Roy Lichtenstein Crying girl 1963

A team he knows will never be accepted.

• Showdown Looms In Italy As Caretaker PM Assembles Team (AFP)

Italy’s caretaker prime minister was Tuesday assembling a cabinet lineup despite almost certain rejection by the populists whose bid for power collapsed at the weekend. Fresh elections are now looming as the most likely outcome of the long-running political saga sparked by inconclusive elections in March. Carlo Cottarelli, a former IMF economist, was tasked with naming a technocrat government on Monday after President Sergio Mattarella nixed a cabinet proposed by the far-right League and anti-establishment Five Star Movement (M5S). The president in particular vetoed their pick for economy minister, fierce eurosceptic Paolo Savona, throwing the eurozone’s third largest economy into a fresh crisis.

Savona has called the euro a “German cage” and said that Italy needs a plan to leave the single currency “if necessary”. Mattarella said that an openly eurosceptic economy minister was counter to the parties’ joint promise to simply “change Europe for the better from an Italian point of view”. Cottarelli said Italy would face new elections “after August” if parliament did not endorse his team, a near certainty given that M5S and the League together hold a majority. [..] Salvini and Di Maio furiously denounced the presidential veto, blasting what they called meddling by Germany, debt ratings agencies, financial lobbies and even lies from Mattarella’s staff. “Paolo Savona would not have taken us out of the euro. It’s a lie invented by Mattarella’s advisors,” Di Maio said in a live video on Facebook. “The truth is that they don’t want us in government.”

Draghi vs the vigilantes.

• The Biggest Short-Sellers Of Italian Bonds (ZH)

[..] it was in December when we first pointed out a dramatic observation by Citi, which noted that over the past several years, the only buyer of Italian government bonds was the ECB, and that even the smallest political stress threatened a repeat of the 2011 “Berlusconi” scenario, when the freshly minted new ECB head Mario Draghi sent Italian yields soaring to prevent populist forces from seizing power in Italy. Or maybe it didn’t, and it only took the bulls far longer than the bear to admit that nothing in Europe had been fixed, even as the bears were already rampaging insider Europe’s third largest economy.

Consider that according to the latest IHS Markit data, demand to borrow Italian government bonds — an indicator of of short selling — was up 33% to $33.3 billion worth of debt this year to Tuesday while demand to borrow bonds from other EU countries excluding Italy has risen only 5% this year. That said, things certainly accelerated over the last week, when demand to borrow Italian bonds soared by $1.2 billion, which according to WSJ calculations, takes demand, i.e. short selling, close to its highest level since the financial crisis in 2008 (while demand to borrow bonds from EU countries excluding Italy has fallen by $800 million over the past week).

Said otherwise, while the events over the past week may have come as a surprise to many, to the growing crowd of Italian bond shorts today’s plunge and the blowout in Italian-German spreads was not only expected, but quite predictable and extremely lucrative… which is also a major problem as Brussels is well-known to take it very personally when a hedge fund profits from the ongoing collapse of Europe’s failing experiment in common everything, and tends to create huge short squeezes in the process, no matter how obvious the (doomed) final outcome is.

Sorry, but I said it a lot better on Friday.

• If Italy Exits The Euro, It Could Be The End Of The Single Currency (Tel.)

You might think that it would be fitting if the European Union were to come to a sticky end because of Italy. After all, the agreement that established the entity that we now call the European Union was signed in Rome. For several decades after that 1957 treaty, Italy was one of the strongest supporters of the European project. Having endured first fascism and then, after the war, unstable and ineffectual government, it suffered none of the angst about the loss of sovereignty that plagued British debates about joining the European Community. Moreover, in the early years of the union, Italy prospered. At one point its GDP overtook the UK’s, an event that was widely celebrated in Italy as “il sorpasso”, the surpassing, or, if you like, the overtaking.

But the overtaking did not last long. Indeed, since the euro was formed in 1999, the Italian economy has grown by a mere 9%, or less than 0.5% per annum. Over the same period, the UK economy has grown by 42%. This recent disastrous economic performance, plus mounting anxiety about inward migration and the fact that the EU has left Italy to cope with this huge influx on its own, has changed many Italians’ attitudes to the EU. Understandably. These failings go to the heart of the EU project. The truth is that Italy should never have joined the euro in the first place. And it isn’t only Anglo-Saxon euro pessimists such as myself who believe this. At the time the German Bundesbank was appalled at the idea that Italy should be admitted. After all, even then it had a huge public debt and a history of high inflation offset by frequent currency depreciation.

“..the Chinese stock markets permit a much higher level of borrowings than those in the West..”

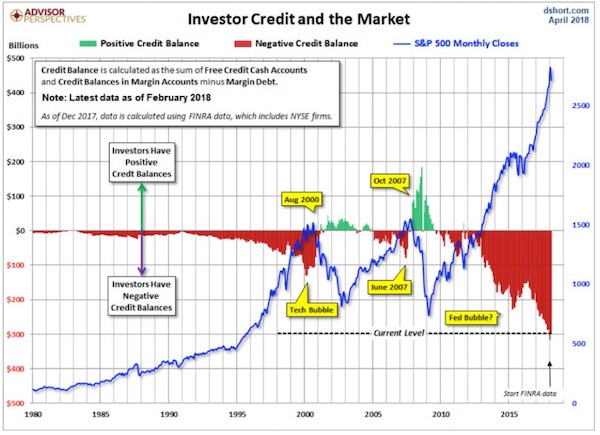

• Stock Market Borrowing at All Time High, Increasing Risk of Downdrafts (NC)

I find it hard to get excited about stock market risks unless defaults on the borrowings can damage the banking/payments system, as they did in the Great Crash. This is one reason the China perma-bears have a point: even though the Chinese government has managed to do enough in the way of rescues and warnings to keep its large shadow banking system from going “boom,” the Chinese stock markets permit a much higher level of borrowings than those in the West, which could make them the detonator for knock-on defaults. The US dot-com bubble featured a high level of margin borrowing, but because the US adopted rules so that margin accounts that get underwater are closed and liquidated pronto, limiting damage to the broker-dealer, a stock market panic in the US should not have the potential to produce a credit crisis.

But if stock market bubble has been big enough, a stock market meltdown can hit the real economy, as we saw in the early 2000s recession. Recall that Greenspan, who saw the stock market as part of the Fed’s mission, dropped interest rates and kept them low for a then unprecedented nine quarters, breaking the central bank’s historical pattern of reducing rates only briefly. Greenspan, as did the Bank of Japan in the late 1980s, believed that the robust stock market prices produced a wealth effect and stimulated consumer spending. It isn’t hard to see that even if this were true, it’s a very inefficient way to try to spur growth, since the affluent don’t have anything approach the marginal propensity to spend of poor and middle class households.

Subsequent research has confirmed that the wealth effect of higher equity prices is modest; home prices have a stronger wealth effect. A second reason for seeing stock prices as potentially significant right now be is that the rally since Trump won the election is important to many of his voters. I have yet to see any polls probe this issue in particular, but in some focus groups, when Trump supporters are asked why they are back him, some give rise in their portfolios as the first reason for approving of him. They see him as having directly improved their net worth.1

Accounting.

• The Financial Scandal No One Is Talking About (G.)

For centuries, accounting itself was a fairly rudimentary process of enabling the powerful and the landed to keep tabs on those managing their estates. But over time, that narrow task was transformed by commerce. In the process it has spawned a multi-billion-dollar industry and lifestyles for its leading practitioners that could hardly be more at odds with the image of a humble number-cruncher. Just four major global firms – Deloitte, PricewaterhouseCoopers (PwC), Ernst & Young (EY) and KPMG – audit 97% of US public companies and all the UK’s top 100 corporations, verifying that their accounts present a trustworthy and fair view of their business to investors, customers and workers.

They are the only players large enough to check the numbers for these multinational organisations, and thus enjoy effective cartel status. Not that anything as improper as price-fixing would go on – with so few major players, there’s no need. “Everyone knows what everyone else’s rates are,” one of their recent former accountants told me with a smile. There are no serious rivals to undercut them. What’s more, since audits are a legal requirement almost everywhere, this is a state-guaranteed cartel. Despite the economic risks posed by misleading accounting, the bean counters perform their duties with relative impunity.

The big firms have persuaded governments that litigation against them is an existential threat to the economy. The unparalleled advantages of a guaranteed market with huge upside and strictly limited downside are the pillars on which the big four’s multi-billion-dollar businesses are built. They are free to make profit without fearing serious consequences of their abuses, whether it is the exploitation of tax laws, slanted consultancy advice or overlooking financial crime.

Interesting fight.

• Fears Of Bad Brexit Deal Raise Tension Between Bank of England, Treasury (G.)

The growing risk of a bad Brexit deal for the City of London is causing severe tensions between the Bank of England and the Treasury, according to reports. Amid mounting fears that Brussels will reject plans put forward by the chancellor, Philip Hammond, for maintaining close ties with the EU for financial services, the Financial Times reported that Bank officials are at loggerheads with the Treasury over the search for a “Plan B” arrangement. Threadneedle Street fears it could be left as a “rule taker” should Britain agree to a new deal that maintains European market access for financial firms without giving the Bank sufficient control over City regulations in future. The concerns stem from the sprawling scale of the City as one of the biggest financial centres in the world.

Mark Carney, the Bank’s governor, used a speech in London last week to highlight the risks posed to the financial system from Brexit and said it was one of the issues raised by Britain leaving the European Union that made him most “nervous”. He also warned in plain terms last year that “we do not want to be a rule taker as an authority”. According to the FT, a number of officials at Threadneedle Street said Jon Cunliffe, the Bank’s deputy governor for financial stability, had fallen out with the Treasury over the issue. The paper quoted one anonymous official saying “the fear is the Treasury is going to give it all away”. The breakdown in relations comes as Hammond strives to prevent an exodus of international banks from the Square Mile, having attempted to reassure them in March that the UK would seek to maintain European market access after Brexit.

Wishful thinking.

• Eastern, Southern African Finance Leaders Debate Yuan As Reserve Currency (R.)

Eastern and southern African central bankers and government officials are to consider the use of China’s yuan as a reserve currency for the region, the official Xinhua news agency said on Tuesday. Seventeen top central bankers and officials from 14 countries in the region will meet at a forum in Harare to consider the viability of the Chinese yuan as a reserve currency, Xinhua said, citing a statement from the Macroeconomic and Financial Management Institute of Eastern and Southern Africa (MEFMI). The forum, to take place on Tuesday and Wednesday, will be attended by deputy permanent secretaries and deputy central bank governors, as well as officials from the African Development Bank, Xinhua reported.

Attendees will strategies on the weakening external positions of most member countries, following the global economy slowdown. “Most countries in the MEFMI region have loans or grants from China and it would only make economic sense to repay in termini (Chinese yuan),” said MEFMI spokesperson Gladys Siwela-Jadagu. “This is the reason why it is critical for policy makers to strategize on progress that the continent has made to embrace the Chinese yuan which has become what may be termed ‘common currency’ in trade with Africa,” she added. “Ascendancy of Chinese yuan in the Special Drawing Rights (SDR) basket of currencies is an important symbol of its importance and the IMF’s approval as an official reserve currency,” said Siwela-Jadagu.

Argentina, Turkey, Indonesia. Next!

• Indonesia’s Currency Is Spiraling. Sacrifices Are Needed To Save It (CNBC)

Indonesia’s rupiah has been growing worryingly weak, and the country’s central bank has seen little success after multiple attempts to prop up the currency. Now, Bank Indonesia said it will meet again on Wednesday — and speculations are rife that the central bank has more tricks up its sleeve. The rupiah has been one of the worst-hit Asian currencies as investors pull out of the Indonesian stock and bond markets amid rising U.S. Treasury yields and strengthening in the greenback. The falling value of the rupiah could spell trouble for the country’s large foreign currency debt, and the outflows from its bonds are bad news for its government.

The central bank has tried to stem the currency weakness with measures including hiking interest rates and buying sovereign bonds, but the rupiah still depreciated: It fell to 14,202 per U.S. dollar on May 23. That was the weakest in more than two years. With the persistent rupiah weakness, more “rate hikes may be needed, with the next one possibly as early as this week,” Eugene Leow, a strategist at Singapore’s DBS Bank, wrote in a Monday note. The central bank hiked interest rates by 25 basis points in its mid-May meeting — the first raise since November 2014. Central bankers were scheduled to convene again in June, but Bank Indonesia last Friday said an additional policy meeting would be held on May 30.

Censors?!

• Papua New Guinea Bans Facebook For A Month To Root Out ‘Fake Users’ (G.)

The Papua New Guinean government will ban Facebook for a month in a bid to crack down on “fake users” and study the effects the website is having on the population. The communication minister, Sam Basil, said the shutdown would allow his department’s analysts to carry out research and analysis on who was using the platform, and how they were using it, admits rising concerns about social well-being, security and productivity. “The time will allow information to be collected to identify users that hide behind fake accounts, users that upload pornographic images, users that post false and misleading information on Facebook to be filtered and removed,” Basil told the Post Courier newspaper. “This will allow genuine people with real identities to use the social network responsibly.”

Basil has repeatedly raised concerns about protecting the privacy of PNG’s Facebook users in the wake of the Cambridge Analytica revelations, which found Facebook had leaked the personal data of tens of millions of users to a private company. The minister has closely followed the US Senate inquiry into Facebook. “The national government, swept along by IT globalisation, never really had the chance to ascertain the advantages or disadvantages [of Facebook] – and even educate and provide guidance on use of social networks like Facebook to PNG users,” said Basil last month. “The two cases involving Facebook show us the vulnerabilities that Papua New Guinean citizens and residents on their personal data and exchanges when using this social network.”

Blame game. Deutsche is hanging in the ropes.

• Deutsche Bank Chief Economist Lashes Out At Former CEO Ackermann (HB)

German executives rarely wash their dirty laundry in public. This week was a notable exception, when David Folkerts-Landau, Deutsche Bank’s chief economist, accused his former bosses of causing the bank’s current woes by racing hell-for-leather into investment banking. Mr. Folkerts-Landau, who has been with Deutsche’s investment banking division for over two decades, accused its former CEOs of reckless expansion and of losing control of the ship. “Since the mid-1990s, the bank’s management has left operational and strategic control of its financial markets business to the traders,” he said in an interview with Handelsblatt. The bank is still reeling from the consequences of this “reverse takeover,” the economist said.

Deutsche Bank has accumulated more than €9 billion in losses over the past three years, due chiefly to the woes of its investment banking division. The bank is in the throes of a revamp intended to refocus operations on more stable sources of revenue, such as private and commercial banking and asset management. Mr. Folkerts-Landau singled out Josef Ackermann, the bank’s flamboyant boss from 2002 to 2012, for particular criticism over his aggressive expansion into investment banking. “Ackermann was (…) fixed on the magic goal of a return on equity of 25% before taxes. At that time, however, this could only be achieved by accepting major financial and ethical risks,” said the German-born economist. After the financial crisis, Mr. Ackermann rejected state aid from the German authorities and postponed tackling the bank’s structural problems, Mr. Folkerts-Landau added.

Yeah, you can do the math in many different ways.

• Fake Maths: The NHS Doesn’t Need £2,000 From Each Household To Survive (G.)

Last week, the Institute for Fiscal Studies and the Health Foundation published a report on funding for health and social care. One figure from the report was repeated across the headlines. For the NHS to stay afloat, it would require “£2,000 in tax from every household”. Shocking stuff! The trouble with figures like this is that while there may be a sense in which this is mathematically true, that kind of framing is dangerously close to being false. If you’re sitting at a bar with a group of friends and Bill Gates walks in, the average wealth of everyone in the room makes you all millionaires. But if you try to buy the most expensive bottle of champagne in the place, your debit card will still be declined.

Similarly, the IFS calculated its “average” figures by taking the total amount it calculated the NHS would need and dividing it by the number of households in the country. That’s certainly one way of doing it – it’s not wrong per se – but in terms of informing people about the actual impact on their own finances, it’s very misleading. We have progressive taxation in this country: not every household gets an equally sized bill. Could you pay more if the government chose to cover the cost of social care through a bump in income tax? Sure, but for the vast majority of the country it would be a few hundred pounds.

That’s without engaging with the underlying assumption that a bump in income tax is the way the government will choose to go. Some people have argued that, since the last couple of decades have seen wealth accumulate disproportionately at the very top, government should tax wealth rather than income. Alternatively, researchers have shown that health spending is one of the best ways to stimulate the economy, so the government could opt against tax increases in the short term and instead let healthcare spending act as a fiscal stimulus, at least until purchasing power had increased.

The reason why is revealing.

• After China’s Waste Import Ban EU Wants To Get Rid Of Single-Use Plastics (RT)

The European Commission wants to ban single-use plastic products like disposable cutlery, straws and cotton buds to fight the plastic epidemic littering our oceans – months after China banned millions of tons of imported EU waste. The EC unveiled the market ban proposal on Monday, which included 10 items that make up 70% of all the marine litter in the EU. As well as the aforementioned items, the list includes plastic plates, drink stirrers, sticks for balloons and single-use plastic drinks containers. The crackdown comes less than six months after the EU announced its first-ever Europe-wide strategy on plastic recycling following China’s ban on waste imports from Western countries.

At the end of 2017, Beijing banned the import of 24 types of waste from the US and EU and accused the nations of flouting waste standard rules. The new proposal says the ban on single-use plastic products will be in place wherever there are “readily available and affordable” alternatives. Where there aren’t “straight-forward alternatives,” the focus will be on limiting their use through a national reduction in consumption. In order for the products to be sold in the EU, they will have to be made exclusively from sustainable materials. Single-use drink containers will only be allowed on the market if their caps and lids remain attached.

[..] The EC’s proposal will now go to the European Parliament and Council for adoption. It will need the approval of all EU member states and the European Parliament in order to pass – a process which could take three to four years before the rules come into force. Once fully implemented in 2030, the EC estimates that the new measures could cost businesses more than €3 billion ($3.5 billion) per year. But they could also save consumers about €6.5 billion per year, create 30,000 jobs and avoid €22 billion in environmental damage and cleanup costs.

Resilient little bugger.

• Great Barrier Reef On Sixth Life In 30,000 Years (AFP)

Australia’s Great Barrier Reef, under severe stress in a warmer, more acidic ocean, has returned from near-extinction five times in the past 30,000 years, researchers said Monday. And while this suggests the reef may be more resilient than once thought, it has likely never faced an onslaught quite as severe as today, they added. “I have grave concerns about the ability of the reef in its current form to survive the pace of change caused by the many current stresses and those projected into the near future,” said Jody Webster of the University of Sydney, who co-authored a paper in the journal Nature Geoscience.

In the past, the reef shifted along the sea floor to deal with changes in its environment – either seaward or landward depending on whether the level of the ocean was rising or falling, the research team found. Based on fossil data from cores drilled into the ocean floor at 16 sites, they determined the Great Barrier Reef, or GBR for short, was able to migrate between 20 centimetres (7.9 inches) and 1.5 metres per year. This rate may not be enough to withstand the current barrage of environmental challenges. The reef “probably has not faced changes in SST (sea surface temperature) and acidification at such a rate,” Webster told AFP. Rates of change “are likely much faster now — and in future projections.”