Edward Hopper The camel’s hump 1931

Madness.

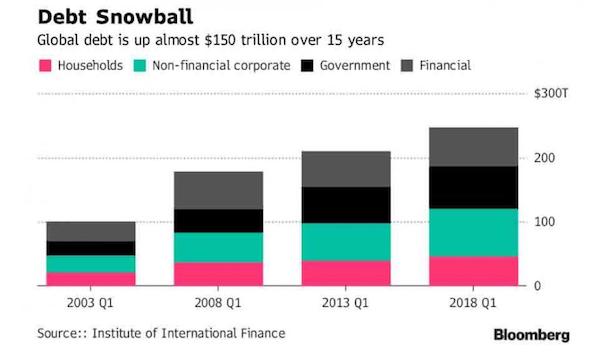

• As Global Debt Hits A Record $247 Trillion, The IIF Issues A Warning (ZH)

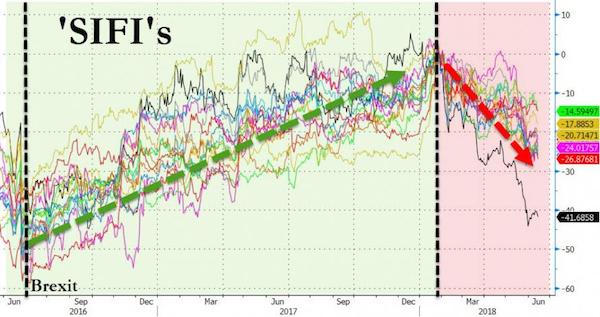

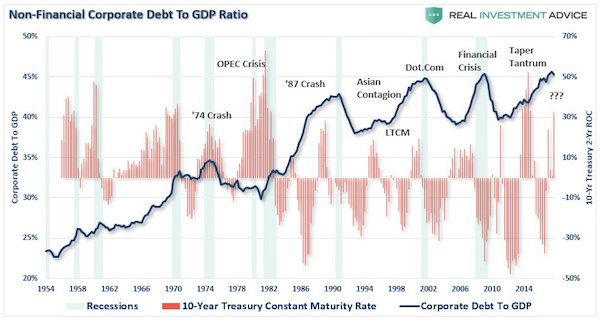

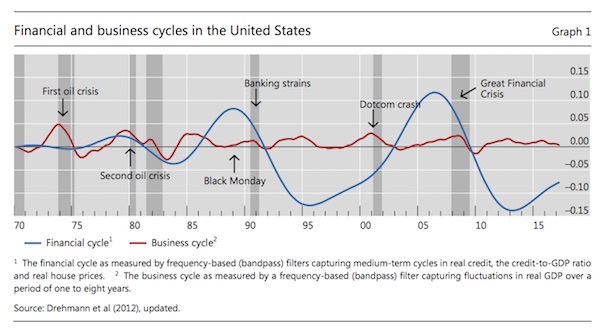

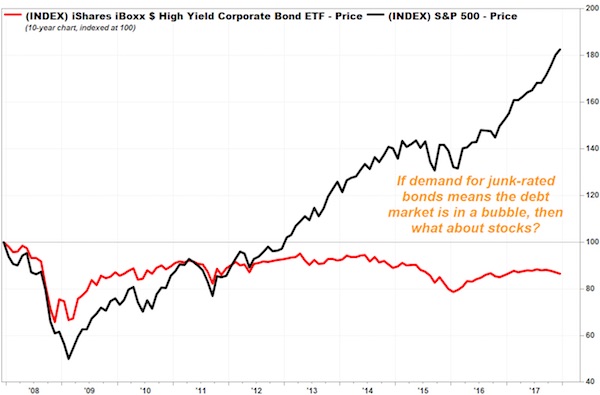

Every quarter the Institute of International Finance publishes a new number of the total amount of global debt outstanding, and every quarter the result is the same: a new record high Today was no exception: according to the IIF’s latest Global Debt Monitor, the amount of debt held in the world rose by the biggest amount in two years during the first quarter of 2018, when it grew by $8 trillion to hit a new all time high of $247 trillion, up from $238 trillion as of Dec. 31, 2017 and up by $30 trillion from the end of 2016. In other words, there is now a quarter quadrillion dollars in global debt, and it represents 318% of global GDP.

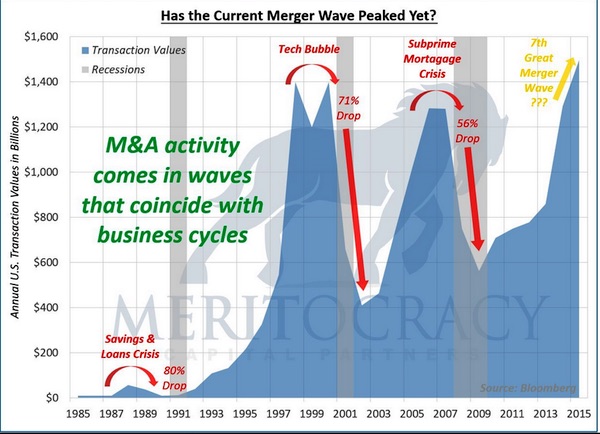

More concerning is that this was the first time since Q3 2016 that global debt to GDP increased, suggesting that the marginal utility of debt is once again below 1. This is how the debt is broken down as of Q1 2018 and compared to Q1 2013: • Non-financial corporate debt: $74 trillion, up from $58 trillion in 5 years • Government debt: $67 trillion, up from $56 trillion • Financial debt: $61 trillion, up from $56 trillion • Household debt: $47 trillion, up from $40 trillion. [..] What was surprising about the report – certainly not the latest all time high debt numbers, those are now standard – is that the IIF voiced a strongly negative opinion of recent developments in the debt arena.

“The pace is indeed a cause for concern,” warned IIF’s Managing Director Hung Tran during a call with reporters. “The problem with the pace and speed is if you borrow or if you lend very quickly, the quality of the credit tends to suffer.” It also means more governments, businesses and individuals have been borrowing that could have trouble paying the money back, or merely paying interest on it as rates rise. “The quality of creditworthiness has declined sharply,” Tran added ominously, echoing what Moody’s said at the end of May.

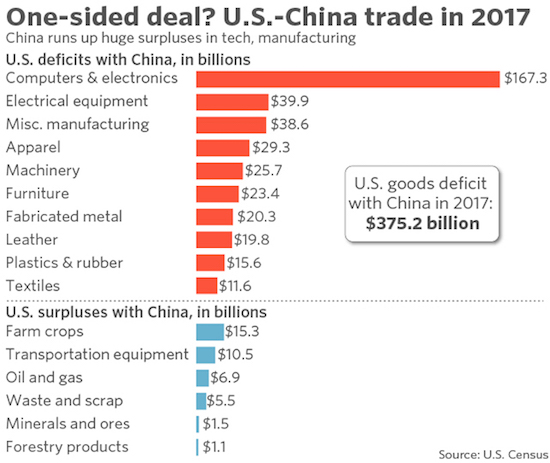

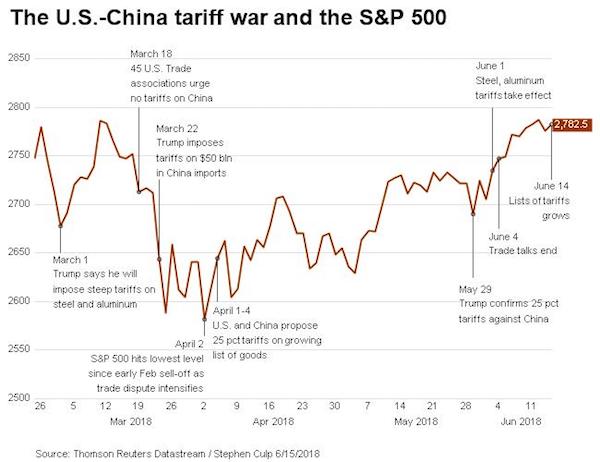

“Tariffs are taxes, plain and simple..”

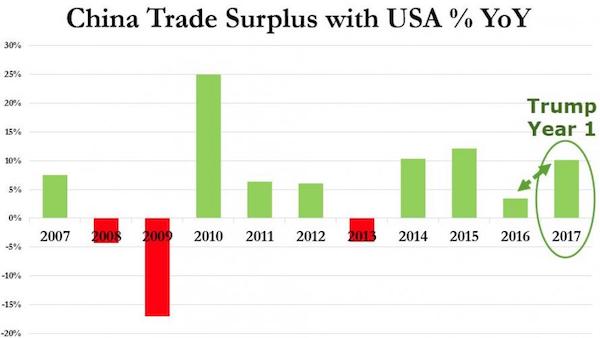

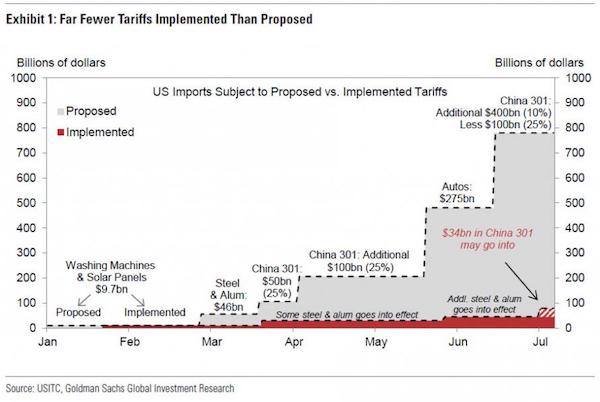

• US To Slap Tariffs On Extra $200 Billion Of Chinese Imports (R.)

The Trump administration raised the stakes in its trade war with China on Tuesday, saying it would slap 10 percent tariffs on an extra $200 billion worth of Chinese imports. U.S. officials released a list of thousands of Chinese imports the administration wants to hit with the tariffs, including hundreds of food products as well as tobacco, chemicals, coal, steel and aluminum. It also includes consumer goods ranging from car tires, , furniture, wood products, handbags and suitcases, to dog and cat food, baseball gloves, carpets, doors, bicycles, skis, golf bags, toilet paper and beauty products. “For over a year, the Trump administration has patiently urged China to stop its unfair practices, open its market, and engage in true market competition,” U.S. Trade Representative Robert Lighthizer said in announcing the proposed tariffs.

“Rather than address our legitimate concerns, China has begun to retaliate against U.S. products … There is no justification for such action,” he said in a statement. Last week, Washington imposed 25 percent tariffs on $34 billion of Chinese imports, and Beijing responded immediately with matching tariffs on the same amount of U.S. exports to China. Investors fear an escalating trade war between the world’s two biggest economies could hit global growth. President Donald Trump has said he may ultimately impose tariffs on more than $500 billion worth of Chinese goods – roughly the total amount of U.S. imports from China last year. The new list published on Tuesday targets many more consumer goods than those covered under the tariffs imposed last week, raising the direct threat to consumers and retail firms.

The tariffs will not be imposed until after a two-month period of public comment on the proposed list, but some U.S. business groups and senior lawmakers were quick to criticize the move. Senate Finance Committee Chairman Orrin Hatch, a senior member of Trump’s Republican Party, said the announcement “appears reckless and is not a targeted approach.” The U.S. Chamber of Commerce has supported Trump’s domestic tax cuts and efforts to reduce regulation of businesses, but it has been critical of Trump’s aggressive tariff policies. “Tariffs are taxes, plain and simple. Imposing taxes on another $200 billion worth of products will raise the costs of every day goods for American families, farmers, ranchers, workers, and job creators. It will also result in retaliatory tariffs, further hurting American workers,” a Chamber spokeswoman said.

No.

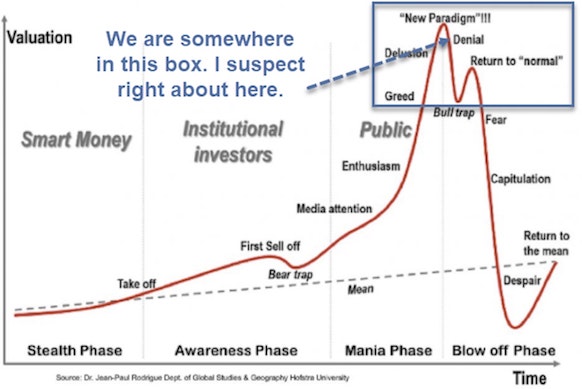

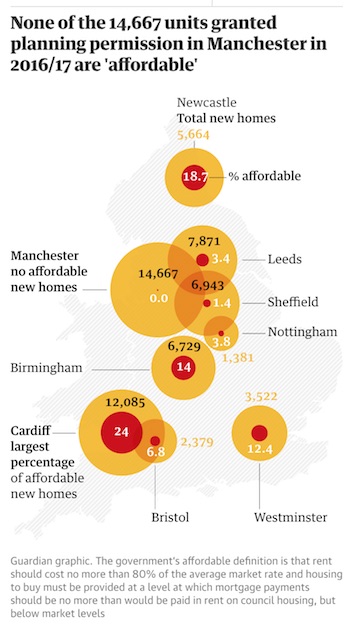

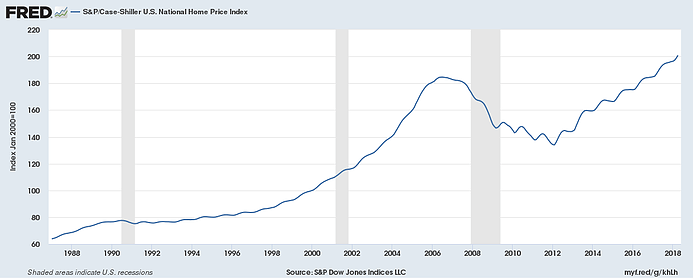

• Has the Fed Permanently Inflated Home Prices? (Whalen)

The importance of the fact that US bank credit metrics are showing essentially zero cost in residential lending from portfolio loans is that it begs the question as to home price valuations and thus loan-to-value (LTV) ratios. A number of analysts have predicted an imminent reset in terms of home prices, but this has not happened for several reasons. The chart below shows the Case-Shiller average for US home price appreciation. First, real estate is a local market, so generalizations such as Case-Shiller are dangerous. New York City has been slumping for the past two years, but other markets around the country such as Denver remain hot.

The work of Weiss Residential Research clearly shows a turn in some major urban markets that have been moving higher since 2012 and before. But these moves seem more a function of buyer exhaustion than a permanent move to a buyers market. They key factor is cheap money chasing a limited supply of homes. Second, the US home market is in a classic supply squeeze. Referring to the work of Laurie Goodman at Urban Institute, the US is adding less than 1 million new units per year net of attrition of obsolete homes. Basically, new household formation is 50% higher than the growth in new housing units. More, the Fed’s manipulation of interest rates and credit spreads encouraged Wall Street to allocate capital to buying residential homes as rental properties, further limiting supply of homes available for sale.

Net, net, Millennials have been priced out of the housing market because the omniscient souls on the Federal Open Market Committee think that boosting asset prices will lead to more spending and job creation. Instead, low interest rates and help from the GSES (Fannie, Freddie and Ginnie) have driven up home prices beyond the reach of many home owners in major metro areas.

Stop. It.

• Trump Forced To Reinstate ‘Catch And Release’ After Court Defeats (G.)

Donald Trump’s administration has said it will release some migrant families from detention with ankle monitors, marking a return to the so-called “catch-and-release” policy the president vehemently denounced. The announcement comes as the US government scrambles to reunite thousands of migrant children who were separated from their parents at the border under the Trump administration’s “zero tolerance” immigration policy. “Parents of children under the age of five are being reunified with their children, then released and enrolled into an alternative to detention (ATD) program, meaning they will be placed on an ankle monitor and released into the community,” said Matthew Albence, a senior official with US Immigration and Customs Enforcement.

The Trump administration was left with few options after a series of court orders. A federal judge last month ordered the reunification of children under five by 10 July. That deadline was not met, officials acknowledged, while noting plans were under way on Tuesday to reunite up to 54 migrant children under five with their parents. There are an estimated 102 migrant children under five in federal custody, with a limited number of cases not qualifying for reunification due to the parents’ criminal background or signs of child abuse. The administration additionally lost in an attempt to overturn a 1997 court precedent that says minors cannot be held for more than 20 days.

What a job the new government has.

• 40% Of Mexican Territory Is Paralyzed By Violence (G.)

As much as 40% of Mexican territory is prisoner to chronic insecurity and violence, the future chief of staff of Andrés Manuel López Obrador, the incoming president, has claimed. Alfonso Romo, a prominent entrepreneur who was part of the leftist’s watershed election triumph last week, made the assertion during a summit of business leaders on Monday in Mexico City. “Veracruz is paralyzed. Tamaulipas, paralyzed; Michoacán, paralyzed. Guerrero, paralyzed,” Romo said, referring to four of the most notoriously violent states in a country that last year suffered a record 29,000 murders.

“I won’t go on, so I don’t scare you,” Romo added, according to the newspaper Unomásuno which splashed the widely-reported claim onto its front page under the bright red headline: “Paralyzed by Insecurity”. López Obrador, or Amlo as he is widely known, made cutting violence a key prong of his third presidential bid and his promise to “pacify” Mexico helped him secure more than 30 million votes. Amlo has vowed to rethink Mexico’s devastating and highly militarized war on drugs – which experts blame for at least 200,000 deaths since 2006 – and be tough on the social causes of crime.

Hard to believe.

• EU Negotiator Michel Barnier Says 80% Of Brexit Deal Is Agreed (G.)

The chief Brexit negotiator for the European Union has declared that 80% of a deal with the UK has been agreed, in a change of narrative that suggests a full agreement can be sealed before October’s deadline. Speaking in New York on Tuesday, Michel Barnier said: “After 12 months of negotiations we have agreed on 80% of the negotiations.” He added that he was determined to negotiate a deal on the remaining 20%. The declaration that four-fifths of the deal is done is a significant change of tone from the EU after months of protests that it could not negotiate because the UK had not put its own proposals on the table.

Speaking at the Council on Foreign Relations in New York, Barnier said he looked forward to a “constructive discussion” with the UK after the white paper on Brexit is published on Thursday. But he warned: “We need clarity for these negotiations to move forward for the time is very short.” Barnier said he had never been shown how Brexit provided added value when the world faced challenges from terrorism and climate change to migration, poverty and financial instability. “It will be clear, crystal clear at the end of this negotiation that the best situation, the best relationship with the EU, will be to remain a member,” he said. Barnier added: “No deal is the worst solution for everybody. It would be a huge economic problem for the UK and also for the EU. I’m not working for that deal, I’m working for a deal.”

Fun with the Sun.

• UK Government Draws Up Secret Plans To Stockpile Processed Food (Sun)

Ministers have drawn up secret plans to stockpile processed food in the event of EU divorce talks collapsing – to show Brussels that “no deal” is not a bluff. Theresa May has ordered “no deal” planning “to step up” — with the government poised to start unveiling some of the 300 contingency measures in the coming weeks. At last week’s Chequers summit, Brexiteer ministers demanded more be done to prepare for Britain leaving the EU out without a new arrangement in place. The Sun can reveal that includes emergency measures to keep Britain’s massive food and drinks industry afloat – including stockpiling ahead of exit day on 29 March next year.

More than £22 billion worth of processed food and drinks are imported in to the UK – 97 per cent from the EU – in an industry that keeps 400,000 workers employed in the UK. Similar stockpiles are also being prepared for medical supplies amid fears of chaos at British ports next year. Brexit department insiders also claim plans have also been “wargamed” to ease pressure on Calais, including importing and exporting more goods through Holland, Belgium and directly from Spain. Last night Downing Street said “no deal preparation work is to be stepped up” and led by new Brexit Secretary Dominic Raab. Yesterday the Cabinet newbie briefed fellow ministers on measures Britain is taking, with No10 saying: “It’s sensible to make preparations for all scenarios and that includes No Deal.”

Humanity.

• Red Cross Tells UK: End Damaging Immigration Detention (Ind.)

The British Red Cross has called for an overhaul of the UK’s immigration detention system. Conditions are such that detainees suffer mental health problems which sometimes lead to suicide attempts, according to the charity. Thousands of innocent asylum seekers – often fleeing war and torture – are detained each year and locked up indefinitely with no support, the charity warned. In the first intervention of its kind by a major charity, the Red Cross calls for significant reforms including a 28-day limit on detention. It found cases of asylum-seekers being detained for as long as two years and seven months. Five of the 26 detainees interviewed for the report had attempted suicide while they were detained, and just 25 of them said they had been given no access to mental health support services.

Pregnant women continue to be “needlessly detained” in breach of the Home Office’s own guidance – with 47 pregnant women detained in the year to June 2017. The charity said the “overly onerous and traumatic” experience of attending immigration reporting centres – which many are required to do every every two weeks – should be overhauled by banning the practice of detaining people when they turn up. Mike Adamson, chief executive of the British Red Cross, said: “Most of the people in the UK asylum process have fled conflict or persecution to find a place of safety. They have already experienced more trauma and anguish than the rest of us could possibly imagine.

“The threat of detention without notice hangs over many people going through the asylum process in the UK. Our research shows that not knowing whether this week will be the week they are detained again, can make the process of having to report regularly extremely distressing. “This can exacerbate existing mental health issues and mean people never truly feel free.”

More humanity.

• I’m A Doctor In Lampedusa. We Can’t Let These Migrant Deaths Go On (Bartolo)

For a long time, I was proud of my country. I work as a doctor on the small island of Lampedusa in the middle of the Mediterranean, a place that is something of a symbolic gateway between Africa and Europe. In recent decades, Italy showed how it could honour humanity, giving the word “welcome” a new meaning, without ever building walls or putting up barbed wire along its borders. These acts of openness were recognised by other countries, by the EU, and by the gratitude of the thousands of people whose lives we saved over the years. But I stopped feeling proud to be Italian from the moment our government, denying all that had previously been done, decided to establish an agreement with Libyan groups in Tripoli – which meant, directly or indirectly, with people smugglers.

I still remember how in 2016 my country had vigorously joined the outrage triggered by Europe’s decision to bankroll Turkey’s President Erdogan with €6bn so he’d ignore or stop the migration flows from Syria. Italy’s position was then sacrosanct. It has since been somehow inexplicably disavowed in deeds. There is only one dramatic difference between what Europe did with Turkey then and what Italy is doing with Libya today. Refugee camps set up in Turkey are more or less efficient; in Libya, people are detained in horror camps where they are raped, tortured and killed. Instead of the wall that Italy did not build on its own territory, we’ve erected two walls elsewhere. The one in Libya has allowed us to cut the number of arrivals on our shores by 70%; the other, within ourselves, allows us to pretend we don’t see what is being done to the 70%.

Well, I can tell you what’s being done to these people. From my workplace, the Lampedusa clinic, their fate is clear to see. They are tortured daily, atrociously, for years on end. Those brought to us, by helicopter or motorboat, are close to death, with burns, serious injuries from blows, electric currents applied to the head or genitals, gunshot wounds, and razor-blade cuts. They are almost always dehydrated, in a state of hypothermia, and so underfed they are on the brink of collapse. They bring to mind the suffering of a concentration camp – yes, a concentration camp.

There will always be scientists willing to claim it’s not cancerous.

• US Judge Allows Lawsuits Over Monsanto’s Roundup To Proceed To Trial (R.)

Hundreds of lawsuits against Monsanto by cancer survivors or families of those who died can proceed to trial, a federal judge ruled on Tuesday, finding there was sufficient evidence for a jury to hear the cases that blame the company’s glyphosate-containing weed-killer for the disease. The decision by U.S. District Judge Vince Chhabria in San Francisco followed years of litigation and weeks of hearings about the controversial science surrounding the safety of the chemical glyphosate, the key ingredient in Monsanto’s top-selling weed-killer. Monsanto is now a unit of Bayer, following a $62.5 billion takeover of the U.S. seed major which closed in June. The U.S. Environmental Protection Agency last September concluded glyphosate is likely not carcinogenic to humans.

But the World Health Organization in 2015 classified glyphosate as “probably carcinogenic to humans.” Chhabria called the plaintiffs’ expert opinions “shaky” and entirely excluded the opinions of two scientists. But he said a reasonable jury could conclude, based on the findings of four experts he allowed, that glyphosate can cause cancer in humans. The plaintiffs will next have to prove Roundup caused cancer in specific people whose cases will be selected for test trials, a phase Chhabria in his Tuesday opinion called a “daunting challenge.” Lawsuits by more than 400 farmers, landscapers and consumers who claim Roundup caused them to develop non-Hodgkin’s Lymphoma, a type of blood cell cancer, have been consolidated before Chhabria.

Good read on what went down. Amazing people. All the equipment that was brought in. All the mud that was removed. Wow.

• Thailand Water Pumps Failed Just After Last Boy Escaped (G.)

The rescue operation to free the last of the 12 boys and their football coach from a Thailand cave could have been a disaster, divers have revealed, with water pumps draining the area failing just hours after the last boy had been evacuated. Divers and rescue workers were still more than 1.5km inside the cave clearing up equipment when the main pump failed, leading water levels to rapidly increase, three Australian divers involved in the operation told the Guardian on Wednesday, in the first detailed account of the mission to be published. The trio, stationed at “chamber three”, a base inside the cave, said they heard screaming and saw a rush of head torches from deeper inside the tunnel as workers scrambled to reach dry ground. Everyone, including the last three Thai navy Seals and medic who had spent much of the past week keeping vigil with the trapped boys, was out of the cave a short time later.