John Vachon Big Four Cafe, Cairo, Illinois 1940

We need more refreshing views like this. Actual thinking people.

• Obama’s Blunder; Trump’s Gambit (Rickards)

[..] Russia is a more natural ally of the U.S. than China. Russia is a parliamentary system, albeit with autocratic overtones; China is a Communist dictatorship. Russia has empowered the Orthodox Church in recent decades, while China is officially atheistic. Russia is encouraging population growth while China’s one child policy and sex-selective abortions resulted in the deaths of over twenty million girls. These cultural aspects – elections, Christianity, and family formation – provide Russia with a natural affinity to western nations. Russia is also superior to China militarily despite recent Chinese advances. That makes Russia the more desirable ally in any two-against-one scenario.

The most powerful argument for embracing Russia to checkmate China is energy. The U.S. and Russia are the two largest energy producers in the world. U.S. energy production is set to expand with the support of the Trump administration. Russian production will expand also based in part on initiatives led by Rex Tillerson of Exxon, soon to be Secretary of State. China has few oil and natural gas reserves and relies heavily on dirty forms of coal and some hydropower. The remainder of China’s energy needs is met through imports. An energy alliance between the U.S. and Russia, supported by Saudi Arabia, could leave the Chinese economy and, by extension, the standing of the Communist Party of China, in jeopardy. That threat is enough to insure Chinese compliance with U.S. aims.

An emerging U.S.-Russian entente could also lead to the alleviation of western economic sanctions on Russia. This would open the door to an alliance between Germany and Russia. Those two economies have near perfect complementarity since Germany is technology rich and natural resource poor, while Russia is the opposite. Isolation of Russia is a fool’s errand. Russia is the twelfth largest economy in the world, has the largest landmass of any country in the world, is a nuclear power, has abundant natural resources, and is a fertile destination for direct foreign investment. The Russian culture is highly resistant to outside pressure, but open to outside cooperation. Just as fifty years of U.S. sanctions failed to change Cuban behavior, U.S. sanctions will not change Russian behavior except for the worse.

Engagement, not confrontation is the better course. The new Trump administration gets this. [..] Fortunately it’s not too late to reestablish a balance of power that favors the United States. China is a rising regional hegemon that should be constrained. Russia is a natural ally that should be empowered. The U.S. has blundered in its foreign policy for the past eight years. A new Trump administration has an opportunity to reverse those blunders by building bridges to Russia, and it seems to be moving in that direction.

“..Ronald Reagan and Herbert Hoover also began their tenures with huge rallies, followed by crashes…”

• Trump Rally May Not Last Long – Marc Faber (CNBC)

If President-elect Donald Trump’s rhetoric ends up fueling a trade war with China, it’s the U.S. that will take it on the chin, Marc Faber, the publisher of the Gloom, Boom & Doom report, told CNBC on Friday. “Mr. Trump is not particularly keen on China,” Faber told CNBC’s “Squawk Box” on Friday. “There may be some trade war escalation or trade restrictions with China, which in my view would rather be negative for the U.S. than for China.” Trump has certainly set his sights on China. On the campaign trail, Trump repeatedly accused China of manipulating its currency in order to give its exports an advantage over U.S.-made goods, and he threatened to slap a tariff of up to 45% on Chinese imports.

While China’s yuan has fallen against the U.S. dollar in recent months, policymakers on the mainland have been intervening to support the currency, not weaken it. But Faber, who is also known as Dr. Doom for his usually pessimistic predictions, noted that China wouldn’t be easily cowed. “China does not depend on the U.S. The U.S. is still its largest export destination as a country, but taken together, all the emerging markets are for China much more important,” Faber noted. China exported about $482 billion in goods to the U.S. last year, more than any other country exported to the United States, according to the Office of the United States Trade Representative. The U.S. exported about $116 billion in goods to China in 2015, putting its goods trade deficit $366 billion.

[..] “We have a credit bubble in China, like, by the way, everywhere else in the world. It’s just bigger in China and that, in my view, will have to be deflated,” he said. Dr. Doom also wasn’t trusting Wall Street’s rally since Trump’s election, nothing that Presidents Ronald Reagan and Herbert Hoover also began their tenures with huge rallies, followed by crashes. On Thursday, the Dow Jones rose 59.71 points, or 0.3%, to close at 19,858.24, after climbing at one point to a mere 50 points away from hitting the 20,000 mark. Faber said that the U.S. market was getting toppish. “If you want to be in equities, the U.S. market is now at the most expensive level compared to Europe, Japan and emerging economies it’s ever been,” he said.

Despite Thursday’s gains, “there were more new 12-month lows than new highs.” He wasn’t optimistic on how much further the market can run. “In March 2017, the U.S. bull market will be eight years old. By any standard, this is a very aging bull market. By June 2017, the economic recovery will be eight years old. By any standard, a recovery that is very mature,” he noted. Faber was also pessimistic about the market’s prospects under the Trump administration. “We have to be very careful when we talk about investments. We have a lot of volatility coming toward us. I think that in general people are far too optimistic about the U.S. becoming again a great country,” he said. “I doubt that one man alone can do it.”

“When you have an adrenaline rush you don’t feel pain. It’s when the adrenaline wears off that you feel it.”

• This Stock Rally Is More Hope Than Substance (WSJ)

Janet Yellen may not have an armored horse, but her effect on the bull market looks very like the ineffective stab of a picador. The stock market bull seemed to be badly hurt after the U.S. Federal Reserve chairwoman’s words on Wednesday. The Fed raised interest rates and said policy makers expected three rate increases next year, while Ms. Yellen said the economy is near full capacity and doesn’t need fiscal stimulus—suggesting rates will rise even faster if president-elect Donald Trump goes ahead with promised tax cuts. But after their stumble, stocks regained their feet on Thursday, with the S&P 500 recovering to where it was before Fed Day. A mere picador is never enough to take down a bull.

The true danger to this latest bull run—the Trump rally—comes from itself. The genius of a matador is to wear out the bull by persuading it to keep charging, entrancing the audience in the process. The stock market has been attracted by the flourishes of Mr. Trump, the appealing prospect of tax cuts and infrastructure spending. The question for the next month is whether the bull will be worn out before Mr. Trump even takes office. When markets move a long way very fast, they become vulnerable. Late investors who pile on to little more than momentum have less confidence in their positions. The more momentum builds, the more it hurts if the bull trips and those momentum investors jump off. This market has moved very fast indeed.

The post-election rotation from defensive stocks to economically sensitive cyclical shares has been the biggest of any similar period since the bounce back after the Lehman crash. The 10-year bond’s losses have almost matched the selloff of the 2013 taper tantrum. And the dollar has surged 9% against the yen, taking it to its strongest since 2002 against a basket of currencies. There are plenty of reasons to worry about whether Mr. Trump’s policies will be implemented quickly, or will be as big-league as he has said. So long as those remain worries for another day, the market can keep rising. David Bloom, head of foreign-exchange strategy at HSBC, says investors who missed out on the fast moves in stocks, bonds and the dollar after the election are now being sucked into the trade to avoid missing out. “We’re in a euphoric time,” he said. “When you have an adrenaline rush you don’t feel pain. It’s when the adrenaline wears off that you feel it.”

We can only imagine where the dollar would be without this mass sell-off.

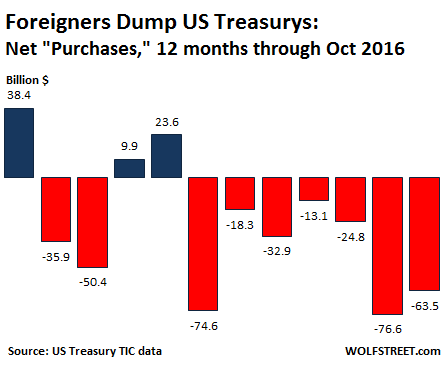

• China, Others are Dumping US Treasurys as Never Before (WS)

All kinds of things are now happening in the world of bonds that haven’t happened before. For example, authorities in China today halted trading for the first time ever in futures contracts of government bonds, after prices had swooned, with the 10-year yield hitting 3.4%. Trading didn’t resume until after the People’s Bank of China injected $22 billion into the short-term money market. What does this turmoil have to do with US Treasurys? China has been dumping them to stave off problems in its own house…. The US Treasury Department released its Treasury International Capital data for October, and what it said about the dynamics of Treasury securities is a doozie of historic proportions. Net “acquisitions” of Treasury bonds & notes by “private” investors amounted to a negative $18.3 billion in October, according to the TIC data.

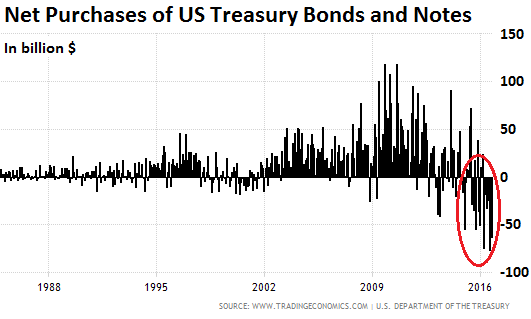

In other words, “private” foreign investors sold $18.3 billion more than they bought. And “official” foreign investors, which include central banks, dumped a net $45.3 billion in Treasury bonds and notes. Combined, they unloaded $63.5 billion in October. In September, these foreign entities had already dumped a record $76.6 billion. They have now dumped Treasury paper for seven months in a row. Over the past 12 months through October, they unloaded $318.2 billion. A 12-month selling spree in this magnitude has never occurred before. There have been a few months of timid net selling in 2012, and some in 2013, and a few in 2014, but no big deal because the Fed was buying under its QE programs. But then, with QE tapered out of the way, the selling picked up in 2015, and has sharply accelerated in 2016.

This chart (via Trading Economics), going back to the early 1980s, shows just how historic this wholesale dumping (circled in red) of US Treasury bonds and notes by foreign entities has been: The chart is particularly telling: It shows in brutal clarity that foreign buyers funded the $1 trillion-and-over annual deficits during and after the Financial Crisis, with net purchases in several months exceeding $100 billion. The other big buyer was the Fed. But since last year, the world has changed. China, once the largest holder of US Treasurys, has been busy trying to keep a lid on its own financial problems that are threatening to boil over. It’s trying to prop up the yuan. It’s trying furiously to stem rampant capital flight. It’s trying to keep its asset bubbles, particularly in the property sector, from getting bigger and from imploding – all at the same time. And in doing so, it has been selling foreign exchange reserves hand over fist.

Beijing’s own policies come back to bite it hard. Fully predictable too.

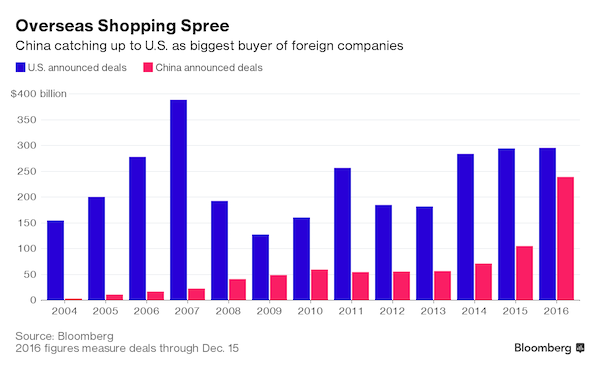

• The Longer China’s Record M&A Spree Lasts, The Stranger The Deals Get (BBG)

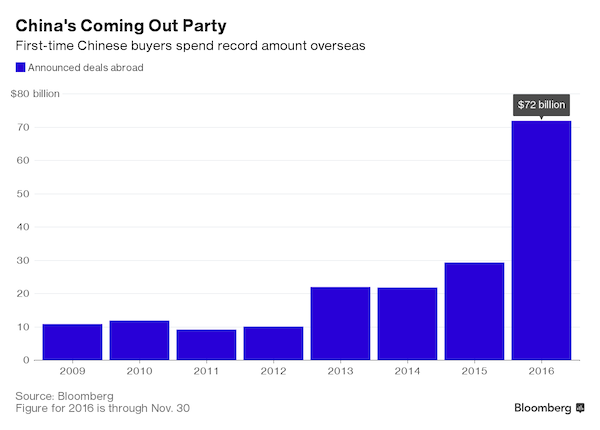

It’s no wonder the country’s regulators are getting concerned. This month, Chinese agencies including the National Development and Reform Commission said they’re closely watching “irrational” outbound purchases in sectors including entertainment and real estate, without naming specific deals. The heightened scrutiny coincides with a broader government effort to limit capital outflows, posing a risk to global takeover volumes after Chinese firms began rivaling their U.S. counterparts as the biggest buyers of overseas assets this year. For the Wall Street bankers helping to sell Western companies, the changing regulatory environment could make a delicate balance even trickier. Advisers need to court a widening pool of Chinese acquirers while at the same time making sure the companies are savvy enough to complete their deals.

“The M&A landscape has shifted focus to Chinese buyers,” said Brian Gu at JPMorgan Chase, the top-ranked adviser on Chinese outbound acquisitions tracked by Bloomberg this year. “How to solicit credible potential Chinese buyers now becomes an essential part of a pitch for any global sell-side mandates.” More than 360 Chinese companies announced their first cross-border acquisitions in the initial 11 months of this year, with the combined size of the transactions more than doubling from the full year 2015, according to data compiled by Bloomberg. Sifting through those new ranks of Chinese acquirers takes some work. When EQT Partners decided to sell Germany’s EEW Energy from Waste, its bankers at Morgan Stanley arranged for executives to meet potential buyers in Shanghai, Beijing and Hong Kong weeks before it began soliciting bids.

[..] While Chinese policy makers have been supportive of outbound acquisitions that help domestic companies gain foreign technology and strengthen industries seen as important drivers of economic growth, the worry is that some deals are being used as a way to move money offshore or make quick profits by re-listing acquired businesses at higher valuations in China. “Some of these companies invest outside of their core competency because they want to get money out of China, as they see the Chinese yuan will continue to depreciate,” said Christopher Balding, a professor at Peking University’s HSBC Business School in Shenzhen, without naming any specific deals.

Nice piece of research from Don Quijones. Title is mine, couldn’t help myself.

• ECB Bond Buying Props Up Oil, Cars, Guns, Drones, Gambling, Handbags (DQ)

In June 2016, the ECB activated its corporate bond buying program, ostensibly to revive the Eurozone’s stalled economy. The program has been shrouded in secrecy, as the ECB has refused to reveal the identity of most of the companies, divulging only the International Securities Identification Number (ISIN) of the bonds, but not the amounts. The ECB coordinates the overall effort, but the actual buying is done by the national central banks. Now the non-profit Corporate Europe Observatory (CEO) has cracked the code, so to speak: Finding the names via the ISIN code is a simple job. CEO has looked them all up to see what investments the ECB has found worthy of public money. Unfortunately, a lack of transparency at the ECB means the amounts held in bonds of individual corporations are not revealed.

While many pension funds do release this information, it seems that the common national bank for hundreds of millions of European citizens is unable to! Nevertheless, a lot can be learned from the lists… For instance, the fact that Europe’s oil majors have been particularly spoiled, with the ECB splurging on bonds issued by Shell no less than 11 times. The central bank bought bonds from Italian oil company Eni 16 times, Spain’s Repsol six times, Austrian OMV six times, and Total 7 times. Gas companies have also fared remarkably well. When counting the purchase of bonds in Spain, for example, 53% are from companies involved in the natural gas sector. The corresponding number in Italy is an astounding 68%. Also well favored are Europe’s biggest car companies, in particular those from Germany, with Daimler and BMW tied in top spot with 15 purchases apiece. The ECB also bought seven times bonds issued by Volkswagen, despite the reputational and financial fallout from its emissions scandal.

And it bought Renault bonds three times. Other companies on CEO’s list of coddled giants include Thales, a French producer of missiles, rifles, armored vehicles, and military drones, which has been engulfed in a spate of corruption scandals in recent years; France’s three major water corporations, Suèz, Vivendi, and Veolia; Novomatic, an Austrian-based gambling company owned by billionaire Johan Graf; and luxury goods companies like LVMH, producer of Moët & Chandon champagne, Hennessy cognac, and Louis Vuitton women’s handbags. These are just some of the corporations benefiting handsomely from a bond-buying binge that has already reached some €46 billion (as of Nov. 25, 2016). When the ECB buys these bonds, it inflates the bond prices and pushes their yields down, which is the purpose, and it thus lowers the cost of capital for this companies even further. By the end of the program, which is “scheduled” to finish in September, 2017, the ECB is expected to have lavished around €125 billion on them.

But that’s not the worst of it. As we reported in August, the ECB has admitted that it is not only buying already-issued bonds trading in secondary markets, as the public was initially led to believe; it is also buying bonds from companies via so-called “private placements.” These debt sales are not open to the broader market, so there’s no need for a prospectus. Only a small number of institutional investors participate. Private placements are not unusual. What’s new is that the ECB is using them to buy bonds. This was done discreetly, but it was leaked – and the ECB had some explaining to do. The central bank’s new role as “debt-buyer of first resort” raises a whole litany of concerns. It grants the ECB an almost god-like grip over Europe’s financial markets. And according to The Wall Street Journal, Citigroup figured “that bonds eligible for ECB purchases have already outperformed ineligible bonds by roughly 30% since the bond-buying program was announced in March.”

A Dutch referendum in April voted down the EU association deal with Ukraine. PM Rutte now pretends that with a few minor tweaks it’s acceptable regardless. Rutte will now take it to his parliament for approval, which would overwrite the referendum result. Democracy. They’re handing the entire continent to Wilders and Le Pen on a platter. Oh, and who does Rutte blame for his behavior? You got it, Russia.

• EU Agrees Dutch Demands On Ukraine Deal To Avoid ‘Present For Russia’ (R.)

EU leaders agreed on Thursday to additional Dutch demands over a landmark deal establishing closer ties with Ukraine, Maltese Prime Minister Joseph Muscat said. The EU’s so-called association agreement with Ukraine is central to the former Soviet republic’s efforts to move closer to the West. Mass street protests toppled a pro-Russian Ukrainian president in 2014 after he tried to ditch it. The Netherlands is the only EU country that has not ratified the deal, which fosters closer political ties and aims to free up trade between Ukraine and the bloc, after Dutch voters rejected it in a referendum last April. The Hague has asked the EU for additional guarantees to ensure the deal does not lead to EU membership for Ukraine.

Asked if all 28 EU leaders have arrived to a common position on the Dutch demand, Muscat said: “Yes, there is agreement.” Dutch Prime Minister Mark Rutte will now take it to his parliament for approval, which would overwrite the referendum result. Rutte told reporters before the talks that it was crucial to get a united European stance in the face of an emboldened Russia. “Russia is an increasing risk, look what happened in Crimea and eastern Ukraine and rockets being placed between Poland and Lithuania. You cannot, as the Netherlands … break this unity, that is why I’m so motivated to get this done,” he said.

Justin is trying to make me believe that building pipelines is the way to go towards a “carbon-free economy”. Sure. He’s turning into soundbite man.

• Justin Trudeau: ‘Globalisation Isn’t Working For Ordinary People’ (G.)

[..] A silver lining for Trudeau may lie in Trump’s pledge to resurrect plans for TransCanada’s Keystone XL pipeline. When the Obama administration rejected the plan last year, Trudeau said in a statement he was “disappointed” in the decision. When Trudeau called Trump to congratulate him after the election, the two briefly spoke about Keystone, said Trudeau, adding that it remains to be see how the US will move forward with plans for the pipeline. Any reluctance to move forward on climate change south of the border could be a boon for Canadian companies across various sectors, said Trudeau. “I know Canada is well positioned to pick up some of the slack and when people finally realise that it’s a tremendous business opportunity to lead on climate change, Canada will already have a head start.”

[..] Last week’s announcement of a national carbon price is a key part of Trudeau’s environmental policy – one that has been derided by environmentalists for enabling the expansion of fossil fuels, compensated by initiatives that include investments in clean tech and promises to phase out federal subsidies for oil and gas companies. The policy saw Trudeau recently approve a liquefied natural gas project in British Columbia as well as two pipelines that will offer Alberta’s oil sands nearly a million barrels a day in increased capacity. The approvals have sparked broad opposition among environmentalists, some First Nations and several of the communities affected by the planned infrastructure projects. “There is a number of people out there who’ve always [believed] if you stop pipeline, you stop the oil sands,” said Trudeau. “Well, actually as we’ve seen, it doesn’t work that way and what we end up with is much more oil by rail.”[..]

The government’s environmental policy takes a long view on the transition to a carbon-free economy, said Trudeau. “It’s not going to happen in a day, or in a week, but it will happen over years and perhaps a decade or two,” he said. “I know there are people out there extremely passionate about the environment, who don’t think I made the right decision on approving a couple of pipelines. But I think that everyone can see at least what it is we’re trying to do and that we’re consistent with what I’ve always said which is, you protect the environment and you build a strong economy at the same time.” The double-barrelled approach, said Trudeau, echoes his government’s broader effort to address the tensions currently wreaking havoc on the political status quo around the world. “People get that we need jobs, we need a protected environment,” he said. “On the other hand, if people have no jobs, if they have no opportunity, they’re not going to worry about protection of the air and water if they can’t feed their kids.”

I don’t know that throwing in the drug legalization topic is very relevant. Just ‘hands off!’ should do it.

• Crackdown On Cash Is An Attack On The Poor And A Reward For Banks (Soos)

The Coalition government recently announced a taskforce to investigate and recommend ways to deal with the so-called black economy. This primary revolves around business transactions conducted in cash to evade taxes. Other justifications concern the illicit drug trade and welfare fraud. The plan is to clamp down on this aspect of the black economy to make it more difficult for workers, businesses and households to evade tax, boosting taxation revenue. It is estimated the black economy accounts for about 1.5% of GDP or $21bn. There is also speculation that the $100-dollar bill may be removed from circulation. The Coalition government’s explanations seem sensible, with the mass media generally supportive. Yet, there are robust arguments why the Australian public should oppose this move – mostly because the government is trying to deal with problems it created itself.

The drug trade in Australia is thriving and constitutes a considerable portion of the black economy. This illegal trade, however, only exists because the government criminalises it. The primary reason offered is that it prevents the production and consumption of dangerous substances for recreational purposes. It clearly does nothing of the sort. By criminalising drugs, product is manufactured in unregulated and uncertain conditions, leading to vastly inferior quality relative to that in the legal and regulated pharmaceutical industry. Huge monopolistic profits are reaped by drug cartels and those in the supply chain, leading to a significant loss of taxable income. None of this would happen if the drug trade was legalised – and there is growing acceptance that it should be.

In short, the government cannot use the pretext of clamping down on an industry which is presently illegal by claiming the cash transactions facilitates the existence and growth of it when it is the government’s own criminalisation policy which brought it into existence. By legalising, billions of dollars of taxes could be raised through the GST, income tax and externality/sin taxes. Another area of alleged concern is welfare fraud. Recipients of welfare payments can work in the black economy, making a modest income without reporting it. If this were properly reported, welfare payments would be reduced. Again, this is a problem government has itself created. While the government and certain sections of the mass media pretend Australia has an out-of-control welfare system, the facts demonstrate Australia has some of the smallest welfare expenditures relative to GDP, easily the most well-targeted and has the highest “target-efficiency” (each dollar in spending reduces income inequality the most) in the OECD.

I’d like to ignore this tale (who reads the WaPo anymore), but the Nation has a passable one: “..the CIA has “(1) attempted to overthrow more than 50 governments, most of which were democratically-elected, (2) attempted to suppress a populist or nationalist movement in 20 countries, (3) grossly interfered in democratic elections in at least 30 countries, (4) dropped bombs on the people of more than 30 countries, (5) attempted to assassinate more than 50 foreign leaders.”

• Why Are the Media Taking the CIA’s Hacking Claims at Face Value? (Nation)

In 1977, Carl Bernstein published an exposé of a CIA program known as Operation Mockingbird, a covert program involving, according to Bernstein, “more than 400 American journalists who in the past 25 years have secretly carried out assignments for the Central Intelligence Agency.” Bernstein found that in “many instances” CIA documents revealed that “journalists were engaged to perform tasks for the CIA with the consent of the managements of America’s leading news organizations.” Fast-forward to December 2016, and one can see that there isn’t much need for a covert government program these days.

[..] The high-profile anchors and analysts on CNN, CBS, ABC, and NBC who have cited the work of The Washington Post and The New York Times seem to have come down with a bad case of historical amnesia. The CIA, in their telling, is a bulwark of American democracy, not a largely unaccountable, out-of-control behemoth that has often sought to subvert press freedom at home and undermine democratic norms abroad. The columnists, anchors, and commentators who rushed to condemn Trump for not showing due deference to the CIA seem to be unaware that, throughout its history, the agency has been the target of far more astute and credible critics than the president-elect.

In his memoir Present at the Creation, Truman’s Secretary of State Dean Acheson wrote that about the CIA, “I had the gravest forebodings.” Acheson wrote that he had “warned the President that as set up neither he, the National Security Council, nor anyone else would be in a position to know what it was doing or to control it.” Following the Bay of Pigs fiasco, President John F. Kennedy expressed his desire to “to splinter the CIA into a thousand pieces and scatter it to the winds.” The late New York Senator Daniel Patrick Moynihan twice introduced bills, in 1991 and 1995, to abolish the agency and move its functions to the State Department which, as the journalist John Judis has observed, “is what Acheson and his predecessor, George Marshall, had advocated.”

[..] To see what a corrosive effect outside powers can have on democratic processes, one need look no further than the 1996 Russian presidential election, in which Americans like the regime-change theorist Michael McFaul (later US Ambassador to Russia from 2012–14) interfered in order to keep the widely unpopular Boris Yeltsin in power against the wishes of the Russian people. For its part, the CIA has a long history of overthrowing sovereign governments the world over. According to historian William Blum, the CIA has “(1) attempted to overthrow more than 50 governments, most of which were democratically-elected, (2) attempted to suppress a populist or nationalist movement in 20 countries, (3) grossly interfered in democratic elections in at least 30 countries, (4) dropped bombs on the people of more than 30 countries, (5) attempted to assassinate more than 50 foreign leaders.”

Yada yada

• Turkey Has Back-Up Plans If EU Fails To Keep Visa-Free Travel Promises (AFP)

President Recep Tayyip Erdogan said Thursday Turkey had back-up plans if the EU failed to keep its promise over visa-free travel for Turks to the passport-free Schengen zone. Turkey and the EU signed a controversial deal in March, in which Ankara agreed to take back Syrian migrants landing on Greek islands in return for incentives including €3 billion in funds and visa-free travel. “If we do not get the expected outcome regarding the visa issue… if promises are not fulfilled, Turkey will no doubt have a plan B and it will have a plan C,” Erdogan warned during a news conference with his Slovenian counterpart in Ankara.

“We do not have to say ‘yes’ to every decision made about us. The EU has given us nothing so far,” he added, without elaborating. Ties between Brussels and Ankara have been strained since a failed July 15 coup in Turkey. The rocky relationship worsened after the European Parliament voted last month in favour of halting long-stalled membership talks with Turkey over its post-coup crackdown, a non-binding vote which Erdogan branded worthless. Turkey accuses the EU of failing to show enough solidarity after the failed putsch while Brussels has repeatedly urged Turkey to act within the rule of law as it arrests tens of thousands of people suspected of links to coup plotters.

Horror story.

• “Without Antibiotics, Essentially You Do Not Have Modern Medicine” (R.)

For nearly two years, a killer stalked the patients of Providence Alaska Medical Center. It was a bacteria called Acinetobacter baumannii, a common cause of infections in hospitals. This one was different. After a rash of mild cases in early 2011, doctors began seeing highly drug-resistant infections in patients, said Dr Megan Clancy, an infectious-disease specialist at the Anchorage, Alaska, hospital. And the bacteria was attacking more patients than just the severely ill ones who are the usual victims of drug-resistant “superbugs.” Clancy took emergency measures. Infected patients were isolated. Staff and visitors had to adhere to strict hand-washing and other infection-control protocols. Furniture and equipment were scrubbed to remove a microbe that can stubbornly persist on all sorts of surfaces.

Clancy also contacted outside researchers for help. They found that a strain of the bacteria had acquired a rare combination of traits. Bacteria typically are either highly resistant to drugs or highly virulent. This strain was both. Doctors quickly burned through the antibiotics used as the second and third lines of defense against superbugs. This strain shook them off. “When you start running out of medications, it gets pretty desperate,” Clancy said. Eventually, they turned to colistin. This powerful antibiotic was largely abandoned in the 1960s for its toxic side effects. Out of necessity, it has become in recent years a weapon of last resort against the worsening superbug scourge.

But in some of the Alaska cases, even colistin didn’t work. For public health officials, that’s the nightmare scenario. “It’s the worst of all possible worlds: You have a bacteria that is good at establishing infection, and it can’t be treated with antibiotics,” said Dr Robert Clifford, a microbiologist at the Walter Reed Army Institute of Research who studied the outbreak.

Needs much more attention. This is how we kill the living world.

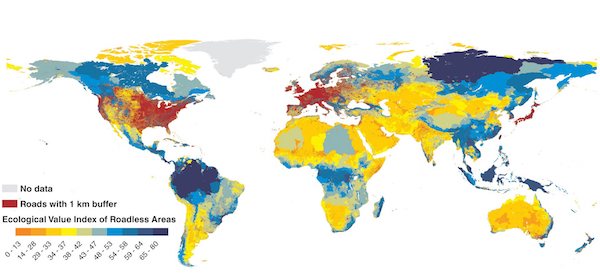

• The Shattering Effect Of Roads On Nature (G.)

Rampant road building has shattered the Earth’s land into 600,000 fragments, most of which are too tiny to support significant wildlife, a new study has revealed. The researchers warn roadless areas are disappearing and that urgent action is needed to protect these last wildernesses, which help provide vital natural services to humanity such as clean water and air. The impact of roads extends far beyond the roads themselves, the scientists said, by enabling forest destruction, pollution, the splintering of animal populations and the introduction of deadly pests. New roads also pave the way to further exploitation by humans, such as poaching or mining, and new infrastructure.

An international team of researchers analysed open-access maps of 36m km of road and found that over half of the 600,000 fragments of land in between roads are very small – less than 1km2. A mere 7% are bigger than 100km2, equivalent to a square area just 10km by 10km. Furthermore, only a third of the roadless areas were truly wild, with the rest affected by farming or people. The last remaining large roadless areas are rainforests in the Amazon and Indonesia and the tundra and forests in the north of Russia and Canada. Virtually all of western Europe, the eastern US and Japan have no areas at all that are unaffected by roads. The scientists considered that land up to a kilometre on each side of a road was affected, which they believe is a conservative estimate.