Paul Gauguin Haymaking in Brittany 1889

The essential discussion of our times.

• What’s The Point Of Growth If It Creates So Much Misery? (G.)

The late Prof Mick Moran, who taught politics and government at Manchester University for most of his professional life, had, according to his colleagues, once had “a certain residual respect for our governing elites”. That all changed during the 2008 financial crisis, after which he experienced an epiphany “because it convinced him that the officer class in business and in politics did not know what it was doing”. After his epiphany, Moran formed a collective of academics dedicated to exposing the complacency of finance-worship and to replacing it with an idea of running modern economies focused on maximising social good. They called themselves the Foundational Economy Collective, based on the idea that it’s in the everyday economy where there is most potential for true social regeneration: not top-down cash-splashing, but renewal and replenishment from the ground upwards.

Foundational activities are the materials and services without which we cannot live a civilised life: clean, unrationed water; affordable electricity and gas without cuts to supply; collective transport on smooth roads and rails; quality health and social care provided free at the point of use; and reliable, sustainable food supply. Then there’s the “overlooked economy” – everyday services such as hairdressing, veterinary care, catering and hospitality and small-scale manufacturing – which employ far more people, across a wider geographical range, than the “high-skill, hi-tech” economy with which recent governments have been obsessed.

For the Foundational Economy authors, focusing on the fundamental value of invisible and unglamorous jobs “restores the importance of unappreciated and unacknowledged tacit skills of many citizens”. It’s a way of looking at economics from the point of view of people rather than figures, and doing something revolutionary (yet so blindingly obvious) in the process. What is the point of “growth” if the basic elements of a decent life are denied to a large and growing number?

A license to kill, then?!

• Don’t Rule Out $400 Oil If The US Sanctions Saudi Arabia (MW)

“The Kingdom affirms its total rejection of any threats and attempts to undermine it, whether by threatening to impose economic sanctions, using political pressures, or repeating false accusation,” a government source reportedly told the official Saudi Press Agency. “The Kingdom also affirms that if it receives any action, it will respond with greater action.” Hence, Saudi-owned Al Arabiya channel’s general manager Turki Aldakhil, in our call of the day, warned we could see an explosive move in oil prices. “If U.S. sanctions are imposed on Saudi Arabia, we will be facing an economic disaster that would rock the entire world,” he wrote in an op-ed.

“If the price of oil reaching $80 angered President Trump, no one should rule out the price jumping to $100, or $200, or even double that figure.” This mess could ultimately throw the entire Muslim world “into the arms of Iran, which will become closer to Riyadh than Washington,” Aldakhil said. “The truth is that if Washington imposes sanctions on Riyadh, it will stab its own economy to death, even though it thinks that it is stabbing only Riyadh.”

Or the end of OPEC?

• How Much Damage Can Saudi Arabia Do To The Global Economy? (G.)

Saudi Arabia enjoys a privileged position both in geopolitical and economic terms. It will have a powerful hand to play if tensions with the US and the west escalate and it follows through with Sunday’s warning of retaliation. Its vast oil reserves – it claims to have about 260bn barrels still to extract – afford the most obvious advantage. The kingdom is the world’s largest oil exporter, pumping or shipping about 7m barrels a day, and giving Riyadh huge clout in the global economy because it wields power to push up prices. An editorial in Arab News by Turki Aldhakhil, the general manager of the official Saudi news channel, Al Arabiya, offers a hint of what could be in the offing.

He said Riyadh was weighing up 30 measures designed to put pressure on the US if it were to impose sanctions over the disappearance and presumed murder of Jamal Khashoggi inside the country’s Istanbul consulate. These would include an oil production cut that could drive prices from around $80 (£60) a barrel to more than $400, more than double the all-time high of $147.27 reached in 2008. This would have profound consequences globally, not just because motorists would pay more at the petrol pump, but because it would force up the cost of all goods that travel by road.

Wonder why the UN has acted now. And did it do so after consulting with the US?

• Ecuador Partly Restores Assange’s Internet (AAP)

The Ecuadorian government has decided to partly restore communications for WikiLeaks founder Julian Assange. They were cut in March, denying the Australian access to the internet or phones and limiting visitors to members of his legal team. He has been living inside Ecuador’s embassy in London for more than six years. The Ecuadorian government said in March it had acted because Assange had breached “a written commitment made to the government at the end of 2017 not to issue messages that might interfere with other states”.

WikiLeaks said in a statement: “Ecuador has told WikiLeaks publisher Julian Assange that it will remove the isolation regime imposed on him following meetings between two senior UN officials and Ecuador’s President Lenin Moreno on Friday.” Kristinn Hrafnsson, WikiLeaks’ editor-in-chief, added: “It is positive that through UN intervention Ecuador has partly ended the isolation of Mr Assange although it is of grave concern that his freedom to express his opinions is still limited. “The UN has already declared Mr Assange a victim of arbitrary detention. This unacceptable situation must end. “The UK government must abide by the UN’s ruling and guarantee that he can leave the Ecuadorian embassy without the threat of extradition to the United States.”

Thought PropOrNot was done, but the Atlantic Council did not.

• Pages Purged By Facebook Were On Blacklist Promoted By Washington Post (Wsws)

Media outlets removed by Facebook on Thursday, in a massive purge of 800 accounts and pages, had previously been targeted in a blacklist of oppositional sites promoted by the Washington Post in November 2016. The organizations censored by Facebook include The Anti-Media, with 2.1 million followers, The Free Thought Project, with 3.1 million followers, and Counter Current News, with 500,000 followers. All three of these groups had been on the blacklist. In November 2016, the Washington Post published a puff-piece on a shadowy and up to then largely unknown organization called PropOrNot, which had compiled a list of organizations it claimed were part of a “sophisticated Russian propaganda campaign.”

The Post said the report “identifies more than 200 websites as routine peddlers of Russian propaganda during the election season, with combined audiences of at least 15 million Americans.” The publication of the blacklist drew widespread media condemnation, including from journalists Matt Taibbi and Glenn Greenwald, forcing the Post to publish a partial retraction. The newspaper declared that it “does not itself vouch for the validity of PropOrNot’s findings regarding any individual media outlet.” While the individuals behind PropOrNot have not identified themselves, the Washington Post said the group was a “collection of researchers with foreign policy, military and technology backgrounds.”

Long expected.

• Sears Files For Bankruptcy (CNBC)

After years of Sears Holdings staying afloat through financial maneuvering and relying on billions of CEO Eddie Lampert’s own money, the 125-year-old retailer filed for bankruptcy. The filing comes more than a decade after Lampert merged Sears and Kmart, hoping that forging together the two struggling discounters would create a more formidable competitor. It comes after Lampert shed assets and spun out real estate, all to pay down the debt the retailer accumulated when that plan went askew. The company still has roughly 700 stores, which have at times been barren, unstocked by vendors who have lost their trust.

Many of the stores have never been visited by a generation of shoppers that can barely recall it was once the the country’s biggest retailer. Lampert, who has a controlling ownership stake in Sears, personally holds some 31 percent of the retailer’s shares outstanding, according to FactSet. His hedge fund ESL Investments owns about 19 percent. Ultimately, it was a $134 million payment that did the company in. The company had a payment due Monday it had not the money to pay.

Why does this still need to be explained?

• The Housing Crisis Will Not Be Solved By Building More Homes (FT)

With great flourish, Theresa May last week announced that she was lifting the borrowing cap which constrains local councils’ ability to finance new housebuilding. “We will only fix this broken market by building more homes,” the prime minister said. “Solving the housing crisis is the biggest domestic policy challenge of our generation. It doesn’t make sense to stop councils from playing their part in solving it. So today I can announce that we are scrapping that cap.” Nope. In reality, councils – or anyone else for that matter – building more homes will do very little to address the fundamental problem in the housing market, and if you want to understand why, there’s a new book which explains it.

‘Why Can’t You Afford To Buy A Home?’ by Josh Ryan-Collins – a researcher at University College London’s Institute for Innovation and Public Purpose – is about the phenomenon which he dubs ‘residential capitalism’. It follows on from his less snappily-titled volume ‘Rethinking The Economics of Land and Housing’, which was written jointly with fellow economist Laurie Macfarlane and policy wonk Toby Lloyd and published last year. Both books address the question of why a growing number of people are being priced out of the property market, with rising house prices accelerating away from household incomes. The answer is financialisation – and it is not an aberration, according to Ryan-Collins.

The ‘housing crisis’ needs to be understood primarily as a product of the banking system. For starters it’s not just a British problem; this is a trend which has gripped developed economies across the world over the past three decades. “Two of the key ingredients of contemporary capitalist societies, private home ownership and a lightly regulated commercial banking system, are not mutually compatible,” he writes. Instead they “create a self-reinforcing feedback cycle”. [..] In the early 1980s, business lending equated to around 40 per cent of GDP on average in advanced economies, while mortgage lending was around 25 per cent. By the time of the financial crisis, mortgage lending had grown to 75 per cent of GDP while business lending had only grown slightly, to 45 per cent.

The Chinese will hold Beijing responsible when their housing bubble bursts.

• Violence, Public Anger Erupts In China As Home Prices Slide (ZH)

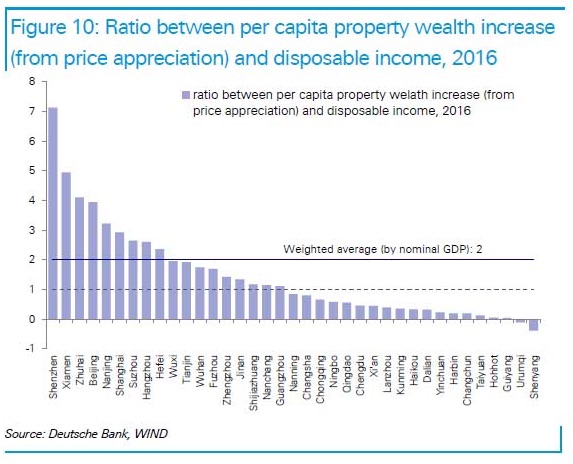

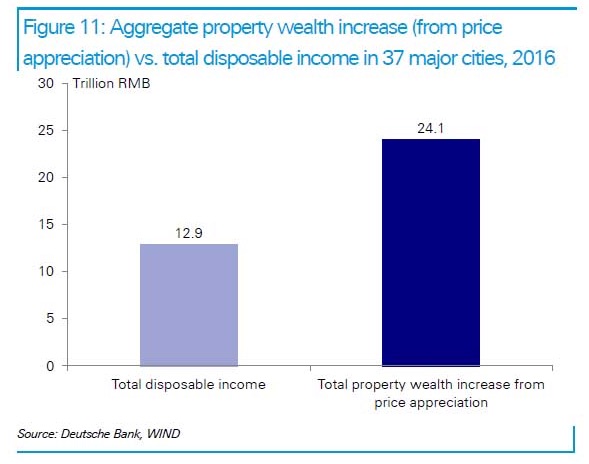

Last March, we discussed why few things are as important for China’s wealth effect and economy, as its housing bubble market. Specifically, as Deutsche Bank calculated at the time, “in 2016 the rise of property prices boosted household wealth in 37 tier 1 and tier 2 cities by RMB24 trillion, almost twice their total disposable income of RMB12.9 trillion.” The German lender added that this (rather fleeting) wealth effect “may be helping to sustain consumption in China despite slowing income growth” warning that “a decline of property price would obviously have a large negative impact.” Naturally, as long as the housing bubble keeps inflating and prices keep rising, there is nothing to worry about as the population will keep spending money buoyed by illusory wealth appreciation.

It is when housing starts to drop that Beijing begins to panic. Fast forward to today, when Beijing may be starting to sweat because whereas Chinese property developers usually count on September and October to be their “gold and silver” months for sales, this year has turned out to be different. As the SCMP reports, not only were sales figures grim for September, but the seven-day national holiday last week also brought at least two “fangnao” incidents – when angry, and often violent, homeowners protest against price cuts offered by developers to new buyers.

These protests are often directed at sales offices, with varying levels of intensity – from throwing rocks to holding banners and putting up funeral wreaths. The risk, of course, is that as what has gone up (wealth effect) will come down, and as home ownership has remained the most important channel of investment for urban households in China in the past decade, price cuts have become increasingly unacceptable and a cause for social unrest. Just last week, angry homeowners who paid full price for units at the Xinzhou Mansion residential project in Shangrao attacked the Country Garden sales office in eastern Jiangxi province last week, after finding out it had offered discounts to new buyers of up to 30%.

There is no solution that everyone can accept.

• ‘Intense Effort’ Fails To Seal UK-EU Brexit Deal After Sunday Talks (AP)

The European Union’s top Brexit negotiator says urgent talks with Britain’s point person did not result in their reaching agreement on outstanding issues. EU negotiator Michel Barnier said: “Despite intense efforts, some key issues are still open” in the divorce talks between the European Union and Britain. Barnier and his British counterpart, Dominic Raab, met in Brussels for surprise talks on Sunday. The discussion prompted rumors that a full agreement might be imminent, but Barnier says the future of the border on the island of Ireland remain a serious obstacle. He says the need “to avoid a hard border” between Ireland and the U.K’s Northern Ireland is among the unsettled issues. An EU official says no further negotiations are planned before an EU leaders summit on Wednesday.

The “Irish backstop” is the main hurdle to a deal that spells out the terms of Britain’s departure from the EU and future relationship with the bloc. After Brexit, the currently invisible frontier between Northern Ireland and Ireland will be the U.K.’s only land border with an EU nation. Britain and the EU agree there must be no customs checks or other infrastructure on the border, but do not agree on how that can be accomplished. The EU’s “backstop” solution — to keep Northern Ireland in a customs union with the bloc — has been rejected by Britain because it would require checks between Northern Ireland and the rest of the U.K.

Budget was accepted by almost two thirds in Senate and Parliament.

• The EU Wants Fiscal Austerity In A Sinking Economy (CNBC)

Over the last three years, net exports shaved 0.5 percent off Italy’s quasi stagnant 1.1 percent GDP growth. And while exports in the first seven months of this year increased 4 percent from the year earlier, that did absolutely nothing to revive the country’s manufacturing output. The industrial production during the January-to-July period dropped at an annual rate of 0.5 percent. That, of course, bodes ill for business investments because the weakness in the manufacturing sector indicates plenty of spare production capacity. In other words, Italian businesses need no new machines and bigger factory floors; they already have what they need to meet the current and expected sales demand.

So, what’s left to support Italy’s jobs and incomes? Nothing — emphatically nothing — keeps screaming the German-run EU: Italy has no independent monetary policy, and, according to the EU Commission, the fiscal stance should remain frozen in a restrictive mode of indefinite duration. Italy knows what that means. Before the onset of the last decade’s financial crisis, and the German-imposed fiscal austerity, Italy’s budget deficit in 2007 was whittled down to 1.5 percent of GDP (compared to nearly 3 percent of GDP in France), the primary budget surplus (budget before interest charges on public debt) was driven up to 1.7 percent of GDP, helping to bring down the public debt to 112 percent of GDP from an annual average of 117 percent in the previous six years.

But then all hell broke loose once the Germans — defiantly rejecting Washington’s call to reason — set out to teach a lesson to “fiscal miscreants” by imposing austerity policies on the euro area’s sinking economies. Italy should never allow that to happen again. What, then, should Italy do? The answer is simple: Exactly what it says it wants to do in the 2019 budget passed last Thursday by an overwhelming majority in the Senate (61 percent of the votes) and in the Parliament’s Lower House (63.4 percent of the votes).

Not just conservatives, the SPD is going going gone as well.

• Merkel’s Conservative Allies Humiliated in Bavaria Election (G.)

Angela Merkel’s conservative partners in Bavaria have had their worst election performance for more than six decades, in a humiliating state poll result that is likely to further weaken Germany’s embattled coalition government. The Christian Social Union secured 37.3% of the vote, preliminary results showed, losing the absolute majority in the prosperous southern state it had had almost consistently since the second world war. The party’s support fell below 40% for the first time since 1954. Markus Söder, the prime minister of Bavaria, called it a “difficult day” for the CSU, but said his party had a clear mandate to form a government.

Among the main victors was the environmental, pro-immigration Green party, which as predicted almost doubled its voter share to 17.8% at the expense of the Social Democratic party (SPD), which lost its position as the second-biggest party, with support halving to 9.5%. Annalena Baerbock, the co-leader of the Greens, said: “Today Bavaria voted to uphold human rights and humanity.” Andrea Nahles, the leader of the SPD, delivered the briefest of reactions at her party’s headquarters in Berlin, calling the results “bitter” and blaming them on the poor performance of the grand coalition in Berlin.

But this suggests that gene editing would be very expensive.

• Stephen Hawking Predicted Race Of ‘Superhumans’ (G.)

The late physicist and author Prof Stephen Hawking has caused controversy by suggesting a new race of superhumans could develop from wealthy people choosing to edit their and their children’s DNA. Hawking, the author of A Brief History of Time, who died in March, made the predictions in a collection of articles and essays. The scientist presented the possibility that genetic engineering could create a new species of superhuman that could destroy the rest of humanity. The essays, published in the Sunday Times, were written in preparation for a book that will be published on Tuesday. “I am sure that during this century, people will discover how to modify both intelligence and instincts such as aggression,” he wrote.

“Laws will probably be passed against genetic engineering with humans. But some people won’t be able to resist the temptation to improve human characteristics, such as memory, resistance to disease and length of life.” In Brief Answers to the Big Questions, Hawking’s final thoughts on the universe, the physicist suggested wealthy people would soon be able to choose to edit genetic makeup to create superhumans with enhanced memory, disease resistance, intelligence and longevity. Hawking raised the prospect that breakthroughs in genetics will make it attractive for people to try to improve themselves, with implications for “unimproved humans”. “Once such superhumans appear, there will be significant political problems with unimproved humans, who won’t be able to compete,” he wrote. “Presumably, they will die out, or become unimportant. Instead, there will be a race of self-designing beings who are improving at an ever-increasing rate.”