DPC Boston and Maine Railroad depot, Riley Plaza, Salem, MA 1910

“About 60% of this year’s global defaults have come from U.S. borrowers, Vazza wrote, up from 55% a year ago..”

• US Companies Led the World in 2015 Debt Defaults, S&P Says (BBG)

More U.S. companies have defaulted on their debt this year than issuers from any other country or region, S&P analysts led by Diane Vazza wrote in a Dec. 24 report. As of last week, 111 companies worldwide had defaulted on their obligations, the highest tally since 2009 when the the figure hit 242 for the same period. About 60% of this year’s global defaults have come from U.S. borrowers, Vazza wrote, up from 55% a year ago, when 33 of 60 defaulters were American. After the U.S., companies from emerging markets were the second-largest defaulters, accounting for 23% of the pool, which is a smaller share than last year, according to S&P data. Plummeting oil prices and speculation about how the Federal Reserve’s plan to tighten monetary policy would affect corporate borrowing costs has made companies more vulnerable, Vazza wrote.

“The current crop of U.S. speculative-grade issuers appears fragile, and particularly susceptible to any sudden, or unanticipated shock,” she wrote. Arch Coal was the most recent addition to the list, having its credit rating downgraded to “speculative default” by Standard & Poor’s last week after the coal producer missed about $90 million in interest payments and exercised a 30-day grace period with the holders of some of its notes. Looking ahead, S&P expects the U.S. corporate default rate will rise to 3.3% by September 2016 from 2.5% a year earlier. The bulk of the failures will come from companies in the oil and gas sector, which accounted for about a quarter of this year’s defaults. Since 1981, the average default rate for global speculative-grade companies is 4.3%, Vazza said.

The Chinese are buying into global bubbles. That’s going to hurt.

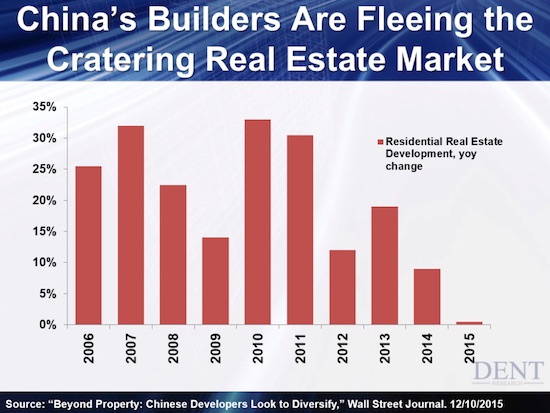

• China’s Unprecedented Real Estate Bubble Is a Ticking Time Bomb (Dent)

We woke up this morning to find oil prices weighing on the market… again… with China suffering the biggest losses. Oil prices have already kept stocks at bay in the best time of the year. Funny how this “Santa Claus” rally that I predicted wouldn’t happen this year, didn’t. The last time was in 2007 and 2008 – the last years the stock market crashed. I’ve been looking at how low oil prices will be the first trigger in the next crisis. Although it helps consumers a bit, low prices kill the $1 trillion QE-driven fracking industry that’s been such a stalwart of this bubble economy. And it’s already causing junk bonds to fall further in value, as energy-related bonds have been as high as 20% of that market recently. But the second and biggest trigger I’ve been warning about is China’s unprecedented real estate bubble collapsing…

Recall the Japanese at the top of their stock and real estate bubble in 1989. They were buying real estate hand-over-fist, from Pebble Beach to Rockefeller Center to London. Then, after bidding them up, they ended up selling those holdings at big losses. The Chinese make the Japanese look prudent! Chinese buyers are bidding up the high end of the top coastal cities in English-speaking countries like they’ll never go down and like they can’t get enough. We’re talking Sydney, Melbourne, Brisbane, Auckland, Singapore, San Francisco, L.A., Vancouver, Toronto, New York, London… These markets are considered “Teflon-proof.” They’re not! In fact, they’re some of the greatest bubbles that exist today. China’s leading cities – like Shanghai, Beijing and Shenzhen – are up 700% or more since 2000!

Guess what happens when the bubble wealth in real estate that has built up in China finally collapses? So does the capacity of the more affluent Chinese to buy real estate around the world. And these are the guys who have by-and-large been driving this global real estate bubble at the margin on the high end! Bear in mind that Chinese real estate has been slowing and prices falling for over a year. That is precisely why China’s stock market bubbled up 160% in less than one year. When Chinese investors realized they could no longer make easy money in the real estate bubble, they turned to stocks. And after the dumb money piled in, the Shanghai Composite stock index fell 42% in just 2.5 months!

China’s move towards a service economy is sure to fail. Xi cannot force his people to spend.

• The Most Important China Chart Of 2015 (BI)

Now that the year is almost over, it’s time to reflect on 2015. BI reached out to the brightest minds on Wall Street to get their thoughts on what just happened. Hopefully, they’ll help us get a better handle on what is about to happen in 2016. Charlene Chu, of Autonomous Research, is widely considered one of the most brilliant China analysts in the world. So we asked her to send us a chart that helped her make sense of the world in 2015. Naturally it’s about China. “The chart below highlights the growth problem China is grappling with. In our view, a broken growth model lies at the core of China’s financial sector issues,” she wrote in an email to Business Insider. “This chart comes directly from official data, which is not adjusted in any way. Secondary industry comprises about 40-45% of GDP. As the title says, nearly half of China’s economy is already experiencing a very hard landing. This will likely intensify in 2016, which will weigh on global growth and add to corporate debt repayment problems.”

CEIC and the National Bureau of Statistics; Charlene Chu, Autonomous Research

In China, GDP is classified into three industries, primary (agriculture), secondary (manufacturing and construction), and tertiary (services). This slowdown in the secondary industry is part of China’s intentional shift toward an economy focused on services and consumer consumption rather than manufacturing. Chu’s point is that it’s happening harder and faster than anyone thought it would. All of this became all too apparent in 2015. This year China experienced two mainland stock market crashes, it devalued its currency, and once booming sectors of the economy — like exports and property — slowed sharply. In response, the government loosened monetary policy and enacted stimulus measures. The measures have had a limited impact, however, indicating that more structural measures will be needed to remedy the situation. Chu expects this slowdown to continue through 2016, affecting markets around the world.

Trying to stop outflows. Ever since the IMF included the yuan in its basket, it’s been all downhill.

• China Suspends Foreign Banks’ Forex Business (Reuters)

China’s central bank has suspended at least three foreign banks from conducting some foreign exchange business until the end of March, three sources who had seen the suspension notices told Reuters on Wednesday. Included among the suspended services are liquidation of spot positions for clients and some other services related to cross-border, onshore and offshore businesses, the sources said. The sources, speaking on condition that the banks were not named, said the notices sent to the affected foreign banks by the People’s Bank of China (PBOC) gave no reason for the suspension. The sources said the banks might have been targeted due to the large scale of their cross-border forex businesses.

“This is part of the PBOC’s expedient means to stabilize the yuan’s exchange rate,” said an executive at a foreign bank contacted separately. China has taken a slew of steps to keep the yuan stable since it devalued the currency in August. The latest move comes just three months since the PBOC ordered banks to closely scrutinize clients’ foreign exchange transactions to prevent illicit cross-border currency arbitrage, which takes advantage of the different exchange rates the yuan fetches in offshore and onshore markets. The spread has been growing since the August devaluation, which makes it increasingly difficult for the bank to manage its currency and stem an outflow of capital from its slowing economy.

The yuan has come under renewed pressure since late November amid speculation that Beijing would permit more depreciation after the IMF announced the currency’s admission into the fund’s basket of reserve currencies. The onshore yuan traded in Shanghai has lost 1.44% of its value since the end of November, and has repeatedly hit 4-1/2 year lows. The offshore market has traced a similar pattern. The Hong Kong-traded offshore yuan hit an intraday low of 6.5965 on Wednesday morning, its weakest since late September 2011.

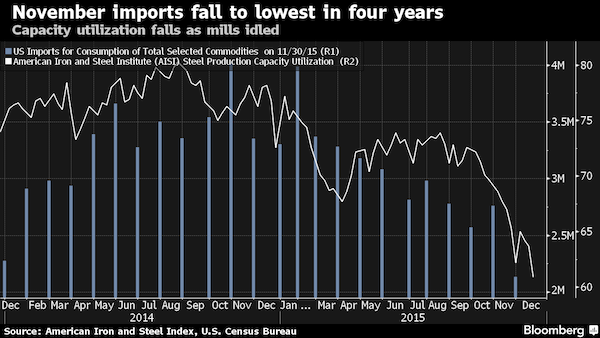

The oil industry is (was) a major purchaser of steel products.

• Oil Prices Become a Problem for US Steelmakers (BBG)

U.S. steelmakers battered by plunging prices have been quick to blame a flood of cheap Chinese shipments. But with imports nearing four-year lows, another culprit is emerging: the energy collapse. Foreign steel coming into the U.S. dropped 36% in November from a year ago, according to U.S. Census Bureau data. That’s with domestic prices at the weakest in at least nine years and new taxes on products from six countries deemed to be unfairly priced. Yet U.S. mills have idled the most capacity since the financial crisis, operating at just 61% in the week ending Dec. 21. Helping explain the capacity decline is a drop in demand for steel pipes and drill bits used in the energy industry after the price of oil plunged 66% in the past 18 months. Previously, sales of high-margin products to oil and gas companies had helped shield U.S. mills from sluggish growth in construction and other industries.

“I don’t think imports are the only problem,” domestic mills face, Timna Tanners at Bank of America said in an interview Tuesday. “Nobody really expected oil to stay as low as it did as long as it has.” An important result of the energy collapse for steel consumption is that inventories held by steel and energy companies take longer to deplete as demand falls, exacerbating the decline in consumption, Tanners said. “Domestic mills in 2014 charged a price that was much higher than the rest of the world and that drew imports,” she said. “The domestic mills can complain that it’s unfairly traded, but there are factors outside of that that have nothing to do with fairness.” The price of hot-rolled steel coil, a benchmark product, has dropped 38% this year, according to The Steel Index, a trade publication that surveys buyers and sellers.

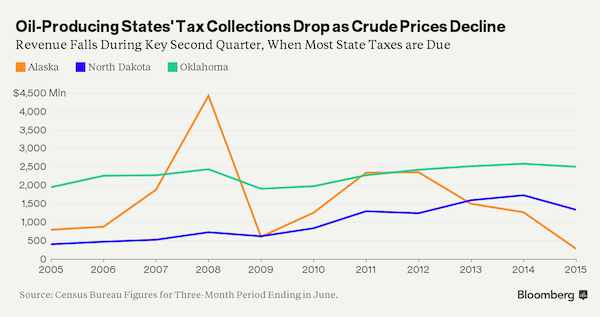

Wait till home prices, and hence property tax revenues, go down as well.

• Oil-Producing US States Battered as Tax-Gushing Wells Are Shut Down (BBG)

In Kern County, California, one of the nation’s biggest oil producers, tumbling energy prices have wiped more than $8 billion from its property-tax base, forcing officials to tap into reserves and cut every department’s budget. It’s only getting worse. The county of 875,000 in the arid Central Valley north of Los Angeles may face another blow in January, when it reassess the oil-rich fields that line the landscape. Last year’s tax bills were based on crude selling for $54 a barrel. It finished Monday at less than $37.

“We may never go back to $99 a barrel, but we were good at $54,” said Nancy Lawson, assistant administrative officer of Kern County, which includes the city of Bakersfield. “If it keeps going down and stays down we may have to look at more cuts in the next budget.”As the price of crude falls for a second year, marking the steepest decline since the recession, the impact is cascading through the finances of states, cities and counties, in ways big and small. Once flush when production boomed, some governments in major energy producing regions are facing a new era of unwelcome austerity as wells are shut – along with the tax-revenue gushers they spouted. Alaska, Louisiana and Oklahoma have seen tax collections diminished by the rout, which has put pressure on credit ratings and led investors to demand higher yields on some securities. In Texas, the largest producer, the state’s sales-tax revenue dropped 3% in November from a year earlier as the energy industry exerted a drag on the economy.

Further west, Colorado’s legislative forecasters on Dec. 21 estimated that the state’s current year budget will have a shortfall of $208 million, in part because of the impact of lower commodity prices. In North Dakota, tax collections have trailed forecasts by 9% so far for the 2015-2017 budget. “The longer it goes the more significant it gets,” said Chris Mier at Loop Capital Markets in Chicago.

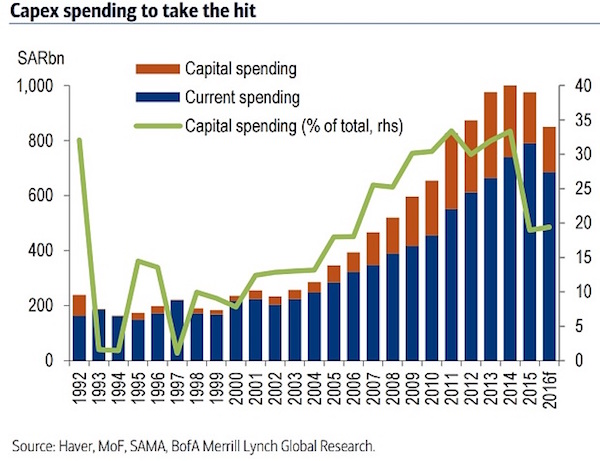

“..these sheikhdoms – which pump about a fifth of the world’s oil – would almost drain their funds entirely by 2020.”

• Gulf States Forced To Empty Their Sovereign Wealth Funds (Reuters)

Oil-rich Gulf sheikhdoms are being forced to raid their sovereign wealth funds to shore up their budgets. With U.S. crude oil prices falling below $40 per barrel in December, they have no choice but to reach into these rainy-day savings. For now, they can hold on to some of their trophy assets, like strategic investments in Volkswagen or Barclays. But if crude prices keep tumbling, a fire sale will be hard to avoid. During the most recent energy boom, the six members of the Gulf Cooperation Council – including Saudi Arabia, Qatar and Kuwait – amassed sovereign funds worth more than $2.3 trillion. These assets have traditionally comprised a mix of debt and other securities, in addition to influential stakes in some of the world’s biggest companies such as Glencore, VW and Barclays.

Large chunks of this cash are now being repatriated back to the region to finance widening budget deficits, which this year are expected to be in the region of 13% of GDP in the GCC. Should oil prices average $56 per barrel next year, then GCC states would need to liquidate some $208 billion of their overseas assets, or just below 10% of their sovereign fund holdings, based on a Breakingviews analysis of their fiscal break-even costs. But if oil prices fall to $20 a barrel, as Goldman Sachs has warned, the GCC states may have to sell $494 billion worth of booty to make up the budgetary shortfalls based on forecast fiscal costs for their oil production in 2016. This is provided they maintain the lavish rates of public spending that the region’s populations have become accustomed to.

At that rate of divestment these sheikhdoms – which pump about a fifth of the world’s oil – would almost drain their funds entirely by 2020. The Saudi Arabian Monetary Agency – which also acts as the country’s central bank – has already started to sell down some of its foreign assets, while money managers are reporting growing redemptions from other funds in the region. Gulf rulers have so far resisted any temptation to jettison their most treasured assets, which in many cases have granted them board seats atop some of the world’s leading companies. As oil keeps falling, even these investment jewels will come up for grabs.

Saud will have to cut payments to its thousands of princes.

• Oil Price Rout Will Bring End To Era Of Saudi Arabian Largesse (Telegraph)

A global oil price rout will bring an end to the era of Saudi Arabian largesse, as crude prices have tumbled to 11-year lows. “The era of material overspending is likely firmly behind us”, said Jean-Michel Saliba, an economist at Bank of America. A brutal sell-off in commodity prices has taken its toll on the Gulf state, which has been dependent on oil for more than three-quarters of its revenues. “Fiscal space is likely tight,” Mr Saliba said, in the wake of a historic budget for the Saudi regime. Officials have been forced to report a record budget deficit of 367bn riyals (£66bn) this year, up from 54bn riyals the previous year. While the deficit was smaller than anticipated, at 15pc of Saudi’s GDP, rather than the 20pc anticipated by economists, Mr Saliba warned that the government’s official figures have been prone to revision in the past, and have “tended to be revised upwards mid-way through the following year”.

Policymakers now plan to slash the deficit to 327bn riyals in 2016, by cutting back spending from 975bn riyals to 840bn riyals. The budget “is a significant one for the Saudi Arabian economy,” explained Mr Saliba. The country’s leadership, painfully reliant on oil, have failed to diversify the Saudi economy. The kingdom’s 2016 budget “likely markets the end of material overspending practices given tighten controls”, as the price of a barrel of Brent crude has tumbled from $115 (£77) in July 2014 to just $36 in recent days. “Budget execution will now be paramount,” said Mr Saliba. The new Saudi budget revealed plans to throttle investment spending. However, officials intend “only to slow the growth in recurring expenditure”, the Wall Street bank explained, rather than planning to cut it outright. The small non-oil parts of the economy will find themselves constrained by plans to cut public spending growth, preventing Saudi Arabia from rebalancing away from the commodity that until now has kept it wealthy.

Don’t forget this is happening as everyone is producing at full blast. Storage space will be finite. And then?!

• Oil Crash Is Giving Ship Owners a Billion-Dollar Windfall (BBG)

The most destructive oil crash in a generation is giving ship owners a billion-dollar windfall. With OPEC abandoning output limits in a drive for market share, ships that carry as much as 2 million barrels a trip are in demand to haul crude from the Middle East to Asia and North America. While oil prices fell about 35% in 2015, average earnings for these carriers jumped to $67,366 a day, the most since at least 2009, according to Clarkson, the world’s largest shipbroker. “The stars are aligned for us right now,” Nikolas Tsakos, CEO of Tsakos Energy Navigation, said in an interview at Bloomberg’s New York offices, adding that falling oil prices will likely stimulate demand and cargoes next year. Tanker analysts are predicting the rate boom will persist for many of the same reasons oil forecasters are bearish.

OPEC shows no sign of reversing its market strategy, and Iran has outlined plans to ramp up its exports once economic sanctions against the country are lifted. At the same time, the U.S. just repealed a four-decades old limit on its exports. With on-land inventories already at record levels, this could mean more barrels will eventually be stored on ships, further increasing profit, said Tsakos. The biggest tanker operators who manage fleets from Europe are Euronav, based in Antwerp, Belgium, DHT, Frontline, which runs Norway-born billionaire John Fredriksen’s tanker fleet, and Tsakos Energy in Greece. All have seen their shares rise this year while most energy producers have fallen. “We are benefiting from what is currently a challenging environment for the energy sector,” said Svein Moxnes Harfjeld, joint CEO for DHT. “We expect 2016 to be a rewarding year.”

America’s very own Greece.

• Puerto Rico’s Debt Trap (Simon Johnson)

The Caribbean island of Puerto Rico — the largest United States “territory” — is broke, and a human calamity is unfolding there. Unless a constructive course of political action is found in 2016, Puerto Rican migration to the 50 states will rival the scale of the 1930s Dust Bowl exodus from Oklahoma, Arkansas, and other climate-devastated states. With public debt service (principal plus interest) projected to reach nearly 40% of government revenue in 2016, Puerto Rico needs a new set of economic policies. But austerity will not work; this must be an investment-led recovery, with official measures oriented toward boosting growth by reducing the cost of doing business. The question is whether Puerto Rico will have that option.

Much of its $73 billion debt has been issued by government corporations. But, though federal law allows such municipal debt to be restructured under Chapter 9 of the bankruptcy code in all 50 states, this does not apply to U.S. territories like Puerto Rico. As a result, a protracted series of confusing legal battles and selective defaults looms. The cost of essential infrastructure services — electricity, water, sewers, and transportation — will go up while quality declines. One response has been to demand further belt-tightening, for example, in the form of wage reductions and health care cuts. But residents of Puerto Rico are also U.S. citizens and they vote with their feet — the population has fallen from 3.9 million to 3.5 million in recent years as talented and energetic people have moved to Florida, Texas, and other parts of the mainland.

The more creditors insist on lower living standards and higher taxes, the more the tax base will simply leave the island — causing bondholders’ losses to rise. Disorganized defaults by public corporations will make it hard for any part of the private credit system to function. Leading conservatives in the U.S. — including at the Hoover Institution — have long argued in favor of using established bankruptcy procedures when large financial firms fail. The same logic applies here: A judge can remove any doubt that actual insolvency exists, while also ensuring that credit remains available during a restructuring. During that process, a judge can rely on precedent and ensure fairness across creditor classes based on the precise terms under which loans were obtained.

Oh good lord, Joe Stalwart Weisenthal…

• Marc Faber Seeing Recession Clashes With Yellen, Likes Treasuries (BBG)

Marc Faber recommends Treasuries and says the U.S. is at the start of an economic recession, clashing with Federal Reserve Chair Janet Yellen’s view that things are improving. “Ten-year U.S. Treasuries are quite attractive because of my outlook for a weakening economy,” Faber, the publisher of the Gloom, Boom & Doom Report, said on Monday. “I believe that we’re already entering a recession in the United States” and U.S. stocks will fall in 2016, he said. Yellen raised interest rates this month for the first time in almost a decade and said Americans should take the decision as a sign of confidence in the U.S. economy. Analysts differ over whether the Fed’s decision to increase its benchmark came at the right time because the inflation rate is stuck near zero even as gross domestic product expands.

The benchmark U.S. 10-year note yield rose 2 basis points, or 0.02 percentage point, to 2.25% as of 8:31 a.m. in New York, according to Bloomberg Bond Trader prices. The price of the 2.25% security due in November 2025 fell 6/32, or $1.88 per $1,000 face amount, to 99 31/32. Treasuries have returned 1.1% in 2015, down from 6.2% last year, based on Bloomberg World Bond Indexes. U.S. economic growth slowed to an annualized 2% rate last quarter from 3.9% in the previous three months, the Commerce Department said Dec. 22. The last time the economy was in a recession was December 2007 until June 2009, according to the National Bureau of Economic Research. “While things may be uneven across regions of the country and different industrial sectors, we see an economy that is on a path of sustainable improvement,” Yellen said Dec. 16 after the Fed increased its benchmark rate by a quarter percentage point.

Bank bailouts and bail-ins are Italy’s political powder keg.

• World’s Oldest Bank Sells Bad Loans To Deutsche (BBG)

Banca Monte dei Paschi di Siena agreed to sell non-performing loans with a book value of about €1 billion to Epicuro SPV, a company backed by affiliates of Deutsche Bank, as the world’s oldest bank seeks to shore up its finances. Most of the loans became non-performing before 2009, the Italian bank said in a statement on Monday. The deal will have a negligible impact on Monte Paschi’s earnings and be completed by the end of the year. The portfolio is composed of almost 18,000 borrowers. CEO Fabrizio Viola is bolstering the bank’s finances by reducing risk and divesting assets after tapping investors twice in less than two years. In June, Monte Paschi sold €1.3 billion of non-performing loans to Cerberus Capita and Banca Ifis.

The portfolio sale is consistent with Monte Paschi’s 2015 to 2018 business plan, which forecasts as much as €5.5 billion of NPL disposals, according to a note from brokerage Fidentiis, which has a sell rating on the bank’s shares. The Siena, Italy-based lender said Dec. 16 that it will restate its financial accounts to comply with a request from Italy’s stock-market watchdog Consob that the bank change how it booked a transaction with Nomura. Consob asked the bank to amend its 2014 and first-half accounts to reflect the deal dubbed Alexandria should be treated as a credit-default swap instead of a repurchase agreement.

Milan prosecutors found new information this year as they investigated the transaction, which the former management had used to hide losses, the bank said, citing Consob’s request. The restatement should have a positive impact of €714 million before taxes on 2015 results, while it will be neutral on capital. Monte Paschi has been engulfed by legal probes into former managers who had covered losses with the Nomura transaction and a similar deal with Deutsche Bank. The lender is now seeking a buyer to help restore profit as bad loans mount.

Can’t help wondering what Beppe is thinking right now. He never wanted M5S to get caught up in the poisonous Italian mainstream politics.

• Italy’s Five Star Movement on the Rise (FT)

When the populist Five Star Movement burst into Italian politics in 2009 during the financial crisis, it was defined by uncompromising protests and the burly, sardonic figure of its leader, the comedian Beppe Grillo. But the Five Star Movement is now attempting to change its face from that of one of Europe s most eccentric -even clownish political parties. The transformation aims to achieve what seemed like a fantasy only a year ago: to govern the country and challenge the centre-left government led by prime minister Matteo Renzi. Mr Grillo, 67, has removed his name from the party logo, signalling that he may soon step aside. His most likely heir is Luigi Di Maio, a 29-year-old smooth-talking Neapolitan with polished looks, tight-fitting dark suits and moderate tones.

The perception of the movement has changed, Mr Di Maio tells the FT. At the beginning there was the idea that this was a protest movement .. “But we crashed through that wall. We want to govern”. The odds of that happening are increasing. The Five Star Movement is now Italy s second party. After trailing Mr Renzi s Democratic party by nearly 20 percentage points a year ago, recent polls suggest the margin has shrunk to about 5 percentage points, 32% to 27%. The Five Star Movement is certainly in the best shape of all of Renzi’s challengers, and he is scared of them, says Gianfranco Pasquino, a professor of political science at SAIS-Europe in Bologna. That the Five Star Movement even has a shot at threatening Mr Renzi says much about the waning political momentum suffered by the 40-year former mayor of Florence, who took office in February 2014 amid high hopes that he could transform Italy.

The economy is growing again after years of stagnation and recession. But the gains have not been broadly felt. “People are discouraged, disappointed and still angry”, Roberto D Alimonte, a political-science professor at Luiss university in Rome, says. The recovery has not filtered down. Mr Di Maio has certainly been honing his message against the prime minister. “Renzi seemed like a new face but it didn’t take much to understand that he was moving in the direction of the same old way of governing this country”, he says. But convincing Italians that the Five Star Movement is a credible alternative remains a tall order since many still see it as a party of pure obstruction and opposition. Mr Grillo’s best known political slogan when he launched the movement was “vaffanculo”, an earthy expletive aimed at the establishment. And he has refused to consider being part of any coalition government.

I really don’t really want to spend time on Trump, or US politics in general, but Taibbi does a way above par analysis.

• In the Year of Trump, the Joke Was On Us (Matt Taibbi)

A pre-2015 Trump fantasy was probably something like romping with models after simultaneously winning the Nobel Prizes for Peace, Literature and Physics (they love me in Sweden – scientists were amazed by the size of my skyscraper!). He almost certainly would have been grossed out by a Ghost-of-Christmas-Future-style image of his 2015 self being feted by crowds of rifle-toting white power nerds. But shortly after Trump jumped into the race, he stumbled onto a secret: whenever he blurted out forbidden thoughts about race, ethnicity or gender, he was showered with the attention he always craved. A sizable portion of the country seemed appalled at the things he said. But at the same time he was suddenly attracting huge and adoring crowds at down-home sites like Bluffton, South Carolina and Mobile, Alabama, pretty much the last places you’d ever expect the Trump brand to take off.

Trump had spent his entire career lending his name to luxury properties that promised exclusivity and separation from exactly the sort of struggling Joes who turned out for these speeches. If you live in a Trump building in a place like the Upper West Side, it’s supposed to mean that you’re too cosmopolitan, stylish, and successful – too smart-set – to mix with the rabble. But the rabble – white, working-class, rural, despising exactly those big-city elites who live in Trump’s buildings – turned out to be Trump’s base. They’re the people who hooted and hollered every time he said something off-color about Muslims or Mexicans or Asians (“We want deal!” Trump snickered earlier this year, in a Chinese-waiter voice) or “the blacks.” It was a bizarre marriage, but it made sense from from a clinical point of view. Attention is attention.

Patient with narcissistic personality disorder discovers massive source of narcissistic supply, so he sets about securing its regular delivery. So one comment about Mexicans turned into another about Megyn Kelly’s “wherever,” which turned into a call for a Black Lives Matter protester to be “roughed up,” which turned into an insane slapstick routine about a Times reporter with arthrogryposis, and so on. By December, you had to check Twitter every few hours just to see which cultural taboo Trump was stomping on now. The presidential campaign Trump began as just the latest in a long line of zany self-promotional gambits has now turned into the long-delayed other shoe dropping from the American civil rights movement. This goofball billionaire mirror-gazer has unleashed a half-century of crackpot grievances about the post-civil rights cultural landscape that a plurality of seething white people felt they never had permission to air, until he came along.

“Turkey has gone from being viewed by Western government officials, media and academics as an influential, moderating force for regional stability and economic growth, to a tacit supporter, if not outright sponsor, of international terrorism.”

• Turkey’s Dangerous Game in Syria (WSJ)

When the Syrian civil war broke out in 2011, Turkey was one of the earliest countries to invest heavily in the overthrow of the Assad regime. Despite a decade of warming relations with Syria, President Recep Tayyip Erdogan was making a bid to become the region’s dominant power. The situation in Syria has since changed dramatically—but the Erdogan strategy has not. The result is that Turkey has become a barrier to resolving the conflict. It wages war on the Syrian Kurds, Islamic State’s most effective opponents. And the country now plays host to an elaborate network of jihadists, including ISIS. Early on, Turkey wanted to foster a Sunni majority government in Syria, preferably run by the local branch of the Muslim Brotherhood.

This would deprive Turkey’s two historical rivals, Russia and Iran, of an important client state, while allowing it to gain one of its own. The plan was simple and elegant. But the Assad regime proved more resilient than expected, and the West refused to intervene and deliver a coup de grâce. So-called moderate Syrian rebels have either been sidelined by Islamist militants, or revealed to have been Islamist militants themselves. Thanks to Islamic State, the war has spread to engulf half of Iraq. And yet, as a global consensus solidified about the importance of defeating ISIS, Turkey has continued to play the game as if it were 2011. This summer, for example, the Erdogan government came to an important agreement to let the U.S. use two of its air bases for strikes against ISIS.

Yet Turkey has used the same bases to attack Kurdish forces in Iraq and Syria. The Erdogan government remains more concerned with limiting the power of the Kurds in Syria than with defeating ISIS. Turkey has gone from being viewed by Western government officials, media and academics as an influential, moderating force for regional stability and economic growth, to a tacit supporter, if not outright sponsor, of international terrorism. It is also viewed as a dangerous ally that risks plunging NATO into an unwanted conflict with Russia. When Russian President Vladimir Putin labeled the Erdogan government “accomplices of terrorists” after its fighter planes downed a Russian jet on Nov. 24, he was bluntly rewording an accusation that has been made repeatedly, but more diplomatically, in the West.

The accusation: Turkey allows oil and artifacts looted by Islamic State to flow across its border in one direction, while foreign jihadists, cash and arms travel in the other. Speaking last year of the porous Turkey-Syria border, Vice President Joe Biden let slip, in a moment of candor, that the biggest problem the U.S. faced in confronting ISIS was its own allies. More recently, on Nov. 27, a senior Obama administration official described the situation to this newspaper as “an international threat, and it’s all coming out of Syria and it’s coming through Turkish territory.”

Throw in eye-watering corruption and you have a lot of misery. Thanks, Victoria Nuland!

• Ukraine Inflation Hits 44% Amid Economic Collapse (Telegraph)

Inflation will hit 44pc in Ukraine this year, as the embattled economy has seen prices soar amid economic collapse. Consumer prices have hit eye-watering levels in 2015, according to the country’s central bank governor. Inflation averaged 24.9pc in 2014. Valeria Gontareva, of the National Bank of Ukraine, said authorities were aiming to get inflation to around 5pc by 2019. The war-torn economy, which has been plunged into crisis following conflict with neighbouring giant Russia, will also start to gradually lift capital controls as it begins to receive disbursements of bail-out cash from international lenders, said Ms Gontareva. Ukraine is set to receive around $9bn in rescue cash in 2016, including $4.5bn from the IMF, $1.5bn from the EU, and $1bn loan guarantee from the United States, which will be released in the first quarter of next year.

The economy has also lumbered under capital controls which limit the purchasing of foreign exchange in a bid to protect the collapsing value of the hryvnia. Bail-out cash will also help boost Ukraine’s dwindling foreign exchange reserves, which have steadily grown over the last months to stand at $13.3bn in December. Ukraine has been locked in a stalemate with Moscow over the repayment of a $3bn bond. Kiev defaulted on the debt earlier this month after Russian authorities refused to take part in a private sector debt haircut. The issue has also stoked tensions with the IMF, which changed its lending rules to continue providing aid to governments who fall into arrears. But Ukraine’s central bank chief said there was now no “hindrance” to the release of IMF aid to the country in 2016. “The IMF mission has agreed everything, they don’t need to come to Kiev anymore.”

Frontex are the vanguard of an occupation force.

• Frontex Sends 300 Guards In Migrant Mission To Greece (AFP)

EU border agency Frontex said Tuesday it had started to deploy 293 officers and 15 vessels on Greek islands to help Athens cope with the massive influx of migrants to its shores. The guards “will assist in identifying and fingerprinting of arriving migrants, along with interpreters and forged document experts,” Frontex said in a statement. “The number of border guards deployed will gradually increase to over 400 officers as well as additional vessels, vehicles and other technical equipment,” it added. More than one million migrants and refugees have landed in Europe this year, with more than 800,000 coming via Greece. At least 3,692 have died attempting to reach Europe across the Mediterranean, according to the International Organization for Migration (IOM).

Topping off the misery. What everyone feared would happen. Kostas and his crew are handing out warm blankets like crazy.

• Heated Areas To Open To Homeless In Athens As Cold Snap Expected (Kath.)

Municipal authorities in Athens are bracing for a cold snap at the end of the week and are opening emergency shelters for the capital’s homeless. Heated halls will be open to vulnerable groups from 10 a.m. on Wednesday at 35 Alexandras Avenue and at the indoor gymnasium opposite 165 Pireos Street. They will remain open until the cold snap ends, which is expected to happen on the weekend. The National Meteorological Service on Tuesday said that temperatures in the capital are expected to drop on Thursday and Friday to nighttime lows of below 0 degrees Celsius (32 Fahrenheit), with a chance of snow in northern parts. The cold weather is also expected to grip other parts of the country, particularly in the north, where authorities are also taking steps to provide warm spaces for vulnerable groups.

F**king Amen, brother. “I was a stranger, and ye took me not in: naked, and ye clothed me not.”

• As Europe Turns Gray (Pantelis Boukalas)

While the religious leaderships of Christian Europe went to pains to remind their faithful in their Christmas messages that Christ and his family were also refugees, Europe’s political leadership did not appear particularly moved – even less so great chunks of the societies that shape the contradictory and self-seeking face of Europe. The fact is that gray is about the most hopeful color that this part of the bloc can be colored, and it has covered much of its area. This is evidenced by elections and public opinion polls in France, Austria, the Czech Republic, Slovakia, the Netherlands and of course Greece, where the rot of racism from the far-right part of those nations is marring the heartfelt expressions of solidarity from so many other members of their societies.

This is also confirmed by the spike in hate attacks: Molotov cocktails launched at refugee camps, anti-refugee rallies, attacks on foreigners, sacred sites and symbols of non-Christian religions, enthusiasm for fences and barricades etc. This gray rot is insidious and threatens to swallow up all that is bright and gives birth to the solidarity shown toward migrants and refugees by those who have chosen to take action in the face of intolerance: people who act in the proper Christian spirit even if they are atheists, agnostics or of another faith. In an atmosphere where consumption fever and the commercialized “Christmas spirit” leaves little room for the true spirit of giving without expecting anything in return to flourish, the symbol of Christ as the political refugee becomes inert.

You cannot use him as a paradigm because he too will become another irritating figure without a home, someone belonging to a bygone era, unwanted and shunned. The fugitive Christ is born and dies every day in the faces of the children that drown in the Aegean or in the waters off Italy, Spain and France. He dies every day in front of the walls of a West that knows how to create wave upon wave of refugees through its cold, calculating actions but is indifferent to helping the victims.

The human mind cannot predict divine will. But maybe it is not blasphemous to speculate that if the Son of God were at Stephansplatz in Vienna last week – during the time of the year meant to celebrate his birth – and seen the disgusting performance of hate staged by far-right “thespians” (men in hoods posing as jihadists, beheading Europeans holding signs welcoming refugees), he would have been unable not to utter the words: “I was a stranger, and ye took me not in: naked, and ye clothed me not.”