DPC Carondelet Street, New Orleans 1905

Did oil soar on The Big Short?! Volatility, exposure, leverage, all the key words apply. Net asset value dropped $700 million in 2 days.

• Oil Bears Closing $600 Million Triple-Short Fund Bet Adds To Tumult (Reuters)

This week’s roller-coaster ride in the global crude oil market was likely fueled in part by the sudden liquidation of a $600 million leveraged fund bet on falling prices, market sources said on Wednesday. Unknown investors in the VelocityShares 3x Inverse Crude Oil Exchange Traded Note (ETN) – which offers the ability to make a bearish bet on prices magnified threefold, with gut-churning ups and downs – bailed out early this week after jumping into the fund in January, ETN data show. Some 1.8 million shares worth more than $602 million were redeemed on Tuesday, the largest outflow from the ETN in the past year, according to data from FactSet Research.

The selloff suggests that at least some big investors are betting that the worst of an 18-month oil market rout is over after U.S. prices fell to $26 a barrel last month for the first time since 2003. Trading activity has also jumped to the highest levels on record. “Speculators are getting out of the down oil market. People start unwinding these positions because they think they have gotten their juice out of it,” David Nadig, vice president, director of exchange traded funds for FactSet, said. The DWTI note inversely tracks the S&P GSCI Crude Oil Index ER, which follows movements in the oil market. And because it offers investors three times the exposure, the impact on the underlying futures is magnified – as is the volatility in the ETN, whose price more than doubled in the first three weeks of January before halving again as oil futures rebounded.

The net asset value of the fund – one of a handful of exchange funds that allows investors to trade oil without the complexity of a futures exchange – fell from close to $1 billion to $417 million on Tuesday and to $322 million on Wednesday, according VelocityShares’ website. As a result, the mass exodus likely forced the ETN’s issuer, Credit Suisse, to quickly buy back short positions as investors redeemed shares.

About to do the biggest takeover in its history. Who’s financing? Profit loss numbers are all over the place in different articles. Guardian said 87%, so being the sensationalist I am, I went with that.

• Shell Confirms 10,000 Job Cuts as Profits Plunge 87% (BBC)

Royal Dutch Shell has confirmed it is cutting 10,000 jobs amid its steepest fall in annual profits for 13 years. It made $1.8bn (£1.23bn) for the fourth quarter of the year, compared with a $4.2bn profit for the same period the year before. Full-year 2015 earnings, excluding identified items, were $10.7bn, compared with $22.6 billion in 2014. The oil firm indicated it would report a massive drop in profits two weeks ago. The company reports earnings on a current cost of supplies (CCS) basis. Last week, shareholders in Shell, which is Europe’s largest oil company, voted in favour of its takeover of smaller rival BG Group. The company cut back hard on investment. Its capital spending for the year was slashed to $28.9bn, $8.4bn lower than in 2014. Shell sold $5.5bn worth of assets in the course of 2015.

When can the bailouts start?

• Bank Selloffs Replacing Oil Rout As Stock Market Pressure Point (BBG)

Breakdowns in financial stocks are becoming a little too routine for comfort of late. Dragged lower by falling interest rates and credit concern, the KBW Bank Index extended its three-day decline to as much as 7.5% earlier Wednesday — the fifth time this year a loss has exceeded 5% over such a stretch, data compiled by Bloomberg show. At times this week, losses from Bank of America to Citigroup have exceeded 10%. Daily drubbings in financials are rapidly supplanting anxiety over oil and its related shares as the equity market’s biggest headache. At 15.7% of the Standard & Poor’s 500, banks, brokerages and insurance companies are second only to technology companies as the biggest group and more than twice the size of energy producers.

“Crushing the banks like this is a macro narrative,” Michael Antonelli at Robert W. Baird & Co. in Milwaukee, said by phone. “It definitely puts a different tone on this selloff.” More than $350 billion have been erased in financial shares in 2016, the worst start to a year in data going back to 1990. The selloff in Goldman Sachs, Citigroup and Bank of America continued Wednesday, driving the industry down another 1.6% at 12:30 p.m. in New York. So far this year, the group has lost 13%, almost double the benchmark gauge’s decline. Volatility in bank shares is spiking to levels not seen since the financial crisis, deepening the rout that just sent stocks to the worst January in seven years.

Instances when the KBW Bank Index fell more than 5% over three days in 2016 have exceeded all the occurrences in the past three years combined. At 23% of trading days, the annualized frequency is greater than any year except 2008 and compares with a two-decade average of 4.4%. The losses came as the 10-year Treasury yield fell below 1.86% for the first time since April while credit rating agencies warned of rising debt defaults among American businesses. Moody’s on Wednesday said that the number of U.S. companies that have the highest risk of defaulting on their debt is nearing a peak not seen since the height of the financial crisis, just one day after S&P downgraded some of the biggest U.S. explorers, citing oil’s plunge.

Deutsche. And then the French.

• European Banks Near ‘Terrifying’ Crisis: Raoul Pal (CNBC)

With European banks sitting at multiyear lows, one widely followed market watcher said some of the biggest ones could go bankrupt. Former hedge fund manager and Goldman Sachs alumnus Raoul Pal said his scenario is one most investors aren’t looking at right now. Pal said the banking issues have the potential to overtake risks associated with China’s growth slowdown and cheap oil. “So many of these [bank stocks] are falling so sharply. I think people haven’t even caught up with what is going on, and that really concerns me,” the founder of Global Macro Investor told CNBC’s “Fast Money” on Tuesday. “I look at the big long-term share charts of them, and I think this looks very terrifying indeed. I have not seen anything like this for a long time.”

For Pal, negative interest rates are the chief reason why the bank stocks are in trouble. He said European banks have a tougher time coping in the environment than U.S. banks. The major European banks, he added, are already being stretched by global worries and issues within the banking system. He said the trouble could spread to U.S. banks. He suggested going short in this type of market despite a potential “free-fall” scenario.

Deutsche’s derivatives holdings are so outsized they risk bringing the dominoes down in rapid sequence.

• Deutsche Bank’s Troubles Unmask Bigger Risks (AFR)

At the Deutsche Bank annual meeting in Frankfurt in 2015 a disgruntled investor got up in front of the microphone and asked the board of directors if there was a financial scandal the bank wasn’t involved in. A month earlier, the bank had been fined $US2.5 billion by US and British authorities after a seven-year investigation for its part in rigging benchmark interest rates. Investors were baying for blood, as tougher regulatory requirements and litigation seemed to be taking their toll on the bank’s share price. At the time, stock in Deutsche Bank was closer to €30, well down from its pre-global financial crisis high of €177, while on Tuesday night shares in the bank fell to a fresh low of €15.54, prompting a new wave of worries. For a start, Deutsche Bank is trading on a price to book valuation of 0.34 times, which implies the market thinks that almost 70% of its loans are impaired and some nasty news is just around the corner.

The bank posted a €6.8 billion loss in 2015, thanks to a €12 billion write-down linked to litigation charges and restructuring costs, and it set aside more to cover any potential litigation. At a time when it seems like a cottage industry has sprung up in predicting the next financial crisis, there’s talk that although this current period of turbulence might not be the next crisis, it will certainly do until that next crisis does arrive. At the heart of these latest concerns is that investors are losing faith in what central banks can do. But the performance of big global bank stocks like Deutsche Bank has also sparked the selling. It was August 2014 when Paul Schulte, the chief executive of SGI Research, warned Australian investors that all was not well at Deutsche Bank and he still thinks the bank has several problems to deal with.

First, he said that more than any other global investment bank Deutsche had too many leftover assets from the global financial crisis – more than $US10 billion by his estimates – that are very illiquid and simply too hard to value. With regard to all the financial scandals mentioned at 2015’s annual meeting, he also thinks there are further fines to come, while Deutsche also seems to have a large book of commodity-related derivatives that are under stress from the collapses in most commodity prices. Schulte says there is still too much leverage at Deutsche and it is in the centre of a sclerotic system of Euro-paralysis, which prevents any dramatic sort of “TARP” program. “This has been brewing under everyone’s nose, because while people thought that the problem was periphery banks in Ireland or Spain, the actual problem is that Deutsche Bank, and the French banks with lots of toxic debt in commodities, are over-stretched, badly run, have no sense of risk management and are organs of state capitalism,” Schulte says.

So far this calendar year shares in Deutsche Bank have fallen 30% but it’s not flying solo. Citi is down 22%, Goldman Sachs is down 16%, JP Morgan is down 14%, Morgan Stanley is down 23%, BofA is down 22% and Credit Suisse 22%. Shares in UBS are also down 20% in 2106, slipping 7% on Tuesday night after its latest profit numbers implied its strategy of moving away from the volatile investment banking business to focus on steady business of wealth management wasn’t working so well. That compares to a 7% fall in the Dow Jones and S&P 500, a 5% decline in the FTSE 100 and 11% drop in the DAX.

“You can’t grow your banking system 1,000% in 10 years and not have a loss cycle. And your currency won’t stay strong when you go to rectify that balance.”

• Kyle Bass: China Banks Months Away From ‘Danger Territory’ (CNBC)

Hayman Capital Management founder Kyle Bass has been ringing the alarm bells about China’s banking system and the yuan for months, and now he says the day of reckoning could be just months away. The premise of Bass’ bet goes like this: China’s banking system has grown to $34.5 trillion, equal to more than three times the country’s GDP. The country is due for a loss cycle as cracks begin to show in its economy. When that happens, central bankers will have to dip into China’s $3.3 trillion of foreign exchange reserves to recapitalize the banks, causing a significant depreciation in the value of the yuan, according to Bass.

On Wednesday, he said China’s export-import industry requires China to maintain $2.7 trillion in foreign exchange reserves to continue operating smoothly, citing an International Monetary Fund assessment. “They’ll hit that number in the next five months,” he said in an interview on CNBC’s “Squawk on the Street.” “Those that think they can burn it to zero and they have many years ahead of them, they really only have a few months ahead of them before they get into a real danger territory.” Bass is best known for making a winning bet on the subprime mortgage crisis and later profiting from his call that the Japanese yen would fall in tandem with a projected round of monetary stimulus by the Bank of Japan.

Bass confirmed Wednesday he is devoting much of his fund to his bet the yuan will depreciate. He characterized shorts against the currency, including his, as totaling “billions.” The market will ultimately come to view a 10% yuan devaluation as “a pipe dream,” he said. “When you look at the size of the imbalance and the size of their economy, it’s going to go 30 or 40% in the end, and it’s going to be the reset for the world.” To be sure, China’s controlled devaluation of the yuan this year has sparked growth concerns that roiled equity markets around the world and contributed to the worst January for the Dow and S&P 500 since 2009. Bass said he has no doubt the People’s Bank of China has the ability to recapitalize the nation’s financial institutions should they need bailing out.

But the problem is that it will have to expand its balance sheet by trillions of dollars to do so, he explained. Right now, too few people are focused on China’s banking system, Bass said, but the narrative will swing that way this year. Bass ticked off a list of concerns about the Chinese economy, including industrial production at financial crisis lows and the lowest nominal fourth-quarter year-over-year GDP print in 40 years. “This isn’t an aberration. This isn’t a speed bump. This is China’s excess — let’s call it misallocation of capital — coming home to roost,” he said. “You can’t grow your banking system 1,000% in 10 years and not have a loss cycle. And your currency won’t stay strong when you go to rectify that balance.”

‘China has already accumulated a large and growing share of global trade. A major devaluation would see this share expand further with the possible result of completely destroying manufacturing outside of China.’

• Hugh Hendry: Major Chinese Devaluation Would Be Disastrous (CW)

China could potentially ‘destroy’ global manufacturing if it seeks to regain growth through further weakening its currency, hedge fund specialist Hugh Hendry has warned. In his latest market outlook, Hendry, who is founder and CIO of Eclectica Asset Management, said a move similar – or even beyond – what the Chinese undertook last summer would cause major ructions in global markets. ‘What could, should and is troubling the world is the potential for a substantial devaluation of the yuan: this would surely have disastrous outcomes for global diplomacy and economics,’ said the hedge fund specialist. ‘China has already accumulated a large and growing share of global trade. A major devaluation would see this share expand further with the possible result of completely destroying manufacturing outside of China.’

Hendry said this is purely a theoretical fear at this stage but, given the unexpected nature of some Chinese government policies, it cannot be discounted. ‘Even apportioning a small possibility to such an event has a significantly detrimental impact on the global economy via a reversion to protectionism and insular politics.’ A knock-on effect, Hendry said, is further extremist politics in the western world could come to the fore in response to the inevitable global downturn which a devaluation would cause. ‘At worst, we could see a mini-dark age of rampant protectionism, global trade coming to a halt, a significant decline in immigration and even restrictions on overseas travel.’

Hendry said this was the ‘extreme bearish’ view and one which would completely ruin the investment case for risk assets. While Hendry does not expect it to come to pass, he said it would not be wise to discount it entirely. One of the major reasons for this overarching concern, Hendry said, is the fact China has neither committed to full free-market economics and yet not overtly retained its fully-managed model. He said this has left many investors in an awkward middle ground. ‘In our minds the question is not one of capital flight but the extent to which commercial hedging of foreign trade has been brought into line. That is to say, to what extent Chinese exporters now hedge their overseas revenues into yuan,’ he said.

Nice recount of one of our fave bubble tales.

• The Great Skyscraper Bubble Is Ready to Pop! (Dent)

In 1928, construction on the world’s tallest building began in New York: the Bank of Manhattan Trust Building at 40 Wall Street. Today, it’s “The Trump Building.” When its developers learned that the Chrysler Building would be even taller, they added three stories to the Manhattan Building to secure the title of “world’s tallest.” Then the Chrysler Building came along and added a giant spire, beating it by just over a hundred feet. Of course, that didn’t last long either. Each of these buildings held the title for less than a year before the Empire State Building topped out at 1,454 feet, more than 400 feet taller than the other two. And then: the economy collapsed. The Great Depression hit. And it took decades for the global economy to recover – and it wasn’t until the 1970s before a taller building emerged.

Those buildings were the Twin Towers in the early 1970s, and the Sears Tower in Chicago in ’73. And then, right on cue, another major recession hit in the middle of the decade. Notice a pattern? It is no coincidence that in both cases, the construction of major buildings coincided with long-term economic peaks. It happened in the 1930s and again in the 1970s. Historically, there have been clear peaks in skyscrapers when the economy is at a high. It’s like when the party’s raging and the whole world thinks the economy will never go down, these mammoth hunks of steel pop out of the ground as if to say the high will go on forever! And I haven’t even said a word about where we are today… 106. That’s how many skyscrapers popped up around the world in 2015. It’s the largest number completed in a single year on record.

Before this decade, it was usually around 20 or 30. Now it’s up to five times that! Oh, but it gets better! The Council on Tall Buildings and Urban Habitat expects 135 skyscrapers to be finished in 2016, and another 140 in 2017. And get this: the Council says the number of “supertall” skyscrapers (300 meters or higher) has doubled from 50 in 2010… to 100 in 2015 – just five years in the most artificial global bubble in human history. No coincidence there, either! It should be pretty obvious: the more the global economy expands, the higher and greater the number of major buildings that go up. And they concentrate in the leading countries and regions of the world at the time. So it’s probably no surprise that China – a country that has overbuilt its infrastructure over a decade into the future, indebting themselves with tens of trillions of dollars – is dominating the current race for who will build the next tallest skyscraper in the world.

Right now, that title belongs to the Burj Khalifa in Dubai, standing at 2,717 feet. It was completed in 2010. The second highest – the Shanghai Tower in China, at 2,073 feet – finished last year. But now China has plans to complete another project in 2017 – the Phoenix Towers in Wuhan, south-central China. The tallest will be the first ever to stand one kilometer high, or 3,280 feet. Oh, and it’s going to be pink! China’s not the only one in the current race. Saudi Arabia has plans to complete their own 3,280-foot Kingdom Tower by 2019 – just as oil has been crashing and its government deficits are swelling. It’s just a big ego game to these up-and-coming countries!

“..it is very hard to see how this Baby Boom generation, with 10,000 of them retiring a day, can afford one more devastating crash in their stock holdings..”

• Investors Heading for Slaughter One More Time – David Stockman (Hunter)

Former Reagan White House Budget Director David Stockman says retail investors are going to take, yet, another very big hit. Stockman explains, “The retail investor waded in again. The sheep lined up and, unfortunately, are heading for the slaughter one more time. I think it is very hard to see how this Baby Boom generation, with 10,000 of them retiring a day, can afford one more devastating crash in their stock holdings. That is, unfortunately, what we are heading for. That’s why I say it’s dangerous. When the bubble breaks, it will spill and flow throughout the Main Street economy.”

Stockman warns the next crash will be bigger than any other in history. Stockman, the best-selling author of “The Great Deformation,” says, “I think we have been building a bubble year by year since the early 1990’s. The earlier crashes that we are so familiar with, Dot Com and the Housing Crash, were only interim corrections that were not allowed to work their way clear. The rot was not effectively purged from the system because central banks jumped back in within months of the corrections and doubled down in terms of the stimulus and liquidity that they pumped into the market.” Stockman contends that “you simply cannot fake your way in this market any longer.”

Stockman explains, “I have pointed out that Wall Street continually tells you that the market is not that overvalued. . . . I have pointed out . . . actual earnings are down 15%. The market is expensive, it is exceedingly expensive, and it’s really . . . 21 times earnings. Therefore, the whole bubble vision on valuations of the market is terribly misleading. Even the Wall Street version of earnings is going to be hard to maintain when the global recession sets in, and then investors are going to suddenly discover that the market is drastically overvalued. They are going to want to get out, and they are all going to want to get out all at the same time. That creates the kind of selling panics that can take the market down. We have kind of been in no man’s land for the last 700 days. The market is struggling to stay above 1870 on the S&P 500. It first crossed that level in late March 2014. It has had 35 efforts to rally and break to new highs. None of them have been sustained. My point about all that is that’s the way bull markets die.”

Stockman contends, “We are nearing the end. I think the world economy is plunging into an unprecedented deflation recession period of shrinkage that will bring down all the markets around the world that have been vastly overvalued as a result of this massive money printing and liquidity flow into Wall Street and other financial markets.”

Tyler Durden’s comment: “It’s probably nothing”.

• US January Truck Orders Down 48% (Reuters)

U.S. January Class 8 truck orders fell 48% on the year, preliminary data from freight transportation forecaster FTR showed, indicating that 2016 could be another weak year for truck makers. FTR estimated that orders for the heavy trucks that move goods around America’s highways totaled 18,062 units in January. This follows on from a full-year decline in 2015 of nearly 25% to 284,000 units from 276,000. “It is not looking to be a strong year,” for the market, FTR chief operating officer Jonathan Starks said in a statement. Amid uncertainty over U.S. economic growth and a lackluster performance for retailers in the fourth quarter, trucking companies have been holding back on buying new models.

Interesting little piece of history. Worth a read.

• Why The US Treasury Hides Its Saudi Investor (BBG)

As Bloomberg reported last month, the U.S. Treasury makes public the precise holdings of more than 100 countries, but those of Saudi Arabia are essentially kept secret, lumped together with 14 other nations. This arrangement, which conflicts with contemporary conventions of financial transparency, has a peculiar – and very controversial – origin in the oil crisis of the 1970s. Saudi Arabia’s special status took shape during the Arab-Israeli War of 1973. When the U.S. provided military supplies to Israel, the Organization of Petroleum Exporting Nations imposed an oil embargo on countries that supported the Jewish state, sending oil prices skyrocketing and wreaking economic havoc. In response, President Richard Nixon created the Federal Energy Office on Dec. 4, 1973, and installed William Simon, then deputy Treasury secretary, to be the nation’s first “energy czar.”

Simon, who rose to prominence trading bonds at Salomon Brothers, had acquired a reputation as a hothead. After the Shah of Iran claimed that the U.S. was still importing the same amount of oil after the embargo as it had previously, Simon described Iran’s leader as “irresponsible and reckless” and a “nut.” Although he grudgingly retracted these comments, Simon’s suspicion of Iran remained: He believed that the shah was a dangerous megalomaniac. This belief put him at odds with Nixon and Henry Kissinger, both of whom considered the Iranian strongman indispensable to U.S. interests in the Middle East. Simon’s sympathies lay instead with another oil-exporting nation: Saudi Arabia, which had reluctantly joined the embargo. As Simon sought to tame the oil crisis, the Watergate scandal engulfed Washington.

Then, in May 1974, Secretary of the Treasury George Schultz stepped down, and Nixon promoted Simon to the post. In the chaos of Nixon’s final days in office, Simon moved quickly and scheduled a trip to Saudi Arabia in August 1974, the month that Nixon resigned. Simon cooked up an ingenuous plan that aimed to achieve several objectives: It would find new buyers for U.S. debt in an era of rising budget deficits, ensure that so-called petrodollars would return to the U.S. and help cultivate a partnership with Saudi Arabia at the expense of Iran. The main component was a campaign to persuade Saudi Arabia to invest much of its surplus cash in Treasury bonds. The Saudis agreed, but with one caveat: The purchases had to remain secret, perhaps because they might call into question the kingdom’s loyalties to OPEC.

The Brits think their EU thing is a big deal, for some reason.

• Crippled EU Is No Longer The ‘Anarcho-Imperial Monster’ We Once Feared (AEP)

The point of maximum danger for British parliamentary democracy was 13 years ago, the high-water mark of EU hubris and triumphalism. Events moved with lightning speed from the Maastricht Treaty in 1992 until the rapturous closure of the EU’s “Philadelphia” Convention in June 2003, and always in the one direction of ever closer union. Whether or not you care to speak of a “superstate”, the thrust was entirely at odds with the principle of sovereign and self-governing nation states in Europe. Nobody can say the European elites lacked panache. In a fever of treaties they vaulted from the creation of the euro to a nascent foreign policy and defence union at Amsterdam in 1997. An EU intelligence cell and military staff were created in Brussels, led by nine generals and 57 colonels, with plans for a Euro-army of 100,000 troops, 400 aircraft and 100 ships to project power across the globe.

They launched a European satellite system (Galileo) so that Europe would no longer have to be a “vassal” of Washington, in the revealing words of French leader Jacques Chirac. They set up a proto-FBI (Europol) and an EU justice department, replicating the structures of the US federal government one by one. They were equipping the EU with the apparatus of full-blown state. When Ireland voted no to the Nice Treaty – legally rendering it null and void – the Irish were swatted away. Nothing would stop this juggernaut. The furthest reach was the EU Convention gathered to draft the Treaty to end all Treaties , the European Constitution. It was supposedly launched in order to bring Europe closer to its citizens after anti-EU rioters set fire to Gothenburg, and as we began to hear the first drumbeats of populist revolt.

The forum was immediately hijacked by EU insiders and used for the opposite purpose, a drama I witnessed first-hand as Brussels correspondent. The text asserted in black and white that “the Constitution shall have primacy over the laws of the member states”. The document was to bring all EU law – as opposed to narrow “Community law” – under the jurisdiction of the European Court (ECJ) for the first time, creating a de facto supreme court. The Charter of Fundamental Rights, described by one British minister as having no more legal authority than the “Sun or the Beano”, would become legally-binding, and with it Article 52, allowing all rights to be suspended in the “general interest” of the union – the Magna Carta be damned. It was to give the EU “legal personality”, enabling it to agree treaties in its own name.

It would create an elected president. It was the jump from a treaty club of sovereign nations to what amounted to a unitary state, or an “anarcho-imperial monster” in the words of ex-commission official Bernard Connolly. When the early drafts began to circulate I sent a message to Charles Moore, then editor of The Telegraph, alerting him that in my view Britain faced a national emergency. In hindsight, I need not have been so alarmed. It is now obvious that the EU had bitten off more than it could chew, and the Ode to Joy anthem at the closure of that giddy Convention marked the moment when the European Project flamed out as a motivating force in history and began descending into the existential crisis we see before us. The proposals were rejected by French and Dutch voters.

Although EU leaders slipped most of the text through later by executive Putsch under the guise of the Lisbon Treaty, this was a step too far. It has come back to haunt them. The refusal to accept the emphatic verdict of the people crystallized a long-simmering suspicion that the Project had escaped democratic control.

Not going to happen

• MPs Call For Immediate Halt Of UK Arms Sales To Saudi Arabia (Guardian)

An all-party group of MPs has called for an immediate suspension of UK arms sales to Saudi Arabia and an international independent inquiry into the kingdom’s military campaign in Yemen. The call from the international development select committee follows evidence from aid agencies to MPs warning that Saudi Arabia was involved in indiscriminate bombing of its neighbour. The UK government has supplied export licences for close to £3bn worth of arms to Saudi Arabia in the last year, the committee said, and has also been accused of being involved in the conduct and administration of the Saudi campaign in Yemen.

In their letter to the international development secretary, Justine Greening, it urged the UK to withdraw opposition to an independent international inquiry into alleged abuses of humanitarian law in Yemen. A leaked UN report last week said Saudi Arabia was involved in breaches of humanitarian law, and in response the Saudis set up an internal inquiry, a move welcomed by the Foreign Office. The committee said it was astonished to hear the extent to which the government had watered down calls for an independent inquiry proposed by the Netherlands last September at the UN.

“It is a longstanding principle of the rule of law that inquiries should be independent of those being investigated. Furthermore given the severity of the allegations that the Saudi-backed coalition has targeted civilians in Yemen, it is really unthinkable that any investigation led by coalition actors would come to the conclusion that the allegations were accurate.” It said it was shocked that the UK government could claim there had been no breaches of humanitarian law and had significantly increased arms sales to the Saudis since the start of its intervention in Yemen. “We received evidence that close to £3bn worth of arms licences have been granted for exports to Saudi in the last six months. This includes £1bn worth of bombs rockets and missiles for the three-month period from July to September last year – up from only £9m in the previous three months,” the MPs said.

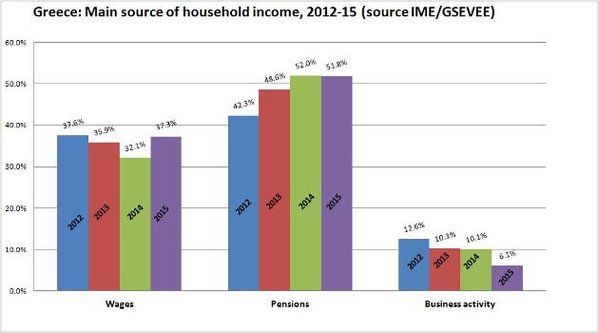

The real issue is that over half of all Greeks depend on a pension, of someone in the family, to live. That includes many of the young unemployed. See the graph I inserted below (not original with the article). Entire families forced to live on a €500-€600 pension are not an exception.

• Greek Pension Reform Sparks General Strike (BBG)

Socrates Vrysopoulos is an unlikely militant. The 38-year-old Greek banking and commercial lawyer is part of a month-old bar-association boycott of the country’s courts, in protest against the government’s pension-reform plans. He says they cripple small businesses and the self-employed, raising the tax and social insurance for a young lawyer with annual income of €20,000 ($21,900) by 27% to €13,800. “A reform is supposed to be a new scheme that helps you improve an existing situation,” said Vrysopoulos, who started his own law firm in 2011. “This is not a reform at all. It’s a way to get more money to repay your loans as a country.” Farmers are blocking highways and workers are joining the protest on Thursday as unions hold the first one-day general strike of 2016 and stage rallies against Prime Minister Alexis Tsipras’s pension proposals.

Self-employed doctors, taxi drivers and civil engineers are throwing their lot in with the protesters, while traffic is set to be disrupted with metro, buses, ferries and flights within Greece affected. The pension reform, needed to fulfill demands of the country’s institutional creditors, is becoming a thorny issue for the 41-year-old premier elected by the Greeks just over a year ago for his anti-austerity promises. Hanging onto a thin parliamentary majority and facing a revived opposition party that has leaped ahead in opinion polls by electing a new leader last month, the reform poses the biggest test to Tsipras’s political survival since last year’s bailout negotiations threw Greece’s euro-area membership in doubt. “Pensions are the sacred cow of the Greek political system,” said Platon Tinios, an assistant professor at the University of Piraeus and visiting senior fellow at the London School of Economics.

While the current changes complete the series of reforms started with the country’s first bailout in 2010, they provide few assurances Greece won’t need a whole new pension system in a few years, he said. Greece has almost 2.7 million pensioners, and the average gross pension for retirees is about €960 per month, according to the most recent available Labor ministry data. The sum total of pensioners and unemployed is higher than the 3.7 million currently working in Greece, according to the latest Labor Force Survey published by the Hellenic Statistical Authority. Last year, the state spent 22.7% of its ordinary budget to plug the hole in pension funds, according to the country’s Parliamentary Budget Office. The non-partisan office said in a report published last month that public expenditure for pensions equals 14.9% of Greece’s GDP, versus an average of 7.9% among member-states in the OECD. “Without changes, the social security system is unsustainable,” the Parliamentary Budget Office said.

In case anyone was still wondering what they flee.

• Drone Footage Reveals Extent of Devastation In Syria (Ind.)

As attitudes and policies towards refugees harden across Europe, a video has emerged that exposes the utter devastation Syrians are fleeing from. Revealing in detail the consequences of the country’s five-year civil war, the drone footage shows the piles of rubble ruined buildings that Homs – previously Syria’s third largest city – has been reduced to. While the video reflects the utter desolation in a city that was once home to more than 650,000 people, peace talks aimed at ending hostilities remain frustratingly unproductive. Arguments over who should or should not attend the negotiations overshadowed the continuous damage wrought in a war that has seen over 11 million Syrians flee, more than half the country’s entire population. The video was shot by Alexander Pushin, a cameraman for Russian state television.

While his drone footage from Syria has been described as propaganda designed to promote Russia’s military involvement in the country, the startling scale of devastation it exposes is beyond question. Even as news emerged of nine people who died attempting to reach the relative safe haven of Europe, anti-refugee sentiment appears to be growing across the continent. Denmark recently introduced legislation that permits the seizing of refugees’ valuables, which drew comparisons to the treatment of Jews by Nazi Germany. Sweden is rejecting applications from 80,000 people who sought asylum in the Scandinavian country last year, while Finland also intends to expel 20,000 of the 32,000 applications received in 2015. Angela Merkel announced recently that Syrian refugees would be expected to return to the Middle East once the conflict is over, while British Prime Minister David Cameron dismissed those living in the squalor of Calais’ “Jungle” as “a bunch of migrants”.

They want deals with Jordan, Egypt too. Anything to keep them out of Europe. Cattle trade.

• EU Agrees Funding For Turkey To Curb Migrant Flows (Reuters)

European Union countries on Wednesday approved a €3 billion fund for Turkey to improve living conditions for refugees there in exchange for Ankara ensuring fewer of them migrate on to Europe. The EU is counting on the deal to lower the number of asylum seekers arriving in Europe after over a million streamed onto the continent in 2015, mainly by sea from Turkey, with figures indicating little sign of the flow ebbing so far this year. All 28 EU countries signed off on the proposal at a meeting in Brussels after Italy dropped its opposition to the plan, which was first agreed with Ankara in November. The bloc’s executive European Commission welcomed the decision on Turkey, currently home to an estimated 2.5 million refugees from the civil war in Syria next door.

“Turkey now hosts one of the world’s largest refugee communities and has committed to significantly reducing the numbers of migrants crossing into the EU,” said Johannes Hahn, Commissioner for Neighbourhood Policy and Enlargement. “The Facility for Refugees in Turkey will go straight to the refugees, providing them with education, health and food. The improvement of living conditions and the offering of a positive perspective will allow refugees to stay closer to their homes.” Prime Minister Mark Rutte of the Netherlands, the current holder of the EU’s rotating presidency, said cooperation with Turkey on the migration crisis would also focus on targeting human traffickers who have arranged passage for many people.

[..] Struggling with its own weak economy and large debt loads, Italy unblocked the funding only after Brussels said it would exempt contributions to the Turkey fund in calculating EU countries’ budget deficits. Under EU rules, countries must keep their budget shortfalls low or face disciplinary action. Italy wanted to exempt more migration-related spending from its budget gap and sought to agree a figure of about €3.2 billion this year. The European Commission refused to endorse a lump-sum up front and said that any such spending would be analyzed separately after it takes place. But on Wednesday, Rome secured an additional declaration before agreeing to the fund, in which it says it still “strongly expects” Brussels will exempt from its deficit figures “the full amount of costs” it incurred from 2011 when a conflict in its ex-colony Libya started and triggered higher migration to Italy.