Ivan Aivazovsky The Galata tower by moonlight 1845

Nobody seems to care much.

• The Trump Administration Is Headed For A Gigantic Debt Headache (CNBC)

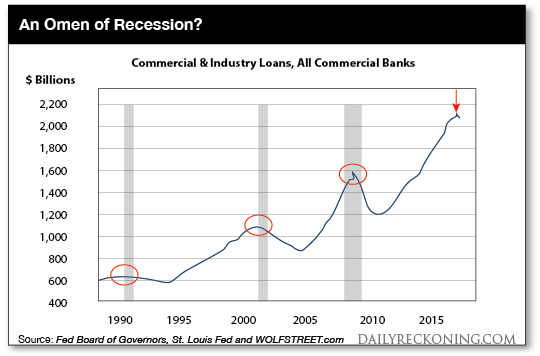

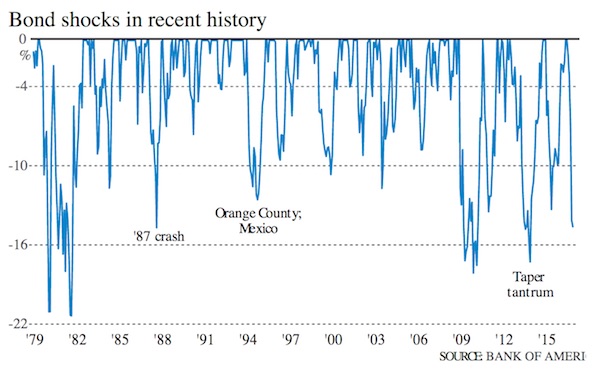

Swelling government debt levels are shaping up to be the biggest economic challenge for President Donald Trump, a problem that could spill into the stock market. This week’s Treasury Department announcement that it would have to increase the amount of bond auctions over the next three months was a low-key reminder that the government IOU is only getting bigger and will start influencing interest rates sooner rather than later. As more product comes to market, investors could be expected to demand higher yields to snap up all the supply. And those higher yields mean higher costs at a time when taxpayers already have shelled out nearly half a trillion dollars this year in debt service.

Put it all together and it raises questions about how long the spurt in economic growth will continue, what will happen the next time the economy falls into recession and what impact it all will have on financial markets. “We’re applauding strong growth — yet have no choice but to borrow the largest amount of money since the financial crisis a decade ago,” Bernard Baumohl, chief global economist at The Economic Outlook Group, said in a note. “And that’s just the start, the US will [be] running trillion dollar deficits as far as the eye can see.” The total U.S. debt just passed the $21.3 trillion mark, of which $15.6 trillion is owed by the public.

The Treasury announced Wednesday that it will be adding $1 billion each to auctions of 2-, 3- and 5-year debt over the next three months, and $1 billion each for 7- and 10-year note and 30-year bond auctions in August. In addition, the department is issuing a new two-month note to help assure liquidity in the fixed income market. The changes will add $30 billion to the debt issuance for the quarter. On the overall, the Treasury said it expects to borrow $769 billion in the second half of the year, a projected 63% increase from 2017.

So much for Apple then.

• The First Company To Reach $1 Trillion In Market Value Was In China (CNBC)

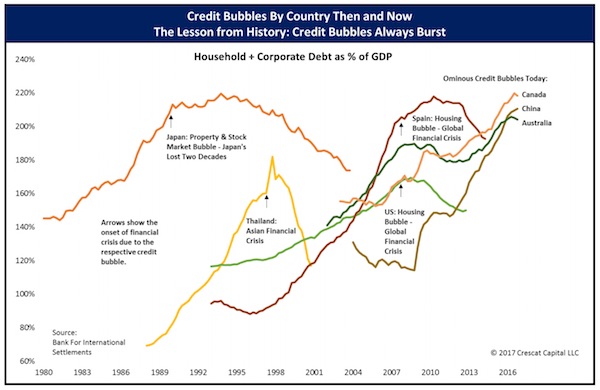

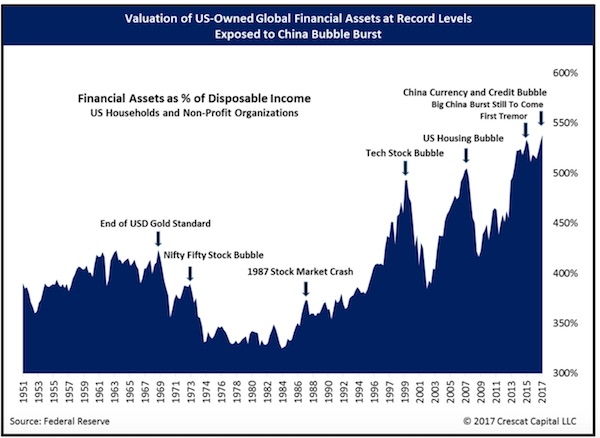

Before Apple hit $1 trillion in market value Thursday, there was Chinese oil giant PetroChina, which reached the milestone more than a decade ago. It did not fare too well after that. PetroChina’s market cap hit $1 trillion in 2007 following a successful debut on the Shanghai Stock Exchange on Nov. 5 of that year. The company’s Shanghai-listed shares nearly tripled at the open that day, with its Hong Kong-listed shares following them higher. (It had debuted on the Hong Kong exchange years earlier.) The rise gave the company a market cap of $1.1 trillion on both the Shanghai and Hong Kong exchanges.

According to Reuters, PetroChina’s opening price in Shanghai valued the company at 60 times analysts’ forecasts for its 2007 earnings per share, above the global average of 18 times for oil companys at the time. It was all downhill from there, however. PetroChina’s market value plummeted to less than $260 billion by the end of 2008, representing the largest destruction of shareholder wealth in world history, according to Bloomberg. Blame the financial crisis and a collapse in oil prices. When PetroChina made its debut in 2007 brent crude prices were at one point, above $140 a barrel. Today they are about half that.

This piece cites PetroChina, but says not enough shares were outstanding. But Apple’s outstanding shares shrank a lot as well, because of buybacks.

• Apple Becomes World’s First Trillion-Dollar Company (G.)

Apple became the world’s first trillion-dollar public company on Thursday, as a rise in its share price pushed it past the landmark valuation. The iMac to iPhone company, co-founded to sell personal computers by the late Steve Jobs in 1976, reached the historic milestone as its shares hit $207.05, the day after it posted strong financial results. Apple’s share price has grown 2,000% since Tim Cook replaced Jobs as chief executive in 2011. The company hit a $1tn market capitalisation 42 years after Apple was founded and 117 years after US Steel became the first company to be valued at $1bn in 1901. It means Apple’s stock market value is more than a third the size of the UK economy and larger than the economies of Turkey and Switzerland.

While energy company PetroChina was cited as the world’s first trillion-dollar company after its 2007 flotation, the valuation is considered unreliable because only 2% of the company was released for public trading. Saudi Arabia’s national oil company Saudi Aramco could be worth up to $2tn upon its planned stock market float but the value is yet to be tested. This week’s rise in Apple’s share price was powered by quarterly financial results released on Tuesday that were better than Wall Street had expected. The tech giant racked up profits of $11.5bn in three months on the back of record sales that hit $53.3bn, pushing shares of the iPhone giant higher and easing the value of the company up from $935bn towards $1tn (£770bn).

Ryan Cooper focuses on lower wages as a result of buybacks. I would go for the death of price discovery. Apple may be ‘worth’ one trillion, but it has a $100 billion buybacks war chest. That’s 10%. So what is it really worth.

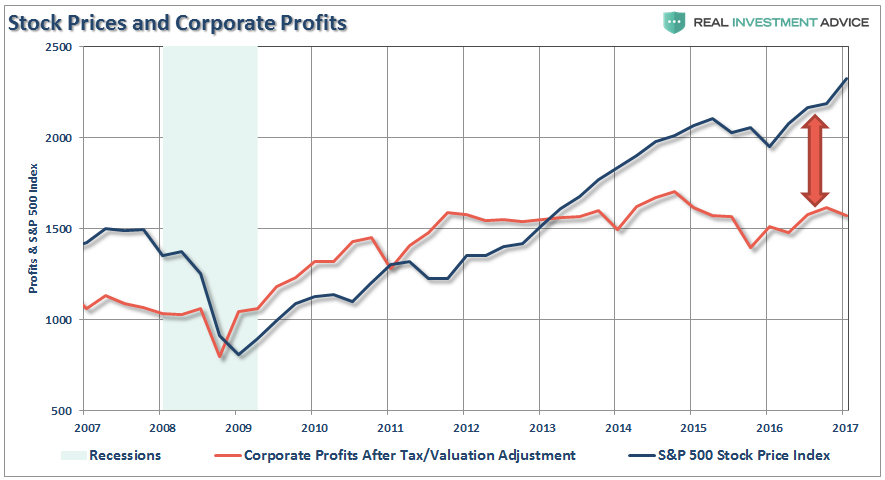

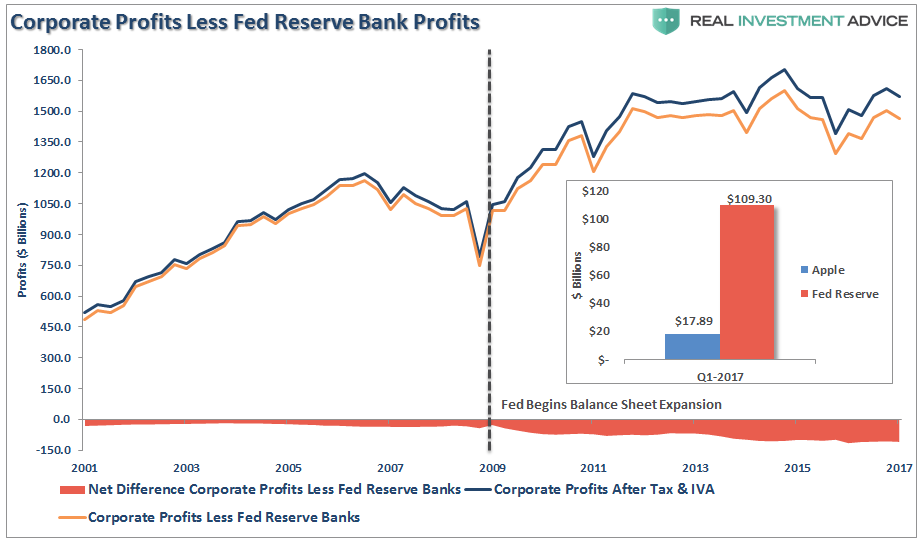

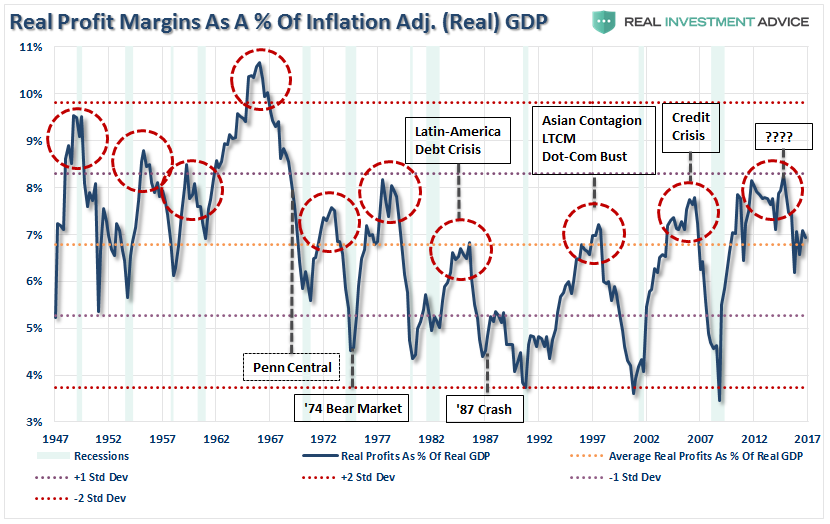

American corporations are simply raking in profits. Some are so bloated and cash-rich they literally can’t figure out what to do with it all. Apple, for instance, is sitting on nearly a quarter of a trillion dollars — and that’s down a bit from earlier this year. Microsoft and Google, meanwhile, were sitting on “only” $132 billion and $63 billion respectively (as of March this year). However, American corporations in general are taking those profits and kicking them out to shareholders, mainly in the form of share buybacks. These are when a corporation uses profits, cash, or borrowed money to buy its own stock, thus increasing its price and the wealth of its shareholders. (Big Tech is doing this as well, just not fast enough to draw down their dragon hoards.)

As a new joint report from the Roosevelt Institute and the National Employment Law Project by Katy Milani and Irene Tung shows, from 2015 to 2017 corporations spent nearly 60% of their net profits on buybacks. This practice should be banned immediately, as it was before the Reagan administration. The most immediately objectionable consequence of share buybacks is they come at the expense of wages. Milani and Tung calculate that if buybacks spending had been funneled into wage increases, McDonald’s employees could get a raise of $4,000; those at Starbucks could get $8,000; and those at Lowes, Home Depot, and CVS could get an eye-popping $18,000.

Some economists are skeptical of this reasoning, arguing that wages are set according to labor market conditions. But if you set aside free market dogmatism, it is beyond obvious that this sort of behavior is coming at workers’ expense. Wall Street bloodsuckers are not at all subtle about it, screaming bloody murder and tanking stocks every time a public company proposes paying workers instead of shareholders. Indeed, it provides a highly convincing explanation for something that has been puzzling analysts for months: the situation of wages continuing to stagnate or decline while unemployment is at 4%. The answer is that wages are low in large part because the American corporate structure has been rigged in favor of shareholders and executives.

And Tesla was up 16% yesterday?!

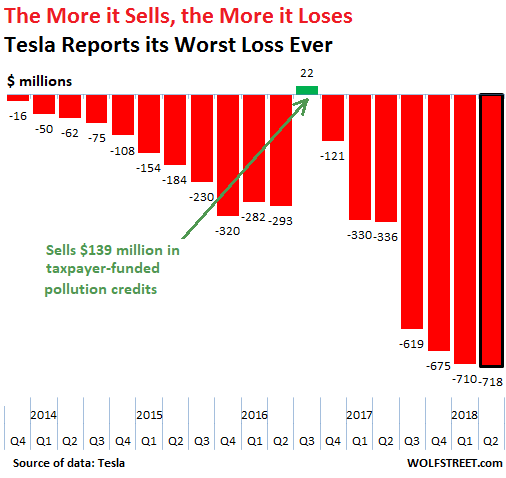

• Where Are the 17,000 Model 3 Cars Tesla “Produced” But Didn’t “Deliver”? (WS)

Tesla never ceases to astound with its hype and promises and with its results that are just mindboggling, including today when it reported its Q2 “earnings” – meaning a net loss of $718 million, its largest net loss ever in its loss-drenched history spanning over a decade. It was more than double its record loss a year ago: The small solitary green bump in Q3 2016 wasn’t actually some kind of operational genius that suddenly set in for a brief period. No, Tesla sold $139 million in taxpayer-funded pollution credits to other companies, which allowed it to show a profit of $22 million. Tesla adheres strictly to a business model that is much appreciated by the stock market: The more it sells, the more money it loses.

Total revenues – automotive and energy combined – rose 43% year-over-year to $4.0 billion in Q2. This increase in revenues was bought with a 113% surge in net losses. When losses surge over twice as fast as revenues, it’s not the light at the end of the tunnel you’re seeing. In between the lines of its earnings report, Tesla also confirmed the veracity of the many videos and pictures circulating on the internet that show huge parking lots filled with thousands of brand-new, Model 3 vehicles, unsold, undelivered, perhaps unfinished, waiting for some sort of miracle, perhaps needing more work, more parts, or additional testing before they can be sold, if they can be sold.

But these thousands of vehicles were nevertheless “factory gated,” as Tesla said, to hit the 5,000 a week production goal. And so they’re unfinished and cannot be delivered but are outside the factory gate, and Tesla didn’t totally lie about its “production” numbers. Now it put a number on these “produced” but undelivered vehicles: 12,571 in Q2 on top of the 4,497 in Q1, for a total of 17,000 vehicles sitting in parking lots.

Wealth transfer.

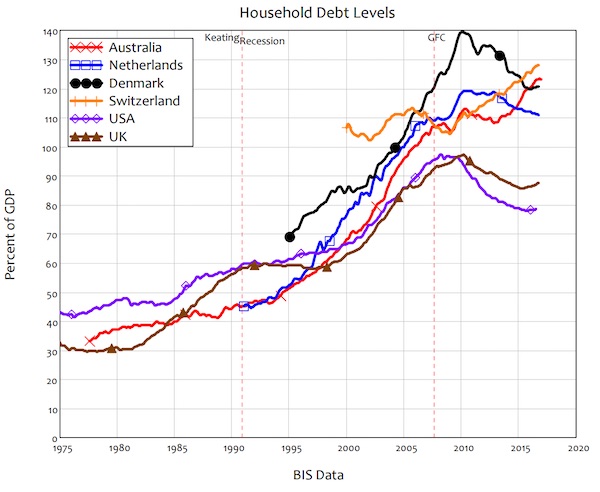

• Middle-Class Americans Still Haven’t Recovered From Housing Bust (MW)

A new study by the Opportunity and Growth Institute at the Minneapolis Fed found that the housing boom and bust made middle-class Americans poorer but boosted wealth for the richest 10%, widening the income and wealth gap substantially. Authors of the paper examined the relationship between incomes and asset prices over the past 70 years, concluding that rising and falling housing and stock markets have been the main drivers of wealth inequality. In the simplest model, the authors wrote, how fast wealth accumulates should be a function of how fast incomes rise. But incomes played only a minor role in wealth distributions in postwar America. Instead, wealth accumulation for most Americans was driven by booming home prices over the past several decade until 2007.

[..] ..real incomes of middle-class Americans rose by a third between 1970 and 2007, or less than 1% a year, while incomes of the bottom half have been largely stagnant since about 1970. Incomes for the top 10%, meanwhile, have doubled over the same period. Incomes for the bottom 90% have stagnant over the past 10 years. On the wealth distribution side, however, the poor became poorer, while the rich became richer after the financial crisis. Up until 2007, middle class Americans saw their wealth increase at the same rate as their wealthy counterparts, rising 140% over 40 years. Incomes for households in the bottom half doubled from 1971 until 2007—all thanks to booming house prices.

Perspective: “Chinese stocks were worth $6.09 trillion, compared with $6.17 trillion in Japan. The US market is worth $31 trillion.”

• China Loses Spot As World’s No. 2 Stock Market to Japan (AFP)

China’s stock market has been overtaken as the world’s second-biggest by Japan’s, having been swiped this year by the threat of a trade war with the United States and slowing economic growth. Data from Bloomberg News in intra-day trade on Friday showed the value of equities on the mainland had slipped behind those in their neighbouring country for the first time since taking the number-two spot in 2014. The figures showed Chinese stocks were worth $6.09 trillion, compared with $6.17 trillion in Japan. The US market is worth $31 trillion. While global markets have been broadly hit by fears of a trade war between the world’s top two economies, Chinese equities are among the worst performers this year, with the benchmark Shanghai Composite Index slumping more than 16% since the start of January.

The pressure was ratcheted up this week when the White House said it was considering more than doubling threatened tariffs on a range of Chinese imports worth $200 billion. Washington has already imposed tariffs on $34 billion worth of goods and is considering hitting another $16 billion in the coming weeks. “Losing the ranking to Japan is the damage caused by the trade war,” Banny Lam, head of research at CEB International Investment in Hong Kong, told Bloomberg News. “The Japan equity gauge is relatively more stable around the current level but China’s market cap has slumped from its peak this year.”

But what really happened? Julian Assange knows. Kim Dotcom knows.

• Judge Rejects Suit Against Fox News Brought By Parents Of Seth Rich (NBC)

A New York judge has rejected a lawsuit brought against Fox News by the parents of a Democratic National Committee employee killed in 2016. In a ruling Thursday, U.S. District Judge George Daniels said he understood Joel and Mary Rich might feel that the tragic death of their son was exploited for political purposes, but that the lawsuit lacked specific instances of wrongdoing necessary to proceed to trial. In the March lawsuit, the parents said that Fox News turned the death of their son, Seth Rich, into a “political football” by claiming he had leaked DNC emails to Wikileaks during the presidential campaign. The 27-year-old Rich was killed in what Washington police believe was a random robbery attempt. The judge also dismissed a related suit by a private investigator.

Nice twist.

• Saudi Arabia Planned To Invade Qatar Last Summer. Tillerson Intervened (IC)

Thirteen hours before Secretary of State Rex Tillerson learned from the presidential Twitter feed that he was being fired, he did something that President Donald Trump had been unwilling to do. Following a phone call with his British counterpart, Tillerson condemned a deadly nerve agent attack in the U.K., saying that he had “full confidence in the U.K.’s investigation and its assessment that Russia was likely responsible.” White House Press Secretary Sarah Sanders had called the attack “reckless, indiscriminate, and irresponsible,” but stopped short of blaming Russia, leading numerous media outlets to speculate that Tillerson was fired for criticizing Russia.

But in the months that followed his departure, press reports strongly suggested that the countries lobbying hardest for Tillerson’s removal were Saudi Arabia and the United Arab Emirates, both of which were frustrated by Tillerson’s attempts to mediate and end their blockade of Qatar. One report in the New York Times even suggested that the UAE ambassador to Washington knew that Tillerson would be forced out three months before he was fired in March. The Intercept has learned of a previously unreported episode that stoked the UAE and Saudi Arabia’s anger at Tillerson and that may have played a key role in his removal. In the summer of 2017, several months before the Gulf allies started pushing for his ouster, Tillerson intervened to stop a secret Saudi-led, UAE-backed plan to invade and essentially conquer Qatar, according to one current member of the U.S. intelligence community and two former State Department officials, all of whom declined to be named, citing the sensitivity of the matter.

A nation that refuses to feed its children.

• Food Banks Appeal For Donations To Feed Children During School Holidays (G.)

Calls have been made for the public to donate to their local food bank during the summer holidays owing to increasing demand from families who rely on free school meals during term time. The Trussell Trust, an anti-poverty charity, said an increase in food bank use over the summer was driven by a rise in demand by children, as it released figures from its network of more than 420 food banks across the country. While the number of adults seeking supplies from food banks during the summer months decreased in 2017, the number of children needing support shot up. During July and August 2017, food banks provided more than 204,525 three-day emergency supplies, 74,011 of which went to children. In the preceding two months, 70,510 supplies went to children. The number of adults seeking help from food banks fell from 131,521 in May and June to 130,514 in July and August.

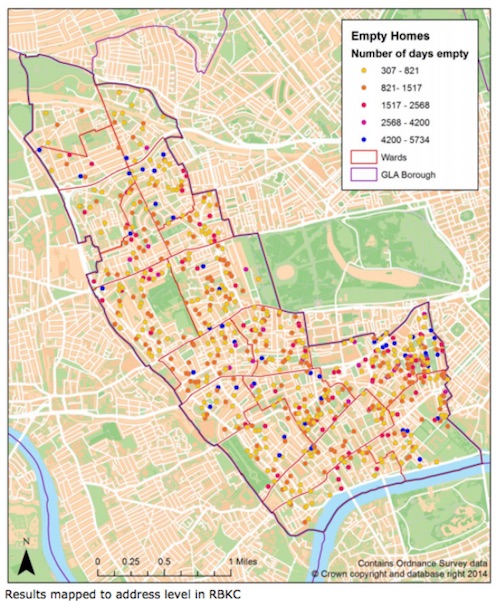

“..a billionaire’s flat in Knightsbridge costs just £1,421 a year, while a shop on the floor below can pay £244,000 in business rates.”

• Britain Heading Back To Pre-Victorian Days (G.)

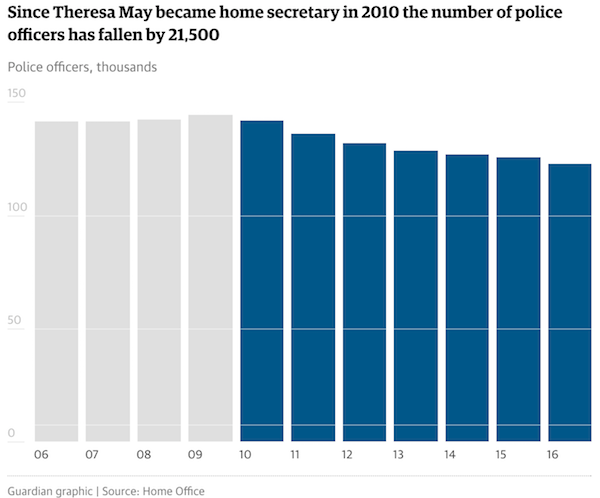

Is Northamptonshire Britain’s first banana republic? This once lovely county, much of it now a waste of wind turbines and warehouses, is close to bankruptcy. It must sack staff, freeze pay, close two-thirds of its libraries and stop all bus subsidies. It faces default on its statutory duty to public health, children in care and the elderly. While much of this is due to mismanagement, the National Audit Office says that 15 other counties, believed to include Somerset and Surrey, are in similar straits. Years of austerity are coming home to roost – and where least expected, among the rich shires. What is going on? Local councils cannot do what central government can do, which is tax and borrow to meet need.

Each year Whitehall spends more. It can tip money into the NHS and triple-lock pensions – good causes both – as well as vanity projects such as aircraft carriers, high-speed trains and nuclear power stations. Councils have no such discretion. Since 2010 their spending has shrunk by over a third, with central government grants slashed by as much as NHS spending has risen. 95% of British taxation is controlled by the centre, against 60% in France and 50% in the US. Yet local spending must pick up the casualties of the welfare state – vulnerable children, elderly and infirm people. It must fund the day centres, youth clubs, care homes and visits to problem families. To do so, services that most modern communities expect from government must now be butchered, such as parks, libraries and museums.

Local, not national, austerity is sending Britain back to pre-Victorian days. The solution is swift and easy. The government should uncap local taxes, free local spending, and allow local people to pay for what they want. It was how local government ran, perfectly well, up to the early 1980s. In most other countries it is still regarded as a normal feature of democracy. At present Britain’s meagre local revenue derives from a regressive household tax fixed on 1991 property valuations, which no government (except in Wales) has had the guts to revalue. Thus a billionaire’s flat in Knightsbridge costs just £1,421 a year, while a shop on the floor below can pay £244,000 in business rates. It is no surprise that the former goes to the council, and much of the latter is paid to central government.