, is not only a significant loss for Russia but also a grim reflection of global corporate interests and the biological risks the Western powers were willing to take in their reckless pursuit of hegemony. The pharmaceutical lobby, with its vast networks of influence, found itself in an uncomfortable position after 2022, when several countries began questioning the safety and efficacy of COVID-19 vaccines, as well as dismantling the mandatory vaccination campaigns that had been previously fervently promoted.

“..there are rules of warfare and there are certain things that you just kind of don’t do.”

• Trump’s Ukraine Envoy Condemns Murder of Russian General (RT)

The assassination of Russian General Igor Kirillov in Moscow probably won’t impede peace talks, but was “not a good idea at all” for Kiev, US President-elect Donald Trump’s special envoy for Ukraine and Russia, Keith Kellogg, has said. Kirillov, who commanded the Russian Radiological, Chemical, and Biological Defense Forces, was killed in an explosion in southeastern Moscow early on Tuesday. The Russian authorities have detained a suspect, whom they say was recruited by Ukrainian intelligence and paid to carry out the attack. In an interview with Fox News on Wednesday, Kellogg was asked whether the murder of Kirillov would hinder peace talks between Moscow and Kiev, which Trump hopes to broker once inaugurated next month. “I don’t think it’s really a setback,” he responded, “but I would say this: there are rules of warfare and there are certain things that you just kind of don’t do.”

“When you’re killing flag officers, general officers – admirals or generals – in their hometown, it’s kind of like you’re extending it and I don’t think it’s really smart to do it. It’s not kind of the rules of war,” he continued, reiterating that the bombing was “not a good idea at all, in my opinion.” In light of the murder, former Russian President Dmitry Medvedev has warned that “all NATO decision-makers” from countries assisting Ukraine “can and should be considered legitimate military targets for the Russian state.” Kellogg, formerly a lieutenant general in the US Army, confirmed to Fox News that he will travel to Kiev before next month’s inauguration on a “fact-finding” mission. Kellogg will not travel to Moscow, but according to a Bloomberg report earlier on Wednesday, he is open to the idea.

Previously a staunch supporter of increased military aid to Kiev, Kellogg was nominated as Trump’s special envoy for Ukraine and Russia last month. In an announcement on social media, the incoming president promised that Kellogg would help “secure PEACE THROUGH STRENGTH, and Make America, and the World, SAFE AGAIN!” Back in June, Kellogg told Reuters that he had advised Trump to use military aid as leverage to force Moscow and Kiev into peace talks. “We tell the Ukrainians: ‘You’ve got to come to the table, and if you don’t come to the table, support from the United States will dry up,’” he told the news agency.

“And you tell [Russian President Vladimir] Putin he’s got to come to the table and if you don’t come to the table, then we’ll give Ukrainians everything they need to kill you in the field.” Trump has repeatedly promised to end the conflict within a day of taking office, without providing any detailed plan as to how he intends to achieve this goal.Moscow maintains that any settlement must begin with Ukraine ceasing military operations and acknowledging the “territorial reality” that it will never regain control of the regions of Donetsk, Lugansk, Kherson, and Zaporozhye, as well as Crimea. In addition, the Kremlin insists that the goals of its military operation – which include Ukrainian neutrality, demilitarization, and denazification – will be achieved.

There are no such conditions that Russia would agree to.

• US Sets Conditions For Ukrainian NATO membership (RT)

Ukraine can only hope to join NATO if it reforms its military and succeeds in improving its democratic institutions, US Secretary of State Antony Blinken has said. Speaking at the Council on Foreign Relations in New York on Wednesday, Blinken rejected the idea that the US, Germany, or other NATO allies are “standing in the way” of Kiev’s accession to the bloc. Ukraine has long aspired to become a full-fledged NATO member, and formally applied to join in the autumn of 2022 after four of its former regions overwhelmingly voted to join Russia. The bloc, Blinken insisted, has “put Ukraine on a path to NATO membership” and taken concrete steps to advance this goal, while stopping short of clarifying the accession timeline.

“We set up for the first time in NATO’s history a dedicated command whose purpose is to help Ukraine along that path, to take the practical steps that it needs to take – in continuing to build and reform its military institutions, to continue to strengthen its democracy – that are necessary for membership,” he said. The secretary of state admitted that it would be “very challenging for Russia” to agree to a peace deal over Ukraine that would not explicitly remove the prospect of Kiev joining NATO. However, he argued that Ukraine could potentially receive “other kinds of assurances, commitments, guarantees” that would be similar to Article 5 of the NATO Charter, which states that an attack on one member of the bloc is an attack on all.

In October, Politico reported that some NATO allies were not particularly happy with Vladimir Zelensky’s ‘victory plan’, which calls for Ukraine to receive an immediate invitation to join the bloc. The article identified the US and Germany as the countries opposed to his request over fears that it would draw them into a direct conflict with Russia.

Publicly, NATO has ruled out full membership for Ukraine as long as it is embroiled in the conflict with Russia. However, some Western officials have floated an option of “partial membership” for Kiev, an idea rejected by Zelensky, who argued that this would essentially mean that the country recognizes all of its territorial losses to Russia. Moscow has long been opposed to NATO expansion towards its borders, seeing it as an existential threat. Russian President Vladimir Putin has said that Kiev’s ambition to join the bloc is one of the key reasons for the conflict, with Ukrainian neutrality, along with demilitarization and denazification, being Moscow’s main goals.

Is that a warning? A threat?

• No Western Troops In Ukraine Without Russian Approval – Germany (RT)

Both Moscow and Kiev would need to be on board with any initiative involving the deployment of Western peacekeeping troops in Ukraine, German Defense Minister Boris Pistorius has said. Some EU leaders have raised the possibility of a Western peacekeeping force in Ukraine if a ceasefire is reached. Donald Trump, set to be sworn in as US president next month, recently stated that he wants to bring both Russian President Vladimir Putin and Ukraine’s Vladimir Zelensky to the negotiating table. Pistorius stressed that any discussion of a European troop presence in the conflict is premature, speaking at a press conference in Berlin on Monday. “If there is a ceasefire, then, of course, the Western community, NATO partners, possibly the United Nations, and the EU will have to discuss how such a peace, such a ceasefire can be secured,” he said.

Pistorius added that, as the EU’s largest economy, Germany “would play a role there,” without elaborating on what the role would entail. He noted that a mandate for a foreign peacekeeping force would also need to be defined. “It must be clear that the two nations negotiating for the ceasefire, Ukraine and Russia, have to agree on a mandate they would accept and on the participants of such a mandate,” Pistorius said.

On Tuesday, Zelensky stated that he expects to be in direct contact with the White House after Trump’s inauguration to find out which points of his so-called ‘peace formula’ the new US president supports. Moscow has previously dismissed Zelensky’s initiatives as completely divorced from reality. The Kremlin has argued that Kiev is not ready to negotiate. “The Ukrainian side still refuses to hold any negotiations,” Kremlin spokesman Dmitry Peskov told journalists on Tuesday. He stressed that Zelensky has “legally forbidden himself from these negotiations,” referring to the Ukrainian leader’s 2022 decree banning any talks with Putin. Therefore, Peskov said, “it is premature to talk about everything else, namely peacekeepers, at this time.”

Not something that can be solved with more money. But tell him that.

• RT Winning ‘Cognitive War’ – BBC Director (RT)

RT and Chinese media outlets are winning public trust and waging a “cognitive war” on Western audiences, the director of British state broadcaster the BBC, Tim Davie, has told parliament, at a hearing during which he asked for more taxpayer money. Davie appeared before lawmakers on Tuesday to argue for continued funding of the BBC World Service, which broadcasts in around 40 languages to a reported audience of 320 million people per week. Maintaining this service is vital to Britain’s interests, he claimed, arguing that “we are facing a tsunami of bad actors, disinformation, [and] fakery. The threats are overwhelming.” “As a nation we’ve got a public service broadcaster with the most trusted news service in the world. That’s something,” he said. “The trouble is around us… you’re seeing trust ratings for RT and other Chinese services grow as they just take over more slots.”

“It is cognitive warfare, as it’s been called, as people try and win the hearts and minds of populations and people around the world.” Davie made similar claims at a speech in London in October, stating that the BBC’s axing of more than 380 jobs and cancelation of radio broadcasts in ten languages, including Arabic and Persian, amounted to a loss in the “propaganda” battle against Russia and China. Davie told lawmakers that a recent £32.6 million boost in funding would preserve the World Service’s current language services, but that additional taxpayer money would be needed to keep these services running past 2026. The BBC is an almost entirely state-funded operation, financed by an annual license fee of £169.50 ($221) owed by every British household with a television or device capable of receiving broadcasts. The UK’s Office for National Statistics classifies the fee as a tax, and the BBC as part of the “central government sector” of the UK economy.

The British Foreign Office also pays £104 million ($135.5 million) of the World Service’s £334 million ($435.3 million) annual budget, and is the largest financial backer of the BBC’s ‘Media Action’ department. This department, which is also funded by the governments of the US, Canada, Norway, Sweden, the EU, UN, and the Bill and Melinda Gates Foundation, claims that it spends this money fighting “disinformation, division and distrust” in two dozen developing countries. Davie’s grievances echo those of the US State Department. After announcing a raft of sanctions on RT and its parent company in September, department official Jamie Rubin told reporters that “one of the reasons… why so much of the world has not been as fully supportive of Ukraine as you would think they would be… is because of the broad scope and reach of RT.”

In a report published on Tuesday, the Center for Strategic and International Studies (CSIS), a think tank funded by the US government and almost a dozen arms manufacturers, expressed concern that RT en Espanol is the second-most popular media outlet in Colombia, and along with Sputnik’s Spanish-language service, has an audience of approximately 32 million in Latin America and the Caribbean. US state-run Voice of America (VOA) is not even among the top 100 outlets in the region, CSIS noted. Like Davie, CSIS claimed that the problem can be fixed with more money. Ukraine and its Western backers, the report recommended, should invest in pro-Kiev news outlets in Latin America and hire local influencers and social media personalities to spread “high-quality” propaganda created in the US.

“It is again a demonstration of Europe’s infamous lack of true leadership.”

• The Tone Regarding Ukraine’s Future Has Shifted Significantly And Fast (Rabo)

Since February 2022, the Western mantra was that Ukraine would be supported for as long as it takes and that it was up to Ukraine to decide whether it wanted to engage in negotiations with Russia. A logical argument for those who also continued to emphasize Ukraine’s sovereignty and, directly related to it, the right of self-determination. Both are crucial pillars of the concept of the nation state that has it roots in the Treaty of Westphalia. If the West would be as serious about upholding the international rules-based order as has been voiced so often, then Ukraine should be considered the litmus test. Not continuing or even stepping up support would in effect boil down to the alternative scenario in which the West would signal that they are unreliable guarantors of security alliances or partnerships (remember that Ukraine received those guarantees from the US and the UK in exchange for giving up its nuclear deterrent), that might makes right and that the West can be impressed and coerced by rattling the nuclear sabre, amongst others.

The negative consequences should be clear to anybody with even a basic understanding of security studies or international affairs. History also provides us with clues of what might be the result of such an approach. During the 1930’s, Germany felt humiliated because of the treaty of Versailles and the Nazis came with a fascist concept of a civilization state claiming territory based on both historic and ethnic grounds. After it could seize some territories without putting up a real fight, it eventually decided to test France and the UK by invading Poland. Back in the late 1930’s, the United Kingdom was still recovering from the impact of the Great War and the gradual loss of control over its empire and its hegemonic status. From Chamberlains point of view, another large war was to be avoided at all cost. But as all of us know by now, this attitude soon proved to be even more costly in a such a way that nobody could ever have imagined. The parallels with the current situation should be clear and as such have often been drawn by international relations observers.

Making a leap in time, Putin has been very clear all along about his views of the collapse of the Soviet Union which he calls the greatest geopolitical catastrophe of the century. So to be clear, apparently from the Kremlin’s point of view it is not the more than 25 million Russians that died during World War II fighting Nazi Germany but the nonviolent collapse of a communist block that subjugated many previously independent and sovereign states, that was the greatest geopolitical catastrophe of the (last) century. Eager to reverse what the Kremlin seems to consider as an unpalatable humiliation, Russia embarked on several ‘adventures’ in Georgia, Chechnya, and now clearly Ukraine. This is relevant because this point of view makes it less likely that a deal between Russia, Ukraine and the West will turn out to be a stable and durable one.

Taking all of the above into account it is the West that now seems to position itself as deal takers instead of deal makers when dealing with rule breakers. The majority of blame should go to Europe. While the war has already been dragging on for almost three years, many European member states continue to talk the talk instead of walk the walk. At the cost of precious lives and Europe’s own security. It is again a demonstration of Europe’s infamous lack of true leadership. We have plenty of Chamberlains and government officials dragging their feet but there is no Churchill in sight, except perhaps for some countries in the east that have been ignored in the past but have been warning the rest of us in Europe for many years.

“[Social media companies] were one monolithic whole, and they were all working with the U.S. government in a censorship system that a federal court called ‘perfectly Orwellian’.”

• “Free Speech Is A Human Right!” Professors Jonathan Turley & Dave Karpf (ZH)

In a divide that says a lot about where Americans stand, depending on whom you ask “The Twitter Files” were a revolutionary exposé of government censorship or a “nothingburger”. George Washington law professor and favorite among ZeroHedge readers Jonathan Turley debated his left-leaning GW colleague, David Karpf, on the preeminent speech question of our age: how to secure free online discourse. Moderated by Gene Epstein of The SoHo Forum, they discussed Musk’s acquisition of Twitter and whether its new form — X — has been a net positive for society. We encourage readers to listen to the full debate, but for those short on time here were the key moments: After Musk released internal Twitter documents from the previous regime to journalists like Taibbi and Shellenberger, we often heard from the left and mainstream media that it was exaggerated excerpts from routine and banal content moderation discussions. Karpf shares this view.

Turley, on the other hand, argues that it was a pivotal moment in exposing a censorship apparatus that had grown out of hand. “The statement that the Twitter files was a ‘nothingburger’ is really breathtaking,” he says. “They were censoring jokes. They were censoring people who had dissenting views of COVID. People were barred and throttled and blacklisted.” “[Social media companies] were one monolithic whole, and they were all working with the U.S. government in a censorship system that a federal court called ‘perfectly Orwellian’.”

— ZeroHedge Debates (@zerohedgeDebate) December 18, 2024

The question of Stanford physician Jay Bhattacharya was raised. The Context: A now-infamous leaked email between Francis Collins and Anthony Fauci, then-directors of National Institute of Health (NIH) and National Institute of Allergies and Infectious Diseases (NIAID), respectively, revealed that the top Biden Admin scientists privately ordered a “devastating published take down” of Bhattacharya’s criticism of national lockdown policy. It was additionally revealed that he was shadow-banned on Twitter.

Asked whether these actions taken against Bhattacharya — now Trump’s pick to lead the NIH — constituted a free speech infringement, Karpf replied that Bhattacharya’s current success proves that his “cancelling” was ineffective and thus inconsequential. Turley took issue, saying Karpf and his ilk are essentially advocating for certain voices to be “disappeared”. “I’m really troubled by this line of argument,” Turley rebutts. “It’s sort of like a doctor saying, ‘Yes I committed malpractice, but I didn’t kill the patient… The fact that people can survive is a rather chilling test when determining whether this was a good or bad thing.”

— ZeroHedge Debates (@zerohedgeDebate) December 18, 2024

As Turley points out, for centuries governments have tried to limit the means through which their subjects can communicate via unauthorized channels.“The internet itself is the most important invention since the printing press,” he argues. “When the printing press came out, the first reaction of governments was to limit the printing press. The internet scared the daylights out of governments. Also now with social media. “Turley describes social media platforms as powerful tools that have scaled communication from orators standing atop boxes on urban street corners to everyone having global reach at all times.

— ZeroHedge Debates (@zerohedgeDebate) December 18, 2024

He views this as tremendously positive for speech while Karpf believes Musk abused this power to elect Trump and that Turley is only celebrating because “his side” won. Karpf: “We are now at a version of Twitter where Elon Musk is spending basically every day with President-to-be Donald Trump, helping to dictate what government policy should be and which agencies should effectively go away. And he’s calling for people who work for the government to be fired.”

“Oh you mean the ‘Election Integrity’ Team that was undermining election integrity? Yeah, they’re gone.”

• Clouds Form Over Bluesky (Turley)

After the election, liberal pundits and media have attempted to rally the public in a shift from X to Bluesky, a smaller site that is viewed as a safe space for the left. I have been critical of the move as a retreat deeper into the liberal echo chamber after an election that showed how out-of-touch many of these writers were with the majority of voters. They would be better served engaging with a broader swath of public opinion. Today, one of the top Bluesky officials embraced Canadian-style speech controls and rejected more robust views of free speech as the model for the site.Bluesky has long been criticized as a site built on the concept of “safe spaces” in higher education for those triggered by opposing views.

Many of those leaving Twitter long for the “good ole days” of when all social media platforms engaged in extensive censorship to exclude or marginalize opposing voices.This week, Aaron Rodericks, the head of trust and safety at Bluesky, confirmed the worst fears of the site. Bluesky has been hammered with complaints from conservatives and libertarians that they have been subject to not only death threats on the site but also blocked from posting.Some have demanded even more aggressive measures to block or suppress conservative or libertarian views deemed threatening or demeaning. Liberal pundits have heralded the site as allowing them to “breathe again” without hearing the type of opposing views allowed on X.

Rodericks espoused the type of anti-free speech rationalizations that are addressed in my recent book, The Indispensable Right: Free Speech in an Age of Rage.” He insisted that there are alternative views of free speech than the type of “absolutism” supported by figures like myself. Rodericks juxtaposed what he called “free speech absolutism” against the more enlightened Canadian model, adding, “I think it just comes down to philosophies of free speech.” He explained: “Being Canadian shapes a lot of my perspective. There’s enough of the American perspective in the world on a day-to-day basis. For example, in the Canadian constitution… you have rights and freedoms, but they’re not unequivocal.” It was a chilling reference for many in the free speech community since free speech is in a free fall in Canada. As we have previously discussed, there has been a steady criminalization of speech, including even jokes and religious speech, in Canada.

The country has eviscerated the right to free speech and association. Yet, that is apparently the model for Bluesky. Rodericks repeats the doublespeak of the anti-free speech movement in claiming that he just wants to create a space where all are welcomed but excluding those who are not welcomed: “I’m glad that [critics] consider it a safe space and ideally it can be a safe space for them as well. The whole point of Bluesky is for it to be safe and welcoming to all users. I think the issue is some people are defining their identity by opposition to others and how well they can harass others and deny their existence. Bluesky may not be the right place for them.” Not surprisingly, Rodericks used to work at trust and safety for Twitter before he was fired by Elon Musk. He has also sued Musk over a tweet. At issue is Musk’s response to the criticism of his firing Rodericks’s team by noting, “Oh you mean the ‘Election Integrity’ Team that was undermining election integrity? Yeah, they’re gone.”

That would seem clearly protected opinion under the First Amendment, but, of course, for the former censors of Twitter, it should not be allowed. We have previously discussed the censorship standards at Twitter. For example, former Twitter executive Anika Collier Navaroli testified on what she repeatedly called the “nuanced” standard used by her and her staff on censorship. Toward the end of the hearing, she was asked about that standard by Rep. Melanie Ann Stansbury (D., NM). Her answer captured precisely why Twitter’s censorship system proved a nightmare for free expression.

Navaroli then testified how she felt that there should have been much more censorship and how she fought with the company to remove more material that she and her staff considered “dog whistles” and “coded” messaging. She said that they balanced free speech against safety and explained that they sought a different approach: “Instead of asking just free speech versus safety to say free speech for whom and public safety for whom. So whose free expression are we protecting at the expense of whose safety and whose safety are we willing to allow to go the winds so that people can speak freely.”

“Eliminating sanctuaries is one of the most important steps that states can take to assist the Trump administration with enforcement..”

• Almost 8 Million Illegal Aliens Live in American ‘Sanctuary Cities’ (AmG)

A new study from a hardline immigration think tank claims that nearly 8 million illegal aliens are currently residing in the United States due to “sanctuary” cities and states run by Democrats. As reported by Breitbart, the study from the Center for Immigration Studies (CIS) determined that there are at least 7.9 million illegals being protected from immigration authorities by these rogue jurisdictions, presenting possible complications for the incoming second Trump Administration. The vast majority of these illegals, 6.3 million, are found in the states of California, Colorado, Connecticut, Illinois, Massachusetts, New Jersey, New York, North Dakota, Oregon, Rhode Island, Utah, Vermont, and Washington. Another 820,000 are living in sanctuary counties located in states that do not have statewide “sanctuary” laws.

And at least 750,000 are living in states that have numerous sanctuary jurisdictions, but not at the state level, including Maryland, New Mexico, and Virginia. “Although there is much imprecision in the data, the bottom line is that close to eight million illegal aliens, equaling 56 percent of the estimated nationwide total, live in sanctuary jurisdictions,” said CIS’s Jason Richwine in the report. Pointing to the strict immigration practices of Texas and Florida, Richwine adds that “every state should follow their lead.” “Eliminating sanctuaries is one of the most important steps that states can take to assist the Trump administration with enforcement,” Richwine continued.

President-elect Donald Trump campaigned heavily on the immigration issue, just as he did in 2016. He has vowed to finish construction of the southern border wall and to carry out the largest mass deportation operation in American history. Former ICE Director Tom Homan, who has been designated as the next border czar for the second Trump Administration, has frequently said in interviews that the federal government may pursue charges against Democratic officials who interfere with immigration authorities.

“..an additional 12 months of liability protection … to allow for the manufacturer(s) to arrange for disposition of the Covered Countermeasure..”

• Feds Quietly Ban Liability For Vax Makers Through Trump’s Full Term (JTN)

The federal government is protecting the manufacturers of COVID-19 and flu vaccines from product liability for another five years, on the cusp of a new administration likely to aggressively look for vaccine injuries and release its hidden books that Just the News went to court to obtain. Didn’t hear about it? That’s because the Department of Health and Human Services does not appear to have told the public outside a Dec. 11 Federal Register notice, primarily read by regulated entities, and a generic page buried deep within HHS’s website. Outgoing agency Secretary Xavier Becerra’s amendment to the declaration under the Public Readiness and Emergency Preparedness Act for “COVID-19 Medical Countermeasures,” enacted 19 months after President Joe Biden formally ended the COVID public health emergency, gives a perfunctory explanation for the liability shield’s continuing necessity.

“I have determined there is a credible risk that COVID-19 may in the future constitute such an emergency,” says the 27-page notice written in Becerra’s voice, dated Dec. 6, much of it rehashing previous amendments and requirements for “covered persons.” “Congress delegated to me the authority to strike the appropriate federal-state balance with respect to Covered Countermeasures through PREP Act Declarations,” he also says. “The 12th Amendment generally extends the protections clarified in the 11th Amendment” from May 2023, which ended some liability provisions and was set to expire Dec. 31, “through 2029,” reads the PREP Act questions and answers page. The extension also covers COVID therapeutics administered “subcutaneously, intramuscularly, or orally” such as Pfizer’s rebound-prone antiviral Paxlovid, whose efficacy Pfizer’s own research has questioned.

A section near the notice’s end provides for “an additional 12 months of liability protection … to allow for the manufacturer(s) to arrange for disposition of the Covered Countermeasure,” implying the shield will last the full decade. The Dec. 11 notice gives no explanation for the lengthy duration of the extension, three times longer than the previous amendment provided. Published a month after President-elect Donald Trump’s victory, it covers the entirety of his pending administration. One X observer noted interesting timing: Pfizer’s combination flu-COVID vaccine was supposed to finish Phase 3 clinical trials last month but failed an important benchmark this summer. “Pfizer would have to go through the normal licensing and approval process” with the Food and Drug Administration “and possibly lose legal immunity going forward” without this extension, the pseudonymous user wrote.

Not sure what to think of this.

“The big lie is aliens created us . . . and there is no God.”

• Will Nuke False Flag Keep Trump Out of Office – Steve Quayle (USAW)

Renowned radio host, filmmaker, book author and archeological dig expert Steve Quayle is telling the public to brace themselves for the evil deeds that will be done to try to keep President Elect Donald Trump from taking office. This includes a false flag nuke that will be blamed on Russia. One side of government is trying to nuke America, and another side of government is trying to stop it. This is what some say all the drone traffic is about. Quayle explains, “A false flag is when you initiate an illegal act. In this case, we are talking about the detonation of not only ‘dirty bombs’ but also nuclear warheads. The rumors are there are active nuclear warheads… They that hate Trump and want to literally destroy this country to save the majority of the Democrats and Republicans that appear to have an affinity for China.

That came out in the Australian News about how many US politicians are on the China payroll.” Lots of crime and treason have been going on in Washington D.C., and it only got worse in the Biden Administration. The so-called Swamp is scared. Quayle says, “They are scared because of the revelation that President Elect Trump is sending public signals that he’s going to clean house. . . . The bottom line answer is if you have sold out to the Chinese. . . . Our government was in collusion with the Chinese. We funded (CV19) gain of function experiments that resulted in the deaths of people who were vaccinated . . . and participated in the knowing and willing destruction of American citizens… A top Communist Chinese Party member said . . . with our bioweapon, we defeated the United States… They are afraid because they know what they are guilty of. . . . President Trump has the goods on them — there is evidence.”

Quayle says there is another government group who is working to stop any false flag. Quayle contends, “They are going to use everything in their bag of evil tricks, including false flag nuclear detonations.” “The Nuclear Emergency Search Team (NEST) are good guys, and they are working tirelessly. They really want to stop this nuclear false flag,” These people who are against Trump are both desperate and evil. Quayle says, “They will do anything, including detonation of nuclear warheads in the US to stop Donald Trump.” “These are soulless creatures. . Their sole purpose is to destroy mankind.. There is only one reason to provoke a nuclear war with Russia, and that is they don’t want Trump in office. They are Luciferian, and they want a mass sacrifice of 250 million Americans.” In closing, Quayle says to be on the lookout for the big lie coming in the future. Quayle says, “The big lie is aliens created us . . . and there is no God. . .”

Red handed.

• CNN Suspected Of ‘Fabricating’ Syrian Jail Release Story (RT)

CNN has been forced to admit that a Syrian man it claimed to have ‘discovered’ in a Damascus prison, and whom it filmed as part of a highly questionable report showing a journalist participating in the captive’s release, is in fact a former intelligence officer who was involved in multiple crimes. The man was reportedly imprisoned because of a dispute with his higher-ups over extorted money. The seeds of the debacle were sown last week when the network released a widely criticized video of CNN Chief International Correspondent Clarissa Ward entering a “secret prison” in Damascus, allegedly in search of missing US journalist Austin Tice, following the overthrow of former Syrian President Bashar Assad. In the video, Ward is accompanied by an armed man, with whom she apparently stumbles upon a locked cell, described as the only one still closed up in the facility.

Upon entering, Ward, who shouted in English throughout, found a man under a blanket, who stood up, thanked her for his release and kissed her hand as they exited the facility. Ward claimed that the man was ‘Adel Ghurbal’ from Homs, an “ordinary citizen.” He was reported by the US network to have been several months in prison and had, according to Ward, spent several days without food or water. He also claimed that he had been interrogated by security services over the contents of his phone. The man showed no signs of hunger nor dehydration, his hair and beard were trimmed and his nails manicured, according to multiple online observers. CNN ignored the obvious signs, however. On Sunday, the Verify-sy web portal debunked CNN’s reporting, citing local sources, by revealing that the man’s real name is Salama Mohammad Salama, also known as Abu Hamza, a first lieutenant in Syrian Air Force Intelligence.

According to the outlet, the man “managed several security checkpoints in Homs and was involved in theft, extortion, and coercing residents into becoming informants.” He also reportedly participated in military operations in Homs, “killed civilians, and was responsible for detaining and torturing numerous young men in the city without cause or on fabricated charges.” Sources also told Verify-sy that Salama was not detained for these crimes, but rather “due to a dispute over profit-sharing from extorted funds with a higher-ranking officer,” for which he had been imprisoned for less than a month. In addition, it shared what it said was an image of Salama in a Syrian military uniform sitting in his office.

”Did CNN fabricate the story of “Freeing a Syrian Detainee from a Secret Prison?.. Did CNN deliberately mislead its audience to rehabilitate Abu Hamza’s image, or did it fall victim to misinformation?” the portal asked. Following the revelation, CNN published an article admitting that the man in the picture did appear to have served in Syrian intelligence, and confirming that he had been accused of extortion. It added that it is “unclear how or why Salama ended up in the Damascus jail,” noting that his “current whereabouts are unknown,” and that CNN has been unable to contact him.

Frens

https://twitter.com/i/status/1869407282033033503

Cat snow

cats vs snow ❄️ pic.twitter.com/kqVD6g6dC0

— Kitty Cat Empire (@KittyCatEmpire) December 17, 2024

Mantis

Gongylus gongylodes, also known as the wandering violin mantis, like a twig with its appendages resembling dried leaves,

Swaying to imitate plant matter moving in the wind

— Science girl (@gunsnrosesgirl3) December 18, 2024

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.