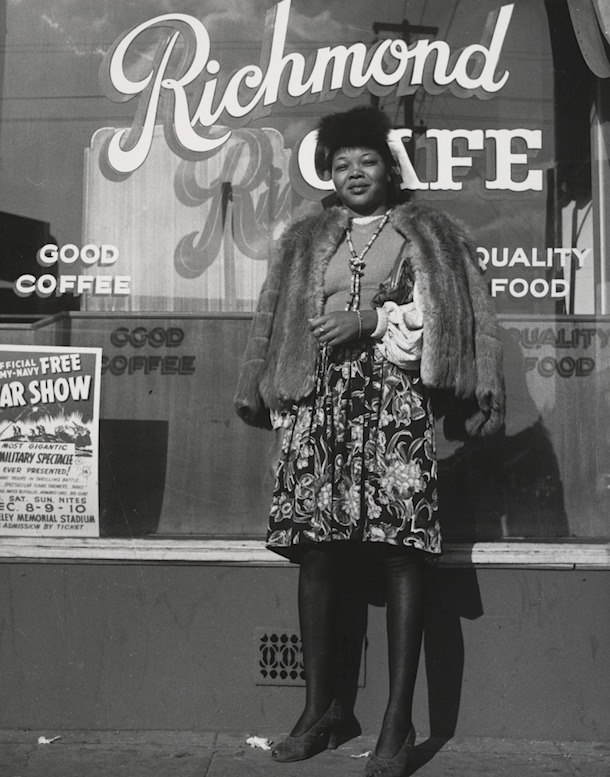

Dorothea Lange Richmond, California 1942

We are facing prolonged discussions and chaos about testing. Everyone wants to reopen their economies, but that is not feasible if there is no testing. Nobody wants to go to a bar or an office or factory floor if they can catch a deadly virus there. Very few people will volunteer to sit on, or work on, a plane or train under such conditions, and few countries would welcome travelers anyway.

But from what I gather, testing facilities and capacities are few and far between, other than perhaps in Wuhan or maybe maybe Seoul. Testing 1% of people doesn’t get you anywhere, not with 15-50% of people being asymptomatic carriers infecting others around them.

Many countries claim they don’t need to do more testing, and most do that only because they can’t. And then you get into antibodies testing, and you find the mess and uncertainties are even bigger there. The entire situation screams for one thing: lockdown, minimize contact, but that’s what they all want to get away from.

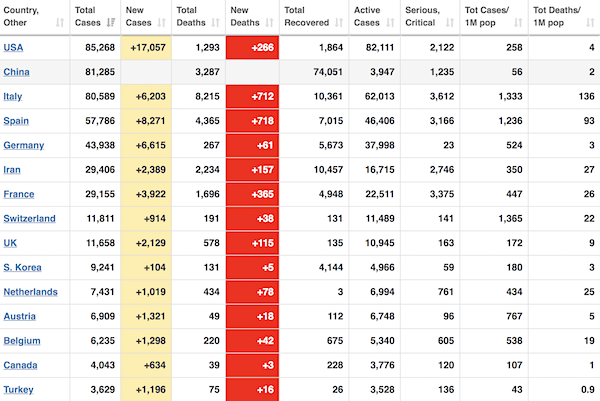

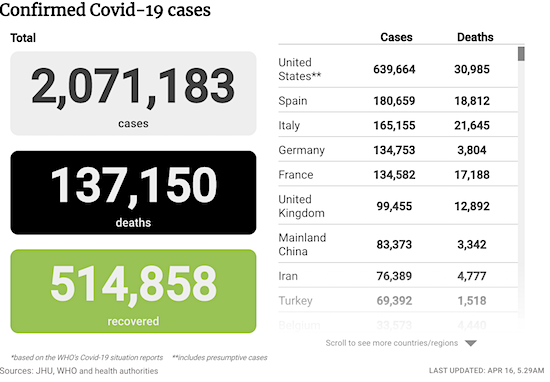

• US records nearly 2,600 #coronavirus deaths in 24 hours – a new record and the heaviest daily toll of any country, Johns Hopkins University reports.

• The total number of US deaths is now 28,326 — higher than any other nation

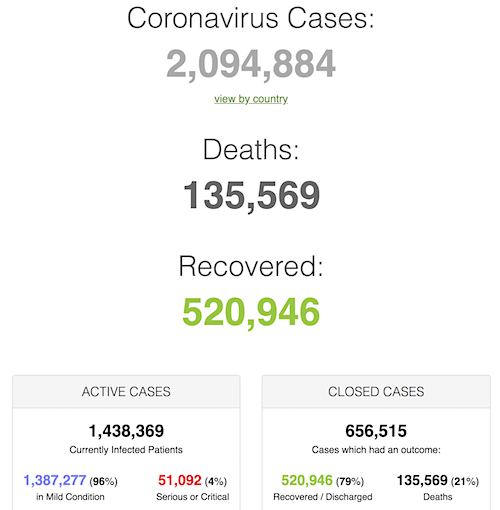

• Cases 2,094,884 (+ 80,884 from yesterday’s 2,014,000)

• Deaths 135,569 (+ 7,977 from yesterday’s 127,592)

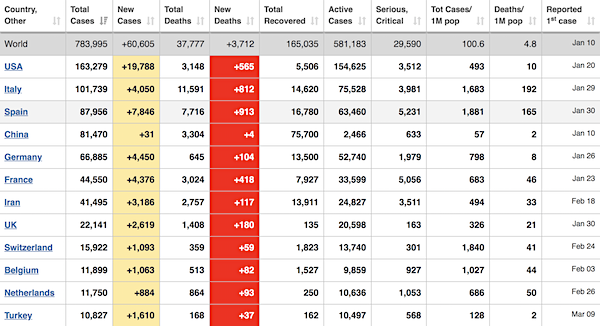

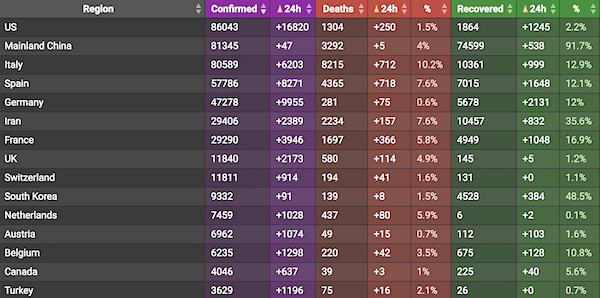

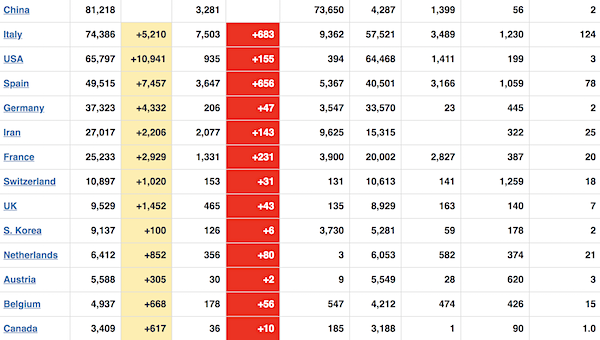

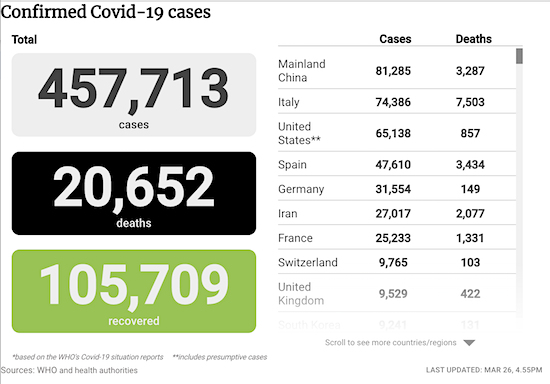

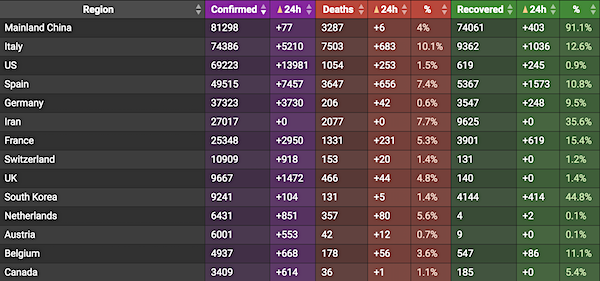

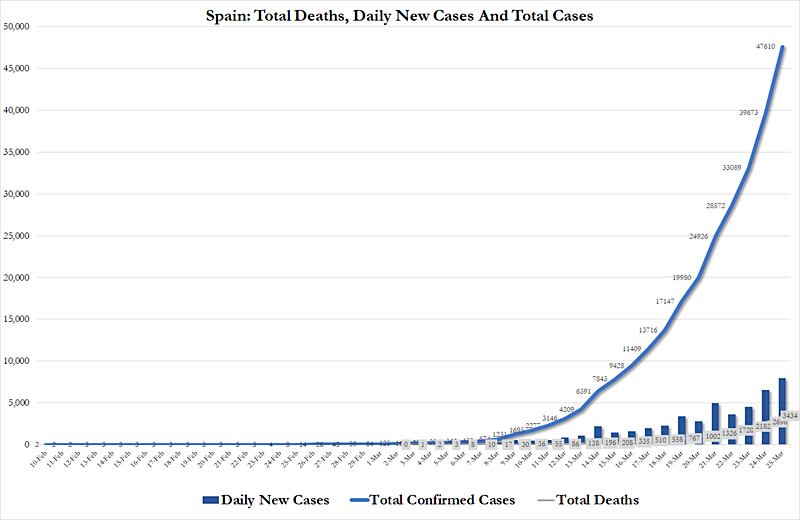

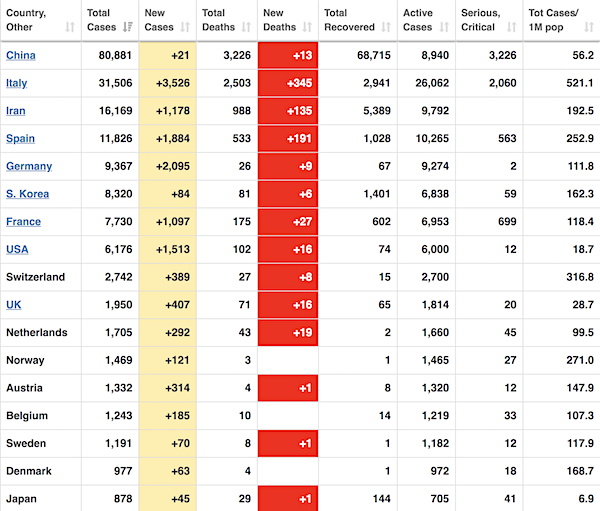

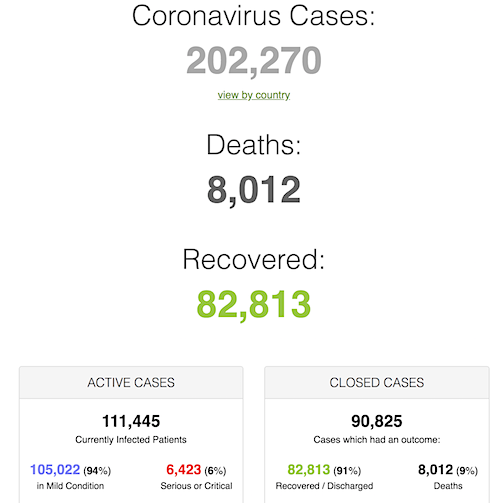

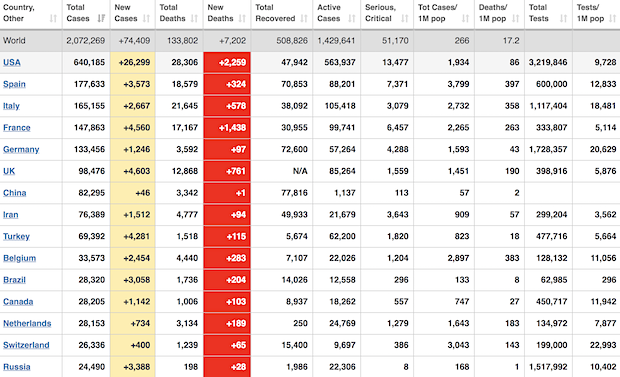

From Worldometer yesterday evening -before their day’s close- (Note: Brazil and Russia are climbing fast)

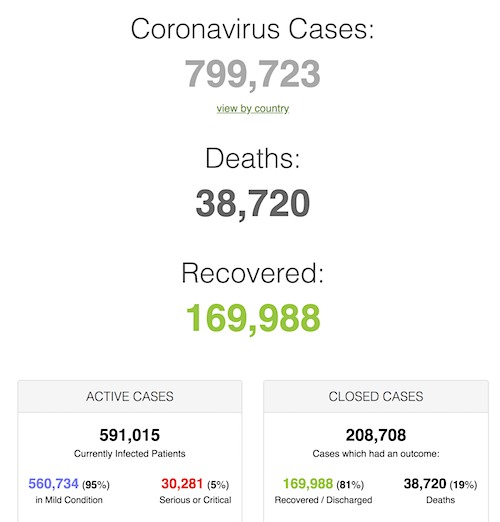

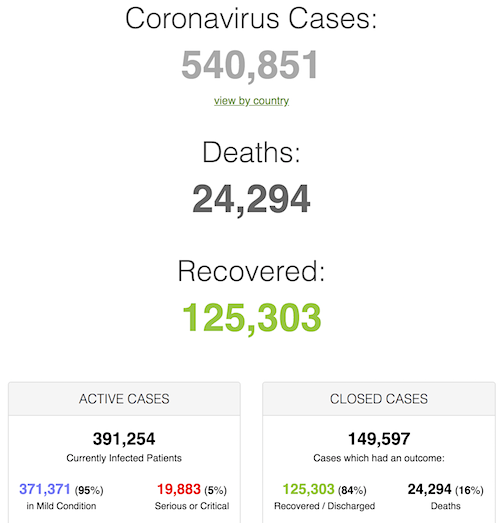

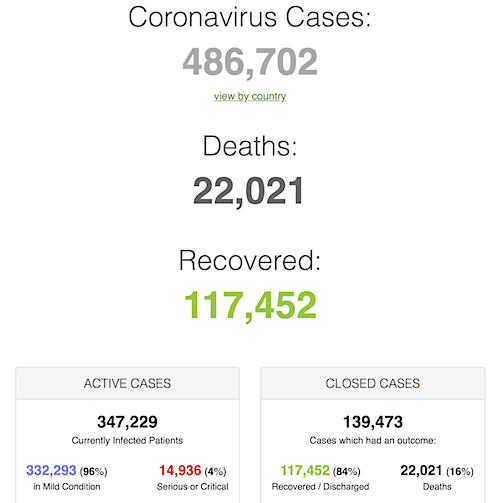

From Worldometer – NOTE: mortality rate for closed cases remains at 21% –

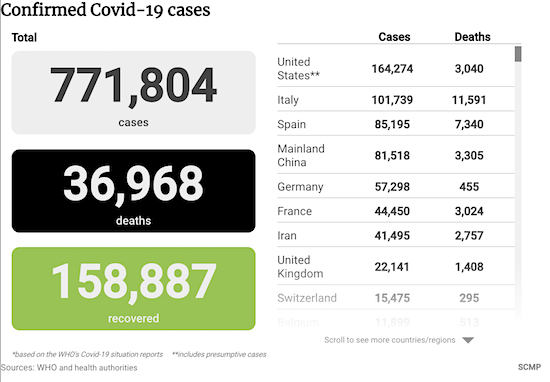

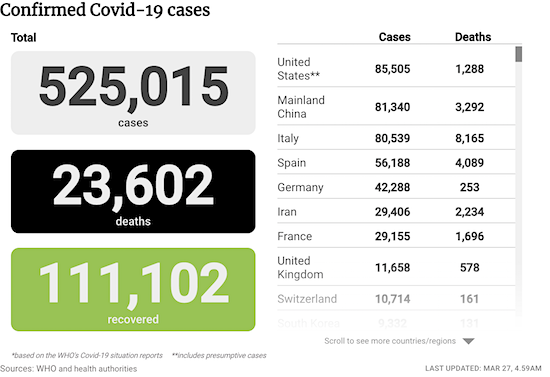

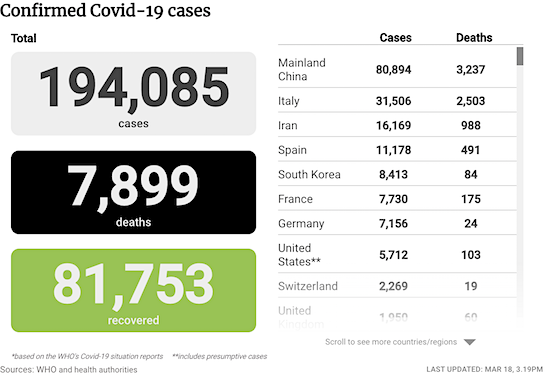

From SCMP:

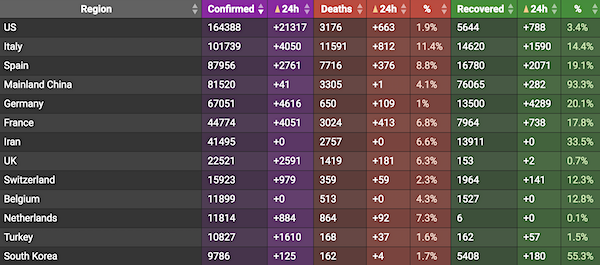

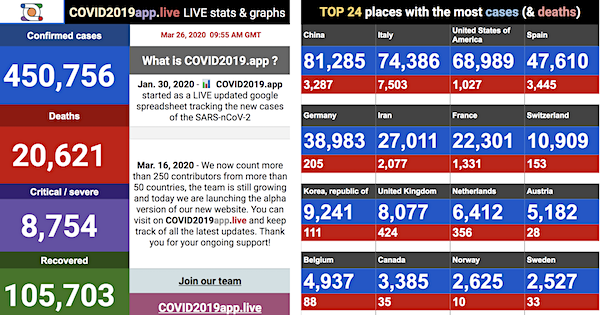

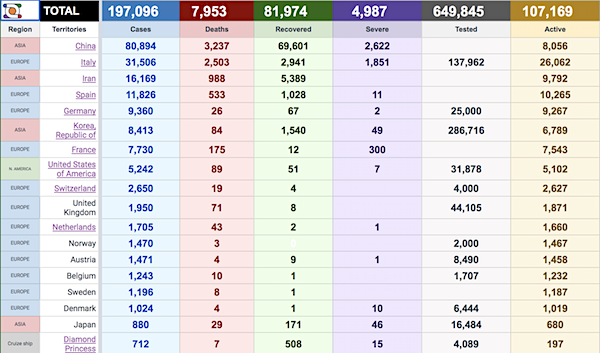

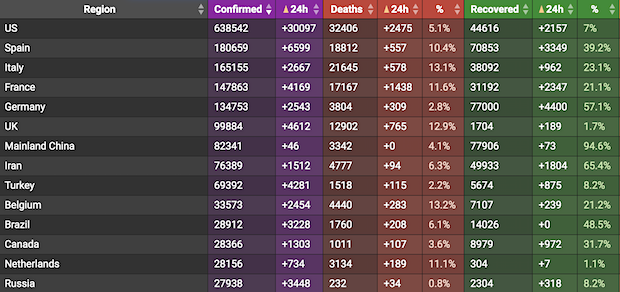

From COVID19Info.live:

How accurate is it anyway?

• Coronavirus Testing Hits Dramatic Slowdown In US (Pol.)

The number of coronavirus tests analyzed each day by commercial labs in the U.S. plummeted by more than 30 percent over the past week, even though new infections are still surging in many states and officials are desperately trying to ramp up testing so the country can reopen. One reason for the drop-off may be the narrow testing criteria that the Centers for Disease Control and Prevention last revised in March. The agency’s guidelines prioritize hospitalized patients, health care workers and those thought to be especially vulnerable to the disease, such as the elderly. Health providers have been turning away others in part due to shortages of the swabs used to collect samples.

It’s not clear whether demand has peaked among the groups on the CDC’s priority list. But after being overwhelmed for weeks, commercial labs say they are now sitting with unused testing capacity waiting for samples to arrive. The continued glitches in the U.S. testing system are threatening to impede attempts to reopen the economy and return to normal life. Expanding testing as much as possible is essential so officials have enough data to determine when it’s safe to lift social distancing measures and allow people to go back to work. Continued testing beyond that point will help officials detect — and stamp out — sparks that could set off new outbreaks. FDA Commissioner Stephen Hahn told POLITICO on Tuesday the White House Coronavirus Task Force is continuing to discuss whether changes to the testing criteria are warranted.

“This is part of an ongoing discussion that we’re having,” he said. “People are working overtime on that one.” Hahn’s comments came as the American Clinical Laboratory Association reported that the number of samples commercial labs handle each day fell from 108,000 on April 5 to 75,000 by April 12. The group’s members, including commercial giants Quest and LabCorp, analyze about two-thirds of all coronavirus tests in the U.S. “ACLA members have now eliminated testing backlogs, and have considerable capacity that is not being used,” ACLA President Julie Khani told POLITICO. “We stand ready to perform more testing and are in close communication with public health partners about ways we can support additional needs.”

You couldn’t create a bigger mess if you tried with all your might.

Oh man- I spent 10 minutes this AM explaining why antibody testing is good for assessing a population, bad for most individual patients. On behalf of many of my infectious disease colleagues- use your influence to have others NOT follow your example pic.twitter.com/f3vg92aC96

— Dimitri Drekonja (@Ddrekonja) April 15, 2020

• Antibody Tests For Coronavirus Can Miss The Mark (NPR)

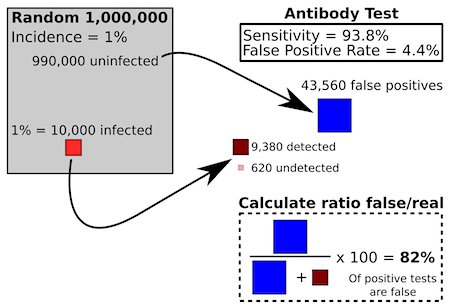

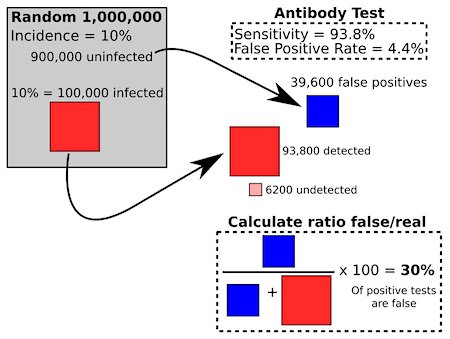

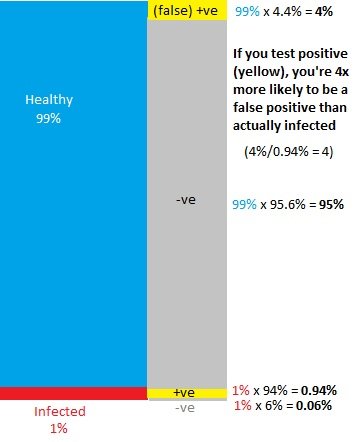

Dozens of blood tests are rapidly coming on the market to identify people who have been exposed to the coronavirus by checking for antibodies against it. The Food and Drug Administration doesn’t set standards for these kinds of tests, but even those that meet the government’s informal standard may produce many false answers and provide false assurances. The imperfect results could be a big disappointment to people who are looking toward these tests to help them return to something resembling a normal life. First of all, it’s not clear whether someone who has antibodies to the coronavirus in their blood is actually immune. Your body produces these antibodies within about a week of infection.

In many other diseases, people do have a period of immunity after they have been exposed to a microbe and recover from illness. But that has not been demonstrated yet with the coronavirus. Another problem is that test results are wrong much more frequently than you might expect. While tests may truthfully say they are more than 90% accurate, in practical use they can often perform far below that level. [..] Dr. Jeremy Gabrysch runs a mobile medical service in Austin, Texas. He got a supply of antibody tests made by a major Chinese manufacturer and says he has tested several hundred people in the last few days. “We offer the test for people who may have suspected they might have had coronavirus back in February or March when testing with the nasal swab [and PCR diagnostic test] was very limited,” he says. The charge: $49 a test.

Gabrysch says he only tests people when he has other evidence they might have been exposed. “If they had an illness that sounds like it could have been coronavirus and they had a positive antibody test, then it’s very likely that this is a true positive, that they indeed had COVID-19,” he says. The test he’s using, produced by Guangzhou Wondfo Biotech in China, boasts a specificity of 99%, which means it only falsely says a blood sample contains antibodies against the coronavirus 1% of the time. But despite that impressive statistic, a test like that is not 99% correct, and in fact in some circumstances could be much worse.

That’s because of this counterintuitive fact: The validity of a test depends not only on the technology, but how common the disease is in the population you’re sampling. “It is kind of a strange thing,” admits Dr. H. Gilbert Welch, a scientist at Brigham and Women’s Hospital in Boston who studies issues surrounding tests and screening. “An antibody test is much more likely to be wrong in a population with very little COVID exposure.” This is a result of statistics, rather than the technology of any given test.

But not those above 65. A very curious finding.

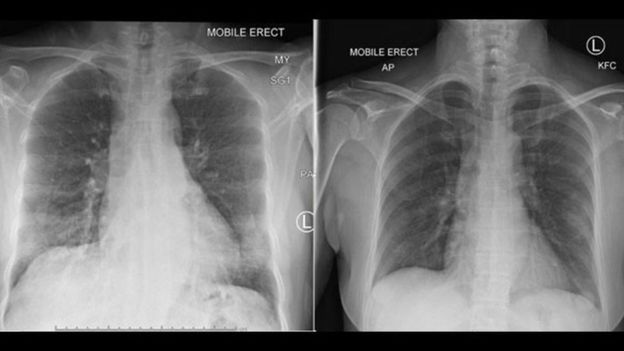

• The Coronavirus Is Particularly Unkind To Those Who Are Obese (LAT)

America’s obesity epidemic appears to be making the coronavirus outbreak more dangerous — and potentially more deadly — in the United States, new research suggests. For younger and middle-aged adults in particular, carrying excess weight may significantly boost the likelihood of becoming severely ill with COVID-19. The evidence for this comes from thousands of COVID-19 patients who sought treatment in emergency departments in New York, and it’s prompting alarm among doctors and other health experts. In the U.S., 42.4% of adults have obesity, which means their body-mass index, or BMI, is 30 or more.

In one of two new studies released this week, COVID-19 patients who were younger than 60 and had a BMI between 30 and 34 were twice as likely as their non-obese peers to be admitted to the hospital for acute care instead of being sent home from the ER. They were also 1.8 times more likely to require critical care in a hospital’s intensive care unit. More severe obesity posed an even greater risk to COVID-19 patients in this under-60 age group. When these patients had a BMI of 35 or higher, they were 2.2 times more likely than their non-obese peers to need standard hospital care and 3.6 times more likely to end up in the ICU. “Obesity appears to be a previously unrecognized risk factor for hospital admission and need for critical care,” wrote the authors of the study published this month in the journal Clinical Infectious Diseases.

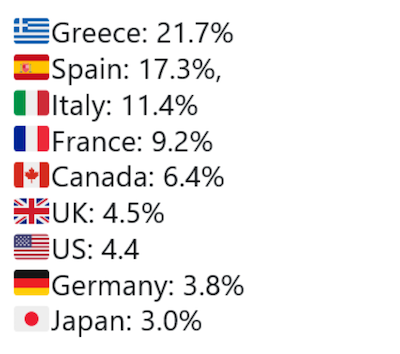

But that only applies to relatively younger patients; among those ages 65 and older, there was no link between obesity status and hospital care. The authors, from New York University’s Grossman School of Medicine, suggested that the country’s high prevalence of obesity might be nudging rates of severe illness and death higher in the U.S. than in South Korea, China and Italy, where obesity rates are lower. The results also give doctors a new way to predict which COVID-19 patients who are not yet senior citizens run a higher risk of hospitalization and critical illness. “Unfortunately, obesity in people <60 years is a newly identified epidemiologic risk factor,” wrote the researchers, who included 3,615 patients in their study.

We need more Wall Street.

• New York Taps Mckinsey To Develop ‘Trump-Proof’ Economic Reopening Plan (R.)

New York Governor Andrew Cuomo has hired high-powered consultants to develop a science-based plan for the safe economic reopening of the region that can thwart expected pressure from President Donald Trump to move more rapidly, state government sources told Reuters on Wednesday. Cuomo, along with many other U.S. governors, shut his state economy to limit the spread of the deadly COVID-19 virus and has warned that he is are prepared to keep businesses shut – perhaps for several months more – unless he can assure public safety. Governors from seven East Coast states formed a coalition on Monday, led by New York, to develop a joint reopening plan. Three governors from the West Coast formed a similar plan. The 10 states, mostly led by Democrats, together make up 38% of the U.S. economy.

As part of Cuomo’s effort, McKinsey & Company is producing models on testing, infections and other key data points that will underpin decisions on how and when to reopen the region’s economy, the sources said. Cuomo has also recalled three former top aides: Bill Mulrow, a senior adviser at Blackstone Group; Steven Cohen, an executive vice president and CEO of MacAndrews & Forbes Inc; and Larry Schwartz, a deputy Westchester County executive. Deloitte is also involved in developing the regional plan, a source said. The goal is to “Trump-proof” the plan, said an adviser to New Jersey Governor Phil Murphy. “We think Trump ultimately will blink on this, but if not, we need to push back, and we are reaching out to top experts and other professionals to come up with a bullet-proof plan,” to open on the state’s terms, said a Cuomo adviser.

35 days too late. https://t.co/xba4APDKLv

— Nassim Nicholas Taleb (@nntaleb) April 16, 2020

Please don’t claim you’re about to eliminate the virus. Ramp up testing as of your life depended on it.

• New Zealand PM: Many Restrictions To Be Kept In Place When Lockdown Ends (R.)

New Zealand Prime Minister Jacinda Ardern said on Thursday that significant restrictions would be kept in place even if the country eases the nationwide one-month lockdown enforced to beat the spread of the coronavirus. New Zealand introduced its highest, level 4 lockdown measures in March, under which offices, schools and all non-essential services like bars, restaurants, cafes and playgrounds were shut down. A decision on whether to lift the lockdown would be made on April 20. The measures were tougher than most other countries, including neighbouring Australia, where some businesses were allowed to operate.

Ardern said if New Zealand moves to the lower level 3 of restriction, it would permit aspects of the economy to reopen in a safe way but there will be no “rush to normality”. “We have an opportunity to do something no other country has achieved, eliminating the virus,” Ardern said at a news conference. New Zealand reported 15 new cases of COVID-19 on Thursday, taking the total to 1,401 in a nation of about 5 million people. There have been nine deaths. Ardern said under level 3, some people could return to work and businesses reopen if they are able to provide contactless engagement with customers. Shops, malls, hardware stores and restaurants will remain shut but can permit online or phone purchases.

It’s been a while since I saw a piece by Ambrose Evans-Pritchard. Very much stuck in business-only mode.

• Investors Are Underestimating The Economic Shock The World Is Facing (AEP)

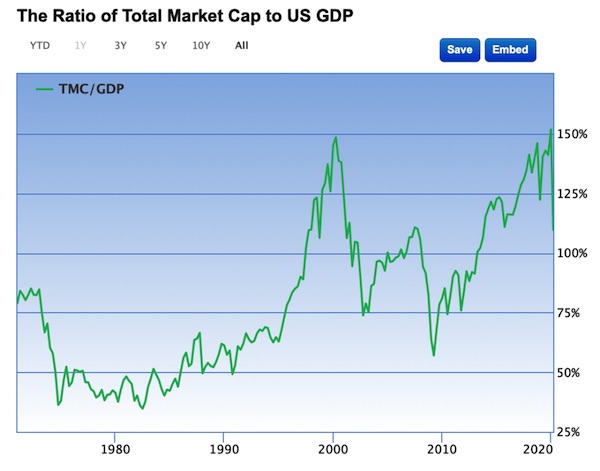

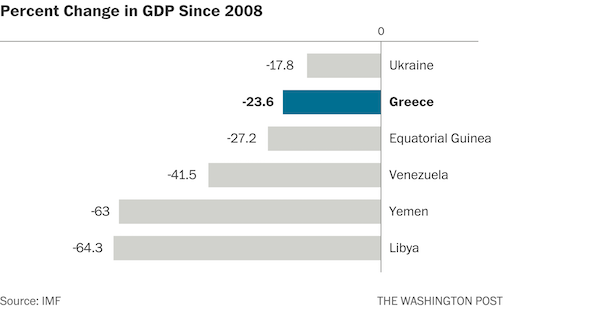

Investors are repeating the mistake they made all through February and early March. They are again underestimating the immense economic shock of COVID-19. Can there be any parallel in market history to the surreal clash of narratives we saw this week? Global bourses soared even as the International Monetary Fund painted a series of scenarios ranging from dire – the most violent slump since the Great Depression – to catastrophic, with all the potential chain-reactions spelt out in its Global Financial Stability Report. Yet Goldman Sachs tells us that COVID-19 is under control and the worst is over. “The number of new active cases looks to be peaking globally, projections of cumulative fatalities and peak healthcare usage are coming down,” it says.

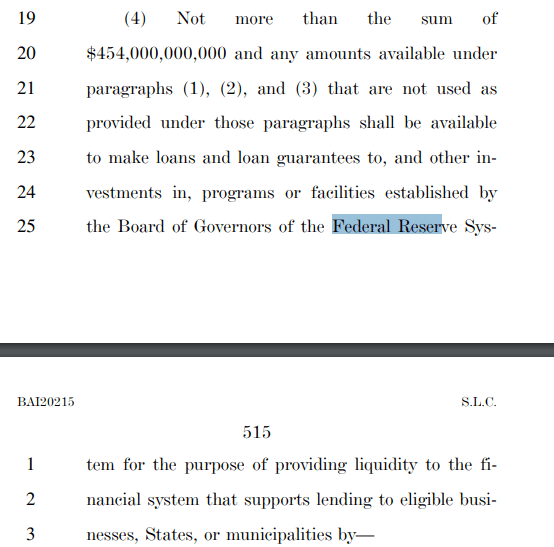

From this breathtaking premise, Wall Street’s fashion leader argues that we should “look through” the Great Lockdown to sunlit uplands ahead, anticipating a further 8% rise in the S&P 500 index by the end of the year. We can disregard normal bear market rules. This time we will avoid the textbook sequence of events in recessions: a swift crash followed by a torrid buy-the-dip rebound, and then a slow downward grind over months as reality hits home, ending only in capitulation at far lower levels. Authorities have spared us such a fate by rescuing everything immediately. “The Fed and Congress have precluded the prospect of a complete economic collapse,” it says.

I agree that $5 trillion of central bank QE, vast fiscal packages (10% of GDP in the US), and blanket guarantees, have averted disaster. They have – in a disjointed way – bought time and given us a chance of emerging from this global sudden stop without irreparable damage to the productive system. What is surely wrong is to imagine that this pandemic is a one-off shock lasting three months or so, followed by an early release from lockdowns and a swift return to near normality. The first glimpses of antibody data – such as Denmark’s test on blood donors – show that we are nowhere near the safe threshold of herd immunity.

They confirm fears that the mortality rate is at least 1% of infections and that therefore no democracies can let the virus run its course without overwhelming their health services and destroying their political legitimacy. The supposed trade-off between lives and the economy is an illusion. The most certain way to turn this crisis into a depression is to give up too soon, as Spain is already doing, and Donald Trump is itching to do. We would end up in the worst of all worlds, with multiple waves, and another forced closure of the economy to avert a winter tsunami, requiring trillions more in fiscal relief. [..] “We need a vaccine. Until we get one, the stock markets are in cloud-cuckoo land,” says professor Anthony Costello from University College London.

That wouldn’t be wise.

• Trump Threatens To Adjourn Congress Over ‘Scam’ Preventing Appointments (R.)

U.S. President Donald Trump threatened on Wednesday to shut down Congress so he could fill vacancies in his administration without Senate confirmation, saying he was frustrated lawmakers were not in Washington to vote on his nominees for federal judgeships and other government positions. “The current practice of leaving town, while conducting phony pro forma sessions, is a dereliction of duty that the American people cannot afford during this crisis,” an angry Trump told reporters at his daily White House briefing on the coronavirus crisis. “It is a scam that they do. It’s a scam and everyone knows it, and it’s been that way for a long time,” Trump said. No U.S. president has ever used the authority, included in the Constitution, to adjourn both chambers of Congress if they cannot agree on a date to adjourn.

It was not immediately clear if Congress’ current absence from Washington because of the global pandemic could be classified as being due to a failure to agree on an adjournment date. The Senate and House of Representatives have both announced plans to return to Washington on May 4, and had been scheduled to be out of Washington for two weeks in April for their annual Easter break even before the coronavirus crisis. Senate Majority Leader Mitch McConnell discussed nominations with Trump on Wednesday and promised to find ways to confirm those “considered mission-critical” to the pandemic, a McConnell spokesman said. “However, under Senate rules, that would take consent from Democratic leader Chuck Schumer,” the spokesman said.

It was obvious before it started that it would be a mess.

• US Coronavirus Small-Business Program Funding Nearly Spent (LAT)

Democrats and the Trump administration were at a stalemate Wednesday over how to resupply the popular Paycheck Protection Program, which helps small businesses cope during the coronavirus pandemic and is due to run out of money as soon as Wednesday night. The standoff came as Senate Democrats pushed the administration to lay the groundwork for how the nation may reemerge from social distancing and stay-at-home orders. Republicans and Democrats agree they need to provide more funding to the Paycheck Protection Program, which offers forgivable loans to help small businesses maintain their payrolls amid the deep economic fallout from the coronavirus. But the GOP balked at additional Democratic demands, such as tagging some of the funding for businesses that don’t have an existing relationship with a bank that supply the loans.

Participating banks have largely given preference to their current customers. As of 9 p.m. Eastern time Wednesday, the Small Business Administration had approved 1.5 million applications totaling more than $324 billion of the $349 billion that Congress authorized in last month’s $2.2-trillion coronavirus relief package, according to the agency. Sen. Marco Rubio (R-Fla.), chairman of the Senate committee with jurisdiction over small business, said that the program is expected to “grind to a halt” Wednesday evening as it hits its spending limit. “Now 700,000 small business applications are in limbo & no new loans will be made until the game of chicken in Congress ends,” Rubio said on Twitter. “Inexcusable.”

[..] The standoff over the funding program comes as Democrats on Wednesday released a national coronavirus testing strategy, arguing that they’re filling a void left by the Trump administration, which hasn’t released a plan to scale up COVID-19 testing to allow Americans to return to work and school. “The U.S. lags the world in testing and we lead the world in COVID-19 cases,” said Sen. Debbie Stabenow (D-Mich.). “We are raising the alarm bells.” [..] Sens. Lamar Alexander (R-Tenn.) and Roy Blunt (R-Mo.), chairmen of two Senate committees responsible for health policy and spending, have said they want to make COVID-19 antibody testing free to all Americans. They acknowledged the need for widespread testing before people will feel comfortable resuming normal activities outside their homes. But Alexander said the money Congress has already authorized should be used to ramp up testing — not new funding.

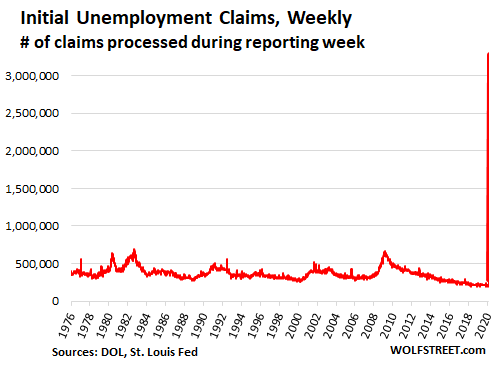

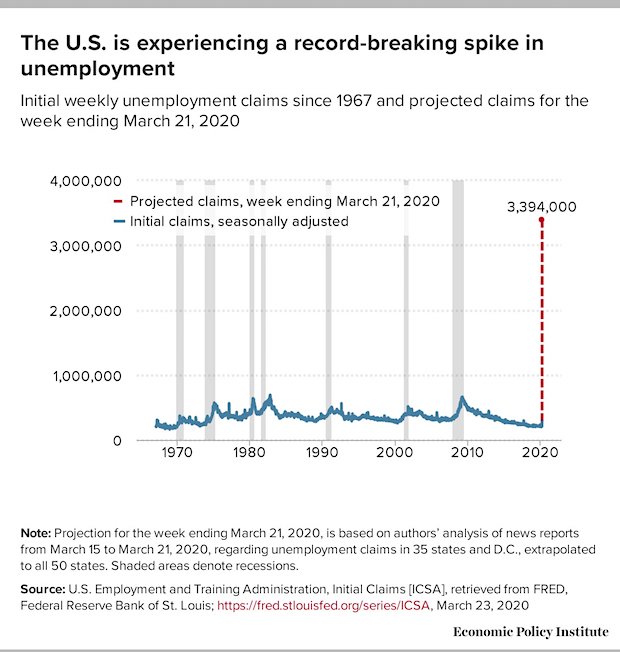

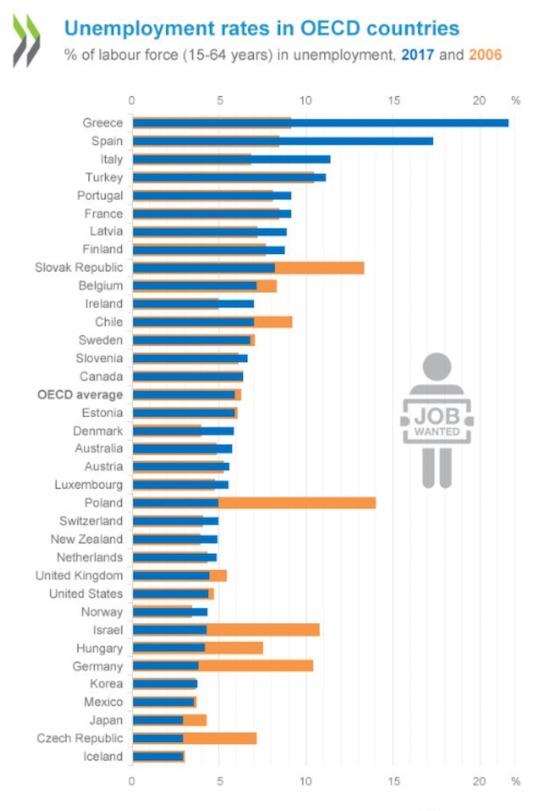

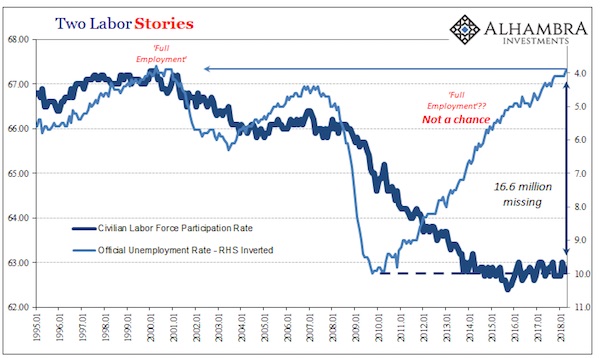

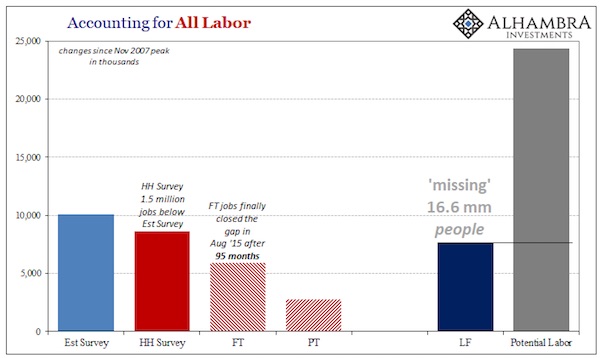

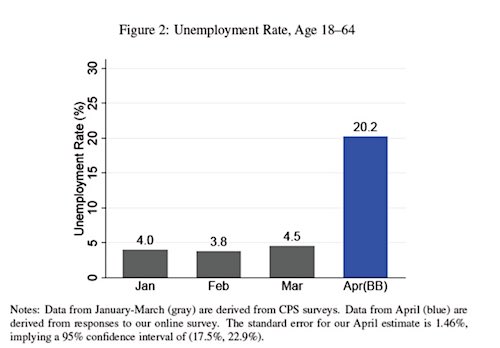

It takes weeks for jobs numbers to come out. That is too long in virustime. These guys try to fill the gap.

• Real Time US Labor Market Estimates During 2020 Coronavirus Outbreak (Bick)

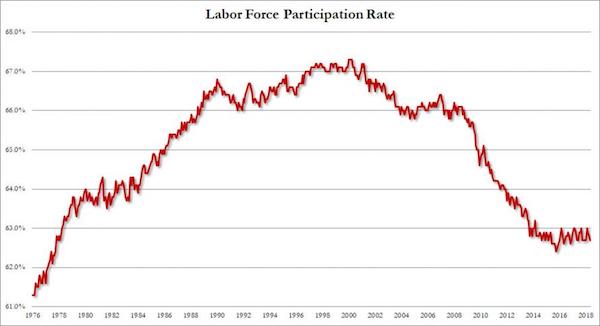

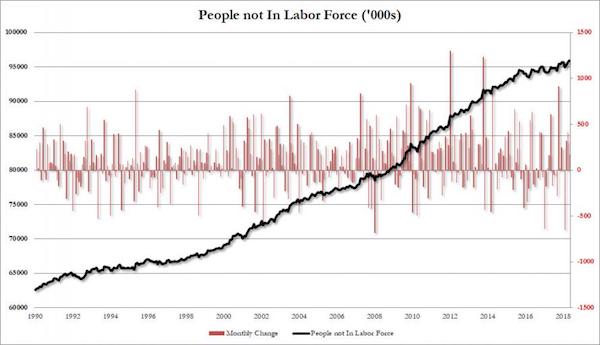

Labor market statistics for the United States are collected once a month and published with a three week delay. In normal times, this procedure results in timely and useful statistics. But these are not normal times. Currently, the most recent statistics refer to the week of March 8- 14; new statistics will not be available until May 8. In the meantime, the Coronavirus outbreak has shut down a substantial portion of the U.S. economy. More timely and frequent data on the impact on the labor force would surely be useful for both policy makers and the broader public. Our core survey closely follows the CPS, which allows us to construct estimates consistent with theirs. The first wave of our survey covers the week of March 29-April 4. Our findings reveal unprecedented changes in the US labor market since the most recent CPS data were collected:

1. The employment rate decreased from 72.7% to 60.7%, implying 24 million jobs lost.

2. The unemployment rate increased from 4.5% to 20.2%.

3. Hours worked per working age adult declined 25% from the second week of March. Half of this decline is due to lower hours per employed as opposed to lower employment.

4. Over 60% of work hours were from home, compared with roughly 10% in 2017-2018.

5. Those who still have their jobs are working fewer hours; 21% report a decline in earnings.

6. Declines were most pronounced for workers who were female, older, and less educated.Effective policies require timely and accurate data on the scale of the downturn, yet traditional data sources are only made available at a significant lag. For example, the March 2020 Employment Situation report by the the Bureau of Labor Statistics (BLS) only reflected labor market outcomes from the week ending Friday March 13, which precedes most major developments related to the outbreak. The April 2020 Employment Situation report will reflect labor market outcomes from the third week of April, but is not scheduled for release until May 8. The gap between the data needs of policymakers and the time lag of traditional data sources has left policymakers “flying blind” to a significant degree. The goal of this project is to help fill that void. [..]

Our major findings for the last week of March are as follows.

1. Dramatic reductions in employment. (a) We find an employment rate of 60.7% during the first week of April, compared with 72.7% in the second week of March, implying 24 million fewer workers. (b) We find an unemployment rate of 20.2% during the first week of April, compared with 4.5% in the second week of March. One positive note is that over half of the unemployed reported being temporarily laid off, suggesting that many could return to work quickly if conditions improve.2. Even larger declines in aggregate labor supply than implied by employment alone. (a) Hours worked per working age adult declined 25% from March. In the first week of April, individuals worked 20.4 hours on average, compared with 27.5 weekly hours in the second week of March. (b) Hours worked per employed declined 12% from March. Even those who are still employed are working 4.5 fewer hours per week, a reduction of over half a day of work. This implies that just under half of the decline in hours per working age adult were due to reductions in hours worked per employed, and are therefore not reflected in changes to the employment rate.

3. Unprecedented increase of the share of hours worked from home. (a) We find that 63.8% of work hours were from home during the first week of April, compared with roughly 10% in the Spring of 2017 and 2018.

4. Lower earnings even for individuals still working the same job as in February. (a) We find that 21.9% of workers still working the same job as in February experienced a reduction in their earnings last week compared to February. About half of these reported that their reduction in earnings was 50% or larger. (b) At the same time, 11% of workers with the same job as in February report higher weekly earnings last week compared with February. 5. Disparities in labor market outcomes by sex, age, education, race, and hourly status. (a) Although negative effects are widespread, they are more pronounced among workers who are female, older, and less educated.

Charles is right. Restart the whole circus now and there will be no buyers.

• Overcapacity/Oversupply Everywhere: Massive Deflation Ahead (CHS)

Oil is the poster child of the forces driving massive deflation: overcapacity / oversupply and a collapse in demand. Overcapacity / oversupply and a collapse in demand are not limited to the crude oil market; rather, they are the dominant realities in the global economy. Yes, there are shortages in a few high-demand areas such as PPE (personal protective equipment), but across the entire spectrum of global supply and demand, there is nothing but a vast sea of overcapacity / oversupply and a systemic decline in demand as far as the eye can see. Here’s a partial list of commodities that are in Overcapacity / oversupply:

1. Overvalued assets 2. Overpriced income streams (as income craters, so will the asset generating the income) 3. Labor: low-skill everywhere, high-skill in sectors experiencing systemic collapse in demand 4. AirBnB and other vacation rental properties 5. Overpriced flats, condos and houses 6. Overpriced rental apartments 7. Overpriced commercial office space 8. Overpriced retail space 9. Overpriced used vehicles 10. Overpriced collectibles

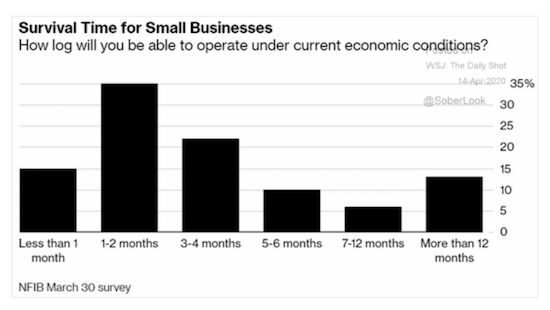

I think you get the idea. Should China restart its export factories, then almost everything being manufactured will immediately be in oversupply, as the global export sector was plagued with mass overcapacity long before the Covid-19 pandemic crushed demand. Incomes will crater as revenues and profits crash, small businesses close their doors, never to re-open, local governments tighten spending, and whatever competition still exists will relentlessly push the price of labor, goods and services lower. Globalization has generated hyper-specialization in local and regional economies, stripping them of resilience. Fully exposed to the demand flows of a globalized class of consumers with surplus discretionary income, regions specialized in tourism, manufacturing, commodity mining, etc.

All these regions are now facing a structural collapse of global demand, and they have no diversified local economy to cushion the blow to jobs, incomes, profits and tax revenues. Thousands of small business that could barely squeak through a 20% decline in revenues are facing a 50% or more decline as far as the eye can see. With costs such as rent, labor, fees, taxes and healthcare at nosebleed levels, an enormously consequential number of small businesses globally cannot survive more than a modest, brief drop in revenues, as their costs remain high even as their sales plummet: costs are sticky, profits slide quickly to zero and beyond.

No, I don’t like Soros being involved, and no, I don’t like the US squeezing Iran in virustime.

But most of all, all countries should think twice before letting the IMF have anything to do with their money supply. It doesn’t come free.

• US Opposition Seen Stalling Major IMF Liquidity Boost (R.)

U.S. opposition is expected to prevent the International Monetary Fund this week from deploying one of its most powerful tools to help countries fight the coronavirus: creating a new allocation of Special Drawing Rights. The move, akin to a central bank “printing” new money, has been advocated by economists, finance ministers and non-profit groups to provide as much as $500 billion in urgently-needed liquidity for the IMF’s 189 member countries. SDRs, based on dollars, euro, yen, sterling and yuan, are the IMF’s official unit of exchange. Member countries hold them at the Fund in proportion to their shareholdings. The IMF last approved a $250-billion new allocation of SDRs in 2009, during the last financial crisis, boosting liquidity for cash-strapped countries. Doing so again now could provide more flexibility to the 100 countries that have already sought IMF emergency loans and grants, and allow new lending to countries with “unsustainable” debt burdens, such as Argentina.

An SDR expansion has attracted some celebrity advocates, such as investor George Soros and U2 lead singer Bono’s ONE anti-poverty organization, along with trade unions and faith-based groups. Finance officials will debate the issue during this week’s virtual IMF and World Bank Spring Meetings, but multiple sources familiar with the Fund’s deliberations say the United States, the IMF’s dominant shareholder, actively opposes such a move. The Trump administration opposes providing countries such as Iran and China with billions of dollars in new resources with no conditions, two of the sources said. [..] The U.S. Treasury Department would prefer to see the IMF focus on using its $1 trillion in existing resources, including $100 billion in emergency loans and grants, to aid countries’ health responses to the crisis, the sources said.

You would think this should wake up Britain. But what are the odds?

• We Scientists Said Lock Down. But UK Politicians Refused To Listen (G.)

In mid-February a colleague mentioned that for the first time in his life he was more concerned than his mother, who had been relatively blase about the risks of Covid-19. It felt odd for him to be telling her to take care. We are both professors in a department of infectious disease epidemiology, and we were worried. Two months on, that anxiety has not gone, although it’s also been joined by a sense of sadness. It’s now clear that so many people have died, and so many more are desperately ill, simply because our politicians refused to listen to and act on advice. Scientists like us said lock down earlier; we said test, trace, isolate. But they decided they knew better.

Am I being unfair? The government assures us that its decisions and timing are based on science, as if it is a neutral, value-free process resulting in a specific set of instructions. In reality, the science around coronavirus is in its infancy and developing daily, with researchers across the world trying to understand how the virus spreads, how the body responds – and how to treat it and control it. The speed at which our knowledge has increased is impressive, from the sequencing of the virus in January through to having candidate vaccines in early February.

Mathematical models are being refined to predict the extent and speed of spread and estimate the impact of control methods. My own group is studying the response of communities, showing how the epidemic is amplifying existing social inequalities. People with the lowest household income are far less likely, but no less willing, to be able to work from home or to self-isolate. But while scientists carry out observations and experiments, testing, iterating and discovering new knowledge, it is the role of policymakers to act on the best available evidence. In the context of a rapidly growing threat, that means listening to experts with experience of responding to previous epidemics.

Ben Hunt is angry enough to start a revolution. While he’s also running a program delivering masks and other PPE to medical workers.

The past few months are not a litany of errors and honest mistakes by the institutions we have charged with protecting us from disease and ruin. They are a litany of betrayals, and their Answers – their False Stories – have been revealed as lies. First we’re going to vaccinate ourselves to their Answers, to their False Stories, so that we think for ourselves again. Without this, we will inevitably fall back into the patterns of crony capitalism and obscene financialization that got us here in the first place. It’s a vaccine that we don’t administer anymore … an intentional decision by the high-functioning sociopaths and political entrepreneurs who rule us, of course.

Like all effective vaccines, it mimics the virus itself in its ability to trigger a physiological response in us. They want to nudge you into allegiance to a policy or a vote or a party. We want to un-nudge you into independence of spirit and thought. They want to infect you with an Answer. We want to innoculate you with a Process. The Process is one of the Old Stories. It is, in fact, the Oldest Story of what makes for a good and just human society. It is a narrative that has directly motivated hundreds of millions of people to organize themselves in hundreds of thousands of beneficial social forms, large and small, for thousands of years. We’re going to use that incepted Process to burn down these systems of iniquity from within and below.

We’re going use that incepted Process to build something better together, as brothers and sisters exercising our birthright – our autonomy of mind. I’m going to tell you exactly how we’re going to develop millions and millions of doses of the Old Story vaccine, and I’m going to tell you exactly how we’re going to administer them and exactly how we are going to change the world from below and from within. And you won’t believe me.

I mean, this happens all the time. I will sit down with someone and walk them through the entire plan … how we’re developing the science of what Isaac Asimov called “psychohistory”, how that gives us the ability to not only measure the narratives of social control that oligarchic institutions broadcast but also to design effective jamming narratives of our own, how we create a decentralized epistemic community of distributed trust and mutual support that we call the Pack, how we burn down these oligarchic institutions from below by jamming their Answers and from within by replacing the current sociopathic leadership with members of the Pack … and it is literally as if a switch goes off in their head and their eyes go dim. But then I’ll say “yada-yada-Trump” or “yada-yada-Biden” or “yada-yada-the-Fed” or “yada-yada-Bitcoin” and they’ll perk right up again!

I’m cheating a bit. This is part of the article above, Inception. But the article is long and this is a very good bit.

“What is hateful to you, do not do to your neighbor. That is the whole Torah; the rest is commentary. Now go and learn it.”

It’s the Golden Rule. It’s the Oldest Story of fundamental human ethics. You can find it in ancient Egyptian stories, preserved in papyri from the Middle Kingdom. You can find it in the ancient Sanskrit epic “Mahabarata”, as the way in which dharma manifests itself in human affairs. You can find it in the ancient Greek writings of Thales and Pythagoras. You can find it in the ancient Persian texts of Zoroaster. But here’s my favorite: A gentile came before two teachers, Shammai the strict and Hillel the tolerant, and to each in turn said, “I will convert to Judaism if you can teach me the whole Torah while I stand on one foot.” Shammai chased him away. But Hillel said to the gentile, “What is hateful to you, do not do to your neighbor. That is the whole Torah; the rest is commentary. Now go and learn it.” The rest is commentary.

The Golden Rule is all you need to know to organize a good and just society. Everything else, all of the rules and principles and books and words and laws that engulf us … ALL of it … is just commentary. The Golden Rule is the vaccine. The Golden Rule is the simplest and most powerful form of the idea of reciprocity, ready and primed for inception in every human dreamer. The Golden Rule is the formal description of empathy. The Golden Rule is the only law of the Pack. The Golden Rule IS the full hearts of Clear Eyes, Full Hearts, Can’t Lose. The Golden Rule is the meme that we’re going to inject in a mass-customized way straight into everyone’s veins with the Narrative Machine. And then YOU are going to burn down the current system of oligarchic iniquity from below and within. And then YOU are going to change the world. All on your own. With no centralized organization and no Answer imposed from above.

Note that this takes place as the world is fast running out of space to store oil reserves in. I’m waiting for numbers of fully loaded tankers floating off ports for weeks or months.

• Major Blow To Keystone XL Pipeline As Judge Revokes Key Permit (G.)

The controversial Keystone XL tar sands pipeline has been dealt a major setback, after a judge revoked a key permit issued by the US Army Corps of Engineers without properly assessing the impact on endangered species. In a legal challenge brought by a coalition of environmental groups, a federal judge in Montana ordered the Army Corps to suspend all filling and dredging activities until it conducts formal consultations compliant with the Endangered Species Act. The ruling revokes the water-crossing permit needed to complete construction of the pipeline, and is expected to cause major delays to the divisive project. Keystone XL is a 1,179-mile pipeline which would transport around 830,000 barrels of oil a day from the tar sands in Alberta, Canada to Nebraska, eventually heading to refineries on the Gulf Coast.

Campaigners welcomed Wednesday’s ruling as a victory for tribal rights and environmental protection. “The court has rightfully ruled against the Trump administration’s efforts to fast track this nasty pipeline at any cost. We won’t allow fossil fuel corporations and backdoor politicians to violate the laws that protect people and the planet,” said Tamara Toles O’Laughlin of environmental group 350.org Judith LeBlanc, director of the Native Organizer Alliance, said: “The revoking of the permit is a victory for treaty rights and democracy. Tribal nations have a renewed opportunity to exercise our legal and inherent rights to protect the water of the Missouri river bioregion for all who live, farm and work on the land.”

Prepare to hear much more about this from Horowitz. Someone will do a major write-up.

• FBI Repeatedly Warned Steele Dossier Fed By Russian Misinformation (Solomon)

The FBI received repeated warnings dating to 2015 that Christopher Steele, the ex-British spy it used to build a case against President Trump, had concerning contacts with Russian oligarchs and intelligence figures that might call into question the credibility of his intelligence reporting, newly declassified documents showed Monday. The suspect sources included a person described as a strong supporter of Hillary Clinton’s campaign and a Russian intelligence figure under separate counterintelligence investigation by the FBI, the memos show. And the red flags included a warning that Russian intelligence appeared to be aware as early as July 2016 that Steele was working on a U.S. election-related investigation, making him susceptible to misinformation.

The revelations are found in newly declassified footnotes from Justice Department Inspector General Michael Horowitz’s December, 2019 report about failures in the Russia probe that included using false evidence to secure a FISA warrant against Trump campaign adviser Carter Page in October 2016. Some of those red flags were raised prior to the bureau’s decision to rely on Steele’s dossier as key evidence in seeking the FISA warrant targeting the Trump campaign in the final days of the 2016 election, and nearly all were raised before Special Counsel Robert Mueller opened his probe in spring 2017.

For instance, FBI officials urged in 2015 that Steele undergo a re-evaluation as an informant (a “validation review,” in spy parlance) after the bureau’s transnational organized crime office learned that he had received contact from five Russian oligarchs, all of whom wanted to have contact with the bureau. “The report noted that Steele’s contact with 5 Russian oligarchs in a short period of time was unusual and recommended that a validation review be completed on Steele because of this activity,” one footnote stated.

We would like to run the Automatic Earth on people’s kind donations. Ads no longer pay for all you read, your support has become an integral part of the process.

Thanks everyone for your generous donations.

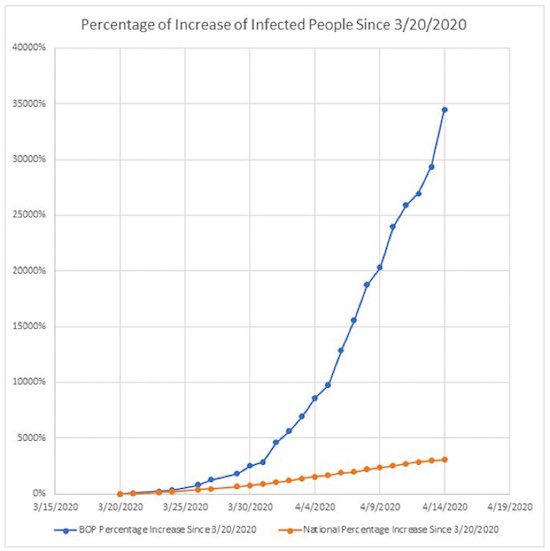

US Bureau of Prisons:

Localism. pic.twitter.com/xyDQyeudYc

— Grant Broggi (@GrantSSC) April 15, 2020

Support the Automatic Earth. It’s good for your mental health.