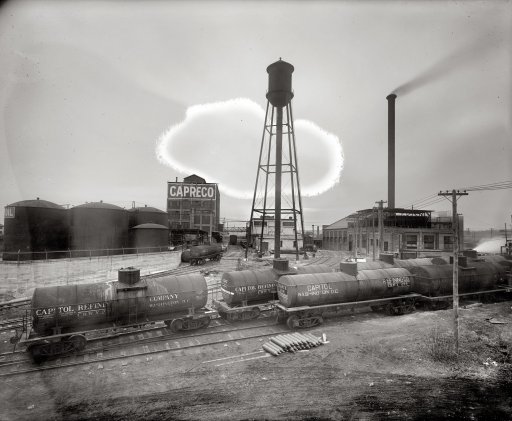

NPC Capitol Refining Co. plant, Relee, Alexandria County 1925

This scenario is playing out across the -western- world. A very big storm brewing.

• Pensioners Prosper, The Young Suffer. UK Social Contract Is Breaking (Willetts)

It marks a dramatic turnaround in the fortunes of different generations. Last week, the Institute for Fiscal Studies estimated that the median income of pensioners (£394 per week) is now higher than the median income of the rest of the population (£385 per week). In many ways, this is a triumph. Nobody wants to see pensioners struggling in poverty. And we might hope that the forces driving up the incomes of today’s pensioners will similarly boost incomes of the generations coming after. But if we investigate what lies behind the headline figures we see that this is not a simply benign economic and social trend from which we might all expect to benefit. Instead, there are some specific reasons why especially younger pensioners, the boomers who are now retiring, have ended up enjoying spectacular advantages that may not boost incomes of the generations coming after them.

We can get a good idea of how this has come about if we look behind the headline figures. First, they measure incomes left over after deducting housing costs. More and more old people own their homes with the mortgage paid off. They have very low housing costs. Meanwhile, younger generations struggle to get on the housing ladder, with high rents for poor quality property. We simply are not building anything like the number of houses we need. Through the 1950s and 1960s, we were building 300,000 houses a year but now, despite all the government’s efforts, we are only at about half that. Getting more houses built and bringing down the cost of housing is crucial to reducing this gap between the generations. Pensioners are also doing well because of the triple lock protecting their incomes.

This means the state pension is boosted by either inflation or earnings or 2.5% – whichever is highest. This is a ratchet that means whatever the state of the economic cycle the state pension keeps on going up. So even when earnings were not increasing, pensioners kept enjoying increases in their pension because it was linked to prices. Inflation has now dipped below zero but, because earnings are going up by 2.9 %, pensioners are going to do as well as workers next April. Increases in the female state pension age do provide some offset to these costs for the exchequer. Nevertheless, the annual ratchet of the triple lock raises public spending at a time when the government is, for example, planning cash cuts in the incomes of working people on tax credits. One estimate suggests that the triple lock is already costing around £6bn a year, significantly more than the £4.5bn cut to tax credits from next April that is causing so much controversy.

Nice list.

• Putting China’s “6.9% GDP Growth” In Context (Lebowitz)

On Friday morning, following Chinese Premiere Li’s comment that growth was still in a “reasonable range”, China’s central bank (PBoC) proceeded to cut interest rates as well as the required deposit reserve ratio for major banks. The language of the Premier and the actions of the PBoC are contradictory. Their actions in conjunction with their words offer even more evidence to believe reported growth is a mirage [..] Before viewing the statistics below take a moment to consider the following: If China’s economy is in fact humming along at a “reasonable” 6.9% pace, then what is the logic and motivation behind aggressively easier monetary policy? Put another way, what don’t we know about the Chinese economy?

Central Bank Actions

- 1yr Benchmark Lending Rate: Since November 2014 China has cut their 1 year interest rate 6 times. Over this period the rate has been lowered from 5.60% to 4.35%

- Required Deposit Reserve Ratio for Major Banks (determines amount of leverage banks can take and therefore the amount of loans they can make): Since February 2015 China has lowered it 4 times from 19.50% to 17.50%.

- Renminbi: Since August China devalued their currency 2.8%

Economic Statistics

- China export trade: -8.8% year to date

- China import trade: -17.6% year to date

- China imports from Australia: -27.3% year over year

- Industrial output crude steel: -3% year to date

- Cement output: -3.2% year over year

- Industrial output electricity: -3.1% year over year

- China Manufacturing Purchasing Managers Index: 49.8 (below 50 is contractionary)

- China Services Purchasing Managers Index: 50.5 (below 50 is contractionary)

- Railway freight volume: -17.34% year over year

- Electricity total energy consumption: -.20% year over year

- Consumer price index (CPI): +1.6% year over year

- Producer price index (PPI): -5.9% year over year, 43 consecutive months of declines

- China hot rolled steel price index: -35.5% year to date

- Fixed asset investment: +10.3% (averaged +23% 2009-2014)

- Retail sales: +10.9% the slowest growth in 11 years

- Shanghai Stock Exchange Composite Index: -30% since June

Are these actions and statistics consistent with a country thought to be growing at 6.90% annually?

But 6.9% was.

• China Premier Says 7% Growth Goal Never Set In Stone (Reuters)

China has never said the economy absolutely must grow seven% this year, Premier Li Keqiang said in comments reported by the government late on Saturday, adding that he had faith in the country’s ability to overcome its economic difficulties. China’s economy in the July-to-September quarter grew 6.9% from a year earlier, data showed last week, dipping below 7% for the first time since the global financial crisis. Speaking at the Central Party School, which trains rising officials, Li said that China’s economic achievements had been not easy to come by and that the difficulties ahead should not be underestimated. Li’s report to the annual meeting of parliament set this year’s GDP growth target at about 7%.

“We have never said that we should defend to the death any goal, but that the economy should operate within a reasonable range,” the central government paraphrased Li as saying in a statement released on its website. China’s economic growth has not been bad over the last year considering the problems in the global economy, he added. There are reasons for optimism going forward, such as rising employment, more spending on tourism and a fast growing service sector, Li said. “The hard work of people up and down the country and the enormous potential of China’s economy gives us more confidence that we can overcome the various difficulties,” he added. China’s central bank cut interest rates on Friday for the sixth time in less than a year, and it again lowered the amount of cash that banks must hold as reserves in a bid to jump start growth in its stuttering economy.

What a great idea.

• China Communist Party Paper Says Country Should Join TTIP (Reuters)

China should join at an appropriate time the U.S.-backed regional trade accord the Trans-Pacific Partnership (TPP) as its broad aims are in line with China’s own economic reform agenda, an influential Communist Party newspaper said on Sunday. China is not among the 12 Pacific Rim countries who earlier this month agreed the trade pact, the most ambitious in a generation. The accord includes Australia and Japan among economies worth a combined $28 trillion. China’s trade minister has said the country does not feel targeted by it, but will evaluate the likely impact comprehensively. In a commentary, the biweekly Study Times, published by the Central Party School that trains rising officials, admitted there were those in China who viewed the TPP as a “plot” to isolate and restrain the country’s global ambitions.

But the broad aims of the TPP, including reducing things such as administrative approvals and protecting the environment, were what China wants to achieve too, it wrote. China has been trying to shift to a more sustainable, ecologically-sound, consumption-led economic growth model. “The rules of the TPP and the direction of China’s reforms and opening up are in line,” the newspaper said. “China should keep paying close attention and at an appropriate time, in accordance with progress on domestic reform, join the TPP, while limiting the costs associated to the greatest degree,” it added. However, how China’s state-owned industries might be affected by joining the TPP would need careful consideration, as the party has made clear their key role in the economy, the newspaper said.

Could as easily be talking about the electricity grid: “So there we are, called into a bank to solve a problem. They take us to a greying man sitting in the corner: ‘Please meet Peter, he is the only one left around here who still understands the systems’”

• Cyber Attacks Bigger Threat To Our Banking System Than Bad Debts (Luyendijk)

Many IT specialists and financial consultants say megabanks have simply become too big and too complex to manage. This would be fine if they were restaurants or hairdressers, companies that can safely go bust. But as we saw in September 2008, megabanks are also too big to fail. Like generals trying to win the last war, financial regulators today are obsessed with preventing a repetition of that 2008 collapse. It was caused by a combination of ever-thinner capital buffers plus overly complex financial products, which had seemed risk-free until they exploded. Hence regulators’ and lawmakers’ response was to force banks to hold more capital to cushion new shocks, and to make the type of product that exploded far less lucrative.

Bankers and regulators like to point out that almost nobody saw the crash of 2008 coming. It was a so-called black swan event – one considered so unlikely as to be outside the realm of the possible, while having huge and irreversible consequences when it does occur. It makes sense to hunt for another black swan, another complex financial product that could blow up and take the global financial sector with it. Many IT specialists with experience in banks I have interviewed seem genuinely concerned that one day a megabank will be shut out of its own data. What happens to the companies who rely on that bank’s payment system? “It would make the panic during a bank run look innocent,” said one.

He spoke of colleagues who retain paper copies of all their internet banking statements and confirmed a favourite quote from another IT specialist I interviewed: “The generation who built the computer systems when automation took off is now reaching retirement age. So there we are, called into a bank to solve a problem. They take us to a greying man sitting in the corner: ‘Please meet Peter, he is the only one left around here who still understands the systems’.” Much of the debate about banks and the dangers they pose to society has focussed on moral hazard; since bankers know they will be saved anyway there is little incentive to be cautious, especially when shareholders demand ever higher returns. That is the problem of Too Big to Fail.

But listen to IT specialists and you realise that the next big blow-up may result from an entirely different problem with banks today: Too Big and Too Complex to manage. This raises very real risks, both of the kind of meltdowns that specialists fear but also of cyber attacks: if you are a terrorist and you want to hit the West where it genuinely hurts, then the IT systems of a big bank must look like an attractive target. All the more reason to break up the banks and make them smaller so should one go then the entire system is not pulled down with it.

Stagnation and deflation.

• The Age Of The Torporation (Economist)

At the economy-wide level companies’ sales are closely related to nominal GDP growth (which includes inflation). So it should be no shock that firms are struggling given that deflation stalks rich countries and growth is slowing in the emerging world. After two lost decades, Japanese firms’ sales per share are still similar to the level in the 1990s. For Western firms there is also a suspicion that the methods used to crank out profits during the golden era were unsustainable. The unease is compounded by the fact that earnings are high relative to two yardsticks. S&P 500 earnings per share are 28% above their ten-year average. And in America profits are stretched relative to GDP). Since the 1970s American firms have yanked on three big levers to boost profits.

First, multinationals expanded abroad, with foreign earnings supplying a third or so of long-term earnings growth. Today, however, it seems that emerging economies are at the end of their 15-year boom. Second, finance was a crucial prop for profits in the two decades to 2007, with the banking industry expanding rapidly and industrial firms such as GE and General Motors building huge shadow banks. The regulatory clampdown since the financial crisis means this adventure is now over. Third, after 2007-08 firms relied heavily on pushing down the share of their profits that they paid out in wages. But now there are hints that wages are rising. On October 14th Walmart said that higher pay and training costs would lower its profits by $1.5 billion, or just under 10%, in 2017.

A week later Chipotle, a fast-food chain specialising in burritos big enough to ballast a ship, blamed falling margins on labour costs. If the share of domestic gross earnings paid in wages were to rise back to the average level of the 1990s, the profits of American firms would drop by a fifth. Faced with stagnation, the quick fix is share buy-backs, which are running at $600 billion a year in America. They are a legitimate way to return cash to investors but also artificially boost earnings per share. IBM spent $121 billion on buy-backs over the past decade, twice what it forked out on research and development. In the third quarter its sales fell by 14%, or by 1% excluding currency movements and asset disposals. Big Blue should have invested more in its own business. Walmart spent $60 billion on buy-backs even as it fell far behind Amazon in e-commerce.

The ‘Hair of the Dog’ cure.

• Listen – Is That The Sound Of A Bubble Bursting Down Under? (Steve Keen)

In everywhere but Australia, I’m famous for predicting the 2008 crash. In Australia, I’m famous for being wrong about house prices – they rose after the crash, when I expected them to fall. So why should you listen to me about the one thing I got wrong? Partly because I got the cause right, but the direction of the cause wrong. As the Irish know only too well, what really causes house prices to rise rapidly is too much mortgage debt, rising too quickly. House prices exploded here in the “Celtic Tiger” days, only to collapse when the mortgage bubble burst – bringing the economy down with it. Australians avoided this nasty hangover by the classic Antipodean method: they went for the ‘Hair of the Dog’ cure.

Whereas the rest of the world unwound its mortgage debt, Australians piled into it – first in 2008 when the government turbocharged the market by doubling the grant it gave to first-home buyers, and then since 2012 when falling interest rates encouraged Baby Boomers to throw their so-called retirement savings into the housing market casino. The Australian hangover cure worked, but at the expense of mortgaging Australia to the hilt. When the crisis hit in 2008, Australian mortgage debt was already higher than in the USA: mortgage debt peaked at 72pc of GDP in America then, but Australia’s level was 10pc higher again. Today, mortgage debt in the USA has fallen to 53pc of GDP-what wimps! The hard-drinking Australians now have a mortgage debt level of 91pc of GDP and rising.

And therein lies the rub. As any fan of the ‘Hair of the Dog’ cure knows, it only works if you keep drinking. So can Australians maintain their record for insobriety and keep imbibing from the Bar of the Banks? Left to their own devices, I have little doubt that my ex-countrymen could keep knocking back the 4X of mortgage debt forever. But as ‘Hair of the Dog’ devotees also know, one danger of this cure is that the bartender will eventually refuse to serve you. And that seems to be happening in Australia now. Two of the banks have recently put up the interest rate on speculator (sorry, I mean investor) loans, while the policeman (the “Australian Prudential Regulation Authority”) has finally awoken from his slumber, and is now insisting on less alcohol in the brew-otherwise known as a lower loan to valuation ratio.

At least 5 years too late. More like 10.

• Mortgage Rate Rises Too Little, Too Late For Australia’s Bloated Banks (David)

In Australia, the big four banks are joining the mortgage interest rate hike bandwagon to boost additional capital in what is truly a high-risk banking and financial system. Simply put, when it comes to lending, banks are facilitators. On the front end, banks’ assets are generated by providing credit (debt) to homebuyers and charging a specific rate of interest. On the back end, banks have liabilities derived from depositors and wholesale lenders, fetching an interest rate which is lower than that charged to homebuyers. The banks earn the difference in revenue. Australian households owe creditors an unconsolidated $1.97tn as of the second quarter of 2015, comprised primarily of mortgages with a remainder of personal loans.

Relative to GDP, this amounts to 121.5%, and the proportion increased by 150 basis points every quarter over the past year. Given this historically and internationally large stock of household debt, the banks are earning mega dollars via net interest rate margins. Australian banks are raking in record-breaking profits due to the sheer volume of mortgage debt issued to homebuyers and residential property investors. This is the primary reason housing prices in Australia are at record levels, relative to inflation, rents and household income: a housing bubble generated by debt-financed speculation. Today, our banks are more exposed to the risk of a shock to the housing market than in any other moment in Australia’s economic history.

There are various reasons for banks to increase mortgage interest rates without a shift in the cash rate set by the Reserve Bank. In Australia’s case, policymakers and the prudential regulator, Apra, woke up – 17 years too late. They finally realised our banks would not be able to withstand a financial shock based on the colossal stock of mortgage and other debts on their balance sheets relative to the amount of security they have to defend their businesses in the event of a severe economic downturn. [..] This is a pyramid or Ponzi scheme, that puts the speculator at risk of owing more to a bank than their property portfolio is worth (negative equity). This presents a clear and present danger to the banking and financial system, depositors, taxpayers and welfare of millions of Australians who have borrowed on a large scale as residential land prices escalate.

Where democracy went to die.

• Portugal Left Vows To Topple Government With No-Confidence Vote (Reuters)

Portugal’s opposition Socialists have pledged to topple the centre-right minority government with a no-confidence motion, saying the president had created “an unnecessary political crisis” by nominating Pedro Passos Coelho as prime minister. The move could wreck Mr Passos Coelho’s efforts to get his centre-right government’s programme passed in parliament in 10 days’ time, extending the political uncertainty hanging over the country since an inconclusive October 4th election. Mr Coelho was named prime minister on Thursday after his coalition won the most votes in the national election but lost its majority in parliament, which swung to leftist parties.

This set up a confrontation with the main opposition Socialists, who have been trying to form their own coalition government with the hard left Communists and Left Bloc, who all want to end the centre-right’s austerity policies. “The president has created an unnecessary political crisis” by naming Passos Coelho as prime minister,” Socialist leader Antonio Costa said. The Socialists and two leftist parties quickly showed that they control the most votes when parliament reopened on Friday, electing a Socialist speaker of the house and rejecting the centre-right candidate. “This is the first institutional expression of the election results,” Mr Costa said. “In this election of speaker, parliament showed unequivocally the majority will of the Portuguese for a change in our democracy.”

Early Friday, Mr Costa’s party gave its lawmakers a mandate to “present a motion rejecting any government programme” that includes similar policies to the last government. After the national election, Passos Coelho tried to gain support from the Socialists, who instead started negotiating with the Communists and Left Bloc. Antonio Barroso, senior vice president of the Teneo Intelligence consultancy in London, said Mr Costa was likely to threaten any Socialist representative with expulsion if they vote for the centre-right government’s programme. “Therefore, the government is likely to fall, which will put the ball back on the president’s court,” Mr Barroso said in a note.

“..in the winter there will be winds that will turn boats over, our beaches will be beaches of death..”

• More Syrians Risk Deadly Crossings To Greece In Race Against Winter (Guardian)

At a reception centre in the village of Moria there have been riots. Human rights groups say conditions in the barbed-wire enclosure are “inhumane”. “They treated us like animals,” sighed Al Shabai. “The Greeks have been very nice, very good, but in there it’s a wild world, people sleep on the ground, in their own shit, please write that, please let the world know.” Newcomers crammed into its floodlit confines are often forced to wait days before they are registered, fingerprinted and split into groups of those considered genuine refugees and those who are economic migrants. “I think it is clear that Greece has enormous structural difficulties because of the economic situation,” the UN High Commissioner for refugees, António Guterres, told the Guardian recently.

“It didn’t have an adequate asylum system [before the emergency] but despite the financial restrictions there is enormous goodwill and in [leftwing] Syriza, Greece has a government that is taking a humanistic approach,” he said after a recent tour of the island. The UN agency, which more usually operates in war zones, has been compelled to increase its presence dispatching personnel not only to the country’s Aegean isles but northern Balkan borders in a first for an advanced western economy.On Lesbos, officials worry that the situation is bound to get worse before it gets better. Although local people have been generally welcoming – citing their own experience as refugees from Turkey after the 1922 Asia Minor disaster – the neo-fascist Golden Dawn party received unusually high support in September’s general election.

Masked men have been attacking refugee boats. For the newly arrived, relief is frequently replaced by frustration. With the vast majority determined to get to Germany before the winter sets in, few want to linger – often electing to walk a distance longer than the Athens Marathon to get to Moria and off the island. “They are tired and cold, totally exhausted and then we tell them they have to wait because there is no bus service and that’s when you see them collapse and get really frustrated,” said Mona Martinsen, a Norwegian aid worker. “It’s out of control, you see people sleeping in their own faeces, its not right, the world has to send more help.”

In his office overlooking the port capital of Mytilini, the island’s mayor, Spyros Galinos, fears that Europe is dragging its feet and that human tragedy will soon be stalking the shores of Lesbos. Already, he says, the waters have grown rougher, causing shipwrecks off the isle that have left 19 people dead in the past nine days. “Right now, they are coming in on the northerly winds, but in the winter there will be winds that will turn boats over, our beaches will be beaches of death,” he said. Every month the municipality spends more than €200,000, with most allocated to cleaning up the island. “Every day the population of a small town arrives on this island,” he says.

What the EU is good at.

• Hotspot ‘Solution’ Deepens Europe’s Refugee Crisis (IRIN)

An EU initiative to screen and fingerprint all migrants and refugees arriving in Italy and Greece is creating chaos, particularly on the island of Lesvos where the new system is causing further delays in registering new arrivals and thousands of people have been queueing in the open for days. The introduction of “hotspots” – an EU term for key arrival points where more rigorous systems for screening and fingerprinting migrants and refugees will be implemented – is central to a controversial plan to relocate 160,000 asylum seekers from Italy and Greece to other member states over the next two years. The relocation scheme, which was agreed to by EU leaders last month, is still in its infancy with just two hotspots functioning and only 89 Eritreans and Syrians transferred from Italy to Scandinavia so far, but the approach is already coming up against major problems.

Previously, most of the more than 600,000 people who have arrived by sea to Italy and Greece this year avoided being fingerprinted and made their own way to northern Europe. It was no secret that, under the EU’s Dublin Regulation, the country that took their fingerprints was responsible for processing their asylum claim, preventing them from claiming asylum in the country of their choice. For their part, authorities in Italy and Greece, already facing a backlog of asylum claims, did not insist that new arrivals be fingerprinted. But the quid pro quo for the relocation deal is that the two countries comply with the new approach. In Italy, the first hotspot opened in late September on the country’s southernmost island of Lampedusa. A further four hotspots are set to begin operations by the end of November – three in Sicily and another in the mainland Puglia region.

Italian officials say people on Lampedusa are being “verbally convinced” to give their fingerprints (EU human rights laws rule out the use of physical force). “We explain that it’s important [to be identified] to go to the countries where they want to go,” said Mario Morcone, head of the interior ministry’s department for civil liberties and immigration. In reality, those accepted for relocation will not get to choose the country they are sent to, and anyone who refuses to give their fingerprints risks being moved to a closed Centre for Identification and Expulsion (CIE) rather than an open reception facility.

Carlotta Sami, a spokeswoman for the UN’s refugee agency, UNHCR, said that so far no one had been transferred to a CIE because everyone had agreed to be fingerprinted. She added that UNHCR backed the new procedure, while emphasising the need for a humanitarian approach. “Everyone should be identified and fingerprinted,” she told IRIN. “It’s very important. A big part of this European refugee crisis is due to a lack of organisation, and the fact that procedures have not been well organised since the beginning. The result is chaos, a further burden on the shoulders of refugees.”

Europe is synonymous with misery.

• Bodies Of 40 Migrants Wash Ashore In Libya (AP)

Libya’s Red Crescent says the bodies of 40 migrants have washed ashore in the Mediterranean country. Red Crescent spokesman Mohamed al-Masrati says 27 of the bodies were found Saturday at the town of Zliten, east of the capital, Tripoli. The rest were found along the shores of Tripoli and the nearby town of Khoms. Al-Masrati says most of the migrants were from sub-Saharan African countries. He says search efforts are underway for another 30 migrants whom they believe were on the boat that capsized. Thousands of migrants seeking a better life in Europe cast off from Libya on rickety boats. The country slid into chaos following the 2011 toppling and killing of dictator Moammar Gadhafi. Smugglers have exploited Libya’s turmoil, sending off thousands of desperate migrants from the country’s shores.

They will never agree.

• Europe Split On Migrant Crisis On Eve Of Brussels Talks (Reuters)

European leaders traded threats and reprimands on Saturday as thousands more migrants and refugees streamed into the Balkans on the eve of European Union talks aimed at agreeing on urgent action to tackle the crisis. Concern is growing about hundreds of thousands of migrants arriving in Europe, many from war zones in the Middle East, and camping in western Balkan countries in ever colder conditions as winter approaches. More than 680,000 migrants and refugees have crossed to Europe by sea so far this year, fleeing war and poverty in the Middle East, Africa and Asia, according to the International Organization for Migration. Bulgaria, Serbia and Romania said they would close their borders if Germany or other countries shut the door on refugees, warning they would not let the Balkan region become a “buffer zone” for stranded migrants.

“The three countries, we are standing ready, if Germany and Austria close their borders, not to allow our countries to become buffer zones. We will be ready to close borders,” Bulgarian Prime Minister Boiko Borisov told reporters. European Commission president Jean-Claude Juncker has invited the leaders of Austria, Bulgaria, Croatia, Macedonia, Germany, Greece, Hungary, Romania, Serbia and Slovenia to Sunday’s mini-summit. The aim of the meeting is to agree “common operational conclusions which could be immediately implemented.” German media have reported that Juncker will present a 16-point plan, including an undertaking not to send migrants from one country to another without prior agreement.

“We carry out our obligations, we are in solidarity with all of Europe,” Ponta said. “But the responsibility cannot be put with just some countries.”

• Balkan Countries Threaten To Close Borders If Germany Does (Reuters)

Bulgaria, Serbia and Romania said on Saturday they would close their borders if Germany or other countries do the same to stop refugees coming in, warning they would not allow the Balkan region to become a buffer zone for stranded migrants. Bulgarian Prime Minister Boiko Borisov announced the decision after meeting his Serbian and Romanian counterparts in the capital Sofia ahead of a planned summit of European Union leaders on Sunday. It is an indication of the divisions that have opened up between European Union states over how to deal with an influx of hundreds of thousands of migrants, many fleeing conflict in Syria, Iraq and Afghanistan.

“The three countries, we are standing ready, if Germany and Austria close their borders, not to allow our countries to become buffer zones. We will be ready to close borders,” Borisov told reporters. “We will not expose our countries to the devastating pressure of millions that would come.” Romanian Prime Minister Victor Ponta said this would be the three countries’ common position at an extraordinary meeting of some European leaders on Sunday to tackle the migrant crisis in the western Balkans. Thousands trying to reach Germany are already trapped there in deteriorating conditions. “We carry out our obligations, we are in solidarity with all of Europe,” Ponta said. “But the responsibility cannot be put with just some countries.”

“If there are countries which close their borders, or build fences, then we have the right to defend ourselves in a timely manner.” Romania’s neighbor Hungary has built a fence to keep out migrants and closed its border with Croatia, prompting Slovenia to consider following suit with its own fence. European Commission chief Jean-Claude Juncker has invited to Sunday’s mini-summit the heads of state or government of Austria, Bulgaria, Croatia, Macedonia, Germany, Greece, Hungary, Romania, Serbia and Slovenia, plus key organizations involved. The aim of the meeting is to agree “common operational conclusions which could be immediately implemented”.

It comes as crowds of refugees and other migrants camp by roads in western Balkan countries in worsening autumn weather after Hungary sealed its borders, causing a chain reaction in other overwhelmed states. “It is important for the people to know that it is not a problem to register (refugees), or build bigger centers, nothing of this is a problem for Serbia,” Serbian Prime Minister Aleksandar Vucic told reporters. “But if someone thinks that we can be the place for two or three million refugees: this is unrealistic.”

To quicken transport north.

• Refugee Crisis Agreement Between Serbia And Croatia (BN.ie)

Serbia and Croatia have agreed to ease the flow of refugees over the border between the countries after thousands of people, including children, were forced to spend the night in near-freezing temperatures along a muddy border passage. The interior ministers of Serbia and Croatia said they will start shipping migrants by train directly from Serbia to Croatia so they will not have to cross on foot, with them often trekking for miles. Refugees will register when they enter Serbia and will be able to cross into Croatia without any delays, which should speed up the process significantly, the ministers said. “We have agreed to stop this torture,” said Croatian interior minister Ranko Ostojic. “There will be no more rain and snow, they will go directly from camp to camp.”

Further west, thousands of migrants aiming to reach northern Europe walked out of refugee camps on the border between Slovenia and Austria on their own, frustrated after waiting long hours in overcrowded facilities. Eager to move on, thousands spread around along railway tracks, highways and mountain roads. Confused and unaware which roads to take to go west, some refugees later turned back and returned to the refugee camps to wait for bus transport to other locations. Tensions have been building after the so-called Balkan route shifted. refugees still cross first from Greece into Macedonia and then Serbia, but now go via Croatia and Slovenia instead of Hungary, which has erected fences along its borders with Serbia and Croatia.

Overwhelmed after nearly 50,000 migrants crossed in just a few days, Slovenia said it has not ruled out erecting a fence of its own along parts of its 400-mile border with Croatia. Prime Minister Miro Cerar was quoted by the state news agency STA as saying Slovenia will consider all options if left to cope on its own with the influx of thousands of people. “Our sights are foremost on finding a European solution,” said Mr Cerar. “But should we lose hope for this … all options are open within what is acceptable.” The country of 2 million people has already deployed 650 army troops to help the police manage the flow and has asked the European Commission for an aid package, including €60 million in financial aid and police gear and personnel.

Is this a better reason to oppose Monsanto than GMO food?

• Tampons, Sterile Cotton, Sanitary Pads Contaminated With Monsanto Glyphosate (RT)

The vast majority, 85%, of tampons, cotton and sanitary products tested in a new Argentinian study contained glyphosate, the key ingredient in Monsanto’s Roundup herbicide, ruled a likely carcinogen by the World Health Organization. Meanwhile, 62% of the samples tested positive for AMPA, glyphosate’s metabolite, according to the study, which was conducted by researchers at the Socio-Environmental Interaction Space (EMISA) of the University of La Plata in Argentina. All of the raw and sterile cotton gauze analyzed in the study showed evidence of glyphosate, said Dr. Damian Marino, the study’s head researcher. “85% of all samples tested positive for glyphosate and 62% for AMPA, which is the environmental metabolite, but in the case of cotton and sterile cotton gauze the figure was 100%”, Marino told TElam news agency.

The products tested were acquired at local stores in Argentina. “In terms of concentrations, what we saw is that in raw cotton AMPA dominates (39 parts per billion, or PPB, and 13 PPB of glyphosate), while the gauze is absent of AMPA, but contained glyphosate at 17 PPB.” The results of the study were first announced to the public last week at the 3rd National Congress of Doctors for Fumigated Communities in Buenos Aires. “The result of this research is very serious, when you use cotton or gauze to heal wounds or for personal hygiene uses, thinking they are sterilized products, and the results show that they are contaminated with a probably carcinogenic substance”, said Dr. Medardo Avila Vazquez, president of the congress.

“Most of the cotton production in the country is GM [genetically modified] cotton that is resistant to glyphosate. It is sprayed when the bud is open and the glyphosate is condensed and goes straight into the product”, Avila continued. Marino said the original purpose of his research was not to test products for glyphosate, but to see how far the chemical can spread when aircraft sprayed an area, such as cropland. “There is a basic premise in research that when we complete testing on out target we have to contrast it with something ‘clean,’ so we selected sterile gauze for medical use, found in pharmacies,” he said. “So we went and bought sterile gauze, opened the packages, analyzed and there was the huge surprise: We found glyphosate! Our first thought was that we had done something wrong, so we threw it all away and bought new gauze, analyzed them and again found glyphosate.”