Unknown Medical supply boat Planter, General Hospital wharf on the Appomattox, City Point, VA 1865

The US risks forcing Japan into a position it cannot afford to be in.

• G-7 Warns on Weak Global Growth as Japan Bristles Over Yen (BBG)

Finance chiefs from the world’s biggest developed economies meeting in Japan underscored concerns that global growth is flagging and reaffirmed a pledge not to deliberately weaken their currencies, even as Japan again warned on the yen’s surge. At the end of two days of talks, Group of Seven central bank governors and finance ministers highlighted risks from terrorism, refugee flows, political conflicts and the potential for a U.K. exit from the EU. While officials agreed not to target currencies to stoke growth and warned of the negative consequences from disorderly moves in exchanges rates, host Japan repeated a stance that recent trading in the yen has been one sided and speculative.

Comments on the yen’s moves by Finance Minister Taro Aso hint at a growing frustration inside Japan’s government about the impact on exporters after the currency surged 9% this year, spurring speculation that the government may intervene. Aso raised the issued in a meeting with U.S. Treasury Secretary Jacob J. Lew on Saturday. “I told him that one-sided, abrupt, and speculative moves were seen in the FX market recently, and abrupt moves in the currency market are undesirable and the stability of currencies is important,” Aso said to reporters. Tensions over the yen were evident over the course of the meetings, which were held at a hot springs resort in the country’s north. As Japan warned about the impact of disorderly trading, Lew repeated his view that the yen’s movement hasn’t been overly volatile.

“It’s a pretty high bar to have disorderly conditions,” Lew told reporters. To be sure, Japan remains a long way from its first intervention since 2011, when the G-7 sanctioned selling the yen to aid the country’s recovery after a devastating earthquake, tsunami and nuclear meltdown. A strengthening dollar amid rising bets that the Federal Reserve may lift interest rates over coming moths is helping ease pressure on Japan’s exporters. Aso also made it clear that the difference of opinion with the U.S. is manageable. “They have an election and we have an election and we both have TPP talks,” Aso said. “There are various things on our plates and we of course have to say various things as that’s our jobs.”

Still, by choosing to be so vocal on the yen, Aso is both attempting to jawbone the currency lower and put a marker down in the event the currency again starts to appreciate rapidly. “There’s no sign that Japan and the U.S. will move closer together,” said Hiroaki Muto, chief economist at Tokai Tokyo Research Center.

Left, right, everyone wants growth. But what if that is quite literally a broken record? What if the ‘New Economics’ should be one that questions perpetual growth? After all, growth is no more than an assumption, and there are others.

• Jeremy Corbyn Calls For New Economics To Tackle ‘Grotesque Inequality’ (G.)

Jeremy Corbyn said the UK needed a serious debate about wealth creation, as he called for a new style of economics to tackle Britain’s “grotesque inequality”. Closing a Labour state of the economy conference in central London on Saturday, the party’s leader said: “Wealth creation is a good thing: we all want greater prosperity. But let us have a serious debate about how wealth is created, and how that wealth should be shared.” Corbyn also said a Labour government would “chase down the tax avoiders and the tax evaders” and ensure HMRC had the resources it needed to do so. Labour needed to be ambitious and bold to win the next election, he said. In the meantime, he insisted that the party could make a difference despite the frustrations of being in opposition.

“We must continue to stand up against the Conservative six-year record of mismanagement of the economy – and stand up for the vital services on which we all depend.” George Osborne had vowed six years ago that austerity would wipe out the deficit, Corbyn said. “That’s the wonderful thing about George Osborne’s five-year plans: they’re always five years away,” he added. Shopfloor workers, entrepreneurs and technicians should be put in the driving seat, the Labour leader said. “We want to see a genuinely mixed economy of public and social enterprise, alongside a private sector with a long-term private business commitment, that will provide the decent pay, jobs, housing, schools, health and social care of the future. Labour will always seek to distribute the rewards of growth more fairly. But to deliver that growth demands real change in the way the economy is run,” Corbyn said.

Citi’s Matt King on markets that are supposed to self-stabilize, a still popular notion. Despite the fact that, as Minsky noted quite a while ago, stability breeds instability.

• “We Are Becoming Convinced That The System Won’t Stabilize” (Matt King)

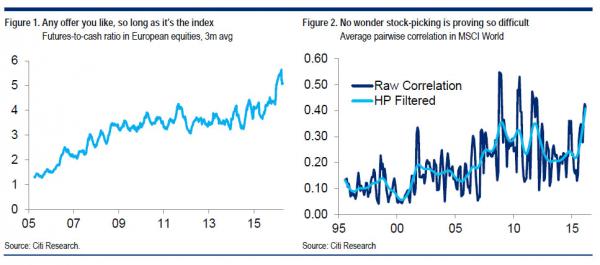

Take market liquidity, for example. Despite near-record notional volumes on TRACE, and policymakers’ protestations that nothing has really changed, market participants continue to lament that bid-offer is misleading, and depth is not what it used to be. Worse, many managers have struggled to make money on the basis of traditional single-name fundamentals, and poor performance is contributing to a steady leakage of flows away from traditional benchmarked funds towards totalreturn funds, indices and ETFs. The shift is not unique to credit: in European equities, futures-to-cash ratios – one convenient measure of index trading versus single-name trading – have reached all-time highs, for example (Figure 1).

Traditional thinking would not read too much into this. A decline in active single-name trading by some market participants should lead to greater dislocations, and hence greater opportunities for others. As index, or asset class, or factor investing becomes more popular, so it should become harder to make money there, and money should return to single-name trading. The system should stabilize. We are becoming more and more convinced this is wrong. In ways that were underappreciated at the time, the pre-crisis era of unlimited leverage led to a veritable bonanza for sellside and buyside alike, in which trading begat more trading, and liquidity begat liquidity. Cyclicals vs non-cyclicals. Value vs momentum. On-the-runs vs off-the-runs. Cash vs CDS. Single names vs indices. The constant arbitraging of relative value relationships led to regular patterns of mean reversion, which in turn encouraged more investors to trade.

In the post-crisis era, this process is running in reverse. Yet what started as a simple desire by regulators to curtail excesses of leverage risks is having much more farreaching repercussions. The curtailment of the hedge fund bid means that many relationships which previously mean reverted are now failing to do so, or at a minimum are doing so much more erratically. Cyclicals vs non-cyclicals. Value vs momentum. On-the-runs vs off-the-runs. Cash vs CDS. Single names vs indices. In principle, these aberrations do constitute trading opportunities – but only for investors with sufficiently strong stomachs and long time horizons, which these days nobody has. Central bank distortions have exacerbated these movements, making investor interest more one-sided and leading one market after another to exhibit more bubble-like tendencies, rising exponentially and then falling back abruptly.

More broken records.

• Greece Braces for More Austerity Amid EU-IMF Quarrel About Debt (BBG)

Greek Prime Minister Alexis Tsipras braces for yet another vote on additional austerity measures, as European creditors remain at loggerheads with the IMF about how much debt relief the country will get for its pain. Lawmakers in Athens are scheduled to vote Sunday evening on an omnibus bill that includes measures ranging from the taxation of diamond dust and coffee to the transfer of thousands of real estate assets from the state to a new privatization fund. The debate will test the resilience of Tsipras’s three-seat parliamentary majority, as euro-area states resist calls from the IMF to set less ambitious fiscal targets and hand Greece more generous debt relief.

Approval of the measures is one of the prior actions Greece has to fulfill to unlock the next tranche of emergency loans from the European Stability Mechanism, the currency bloc’s crisis-fighting fund. The Eurogroup of 19 finance ministers will convene Tuesday to assess the country’s compliance with its latest bailout agreement struck in the summer of 2015. A positive assessment is also a condition for the Eurogroup to ease the servicing terms for over €200 billion of bailout loans handed to the country since 2010.

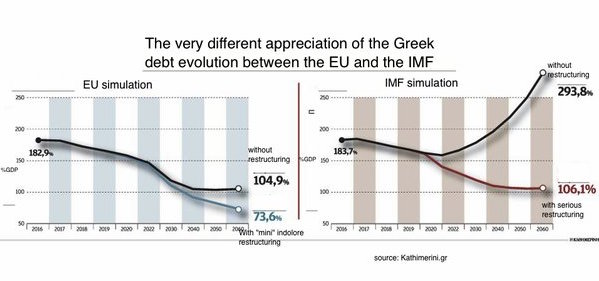

[..] The Washington-based IMF proposed that interest and principal payments on Greece’s European bailout loans be deferred until 2040, and that maturities on those loans will be extended to 2080, according to a document obtained by Bloomberg News. Even though European counter-proposals acknowledge that current Greek debt dynamics are unsustainable, they fall short of what the IMF wants, according to people familiar with the discussions that took place between government officials over the past week. Instead, the euro area expects Greece to maintain a budget surplus level which the IMF has said is a “far-fetched fantasy.”

Really? Are you sure IMF and EU are not playing good cop bad cop here?

• This Time, The IMF Comes Bearing Gifts For The Greeks (G.)

Another Sunday, another vote in the Greek parliament, another self-imposed punishment beating as the parliament in Athens votes through fresh austerity measures. There will be higher VAT and an increase in taxes on all the pleasures of life: coffee, booze, fags, gambling, even pay TV. And just in case Greece might need to tighten its belt by another couple of notches to meet stringent budget targets, there will be additional measures that will kick in if there is any fiscal slippage over the next couple of years. George Harrison started his song Taxman with the words: “Let me tell you how it will be/There’s one for you, nineteen for me.” The Greeks know exactly what he meant. Greece’s predicament is simple. It has debt repayments to make this summer and it doesn’t have the money to pay the bills.

David Simonds/Observer

The EU can solve this acute cashflow problem by unlocking the funds pledged to Greece under the terms of last summer’s bailout agreement, but it will only do so if Athens demonstrates that it is serious about sorting out its budget. Austerity today will lead to generosity from EU finance ministers when they meet on Tuesday. That, at least, is the hope of Alexis Tsipras, Greece’s prime minister, who is looking for a package in which he gets debt relief in return for austerity. Here’s where things get interesting. The difference between this Sunday and all the other tension-packed Sundays that have studded the Greek crisis over the past six and a half years is that, this time, the battle is not between Greece and the “troika” of the European commission, the ECB and the IMF. Instead, there is a face-off between Europe and the IMF.

The Europeans badly want the fund to be part of Greece’s bailout and to contribute money to it. But Christine Lagarde, the IMF’s managing director, says her support is conditional on two things: a credible deficit reduction plan and a decent slug of debt relief. Hardline EU governments, led by Germany, have resisted this idea, fearing the Greeks will interpret any writedown of its debts as a sign of weakness that Athens will exploit to avoid meeting its budgetary commitments.

“Back to 1913. Isn’t it one of the most curious facts that all these historical figures [Tito, Hitler, Stalin, Trotsky, Freud and Franz Ferdinand] lived at the same time at the same place, maybe only a few hundred metres apart? Did any of them ever meet? Were they drinking coffee at the same place? Would the world history look different if Hitler had been psychoanalysed by Freud?”

• Europe Should Heed The Lessons of 1913 (Horvat)

Imagine the following group of curious characters living in the same city: a worker from Croatia, one unsuccessful painter, two Russians, a guy who analyses dreams and a young Austrian soldier and trophy hunter. Tito, Hitler, Stalin, Trotsky, Freud and Franz Ferdinand might make for unusual neighbours but, as Charles Emmerson describes in his recent book, 1913: In Search of the World Before the Great War, they spent plenty of time in the same two square miles of the capital of the Austro-Hungarian empire, Vienna, in 1913. Only one year later, Franz Ferdinand would become the Archduke of the empire, and his assassination in Sarajevo would lead to the first world war. In 1917, the two Russians became the leading figures of the October revolution and, about the same time, Tito – who would soon become leader of Yugoslavia – became active in the communist movement too.

Sixteen years later, on 30 January 1933, the unsuccessful painter became German Reichskanzler – the second world war was just around the corner. And Freud? After Nazi Germany annexed Austria in 1938, the Gestapo came after him and he became a refugee in London. In short, 1913 was one in which the course of history could have altered significantly. I am in no doubt that now might be another such period. At its collapse, the Austro-Hungarian empire consisted of 15 nations and more than 50 million inhabitants. The EU consists of 28 member states – with some now threatening to exit – and a population of 500 million.

Today’s Austria is facing one of its biggest political crises with the resignation of its chancellor, Werner Faymann, a second round of presidential elections looming on 22 May – which will in all likelihood result in a turn to the right – and, at the same time, nationalist calls for a referendum on Tyrol unification. We don’t know if some future Stalin or Hitler is living in Vienna, but the whole of Europe seems to be on the verge of an abyss. Recent news about a Syrian refugee who was shot by guards on the border between Slovakia and Hungary, and Turkish forces using live bullets to drive away Syrian refugees fleeing violence in their home towns point in that direction. If countries such as Denmark and Switzerland start to seize refugees’ assets, what is left of the European project nominally based on solidarity and brotherhood (“Alle Menschen werden Brüder …”, as the official anthem of the EU claims)?

The refugee crisis wasn’t – and can’t be – solved by investing €6bn in Turkey and “outsourcing” the “redundant humans” to the periphery of Europe again. Moreover, the case of German comedian Jan Boehmermann, who was charged for allegedly insulting the Turkish president, Recep Erdogan, shows that the EU’s only foreign policy is something we might call “export-import”. First we export wars (to Libya or Syria), then we import refugees. Then we export the refugees again (to Turkey), and then we import authoritarian values from Turkey, which is now killing one of the foundations of the European project – free speech. And humour.

And there’s more…

• New Evidence About The Dangers Of Monsanto’s Roundup (Intercept)

Some European governments have already begun taking action against one {Roundup’s] co-formulants, a chemical known as polyethoxylated tallowamine, or POEA, which is used in Monsanto’s Roundup Classic and Roundup Original formulations, among other weed killers, to aid in penetrating the waxy surface of plants. Germany removed all herbicides containing POEA from the market in 2014, after a forestry worker who had been exposed to it developed toxic inflammation of the lungs. In early April, the French national health and safety agency known as ANSES took the first step toward banning products that combine glyphosate and POEA. A draft of the European Commission’s reregistration report on glyphosate proposed banning POEA.

[..] manufacturers of weed killers are required to disclose only the chemical structures of their “active” ingredients — and can hide the identity of the rest as confidential business information — for many years no one knew exactly what other chemicals were in these products, let alone how they affected health. In 2012, Robin Mesnage decided to change that. A cellular and molecular toxicologist in London, Mesnage bought nine herbicides containing glyphosate, including five different formulations of Roundup, and reverse engineered some of the other components. After studying the chemicals’ patterns using mass spectrometry, Mesnage and his colleagues came up with a list of possible molecular structures and then compared them with available chemical samples.

“It took around one year and three people (a specialist in pesticide toxicology, a specialist of chemical mixtures, and a specialist in mass spectrometry) to unravel the secrets of Monsanto’s Roundup formulations,” Mesnage explained in an email. The hard work paid off. In 2013, his team was able not only to deduce the chemical structure of additives in six of the nine formulations but also to show that each of these supposedly inert ingredients was more toxic than glyphosate alone. That breakthrough helped scientists know exactly which chemicals to study, though obtaining samples remains challenging. “We still can’t get them to make experiments,” said Nicolas Defarge, a molecular biologist based in Paris. Manufacturers of co-formulants are unwilling to “sell you anything if you are not a pesticide manufacturer, and even less if you are a scientist willing to assess their toxicity.”

So when Defarge, Mesnage, and five other scientists embarked on their most recent research, they had to be creative. They were able to buy six weed killers, including Roundup WeatherMax and Roundup Classic, at the store. But, finding pure samples of the co-formulants in them was trickier. The scientists got one from a farmer who mixes his own herbicide. For another, they went to a company that uses the chemical to make soap. “They were of course not aware that I was going to assess it for toxic and endocrine-disrupting effects,” said Defarge. András Székács, one of Defarge’s co-authors who is based in Hungary, provided samples of the other three co-formulants studied, but didn’t respond to inquiries about how he obtained them.

In February, the team published its findings, which showed that each of the five co-formulants affected the function of both the mitochondria in human placental cells and aromatase, an enzyme that affects sexual development. Not only did these chemicals, which aren’t named on herbicide labels, affect biological functions, they did so at levels far below the concentrations used in commercially available products. In fact, POEA — officially an “inert” ingredient — was between 1,200 and 2,000 times more toxic to cells than glyphosate, officially the “active” ingredient.

Interesting thoughts. Long article. Not sure how fast our hands could change, though, and quite sure our present tech push will be interrupted.

• Technology Is Changing Our Hands (G.)

The new era of the internet, the smartphone and the PC has had radical effects on who we are and how we relate to each other. The old boundaries of space and time seem collapsed thanks to the digital technology that structures everyday life. We can communicate instantly across both vast and minute distances, Skyping a relative on another continent or texting a classmate sitting at the next table. Videos and photos course through the web at the touch of a screen, and social media broadcast the minutiae of both public and private lives. On the train, the bus, in the cafe and the car, this is what people are doing, tapping and talking, browsing and clicking, scrolling and swiping.

Philosophers, social theorists, psychologists and anthropologists have all spoken of the new reality that we inhabit as a result of these changes. Relationships are arguably more shallow or more profound, more durable or more transitory, more fragile or more grounded. But what if we were to see this chapter in human history through a slightly different lens? What if, rather than focusing on the new promises or discontents of contemporary civilisation, we see today’s changes as first and foremost changes in what human beings do with their hands? The digital age may have transformed many aspects of our experience, but its most obvious yet neglected feature is that it allows people to keep their hands busy in a variety of unprecedented ways.

The owner of the Shakespeare and Company bookshop describes the way young people now try to turn pages by scrolling them, and Apple have even applied for patents for certain hand gestures. Patent application 7844915, filed in 2007, covered document scrolling and the pinch-to-zoom gesture, while the 2008 application 7479949 covered a range of multitouch gestures. Both were ruled invalid, not because gestures can’t be patented, but because they were already covered by prior patents. At the same time, doctors observe massive increases in computer- and phone-related hand problems, as the fingers and wrist are being used for new movements that nothing has prepared them for.

Changes to both the hard and soft tissues of the hand itself are predicted as a consequence of this new regime. We will, ultimately, have different hands, in the same way that the structure of the mouth has been altered, it is argued, by the introduction of cutlery, which changed the topography of the bite. The edge-to-edge bite that we used to have up to around 250 years ago became the overbite, with the top incisors hanging over the lower set, thanks to new ways of cutting up food that the table knife made possible. That the body is secondary to the technology here is echoed in the branding of today’s products: it is the pad and the phone that are capitalised in the iPad and iPhone rather than the “I” of the user.

The world risks reaching crisis fatigue. Largely because of how the media present them.

• The Worst Famine Since 1985 Looms Across Africa (G.)

Countries are just waking up to the most serious global food crisis of the last 25 years. Caused by the strongest El Niño weather event since 1982, droughts and heatwaves have ravaged much of India, Latin America and parts of south-east Asia. But the worst effects of this natural phenomenon, which begins with waters warming in the equatorial Pacific, are to be found in southern Africa. A second consecutive year without rain now threatens catastrophe for some of the poorest people in the world. The scale of the crisis unfolding in 10 or more southern African countries has shocked the United Nations. Lulled into thinking that Ethiopia in 1985 was the last of the large-scale famines affecting many millions, donor countries have been slow to pledge funds or support. More than $650m and 7.9m tonnes of food are needed immediately, says the UN. By Christmas, the situation will have become severe.

The scale of the crisis unfolding in 10 or more southern African countries has shocked the United Nations. Lulled into thinking that Ethiopia in 1985 was the last of the large-scale famines affecting many millions, donor countries have been slow to pledge funds or support. More than $650m and 7.9m tonnes of food are needed immediately, says the UN. By Christmas, the situation will have become severe. Malawi, Mozambique, Lesotho, Zimbabwe, Namibia, Madagascar, Angola and Swaziland have already declared national emergencies or disasters, as have seven of South Africa’s nine provinces. Other countries, including Botswana and the Democratic Republic of the Congo, have also been badly hit. President Robert Mugabe has appealed for $1.5bn to buy food for Zimbabwe and Malawi is expected to declare that more than 8 million people, or half the country, will need food aid by November.

More than 31 million people in the region are said by the UN to need food now, but this number is expected to rise to at least 49 million across almost all of southern Africa by Christmas. With 12 million more hungry people in Ethiopia, 7 million in Yemen, 6 million in Southern Sudan and more in the Central African Republic and Chad, a continent-scale food crisis is unfolding. “Food security across southern Africa will start deteriorating by July, reaching its peak between December 2016 and April 2017,” says the UN’s office for humanitarian affairs. The regional cereal deficit already stands at 7.9m tonnes and continues to put upward pressure on market prices, which are already showing unprecedented increases, diminishing purchasing power and thereby reducing food access. As food insecurity tightens and water scarcity increases due to the drought, there are early signs of acute malnutrition in Madagascar, Malawi, Mozambique and Zimbabwe.