Dorothea Lange Arkansas flood refugee family near Memphis, Texas 1937

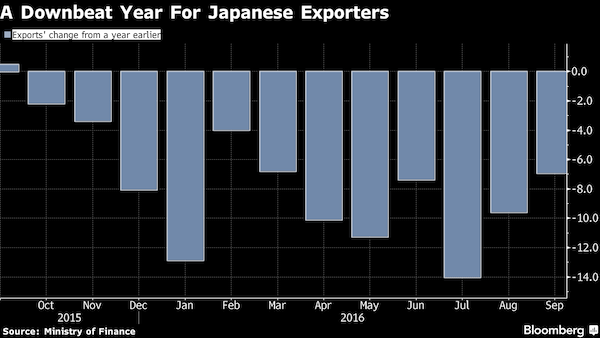

WHAT? “Today’s report confirmed that exports are on the rebound,” said Masaki Kuwahara, senior economist at Nomura.”

• Japan Exports Fall 6.9% YoY, Imports Plunge 16.3% (BBG)

Japanese exports fell for a 12th consecutive month in September, rounding out a rough year for manufacturers struggling with a stronger yen and soft global demand. Yet the numbers were better than expected, and export volumes rose last month by the most in nearly two years, prompting some upbeat assessments by economists. “Today’s report confirmed that exports are on the rebound,” said Masaki Kuwahara, senior economist at Nomura. “Manufacturing activities are picking up globally, especially in Asian nations. That bodes well for Japanese exports.” Overseas shipments dropped 6.9% in September from a year earlier, the Ministry of Finance said on Monday. Imports fell 16.3% during the same period, resulting in a trade surplus of 498.3 billion yen ($4.8 billion).

Prime Minister Shinzo Abe has gotten little help from exports recently as he tries to revive Japan’s economy. Net shipments abroad shaved 0.3 percentage point off GDP growth in the second quarter. The yen has gained 16% since the start of the year, and soft global demand has made matters worse. This environment has made companies more reluctant to invest in domestic production, compounding the difficulty of creating economic growth. [..] Exports to the U.S. fell 8.7% from a year earlier. Those to the EU rose 0.7%. Exports to China, Japan’s largest trading partner, dropped 10.6%.

“..trade and investment peaked in 2007-2008. Since then international trade has declined by roughly half a%. Foreign direct investment, or FDI, has fallen by half. That is not half a percent. That is half.”

• China: Soon The Most Visible Victim of Deglobalization (AJ)

Global exports as a percentage of global GDP hit an all-time high of 30.8% in 2008. They fell precipitously during the global financial crisis of 2008-2009 and have since stabilised at just under 30%. These figures cap off a remarkable quarter-century of global export growth that began back in 1973. In that period global GDP roughly doubled, but global export volumes grew by a factor of 5.6 (based on inflation-adjusted data from the World Bank). China played a leading role in that story, but it was the rise in international trade that pulled the Chinese economy along, not the other way around. China rode the coat-tails of a quarter-century of globalisation.

Most people think of globalisation as a process that began in the 1990s with the collapse of the Soviet Union in 1991 and the foundation of the World Trade Organization in 1995. But the roots of today’s global economy really go back to 1973, when the United States went off the gold standard and most countries moved from fixed to floating exchange rates. Floating exchange rates meant that the era of managed trade was over. The global economy moved into a new phase driven by market forces. The oil exporting countries of the Gulf were the first to benefit as the market price for oil quadrupled between 1973 and 1974. China came to the party just a few years later.

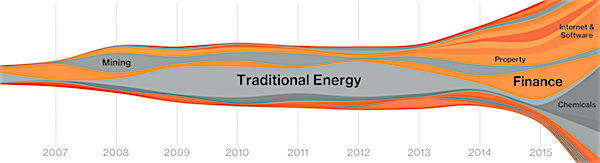

Since then the global economy has become more and more open. After the currency liberalisation of 1973 came a huge increase in international trade and then, in the 1990s, in foreign investment. Both trade and investment peaked in 2007-2008. Since then international trade has declined by roughly half a%. Foreign direct investment, or FDI, has fallen by half. That is not half a percent. That is half. Annual global FDI is down roughly 50% from its 2007 peak of just over $3 trillion. It’s still much larger than it was in the 1990s or earlier decades, but global FDI has stabilised at roughly the levels of the early 2000s. Unlike global FDI, foreign investment into China hasn’t fallen in absolute terms. But it too has stabilised and is no longer rising.

The flipside of deglobalization. Monopoly money.

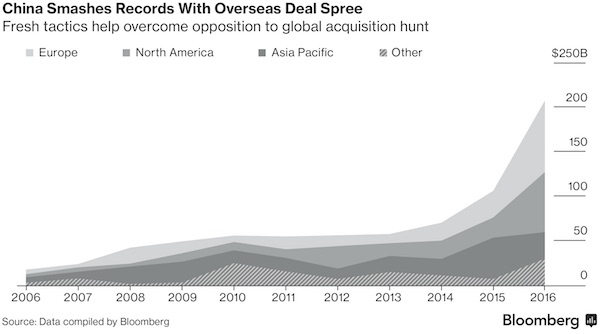

• China Continues To Buy Up The World (BBG)

When a Chinese home-appliance company announced a plan in May to become the largest shareholder in one of Germany’s most advanced robot manufacturers, the backlash was immediate. German politicians and European officials denounced Midea’s offer for Frankfurt-listed Kuka, whose robotic arms assemble Airbus jets and Audi sedans. In a rare public appeal for alternative acquirers, Germany’s economy minister argued that Kuka’s automation technology needed to stay out of Chinese hands. And yet in two months, Midea pulled it off. Thanks to a combination of political courtship, guarantees on jobs and security, and support from influential customers like Daimler CEO Dieter Zetsche, Midea overcame knee-jerk opposition to the deal. By July the appliance maker had secured an 86% stake, valuing Kuka at €4.6 billion.

The experience showed how some Chinese firms are learning to soothe misgivings about the country’s record $207 billion overseas buying spree. While Sinophobia isn’t yet a thing of the past and practices among Chinese buyers vary widely, merger-and-acquisition professionals say a new generation of savvy dealmakers is starting to emerge from the world’s second-largest economy. “Many Chinese companies have become much more adept at navigating international deals in the last few years, and at soothing the concerns stakeholders might have,” said Nicola Mayo, a partner at London law firm Linklaters LLP who specializes in China-Europe transactions. “In many of the larger Chinese companies, you’re dealing with managers who were educated abroad or have worked in international firms. They understand the concerns about China and know they need to move carefully.”

What China’s been buying

And here’s the backlash..

• German Momentum Grows for Curbs on Chinese Overseas Investment (BBG)

Germany is seeking tighter control over foreign investment in European companies, in a sign of a growing protectionist reaction to China’s appetite for overseas acquisitions. Spurred by the purchase of German robot maker Kuka by China’s Midea, Chancellor Angela Merkel’s deputy, Sigmar Gabriel, is calling for EU measures to give national governments expanded powers to block or impose conditions on shareholdings of non-EU companies. He’s found an ally in EU Digital Economy Commissioner Guenther Oettinger, a German who’s a member of Merkel’s party. “It’s absolutely right to initiate this debate at the European level,” Oettinger said in an interview last week. “Everybody has to play by the same rules. Clearly, there are many countries, including big ones such as China, that make market access or corporate takeovers difficult or effectively impossible.”

While Merkel hasn’t publicly backed her vice chancellor’s push, Gabriel’s proposal reflects growing resistance within her government to unfettered Chinese investment in Europe’s biggest economy. In the latest potential Chinese bid, lighting maker Sanan Optoelectronics said it had held talks with Osram Licht on a possible acquisition of the almost century-old German company. The initiative by Gabriel, who also is Germany’s economy minister, calls for allowing EU member states to step in if a non-EU investor seeks to acquire more than 25% of the voting rights in a company [..] Chinese companies have announced or completed acquisitions of German companies worth a record $12.3 billion this year, almost eight times the level of 2015. That includes the purchase of Kuka by Midea, China’s biggest appliance maker, after Gabriel led a failed effort to find an alternative bid by a European suitor.

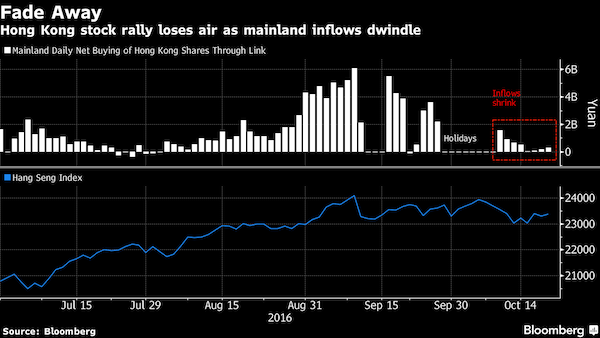

“Investors in Shanghai spent more than $8 billion on Hong Kong shares in September [..] Net buying this month through last week was just 7% of that amount..”

• Chinese Money Flowing to Hong Kong Stocks Has Suddenly Dried Up (BBG)

Hong Kong’s stock market is suffering from a post-holiday hangover. The flood of Chinese money into the city before the mainland’s National Day celebrations in early October has slowed to a trickle since traders returned from the week-long break. Investors in Shanghai spent more than $8 billion on Hong Kong shares in September, the biggest monthly inflow via the exchange link since it began in 2014. Net buying this month through last week was just 7% of that amount, data compiled by Bloomberg show. The narrowing valuation discount on the city’s dual-listed shares and concern about the Federal Reserve’s impending rate increase may have spurred mainland investors to turn off the taps, according to Hong Kong analysts, who also say they’re perplexed at the speed of the shift.

The change is a headwind for equities after the influx of Chinese money helped drive the Hang Seng Index up 12% last quarter for its best such gain in seven years. “It’s a bit of a mystery as to why this is happening,” said Mohammed Apabhai, head of Asia trading strategy at Citigroup. “Nobody has put forward a convincing explanation about exactly why the southbound flow has dried up and whether it’s a temporary phenomenon. That has removed one of the supports from the Hong Kong equity market.” China International Capital cut its rating on Hong Kong-listed mainland banks last week, citing the dwindling inflows. Trades from Shanghai made up as much as 17% of the total turnover in Hong Kong at one point last month, the highest on record. That ratio dropped to less than 7% on Oct. 20.

I have an ominous feeling about this.

• Europe’s Incredibly Safe Banks (BBG)

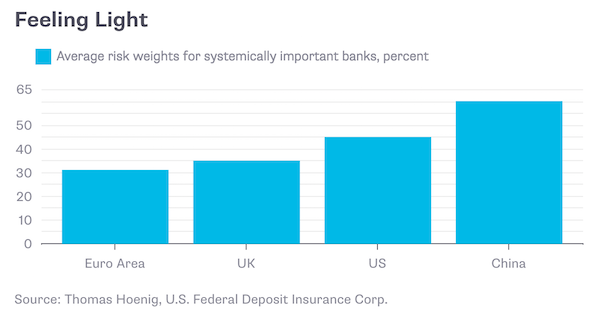

Given the parlous state of Europe’s economy, it’s hard to imagine that the investments of the region’s banks are among the safest in the world. Yet that is precisely what they would have regulators and investors believe. The banks’ safety has come into the spotlight as European officials – including German Finance Minister Wolfgang Schaeuble and European Commission financial-services chief Valdis Dombrovskis – battle with global regulators over requirements for capital, the layer of loss-absorbing financing that prevents bad investments from turning into system-wide disasters. The dispute involves risk-weighting, a process in which the largest and most sophisticated banks assess the riskiness of their assets to figure out how much capital they need.

A loan to a struggling company might require a lot, safe government bonds none at all. Less capital means more leverage, which in good times boosts measures of profitability such as return on equity. Hence, banks have an incentive to make their assets look as safe as possible. Europe’s banks have excelled in this minimizing endeavor. On average for eight of the euro area’s most systemically important institutions, risk-weighted assets amounted to just 31% of total unweighted assets at the end of June – as if about seven out of every 10 euros in investments were risk-free. For Germany’s Deutsche Bank, among the world’s most thinly capitalized, the ratio was just 22%. That compares with averages of 35% and 45% for the largest U.K. and U.S. banks, respectively. Here’s how that looks:

To be sure, lower risk weights could mean that Europe’s banks actually do have safer assets. There’s plenty of evidence, though, to suggest this isn’t the case. The IMF estimates that banks in the euro area are sitting on more than $1 trillion in bad loans. Also, markets place a much lower value on each euro of European banks’ book assets than they do on each dollar of U.S. banks’.

This from a government that relies on soaring housing prices to make its economy appear viable. Australia’s problem is not the extravagant tax perks, or ultra low rates, or Chinese monopoly money pouring in. No, all that’s fine, and all that needs to be done is build build build.

• Unaffordable Australian Housing ‘in Government Sights’ (BBG)

Australian states need to remove or simplify residential land planning regulations that have made homes “increasingly unaffordable” in the nation’s biggest cities, Treasurer Scott Morrison said. Insufficient land releases and complex development regulations must be addressed, Morrison said in the text of a speech being given in Sydney Monday. He’ll use a December meeting with his state counterparts to urge a freeing up of housing supply, an issue which will be a key focus of Prime Minister Malcolm Turnbull’s government, he said. “Of all the determinants of house prices in Australia, whether cyclical or structural, the most important factor behind rising prices has been the long running impediments to the supply side of the market,” Morrison said.

While a three-year surge in Australian home prices paused at the end of last year after banks raised mortgage rates, the market has taken off again as a growing population tries to squeeze into too few properties. Dwelling values in Sydney, which have almost doubled since the end of 2008, are up 14% this year through September, compared with a 9% gain across the nation’s other major cities, according to CoreLogic. The recent rise defies an assessment by real-estate listing firm Domain last year that the boom was over, and is posing a potential headache for new central bank Governor Philip Lowe, who said this month that that fewer properties were changing hands and “some markets have strengthened recently.” Housing in Australia’s three biggest cities – Sydney, Melbourne and Brisbane – “is expensive and increasingly unaffordable,” Morrison said.

Other factors contributing to supply-side constraints are the cost and availability of infrastructure, transaction taxes and negative public attitudes toward urban development, he said. Still, Morrison is again ruling out his government stripping back some of the tax perks for landlords and property investors, known as negative gearing, which the Labor opposition blames for inflating house prices. “The key to addressing housing affordability is not to crash the housing market,” Morrison said. “Rather the objective is to have policies that mitigate the artificial inflation of asset prices, ensure that supply is not restricted from responding to genuine demand and that enable home-buyers, through their own efforts, to make more rapid progress to being able to enter the market.’’

“..the S-curve of “growth” can continue expanding even as the foundation weakens. As the foundations of real growth weaken – productivity, collateral, social mobility, etc. – the system becomes increasingly fragile and brittle.”

• What Is “Impossible” And What Is Inevitable (CH Smith)

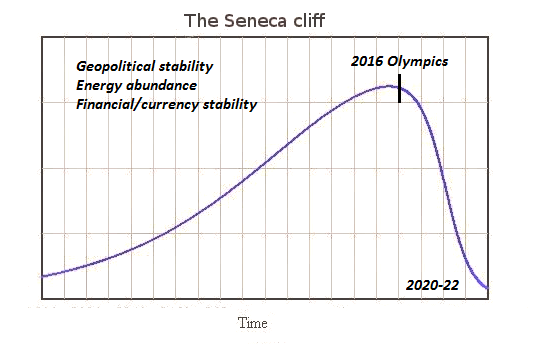

We are about to start a painful learning process about what is “impossible” and what is inevitable. Two charts illustrate Why Our Status Quo Failed and Is Beyond Reform: this chart of the S-Curve of financialization, leverage, debt, central planning, regulatory capture and globalization – that is, the engines of modern “growth” – depicts the inevitable stagnation and decline of these dynamics as overcapacity, debt saturation and diminishing returns take hold. This chart illustrates the status quo’s insistence on doing more of what has failed spectacularly: since all this worked in the boost phase, the central planning Cargo Cult’s “leadership” is convinced it will all work magically again, if only we do more of it. Alas, this is magical thinking. One might as well paint radio dials on rocks and expect the rock to magically turn into a functioning radio.

The chart of the Seneca Cliff illustrates how the S-curve of “growth” can continue expanding even as the foundation weakens. As the foundations of real growth weaken – productivity, collateral, social mobility, etc. – the system become increasingly fragile and brittle. But this fragility is masked by the appearance of stability until a crisis cracks it wide open. Normalcy crumbles into instability, and people and systems accustomed to stable supply chains and political stability struggle to maintain their grip on income streams and resources as abundance slips into scarcity and dependence on central planning becomes a liability of learned helplessness.

The S-curve:

The Seneca Cliff:

There are two sets of solutions as stability and financialized “growth” slide into instability and DeGrowth. 1. Acquire skills that will be increasingly scarce and a network of collaborators, customers and suppliers who value/make use of these skills. 2. Create a new mode of production that doesn’t rely on central banks, states and global finance to function: in effect, a decentralized, localized networked system that exists in parallel with the centralized hierarchies of the current mode of production which is centralized, industrialized, globalized, financialized, neofeudal, neoliberal, neocolonial, and dependent on ever-expanding leverage, debt, central planning, regulatory capture and fossil fuel consumption.

Here’s the theme I wrote about in yesterday’s “Ungovernability”: “I think the issue is, what’s going to be the aftermath of this campaign. Can somebody govern…?”

• Watergate’s Bob Woodward: “Clinton Foundation Is Corrupt, It’s A Scandal” (ZH)

CHRIS WALLACE, FOX NEWS SUNDAY: Then there are the allegations about the Clinton Foundation and pay to play, which I asked Secretary Clinton about in the debate, and she turned into an attack on the Trump Foundation. But, Bob, I want to go back to the conversation I was having with Robby Mook before. When – when you see what seems to be clear evidence that Clinton Foundation donors were being treated differently than non-donors in terms of access, when you see this new – new revelations about the $12 million deal between Hillary Clinton, the foundation, and the king of Morocco, are voters right to be troubled by this?

BOB WOODWARD, THE WASHINGTON POST: I – yes, it’s a – it’s corrupt. It’s – it’s a scandal. And she didn’t answer your question at all. And she turned to embrace the good work that the Clinton Foundation has done. And she has a case there. But the mixing of speech fees, the Clinton Foundation, and actions by the State Department, which she ran, are all intertwined and it’s corrupt. You know, I mean, you can’t just say it’s unsavory. But there’s no formal investigation going on now, and there are outs that they have. But the election isn’t going to be decided on that. I mean Karl was making the point about this, I’m not going to observe the result of the election. I mean that’s – that’s absurd. I mean it has no consequence. If Trump loses, they’re not going to let him in the White House. He’s not going to have a transition team. And – and to focus on that, I think, is wrong. I think the issue is, what’s going to be the aftermath of this campaign. Can somebody govern…?

Call him as crazy as you wish, but he does make a lot of sense here.

• It’s Time To Drain The Swamp: Five-Point Plan For Ethics Reform (Trump)

I’m proposing a package of ethics reforms to make our government honest once again.

First: I am going to re-institute a 5-year ban on all executive branch officials lobbying the government for 5 years after they leave government service. I am going to ask Congress to pass this ban into law so that it cannot be lifted by executive order.

Second: I am going to ask Congress to institute its own 5-year ban on lobbying by former members of Congress and their staffs.

Third: I am going to expand the definition of lobbyist so we close all the loopholes that former government officials use by labeling themselves consultants and advisors when we all know they are lobbyists.

Fourth: I am going to issue a lifetime ban against senior executive branch officials lobbying on behalf of a foreign government.

Fifth: I am going to ask Congress to pass a campaign finance reform that prevents registered foreign lobbyists from raising money in American elections.

Prof. Dabashi revels in comparing Trump to Hitler, a weird thing to do for any intellectual, and absolute nonsense. But he’s right in many other aspects.

• Trump is America: The Poetic Justice Of The World (Dabashi)

Hours before the scheduled third and final debate between Donald Trump and Hillary Clinton in Las Vegas, The New York Times published an article in which it argued that the Republican presidential nominee in effect has no foreign policy beyond using and abusing global issues to elicit gut fears and hostile fantasies of his domestic followers, that foreign policy has in effect become a matter of domestic fear-mongering. The piece could not have been more timely and poignant – but not in the sense that The New York Times intended it further to discredit the liberal bete noire of this election. In a sense far more serious and accurate. For the World at large, Trump is America and America is Trump. What has now become domestic politics to the US has been its foreign policy for a much longer history.

There are decent Americans who insist Trump is “the worst of America”. But for the world at large and at the receiving end of American military might, Trump is the very quintessence of America because Trump is what America does to the world, and now it has come dangerously close to do unto itself what it has habitually done unto others. Liberal America is now scared that Trump will do to America what America has done to the world. It was just “foreign policy” when America set up lunatic puppet dictators just like Trump to torture, maim, and murder their own people around the globe to protect its “national security interest”. It was just something “Daddy” did at work. When he came home he was all good, kind, and cuddly – just like Obama.

Now the Daddy is about to become a nasty, vicious, domestic abuser – like Trump. Trump is the poetic justice of the world. So long as America was only doing to the world at large what America now fears Trump may do to America, there was no outcry. There was consensus. The world deserved what America did to the world. Now liberal America is up in arms to disown, to exorcise, to dispel this demonic spirit from itself and put it back in a bottle and hand it over to Hillary Clinton so she can continue the habitual exercise of doing it to the world and be a nice, lovely-looking grandma at home, as Ronald Reagan was its grandpa before her.

Hamid Dabashi is the Hagop Kevorkian Professor of Iranian Studies and Comparative Literature at Columbia University.

“..the Saudis have included in their bombing targets cows..”

• Saudi, Allies ‘Deliberately Targeting Yemen’s Food Industry’, Bomb Cows (Fisk)

The Yemen war uniquely combines tragedy, hypocrisy and farce. First come the casualties: around 10,000, almost 4,000 of them civilians. Then come those anonymous British and American advisers who seem quite content to go on “helping” the Saudi onslaughts on funerals, markets and other obviously (to the Brits, I suppose) military targets. Then come the Saudi costs: more than $250m (£200m) a month, according to Standard Chartered Bank – and this for a country that cannot pay its debts to construction companies. But now comes the dark comedy bit: the Saudis have included in their bombing targets cows, farms and sorghum – which can be used for bread or animal fodder – as well as numerous agricultural facilities.

In fact, there is substantial evidence emerging that the Saudis and their “coalition” allies – and, I suppose, those horrid British “advisers” – are deliberately targeting Yemen’s tiny agricultural sector in a campaign which, if successful, would lead a post-war Yemeni nation not just into starvation but total reliance on food imports for survival. Much of this would no doubt come from the Gulf states which are currently bombing the poor country to bits. The fact that Yemen has long been part of Saudi Arabia’s proxy war against Shiites and especially Iran – which has been accused, without evidence, of furnishing weapons to the Shia Houthi in Yemen – is now meekly accepted as part of the Middle East’s current sectarian “narrative” (like the “good” rebels in eastern Aleppo and the “very bad” rebels in Mosul). So, alas, have the outrageous bombings of civilians. But agricultural targets are something altogether different.

A NATO Schengen zone means foreign soldiers can move into any country the command wishes. If that’s not a recipe for disaster, I don’t know what is. Imagine deplying Turkish troops in Greece, or Polish in Britain, French in Germany.

• NATO Continues To Prepare For War With Russia (Korzun)

NATO uses any pretext to accuse Russia of harboring aggressive intentions. It has raised ballyhoo over the recent deployment of Iskander short-range surface-to-surface ballistic missiles to the Kaliningrad region. Time and time again, the alliance reaffirms its bogus Russia narrative. “We see more assertive and stronger Russia that is willing to use force,” concluded NATO General Secretary Jens Stoltenberg speaking at the round table in Passau, Bavaria on October 10. At the same time, NATO is pushing ahead with its military “Schengen zone” in Europe. “We are working to ensure that each individual soldier will not require a decision at the political level to cross the border,” said Estonian Defense Minister Hannes Hanso.

The idea is to do away with travel restrictions on the movement of NATO forces troops and equipment across Europe. There will be no need to ask for permissions to move forces across national borders. It will undermine the sovereignty of member states but facilitate the cross-continent operations instead. The Baltic States and Poland are especially active in promoting the plan. The restrictions in place hinder rapid movement of the 5,000 strong “Very High Readiness Joint Task Force”. Besides being the first response tool, it could be used for preventing Article 4 situations, such as subterfuge, civil unrest or border infractions, from escalating into armed conflict. The troops can move freely in time of war, but introducing a NATO Schengen zone is needed for concentrating forces in forward areas in preparation for an attack across the Russian border.

The formation of the much larger 40 thousand strong NATO Response Force (NRF) is on the way. Meanwhile, the US and Norwegian militaries are discussing the possibility of deploying US troops in Norway – a country which has a 200 km long common border with Russia. The deployment of US servicemen would be part of a rotating arrangement in the country that would fulfil a “long-standing US wish.” Norwegian newspaper Adresseavisen reported on October 10 that 300 combat US Marines could soon be in place at the Værnes military base near Trondheim, about 1,000 kilometres from the Russian-Norwegian frontier. The air station also serves as part of Marine Corps Prepositioning Program-Norway, a program that allows the Corps to store thousands of vehicles and other major pieces of equipment in temperature-controlled caves ready for combat contingency.

Several defence sources told the newspaper that the plans to put US troops at the military base have been underway for some time. According to Military.com, the information that the plans are underway was also confirmed by American Maj. Gen. Niel E. Nelson, the commander of Marine Corps Forces Europe and Africa. 300 Marines can be easily reinforced. The only purpose for the deployment is preparation for an attack against Russia. After all, the Marines Corps is the first strike force. And it’s not Russian Marines being deployed near US national borders, but US Marines deployed in the proximity of Russian borders. The provocative move is taking place at the time the Russia-NATO relationship is at the lowest ebb.

Not sure how serious to take this, but it’s plenty entertaining. Just look at the woman who’s after Juncker. She’s would scare me too. Already does.

• Juncker To Face No Confidence Vote In EU Parliament (Exp.)

Lifelong anti-corruption campaigner Eva Joly has launched a bid to boot out the controversial EU president in yet another blow to his crumbling authority. The French magistrate and politician, who was born in Norway, blasted the eurocrat’s past as president of Luxembourg and vowed to lead an MEPs’ rebellion to “make him fall”. Ms Joly has accused Brussels’ top unelected official of favouring certain multinational corporations for “sweetheart” tax deals when he was head of the tiny European state. Mr Juncker has denied being corrupt, claiming that any decisions related to the tax arrangements of large companies during his time in office were “strictly a matter for the tax administration”. But the damaging row has seriously dented his already battered reputation and has added to the growing calls from across the continent for him to quit.

And Ms Joly, from the Green party, said the escalating scandal could finally finish off the “considerably weakened” Teflon bureaucrat. She said: “Everyone knows that this system was built while he was prime minister. It is a scandal that he leads the Commission. We, the Greens, we do not want it. “At the first opportunity, I will bring a motion [before the the European Parliament] to make him fall.” Such a vote would severely test MEPs’ loyalty towards the Brussels chief at a time when he has become the face and symbol of all Europe’s ills. Mr Juncker is seen as the centrepiece of a federalist European dream which has driven Britain to the exit door and angered many eastern European states, who are already calling for him to quit. He has also apparently lost the support of German leader Angela Merkel over Brussels’ farcical handling of the migrant crisis, making his position at the heart of the Brussels machine ever more tenuous.

“Concerned speculation about the Ecuadorian embassy exile had risen to such an degree, that overnight Wikileaks announced it would provide a state update on Assange’s current status.”

• Wikileaks Status Update on Julian Assange and the US Election (ZH)

On Tuesday, the government of Ecuador issued a statement saying that it had decided to not permit Mr. Assange to use the government of Ecuador’s internet connection during the US election citing its policy of “non interference.” Ecuador’s statement also clarified that it does not seek to interfere with WikiLeaks journalistic work and that it would continue to protect Mr. Assange’s asylum rights. Mr. Assange has asylum at the Ecuadorian embassy in London, where the United Nations has ruled he has been unlawfully deprived of liberty by the United Kingdom and the Kingdom of Sweden for the last six years. He has not been charged. It is the government of Ecuador’s prerogative to decide how to best guard against the misinterpretation of its policies by media groups or states whilst ensuring that it protects Mr. Assange’s human rights.

WikiLeaks is a global, high volume publisher that publishes on average one million documents and associated analyses a year. WikiLeaks publishes its journalistic work from large data centers based in France, Germany, the Netherlands and Norway, among others. Most WikiLeaks staff and lawyers reside in the EU or the US and have not been disrupted. WikiLeaks has never published from jurisdiction of Ecuador and has no plans to do so. Similarly Mr. Assange does not transmit US election related documents from the embassy. WikiLeaks is entirely funded by its readers, book and film sales. Its publications are the result of its significant investigative and technological capacities. WikiLeaks has a perfect, decade long record for publishing only true documents. It has many thousands of sources but does not engage in collaborations with states. Mr. Assange has not endorsed any candidate although he was happy to speak at the Green’s convention due to Dr. Jill Stein’s position [on] whistleblowers, peace and war.