Willem de Kooning Gotham News 1955

You could perhaps say that this is part 4 in a series on -America’s- peak wealth, even if it was never intended to be such a series; it just happened. First, in a February 18 essay about declining economic growth, “Not Nearly Enough Growth To Keep Growing”, I said “..the Automatic Earth has said for many years that the peak of our wealth was sometime in the 1970’s or even late 1960’s”.

That prompted a reply from long-time Automatic Earth reader Ken Latta, which he turned into an article a few days later which I published on February 23 as “When Was America’s Peak Wealth?” Ken reasoned that America’s peak wealth was sometime in the late ’50s to early 60’s.

Then yesterday, I posted “Peak American Wealth – Revisited”, which contains Ken’s responses to what various readers had written in the Comments section of the second piece. I remarked that many of the commenters seemed, like Ken, to be in their 70s. All this led to an even livelier and more personal Comments section for that article, including quite a few by younger readers.

Not that I ever had the impression that the Automatic Earth had become an old folks home, I just figured ‘older’ people are more likely to be triggered by talking about the 1960s, a period the younger only know from second-hand accounts. Still, it’s good to see, also in private emails, that there are quite few in their 20s and 30s who’ve been reading us for many years, and who do understand quite a bit about the crisis we’re in.

One of the mails I received was from long time acquaintance (for lack of a better word, I don’t think we ever met) Charles A. Hall. I’ve been familiar with Charlie’s work as systems ecologist on energy -in a very broad sense- for a long time, and have always held him in high esteem. That he reads the Automatic Earth on a regular basis is of course a privilege for us. That what he sees as my mistakes urge him to write an article is an even greater honor.

I’ll let Charlie do his own PR line: “Dr. Hall is Emeritus Professor at State University of New York College of Environmental Science and Forestry, Syracuse. Author of 13 books and nearly 300 scientific papers on these topics including Energy and the wealth of Nature (with Kent Klitgaard) and his new Energy Return on Investment: a Unifying Principle for Biology, Economics and Sustainabiity (both from Springer Press).”

And I do agree with the honorable professor that discussing peak US wealth without giving energy a prominent position in that discussion is far from ideal. At the same time, economic systems can fall apart of their own accord and/or through human hubris. Even with equal or growing energy availability, no everlasting growth is guaranteed -or even possible.

Interesting detail is that Dr. Hall puts the ‘peak wealth time’ in the late 70s to early 80s. That’s quite a bit later than either Ken Latta or I did, and than most of our commenters seem to do. But point taken: absent energy no wealth can be created. Here’s Charlie:

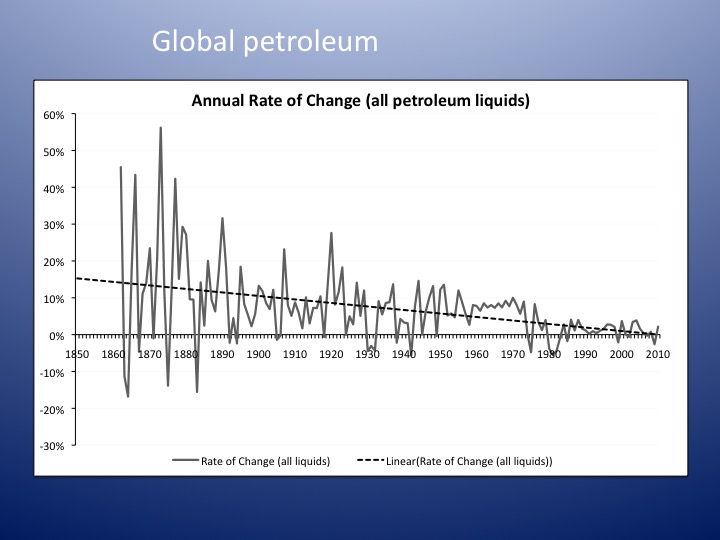

Charles A. Hall: I keep being amazed at the inability of economists, commentators and most regular citizens to fail to understand the importance of resources in general and petroleum (oil and gas) in particular to the material well being of society. This is exemplified by the recent posts of Latta and Meijer. I provide a few simple graphs to make my point, and then below add some excerpts lifted and slightly modified from our book (Hall and Klitgaard, Energy and the Wealth of Nations, Springer).

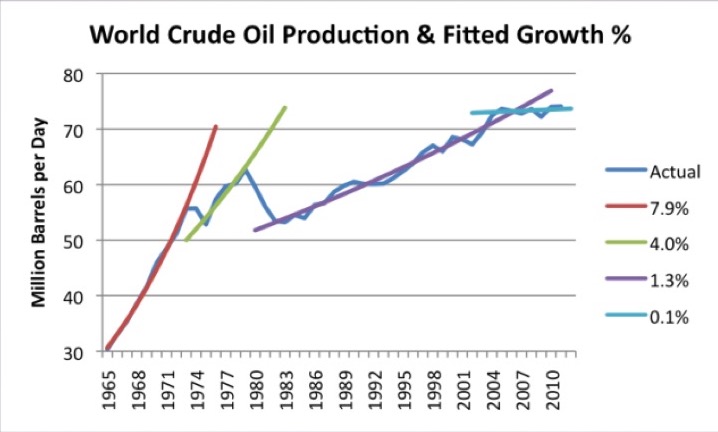

John Hickenlooper, when he was Mayor of Denver, understood the importance of oil and its restrictions. He said: “This land was originally settled by the Sioux. Everything that the Sioux depended upon, their food, clothing, shelter, implements and so on, came from the bison. They had many ceremonies giving thanks and appreciation to the Bison. We today are as dependent upon oil as the Sioux were on the bison, but not only do we not acknowledge or celebrate that, but most people do not have a clue”. Since 2010 global oil production is no longer increasing and may indeed be decreasing. Almost certainly it will decrease substantially in the future as we enter, in the words of geologist Colin Campbell, “the second half of the age of oil”.

The American dream was the product of industrious and clever people working hard within a relatively benign political system that encouraged business in various ways, but that all of these things also required a large resource base relative to the number of people using it. A key issue was the abundance of oil and gas in the United States, which was the world’s largest producer in 1970. But in 1970 (and 1973 for there was a clear peak in US oil production, and while the continued increase in oil production worldwide buffered the United States (and other countries) from the local peak it seems clear by 2017 that global oil production has reached its own peak while demand from around the world continues to grow.

This mismatch between supply and demand resulted in a sharp increase in the price of oil and many economic problems that we believe it caused, at least in part, including the stock market decline of 2008, the sub-prime real estate bust, the failure of many financial corporations, the fact that some 40 odd of 50 states are officially broke and that there is a substantial decrease in discretionary income for many average Americans. As developed later …. all of these economic problems are a direct consequence of the beginning of real shortages of petroleum in a petroleum-dependent society.

The historical ability to achieve wealth in the United States is in large part a consequence of the incredible resource base once found on the North American continent. These include initial endowments of huge forests, immense energy and other geological resources, fish, grass and, perhaps of greatest importance, rich deep soils where rain falls during the growing season.

While many other regions of the world also have, or had, a similarly huge resource base the United States has several other somewhat unique important attributes. The fact that these resources have been exploited intensely for only a few hundred years (vs. many thousand as in Europe or Asia), the presence of large oceans separate us from others who might want our resources; results in resources per capita that is relatively large, an extremely low human population density in the past and even now, so that the resources per capita is still relatively high.

A critical component of these patterns was the large increase in labor productivity during the first two thirds of the 20th century. This allowed both industry owners and labor, especially of the largest corporations, to do better and better. What was less emphasized but enormously clear in retrospect was that to allow the economy to expand it was possible to massively increase the production from oil, gas and coal fields, some new, and some old but barely tapped previously, so that once the economic engine was started there was a great deal of high quality energy available. The United States began using many times as much energy per person as had been the case relatively few decades before or was the case in Europe.

But in 1973 the United States experienced the first of several “oil shocks” that seemed, for the first time, to inject a harsh note of vulnerability into the united chorus of the American Dream for all. Before the 1970s nearly all segments of American society – including labor, capital, government, and civil rights groups – were united behind the agenda of continuous economic growth. The idea that growth could be limited by resource or environmental constraints, or, more specifically, that we could run short of energy-providing fossil fuels was simply not part of the understanding or dialog of most of this country’s citizens. But this was to change in the 1970s.

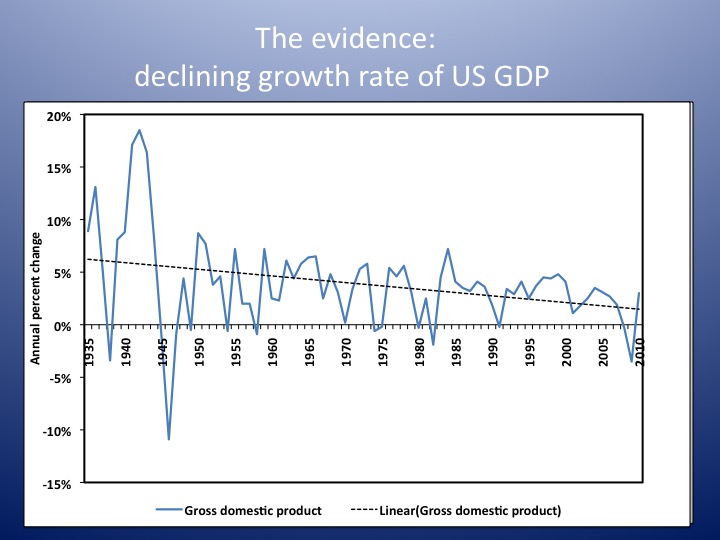

In retrospect, we can now say that the pillars of post-war prosperity began to erode in the 1970s and early 1980s, and that changes in the social sphere also began to complicate and add to the biophysical changes derived from the decline in the availability of cheap oil. Even though the oil market had stabilized and cheap energy returned to the United States in the late 1980’s, the changes in the structure of the economy were long lasting. The economy ceased growing exponentially, although it continued to grow linearly but at a decreasing rate, from 4.4 percent per year in the 1960s to 3.3, 3.0, 3.2 to 2.4 percent to close to one percent in the following decades.

Many formerly “American” companies became international and moved production facilities overseas where labor was cheaper and oil, no longer cheaper in the US compared to elsewhere, was the same price, although cheap enough to pay for the additional transport required. The decrease in labor costs when production facilities were moved to other countries outweighed the costs and the process of globalization accelerated. Productivity growth (formerly strongly linked to increasing energy used per worker hour) in manufacturing industries began to slow, falling from 3.3% per year in the 1966-1973 period to 1.5% from 1973-1979 to essentially zero in the early 1980s.

Mainstream economists seemed at a loss to explain this phenomenon. Their statistical models, which relied on the amount of equipment per worker, education levels and workforce experience left more factors unexplained than explained. Even the profession’s productivity guru, Edward Denison, had to admit that the seventeen best models explained only a fraction of the problem, leaving half of the increase in wealth unexplained. But Denison’s model did not include energy, but only capital and labor. When Reiner Kummel and his colleagues included energy in the same model they found that the unexplained residual disappeared and that energy was even more important than either Capital or Labor.

My point, and this could be emphasized with many more citations and analyses, is that humans for some peculiar reason are unable or unwilling to give natural resources, the biophysical basis of real economies, their proper due. The days of abundant, cheap, exponentially growing availability and use of many resources, including especially high quality fossil fuels, is forever behind us. Fracked oil is expensive and already declining, we still import about half our oil, and consequently our economy cannot physically grow as readily as in the past. While there are many reasons beyond resources (such as concentration of wealth) for the failure of our economy to grow, we must first start with biophysical reality.

See also my new book “Energy Return on Investment: A unifying principle for Biology, Economics and Sustainability (Springer)