Leonardo da Vinci Salvator Mundi 1513

It doesn’t get much more damning than this. Nothing Monty Python about it.

• Landmark Study Links Tory Austerity To 120,000 Deaths (Ind.)

The Conservatives have been accused of “economic murder” for austerity policies which a new study suggests have caused 120,000 deaths. The paper found that there were 45,000 more deaths in the first four years of Tory-led efficiencies than would have been expected if funding had stayed at pre-election levels. On this trajectory that could rise to nearly 200,000 excess deaths by the end of 2020, even with the extra funding that has been earmarked for public sector services this year. Real terms funding for health and social care fell under the Conservative-led Coalition Government in 2010, and the researchers conclude this “may have produced” the substantial increase in deaths.

The paper identified that mortality rates in the UK had declined steadily from 2001 to 2010, but this reversed sharply with the death rate growing again after austerity came in. From this reversal the authors identified that 45,368 extra deaths occurred between 2010 and 2014, than would have been expected, although it stops short of calling them “avoidable”. Based on those trends it predicted the next five years – from 2015 to 2020 – would account for 152,141 deaths – 100 a day – findings which one of the authors likened to “economic murder”. The Government began relaxing austerity measures this year announcing the end of its cap on public sector pay rises and announcing an extra £1.3bn for social care in the Spring Budget. Over three years the additional funding for social care is expected to reach £2bn, which Labour leader Jeremy Corbyn said was “patching up a small part of the damage” wrought by £4.6bn cuts.

[..] The papers’ senior author and a researcher at UCL, Dr Ben Maruthappu, said that while the paper “can’t prove cause and effect” it shows an association. And he added this trend is seen elsewhere. “When you look at Portugal and other countries that have gone through austerity measures, they have found that health care provision gets worse and health care outcomes get worse,” he told The Independent. One of his co-author’s, Professor Lawrence King of the Applied Health Research Unit at Cambridge University, said it showed the damage caused by austerity “It is now very clear that austerity does not promote growth or reduce deficits – it is bad economics, but good class politics,” he said. “This study shows it is also a public health disaster. It is not an exaggeration to call it economic murder.”

After a report like that, yes. The Tories have taken things too far.

• Jeremy Corbyn Will Inevitably Become UK Prime Minister – Varoufakis (BI)

Yanis Varoufakis, former finance minister of Greece and author of “Adults in the Room: My Battle with the European and American Deep Establishment,” explains that Jeremy Corbyn as Prime Minister may be a likely scenario and that this would be beneficial for the UK economy. The following is a transcript of the video. Isn’t it astonishing that after Jeremy Corbyn was being described as “the longest suicide note by the Labour Party” about a year ago, today there is an air of inevitability in a Corbyn-led government. I think it’s a delicious irony and I’m very excited by this transition from impossibility to inevitability. In the interests of full disclosure, I’m a friend of Jeremy Corbyn, a supporter, I’ve worked with his team and will continue to do so.

I believe that the re-orientation of British politics under Corbyn and in particular of the Labour Party is highly beneficial, not only to the large strata within British society that have been discarded in the last 20 to 30 years, but interestingly also for British business that produces real stuff as opposed to the City of London and various other service sectors that produce precarious jobs and nothing much of substance. British manufacturing has been left in the margins for far too long and the dearth of investment in fixed capital is something that this Conservative government has absolutely no interest in, or no concept of. A Labour, Corbyn-led government, might be what is necessary in order to create better circumstances both for labour and manufacturing capital in the United Kingdom.

“Quite simply, people get hurt when the rich don’t pay their taxes.”

• Why Care More About Benefit Scroungers Than Billions Lost To The Rich? (G.)

Will the Paradise Papers shift the public’s focus? The leaks alone are seemingly not enough. The 2016 British Social Attitudes survey was conducted just four months after the release of the Panama Papers. Even then, the British public remained more concerned about benefit claimants than tax avoiders. Fundamentally, the Paradise Papers are about numbers – vast sums of money disappearing offshore that could be spent on public services here in the UK. However, as the former chair of the UK Statistics Authority, Andrew Dilnot, has often pointed out, people are bad at dealing with numbers on this scale. Unless you are an economist or a statistician, numbers in the millions and billions are just not particularly meaningful.

The key is to link these numbers to their consequences. The money we lose because people like Lewis Hamilton don’t pay some VAT on their private jet means thousands more visits to food banks. The budget cuts leading to rising homelessness might not have been necessary if Apple had paid more tax. Fewer people might have killed themselves after a work-capability assessment if companies like Alphabet (Google) had not registered their offices in Bermuda, and the downward pressure on benefits payments was not so intense. The causal chains connecting these events are complex and often opaque, but that does not make their consequences any less real, especially for those who have felt the hard edge of austerity.

The Paradise Papers have dragged the murky world of offshore finance into the spotlight. However, calls for change may founder against the British public’s persistent focus on the perceived crimes of the poor. That is, unless we – as academics, politicians, journalists and others – can articulate how the decisions of the very rich contribute to the expulsion of the vulnerable from the protection of state-funded public services. Quite simply, people get hurt when the rich don’t pay their taxes.

Oh, cut it out.

• No Evidence Of Russian Interference In Brexit, PM May Admits In Parliament (RT)

Theresa May has rejected allegations that Russia interfered in the Brexit referendum. Speaking during Prime Minister’s Questions, she stated: “If they care to look at the speech on Monday, they will see that the examples I gave were not in the UK.” During a speech May gave at the Lord Mayor’s banquet, the British leader accused Russia of meddling in European elections, hacking attacks on western government institutions, and spreading fake news. During the customarily confrontational Prime Minister’s Questions, May said that, in her speech, she had indeed cited “Russian interference” occurring “in a number of countries in Europe.” However, she denied that this applied in any way to her own country.

Following the session, a spokesperson for Labour leader Jeremy Corbyn said that “I think we need to see more evidence about what’s being talked about. “In relation to Russia and tensions between NATO and Russia and western powers and Russia more generally, Jeremy has made clear on a number of occasions that we need to see an attempt through dialogue to ratchet down tensions with Russia.” May was responding to a question from Labour MP Mary Creagh, who referred to an assertion by Foreign Secretary Boris Johnson that he had seen no evidence of Russia interfering in the Brexit referendum. Johnson made the comment during an appearance before a Commons committee hearing on November 1. Upon prompting by a senior civil servant, Johnson replied “nyet,” and added in English that there was “not a sausage” of evidence.

Once again: China needs its foreign reserves.

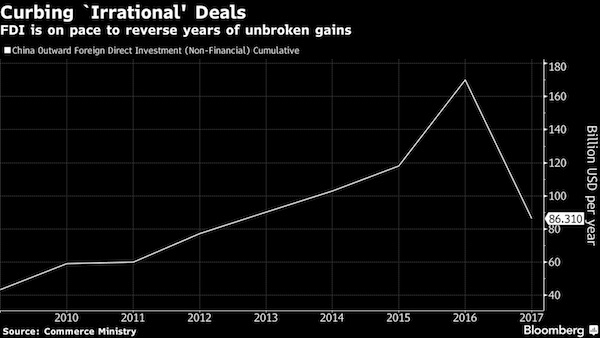

• China’s Outbound Investment Plunged 41% On Year In January To October (BBG)

China’s non-financial outbound investment slumped to $86.3 billion in January to October, plunging 41% from a year earlier, as projects in some industries dried up. There were no new real estate, sports or entertainment deals for the period, the Commerce Ministry said in a statement Thursday. Most outbound investment was in leasing and business services, manufacturing, wholesale and retail sales and information technology services. “Irrational” outbound investment has been curbed further, the ministry said, repeating the language it has used this year as authorities push to halt capital outflows.

That’s reversing an unbroken streak of acceleration since at least 2010: Outbound investment soared 44.1% last year to $170.1 billion, about four times the 2009 level, Mofcom data show. “The combination of hardened capital controls and a crackdown on outbound M&A has dented China’s overseas investment,” said Tom Orlik, chief Asia economist at Bloomberg Economics in Beijing. “A short-term downturn was necessitated by the pressing need to stabilize the yuan. Sustained for too long, falling overseas investment would be tough to square with ambitions for greater international influence through the Belt and Road program.”

In which sorcery is somehow the opposite of socialism.

• Senior China Minister Says Some Officials Practice Sorcery (R.)

Some top Chinese officials are guilty of practicing sorcery and would rather believe in gurus and Western concepts of democracy than the Communist Party, a senior minister wrote on Thursday, warning of the danger they presented to its survival. China guarantees freedom of religion for major belief systems such as Buddhism, Christianity and Islam, but party members are meant to be atheists and are barred from what it calls superstitious practices, such as visits to soothsayers. Recent years have seen several cases of officials jailed as part of President Xi Jinping’s crackdown on corruption being accused of superstition, part of the party’s efforts to blacken their names.

Some senior officials in leadership positions had “fallen morally”, their beliefs straying from the correct path, wrote Chen Xi, the recently appointed head of the party’s powerful Organisation Department that oversees personnel decisions. “Some don’t believe in Marx and Lenin but believe in ghosts and gods; they don’t believe in ideals but believe in sorcery; they don’t respect the people but do respect masters,” he wrote in the official People’s Daily, referring to spiritual leaders or gurus. People in China, especially its leaders, have a long tradition of turning to soothsaying and geomancy to find answers to their problems in times of doubt, need and chaos. The practice has grown more risky amid Xi’s war on graft, in which dozens of senior officials have been imprisoned.

Large scale arrests in the future?

• Corruption in China Could Lead To Soviet-Style Collapse – Graft Buster (ToI)

China must step up its battle against corruption in order to safeguard against a Soviet-style collapse, the country’s second most senior graft buster said in an editorial on Wednesday. Yang Xiaodu, the deputy secretary of the Central Commission for Discipline Inspection, who was promoted to the ruling Communist Party’s 25-strong Politburo last month, said failure would risk the “red country changing colour”. In unusually direct and strongly worded criticism of previous administrations, Yang said “in a previous period”, corruption had been allowed to fester to such an extent that the party’s leadership had weakened, with supervision soft, and ideology apathetic. “It had developed to the point where if not rectified, the country could change colour,” Yang wrote in the official People’s Daily.

“The future fate of the party and the country’s people could follow the same old road to ruin as the Soviet Union and the Eastern Bloc.” President Xi Jinping, like many officials before him, is steeped in the party’s long-held belief that loosening control too quickly or even at all could lead to chaos and the break up of the country. The party regularly implores cadres to study the collapse of the Soviet Union in the early 1990s. Yang’s editorial is the latest salvo signalling that the intensity of Xi’s signature war on corruption would not wane despite the departure of Xi’s right-hand man, Wang Qishan, who was widely seen as China’s second most powerful politician before being replaced as anti-corruption chief in a leadership reshuffle last month. Wang’s replacement, Zhao Leji, wrote a similarly strongly worded editorial in the People’s Daily on Saturday.

Not doing well. At all.

• The Complete Idiot’s Guide To The Biggest Risks In China (ZH)

With both commodities and Chinese stocks suffering sharp overnight drops, it is hardly surprising that today trading desks have quietly been sending out boxes full of xanax their best under-25 clients (those veterans who have seen one, maybe even two 1% market crashes), along with reports explaining just what China is and why it matters to the new generation of, well, traders. One such analysis, clearly geared to the Ritalin generation complete with 3 second attention spans, comes from Deutsche Bank which in a few hundred words seeks to explain the key risks threatening the world’s most complex centrally-planned economy, and ground zero of the next financial crash. Which, one day after our summary take on why the Chinese commodity, economic and financial crash is only just starting (as those who traded overnight may have noticed), is probably a good place to reiterate some of the more salient points.

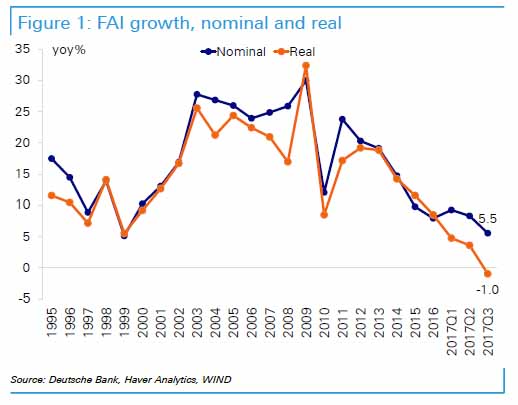

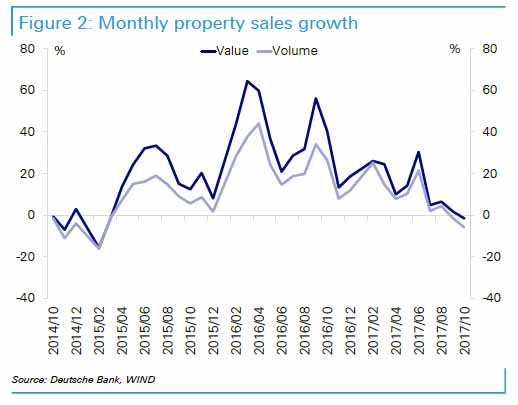

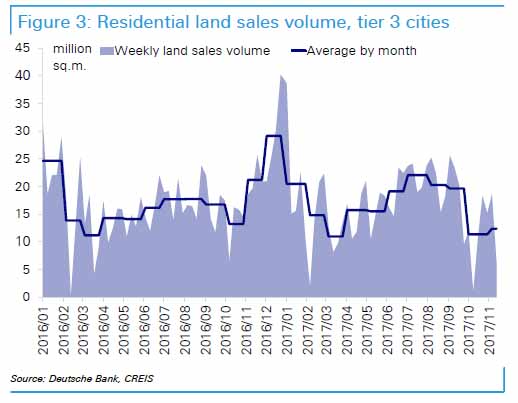

As Deutsche Bank’s Zhiwei Zhang writes in “Risks to watch in the next six months”, the key thing to keep in mind about China now that the 19th Party Congress is in the rear-view mirror, is that the government is likely to tolerate slower growth in 2018. Han Wenxiu, the deputy head of the Research Office of the State Council, said that GDP growth at 6.3% in 2018-2020 would be sufficient to achieve the Party’s 2020 growth target. And while this is a positive message for the long term, it indicates growth will likely slow in 2018. And, as DB warns, recent economic data suggest the economic cycle has indeed cooled down. For all those seeking key Chinese inflection points, here are the three big red flags involving China’s economy:

For the first time since Q4 2004, fixed asset investment (FAI) growth turned negative in real terms in Q3 this year.

Growth of property sales for the nation turned negative as well in October, the first time since 2015.

The property market boom in Tier 3 cities is also losing momentum.

We hope not to have lost by now all the Millennial traders who started reading this post. To those who persevered, here – in addition to the risks facing the economy – are the other two main risks facing China’s investors: (rising) inflation and (rising) interest rates.

The most corrupt are the most powerful. Cue China.

• Why the Anti-Corruption Drive in Saudi Arabia is Doomed to Fail (CP)

The problem in resource-rich states is that corruption is not marginal to political power, but central to acquiring it and keeping it. Corruption at the top is a form of patronage manipulated by those in charge, to create and reward a network of self-interested loyalists. It is the ruling family and its friends and allies who cherrypick what is profitable: this is as true of Saudi Arabia as it was true of Libya under Gaddafi, Iraq under Saddam Hussein and his successors, or Iraqi Kurdistan that was supposedly different from the rest of the country. Corruption is a nebulous concept when it comes to states with arbitrary rulers, who can decide – unrestrained by law or democratic process – what is legal and what is illegal. What typifies the politics of oil states is that everybody is trying to plug into the oil revenues in order to get their share of the cake.

This is true at the top, but the same is the case of the rest of the population, or at least a large and favoured section of it. The Iraqi government pays $4bn a month to about seven million state employees and pensioners. These may or may not do productive work, but it would be politically risky to fire them because they are the base support of the regime in power. Anti-corruption drives don’t work, because if they are at all serious, they soon begin to cut into the very roots of political power by touching the “untouchables”. At this point principled anti-corruption campaigners will find themselves in serious trouble and may have to flee the country, while the less-principled ones will become a feared weapon to be used against anybody whom the government wants to target.

A further consequence of the traditional anti-corruption drive is that it can paralyse government activities in general. This is because all officials, corrupt and incorrupt alike, know that they are vulnerable to investigation. “The safest course for them is to take no decision and sign no document which might be used or misused against them,” a frustrated American businessman told me in Baghdad some years ago. He added that it was only those so politically powerful that they did not have to fear legal sanctions who would take decisions – and such people were often the most corrupt of all.

Wishful thinking?

• Saudi Walks Back Escalation As Dramatic Moves Backfire (AP)

Saudi Arabia’s dramatic moves to counter Iran in the region appear to have backfired, significantly ratcheting up regional tensions and setting off a spiral of reactions and anger that seem to have caught the kingdom off guard. Now it’s trying to walk back its escalations in Lebanon and Yemen. On Monday, the kingdom announced that the Saudi-led coalition fighting Shiite rebels in Yemen would begin reopening airports and seaports in the Arab world’s poorest country, days after closing them over a rebel ballistic missile attack on Riyadh. The move came just hours after Lebanese Prime Minister Saad Hariri, who shocked the nation by announcing his resignation from the Saudi capital on Nov. 4, gave an interview in which he backed off his strident condemnation of the Lebanese militant Hezbollah, saying he would return to the country within days to seek a settlement with the Shiite militants, his rivals in his coalition government.

The two developments suggest that Saudi Arabia’s bullish young crown prince, Mohammed bin Salman, may be trying to pedal back from the abyss of a severe regional escalation. “This represents de-escalation by the Saudis,” said Yezid Sayigh, a senior fellow at the Carnegie Middle East Center in Beirut. “The general trend is that the Saudis are going to back off and this is largely because of the unexpected extent of international pressure, and not least of all U.S. pressure.” Mohammed bin Salman, widely known by his initials, MBS, has garnered a reputation for being decisive, as well as impulsive. At just 32 years old and with little experience in government, he has risen to power in just three years to oversee all major aspects of politics, security and the economy in Saudi Arabia. As defense minister, he is in charge of the Saudi-led war in Yemen.

He also appears to have the support of President Donald Trump and his son-in-law, senior adviser Jared Kushner, who visited the Saudi capital earlier this month. Saudi partners in the Gulf and the Trump administration rushed to defend the kingdom publicly after a rebel Houthi missile was fired at the Saudi capital, Riyadh, from Yemen last week. A top U.S. military official also backed Saudi claims that the missile was manufactured by Iran. However, Saudi Arabia’s move to tighten an already devastating blockade on Yemen in response to the missile was roundly criticized by aid groups, humanitarian workers and the United Nations, which warned that the blockade could bring millions of people closer to “starvation and death.” Saudi Arabia’s decision to ease the blockade after just a week suggests it bowed to the international criticism, and did not want the bad publicity of even more images of emaciated Yemeni children and elderly people circulating online and in the media.

“WaPo ran sixteen smear pieces on Bernie Sanders in the span of sixteen hours at the hottest point in the Democratic presidential primary battle.”

• Friendly Reminder That Jeff Bezos Is Trying To Take Over The Universe (CJ)

Jeff Bezos, currently the wealthiest human being on planet Earth, did not purchase the Washington Post in 2013 because he was expecting newspapers to make a lucrative resurgence. This self-evident fact doesn’t receive enough attention. I will say it again for emphasis: Jeff Bezos, who has used his business prowess to become the wealthiest person in the world, did not purchase the Washington Post in 2013 because he was expecting newspapers to make a profitable comeback. That did not happen. What did happen is the world’s richest plutocrat realizing that he needed a mouthpiece to manufacture public support for the neoliberal corporatist establishment that he is building his empire upon. This is why WaPo ran sixteen smear pieces on Bernie Sanders in the span of sixteen hours at the hottest point in the Democratic presidential primary battle.

[..] Last year Silicon Valley venture capitalist Chamath Palihapitiya said that Amazon is “a multi-trillion-dollar monopoly hiding in plain sight.” In June Stacy Mitchell, co-director of the Institute for Local Self-Reliance, wrote that Amazon is trying to “control the underlying infrastructure of the economy.”\ Bezos continues to get cozier and cozier with the US power establishment as his empire metastasizes across human civilization. He kicked WikiLeaks off Amazon servers in 2010, he scored a 600 million dollar contract with the CIA in 2013, he joined a Pentagon advisory board in 2016, he hung out with Defense Secretary James Mattis in August, and he’s spent nearly ten million dollars this year lobbying the federal government, which is likely what led to an NDAA amendment gifting Amazon a $54 billion market it’s expected to dominate as a supplier to the Pentagon. Billion. With a ‘b’.

[..] I gave this story a jokey headline, but seriously, watch Jeff Bezos very closely. Your future is increasingly more likely to be imperiled by new money tech plutocrats like him than by old money plutocrats like Soros and the Rothschilds.

Interesting. Earthquakes are no. 1 incentive.

• Why Japan Knocks Down Its Houses After 30 Years (G.)

In the suburban neighbourhood of Midorigaoka, about an hour by train outside Kobe, Japan, all the houses were built by the same company in the same factory. Steel frames fitted out with panel walls and ceilings, these homes were clustered by the hundreds into what was once a brand new commuter town. But they weren’t built to last. Daiwa House, one of the biggest prefabricated housing manufacturers in Japan, built this town in the 60s during a postwar housing boom. It’s not unlike the suburban subdivisions of the western world, with porches, balconies and rooflines that shift and repeat up and down blocks of gently curving roads. Most of those houses built in the 60s are no longer standing, having long since been replaced by newer models, finished with fake brick ceramic siding in beiges, pinks and browns.

In the end, most of these prefabricated houses – and indeed most houses in Japan – have a lifespan of only about 30 years. Unlike in other countries, Japanese homes gradually depreciate over time, becoming completely valueless within 20 or 30 years. When someone moves out of a home or dies, the house, unlike the land it sits on, has no resale value and is typically demolished. This scrap-and-build approach is a quirk of the Japanese housing market that can be explained variously by low-quality construction to quickly meet demand after the second world war, repeated building code revisions to improve earthquake resilience and a cycle of poor maintenance due to the lack of any incentive to make homes marketable for resale. In Midorigaoka, even the newer homes built in the 80s and 90s are nearing the end of their expected lifespan.

Under normal circumstances, their days might be numbered. But down at the end of one block, there’s a sign things are changing. Scaffolding surrounds a vacant house on a corner and workers from Daiwa House are clanging away inside. They’re not demolishing the house but refurbishing it – reorganising the floor plan, knocking down walls, opening up the kitchen and enhancing the insulation. Rather than tear down the house so the next buyer can build something new, they’re rebuilding it from the inside and putting it back on the market. It’s a relatively rare commodity, but something that is increasingly common across Japan: a secondhand home.

I’ve long predicted that Greece will be much less peaceful once Syriza loses power. But yeah, the whole country’s put up for sale, so foreigners are certain to take over.

• Kyle Bass: Investors to Pour Billions into Greece after Political Change (GR)

Hedge fund manager, Kyle Bass, believes that Greece will come out of the crisis and investors will pour billions into its economy once the government changes, according to a CNBC report. The founder and chief investment officer of Hayman Capital Management; which manages an estimated $815 million in assets, is closely following the course of the Greek economy and political situation, and has invested in Greek bank stocks. Bass says that foreign investors are waiting on the sidelines for a political shift to take place in 2018. “My best guess is a snap election for prime minister will be called between April and September of next year and Prime Minister Alexis Tsipras will lose power. When that happens, there will be a massive move into the Greek stock market. Big money will flow in as investors feel more confident with a more moderate administration,” Bass said.

“It’s going to take Kyriakos Mitsotakis; president of New Democracy, the Greek conservative party, to be voted in as prime minister to reform the culture and rekindle investor confidence,” the investor said. “I have no doubt 15 billion euros in bank deposits will come back to Greek banks if he’s elected. The stock and bond markets will also jump following the election.” Bass says that global investors are waiting for the political change in order to invest in real estate, energy and tourism. So far, the hedge fund manager noted, Greece has proceeded with privatizations of its main port; regional airports; its railway system; the largest insurance company, and there are more important ones to be completed within the next two years. “There is so much potential in Greece,” Bass said, noting that investors are waiting for the right moment to enter, the CNBC report concludes.

Europe just lets it get worse.

• Lesvos Reaches Breaking Point, Mayor Declares General Strike (G.)

With reception centers on Lesvos bursting at the seams and dozens more migrants arriving daily, the island’s mayor, Spyros Galinos, on Tuesday declared a general strike for Monday in protest. Currently, some 1,500 people – including hundreds of small children – are stranded on the island living in tents, and fears are growing that winter may bring a new humanitarian crisis. In total, there are more than 8,000 migrants and refugees on Lesvos, a favored destination of traffickers bringing people over from neighboring Turkey. “Lesvos has a population of 32,000 residents and there are at the moment 8,300 migrants and refugees,” Galinos told Kathimerini. Moreover, local police union members held a protest over deteriorating working conditions.

“The situation on Lesvos has fueled insecurity among citizens. The police force is dealing exclusively with the migrant issue,” the union chief Dimitris Alexiou said. “We are not expendables,” he added. And with flows to the eastern Aegean islands from Turkey showing no signs of letting up, locals and migrants have reached the end of their tether. Since the beginning of November, 1,603 people have arrived on the islands. In September, 6,000 people arrived from Turkey, the same number as in October. On Monday, another 101 migrants landed on eastern Aegean islands, while more than 400 arrived over the weekend. The situation in the Moria camp on Lesvos is a case in point.

“Conditions at Moria have reached breaking point as the facility is three times over capacity,” said Michael Bakas, coordinator of the northern Aegean branch of the Ecologist Greens, who escorted visiting Group of the Greens MEP and vice chairwoman of the European Parliament’s Subcommittee on Human Rights Barbara Lochbihler. Bakas said about 1,000 children are currently stranded at the camp. The issue will be discussed at the EU assembly on Wednesday.

Monsanto must now have as many lawyers as scientists on its payroll. Time to say enough is enough.

• Monsanto, US Farm Groups Sue California Over Glyphosate Cancer Warnings (R.)

Monsanto and U.S. farm groups sued California on Wednesday to stop the state from requiring cancer warnings on products containing the widely used weed killer glyphosate, which the company sells to farmers to apply to its genetically engineered crops. The government of the most populous U.S. state added glyphosate, the main ingredient in Monsanto’s herbicide Roundup, to its list of cancer-causing chemicals in July and will require that products containing glyphosate carry warnings by July 2018. California acted after the World Health Organization’s International Agency for Research on Cancer (IARC) concluded in 2015 that glyphosate was “probably carcinogenic”. For more than 40 years, farmers have applied glyphosate to crops, most recently as they have cultivated genetically modified corn and soybeans.

Roundup and Monsanto’s glyphosate-resistant seeds would be less attractive to customers if California requires warnings on products containing the chemical. In the lawsuit, filed in federal court in California, Monsanto and groups representing corn, soy and wheat farmers reject that glyphosate causes cancer. They say the state’s requirement for warnings would force sellers of products containing the chemical to spread false information.“Such warnings would equate to compelled false speech, directly violate the First Amendment, and generate unwarranted public concern and confusion,” Scott Partridge, Monsanto’s vice president of global strategy, said in a statement.

The controversy is an additional headache for Monsanto as it faces a crisis around a new version of an herbicide based on another chemical known as dicamba that was linked to widespread U.S. crop damage this summer. The company, which is being acquired by Bayer AG for $63.5 billion, developed the product as a replacement for glyphosate following an increase of weeds resistant to the chemical. Monsanto has already suffered damage to its investment of hundreds of millions of dollars in glyphosate products since California added the chemical to its list of products known to cause cancer, according to the lawsuit.

Weep.

• Plastics Found In Stomachs Of Deepest Sea Creatures (G.)

Animals from the deepest places on Earth have been found with plastic in their stomachs, confirming fears that manmade fibres have contaminated the most remote places on the planet. The study, led by academics at Newcastle University, found animals from trenches across the Pacific Ocean were contaminated with fibres that probably originated from plastic bottles, packaging and synthetic clothes. Dr Alan Jamieson, who led the study, said the findings were startling and proved that nowhere on the planet was free from plastics pollution. “There is now no doubt that plastics pollution is so pervasive that nowhere – no matter how remote – is immune,” he said. Evidence of the scale of plastic pollution has been growing in recent months. Earlier this year scientists found plastic in 83% of global tapwater samples, while other studies have found plastic in rock salt and fish.

Humans have produced an estimated 8.3bn tonnes of plastic since the 1950s and scientists said it risked near permanent contamination of the planet. Jamieson said underlined the need for swift and meaningful action. “These observations are the deepest possible record of microplastic occurrence and ingestion, indicating it is highly likely there are no marine ecosystems left that are not impacted by anthropogenic debris.” He said it was “a very worrying find.” “Isolating plastic fibres from inside animals from nearly 11 kilometres deep (seven miles) just shows the extent of the problem. Also, the number of areas we found this in, and the thousands of kilometre distances involved shows it is not just an isolated case, this is global.”

[..] The team examined 90 individual animals and found ingestion of plastic ranged from 50% in the New Hebrides Trench to 100% at the bottom of the Mariana Trench. The fragments identified include semi-synthetic cellulosic fibres, such as Rayon, Lyocell and Ramie, which are all microfibres used in products such as textiles, to plastic fibres that are likely to come from plastic bottles, fishing equipment or everyday packaging. Jamieson said deep-sea organisms are dependent on food “raining down from the surface which in turn brings any adverse components, such as plastic and pollutants with it.” “The deep sea is not only the ultimate sink for any material that descends from the surface, but it is also inhabited by organisms well adapted to a low food environment and these will often eat just about anything.”

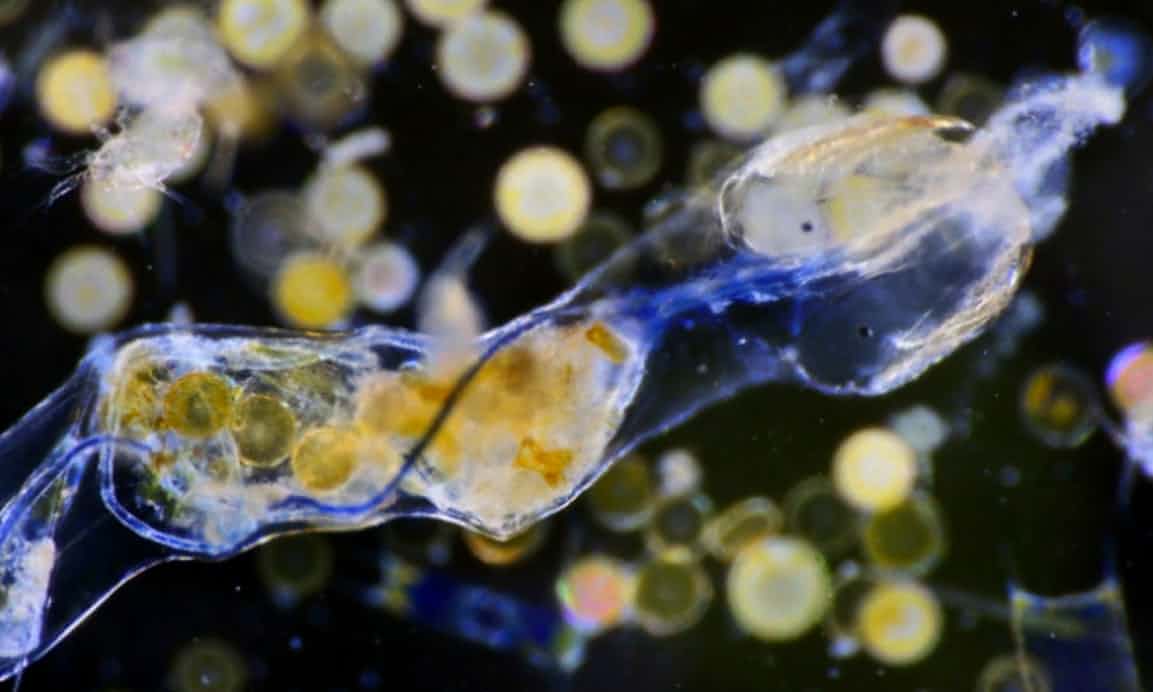

This microscopic arrow worm has eaten a blue plastic fibre that is blocking the passage of food along its gut. Photograph: Richard Kirby/Courtesy of Orb Media