Kandinsky Capricious Line 1924

The Brexit talks start today. They should not. Theresa May can start, but she won’t be there to finish them.

• Britain’s Brexit jam is Brussels’ Too (Pol.eu)

As Brexit talks start Monday, Britain’s back is hard against a wall. And nobody, not even in Brussels, wanted it that way. Elections in the U.K. were supposed to give Prime Minister Theresa May a stronger hand against the EU and naysayers back home. Instead, her negotiating team will hobble into the talks with May in peril, still working to finalize a power-sharing agreement to allow her to form a minority government. The EU’s stance on major Brexit issues has been ironclad for months, backed by the 27 nations in a disciplined display of unity. Second-guessing about May’s approach has intensified since her election setback, so much so that there have been calls for the EU to avert potential disaster by laying out clear paths for the U.K.’s exit.

The view in Brussels, however, is there is no way to help May short of making clear that Britain is welcome to change its mind — a point reiterated by German Finance Minister Wolfgang Schäuble, French President Emmanuel Macron and European Commission First Vice-President Frans Timmermans, among others. While no one realistically expects such a total reversal, there is unease over the lack of clarity on the U.K.’s goals. “Clearly the Brits are not ready yet and it’s a pity,” a senior Commission official said. “Everybody has sympathy for [May] now because she put herself in an impossible situation,” the official said. “How we can help her? Where she is now, nobody can help her. What she said to the backbenchers, in a way made sense, ‘I put you in this mess. I will take you out of this mess.’ But who else can do anything for her? It’s just hell.”

“And all the questions,” the official added, “Withdrawal? No withdrawal? Now? Later? It’s for them to consider. What can Brussels say?” The EU has published and transmitted to the U.K. its position papers on the two issues Brussels insists take precedence: citizens’ rights and the financial settlement. May’s aides said she wanted to make a “big, generous” offer on citizens’ rights, but so far the U.K. has not published any similar documents laying out its positions.

Brussels wants an orderly destruction of Britain, not a messy one.

• EU Leaders Fear Fragile State Of Tories Will Lead To Brutal Brexit (G.)

European leaders fear that Theresa May’s government is too fragile to negotiate viable terms on which to leave the union, meaning the discussions that officially begin on Monday could end in a “brutal Brexit” – under which talks collapse without any deal. As officials began gathering in Brussels on Sunday night, the long-awaited start of negotiations was overshadowed by political chaos back in Westminster, where chancellor Philip Hammond warned that failing to strike a deal would be “a very, very bad outcome”. The EU side fears that, in reality, the British government will struggle to maintain any position without falling apart in the coming months, because, without support from the Democratic Unionist party, May’s negotiating hand is limited. There are also concerns that any DUP backing to give May a majority in the House of Commons would come with strings attached.

Hammond has been urged to publish the cost of any deals made with the DUP to prop up the government. Shadow chancellor John McDonnell has raised concerns over reports that the DUP wants to end airport tax on visitors to Northern Ireland, which generated about £90m in 2015/16, according to HMRC estimates. The abolition of air passenger duty is one of the DUP’s key demands, as it pits Northern Ireland unfavourably against the Republic of Ireland, where the duty has been abolished. As well as concern over any terms agreed with the DUP, May will have to assuage fears from Ireland’s new taoiseach, Leo Varadkar, when she meets him in Downing Street on Monday, that Brexit will not infringe on the rights of people in Ireland. The taoiseach will also raise the impact of any Tory-DUP deal on power-sharing in Northern Ireland.

The prime minister has said she is confident of getting the Queen’s speech through the Commons, regardless of whether a deal is reached with the DUP by the time of the state opening of parliament on Wednesday. British Brexit negotiators are hoping to shore up confidence in their hardline approach to the start of talks by making early progress on the vexed question of citizens’ rights. [..] Pierre Vimont, a veteran French diplomat, now at the Carnegie Europe thinktank, said lack of clarity did not matter for the opening, which was more about “a first glimpse into their overall attitude and position” and setting the tone. “It will be atmospherics and the way both sides show a genuine commitment to work ahead. I think that will be the most important. “But the British delegation will need to rather quickly put its house in order and to have a clear idea of where it wants to go.”

We’ve seen that truth in Grenfell Tower.

• Pain Without Gain: The Truth About British Austerity (G.)

There are few people in the developed world who still cling to the maxim that “home life ceases to be free and beautiful as soon as it is founded on borrowing and debt”. hese days we can’t afford to take the same view as Helmer, the husband in Ibsen’s A Doll’s House, one of literature’s most cautious budgeters. It’s a nice idea to be free of debt and just spend what you earn. But when a home costs many times the average annual income and life’s running costs often exceed the monthly income, borrowing is not something that can be avoided. The government knows this only too well. This week sees publication of the public borrowing total for May and it is not expected to make pleasant reading.

Together with April’s shocker, when government borrowing was higher than the same month last year, the first two months of this financial year are forecast to show the borrowing requirement for the year is on track to be higher, not lower than last year. When David Cameron and George Osborne were in Downing Street, bringing down the deficit was the main aim of domestic policy. Until just last year, the plan was to cut the deficit to zero by 2020 and start bringing down the debt-to-GDP ratio from this year. The EU referendum vote and Theresa May’s arrival at No 10 changed all that. Once she adopted a hard-Brexit stance, the economy began to turn. Her chancellor, Philip Hammond, was forced to loosen the purse strings. It meant that both of the main political parties went into the election with plans for the deficit to remain at about 2.5%.

Independent forecasts for GDP growth over the next five years are below this figure, meaning that far from cutting the overall debt-to-GDP ratio, both parties were content to push it towards 90% – higher than any government has experienced in 50 years. That’s why so many headlines after the election have declared austerity dead and why the deficit was the dog that didn’t bark when the electorate went to the polls. The pressure on the deficit has only worsened since then. It has become clear to many of May’s advisers and close colleagues that the Tory party might not survive a second election this year without stealing some of Labour’s clothes. There is the possibility she will sanction scrapping, or dramatically reducing tuition fees, to nullify one of Labour’s most popular pledges.

The health secretary, Jeremy Hunt, hinted that the cap on nurses’ pay might be relaxed, while local authority spending may need to increase after the Grenfell Tower fire. Meanwhile, household debts are on the increase. Credit card, car loan and student debt, and borrowing using that most pernicious of loans, the second mortgage, have all risen sharply in the last couple of years. Making matters worse, the proportion of savings in the economy is at rock-bottom levels. It all adds up to an economy running on empty, with everyone, including ministers, borrowing extra each year just to keep the wheels turning.

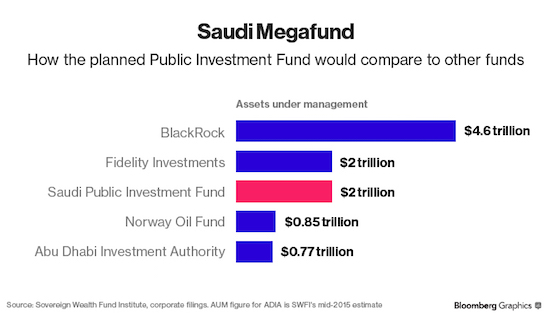

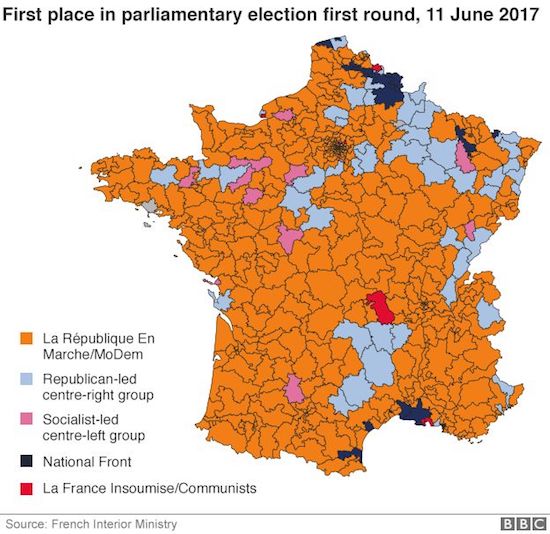

Macron won, but his majority is nowhere near as big as predicted. He was expected to get well over 400 seats, and ended up with 308. See the graphs. Next, he’ll be up against the unions. He’s promised to fire 120,000 public workers. Good luck.

• France Gives Macron Big Majority With Little Enthusiasm (EUO)

French president Emmanuel Macron won a three-fifth majority in the lower house in the second round of the legislative elections on Sunday (18 June), but less than half of voters cast a ballot. Macron’s political movement, La Republique en Marche (LRM, The Republic on the Move) won 308 seats in the National Assembly, out of 577, after obtaining 43.06% of the vote. Its centrist ally, the Modem party, got 40 seats (6%). While not as big as expected after the first round, LRM’s majority left other parties behind and completed Macron’s destruction of the old political landscape. The conservative Republicans party will be the main opposition faction, with 113 seats (22.2%), down from 192 in the outgoing assembly.

The party leader, Francois Baroin, said he was happy that the Republicans will be “big enough” to “make its differences with LRM heard”. The Socialist Party (PS), which had been the main party with 270 MPs, was left with 29 seats (5.68%). Several ministers who served under former socialist president Francois Hollande lost out to newcomers. The PS leader, Jean-Christophe Cambadelis, who was himself eliminated in the first round, resigned from his position. Some 431 new MPs will enter the assembly and a record 224 of the MPs will be women.

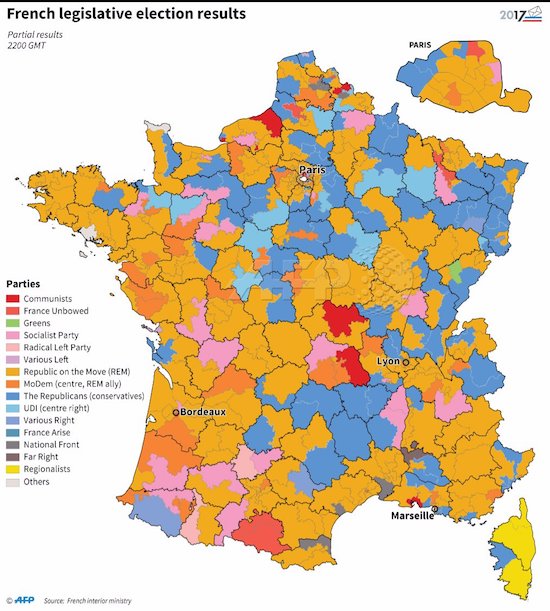

The ECB has $4.73 trillion in assets. It buys anythng but Greece.

• German Politicians Hammer the ECB, But Only to Get Votes (DQ)

These days it’s easy to tell when general elections are approaching in Germany: members of the ruling government begin bewailing, in perfect unison, the ECB’s ultra-loose monetary policy. Leading the charge this time was Finance Minister Wolfgang Schaeuble, who on Tuesday urged the ECB to change its policy “in a timely manner”, warning that very low interest rates had caused problems in “some parts of the world.” Werner Bahlsen, the head of the economic council of Merkel’s CDU conservatives, was next to take the baton. “The ongoing purchase of government bonds has already cost the European project a great deal of credibility and has damaged it,” he said. “The ECB can only regain trust with the return to a sound monetary policy.” As Schaeuble and Balhsen well know, that is not likely to occur any time soon.

Indeed, like all other Eurozone finance ministers, Schaeuble is benefiting handsomely from the record-low borrowing costs made possible by the ECB’s negative interest rate policy. But by attacking ECB policy he and his peers can make it seem that they take voters’ concerns about low interest rates seriously, while knowing perfectly well that the things they say have very little effect on what the ECB actually does. In short, they are telling their voters what they want to hear. A survey by the CDU’s economic council showed that less than a quarter of its roughly 12,000 members had confidence in the ECB’s current course. 76% said they backed Bundesbank head Jens Weidmann’s monetary policy stance. Herr Weidmann said on Thursday that the ECB is at risk of coming under political pressure because any hint of policy tightening could push yields higher and blow a hole in national budgets.

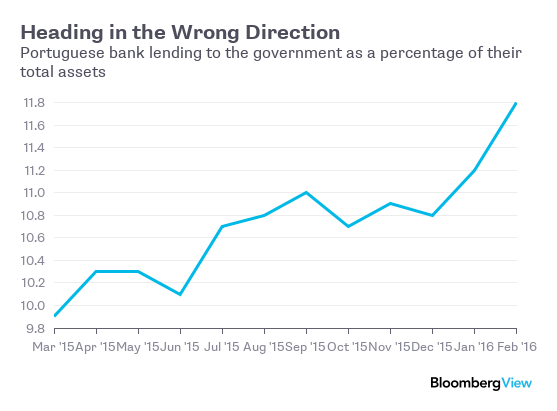

It’s a probably a bit late in proceedings for such worries, what with the ECB now boasting the largest balance sheet of any central bank on Planet Earth. At last count, it had €4.22 trillion ($4.73 trillion) in assets, which equates to 39% of Eurozone GDP. Many of those assets are sovereign bonds of Eurozone economies like Italy, Spain and Portugal. The ECB’s binge-buying of sovereign and corporate bonds has spawned a mass culture of financial dependence across Europe. In the case of Italy, the sheer scale of the government’s dependence on the ECB for cheap funding is staggering: since 2008, 88% of government debt net issuance has been acquired by the ECB and Italian Banks. At current government debt net issuance rates and announced QE levels, the ECB will have been responsible for financing 100% of Italy’s deficits from 2014 to 2019.

It’s not just governments that are dependent on the ECB’s largesse: so, too, are the banks. In total, European banks have approximately €760 billion of funding from long-term lending schemes, the bulk of which comes from the four rounds of the most recent program launched in March 2016. As of the end of April 2017, Italian banks were holding just over €250 billion of the total long-term loans — almost a third of the total. Spain had €173 billion, while French banks had €115 billion and German lenders €95 billion. As the FT reports, the funding appears to play much less of a role in stimulating economic activity through lending, and a much larger role in mitigating the pain that low interest rates — and poor asset quality — can inflict on banks.

Propping up zombies.

• Central Bank Liquidity Is The ‘IV Drip’ Of The Rally (CNBC)

If it weren’t for liquidity right now, the stock market rally could be ripping apart, according to BMO Private Bank’s chief investment officer. “Any sense that this IV drip of liquidity coming into the market is slowing down at all is going to cause some issues,” Jack Ablin said on CNBC’s “Futures Now.” He emphasized that investors have been encouraged to take on risk due to the trillions of dollars being pumped into the financial system by central banks. Ablin’s comments came a day after the Federal Reserve decided to lift short-term interest rate by a quarter%age point. Even though the rate hike was expected, Ablin admits there was some concern tied to the Fed’s statement.

The Fed put in some new wording, saying that it “expects to begin implementing a balance sheet normalization program this year, provided that the economy evolves broadly as anticipated.” That part left Ablin “a little bit taken aback with the timing,” he said. However, “I think the good news here is, ‘Look, this is a potentially contrived crisis.’ This could be the taper tantrum all over again where [The Fed says] ‘OK, look, we don’t want to cause major upset here. We will continue to pump if equity risk taking takes a hit.'” Ablin said he’s “somewhat optimistic” that the rally will continue. He prefers developed and emerging markets over U.S. stocks, arguing that places like Europe could see bigger gains than in the United States because the economy has been surprising experts to the upside.

This story gets insaner by the day.

• Mueller Has “Not Yet” Decided Whether To Investigate Trump (ZH)

In the biggest political story of the past week, one which was timed to coincide with Donald Trump’s Birthday, the WaPo reported citing anonymous sources, that Special Counsel Robert Mueller was investigating President Trump for possible obstruction of justice. Just a few hours later on Thursday night, the DOJ’s Deputy Attorney General Rod Rosenstein, who is overseeing the Russia probe due to Jeff Sessions recusal, released a stunning announcement which urged Americans to be “skeptical about anonymous allegations” in the media, which many interpreted as being issued in response to the WaPo report. “Americans should exercise caution before accepting as true any stories attributed to anonymous ‘officials,’ particularly when they do not identify the country — let alone the branch or agency of government — with which the alleged sources supposedly are affiliated. Americans should be skeptical about anonymous allegations. The Department of Justice has a long-established policy to neither confirm nor deny such allegations.”

Then on Sunday, the plot thickened further when according to ABC, special counsel Robert Mueller has not yet decided whether to investigate President Trump as part of the Russia probe, suggesting the WaPo report that a probe had already started was inaccurate. “Now, my sources are telling me he’s begun some preliminary planning,” Pierre Thomas, the ABC News senior justice correspondent, said of Mueller on ABC’s “This Week” although he too, like the WaPo, was referring to anonymous sources, so who knows who is telling the truth. “Plans to talk to some people in the administration. But he’s not yet made that momentous decision to go for a full-scale investigation.”On Friday, Trump responded to the Washington Post story by tweeting: “I am being investigated for firing the FBI Director by the man who told me to fire the FBI Director! Witch Hunt.” But also on Sunday Trump’s lawyer Jay Sekulow insisted the president was not literally confirming the investigation but was just referring to the story.

“Let me be clear: the president is not under investigation as James Comey stated in his testimony, that the president was not the target of investigation on three different occasions,” Sekulow said Sunday. “The president is not a subject or target of an investigation.” “Now Mueller faces a huge decision,” Thomas told “This Week” host Martha Raddatz. “Does he believe the president, who says there’s no wrongdoing here, or does he go after the president in the way James Comey wants him to do?” And so, yet another blockbuster media report has been cast into doubt as a result of more “he said, he said” innuendo, which will be resolved only if Mueller steps up and discloses on the record whether he is indeed investiating Trump for obstruction, or any other reason. That however is unlikely to happen, and so the daily ping-ponging media innuendos will continue indefinitely.

“These two countries are in a very deep hole,” he said. Congress needs to “stop digging.”

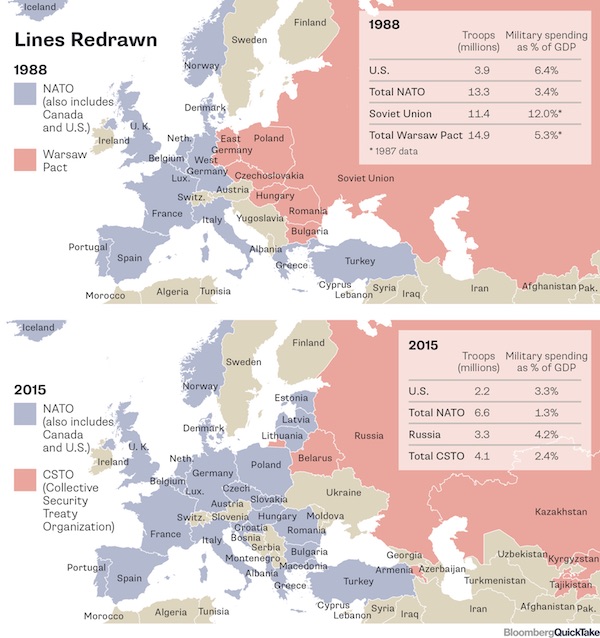

• Cold War Deja Vu Deepens as New Russia Sanctions Anger Europe (BBG)

Russia on Sunday accused the U.S. of returning to “almost forgotten Cold War rhetoric,” after President Donald Trump’s decision to reinstate some sanctions on Cuba. It could have dropped “forgotten.” There’s been a lively debate among historians and diplomats for years over whether the souring of relations between the U.S. and Russia amounts to a new Cold War, and lately the case has been getting stronger by the day. Trump’s restoration on Friday of some of the Cold War restrictions on Cuba his predecessor, Barack Obama, eased just months ago was only one example. Earlier in the week, the U.S. Senate approved a bill to entrench and toughen sanctions on Russia that includes several vivid flashbacks to before the fall of the Berlin wall.

German Chancellor Angela Merkel added her voice on Friday to rising European condemnation of a proposal in the Senate draft that would penalize companies investing in new Russian energy pipelines. Nord Stream 2, a project to double the supply of Russian natural gas to Germany via the Baltic Sea, would be especially vulnerable. President Ronald Reagan used similar sanctions in an attempt to thwart the joint German-Soviet construction of a natural gas pipeline in the early 1980s, only to drop them amid intense opposition from Europe. Again, Germany led the pushback. The Senate bill would also codify a raft of existing sanctions against Russia, so that Trump would need Congressional approval to lift them. That happened in 1974, too, and the measures proved hard to kill.

The legislation wasn’t repealed until a decade after their target, the U.S.S.R., had ceased to exist. The sense of Cold-War deja vu has been building for some time, according to Robert Legvold, a professor at Columbia University and author of “Return of the Cold War.” There’s a renewed arms race, nuclear saber rattling, the buzzing of ships and planes, proxy wars and disputes over whether missile defense systems count as offense or defense. If the trend continues, said Legvold, it will prevent the strategic cooperation between the U.S. and Russia that’s needed to prevent approaching security challenges from spinning out of control: The rise of China, the race to exploit resources in the Arctic, international terrorism and, above all, a world with nine nuclear powers that’s more complex and unstable than in the 20th century. “These two countries are in a very deep hole,” he said. Congress needs to “stop digging.”

It’s hard to agree on gold. Always has been.

• Goodbye, Yellow Brick Road (Grant)

It’s no work at all to make modern money. Since the start of the 2008 financial crisis, the world’s central bankers have materialized the equivalent of $12.25 trillion. Just tap, tap, tap on a computer keypad. “One Nation Under Gold” is a brief against the kind of money you have to dig out of the ground. And you do have to dig. The value of all the gold that’s ever been mined (and which mostly still exists in the form of baubles, coins and ingots), according to the World Gold Council, is a mere $7.4 trillion. Gold anchored the various metallic monetary systems that existed from the 18th century to 1971. They were imperfect, all right, just as James Ledbetter bends over backward to demonstrate. The question is whether the gold standard was any more imperfect than the system in place today.

[..] As if to clinch the case against gold—and, necessarily, the case for the modern-day status quo—Mr. Ledbetter writes: “Of forty economists teaching at America’s most prestigious universities—including many who’ve advised or worked in Republican administrations—exactly zero responded favorably to a gold-standard question asked in 2012.” Perhaps so, but “zero” or thereabouts likewise describes the number of established economists who in 2005, ’06 and ’07 anticipated the coming of the biggest financial event of their professional lives. The economists mean no harm. But if, in unison, they arrive at the conclusion that tomorrow is Monday, a prudent person would check the calendar.

Mr. Ledbetter makes a great deal of today’s gold-standard advocates, more, I think, than those lonely idealists would claim for themselves (or ourselves, as I am one of them). The price of gold peaked as long ago as 2011 (at $1,900, versus $1,250 today), while so-called crypto-currencies like bitcoin have emerged as the favorite alternative to government-issued money. It’s not so obvious that, as Mr. Ledbetter puts it, “we cannot get enough of the metal.” On the contrary, to judge by ultra-low interest rates and sky-high stock prices, we cannot—for now—get enough of our celebrity central bankers.

Pretty far out.

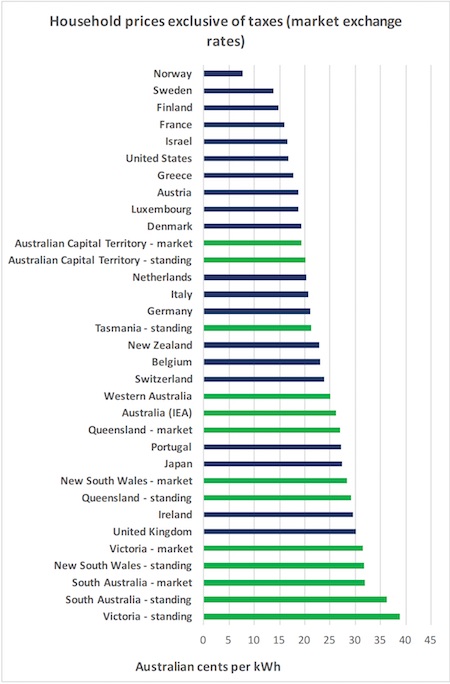

• Australia Has The World’s Most Costly Energy Bills (MB)

In reality, there are three main components of household bills. Whether households actual ultimately pocket these savings will depend on what happens with all three. The first, is the wholesale cost. That’s the cost of actually generating the electricity, be it burning lumps of coal, a gas-fired electricity plant, solar panels, wind turbines or whatever clever ways we may come up with in the future to produce electricity. Today, 77 per cent of Australian electricity comes from mostly brown and black coal, 10 per cent from gas, and 13 per cent from renewable sources. For a long time, this part of the system, of producing the electricity and getting it into the grid, has been going pretty well. Australians have enjoyed a reliable and low-cost supply of wholesale energy.

Basically, we burned ship loads of cheap coal, and to hell with the environment. This is the part of the system that is now utterly falling apart and is in most need of repair – which we’ll get to. The second major component of household electricity bills is the cost of transmission and distribution. The costs involved in building poles and wires and actually getting electricity to your wall sockets makes up about 40 per cent of your total bill. This part of the electricity price equation has been broken for decades, and is the main reason power bills have nearly doubled over the last decade. Power lines are natural monopolies. Traditionally they were all government owned. Jeff Kennett privatised Victorian networks, but until very recently, distribution networks in other states, such as NSW and Queensland, have remained government owned, with regulated pricing.

And basically, they stuffed that up for consumers by deciding to let the networks earn a guaranteed rate of return, based on their costs. That is, the more they spent, the more they earned. …The third and final component of a household’s bill is the margin added by electricity retailers. In theory, anyone can set up a business retailing electricity and there are many suppliers. In reality, pricing structures are so complex consumers do not exercise their power to switch providers, and retail margins remain higher than otherwise.

center>

Moving towards a very deep black hole.

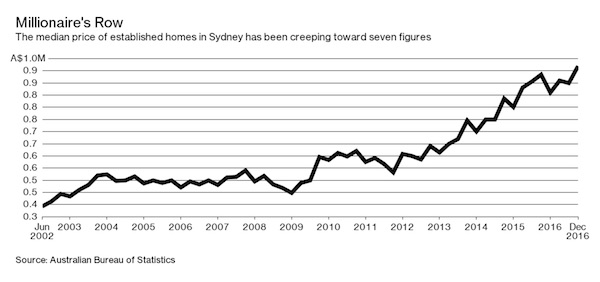

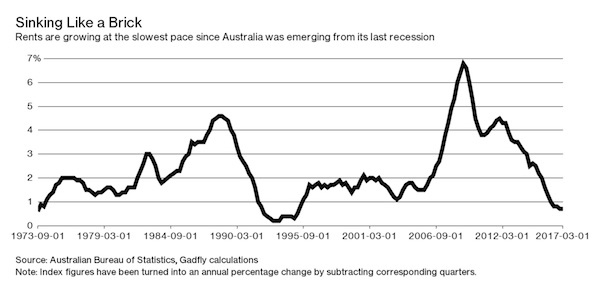

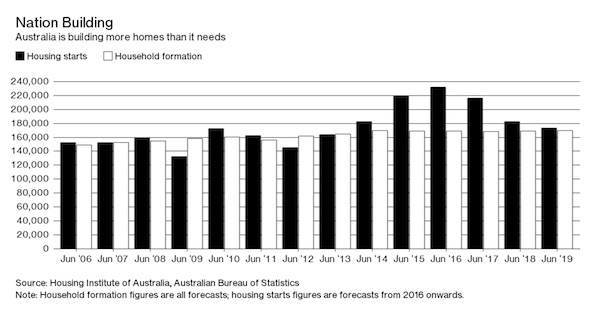

• Australia’s Haunted Housing Market (BW)

Forget all the headlines about the undimmed pace of house price inflation – up 19% in Sydney during March, pushing the median house price in the city to A$1.15 million ($875,000) according to Domain, a property-listings website. House prices, after all, aren’t so much a guide to the state of the housing market as to the 1% or so of homes that bought or sold in a typical year. Even there, they’re less an indicator of supply and demand for housing than of how supply and demand for mortgage credit interact with real estate fundamentals. Splurge on mortgage credit, and even an overbuilt housing market can enjoy price appreciation; cut back on home loans, and the opposite may be the case. That’s why it’s worth looking at the state of rents. Right now, they’re growing at the slowest pace in more than two decades, according to calculations based on Australian Bureau of Statistics data.

This hasn’t completely escaped notice. Philip Lowe, who took over as Governor of the Reserve Bank of Australia in September, has included the same boilerplate reference (with minor cosmetic modifications) in each of the eight monetary policy decision statements he’s put out so far: In the eastern capital cities, a considerable additional supply of apartments is scheduled to come on stream over the next couple of years. Rent increases are the slowest for two decades. As Lowe indicates, the reason for the slowdown in rents isn’t hard to discern. For most of Australia’s recent history, building has struggled to keep pace with household formation. Supply of new homes has kept close to demand, and as a result rents have tended to grow more or less in line with incomes.

Compare the Housing Institute of Australia’s forecasts of housing starts and the Australian Bureau of Statistics’ forecasts of household formation, and the glut really comes into focus: The surplus of homes that Australian cities have built over the past five years, based on those numbers, is equivalent to a whole year’s worth of excess supply. That’s a worrying development for those hoping that Australia’s house price boom is sustainable, especially given the way that the country’s regulators look to be finally attempting to raise credit standards after years of laxity. Still, if Australia manages to deflate the housing bubble without seriously damaging its economy, the heroes and villains will be quite different from the popular perception. While governments and regulators spent years adding to the problem with tax breaks and hostility to macroprudential regulation, it may well be property investors and foreigners who helped ease the crisis.

The EU should look at its own human rights record.

• Greece Blocks EU Statement On China Human Rights At UN (R.)

Greece has blocked a EU statement at the UNs criticizing China’s human rights record, a decision EU diplomats said undermined efforts to confront Beijing’s crackdown on activists and dissidents. The EU, which seeks to promote free speech and end capital punishment around the world, was due to make its statement last week at the U.N. Human Rights Council in Geneva, but failed to win the necessary agreement from all 28 EU states. It marked the first time the EU had failed to make its statement at the U.N.’s top rights body, rights groups Amnesty International and Human Rights Watch said. A Greek foreign ministry official said Athens blocked the statement, calling it “unconstructive criticism of China” and said separate EU talks with China outside the U.N. were a better avenue for discussions. An EU official confirmed the statement had been blocked.

“Greece’s position is that unproductive and in many cases, selective criticism against specific countries does not facilitate the promotion of human rights in these states, nor the development of their relation with the EU,” a Greek foreign ministry spokesperson said on Sunday. Presented three times a year, the statement gives the EU a way to highlight abuses by states around the world on issues that other countries are unwilling to raise. The impasse is the latest blow to the EU’s credentials as a defender of human rights, three diplomats said, and raises questions about the economically powerful EU’s “soft power” that relies on inspiring countries to follow its example by outlawing the death penalty and upholding press freedoms. It also underscores the EU’s awkward ties with China, its second-largest trade partner, diplomats said.

[..] Hungary, another large recipient of Chinese investment, has repeatedly blocked EU statements criticizing China’s rights record under communist President Xi Jinping, diplomats said. One EU diplomat expressed frustration that Greece’s decision to block the statement came at the same time the IMF and EU governments agreed to release funds under Greece’s emergency financial bailout last week in Luxembourg. “It was dishonorable, to say the least,” the diplomat said. The Greek foreign ministry spokesperson said that “during the formulation of the common statement there were also other countries that expressed similar reservations” and that Greece participates on an equal footing in setting up the EU’s common foreign policy.

Many will claim this is employers seeking illicit profits. But for many it’s the only way not to be forced to fire people, to keep them fed.

• Greece Cracks Down On Voucher Misuse By Employers (EurActiv)

The growing trend of distributing vouchers to employees to avoid taxes has raised eyebrows in the Greek government, which has moved to crack down on unprecedented levels of tax evasion in the cash-strapped country. The government says vouchers are allowed only as an extra benefit and not as part of a taxable salary. But according to Greek media reports, more than 200,000 workers, mostly newcomers, receive up to 25% in their salary via vouchers, which they use in supermarkets to buy food. The total amount, according to the reports, reaches €300 million annually. Up to a specific amount, the vouchers are tax-free for businesses, which are also exempt from employer security contributions. A source at the Greek labour ministry told EURACTIV.com that replacing any part of the legal wage of employees with vouchers is illegal.

“Vouchers are only allowed as an extra benefit and in no case can they be a substitution for legally defined earnings,” the source noted, adding that all complaints filed with the Labour Inspectorate are being investigated. As of June, companies are required to pay salaries only to bank accounts in order to put a stop to the practice of avoiding paying salaries altogether or paying only a fragment. “The Labor Inspectorate (SEPE) is in constant collaboration with Greece’s Financial and Crime Unit (SDOE), the financial police and the Independent Public Revenue Authority to address all forms of labour market violations and the coordination of their audit work,” the source said. Vouchers are coupons companies distribute to their employees to improve work, health and safety by supporting proper nutrition.

The rationale behind vouchers is that they process will enhance satisfaction and boost productivity levels while improving the employee living standards. For the government, the proper use of vouchers should also result in more tax revenues. The labour market in Greece has been in turmoil after 7 years of austerity-driven bailout programmes. There are cases of employers who have taken advantage of the “flexible” labour relations to impose unusual working conditions. For many, the use of vouchers is seen as a means to improve the atmosphere at work. Sotiris Zarianopoulos, a non-attached MEP from the Greek Communist Party (KKE), has recently asked the European Commission about these practices. The Greek lawmaker noted that this is only a part of a “jungle labour market” created by EU policies and implemented by the leftist Syriza government.

On the verge of heading back to Greece, I’m wary of what comes after the calm.

• Greek Summer Calm Before The Storm (K.)

Even though Prime Minister Alexis Tsipras hailed last week’s Eurogroup deal as step in the right direction, Greece still has many rivers to cross as the agreement secured in Luxembourg fell far short of the goals set by the government. First and foremost, Tsipras will have to deal with dissent emanating from SYRIZA MPs that had agreed to vote through a batch of tough legislation last month with the understanding that, in exchange, Greece will be granted debt relief and access to the ECB’s quantitative easing program. However, contrary to the government’s aims at the Eurogroup, debt relief talks were deferred to 2018, while Greece’s inclusion in the QE seems highly unlikely before that.

Although analysts believe that dissenters may not raise the ante during the summer – due to the tourist season and relief provided by the release of a bailout tranche – the government is expected to come under new pressure in the fall when Tsipras drafts the 2018 budget, which must stipulate a primary surplus of 3.5%. Given the huge difficulties to achieve this target, Athens will find it hard to convince representatives of the country’s creditors that it will able to achieve this target without the need for yet more measures. The Greek PM will also struggle in the fall to clear the hurdles leading to the completion of the country’s third bailout review, which will also involve the IMF. The review’s focus will be on streamlining the Greek public sector, from which SYRIZA has drawn a large chunk of votes in the past and would not like to rock the boat.

Another sticking point could be Tsipras’s promise to bring back growth, when forecasts for 2017 see an anemic rate of 1.5 to 1.8%. According to reports, the left-led coalition is banking on elections taking place in June 2018 at the earliest so that it avoids having to implement pension cuts in 2019, as it had agreed with creditors and passed into law. On the other had, some reports suggest that Tsipras may seek to spring an election surprise this fall or by the end of the year. This, however, will hinge on whether Greece will be given specifics by creditors about what sort of debt relief it can expect after the German elections in September, and on the degree of difficulty it will have to draft the 2018 budget.