Marion Post Wolcott Old buildings in New Orleans Jan 1941

There’s a lot of interesting pieces being written on a daily basis, if you care to look for them, and there’s never enough time and space to afford them the attention they should really deserve. Luckily, there are still many people out there, even in the financial world, who have a pretty astute understanding of what’s going on versus what we are told to believe there is. Not that I don’t think there are no smart people in finance, just that many of them watch the world through the blinders their world comes with. Most of us – and therefore them, too – follow the herd, after all.

I like, for instance, the angle of Joe Calhoun at Alhambra Investment Partners, who argues that the US has already turned into Japan:

Return To Normalcy – Even The Supply Of Greater Fools Is Limited

For all those who worried that the US might turn into Japan, well worry no more, that ship has sailed. Over a half decade of zero interest rates says we already have become Japan, with the same demographic, productivity and structural problems so well documented. High taxes, a shrinking workforce, offshored production, protection of large incumbent firms, political gridlock, a falling savings rate, a growing xenophobia and an affinity for sushi all point to America as the economic kissing cousin of the land of the setting sun. Turns out the Vapors were not just one hit wonders but keen eyed economic forecasters as well.

The US economy isn’t acting normally, now in the 6th year of an anemic expansion the likes of which we haven’t seen since, well, never. The temptation is to compare this period with the Great Depression but even the recovery from the early part of that self inflicted economic wound was better in some respects. The unemployment rate has fallen but the path of improvement has been a road less traveled in economic history. No matter the reason, full time employment has become an unreachable dream for too many Americans. Multiple part time jobs and underemployment have made debt a way of life [..] to achieve the perception, the illusion, of success, if not the real thing.

A return to normalcy would mean a rejection of the idea that debt is the sine qua non of economic growth. A return to normalcy would mean a recognition that the Fed’s monetary gnomes are the ones who got us in this mess and are therefore wholly unsuited in their role as the economy’s knight in shining armor. A return to normalcy would mean rewarding and recognizing savers as the unsung heroes of economic growth. A return to normalcy would mean a shared prosperity for all rather than just the privileged few with access to the Fed or the ear of their congressional representative.

Achieving the goals of the Fed’s extraordinary policies – full employment and low inflation – would require an extraordinary set of conditions to develop. The economy would have to achieve a rate of growth that has escaped it for years while the Fed would have to extricate itself from a policy regime they barely – and that is generous – understand. I see no reason other than wishful thinking to believe those conditions can be met.

And what I also like a lot is Salient Partners’ Ben Hunt and his take on Mario Draghi in Wonderland:

Mario Draghi is Alice. The Red King? Well, That’s Us

We’re all familiar with the Queen of Hearts from Alice in Wonderland, less so with the Red King. He’s sleeping all the while, and when Alice goes to wake him up she’s warned off by Tweedledee and Tweedledum, who tell her that everything in Wonderland – including Alice herself – is perhaps just the dream of the Red King. Wake him up and maybe, just maybe, everything goes … poof! Europe is once again nearing a potential Red King moment, something last seen in the summer of 2012.

Then the wake-up call was a series of national elections, particularly in Greece. Today it’s a restructuring of the European financial system, a process started in 2012 with the recapitalization of Spanish banks, continued with the depositor bail-in of Cypriot banks, and now at a tipping point with the imminent ECB regulatory control over all large EU banks. Mario Draghi is Alice, and the dream is a unified European identity triumphant over individual national identities, symbolized and crystalized in a single currency, the Euro. The Red King? Well, that’s us. [..]

So what makes the summer of 2014 different from the summer of 2012? If Draghi sang a lullaby to the fitful Red King two years ago with his “whatever it takes” pledge, why won’t he do the same today by following through with a no-muss-no-fuss ECB regulatory take-over of major EU banks? Odds are he will. But what’s different today is that it’s his own institution on the line. What’s different today is that a heartfelt speech and a mythical OMT program – pure Narratives, in other words – are not sufficient. The ECB actually has to assume responsibility for these banks if Draghi is to move forward with the next step of the Grand Plan, and there’s nothing intangible or mythic about that.

I think that the best way to understand the recent spate of write-downs and default notifications from European banks (Erste Bank on July 4th, Espirito Santo on July 10th) is in the context of this regulatory unification of big EU banks. For the first time in decades these banks are being examined for real. No more patsy national regulators with their revolving doors and inherited culpability, but a highly professional independent banking bureaucracy looking carefully at every bottle and tin in the pantry because they’re scared to death of swallowing some poisonous balance sheet. The problem for the ECB, of course, is that Espirito Santo and Erste are not isolated incidents, any more than Laiki and Fortis and Anglo Irish and WestLB and BMPS and … should I go on? … were isolated incidents.

The problem is that no amount of public scrubbing and show trials can change the fact that the entire European banking system has been an enthusiastic accomplice to domestic political interests for the past 30+ years, stuffing their collective balance sheets to the gills with loans in direct or indirect service to domestic political demands. [..] But precisely because the politically-inspired rot is so widespread, taking a bank like Espirito Santo into the street and shooting it in the head no more solves Europe’s systemic banking crisis than executing Bear Stearns in March 2008 solved the US systemic banking crisis. As Dorothy Parker once wrote, “beauty is only skin deep, but ugly goes clear to the bone.” That’s the European financial system: politically ugly, clear to the bone.

But my favorite for the day has to be the rather incomparable Paul B. Farrell at MarketWatch, who watches events unfold with a combination of the liberty and experience that come with age, and the brains he was born with. Farrell writes about the work of Harvard philosopher Michael Sandel, who makes one wish we had a whole bunch more solid philosophers, and, even more, that they would be listened to. Sandel himself perhaps best explains the reason why we are are not listening.

Our Market Society Has Made A Deal With The Devil (Paul B. Farrell)

For years we’ve been asking: Why does capitalism blindly drive the human brain down this self-destructive path, whether it’s money, global warming, gun sales or voting rights? Why more books and ministers filling arenas with the message, God Wants You to Be Rich? Why is Pope Francis warning that a new “worship of the ancient golden calf has returned in a new and ruthless guise in the idolatry of money and the dictatorship of an impersonal economy?” Why? There is someone who brilliantly explains why free-market capitalism is controlling our brains, sabotaging our world: Harvard philosopher Michael Sandel, author of bestseller “What Money Can’t Buy: The Moral Limits of Markets, and Justice: What’s the Right Thing to Do?”

For more than three decades Sandel’s been teaching us why capitalism is undermining human morality. And why we choose to deny it. Why do we bargain away our moral soul? His classes number over a thousand. You can even take his course online free . He summarized capitalism’s takeover of the human conscience in “What Isn’t for Sale?” in the Atlantic. Listen:

“Without being fully aware of the shift, Americans have drifted from having a market economy to becoming a market society … where almost everything is up for sale.” Capitalism is America’s new “way of life where market values seep into almost every sphere of life and sometimes crowd out or corrode important values, non-market values.”

“The years leading up to the financial crisis of 2008 were a heady time of market faith and deregulation — an era of market triumphalism,” says Sandel. “The era began in the early 1980s, when Ronald Reagan and Margaret Thatcher proclaimed their conviction that markets, not government, held the key to prosperity and freedom.” Then in the 1990s the “market-friendly liberalism of Bill Clinton and Tony Blair … consolidated the faith that markets are the primary means for achieving the public good.” Yes, Ayn Rand’s “pure, uncontrolled, unregulated laissez-faire capitalism” took over America’s brain, our soul, became the nation’s collective unconscious.

Today “almost everything can be bought and sold,” warns Sandel. “Markets, and market values, have come to govern our lives as never before.” Yet few are aware of this historic shift. “We did not arrive at this condition through any deliberate choice. It is almost as if it came upon us,” says Sandel.

As a result, “market values were coming to play a greater and greater role in social life. Economics was becoming an imperial domain. Today, the logic of buying and selling no longer applies to material goods alone. It increasingly governs the whole of life.” Everything has a price.

Examples everywhere: “For-profit schools, hospitals, prisons … outsourcing war to private contractors … police forces by private guards … drug companies aggressive marketing of prescription drugs prohibited in most other countries.” Ads in “public schools … buses … corridors … cafeterias … naming rights to parks and civic spaces … blurred boundaries within journalism, between news and advertising … buying and selling the right to pollute … campaign finance in the U.S. that comes close to permitting the buying and selling of elections.”

Here I would argue, since I don’t see either Sandel or Farrell do it explicitly, that in the end, if you follow the logic, this means that people, too, are for sale. If everything has a price, everyone has a price. Or at least everybody has to work their behinds off not to be for sale, but they do so working jobs that, if you look with an objective eye, simply mean they’ve sold themselves. Basically, anyone who works a job they wouldn’t work if they weren’t paid to do it, is for sale. Not a popular point of view when you ask people to look in a mirror, but hard to argue with.

The 2008 crash ended our faith in conservative free-market capitalism: “The financial crisis did more than cast doubt on the ability of markets to allocate risk efficiently. It also prompted a widespread sense that markets have become detached from morals,” says Sandel. But so what? “Why worry that we are moving toward a society in which everything is up for sale?”

Two big reasons concern Sandel, both echo the warnings of Pope Francis and Piketty: One is inequality: “Where everything is for sale, life is harder for those of modest means.” If wealth just bought things like yachts inequalities might not matter. “But as money comes to buy more and more, the distribution of income and wealth looms larger.” Second, corruption: “Putting a price on the good things in life can corrupt … the meaning of citizenship.”

Sandel warns America’s new capitalism brain is devaluing “nonmarket values worth caring about. When we decide that certain goods may be bought and sold” they become “commodities, as instruments of profit and use.” But “not all goods are properly valued in this way … Slavery was appalling because it treated human beings as a commodity, to be bought and sold at auction.”

Nor do we permit “children to be bought and sold, no matter how difficult the process of adoption can be.” The same with citizenship … jury duty … voting rights. “We believe that civic duties are not private property but public responsibilities. To outsource them is to demean them, to value them in the wrong way.” Yet today many are for sale, have a price.

I’m doing the equivalent of licking my fingers here.

Sandel’s core message is simple: “The good things in life are degraded if turned into commodities. So to decide where the market belongs, and where it should be kept at a distance, we have to decide how to value the goods in question – health, education, family life, nature, art, civic duties, and so on. These are moral and political questions, not merely economic ones.” But in today’s new capitalist world, everything has a price.

Worse, that debate never happened during the 30-year rise of “market triumphalism … without quite realizing it, without ever deciding to do so, we drifted from having a market economy to being a market society.” The difference is profound: “A market economy is a tool … for organizing productive activity. A market society is a way of life in which market values seep into every aspect of human endeavor … where social relations are made over in the image of the market.” Where everything has a price.

But not only did the debate not happen, it may never. Because politicians aren’t up to debating values. They’re pushing America past the point of no return. Today, “political argument consists mainly of shouting matches on cable television, partisan vitriol on talk radio, and ideological food fights on the floor of Congress” warns Sandel. So it is “hard to imagine a reasoned public debate about such controversial moral questions as the right way to value procreation, children, education, health, the environment, citizenship, and other goods.”

Here I would add what I’ve often talked about: basic human necessities should not be part of a market either. Since everyone needs water, food, heat and shelter, we should never even risk leaving them in the hands of just a few people or corporations. And this is the ultimate slippery scale: if you give them one finger, they’ll take your whole hand at some point. It’s like when you allow money into your political system: money will end up buying the entire system outright. Once it’s got a way in, there’s nothing you can do about it anymore.

But look at where we are with regards to our water supply, our food supply; much of it is already ‘reformed’, privatized and owned by big corporations. And look at how much money people must pay for their homes, in 30 or 40 year loans. In Sweden, they have trouble getting people to pay off their homes in 50 years. There are countries where multi-generational mortgages are the norm. We sold our ethics, our values and our necessities, and for the most part we never even noticed. We put ourselves up for sale.

Can we change? “The appeal of using markets to put a price on public values is that there’s no judgment on the preferences they satisfy.” Morals become irrelevant. No debate is needed. Markets don’t “ask whether some ways of valuing goods are higher, or worthier, than others. If someone is willing to pay for sex, or a kidney … the only question the economist asks is ‘How much?’ Markets … don’t discriminate between worthy preferences and unworthy ones.”

Unfortunately capitalism eliminates moral values, just as Nobel economist Milton Friedman and capitalist philosopher Ayn Rand were to preaching conservatives for a long time. As Sandel puts it: “Each party to a deal decides for him- or herself what value to place on the things being exchanged. This nonjudgmental stance toward values lies at the heart of market reasoning, and explains much of its appeal.” But unfortunately, market capitalism “has exacted a heavy price … drained public discourse of moral and civic energy.” Capitalism never has to ask the tough question: “What’s the right thing to do?”

Sandel is a great teacher. And, yes, he’s too idealistic. We need more like him. But you don’t have to be a fatalist to know that without a global economic catastrophe, today’s market capitalists — billionaires, bankers, CEOs, hedgers, lobbyists and every special interest group getting rich off the new Market Society — will never, never voluntarily surrender their control of America’s wealth machine. No, they will keep blindly driving us down their self-destructive path with the delusional conviction God wanted them to get rich. The truth is, they made a wager with the devil … money for a soul.

Thing is, we’re not just talking about billionaires or bankers here, we’re talking about ourselves. We are the ones who allowed this to happen. We are the ones who in out increasingly blind chase for more lost sight of what we incrementally had less of. We let it slip out of our hand because we were too busy doing other things. We never realized we couldn’t win one without losing the other.

Farrell says that Sandel’s writings should be “required for Wall Street insiders, corporate CEOs, and all 95 million Main Street investors.” I think it should be for every single one of us. Because we no longer understand what we lost, and how much we lost. And blaming other people for it is not helpful either; only by seeing our own faults and failures in what we lost do we have a shot at getting at least some of it back.

• Global Equity Melt-up In Full Swing Even If Investors Hate Themselves (AEP)

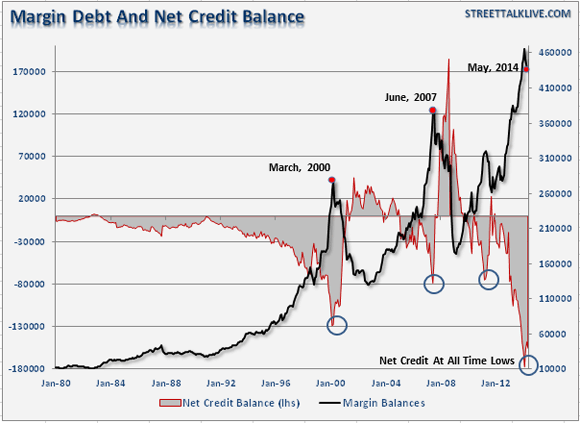

There is no longer much doubt. We are in the midst of a late-cycle blow-off in global equity markets Bank of America’s monthly survey of world fund-managers shows that investors have their second highest allocation to stock markets in thirteen years at 61pc. It is lead by shares in technology, energy, and even banks, and is stretched to a net 35pc overweight in Europe. “The summer ‘melt-up’ is likely to be followed by an autumn correction,” it said This happened in 2007 as you can see from the chart below, and again in early 2011 just before the European Central Bank triggered Part II of the EMU debt crisis by raising rates twice. Investors seem determined to keep dancing until the music actually stops, even though the largest majority since the height of the dotcom bubble think equities are overvalued. They are chasing momentum. It is irresistible to try to eke a little more out of the rally.

This dovetails with warnings from the Bank for International Settlements that markets are now “euphoric”, with the fear gauge (volatility) almost switched off, and the Tobin’s Q measure of the S&P 500 flashing more emphatic overvaluation warnings than in 2007. We are not necessarily at the end of this surge. Cash holding are still very high at 4.5pc, so funds still have a little more money to throw at stocks. High cash levels are theoretically a contrarian buy signal, while anything under 3.5pc is a sell signal, but as you can see it was a counter-indicator in 2007. The proportion in cash peaked at the top of boom. It offered false comfort.

[..] There is a reason why funds are not buying bonds. Central banks are doing it for them. This is either by QE – the Bank of Japan is eating up 70pc of all new debt issuance by the Japanese government – or by FX reserve accumulation.

IMF data shows that central banks have added $774bn to $11.86 trillion over the last year. Almost all of this went into bonds. Sovereign wealth funds are buying bonds too. These behemoths are crowding out the private market. So in a sense, the equity rally is a function of the collective acts of monetary authorities pushing investors into stocks. This of course is why the BIS is in despair. “Overall, it is hard to avoid the sense of a puzzling disconnect between the markets’ buoyancy and underlying economic developments globally,” it said. Just wait until the Fed tightens in earnest.

Read more …

Need any more proof?

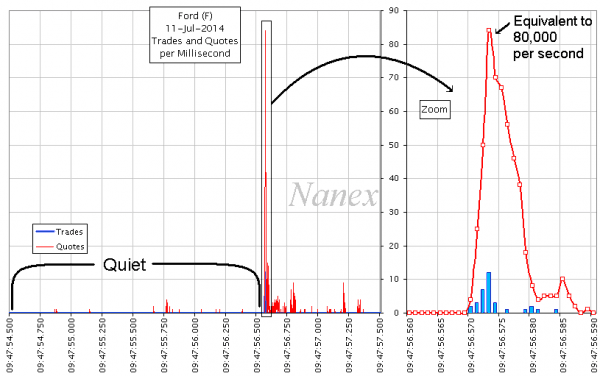

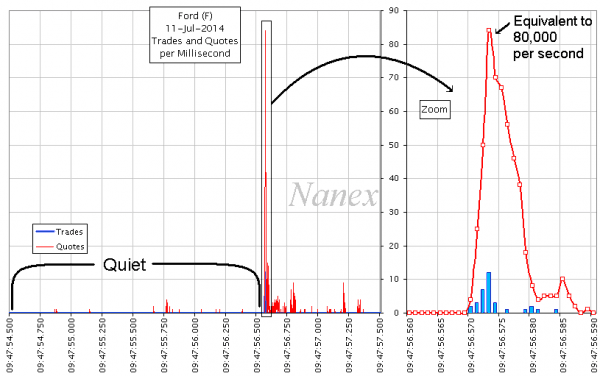

• Market Rigging Explained (Nanex/Zero Hedge)

We received trade execution reports from an active trader who wanted to know why his larger orders almost never completely filled, even when the amount of stock advertised exceeded the number of shares wanted. For example, if 25,000 shares were at the best offer, and he sent in a limit order at the best offer price for 20,000 shares, the trade would, more likely than not, come back partially filled. In some cases, more than half of the amount of stock advertised (quoted) would disappear immediately before his order arrived at the exchange. This was the case, even in deeply liquid stocks such as Ford Motor Co (symbol F, market cap: $70 Billion). The trader sent us his trade execution reports, and we matched up his trades with our detailed consolidated quote and trade data to discover that the mechanism described in Michael Lewis’s “Flash Boys” was alive and well on Wall Street.

Let’s take a look at what we found from analyzing 5 large trades executed at different times over a 4 minute period in Ford Motor Co. Before each of these trades, the activity in the stock was whisper quiet. Here’s a chart showing millisecond by millisecond trade and quote counts in Ford leading up to one of these 5 trades:

You can clearly tell when the trade hits: activity explodes to over 80 quotes in 1 millisecond (this is equivalent to 80K messages/second as far as network/system latency goes). But the point here is that nothing was going on in this stock in the immediate period before this trade hits the market. In this particular example, there were a total of 24,800 shares advertised for sale at $17.38 (all trades and offered liquidity will be at this same price) from 8 exchanges. The trader wanted 20,000 of these shares. What he got was only 12,133 shares and 600 of these were on a dark pool (which wasn’t part of the 24,800 shares of liquidity on the lit exchanges)! Worse, someone ELSE was filled for 1,570 shares during these same milliseconds! Remember, nothing was happening in Ford until his order came into the market. Based on the other 4 examples, we are sure that no trades would have occurred during these few milliseconds of time if it wasn’t for this trader’s order.

What happened to the 24,800 shares offered and why couldn’t he get at least 20,000 of them? How is it that others were able to get shares during this time? This is especially disturbing when you consider these other traders (HFT) only bought shares in reaction to the original trader’s order.

Read more …

R-squared.

• There’s A Big Hole In The Bull Case For Stocks (MarketWatch)

Some say the stock market’s high price-to-earnings ratio is justified by low interest rates. That seems plausible, right? Think again. There is precious little historical support for this notion. To be sure, virtually everyone I hear from or talk to is certain that above-average high P/E ratios are justified by low rates. The belief is so widespread on Wall Street that few have bothered to examine the historical record. If they did, they would be very surprised indeed. One analyst who did take the trouble to do so is Clifford S. Asness of AQR Capital Management. More than a decade ago, he published his analysis of data extending back more than a century. Titled “ Fight the Fed Model ,” his study appeared in the fall 2003 issue of the Journal of Portfolio Management. Asness’ findings are best understood in terms of a statistic known as the “R-squared,” which reflects the degree to which fluctuations in one thing predicts or explains changes in another. The R-squared ranges between 0 and 1, with 1 indicating the highest possible degree of predictive power and 0 meaning there is no detectable relationship. [..]

How did anyone ever come to believe that the P/E should be adjusted by interest rates? I can think of two possible explanations: one based on lazy thinking and the other on Wall Street’s bullish bias. I mention the first possibility because Asness found some statistical support for the interest-rate-adjusted P/E over the 20-year period between 1982 and 2001. It might therefore be that some believers in the adjusted P/E genuinely believed they had history on their side, even though they were focusing on only a small and unrepresentative subset of the full record. My hunch, however, is that Wall Street’s bullish bias is the bigger reason why so many think an interest-rate-adjusted P/E is superior to the unadjusted. The adjusted version does have some superficial plausibility, and that’s all Wall Street needed to tell a story for why we should buy into a market that is otherwise increasingly overvalued.

Read more …

Yup.

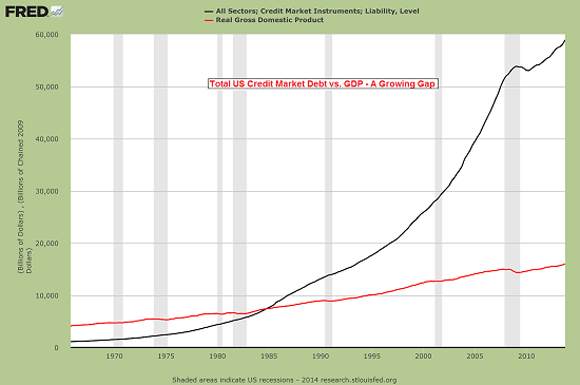

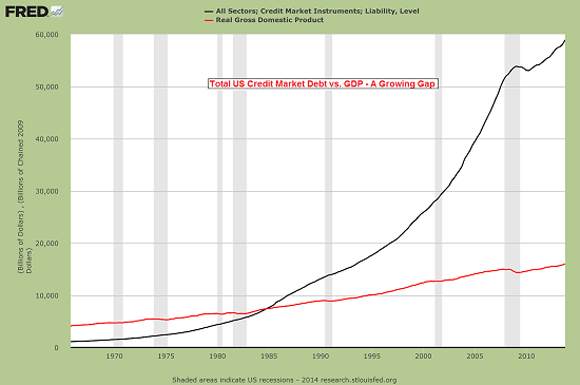

• Why We’re Doomed: Interest and Debt (CH Smith)

Even if the economy were growing at a faster pace, it wouldn’t come close to offsetting the interest payments on our ever-expanding debt. If you want to know why the Status Quo is unsustainable, just look at interest and debt. These are not difficult to understand: debt is a loan that must be paid back or discharged/written off and the loss absorbed by the lender. Interest is paid on the debt to compensate the owner of the money for the risk of loaning it to a borrower. It’s easy to see what’s happening with debt and the real economy (as measured by GDP, gross domestic product): debt is skyrocketing while real growth is stagnant. Put another way–we have to create a ton of debt to get a pound of growth. There is no other way to interpret this chart.

The Status Quo has only survived this crushing expansion of debt by dropping interest rates to historic lows. This is a chart of the yield on the 10-year Treasury bond, which reflects the extraordinary decline in interest rates over the past two decades. The Federal Reserve has pegged rates at essentially 0% for years. That means the strategy of lowering interest rates to enable more debt has run out of oxygen: rates can’t drop any lower, and so they can either stay at current levels or rise. Near-zero interest rates for banks borrowing from the Fed doesn’t mean conventional borrowers get near-zero rates: auto loans are around 4%, credit cards are still typically 16% to 25%, garden-variety student loans are around 8% and conventional mortgages are about 4.25% to 4.5% for 30-year fixed-rate home loans. This decline in interest rates means households can borrow more money while paying the same amount in interest. So the interest payment on a $30,000 car today is actually less than the payment on a $15,000 auto loan back in 2000.

Read more …

Not a sign that he’s feeling calm and collected.

• Mark Carney Blasts BIS For Calling For Rate Rises In A “Vacuum” (Telegraph)

Mark Carney has rejected calls by the Bank for International Settlements (BIS) for a swift return to normal interest rates, lambasting the lauded Swiss institution for operating “in a vacuum” and “outside political and economic reality”. The Governor of the Bank of England said that BIS, considered to be the “bank of central banks” and a bastion of monetary policy, was issuing recommendations from a false premise. Mr Carney views, which are the strongest dismissal of BIS yet among global central bankers, came hours after a shock rise in inflation led to more calls for a rise in interest rates. The jump in the Consumer Prices Index, from 1.5pc in May to 1.9pc in June, was the biggest monthly rise since October 2012.

Giving evidence to the Treasury Select Committee on financial stability, Mr Carney was asked his view on The Daily Telegraph’s interview with Jaime Caruana in which the head of BIS warned that the world economy is just as vulnerable now to financial crisis as it was in 2007. Mr Caruana had warned that investors were ignoring the risks of monetary tightening. In its annual report last month, BIS said the policy of “forward guidance”, adopted by the Bank of England and America’s Fed, was encouraging investors to take on more risk. Mr Carney told the MPs that the BIS report was “interesting”. But he added “It’s a report that’s made in a vacuum though, the vacuum of Basel, a world where a central bank doesn’t have a mandate… a world where a central bank is not accountable to Parliament and through Parliament to the people, to achieve specific targets.”

Read more …

• JPMorgan Pulls Back From Mortgage Lending On Foreclosure Worries (Reuters)

JPMorgan Chase & Co, the second-largest U.S. mortgage lender, is backing away from making home loans to less creditworthy borrowers after losing faith in its ability to recover much money from foreclosing on homes, even with government guarantees. The shift reflects a change in the way JPMorgan runs its mortgage business: while it used to regard collateral and U.S. government lending programs as key backstops to most of its loans, it now pays closer attention to the credit quality of borrowers. The bank wants to reduce the chances of having to foreclose on a loan, because it’s bad business. “The cost to take a customer through the foreclosure process is just astronomical now,” Kevin Watters, chief executive of JPMorgan Chase’s residential mortgage banking business in New York, told Reuters in an interview. In addition to federal standards, states, and in some cases local governments, have written their own rules making it more expensive for banks to recover loan losses, he said.

According to foreclosure data firm RealtyTrac, it took an average of 120 days to foreclose on a home at the beginning of 2007, just as the housing bubble was starting to burst. In the first quarter of 2014, it took 572 days, or more than 1.5 years. Lenders have generally been paying more attention to borrowers’ credit quality since the financial crisis, but JPMorgan is going a step further in its reluctance to rely on government loan guarantees and insurance. If other lenders choose the same path as JPMorgan, it could become more difficult for people to secure financing to buy homes, even though government programs are intended to help credit flow to these borrowers, said Christopher Mayer, a professor of real estate finance at Columbia University. “This could reduce the number of first-time buyers and slow the speed with which people who lost their homes during the crisis can become homeowners again,” said Mayer.

Read more …

You think?

• U.K. Buy-to-Let Real Estate: Headed for Mayhem? (Bloomberg)

Shahram Kordestani, who owns seven U.K. rental homes, has advice for investors eager to join the swelling ranks of landlords: Do so at your peril. Kordestani, who has been renting homes in London and southeast England for about 12 years, said when interest rates rise, the jump in mortgage payments will hammer buy-to-let investors who have helped push up property values. “There is going to be mayhem,” said Kordestani, 52. “Whoever pays those prices is going to suffer.”

The loan-to-income cap that Bank of England Governor Mark Carney introduced last month to cool Britain’s housing market does not apply to buy-to-let — the fastest-growing type of mortgage by value. Economists say a hike in the central bank’s benchmark interest rate or falling prices could result in a repeat of the past, when repossessions of private-landlord homes hit a record high after the 2008 financial crisis. “It was a mistake not to include buy-to-let investment,” said Rob Wood, a former central bank official who is now an economist at Berenberg Bank in London. “It’s one way in which households can speculate on house prices rising and that is exactly the sort of dangerous debt build-up that Mark Carney was trying to avoid.”

Read more …

Let’s not confuse cost of living with inflation.

• As UK Cost Of Living Rises, Young People Hit Hard (CNBC)

Low wage growth has plagued Britain’s economic recovery, failing to pick up despite firm signs elsewhere of a strengthening economy. Average weekly pay (including bonuses) in the three months to April expanded by just 0.7% year-on-year. This was below expectations and down from 1.9% in the three months to March. “It is becoming harder for people to get by as average wages continue to fall behind the rising cost of living. Ministers may have moved on from Britain’s living standards crisis but it’s still the top concern for families,” Frances O’Grady, general secretary of the TUC union, said in a statement. “An economic recovery based on shrinking pay packets is not one built to last.”

Young Britons have been hit hard by the rise in living costs, with a report by the Institute for Fiscal Studies (IFS) finding that “the recession and its aftermath have been much harder on the young than the old.” Between 2007-2008 and 2012-2013, real (inflation-adjusted) median household income among 22-30 year olds fell by 13%. In comparison, income fell 7% among 31-59 year olds, and remained stable for those aged 60 and over. This slide in real wages was driven, firstly, by a fall of 4%age points in employment of those in their 20s, the IFS said. The employment level remained unchanged among 31-59 year olds. Secondly, young peoples’ real median pay fell by 15%, while for people between the ages of 31-50, pay fell just 6%.

Read more …

Print print.

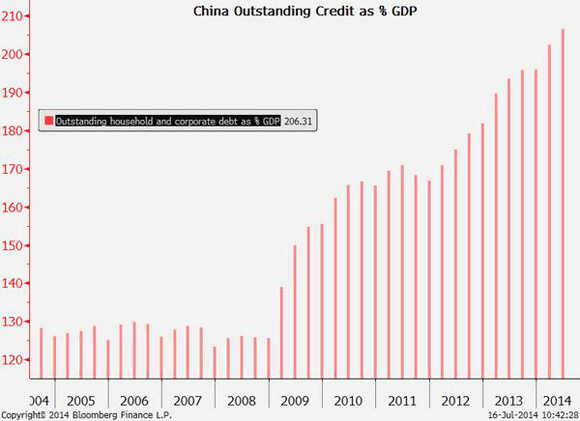

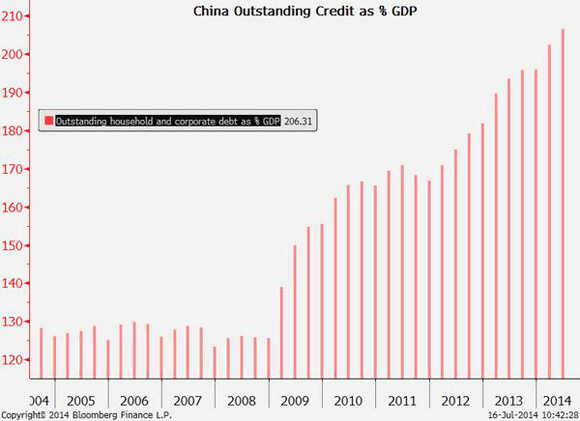

• China Developers At Risk As Trust Funds Dry Up (Reuters)

China’s shadow banking firms slashed lending to property developers in the first half of this year, closing off a crucial funding avenue just as the housing market cools, potentially spelling trouble for the sector and the broader economy. Trust companies, which pool money from rich people and companies to make high-interest loans and are part of the China’s vast and opaque shadow banking system, were a ready source of cash during the housing boom, particularly for smaller developers that had trouble borrowing from banks. But in the first half of this year, trusts lent real estate firms 39% less than in the previous six months, according to trust research company Use Trust based in Nanchang. At the same time, the average interest on 48.3 billion yuan ($7.78 billion) in loans made through wealth management products climbed 16 basis points to 9.67%.

That bodes ill for Chinese developers who must repay nearly 600 billion yuan ($96.83 billion) worth of trust loans next year, according to brokerage firm Jefferies. “Default risk is heightening because trusts rely heavily on house prices rising,” said Xie Ya Xuan, an economist at China Merchants Securities’ Research and Development Center in Shenzhen. Trust firms, under greater scrutiny from regulators worried about rapid growth of shadow banking, are both finding it harder to raise money themselves and growing wary of lending to developers, particularly smaller ones, while the market cools. New home prices in China fell in June for the third straight month, private sector surveys show, as some developers cut prices to spur sales, with many expected to offer steeper cuts as they scramble to meet 2014 sales targets.

Read more …

Don’t trust any numbers coming out of Beijing.

• China Is “Fixed”: GDP Beats As Retail Sales, Home Prices Tumble (Zero Hedge)

Having glimpsed the ugly reality of the under-belly of the Chinese economy last week, and the divergence between that and the government’s PMI survey fallacy, it is no surprise that by the magic of excel, GDP and Industrial Production modestly beat expectations (+7.5% YoY vs 7.4% exp and +9.2% YoY vs +9.0% exp respectively). However, despite epic credit injections, home prices tumbled 9.2% YoY and Retail Sales missed expectations rising only 12.4% YoY. Even as it is self-evident that re-flating the next chosen bubble, or attempting to socialize losses, is not sustainable in the long-run, it is clear (given the surge in deposit creation in recent months) that China has chosen the path of short-term easy-street as opposed to the reform-based hard-street they had promised.

Read more …

• Property Looms Over China’s Target (WSJ)

China is back on its official growth target. But given mounting property pain, investors have to wonder what trajectory it’s really on. Official figures show the economy grew 7.5% in the second quarter from a year earlier, the same rate as the government’s full-year growth target. On a seasonally adjusted basis, it expanded an annualized 8.2%, an acceleration from 6.1% in the first quarter, confirming earlier signals that the economy had picked up steam. It’s not hard to see why. A bundle of stimulus measures flowed through the economy, including a cheaper currency, easier lending conditions and accelerated government spending. Growth in total social financing, the broadest measure of lending in the economy, had been on a slowing trajectory for a year before picking back up in May and June.

One big fillip is from railroads. ANZ economists figure spending on new railways could be above 1 trillion yuan ($161 billion) this year, nearly 60% higher than last year and more than the amount spent in 2010, when China used railway construction as a stimulus in the wake of the global financial crisis. What’s harder to see is a bottom in the all-important property market. That will be the ultimate determinant of how much more stimulus Beijing will have to apply to keep the growth rate steady. Residential construction starts measured by floor space fell 15% last quarter from a year earlier, less steep than the first quarter, but still bad. And most troubling, unsold apartment inventories continue to rise, up 25% in June from a year earlier. Until buyers start eating away at the empty space, developers are unlikely to start new projects.

Read more …

Back to the shadows.

• China Shadow-Banking Curb Fuels Loan-Backed Debt Spree (Bloomberg)

Chinese banks’ sales of bonds backed by loans have surged 22-fold this year as the government seeks to curb shadow banking, while still allowing lenders to make room on their balance sheets for new financing. Banks have issued 78.7 billion yuan ($12.7 billion) of such securities, compared with 3.6 billion yuan in the same period last year and 15.8 billion yuan for all of 2013, Bloomberg-compiled data show. Such transactions must get approval from regulators and are more transparent than wealth-management products and trusts, which have been used by banks to bypass capital controls.

Premier Li Keqiang is seeking to shift financing to official channels after shadow-banking assets jumped 32% in 2013 to 38.8 trillion yuan, according to Barclays Plc estimates. The banking regulator tightened rules on new trust products in April, after failures of such investments sparked protests. Authorities approved the first asset-backed security tradable on the Shanghai stock exchange last month, and yesterday authorized the first mortgage-backed notes since 2007. “Regulators are closing one door, but opening a window,” said Liu Dongliang, a senior analyst in Shanghai at China Merchants Bank Co., the nation’s sixth-biggest lender. “To Chinese regulators, asset-backed securities, which are standardized products, are safer and more transparent than the shadow-banking products that are hard to monitor.”

Read more …

• 9 EU Countries Ready To Block Economic Sanctions Against Russia (RT)

France, Germany, and Italy are among EU members who don’t want to follow the US lead and impose trade sanctions on Russia. US sanctions are seen as a push to promote its own multibillion free-trade pact with Europe. “France, Germany, Luxembourg, Austria, Bulgaria, Greece, Cyprus, Slovenia, and EU President Italy see no reason in the current environment for the introduction of sectorial trade and economic sanctions against Russia and at the summit, will block the measure,” a diplomatic source told ITAR-TASS. In order for a new wave of sanctions to pass, all 28 EU members must unanimously vote in favor. EU ministers plan to discuss new sanctions against Russia at their summit in Brussels on Wednesday, July 16. Even if only one country vetoed, sanctions would not be imposed. With heavyweights like France and Germany opposed to more sanctions the measure will likely again be stalled, the source said.

According to the source, the US sees slapping Russia with sanctions as a way to promote its own trade agenda with Europe, a side rarely explored in mainstream media. The Transatlantic Trade and Investment Partnership (TTIP) between the US and Europe would create the world’s largest free trade zone, but some worry it could balloon into an “economic NATO” or could end up putting corporation interest above national. “Last year the EU and the US started difficult negotiations on a free trade agreement, which would force the EU into serious concessions, in particular, agricultural quality standards and regulation on genetically modified products. In this circumstance, restrictions against Russia will force EU countries to expand trade with the US,” the source said, citing shale gas as an example.

Read more …

Let’s see what happens. $50 billion is peanuts.

• BRICS Agree on $50 Billion Bank With Something for Everyone (Bloomberg)

Leaders of the five BRICS nations agreed on the structure of a $50 billion development bank by granting China its headquarters and India its first rotating presidency. Brazil, Russia and South Africa were also granted posts or units in the new bank. The leaders also formalized the creation of a $100 billion currency exchange reserve, which member states can tap in case of balance of payment crises, according to a statement issued at a summit in Fortaleza, Brazil. Both initiatives, which require legislative approval, are designed to provide an alternative to financing from the International Monetary Fund and the World Bank, where BRICS countries have been seeking more say. The measures coincide with a slowing of economic growth in the five countries to about 5.4% this year from 10.7% in 2007, according to economists surveyed by Bloomberg.

“The BRICS are gaining political weight and demonstrating their role in the international arena,” Brazilian President Dilma Rousseff said after a signing ceremony. Until the eve of the summit, India and South Africa had vied with China to host the headquarters of the bank, dubbed the New Development Bank. The administration of Indian Prime Minister Narendra Modi gave in after it was reminded that his country’s previous administration had agreed to Shanghai as the bank’s headquarter, according to an Indian official, who requested not to be named because the talks were not public.

Read more …

Portugal’s a place to watch.

• Portugal’s Bank Woes Just Got More Complicated (CNBC)

The saga surrounding troubled Portuguese lender Banco Espirito Santo (BES) took another twist on Wednesday, with the fortunes of a telecoms merger shedding more light on the strength of the country’s banking sector. Portugal Telecom rushed Wednesday to salvage a possible tie-up with Oi, the Brazilian telecoms company, after a possible default by Rioforte, an investment unit of the Espirito Santo group, called the deal into question. The two telecoms firms said they had signed a “memorandum of understanding”, in the hope of keeping the deal alive, and insisted they remained committed to “full completion” of the deal. Shares in Portugal Telecom rose 6.8% in morning trade. Concerns about a Portugal Telecom-Oi deal arose after Rioforte – a holding company of the Espírito Santo Group, which is responsible for its non-financial investments – missed a debt repayment of €847 million ($1.15 billion) on Tuesday evening.

Portugal Telecom bought the debt from Luxembourg-based Rioforte in April and it was held in subsidiaries of Portugal Telecom that were given to Oi in May in anticipation of the deal. However, both parties have now revised the terms of the merger and the Rioforte debt will be passed back to Portugal Telecom. The company has also said that it would pursue legal and procedural options against Rioforte and related parties to the “full extent of the law” in the hope of securing repayments on the debt. But Bill Blain, a fixed income strategist at Mint Partners, argued that debt of the various Espirito Santo holding companies was most likely “toast”. With regards to BES, he said the troubled lender should be now worried about its exposure to Portugal Telecom. “In the utter absence of any clear information or transparency, my best guess is that BES looks more and more likely to bail-in subordinated debt holders,” he said in a note, with junior debt holders facing the possibility of losing part of their investment.

Read more …

• Espirito Santo’s Rioforte Fails to Repay $1.2 Billion of Debt (Bloomberg)

Rioforte Investments SA, a holding company in Portugal’s Espirito Santo group, failed to pay 847 million euros ($1.2 billion) of short-term debt, becoming the second company in the group to miss a payment. Rioforte owes the money to Portugal Telecom SGPS SA, which said today the payment wasn’t made. Rioforte owns 49% of Espirito Santo Financial Group, which in turn holds 20% of Banco Espirito Santo SA, Portugal’s second-biggest bank by market value. Investors are concerned that financial problems within the Espirito Santo group will spill into the bank and subordinated bondholders may be made to take losses in a rescue. Luxembourg-based Rioforte plans to file for creditor protection, a person familiar with the matter said yesterday, asking not to be identified because they’re not authorized to speak about it. “This increases the risk that subordinated bondholders will get bailed in,” said Bill Blain, a strategist at brokerage Mint Partners Ltd. in London. “This is not good news for the bank.”

Read more …

• Mario Draghi is Alice. The Red King? Well, That’s Us (Ben Hunt)

So what makes the summer of 2014 different from the summer of 2012? If Draghi sang a lullaby to the fitful Red King two years ago with his “whatever it takes” pledge, why won’t he do the same today by following through with a no-muss-no-fuss ECB regulatory take-over of major EU banks? Odds are he will. But what’s different today is that it’s his own institution on the line. What’s different today is that a heartfelt speech and a mythical OMT program – pure Narratives, in other words – are not sufficient. The ECB actually has to assume responsibility for these banks if Draghi is to move forward with the next step of the Grand Plan, and there’s nothing intangible or mythic about that.

I think that the best way to understand the recent spate of write-downs and default notifications from European banks (Erste Bank on July 4th, Espirito Santo on July 10th) is in the context of this regulatory unification of big EU banks. For the first time in decades these banks are being examined for real. No more patsy national regulators with their revolving doors and inherited culpability, but a highly professional independent banking bureaucracy looking carefully at every bottle and tin in the pantry because they’re scared to death of swallowing some poisonous balance sheet. The problem for the ECB, of course, is that Espirito Santo and Erste are not isolated incidents, any more than Laiki and Fortis and Anglo Irish and WestLB and BMPS and … should I go on? … were isolated incidents.

The problem is that no amount of public scrubbing and show trials can change the fact that the entire European banking system has been an enthusiastic accomplice to domestic political interests for the past 30+ years, stuffing their collective balance sheets to the gills with loans in direct or indirect service to domestic political demands. What? You mean that 6 billion euros lent to politically-connected business interests in Angola (a Portuguese colony until 1975) were maybe not such a good idea for Espirito Santo? I’m shocked! But precisely because the politically-inspired rot is so widespread, taking a bank like Espirito Santo into the street and shooting it in the head no more solves Europe’s systemic banking crisis than executing Bear Stearns in March 2008 solved the US systemic banking crisis. As Dorothy Parker once wrote, “beauty is only skin deep, but ugly goes clear to the bone.” That’s the European financial system: politically ugly, clear to the bone.

Read more …

• Return To Normalcy – Even The Supply Of Greater Fools Is Limited (Alhambra)

The Fed has kept interest rates at zero for 6 years now and their expectations setting forward guidance says 7 is in the bag. For all those who worried that the US might turn into Japan, well worry no more, that ship has sailed. Over a half decade of zero interest rates says we already have become Japan, with the same demographic, productivity and structural problems so well documented. High taxes, a shrinking workforce, offshored production, protection of large incumbent firms, political gridlock, a falling savings rate, a growing xenophobia and an affinity for sushi all point to America as the economic kissing cousin of the land of the setting sun. Turns out the Vapors were not just one hit wonders but keen eyed economic forecasters as well.

The US economy isn’t acting normally, now in the 6th year of an anemic expansion the likes of which we haven’t seen since, well, never. The temptation is to compare this period with the Great Depression but even the recovery from the early part of that self inflicted economic wound was better in some respects. The unemployment rate has fallen but the path of improvement has been a road less traveled in economic history. No matter the reason, full time employment has become an unreachable dream for too many Americans. Multiple part time jobs and underemployment have made debt a way of life, starting with the ubiquitous student loan and throughout life as a way to achieve the perception, the illusion, of success, if not the real thing.

Companies aren’t investing for the future, preferring to spend on the present through stock buybacks and dividends that in many cases exceed their current cash flow, the difference being plugged with debt. Balance sheets are seen as sound by investors who see cash on the asset side of the ledger, forgetting apparently that there is a liability side as well. Where we have seen investment, the returns have left much to be desired. The capital sunk into extracting high cost oil and gas is staggering, approaching $1 trillion per year and $5.5 trillion globally since 2008. What we got for that staggering sum is not a single field that can produce profitably at less than $80/barrel and $4.5 per foot of gas. In some cases, the search for oil has gone to such extremes the breakeven prices are well over $100/barrel.

Read more …

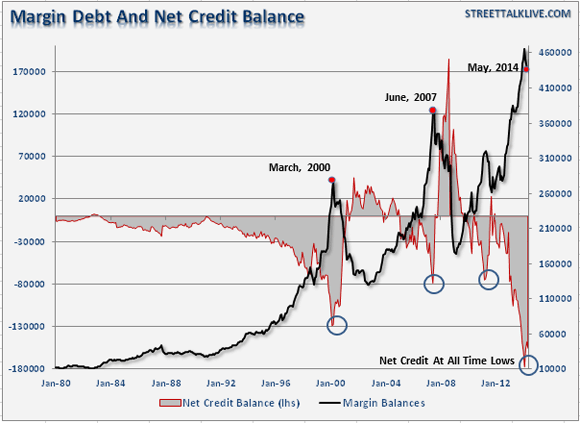

Scary graph.

• Every Time Is Different, And The Same (STA)

Market crashes are an “emotionally” driven imbalance in supply and demand. You will commonly hear that “for every buyer there must be a seller.” This is absolutely true to a point. However, what moves prices up and down, in a normal market environment, is the price level at which a buyer and seller complete a transaction. In a market crash, however, the number of people wanting to “sell” vastly overwhelms the number of people willing to “buy.” It is at these moments that prices drop precipitously as “sellers” drop the levels at which they are willing to dump their shares in a desperate attempt to find a “buyer.” This has nothing to do with fundamentals. It is strictly an emotional panic which is ultimately reflected by a sharp devaluation in market fundamentals.”

(Note: this is also the danger of excessive margin debt in the financial markets. Margin debt is comprised of “loans” based on the value of a stock portfolio. As prices plunge, the drop in valuations trigger “calls” on margin loans which then requires more sells. The additional selling triggers more selling, and so on. In a highly complacent market environment, as we have currently, there is little attention paid to geopolitical tensions, economic or fundamental data or a variety of other relevant risks. The emotional “greed” to chase returns overrides the sense of logic. “Warnings” that do not immediately lead to a market correction are simply viewed as wrong. However, as investors, are we not repeatedly told to “buy when there is blood in the streets.” Yet, in order to be able to buy in times of “panic,” one would have needed to have “sold” into “exuberance.”

The point is simple. Stock market crashes are triggered by an “emotional panic,” rather than a fundamental data point. While fundamentals are indeed important in determining the long-term (10 years or more) return on an investment, they are terrible at predicting “emotionally driven” turning points in market prices. Like a crowded theatre, no one worries when one or two people exit the building. However, the problem comes when someone yells “fire” and everyone tries to exit the building at the same time. The rush for the exits sends share prices plummeting regardless of the underlying fundamentals.

Read more …

• Our Market Society Has Made A Deal With The Devil (Paul B. Farrell)

There is someone who brilliantly explains why free-market capitalism is controlling our brains, sabotaging our world: Harvard philosopher Michael Sandel, author of bestseller “What Money Can’t Buy: The Moral Limits of Markets, and Justice: What’s the Right Thing to Do?” For more than three decades Sandel’s been teaching us why capitalism is undermining human morality. And why we choose to deny it. Why do we bargain away our moral soul? His classes number over a thousand. You can even take his course online free. He summarized capitalism’s takeover of the human conscience in “What Isn’t for Sale?” in the Atlantic. Listen: “Without being fully aware of the shift, Americans have drifted from having a market economy to becoming a market society … where almost everything is up for sale.” Capitalism is America’s new “way of life where market values seep into almost every sphere of life and sometimes crowd out or corrode important values, non-market values.” His course should be required for Wall Street insiders, corporate CEOs, and all 95 million Main Street investors.

Here’s an overview: “The years leading up to the financial crisis of 2008 were a heady time of market faith and deregulation — an era of market triumphalism,” says Sandel. “The era began in the early 1980s, when Ronald Reagan and Margaret Thatcher proclaimed their conviction that markets, not government, held the key to prosperity and freedom.” Then in the 1990s the “market-friendly liberalism of Bill Clinton and Tony Blair … consolidated the faith that markets are the primary means for achieving the public good.” Yes, Ayn Rand’s “pure, uncontrolled, unregulated laissez-faire capitalism” took over America’s brain, our soul, and became the nation’s collective unconscious. For both the GOP and Dems. Today “almost everything can be bought and sold,” warns Sandel. “Markets, and market values, have come to govern our lives as never before.” Yet few are aware of this historic shift. “We did not arrive at this condition through any deliberate choice. It is almost as if it came upon us,” says Sandel.

Read more …

Oxfam director.

• Why Your Morning Corn Flakes Could Milk Your Money (MarketWatch)

For many of us, climate change evokes images of skies darkened by coal-burning plants or oceans slick from spilled oil. But it’s time to take a closer look at another industry with hands dirty from polluting the atmosphere — an industry whose investors have a great deal to lose if nothing is done to stop the climate crisis: Food companies. People don’t normally think “climate change” when they sit down to enjoy a favorite meal. Tony the Tiger and the Pillsbury Doughboy don’t evoke images of droughts, floods or storms. But maybe they should. Oxfam recently released a report, “Standing on the Sidelines,” which shows that reckless deforestation, nitrous oxide released from the overuse of fertilizers, large-scale land clearance, and other harmful production practices in the industrial-scale supply chains of the world’s 10-biggest food companies are huge contributors to global warming that, ironically, could cause tens of millions of people to suffer hunger unnecessarily.

Together, these 10 companies, Associated British Foods, Coca-Cola, Danone, General Mills, Kellogg, Mars, Mondelez, Nestlé, PepsiCo and Unilever, create an astounding 264 million tons of greenhouse gas emissions every year — as much as 69 coal-fired power plants. If these “Big 10” were a country, it would be the 25th biggest polluter on the planet, spewing more emissions than oil and gas producers Qatar and the United Arab Emirates. The emissions these companies cause are contributing to a growing humanitarian catastrophe. By 2050, there could be 50 million more people made hungry because of climate change. More frequent, unpredictable and extreme storms, floods, droughts and shifting weather patterns are affecting food supplies, driving up food prices and causing more hunger and poverty.

Read more …

• Huge ND Wastewater Spill Prompts Calls For Fracking Regs (Oilprice.com)

Beaver dams have so far prevented about 1 million gallons of fracking wastewater discovered spilled July 8 from a rural North Dakota pipeline from spreading too far. But area residents, environmentalists and even a Republican state legislator all want more reliable measures. The spill of the toxic saltwater, a byproduct of hydraulic fracturing, came from gas extraction operations at the Fort Berthold Indian Reservation and occurred days before it was discovered. The federal Environmental Protection Agency said the underground pipeline spilled about 24,000 barrels, or 1 million gallon, in North Dakota’s thriving oil and gas region. The water, which can be 10 times saltier than seawater and contains salt and fossil fuel condensates, was being piped away from fuel extraction sites for safe disposal.

The spill has been threatening Bear Den Bay on nearby Lake Sakakawea, which provides water for the reservation occupied by the Arikara, Hidasta and Mandan tribes, though the EPA said there is no evidence that the lake has been contaminated. In fact, it said, most of the saltwater had pooled near where it had spilled and that beaver dams in the area had kept it from spreading. As a result, the EPA said, the local soil has simply been absorbing the spill. That’s a bit too fortuitous for Wayde Schafer, a spokesman for the Sierra Club in North Dakota. He said there have been four other spills in the region recently, including three caused by lightning strikes and a fourth attributed to a cow that rubbed against a tank valve. With its current oil and gas boom, North Dakota has become the second most productive energy state behind Texas. By relying greatly on fracking, though, it also produces millions of barrels of wastewater daily that, like nuclear waste, must be buried underground forever.

In 2013 alone, there were 74 pipeline leaks that spilled 22,000 barrels of saltwater. Yet that same year, the North Dakota Legislature voted 86 to 4 against a bill that would have mandated flow meters and cutoff switches on wastewater-disposal pipelines. Energy companies protested the cost of such measures, and even state regulators argued they wouldn’t detect small leaks.

Read more …