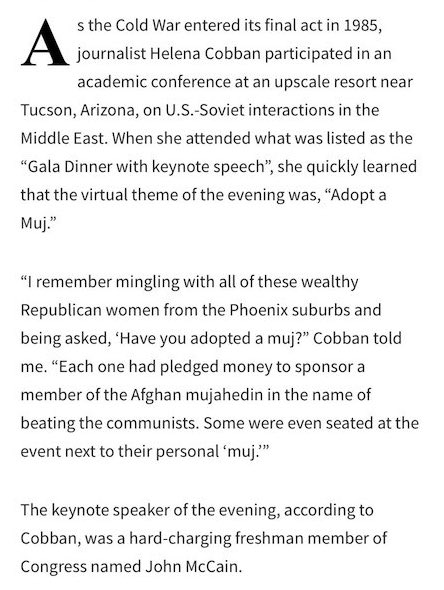

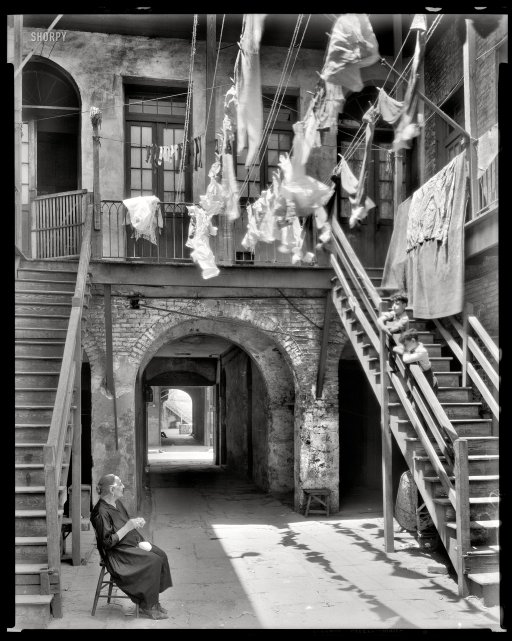

John Singer Sargent Open Doorway, Morocco 1879-80

“Trump Saved The USA”

https://twitter.com/i/status/1669931150448513026

Watters Gates

https://twitter.com/i/status/1669874281948348425

Day 1

Remember Trump’s 1st day walking into Congress as President

& all the democrats were fuming? One of my favorite moments in history pic.twitter.com/dPgj0djXVN

— E (@ElijahSchaffer) June 16, 2023

Agenda 21

— illuminatibot (@iluminatibot) June 16, 2023

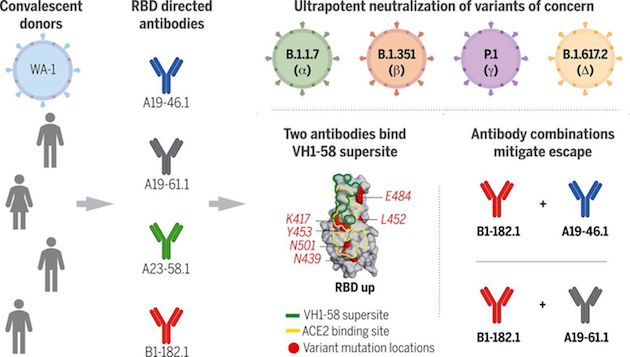

Pfizer Japan

The first covid vaccine lawsuit against Pfizer and the government was filed in Japan.

The city hospital cremated the dead body without conducting any autopsy to destroy the evidence.

The lawyer will pursue the accountability of the government for promoting the dangerous vaccines. https://t.co/3rD5yZHSeM pic.twitter.com/rwtjsI7r0D— ShortShort News (@ShortShort_News) June 17, 2023

REPORTER: “Donald Trump was indicted on 38 charges. He is facing up to 400 years. What does Moscow think about this?”

ZAKHAROVA: “There is nothing surprising about this. This is democracy in a liberal dictatorship style… As for 400 years, apparently they are afraid of him because they consider him immortal. The only thing I can tell you is that we will see more and more wonders and mystifications for one simple reason – liberalism has sunk into one of its deepest crises…”

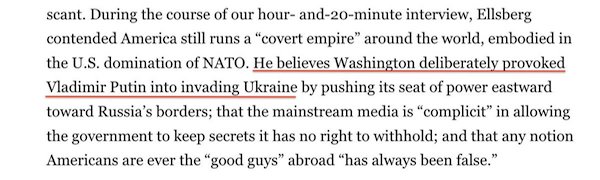

“Ukrainian casualties were extremely heavy, with Russia achieving a 10:1 kill ratio in terms of manpower..”

• Ukrainian Counteroffensive’s Second Week Ends in Failure (Scott Ritter)

Operation enters the second week of Ukraine’s long-awaited and highly touted counteroffensive, some basic conclusions can be drawn even though the fighting continues, and will continue to rage, for some time to come. First and foremost, the counteroffensive gambit has failed. While there is still considerable combat strength left in the Ukrainian military, including more than 75% of the NATO-trained and -equipped 60,000-strong cohort Ukraine had assembled in the past eight months, fundamentally flawed assumptions about the quality of the force on which Ukraine and its NATO allies had placed their collective hopes for victory over Russia have been exposed. In short, Ukraine lacks the military capacity to overcome Russian defenses.

Ukraine’s most elite assault brigades, equipped with the latest Western military technology, failed to advance out of what Russian defensive doctrine calls the “cover” line of defense—the buffer that is designed to channel and disrupt an attacking force prior to reaching the “main” line of defense. Ukrainian casualties were extremely heavy, with Russia achieving a 10:1 kill ratio in terms of manpower, which is unsustainable from the Ukrainian perspective. The reasons for the Ukrainian failure are fundamental in nature, meaning that they cannot be overcome as things currently stand and, as such, the Ukrainian military has zero chance of success, no matter how hard they press subsequent attacks.

First and foremost is the quality of the Russian defenses, especially in terms of the barrier network (minefields, obstacles, and trenches) which, when combined with the tenacity of the Russian defender and the overwhelming superiority Russia enjoys in terms of fire support (both artillery and air-delivered), is the reason the Ukrainians are unable to advance beyond the “cover” layer of the Russian defenses. Ukrainian equipment and tactics are insufficient to the task of breaching the Russian obstacle barriers in any meaningful manner, dooming the attacking forces to be destroyed piecemeal by Russian artillery and air strikes, as well as local counterattacks mounted by Russian special forces.

Besides the poor tactics and equipment deficiencies (yes, the Leopard tanks and Bradley fighting vehicles were not the miracle weapons Ukraine and its Western supporters had hyped them up to be), the Ukrainians are paying the price for Russia’s impressive suppression of enemy air defense (SEAD) campaign that has been ongoing for many weeks now. Russia has not only neutralized Ukraine’s ability to defend strategic targets far beyond the front lines, but also to project any meaningful air defense capability into the actual zone of conflict. This, combined with the lack of any viable air force, leaves the attacking Ukrainian ground forces exposed to the full weight of Russian air power.

No weapons of their own left.

• Ukraine Demilitarization Mainly Completed – Peskov (Sp.)

Kremlin spokesman Dmitry Peskov said on Saturday that Ukraine’s demilitarization had been mainly completed as Kiev was using its own weapons much less and deploying more weapons supplied by the West. “Ukraine was very militarized at the start of the special military operation. And, as [Russian President Vladimir] Putin said yesterday, one of the tasks was the demilitarization of Ukraine. In fact, this task has been mainly completed because Ukraine is using much less of its own arms, while it is deploying more weapons systems supplied by the West,” Peskov told Russian broadcaster RT Arabic.

On the subject of peace negotiations, Peskov said on Saturday that there are provisions of different Ukraine peace initiatives that do not correlate with the Russian stance and are unacceptable, but Moscow is ready for a dialogue with Kiev. “Those provisions of different peace initiatives, which do not correlate with our stance, are certainly unacceptable for us, but we are open to dialogue unlike the Ukrainian side,” Peskov told Russian newspaper Izvestia. On Friday during a visit from several African leaders, Ukrainian President Volodymyr Zelensky reiterated that his country would not discuss an end to the conflict until Russian troops withdrawal from what he claims are Ukraine’s borders.

“They’ve got to meet the same standards. So we’re not going to make it easy..”

• Biden Lays Down NATO warning For Ukraine (RT)

Ukraine will not have an “easy” entry into the US-led NATO alliance and will be required to meet the “same standards” as any other member of the bloc, US President Joe Biden has declared. His remarks come amid reports of a simplified procedural plan for Kiev, tabled by NATO Secretary General Jens Stoltenberg. “They’ve got to meet the same standards. So we’re not going to make it easy,” Biden told reporters near Washington on Saturday. His statement comes in the aftermath of a meeting he had with Stoltenberg, who was hosted at the White House this Tuesday. At the meeting, the NATO chief reportedly floated a plan to simplify the accession process for Ukraine, arguing that Kiev had already made significant progress toward membership.

Under his scheme, the country would not have been required to complete a so-called “membership action plan” (MAP), usually imposed by the US-led bloc on applicants. While other Eastern European members of the bloc went through this procedure before being admitted, the most recent addition, Finland, was spared the process. Multiple US media reports had suggested Biden appeared to be “open” to the plan and had even provisionally supported it. At the same time, other reporting on the subject suggested Biden had another scheme for Ukraine in mind.

For instance, the New York Times reported the US administration was reluctant to ever grant Ukraine full NATO membership, pushing instead for the ‘Israel model,’ which would mean a time-limited commitment to maintain the flow of Western weapons to a designated country. Joining NATO has been a top talking point for pro-Western Ukrainian politicians for decades already, yet little to no progress has actually been made on that path. The pace has seemingly picked up amid the ongoing conflict between Moscow and Kiev – triggered, among other things, by Ukraine’s NATO aspirations – with top Ukrainian officials repeatedly urging the US-led alliance to let the country in.

“..At that time, even “in a fit of desperate rage,” “the ruling circles of a group of countries” would never have “unleashed a full-scale war in the underbelly of a nuclear superpower.”

• Partners in Doomsday (Seymour Hersh)

Meanwhile, there has been an escalation in rhetoric about the war and its possible consequences from within Russia. It can be observed in an essay published in Russian and English on June 13 by Sergei A. Karaganov, an academic in Moscow who is chairman of the Russian Council on Foreign and Defense Policy. Karaganov is known to be close to Putin; he is taken seriously by some journalists in the West, most notably by Serge Schmemann, a longtime Moscow correspondent for the New York Times and now a member of the Times editorial board. Like me, he spent his early years as a journalist for the Associated Press. One of Karaganov’s main points is that the ongoing war between Russia and Ukraine will not end even if Russia were to achieve a crushing victory.

There will remain, he writes, “an even more embittered ultranationalist population pumped up with weapons—a bleeding wound threatening inevitable complications and a new war.” The essay is suffused with despair. A Russian victory in Ukraine means a continued war with the West. “The worst situation,” he writes, “may occur if, at the cost of enormous losses, we liberate the whole of Ukraine and it remains in ruins with a population that mostly hates us. . . . The feud with the West will continue as it will support a low-grade guerrilla war.” A more attractive option would be to liberate the pro-Russian areas of Ukraine followed by demilitarization of Ukraine’s armed forces. But that would be possible, Karaganov writes, “only if and when we are able to break the West’s will to incite and support the Kiev junta, and to force it to retreat strategically.

“And this brings us to the most important but almost undiscussed issue. The underlying and even fundamental cause of the conflict in Ukraine and many other tensions in the world . . . is the accelerating failure of the modern ruling Western elites” to recognize and deal with the “globalization course of recent decades.” These changes, which Karaganov calls “unprecedented in history,” are key elements in the global balance of power that now favor “China and partly India acting as economic drivers, and Russia chosen by history to be its military strategic pillar.” The countries of the West, under leaders such as Biden and his aides, he writes, “are losing their five-century-long ability to siphon wealth around the world, imposing, primarily by brute force, political and economic orders and cultural dominance. So there will be no quick end to the unfolding Western defensive and aggressive confrontation.”

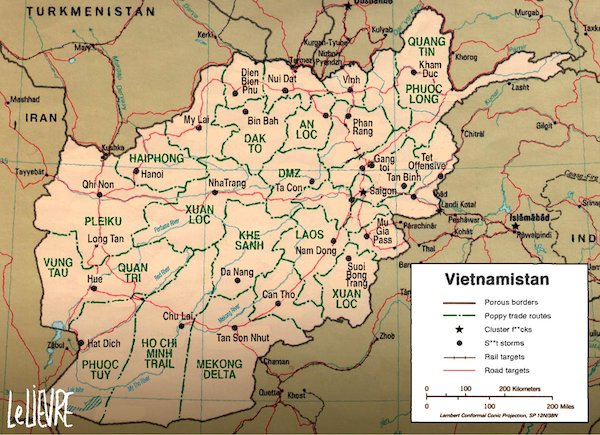

This shakeup of the world order, he writes, “has been brewing since the mid-1960s. . . . The defeat in Iraq and Afghanistan, and the beginning of the Western economic model crisis in 2008 were major milestones.” All of this points toward large-scale disaster: “Truce is possible, but peace is not. . . . This vector of the West’s movement unambiguously indicates a slide toward World War III. It is already beginning and may erupt into a full-blown firestorm by chance or due to the incompetence and irresponsibility of modern ruling circles in the West.”

In Karaganov’s view—I am in no way condoning or agreeing with it—the American-led war against Russia in Ukraine, with the support of NATO, has become more feasible, even ineluctable, because the fear of nuclear war is gone. What is happening today in Ukraine, he argues, would be “unthinkable” in the early years of the nuclear era. At that time, even “in a fit of desperate rage,” “the ruling circles of a group of countries” would never have “unleashed a full-scale war in the underbelly of a nuclear superpower.”

“There was an agreement made in 2022. Which is why Russia removed their troops from the Kiev area. Ukraine, pressured by the US/UK – reneged on the agreement. Think of how many Ukrainians died because of that decision.”

• Putin: Kiev Threw Russia-Ukraine Settlement Deal Into Dustbin of History (Sp.)

Russian President Vladimir Putin presented the African delegation with the draft of the Istanbul agreement on the Ukraine settlement, which, as the Russian president said, specifies everything from the number of armed forces to units of military equipment and personnel. “Here it is! It exists!” Putin said, showing the document signed by a Ukrainian representative. “And it is called accordingly – the treaty on permanent neutrality and security guarantees for Ukraine. Exactly about guarantees. Eighteen articles,” the Russian leader noted. “Moreover, there is also an annex to it. They [clauses] also concern the armed forces, other things. Everything is specified – down to the units of combat equipment and personnel of the armed forces. The document is here!” Putin said, adding that the document had been initialed and signed by the Ukrainian delegation.

“But after we withdrew the troops from Kiev, as we promised, the Kiev authorities, as their masters usually do, threw it all into the dustbin of history. Let’s put it clearly. I’ll try to put it intelligently. They gave it up,” he added. The president also addressed the root of the crisis, reminding his audience that the violence engulfed Ukraine after the bloody 2014 coup, which was backed by the US and the EU. “All the problems in Ukraine began after the state, unconstitutional, armed and bloody coup in 2014. And this coup was supported by Western sponsors. They, as a matter of fact, do not hesitate to talk about it,” he stressed. Earlier on Saturday, Putin personally received and greeted the African delegates at the Konstantinovsky Palace to discuss the joint African peace initiative on Ukraine.

South African President Cyril Ramaphosa revealed a ten-point plan for peaceful settlement. One of the points relates to the fact that all sides in the conflict are entitled to security guarantees. The fourth point refers to the fact that the authors of the plan recognize the sovereignty of all sides of the conflict. The sixth point refers to the “free movement of grain across the Black Sea” so that there would be no obstacles to it. “The third point is that we would like to see de-escalation of the conflict. De-escalation on both sides. Because escalation is not conducive to peace negotiations. So we would be interested in de-escalation of the conflict so that we can find a way to peace.”

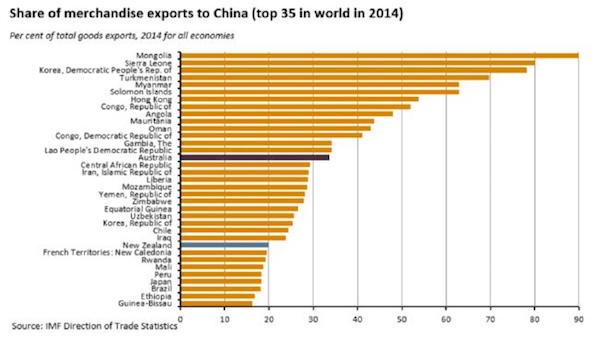

Putin also underlined the issue of the grain deal, noting that about 31.7 million tonnes of agricultural products were exported from Ukrainian ports – while only 3% of this volume was sent to needy African countries, so the United States has “deceived the international community,” “Once again, these neo-colonial European, and in fact American, authorities have deceived the international community and needy African countries: 31.7 million tonnes were exported, and only three percent went to needy African countries. Isn’t that a lie? Accustomed to lying to the world for centuries and continue to do so today,” Putin said at a meeting with the African delegation at the Konstantinovsky Palace near St. Petersburg.

BREAKING: Putin holds up a peace agreement that Ukraine & Russia signed over a YEAR ago, in spring 2022.

Not one word of this in mainstream media.

Russians are signalling they want a diplomatic settlement. Why isn't this welcomed? How can they claim Russia sabotaged the talks? pic.twitter.com/SLP5OcohyR

— Richard Medhurst (@richimedhurst) June 17, 2023

The opposite of diplomacy. Hard to believe.

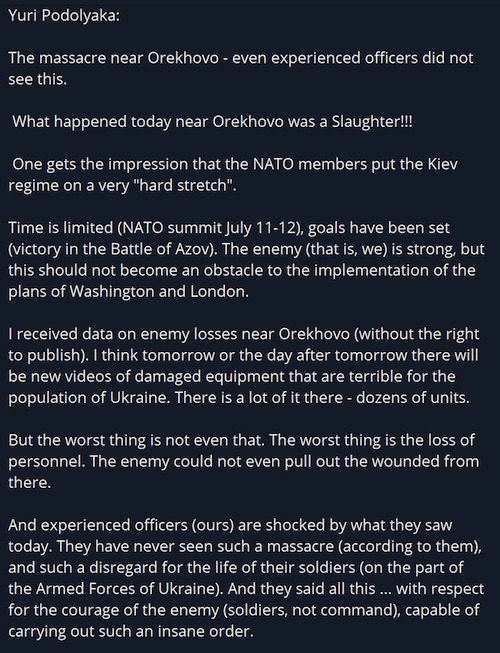

• South African President’s Security Detail Prevented From Going To Russia (RT)

South African President Cyril Ramaphosa has had to travel to Russia without dozens of his bodyguards, after Polish authorities effectively blocked a planeload of security personnel and members of the press pool at Warsaw airport, with Hungary then refusing to let the plane enter its airspace. One of the journalists told RT on Saturday that Budapest’s decision would not affect President Cyril Ramaphosa’s visit to St. Petersburg. The head of state is already in Russia, having arrived separately with a smaller contingent. South African reporter Queenin Masuabi confirmed the situation in a Twitter post, saying: “our government have been unable to secure access [to] the Hungarian airspace.” She added that “members of the Presidential Protection Unit, along with journalists, will not be traveling to Russia.”

On Thursday, the Polish Border Security Service allegedly prohibited members of Ramaphosa’s security team, consisting of more than 100 personnel, along with 20 reporters, from leaving their plane at Chopin Airport in Warsaw. According to one of the journalists stranded on board, who spoke to RT, Polish officials had demanded that members of the South African Presidential Protection Services (PPS) surrender their weapons, claiming that they did not have the correct permits to bring them into the country. One member of the team was even reportedly strip-searched by Polish police despite holding a diplomatic passport. “That’s never happened before in all the years of travel by the PPS. This is now a diplomatic row,” the reporter told RT, describing the “hostile welcome” as completely unexpected.

Another journalist on the plane said Polish authorities allowed the delegation to leave the aircraft on Friday after a more than 24-hour wait. Ramaphosa’s head of security, Major General Wally Rhoode, accused Warsaw of attempting to sabotage Pretoria’s efforts to secure a truce between Ukraine and Russia. Polish authorities, in turn, insisted that Ramaphosa’s delegation chose not to disembark from the plane of their own accord. The Polish Foreign Ministry clarified that the flight had been delayed after discovering “dangerous materials” and “undeclared individuals” on board.

As a result, Ramaphosa had to travel to Kiev without members of his security detail on Friday. The South African head of state, along with senior officials from Senegal, Egypt, Zambia, South Africa, and the Comoros, met with President Vladimir Zelensky in the Ukrainian capital. They put forward a roadmap aimed at a cessation of hostilities between Kiev and Moscow, which the Ukrainian leadership treated without much enthusiasm. On Saturday, the African Peace Mission arrived in St. Petersburg for talks with President Vladimir Putin.

Poland has intercepted a plane carrying the personal protection team of the President of South Africa en route to Kiev.

The head of the security service, has accused Poland of displaying racist behavior. He expressed concern that the actions of the Polish authorities put the… pic.twitter.com/VbKjmBuNRL

— In Context (@incontextmedia) June 16, 2023

“..African countries have shown an understanding of the root causes of the Ukraine crisis, “which was created by the West’s efforts..”

• African Nations Call For Indivisibility Of Global Security (TASS)

African countries stand for the indivisibility of global security, and Russia backs this principled position, Russian Foreign Minister Sergey Lavrov said on Saturday after Russian President Vladimir Putin’s meeting with an African peace mission. “First of all, they (African countries – TASS) highlighted China’s well-known twelve points, which were presented a couple of months ago, and they highlighted those parts of that Chinese initiative that are close to them and that stipulate that there no double standards in the world, that all the principles of the UN Charter in their integrity and correlation are respected and implemented, that there are no unilateral sanctions, that there are no attempts to ensure someone’s security at the expense of others, that security is indivisible on a global scale. They are the principled attitudes that we share,” he said.

Lavrov also pointed out that African countries have shown an understanding of the root causes of the Ukraine crisis, “which was created by the West’s efforts”. “They have shown an understanding that this situation has to be resolved by grappling with those root causes, by working out specific real actions to eliminate the causes that are undermining and have been undermining fair security in Europe throughout many years,” the Russian foreign minister said. The African peace mission has brought together South African President Cyril Ramaphosa, President of the Comoros Azali Assoumani, Senegal’s President Macky Sall, Zambia’s President Hakainde Hichilema, as well as Egypt’s Prime Minister Mostafa Madbouly and Florent Ntsiba and Ruhakana Rugunda, special envoys of the presidents of the Republic of the Congo and Uganda respectively. On June 16, the mission visited Kiev, where they held talks with Ukrainian President Vladimir Zelensky. On June 17, the African delegation held a meeting with Putin in St. Petersburg, where they outlined their initiative.

“..the UAE imported 75.7 tonnes of Russian gold worth $4.3 billion in the past year after imports reached just 1.3 tonnes in 2021..”

• UAE President Meets With Putin In Russia (Cradle)

The UAE’s President, Sheikh Mohammed bin Zayed Al-Nahyan (MbZ), affirmed to his Russian counterpart Vladimir Putin on 16 June that Abu Dhabi seeks to strengthen relations with Moscow. MbZ told Putin on the sidelines of a meeting in St. Petersberg: “I am pleased to be here today with you, your Excellency, and we wish to build on this relationship, and we put our trust in you to do so.” He added that the UAE will continue to support efforts toward facilitating a political solution via diplomacy in order to resolve the political dispute between Moscow and Kiev, and ensure political stability. Following the start of Russia’s war in Ukraine, the UAE did not take a stance against Moscow as desired by Washington, and has since attempted to mediate between the Russian and Ukrainian sides.

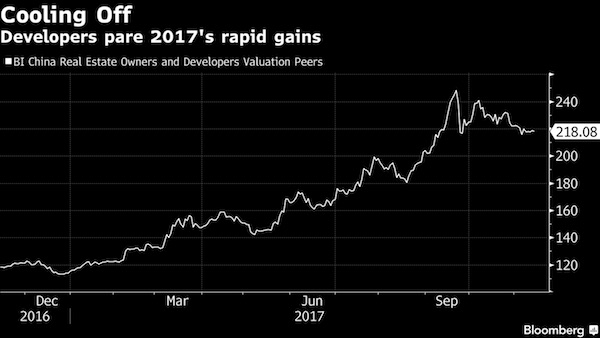

Abu Dhabi has previously facilitated prisoner exchanges between the two. According to a Reuters report, Putin thanked MbZ for his role in the prisoner exchanges, calling the UAE a “very good partner” to Moscow. Reuters reported on 25 May that the UAE has also become an integral facilitator for Russian gold sales since western sanctions over the war in Ukraine blocked Russia’s more traditional export routes. Russian customs records viewed by Reuters show the UAE imported 75.7 tonnes of Russian gold worth $4.3 billion in the past year after imports reached just 1.3 tonnes in 2021. Since the start of the Russia-Ukraine war, western financial institutions stopped brokering Russian gold sales; however, Russian gold producers found new markets in countries willing to fill the void.

A month prior, AP reported that Russian and UAE intelligence officers disclosed that the two nations are collaborating to combat US and UK intelligence agencies in response to an alleged US intelligence breach. Additionally, Russian nationals have become the largest buying group of real estate in Dubai since the war in Ukraine began, driving sales to a new record high.

350,000 young dead bodies.

“After relevant surgical procedures, the bodies are burned and the relatives are told that the serviceman is just missing..”

• Ukraine Ready To Pay West In People’s Organs For Military Aid – Moscow (TASS)

Ukraine is ready to trade the organs of its people for Western military assistance, Russian Foreign Ministry Spokeswoman Maria Zakharova said on the sidelines of the St. Petersburg International Economic Forum on Thursday. The diplomat said the Kiev regime is rapidly turning the country into a global hub of human organ trafficking. “The Kiev regime is ready to pay anything for the military assistance it gets. It’s now even come to the human organs of its citizens. A time will probably come when Ukraine will understand the true reason why its pretend US and European friends cared about it. But that won’t be soon enough. Still, better later than never,” she said.

“They literally took a knife to the country, but it will be too late to complain. The patient has already signed consent for surgery. The relevant international organizations, with an art worthy of a better cause, are ignoring these obvious and criminal phenomena,” Zakharova said. The diplomat said Western countries are the main beneficiaries of illicit transplantation practices in Ukraine. “The scenario has been rehearsed in Yugoslavia. All organs that were removed from the people, who were killed then, went to cater to the needs of Westerners,” she said. According to Zakharova, the business of illicit transplantation surgeries is thriving thanks to the high losses that Ukrainian forces suffer at the frontline.

“After relevant surgical procedures, the bodies are burned and the relatives are told that the serviceman is just missing. These dreadful machinations wouldn’t be possible without permission granted by the Kiev regime at the highest level. That’s because they are backed by legislation. The country has essentially become a honeypot for criminals. The money that illicit transplant operators are making in Ukraine is simply insane, and they aren’t going to stop,” the diplomat continued. Ukraine has done a lot to streamline transplantation surgeries.

“For example, on December 16, 2021, the Verkhovnaya Rada adopted Law 5831 On Regulating the Transplantation of Human Anatomical Materials. Under the law, a transplantation now doesn’t require a notarized consent from the living donor or his relatives. The procedure for organ removal from the deceased has also been significantly simplified, even if they didn’t give their consent for donating their organs post-mortem. That means it has been made legal by law, not just a fact on the ground,” she said. “Not only government clinics, but also private clinics have been given the right to perform transplantations. Can you imagine a private clinic in Ukraine these days? On April 4, 2022 the Verkhovnaya Rada adopted Law 5610 On Amending the Tax Code. It exempted organ transplantation surgeries from the VAT. It’s not just about budget revenue, it’s about additional control,” Zakharova said.

“..literally every country” was approached..”

And still 130 showed up.

• West Pressured Countries To Skip SPIEF – Moscow (RT)

The US and its allies threatened countries with consequences if they decided to send delegations to the St. Petersburg International Economic Forum (SPIEF), Russian Foreign Ministry spokeswoman Maria Zakharova has said. Speaking to TASS news agency on the sidelines of the forum in Russia’s second-largest city on Saturday, Zakharova was asked whether the West had tried to pressure nations that intended to participate in the event. “There was immense pressure,” she replied, adding that “literally every country” was approached. “They wrote letters. Threats were made during the meetings,” she claimed. Washington was the “leader” of these efforts, and was helped by other “NATO-centric countries,” the spokeswoman said.

The US and its allies told nations that were planning to attend SPIEF that they “would face consequences, that the next… package of sanctions is just around the corner and that everyone should think twice before participating in events on the territory of Russia,” Zakharova said. The West has been acting in a similar manner ahead of talks between Moscow and other capitals, or the signing of major business deals between Russian firms and foreign partners, she claimed. “Every time, curators from the US, UK, the EU either head out in advance to relevant countries… to pressure local officials and business representatives, intimidate, paint scary pictures. Or they come afterwards in order to try to destroy the agreements that had been reached,” Zakharova said.

She claimed that such efforts routinely take place ahead of visits by Russian Foreign Minister Sergey Lavrov to the African continent. According to Zakharova, the US and its allies target Russia’s international ties in all areas, including “culture, economy, business, politics, media cooperation.” SPIEF, which has been held annually since 1997, welcomed some 17,000 guests from 130 countries this year, the organizers said. With Western nations dropping out of the event due to the conflict in Ukraine, most of the participants came from Asia, including China and India, the Middle East, Latin America and Africa. The United Arab Emirates is the guest of honor of this year’s forum, which closes on Saturday.

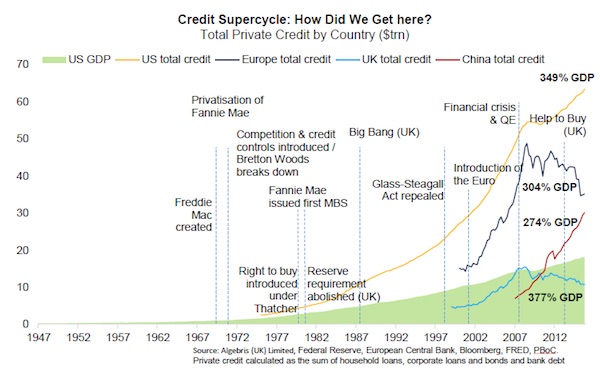

“..the Asian-Pacific countries are the main holders of the US debt and thus are facing the biggest risks..”

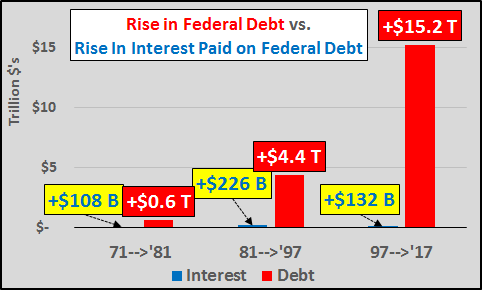

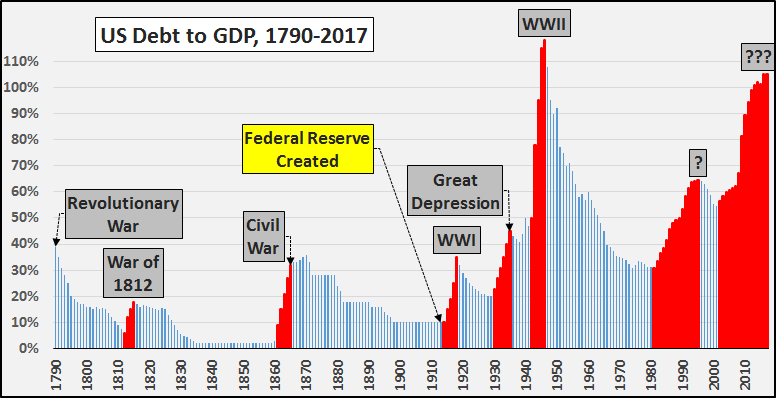

• Rosneft’s Sechin: ‘Inflated US Debt Looms Over Asia-Pacific’ (Sp.)

Igor Sechin, head of Russia’s energy company Rosneft stated that US debt is inflated and looms over the Asia-Pacific region as its main holder. “The US debt has jumped 10-fold from $3 trillion to over $31 trillion over the past 30 years. This is two times ahead of the economic growth rate and the cost of servicing it can reach $1 trillion a year, which is a fifth of the budget, and this figure is growing,” Sechin said. He stressed that the Asian-Pacific countries are the main holders of the US debt and thus are facing the biggest risks. Sechin also touched upon the matter of Europe’s dependence on US energy resources. According to him, as a result of the refusal to buy Russian gas and in the absence of other sources of LNG, Europe has found itself completely dependent on energy supplies from the US. “In fact, the European policy of diversification of gas supplies has completely failed,” Sechin concluded.

Step by step.

• De-Dollarization: Asian Central Banks To Adopt Iran’s SWIFT Alternative (ZH)

In the latest shot fired in the growing rebellion against US dollar dominance, the nine-nation Asian Clearing Union (ACU) has agreed to use Iran’s financial messaging system as an alternative to the dollar-denominated SWIFT system that has long served as the globe’s financial nervous system. “The secretary general of the Asian Clearing Union (ACU) says Iran’s financial messaging system SEPAM will replace SWIFT, a dollar-based international system, in trade exchanges between ACU members beginning next month,” Iran’s IRNA News Agency reported. At a Tehran summit in May, ACU members agreed to establish a SWIFT alternative within a month. The adoption of Iran’s SEPAM will be an interim measure, as the ACU will develop its own messaging system over the next several months.

Established in 1974, the ACU now comprises the central banks of India, Pakistan, Iran, Bangladesh, Myanmar, Maldives, Nepal, Sri Lanka and Bhutan. Belarus and Mauritius applied for ACU membership at the May summit meeting. Along with Russia and Belarus, Iran has been excluded from SWIFT as part of the US economic sanctions regime. Russia and Iran have established their own alternative connection, linking Iran’s SEPAM with the Financial Messaging System of the Bank Of Russia. In May, Russian Deputy Prime Minister Alexander Novak told press that “approximately 80% of our mutual settlements are in national currencies: rials and rubles.” The broad de-dollarization trend is the inevitable result of the US government’s knee-jerk use of economic warfare to punish countries that resist its agenda. The quantity of US sanctions exploded by 933% between 2000 and 2021.

You needn’t be a current target of US sanctions to be attracted to non-dollar trade alternatives. “In the face of the American empire’s relentless and compulsive use of sanctions to punish noncompliance with its edicts, any rational government would be wary of the possibility of being targeted over some future controversy with Washington,” wrote Brian McGlinchey at Stark Realities. The ACU’s move follows a growing assortment of other de-dollarization initiatives around the globe. As catalogued by The Cradle’s Pepe Escobar, a sampling includes:

• China and France’s Total trading liquid national gas in yuan

• Russia and China using the ruble or yuan for more than 70% of their trade

• India and Russia trading oil in rupees

• Brazil’s Banco BBM becoming the first Latin American bank to join China’s SWIFT alternative — the Cross-Border Interbank Payment System (CIPS)

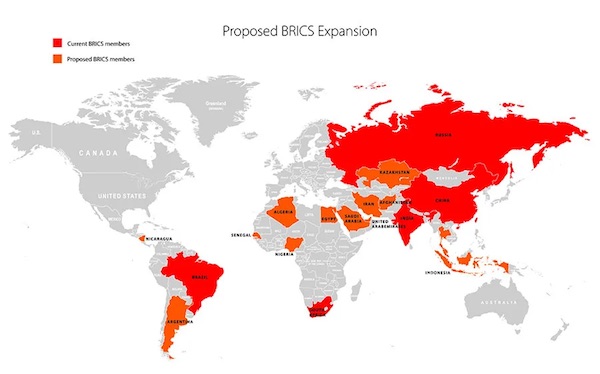

• 19 countries applying to join BRICS, the a geopolitical rival to the the G7 that originally comprised Brazil, Russia, India, China and South Africa

As Escobar summed up the world-changing transition, “The Hegemon – clinging to a toxic cocktail of neoliberalism, sanction dementia, and widespread threats – is bleeding from within. De-dollarization is an inevitable response to system collapse. In a Sun Tzu 2.0 environment, it is no wonder the Russia-China strategic partnership exhibits no intention of interrupting the enemy when he is so busy defeating himself.”

Give it all to Ukraine so they can skim it.

• ECB Warns EU Against Skimming Profits From Stolen Russian Money (RT)

The European Central Bank (ECB) on Friday privately warned the European Commission against tapping interest from frozen Russian assets, the Financial Times reported, citing a draft internal note from the ECB’s governing council. EU lawmakers have been mulling ways of deploying some of the proceeds for the restoration of Ukraine, which faces a huge reconstruction bill once the conflict with Russia ends. According to the report, the ECB fears that such actions could encourage other central banks that hold large forex reserves to “turn their back” on the euro, especially if the EU decides to act alone and not in a joint move with G7 countries.

“There is no disagreement that this is morally the right thing to do, but the ‘how’ is very difficult. You can’t skirt the rule of law. And if you find something that is legally tenable what are the implications for the euro’s standing as a global currency?” an unnamed EU diplomat told the newspaper. He added that the commission is finalizing proposals on the potential tapping of frozen Russian assets, which are expected to be unveiled later this month. EU securities depositories have seized some €196.6 billion ($215 billion) in Russian assets since the start of the conflict, the news outlet noted, adding that Belgium-based Euroclear alone generated €734 million ($805 million) of interest on cash balances from Russia-sanctioned assets in the first quarter of 2023.

In total, Western governments have frozen about $300 billion in Russian central bank assets since the start of Russia’s military operation in Ukraine, and seized more than $80 billion worth of assets belonging to Russian citizens and businesses. While addressing the St. Petersburg International Economic Forum (SPIEF) on Friday, Russian President Vladimir Putin described these actions as “medieval.” “Many businessmen were stunned to see that their accounts in the West were frozen. It never crossed anyone’s mind. This is robbery. They closed them, took them away and won’t even explain why. It’s shocking. It’s like the Middle Ages,” the Russian president said.

“..just a run-of-the-mill respiratory season, weaponized and fueled by a continuous global hysteria.”

• There Was No Pandemic (Schachtel)

Now that the hysteria is finally winding down, “experts” and commentators on both the pro lockdown and anti lockdown side are discussing the “lessons learned” from the pandemic, as if there was something uniquely outside of the norm about the nature of illness we’ve witnessed. They’ve boxed themselves into a false paradigm, similar to the lab leak versus natural origin debate. These forces, whether they are aware of it or not, are operating within a purposely limited framework. They’ve been captured by the Government Health/Big Pharma narrative that there was in fact an emergency that demanded a response, and most won’t dare step out of line to question the authenticity of the premise itself.

But as we explained Thursday in our piece, “it really was just the flu, bro,” there was no significant distinction between the covid years and your average flu season. There are no “lessons to be learned from the pandemic” because there was no pandemic. Covid-19 simply doesn’t fit the bill, according to the widely understood interpretation of what a pandemic entails. We must let go of the limitations of this false “pandemic” construct that is labeled covid-19. We need not take the bait that there was a pandemic that had to be dealt with. There was certainly a global hysteria, but it was a psychological hysteria. There was no global viral emergency, because the vast majority of the global population was not significantly threatened by this supposedly devastating disease.

Had the world been caught up with say, some other “emergency” on our minds, “the pandemic” would have just been written off as another human respiratory illness season. If anything, the lesson to be learned is not to put your trust in the hands of the government, which, either through malice or reckless indifference, encouraged widespread iatrogenic injury as the solution to a nonexistent pandemic. It wasn’t “the pandemic” that devastated the global economy and wrecked civilization, it was the top-down dictates from above that caused millions of excess deaths worldwide, all to supposedly combat a disease that was not out of the ordinary whatsoever. Covid-19 was just the flu. There was no pandemic, but just a run-of-the-mill respiratory season, weaponized and fueled by a continuous global hysteria.

“..American Ambassador to Ukraine, Marie Yovanovitch, sent panicky emails to the folks back home about Onyshschenko’s allegations of Biden bribery..”

• Call the Exorcists! (Jim Kunstler)

The dybbuk Weissmann is best known, of course, for directing the Special Counsel’s “Russian Collusion” campaign (2017 – 2019) in the mental absence of its nominal chief, Robert Mueller, an endeavor that, in the end, could not find any instance of then-President Trump colluding with said Russians — but did, via a firehose of media leaks, succeed in casting a Trump derangement spell over half the US population. Dybbuk Weissmann lately haunts the MSNBC cable news channel as a “legal analyst.” And yet, this shape-shifting fiend turns up again now in the Biden family global bribery matter, of all things. See if you can follow the convoluted tale coming out of Dybbuk Central a.k.a. Ukraine and the FBI.

You may already know that in May, 2014, R. Hunter Biden, son of then-vice president Joe Biden, was appointed to the board of the Ukrainian natgas company Burisma, where he was paid $80,000-a-month for his expertise (he had none) in the global gas industry. As it happened, at exactly the same time Veep Joe Biden was appointed as then-President Barack Obama’s “point man” in Ukraine after the 2014 Maidan Coup, engineered by Assistant Secretary of State Victoria Nuland and the CIA, that ousted elected President Viktor Yanukovych. By and by, Ukraine elected a new American-friendly president, Petro Poroshenko. Burisma was owned by an oligarch name of Mykola Zlochevsky. Apparently, the $80-K-a-month for Hunter Biden was not enough. The friendly American veep, Joe Biden, pressed Burisma’s Zlochevsky to provide $5-million payment each to Hunter and himself for additional Biden family services in Ukraine.

President Petro Poroshenko had a political confidant and fixer (problem solver) named Oleksandr Onyshchenko, then a member of Ukraine’s parliament. In the 2015-16 time-frame, Onyshchenko conveyed a message to Zlochevsky that paying large sums of money to the Bidens might not be a good idea. Somehow, Onyshchenko’s complaints about the Bidens’ grift operation made it into the leading Kiev newspaper. As we all know, in November, 2016, Donald Trump was elected US President. Catastrophe! Freak-out in the US embassy in Kiev! December, 2016, American Ambassador to Ukraine, Marie Yovanovitch, sent panicky emails to the folks back home about Onyshschenko’s allegations of Biden bribery. One of the recipients was a CIA agent implanted in the National Security Council name of Eric Ciaramella, later known as the Ukraine Phone Call Whistleblower.

Now, you may recall that in the summer of 2019, the owner of a Delaware computer repair shop, one John Paul Mac Isaac, came into possession of a laptop abandoned by Hunter Biden — under law, being left 90-days after repairs were made — and seeing its startling contents, tried to give it to the FBI, but was rebuffed. By then, CIA agent Eric Ciaramella had blown his whistle over a phone call Mr. Trump made to new Ukraine President Volodymyr Zelensky inquiring about the Bidens’ doings there. Later that fall, with impeachment proceedings started against President Trump, FBI agents came back at Mr. Mac Isaac and took the computer into the agency’s possession. Consider that FBI Director Christopher Wray must have known about the laptop coming into his HQ and what it contained — and known that throughout the impeachment and Senate trial proceedings of Mr. Trump, And, of course, Mr. Wray did not volunteer any of this evidence about the Bidens to Mr. Trump’s defense attorneys. Nor did then-Attorney General William Barr, Mr. Wray’s superior. Odd, a little bit?

Tiny turtle

https://twitter.com/i/status/1670107887258030080

2 types

https://twitter.com/i/status/1669804332961656832

Eagle

Coming in really fast and almost sideways. Look at that wing control! Epic birds. pic.twitter.com/LVbmkV5oUd

— Mark Smith Photography (@marktakesphoto) June 17, 2023

Eagle??

https://twitter.com/i/status/1669813828295573506

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.