Esther Bubley Watching parade to recruit civilian defense volunteers, Washington DC 1943

Another wonderful Ambrose dramatic exeggaration.

• Central Pillar Of Global Order In Danger Of Collapse As TTIP Disintegrates (AEP)

The Transatlantic pact intended to unite Europe and North America in a vast free trade zone is close to collapse after France called for a complete suspension of talks, accusing the US of blocking any workable compromise. “Political support in France for these negotiations no longer exists,” said Matthias Fekl, the French commerce secretary. Mr Fekl said his country would request a formal decision by EU ministers at a summit in Bratislava to drop the hotly-contested deal, known as the Transatlantic Trade and Investment Partnership (TTIP). “The Americans are offering nothing, or just crumbs. That is not how allies should negotiate. There must be a clear and definite halt to these talks, to restart them later on a proper basis,” he said.

The project is infinitely more than a trade deal. It is part of a strategic push to bind together the two halves of North Atlantic civilisation at a dangerous moment when the Western liberal order is under threat. The two sides are currently drifting towards divorce. “TTIP was supposed to set the rules for the global trade,” said Rem Korteweg, a trade expert at the Centre for European Reform. “It was to be a central pillar of an alliance of like-minded countries. If it all falls apart in acrimony, what kind of global governance are we going to have?” he said. Mr Fekl’s hard-line comments were echoed in slightly softer language by French president François Hollande, who said on Tuesday that there was no chance of a deal on TTIP before the next administration takes power in Washington.

“The talks have become bogged down, the positions have not been respected, and the imbalance is obvious. It is better that we face up to this candidly rather than prolong a discussion on foundations that cannot succeed,” he said.

There’s a lot more to get rid of.

• The New TTIP? Meet TISA, ‘Secret Privatisation Pact’ (Ind.)

An international trade deal being negotiated in secret is a “turbo-charged privatisation pact” that poses a threat to democratic sovereignty and “the very concept of public services”, campaigners have warned. But this is not TTIP – the international agreement it appears campaigners in the European Union have managed to scupper over similar concerns – this is TISA, a deal backed by some of the world’s biggest corporations, such as Microsoft, Google, IBM, Walt Disney, Walmart, Citigroup and JP Morgan Chase. Few people may have heard of the Trade In Services Agreement, but campaign group Global Justice Now warns in a new report: “Defeating TTIP may amount to a pyrrhic victory if we allow TISA to pass without challenge.” Like the Transatlantic Trade and Investment Partnership, TISA is being negotiated in secret, even though it could have a major impact on countries which sign up.

While TTIP is only between the EU and US, those behind TISA have global ambitions as it involves most of the world’s major economies – with the notable exceptions of China and Russia – in a group they call the “Really Good Friends of Services”. The Department for International Trade dismissed the idea that public services were at risk from TISA, adding that the UK was committed to securing an “ambitious” deal. But according to Global Justice Now’s report, the deal could “lock in privatisation of public services”; allow “casino capitalism” by undermining financial regulations designed to prevent a recurrence of the 2008 recession; threaten online privacy; damage efforts to fight climate change; and prevent developing countries from improving public services.

Nick Dearden, director of group, said: “This deal is a threat to the very concept of public services. It is a turbo-charged privatisation pact, based on the idea that rather than serving the public interest, governments must step out of the way and allow corporations to ‘get on with it’. “Of particular concern, we fear TISA will include clauses that will prevent governments taking public control of strategic services, and inhibit regulation of the very banks that created the financial crash.” He suggested pro-Brexit voters should be concerned at the potential loss of sovereignty. “Many people were persuaded to leave the EU on the grounds they would be ‘taking back control’ of our economic policy,” Mr Dearden said. “But if we sign up to TISA, our ability to control our economy – to regulate, to protect public services, to fight climate change – is massively reduced. In effect, we would be handing large swathes of policy-making to big business. “

Growth based on debt reduces productive investment.

• Debt, Deficits & Economic Warnings (Roberts)

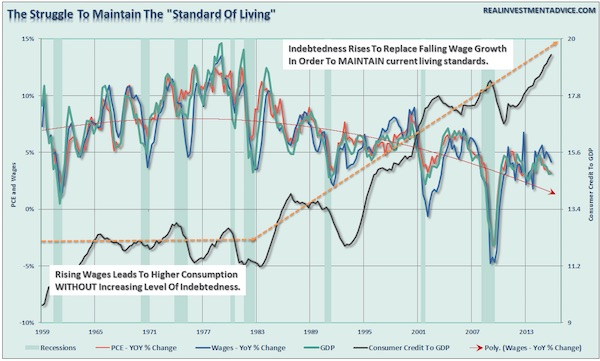

By increasing taxes, to generate additional revenue for the government, you decrease the available capital that could be used for productive investments. Since the government doesn’t want factories, office buildings, or oil wells, but rather cash, this forces the liquidation of productive investments thereby reducing capacity for economic growth. The current Administration is failing once again to recognize the problems that exist with this country, at this moment, does not lie with the “rich.” Instead, the problem is a lack of ability for consumers to maintain a standard of living that is well beyond their earnings capability. While the two most recent Administrations have been heavily criticized for running burgeoning deficits – the reality is that the average American has been doing the same for the past thirty years.

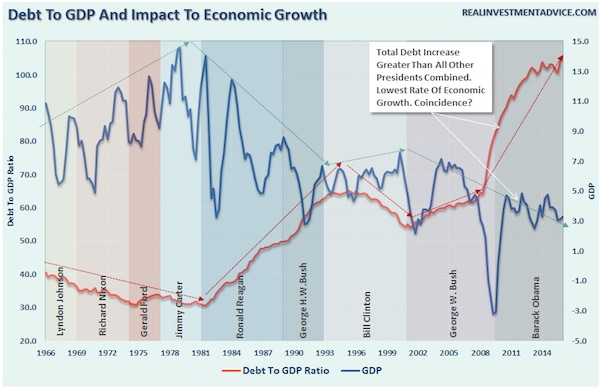

[..] as the “rich” invest in productive investments it leads to higher employment, strong consumer demand and economic growth. In turn, this leads to higher tax revenue. “However, deficits, and deficit spending, are HIGHLY destructive to economic growth as it directly impacts gross receipts and saved capital equally. Like cancer – running deficits, along with continued deficit spending, continues to destroy saved capital and damages capital formation.” Debt is, by its very nature, a cancer on economic growth. As debt levels rise it consumes more capital by diverting it from productive investments into debt service. As debt levels spread through the system it consumes greater amounts of capital until it eventually kills the host. The chart below shows the rise of federal debt and its impact on economic growth.

The reality is that the majority of the aggregate growth in the economy since 1980 has been financed by deficit spending, credit creation and a reduction in savings. This reduced productive investment in the economy and the output of the economy slowed. As the economy slowed, and wages fell, the consumer was forced to take on more leverage to maintain their standard of living which in turn decreased savings. As a result of the increased leverage more of their income was needed to service the debt – and with that the “debt cancer” engulfed the system.

Excellent from Jeffrey Snider.

• The Academic Math of This Economy and The Long Run Consequences (Snider)

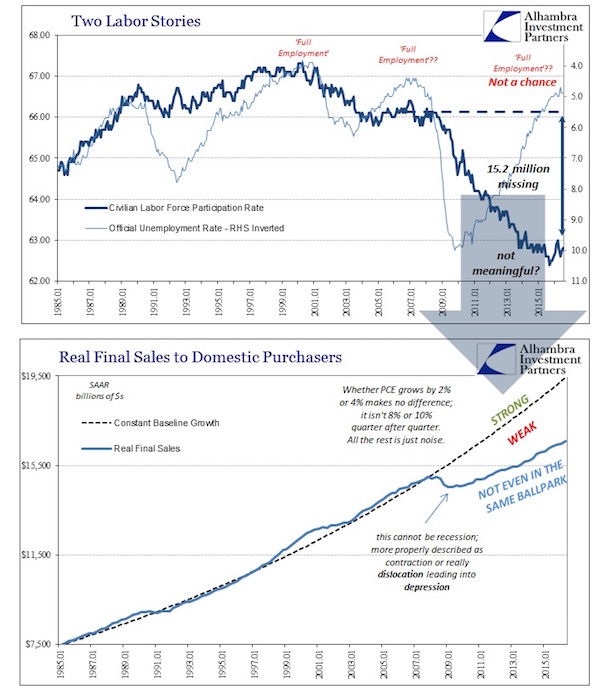

[..] the continued and “unexpected” lack of recovery after nine years of failure in monetary policy is forcing the math to recognize what is obvious in non-mathematical terms. No regressions are at all necessary to conclude that the bond market has, in fact, made sense this whole time and that it is economists who have no idea what is going on or why. By the mathematics of 2011, real GDP “should be” $19.3 trillion in Q2 2016; it was instead just $16.6 trillion after the third straight quarter near 1%. To the academics, “gloom” is irrational and thus requires translation into math to become somehow backwards explanatory for why the economy that “should be” isn’t.

In the actual economy, “gloom” is properly called reality. In this world, people know all-too-well that jobs disappeared during and after the Great Recession and never came back. No amount of asset price manipulation can possibly make up that difference. Economists try to convince everyone but really themselves that it didn’t matter when it is this very math that proves yet again it did; in fact, the true state of labor beyond the unemployment rate and Establishment Survey is all that matters.

The math of potential and even gloom is just the frustratingly late catch-up forcing economists to come to terms with the fact they have been all wrong about all of this all along. You need no PhD to so easily understand that you just cannot substitute jobs with debt; doing so is economic suicide. At some point over the long run you must come to terms with that discrepancy. This math is finally welcoming economists to that long run, a place their patron saint, Keynes, said didn’t exist. It really does as the math has been recalculated far more toward the “impossible” [..]

Yikes graphs. A G-20 that might actually count for something.

• China Turmoil Looms As Traders Bet On Post-G-20 Yuan Tumble (ZH)

Something is different this time. For the last few years, China has ‘ensured stability’ in the Yuan ahead of major geopolitical events – no matter what – only to let things slide back into turmoiling after. Ahead of this weekend’s G-20, however, and amid notably deteriorating fundamentals (and an increasingly hawkish-sounding Fed), China has let the Yuan tumble in the last week… and traders are piling into bets on post-G-20 weakness to continue. As Bloomberg notes, history shows that the Chinese currency usually strengthens ahead of major political or economic events, such as President Xi Jinping’s state visits to the U.S. and the Boao Forum.

But this time – ahead of the G-20 gathering – onshore Yuan is being allowed to weaken… back near post-Brexit lows…

Perhaps as another warning to The Fed? But as Bloomberg reports, derivative markets are pointing to renewed bets on yuan depreciation, with a measure of expected price swings poised for the biggest monthly increase since January.

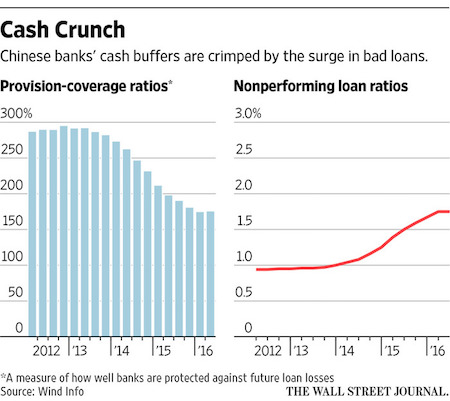

Not even the same ballpark. “The IMF estimates China’s nonperforming-loan ratio at 15%, compared with the official 1.75% figure..”

• Chinese Banks Step Up Bad-Loan Write-Offs (WSJ)

China’s largest banks are writing off huge volumes of soured loans in an effort to clean up their balance sheets, as they look to improve their future profitability despite the country’s economic slowdown. The country’s top four banks collectively wrote off 130.3 billion yuan ($19.5 billion) of bad loans in the first half of 2016, 44% more than in the same period a year earlier. The clear-out has helped banks in one sense: Overall, their nonperforming loans as a proportion of their lending book were unchanged at the close of the second quarter from the end of March, the first quarter since mid-2013 that the key metric hasn’t increased.

But the write-offs have come as a number of other challenges beset Chinese banks. New loans are shriveling—nearly all in July went to mortgages. A series of interest-rate cuts by the central bank since 2012 have squeezed banks’ earnings. And a plan by Beijing to let companies allot their equity to banks in exchange for loan forgiveness is likely to saddle lenders with more dubious assets in coming months, bankers and analysts say. The IMF estimates China’s nonperforming-loan ratio at 15%, compared with the official 1.75% figure reported by the government, because of differences in the way bad loans are recognized.

Buying know-how.

• China’s Biggest-Ever Metals Deal Snaps Up Cleveland’s Aleris (BBG)

China’s influence in global metals markets just stepped up a gear after the owner of its top supplier of aluminum products agreed to buy Aleris of the U.S. for $2.3 billion, marking the nation’s biggest-ever overseas purchase of a metals processor.

The purchase of the Cleveland, Ohio-based company by Zhongwang USA, owned by Liu Zhongtian, founder and chairman of China Zhongwang, will open up new markets for the Chinese company among aerospace and automotive companies. Monday’s deal underscores China’s shift to higher value-added products and will give Zhongwang access to technological know-how and more demanding customers, said Paul Adkins, managing director of Beijing-based aluminum consultancy AZ China.“Aleris supplies the Boeings and the big carmakers of this world – very advanced consumers,” Adkins said by phone on Tuesday. “Buying it has to provide some sort of opportunity for Zhongwang to bring that know-how back to China. When you’ve got more than half of the world’s primary aluminum supply in China, there is a natural momentum for China to pull other parts of the supply chain into its orbit.” China Zhongwang is Asia’s biggest producer of extruded aluminum, and already has ambitions to sell aluminum sheet to China’s emerging auto and aerospace industries. It’s due this year to start up a flat-rolled aluminum plant in Tianjin, near Beijing, which will supply products that China still has to import.

Not an entirely new criticism, but good to point out from time to time.

• Case Shiller Lags and Understates the Housing Bubble (Adler)

Here’s how the Case Shiller Index (CSI) press release spun the data on the state of the US single family housing market today: “The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 5.1% annual gain in June, unchanged from last month. The 10-City Composite posted a 4.3% annual increase, down from 4.4% the previous month.The 20-City Composite reported a year-over-year gain of 5.1%, down from 5.3% in May.” The problem is that Case Shiller’s methodology causes price suppression and severe lag. That gives the impression that the US housing market isn’t in a bubble. It’s a misimpression, considering that market prices on average are actually above the 2006 bubble peak.

If 2006 was the top of the most extreme bubble in US history, what does that make today’s higher prices? Case Shiller uses only public record data. The current release, which purports to be June data, is really data culled from government records for recorded sales. The closings were purportedly in June, but the contracts were entered at least a month before, and in most cases 2 months to 3 months prior. So the current CSI release doesn’t represent the current market. In fact, the lag is even greater than that. Case Shiller doesn’t merely use only the most recent month’s data, as you would think. It uses that month and the two prior months, so that effectively it represents average recorded closed sale prices for the 3 months of April May and June. It’s the average price as of the time midpoint of the period, in this case mid May.

Add the typical 45-60 day closing and the current data represents contracts signed in mid to late March. It is now almost September. The Case Shiller data is from 5 months ago. The housing market normally moves in very stable trends over years, if not decades, until there’s a crash. This lag factor isn’t too critical for those buying homes for their families to live in. It’s a little more critical for stock market traders and investors, because at major turning points, misleading data can lead to costly investing mistakes. For traders, using the Case Shiller data would be like making decisions based on where the 3 month moving average of the S&P 500 back in late March. Who would do that when current market prices are available?

It’s the same for the housing market. We have near current data on contract prices from both the NAR, and from the online Realtor firm, Redfin. The NAR compiles the MLS data on contract prices from the entire US and releases it within 30 days of the end of the previous month. Redfin compiles sales from 30 large US metros. So whereas Case Shiller is giving us a smoothed average price as of March, we have current actual prices as of July from both the NAR and Redfin. Apply a little technical analysis to that data, and we can see the state of the housing market as of last month, not 5 months ago. It has actually accelerated a bit this year relative to the prior 12 months. And it’s definitely at a new high versus the last bubble.

No space for the whole list. Useful read though.

• 25 Email Questions Hillary Clinton Must Answer Under Oath By September 29 (SBA)

Judicial Watch today announced it submitted questions to former Secretary of State Hillary Clinton concerning her email practices. Clinton’s answers, under oath, are due on September 29. On August 19, U.S. District Court Judge Emmet G. Sullivan granted Judicial Watch further discovery on the Clinton email matter and ordered Clinton to answer the questions “by no later than thirty days thereafter….” Under federal court rules, Judicial Watch is limited to twenty-five questions. The questions are:

1) Describe the creation of the clintonemail.com system, including who decided to create the system, the date it was decided to create the system, why it was created, who set it up, and when it became operational.

2) Describe the creation of your clintonemail.com email account, including who decided to create it, when it was created, why it was created, and, if you did not set up the account yourself, who set it up for you.

3) When did you decide to use a clintonemail.com email account to conduct official State Department business and whom did you consult in making this decision?

4) Identify all communications in which you participated concerning or relating to your decision to use a clintonemail.com email account to conduct official State Department business and, for each communication, identify the time, date, place, manner (e.g., in person, in writing, by telephone, or by electronic or other means), persons present or participating, and content of the communication.

5) In a 60 Minutes interview aired on July 24, 2016, you stated that it was “recommended” you use a personal email account to conduct official State Department business. What recommendations were you given about using or not using a personal email account to conduct official State Department business, who made any such recommendations, and when were any such recommendations made?

Corporations have too much political power to let that happen.

• Could EU’s ‘Apple Tax’ Reboot Corporate Tax Reform In The US? (Forbes)

For years, corporate tax reform in the U.S. has been dead in the water, in part because of deep disagreements within the American business community over what such a restructuring should look like. But the European Union’s increasingly aggressive effort to force its members to collect tax on U.S.-based multinationals has the potential to change that dynamic. The EU’s push has resulted in a series of major initiatives, none bigger than its decision to order Ireland to collect a stunning $14.5 billion in back taxes from Apple. That ruling has generated a swift backlash from the U.S. high-tech industry, U.S. policymakers across the political spectrum, and from Ireland itself. Yet, for all the howling, it might open the door for long-awaited tax reform in the United States.

To understand why, think about two kinds of U.S. corporations—those that pay lots of taxes and those that pay little or none. Some—especially companies whose business is built on intellectual property—have structured themselves in a way that sharply reduces their worldwide taxes. They shift income to related firms located in low-tax or no-tax countries while allocating interest costs and other expenses to the high-rate U.S. The result: Many pay effective tax rates in the single digits. At the same time, firms such as retailers, without the ability to shift income to low-tax countries, pay quite high effective tax rates. That split hamstrings the debate over corporate tax reform, especially the version that would eliminate tax preferences in exchange for a lower corporate rate.

If you are already paying close to the top statutory rate of 35%, you love that swap. After all, you are paying a high effective rate because those tax preferences are not helping you, so why not support legislation to ditch them in exchange for a lower rate? But for low-tax firms, the political calculation is dramatically different. If tax preferences make it possible for you to pay an effective rate of 10%, why would you give them up in return for a new U.S. statutory rate of 28%, or even 25%? How do you explain to your shareholders why more than doubling your rate is a good thing?

Too many doubts.

• Bitcoin Was Brought Down By Its Own Potential – And The Banks (Qz)

The best that can be said about Bitcoin right now is that it still exists. Split by internal divisions while its most useful aspects are harvested by the very financial behemoths it once hoped to destroy, Bitcoin is fast becoming the tech world’s version of Waiting for Godot, wherein a hermetically sealed community squabbles and bickers over arcane points of code and law as their world slowly crumbles around them. In the last 12 months, attempts made to produce a road map for the cryptocurrency’s future have come to naught, all while core developers abandon the project and opaque Chinese mining concerns wield outlandish power. Welcome to today’s Bitcoin—a phenomenon so internally focused that its advocates have barely noticed the battle has already been lost.

Back at its inception, the conversation around the currency was driven by an almost unconscionable optimism. This wasn’t simply a mechanism for the easy transfer of capital: This was a tool by which the entire international financial system could be made anew, with corrupt central banks, inflationary currencies, and immoral stockbrokers consigned to the dustbin of history. In a world still reeling from the chaos of the global financial crisis, Bitcoin seemed less like a currency and more like a way of future-proofing the global economy from ever having to deal with something so awful again.

The Bitcoin boom of late 2013 brought greater mainstream attention to the cryptocurrency. Bitcoin’s value surged from $200 to $1,200 over the space of a few weeks, temporarily rendering it more valuable than gold. This was to be a short-lived state of affairs, however, as a string of scandals, hacks, exchange collapses, and—dare I say it—common sense brought the price of Bitcoin plummeting back to Earth. Cue three years of stagnation and false promise, as Bitcoin has struggled to prove its use for, well … anything, really. Even after all this time, Bitcoin is still an economy driven almost entirely by potential—by the dream that, one day soon, Bitcoin will become the lingua franca of the global economic order.

“One criticism of the Anthropocene as geology is that it is very short,” said Zalasiewicz. “Our response is that many of the changes are irreversible.”

• The Dawn Of The Anthropocene (G.)

Humanity’s impact on the Earth is now so profound that a new geological epoch – the Anthropocene – needs to be declared, according to an official expert group who presented the recommendation to the International Geological Congress in Cape Town on Monday. The new epoch should begin about 1950, the experts said, and was likely to be defined by the radioactive elements dispersed across the planet by nuclear bomb tests, although an array of other signals, including plastic pollution, soot from power stations, concrete, and even the bones left by the global proliferation of the domestic chicken were now under consideration. The current epoch, the Holocene, is the 12,000 years of stable climate since the last ice age during which all human civilisation developed.

But the striking acceleration since the mid-20th century of carbon dioxide emissions and sea level rise, the global mass extinction of species, and the transformation of land by deforestation and development mark the end of that slice of geological time, the experts argue. The Earth is so profoundly changed that the Holocene must give way to the Anthropocene. “The significance of the Anthropocene is that it sets a different trajectory for the Earth system, of which we of course are part,” said Prof Jan Zalasiewicz, a geologist at the University of Leicester and chair of the Working Group on the Anthropocene (WGA), which started work in 2009. “If our recommendation is accepted, the Anthropocene will have started just a little before I was born,” he said. “We have lived most of our lives in something called the Anthropocene and are just realising the scale and permanence of the change.”

“The number of migrants on Lesvos has reached 5,226 while existing camps are only designed to host 3,500. The situation on Chios is equally disheartening, with 3,309 migrants in accommodation for 1,100.”

• Greek Islands Raise Alarm Over Fast Increasing Refugee Arrivals (Kath.)

Local and port authorities on the islands of the eastern Aegean are demanding immediate government action to decongest overcrowded migrant camps, insisting that they cannot cope with the recent surge in arrivals from neighboring Turkey. In a letter addressed to Shipping and Island Policy Minister Theodoros Dritsas, the Lesvos Port Authority raised the alarm, saying the island simply does not have the available infrastructure to accommodate the increased flows. The number of migrants on Lesvos has reached 5,226 while existing camps are only designed to host 3,500. The situation on Chios is equally disheartening, with 3,309 migrants in accommodation for 1,100.

According to the latest data, there are 12,120 migrants on the islands. A March deal between the European Union and Turkey to stem the flow managed to limit monthly arrivals to just a few thousand. However, the figure rose to its highest in four months in August. While Interior Ministry officials have attributed the overcrowded conditions at the camps to delays in the registration process, some critics have interpreted the increased traffic as a form of pressure from Ankara, which has linked the deal’s implementation to visa-free travel for its citizens within the EU.

“There are still an estimated 277,000 migrants in Libya, as well as 348,000 internally displaced people and 310,000 returnees..”

• Counting The Lost And Nameless Dead Of The Mediterranean (SMH)

The central Mediterranean is by far the most dangerous crossing into Europe for migrants. On Monday alone, 6908 migrants were rescued in the Channel of Sicily in 35 rescue operations, pulling them from 44 rubber dinghies, eight small wooden boats and two bigger fishing boats. The surge came after a week of windy and rough conditions had kept would-be migrants on the shores of Libya. Two people were reported to have died. There has also been a surge this week in the number of migrants arriving on Greek islands, where on average 100 people come ashore each day.

Of the 3165 people who have died or went missing this year crossing the sea (as of August 28), 2725 were attempting the passage to Italy from North Africa, according to the International Organization for Migration’s figures. More people died on this route than last year in the same period. [..] As of August 28, 272,070 migrants had crossed the Mediterranean into Europe in 2016. Just under half of the arrivals, or 106,461 (as of August 24) arrived in Italy. There, most arrivals came from Nigeria, Eritrea and Gambia. There are still an estimated 277,000 migrants in Libya, as well as 348,000 internally displaced people and 310,000 returnees – refugees returned from abroad.