Harris&Ewing Preparations for the inauguration of Woodrow Wilson, Court of Honor before White House 1913

There are few things more nonsensical than ‘experts’ saying things like “..there’s a 30% probability that the U.S. will succumb to a recession over the next 12 months..” Yet, people keep listening.

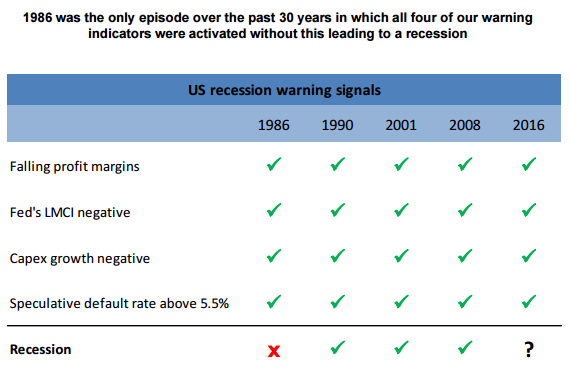

• Unlike in 1986, This Time US Might Not Dodge a Recession: Deutsche Bank (BBG)

Falling corporate margins, weakness in the U.S. labor market and rising corporate default rates — all features of the U.S. economy in 1986, a year it avoided a recession. Even if this year markets are largely shrugging off the deterioration in those key indicators and betting grim readings are down to temporary forces, Deutsche Bank strategists say to take little hope from a 30-year old precedent. Investors jittery over bleak readings on a slew of macro and corporate data have seized on 1986, when the same signals for a U.S recession were in place but the economy ended up growing 3.5% after inflation.

But bets on the continued expansion in U.S. output over the next year might be misplaced, according to European equity strategists at Deutsche Bank, since the economy is on a significantly weaker footing compared to the year that saw the release of Ferris Bueller’s Day Off. They restate the bank’s call that there’s a 30% probability that the U.S. will succumb to a recession over the next 12 months. That compares pessimistically with the 20% that is the average expectations of analysts surveyed by Bloomberg — and even with other analysts at the bank.

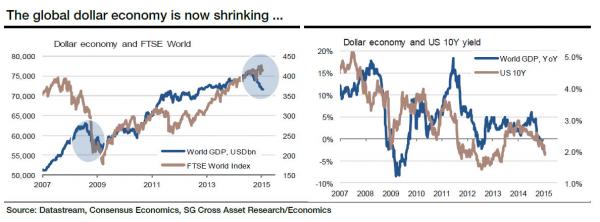

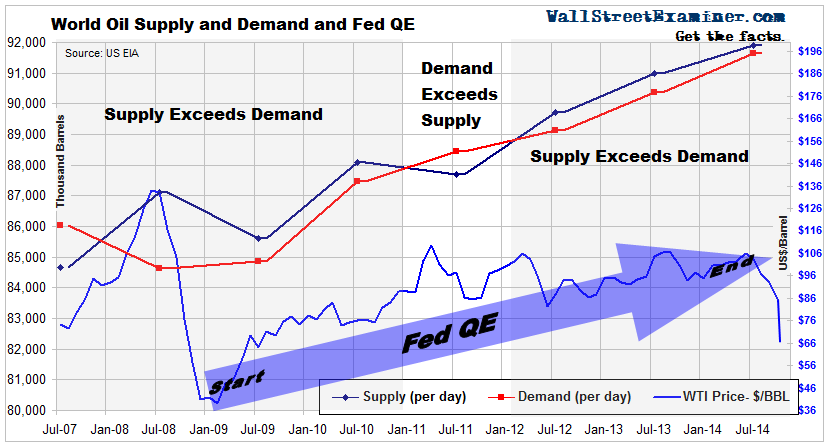

…when central banks stop printing…

• Get Ready For The Mother Of All Stock Market Corrections (Tel.)

[..] According to Chris Watling at Longview Economics, a wide range of indicators confirm the message: recession risks are rising. And if a recession is indeed looming, it almost certainly means a bear market in equities. Looking at all the US recessions of the last 77 years, Mr Watling finds that there is only one (1945) which has not been accompanied by a stock market correction. Complicating matters further is an ever more worrisome phenomenon – that both bond and equity markets are being artificially propped up by central bank money printing. Further easing this week from the Bank of Japan would only deepen the problem. Yet eventually it must end, and when it does, share prices globally will return to earth with a bump. Only lack of alternatives for today’s ever rising wall of money seems to hold them aloft.

Over the last year, central bank manipulation of markets has reached ludicrous levels, far beyond the “quantitative easing” used to mitigate the early stages of the crisis. Through long use, “unconventional monetary policy” of the original sort has become ineffective, and, well, simply conventional in nature. To get pushback, central banks have been straying ever further onto the wild-west frontiers of monetary policy. Today it’s not just government bonds which are being bought up by the lorry load, but corporate debt, and in the case of the Bank of Japan and the Swiss National Bank (SNB), even high risk equities. [..] For global corporations at least, credit has never been so free and easy, encouraging aggressive share buy-back programmes.

This in turn further inflates valuations already in danger of losing all touch with underlying fundamentals. By the by, it also helps trigger lucrative executive bonus awards. Where’s the real earnings and productivity growth to justify the present state of stock markets? As long as the central bank is there to do the dirty work, it scarcely seems to matter. In any case, the situation seems ever more precarious and unsustainable. Conventional pricing signals have all but disappeared, swept away by a tsunami of newly created money. Globally, the misallocation of capital must already be on a par with what happened in the run-up to the financial crisis, and possibly worse given the continued build-up of debt since then.

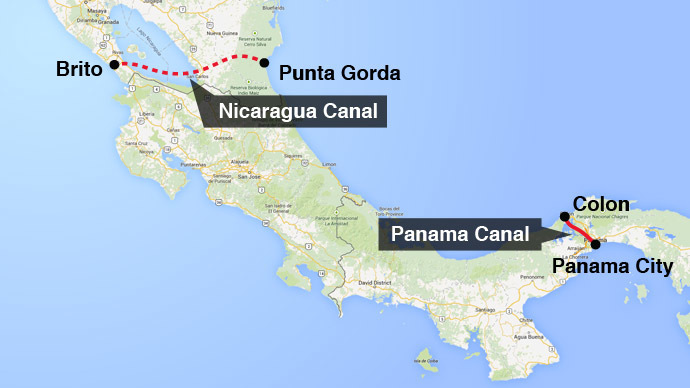

World trade summed up.

• Japan Exports Fall 11th Straight Month, 9.6% YoY, Imports Plunge 17.3% (R.)

Japan’s exports fell 9.6% in August from a year earlier, posting an 11th straight month of decline, Ministry of Finance data showed on Wednesday, underscoring sluggish external demand. The fall compares with a 4.8% decrease expected by economists in a Reuters poll. It followed a 14.0% drop in July, the data showed. Imports fell 17.3% in August, versus the median estimate for a 17.8% decline. The trade balance swung to a deficit of 18.7 billion yen ($184 million), versus the median estimate for a 202.3 billion yen surplus. It was a first trade deficit in three months.

Who says Kuroda has no sense of humor? After failing to lift inflation for years, he now says he will “..allow inflation to overshoot its target..

• Bank of Japan Overhauls Policy Framework, Sets Yield Curve Target (R.)

The Bank of Japan added a long-term interest rate target to its massive asset-buying program on Wednesday, overhauling its policy framework and recommitting to reaching its 2% inflation target as quickly as possible. The central bank also said it will allow inflation to overshoot its target by maintaining an ultra-loose policy – beefing up its previous commitment to keep policy easy until the target was reached and kept in a stable manner. At the two-day rate review that ended on Wednesday, the BOJ maintained the 0.1% negative interest rate it applies to some of the excess reserves that financial institutions park with the central bank.

But it abandoned its base money target and instead adopted “yield curve control” under which it will buy long-term government bonds to keep 10-year bond yields at current levels around zero %. The BOJ said it would continue to buy long-term government bonds at a pace that ensures its holdings increase by 80 trillion yen ($781 billion) per year. Under the new framework that adds yield curve control to its current quantitative and qualitative easing (QQE), the BOJ will deepen negative rates, lower the long-term rate target, or expand base money if it were to ease again, the central bank said in a statement announcing the policy decision. “The BOJ will seek to lower real interest rates by controlling short-term and long-term interest rates, which would be placed as the core of the new policy framework,” it said.

But seriously, historians will look back on today wondering how on earth we could have all swallowed this continuing gibberish.

• Bank of Japan Introduces Rate Target for 10-Year Government Bonds (WSJ)

Japan’s central bank took an unexpected step Wednesday, introducing a zero interest-rate target for 10-year government bonds to step up its fight against deflation, after an internal review of previous measures that fell short of expectations. he adoption of a long-term target, the first such attempt in the BOJ’s history, came as global central banks struggle to find ways to get prices rising. Financial markets gyrated following the Bank of Japan’s announcement of what it called a “new framework” to overcome deflation. Some thought it illustrated the limits of the BOJ’s powers, since the decision didn’t include any direct new stimulus measures, while others were encouraged by the BOJ’s tone.

“Investors are showing a positive response as they got the feeling that the BOJ will do whatever it can do to tackle deflation,” said Kengo Suzuki at Mizuho Securities in reference to the yen’s fall following the BOJ action. The dollar was around 102.60 yen in afternoon Tokyo trading, compared with around 101.90 yen before the decision. The 10-year Japanese government bond yield had already been near zero in recent weeks. It was minus 0.06% just before the decision and was minus 0.03% in Tokyo afternoon trading hours after the decision. The new framework puts 10-year interest rates at the center of policy, a contrast to the BOJ’s approach for the last 3 1/2 years under Gov. Haruhiko Kuroda, when asset purchases and expanding the monetary base were the key policy tool.

Smart from Golem.

• Could Germany Allow Deutsche Bank To Go Under? (Golem XIV)

[..] public bail outs are supposed to be strictly temporary. No holding 80% of RBS for most of a decade. Really? But that’s not the point which is important for Deutsche Bank. The important point is that in any sale of the viable parts of Germany’s only G-SIB, the brutal fact of the matter is that there is no other German financial institution that could afford to buy any of it. Commerzbank? Allianz? Letting an insurer buy a bank? So imagine the situation for Germany. They lose their seat at the top table and then they watch as France, England, American or perhaps China buy the crown of German financial might. So I don’t think it will ever happen. Or at least it will only happen when Germany is truly out of any other options. So if Deutsche is not going to be declared “no longer viable” what are the alternatives?

One option is the UniCredit route. UniCredit was a trillion euro bank. It was Italy’s flag carrier. It had bought Bavaria’s banks and some of Austria’s as well. And yet it’s share price was always paltry. Just 7.6 Euros at the market top in May ’07. And since then it has been a hollow and enfeebled giant. Lumbering and ineffectual. It has been the laughing stock of European banks. But Italy doesn’t seem to mind. They seem content to let UniCredit be the quintessential Zombie bank. Would Germany be as sanguine to leave Deutsche to go the same way? This would, I suggest, be almost as injurious to German pride and industrial policy as letting Deutsche go down completely.

But if Germany decided it could not face the financial consequences of obeying the letter of the resolution law nor leave the bank to be a bloated and useless zombie then the alternatives bring in their train even greater political upheavals. Imagine the German government decides that not bailing out Deutsche just inflicts too much damage on Germany – potentially reducing Germany from the front rank of globally significant nations to something lesser. It becomes a matter of national pride if not of survival. So Germany ignores all the FSB rules and regulations and bails Deutsche bringing it into government ownership/protection – call it what you like. In so doing it demolishes the entirety of European policy regarding bail outs, government debts and austerity.

Where then all the German insistence on fiscal discipline it has forced upon Greece, Ireland, Portugal, Spain and Italy? The Bundesbank, Berlin and the ECB would have no authority at all. Every country would have a green light to do the same for their flag carriers. It would be the end the European experiment. Or the European system would have to try to continue without Germany. And that could only happen if all debts to Germany were repudiated. I realise all this is speculation. But Deutsche has lost 90% of its value. Only RBS has lost more. Deutsche has 7000 legal cases against it. Frau Merkel is losing her grip, Brexit rocked the complacent rulers of Euroland and Madame Marine Le Pen would like to push France to do the same.

Mish restates the obvious: “Keynesian theory says consumers will delay purchases if prices are falling. In practice, all things being equal, it’s precisely the opposite.”

• Keynesian Deflation Humbug (Mish)

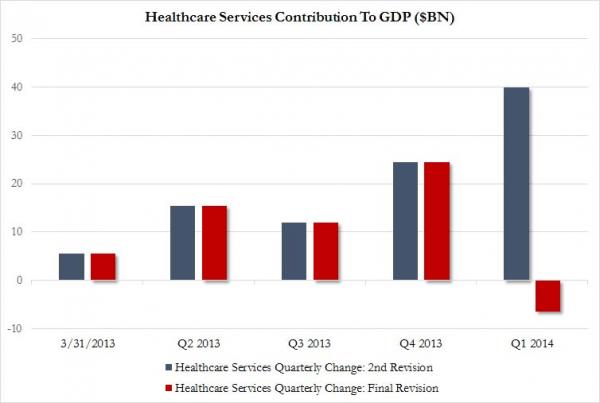

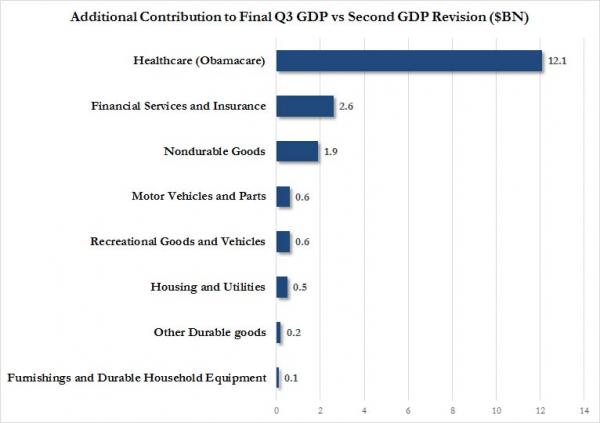

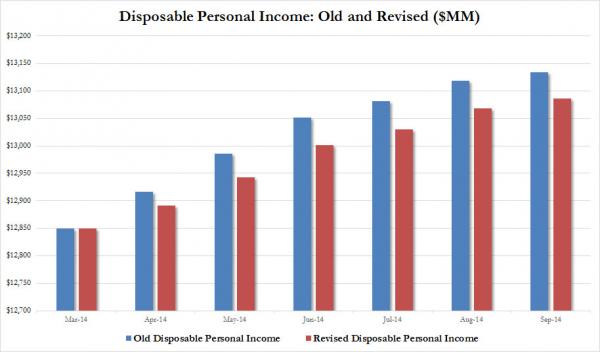

Hip, hip, hooray! The CPI is up more than expected, led by a huge 1.1% month-over-month surge in medical care supplies. Medical care services jumped 0.9%, and shelter jumped 0.3%. This will not help the economy. And it will subtract from consumer spending other than Obamacare and rent, but economists are cheering.

Real World Happiness

- Food at home -1.9%

- Energy -9.2%

- Gasoline -17.3%

- Fuel Oil -12.8%

- Electricity -.07%

- Used cars -4.0%

Unreal World Happiness

- Food Away From Home +2.8%

- Medical Care Commodities +4.5%

- Shelter +3.4%

- Transportation Services +3.1%

- Medical Care Services +5.1%

Keynesian Theory vs. Practice Keynesian theory says consumers will delay purchases if prices are falling. In practice, all things being equal, it’s precisely the opposite. If consumers think prices are too high, they will wait for bargains. It happens every year at Christmas and all year long on discretionary items not in immediate need.

Reality Check Questions

- If price of food drops will people stop eating?

- If the price of gasoline drops will people stop driving?

- If price of airline tickets drop will people stop flying?

- If the handle on your frying pan falls off or your blow-dryer breaks, will you delay making another purchase because you can get it cheaper next month?

- If computers, printers, TVs, and other electronic devices will be cheaper next year, then cheaper again the following year, will people delay purchasing electronic devices as long as prices decline?

- If your coat is worn out, are you inclined to wait another year if there are discounts now, but you expect even bigger discounts a year from now?

- Will people delay medical procedures in expectation of falling prices?

- If deflation theory is accurate, why are there huge lines at stores when prices drop the most?

Bonus Question

If falling prices stop people from buying things, how are any computers, flat screen TVs, monitors, etc., ever sold, in light of the fact that quality improves and prices decline every year?

Anyone who thinks soaring Obamacare and rent is a good thing and will help the economy is crazy.

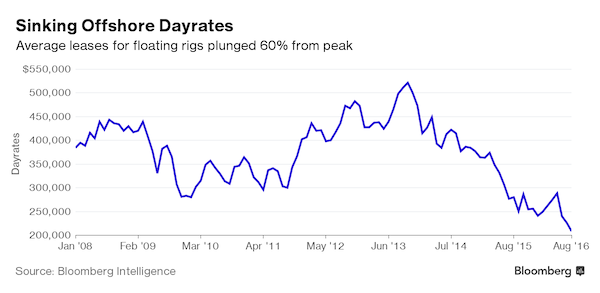

Forget the OPEC output cut talks, here’s what’s really happening in oil.

• Nobody Has Ever Shut Down The World’s Best Drilling Rigs – Until Now (BBG)

In a far corner of the Caribbean Sea, one of those idyllic spots touched most days by little more than a fisherman chasing blue marlin, billions of dollars worth of the world’s finest oil equipment bobs quietly in the water. They are high-tech, deepwater drillships – big, hulking things with giant rigs that tower high above the deck. They’re packed tight in a cluster, nine of them in all. The engines are off. The 20-ton anchors are down. The crews are gone. For months now, they’ve been parked here, 12 miles off the coast of Trinidad & Tobago, waiting for the global oil market to recover. The ships are owned by a company called Transocean Ltd., the biggest offshore-rig operator in the world. And while the decision to idle a chunk of its fleet would seem logical enough given the collapse in oil drilling activity, Transocean is in truth taking an enormous, and unprecedented, risk.

No one, it turns out, had ever shut off these ships before. In the two decades since the newest models hit the market, there never had really been a need to. And no one can tell you, with any certainty or precision, what will happen when they flip the switch back on. It’s a gamble that Transocean, and a couple smaller rig operators, felt compelled to take after having shelled out millions of dollars to keep the motors running on ships not in use. That technique is called warm-stacking. Parked in a safe harbor and manned by a skeleton crew, it typically costs about $40,000 a day. Cold-stacking – when the engines are cut – costs as little as $15,000 a day. Huge savings, yes, but the angst runs high.

OPES helps the US bring Maduro to his knees.

• Crude Slips As Venezuela Says Market Is 10% Oversupplied (Dow Jones)

Oil prices dipped to a new one-month low Tuesday as hopes for any deal between OPEC countries and Russia to freeze production continued to fade. U.S. crude for October delivery recently fell 14 cents, or 0.3%, to $43.18 a barrel on the New York Mercantile Exchange. The October contract expires at settlement, and the more actively traded November contract recently fell 27 cents, or 0.6%, to $43.59 a barrel. Brent, the global benchmark, fell 42 cents, or 0.9%, to $45.53 a barrel on ICE Futures Europe. Recent trade has been marked by fears that more OPEC members are intent on increasing production, even as leaders discuss the possibility of an output cap. Libya, Iran and Nigeria combined want to increase their output by about 1.5 million barrels a day this year.

Even Venezuela is raising exports, despite financial and production troubles, and the moves from all these countries are a clear message that none would be interested in agreeing to a cap, said Bjarne Schieldrop from Sweden’s SEB bank. He added that any deal would probably allow exceptions for Nigeria, Libya, Venezuela and Iran to lift production, possibly nullifying any agreement. “It doesn’t seem like any oil producers outside of North America are doing anything to control their production levels,” said Gene McGillian, research manager at Tradition Energy. Oil has been in a steady downtrend for the better part of two weeks with concerns over lingering oversupply. Prices are down 9.4% since they hit a high point for nearly the past month on Sept. 8.

The biggest drop came in two days last week after the International Energy Agency said a slowdown in global oil demand growth accelerated this quarter, sinking to 800,000 barrels a day – 1.5 million barrels a day lower than the third quarter of 2015. Despite that and talks of an output cap, data show OPEC members broadly producing near-record amounts of crude. “Fundamentals suggest the oil market is likely to remain in surplus for longer than many expected,” strategists at ING Bank said in a note.

Exxon has not: 1) written down valuations of reserves as prices plunged, and 2) accounted for the financial consequences of climate change regulations.

• SEC Probes Exxon Over Asset Valuation, Climate Change Accounting (WSJ)

The U.S. Securities and Exchange Commission is investigating how Exxon Mobil values its assets in a world of increasing climate-change regulations, a probe that could have far-reaching consequences for the oil and gas industry. The SEC sought information and documents in August from Exxon and the company’s auditor, PricewaterhouseCoopers, according to people familiar with the matter. The federal agency has been receiving documents the company submitted as part of a continuing probe into similar issues begun last year by New York Attorney General Eric Schneiderman, the people said.

The SEC’s probe is homing in on how Exxon calculates the impact to its business from the world’s mounting response to climate change, including what figures the company uses to account for the future costs of complying with regulations to curb greenhouse gases as it evaluates the economic viability of its projects. The decision to step into an Exxon investigation and seek climate-related information represents a moment in the effort to take climate change more seriously in the financial community, said Andrew Logan, director of the oil and gas program at Ceres, a Boston-based advocacy organization that has pushed for more carbon-related disclosure from companies.

“It’s a potential tipping point not just for Exxon, but for the industry as a whole,” he said. As part of its probe, the SEC is also examining Exxon’s longstanding practice of not writing down the value of its oil and gas reserves when prices fall, people familiar with the matter said. Exxon is the only major U.S. producer that hasn’t taken a write down or impairment since oil prices plunged two years ago. Peers including Chevron have lowered valuations by a collective $50 billion.

Shipping prices will plummet.

• Court Says Hanjin Shipping Rehab Plan ‘Realistically Impossible’ (R.)

The South Korean court overseeing Hanjin Shipping’s receivership said a rehabilitation plan is “realistically impossible” if top priority debt such as backlogged charter fees exceed 1 trillion won ($896 million), South Korea’s Yonhap newswire reported on Wednesday. Hanjin Shipping, the world’s seventh-largest container carrier, filed for receivership late last month in a South Korean court and must submit a rehabilitation plan in December. With debt of about 6 trillion won ($5.4 billion) at the end of June and the South Korean government’s unwillingness to mount a rescue, expectations are low that Hanjin Shipping will be able to survive. Top priority debt means claims for public interests, which are paid first to creditors and include cargo owners’ damages and unpaid charter fees, Yonhap reported citing the Seoul Central District Court.

Shouldn’t such an inquiry be as obvious as common sense??

• Elizabeth Warren to Wells Fargo CEO: Resign, Return Earnings, Face Inquiry (G.)

Wells Fargo chief executive John Stumpf should resign, return his pay and be criminally investigated over the bank’s illegal sales practices, Senator Elizabeth Warren said on Tuesday. The Massachusetts senator’s comments came moments after Stumpf said he was “deeply sorry” for the more than 2m unauthorized accounts his staff opened for the bank’s customers. The accounts, ranging from credit cards to checking accounts, were opened by thousands of the bank’s employees in an effort to meet Wells Fargo’s sales quotas and have already led to a record $185m fine. While testifying in front of the Senate banking committee, Stumpf said he was “deeply sorry” that the bank let down its customers and apologized for violating their trust.

“I accept full responsibility for all unethical sales practices in our retail banking business, and I am fully committed to doing everything possible to fix this issue, strengthen our culture, and take the necessary actions to restore our customers’ trust,” Stumpf said in his prepared remarks. Warren accused Stumpf of “gutless leadership”, telling him that his definition of being accountable is to push the blame on lower-level employees who do not have a PR firm to defend them. Warren questioned Stumpf’s compensation, asking him: “Have you returned one nickel of the millions of dollars that you were paid while this scam was going on?” “The board will take care of that,” Stumpf said after attempting to duck the question. He also told Warren that this “was not a scam”.

Warren pointed out that during the time that the unauthorized accounts were being opened, the share price of Wells Fargo went up by about $30. Stumpf personally owns about 6.75m shares of Wells Fargo stock and made more than $200m just off his stock during that time, Warren said. [..] At the hearing Stumpf pointed out that the lowest paid employees at Wells Fargo earn $12 an hour and that the employees let go for opening unauthorized accounts were making “good money”, earning $30,000 to $60,000 a year. “How much money did you make last year?” New Jersey senator Robert Menendez asked Stumpf. “$19.3m,” said Stumpf. “Now that’s good money,” said Menendez.

Kudo’s.

• Mexico Police Raid Sawmills To Rescue Monarch Butterfly Refuge (AFP)

A special Mexican police unit has raided seven sawmills near the monarch butterfly’s mountain sanctuary in a bid to prevent illegal logging threatening the insect’s winter migration, officials said Tuesday. Backed up by a helicopter, some 220 members of the country’s police force and 40 forestry inspectors participated in the September 12 operation in the western state of Michoacan. North American governments have taken steps since last year to protect the monarch butterfly, which crosses Canada and the United States each year to hibernate on the fir and pine trees of Mexico’s western mountains. Last week’s raid was the first since the government decided in April to add the police to protection efforts for the brilliant orange and black monarchs.

The force has been conducting foot patrols day and night, using drones and helicopters for surveillance when weather permits, Abel Corona, director of the special units, said at a news conference. [..] Illegal logging dropped by 40% between the 2014-2015 and 2015-2016 butterfly season, environmental protection authorities said last month. But March storms killed seven% of the monarchs. The cold spell came after authorities had reported a rebound in the 2015-2016 season, with the butterfly covering 4.01 hectares (9.9 acres) of forest, more than tripling the previous year’s figure.

Renzi in his referendum desperation finally tells the truth, somewhat.

• Italy PM Renzi: Merkel Is ‘Lying To The Public’, Europe Is a ‘GHOST’ (Exp.)

Angela Merkel has been lying to the public about European unity, Italian Prime Minister Matteo Renzi has said. In a brutal attack on his fellow EU members, he said the first EU summit without the UK amounted to no more than “a nice cruise on the Danube”. Having been excluded from a joint news conference by the German Chancellor, Mrs Merkel and French President Francois Hollande, he said he was dissatisfied with the Bratislava summit’s closing statement. The outspoken Italian premier hit out at the lack of commitments on the economy and immigration in the summit’s conclusions, despite signing it himself. In a fiery interview in Italian daily Corriere della Sera, Mr Renzi intensified his criticisms, although he remained vague on what commitments he would have liked the summit to produce.

The Prime Minister has staked his career on a referendum this autumn over plans for constitutional reform, promising to resign if he loses. Talking about his fellow leaders, he said: “If we want to pass the afternoon writing documents without any soul or any horizon they can do it on their own. “I don’t know what Merkel is referring to when she talks about the ‘spirit of Bratislava’. “If things go on like this, instead of the spirit of Bratislava we’ll be talking about the ghost of Europe.” Mr Renzi said he is preparing a 2017 budget which he claims will cut taxes despite a slowing economy and record high public debt. He added: “At Bratislava we had a nice cruise on the Danube, but I hoped for answers to the crisis caused by Brexit, not just to go on a boat trip.”

He was similarly belligerent about the Italian budget to be presented next month, saying there would be “no negotiation” with Brussels, and money he planned to spend on tackling immigration and making Italy safer from earthquakes would be excluded from EU rules on deficit limits. Other countries were more guilty than Italy of breaking budget rules and Italy had met its commitments on tackling the inflows of migrants crossing the Mediterranean, Renzi said. He said: “I’m not going to stay silent for the sake of a quiet life. “If someone wants to keep Italy quiet they have picked the wrong place, the wrong method and the wrong subject.”

In case anyone still had any doubts about this, here’s more proof that it’s the EU, not Greece, that is responsible for the expanding misery. Europe wants the islands to serve as holding pens, so richer Europe doesn’t have to face the consequences of the policies it itself dictates.

“To avoid secondary movement to the rest of Europe, that means keeping asylum seekers on the islands..”

• EU: Refugees Must Stay On Greek Islands Despite Lesbos Fire (AP)

Authorities on the island of Lesvos called for the immediate evacuation Tuesday of thousands of refugees to the Greek mainland after a fire gutted a detention camp following protests. But EU officials appeared cool to the idea. More than 4,000 people were housed at the camp in Moria on Lesvos where the fire broke out late Monday, destroying or damaging tents and trailers. No injuries were reported at the camp, about 8 kilometers north of the island’s main town. Nine migrants were arrested on public disturbance charges after the chaotic scenes. Families with young children hastily packed up their belongings and fled into the nearby fields as the fire raged after nightfall. Many were later given shelter at volunteer-run camps. “We have been saying for a very long time that overcrowding on the islands must be eased,” regional governor Christiana Kalogirou said.

“On the islands of the northeast Aegean, official facilities have a capacity of 5,450 places, but more than 10,500 people are there. There is an immediate need to take people off the islands because things will get even more difficult,” she said. More than 60,000 migrants and refugees are stranded in transit in Greece, and those who arrived after March 20 have been restricted to five Aegean islands under an EU-brokered deal to deport them back to Turkey. But the agreement has been fraught with delays. In Brussels, a spokeswoman for the European Commission, Natasha Bertaud, said the Greek government had described the situation as being under control. Transfers to the mainland, she said, would remain limited. “To avoid secondary movement to the rest of Europe, that means keeping asylum seekers on the islands for the most part,” Bertaud said.