William Henry Jackson “Street in the French Quarter, New Orleans” 1885

How dare you?

• Two Nations: 27% Of British Children Grow Up In Poverty (Independent)

Christmas shoppers are expected spend £1.2bn today, as 13 million consumers hand over £21m every minute. But while those who can afford it stock up in the desperate rush for gifts on “Panic Saturday”, another 13 million people will have more sobering reasons to worry – living in poverty in a festive Britain characterised as “two nations” divided. The Trussell Trust warned it is expecting its busiest Christmas ever in providing emergency rations – with one million people now relying on food banks run by the charity and other organisations. Many more are expected to get into debt to fund the cost of the festive season. Yet the indulgence will reach new peaks for others as shoppers will spend an average of £92 per person today, according to analysts. The Centre for Retail Research said consumers will spend £4.74bn in stores during the five days before Christmas Day – a 21% increase on last year.

Overall, spending during the final week before the day itself is expected to rise by 7% compared with last year. The predictions come a week after “Black Friday”, when retailers slashed prices encouraging a shopping surge in which sales grew at their fastest rate for 27 years, according to a CBI report released yesterday. About £6.5bn will have been spent by wealthier consumers in the UK’s top supermarkets alone in the two weeks to Christmas, according to analysts Nielsen. Charities warned that these spending figures disguise another Britain, in which families have so little they are unable to afford basics such as food, heating and housing costs. As 2014 draws to a close there are 13 million people in poverty – including 27% of the 2.5 million children in the UK, according to the Child Poverty Action Group (CPAG).

Inequality in the UK is now so extreme that the five richest families are wealthier than the bottom 20% of the entire population, according to Oxfam. Meanwhile, the housing charity Shelter predicts that 93,000 children will be homeless this Christmas, as the number of homeless families trapped in temporary or emergency accommodation exceeds 60,000. “This is a real, stark two-nations Britain that we are talking about,” said Trussell Trust chair Chris Mould. “At Christmas time, when people will be spending more than they have ever done before, we have also tens of thousands of people who haven’t got enough to buy food for themselves and families. “It’s not a tolerable situation. It’s got to be taken seriously. There is a consensus across the country that we can’t just accept this. We’ve got to take action.”

How the west sinks its own companies.

• Manufacturers Face ‘Bloodbath’ In Russia (BBC)

The chief executive of Renault Nissan, Carlos Ghosn, has said that manufacturers in Russia are facing a “bloodbath” because of the plunge in the value of the rouble. The currency has been dropping steadily for several months, but suffered very sharp falls earlier this week. The two firms have stopped taking orders for some new models and raised prices on others. Several rival manufacturers have taken similar steps. However, Mr Ghosn said he was confident the situation would stabilise, eventually. “We didn’t do it [suspend orders] overall, just on some models we said, ‘Sorry, until we see where this situation is going we don’t take orders,'” he told reporters in Tokyo. “When the rouble sinks it’s a bloodbath for everybody. It’s red ink, people are losing money, all car manufacturers are losing money,” he added. The French-Japanese Renault-Nissan alliance is a major player in Russia’s car industry. Not only does it sell vehicles under its own brands, it also controls the domestic manufacturer Avtovaz, better known as the maker of Lada cars.

Mr Ghosn said the group had suspended taking orders for some models, this included cars made in Russia, but also those which used large quantities of imported parts. Orders already placed would be honoured, he said. Other manufacturers have been taking similar steps in response to the decline of the rouble, which has halved in value against the dollar this year. General Motors, Audi and Jaguar Land Rover also suspended deliveries to Russian dealers earlier this week. If car sales in Russia do continue to decline, it could affect British manufacturing. Nissan says about 10% of the cars made at its Sunderland plant are exported to the region. “I certainly think there could be a potential impact on Nissan’s operations in the UK,” said David Bailey, professor of industry at Aston Business School. “It sells for example the Qashqai model in large numbers in Russia.” He said it could also have an impact on the premium end of Jaguar Land Rover, “albeit far less than in the case of Nissan”

Are we sure this is what we want?

• China Offers Enhanced Cooperation as Russia Struggles (Bloomberg)

China offered enhanced economic ties with Russia at a regional summit this week as its northern neighbor struggled to contain a currency crisis. “To help counteract an economic slowdown, China is ready to provide financial aid to develop cooperation,” Premier Li Keqiang said at a Dec. 15 gathering in Astana, Kazakhstan. While the remark applied to any of the five other nations represented at the meeting of the Shanghai Cooperation Organization group, it was directed at Russia, according to a person familiar with the matter who asked not to be named as the plans weren’t public. Any rescue package for Russia would give China the opportunity of exercising the kind of great-power leadership the U.S. has demonstrated for a century — sustaining other economies with its superior financial resources.

President Xi Jinping last month called for China to adopt “big-country diplomacy” as he laid out goals for elevating his nation’s status. “If the Kremlin decides to seek assistance from Beijing, it’s very unlikely for the Xi leadership to turn it down,” said Cheng Yijun, senior researcher at the Chinese Academy of Social Sciences in Beijing. “This would be a perfect opportunity to demonstrate China is a friend indeed, and also its big power status.” Russia isn’t in talks with China about any financial aid, said Dmitry Peskov, a spokesman for President Vladimir Putin. He said he didn’t know if China is preparing to offer aid. China’s Foreign Ministry, asked about assisting Russia, said the country is ready to work with all members of the SCO group to strengthen economic cooperation.

One-time Cold War ally China already proved a help to its neighbor embroiled in tensions with the U.S. and European Union earlier this year, signing a three-decade, $400 billion deal to buy Russian gas. Seeking China’s support is one of Russia’s most realistic options, the state-run Chinese newspaper Global Times wrote in a Dec. 17 editorial. A decision on whether to use some of its windfall gains from falling oil prices to aid Russia would hinge on whether Putin’s government is willing to ask for assistance, said Cheng, who is also a research fellow at the Development Research Center, which is a unit of the State Council, or cabinet.

America’s money comes home.

• Dollar Resumes Climb as Yellen Signals 2015 Interest-Rate Rise (Bloomberg)

A gauge of the dollar rose for the eighth time in nine weeks after Federal Reserve Chair Janet Yellen signaled that the central bank is poised to increase interest rates next year starting as early as April. The greenback headed for gains this year against all except one of its 31 major peers, a feat it hasn’t accomplished since 1997, as Yellen said the impact of Russian turmoil on the U.S. economy is small. Hungary’s forint and the Polish zloty sank on concern the economic crisis that has driven the ruble down 44% this year will spread. The Swiss franc weakened the most in two months versus the euro after the central bank introduced negative interest rates.

Yellen is “really trying to say there’s a lot of volatility out there, but it’s not having a dramatic impact on the outlook of U.S.,” Kevin Hebner, a foreign-exchange strategist at JPMorgan Chase & Co., said by phone yesterday in New York. The process of the market adjusting to the Fed’s rate-rise projections “is going to get the dollar appreciating, especially against the euro and yen.” Bloomberg’s gauge of the dollar rose 0.9% this week in New York to 1,125.58, the highest close since March 2009. That followed a 0.6% fall last week that snapped a seven-week rally. It has gained 10% this year.

Yeah, why not?

• UK Unions Call For North Sea Tax Breaks As Oil Slump Threatens Jobs (Guardian)

The role of the North Sea as a goldmine for future tax revenues and highly paid jobs is under threat unless something is done urgently to address a crisis triggered by plunging oil prices, the government was warned. Leading executives, politicians and union leaders said billions of pounds worth of Treasury income and 37,500 jobs were at risk and some want the tax burden to be lowered further in a bid to stimulate new activity and create longerterm fiscal revenues. Sir Ian Wood, a government adviser and former oil engineering boss, said 10% of the North Sea workforce could be in danger while Robin Allan, chairman of the independent explorers’ association Brindex, told the BBC that the industry was “close to collapse”. Jake Molloy, oil and gas organiser for the RMT union, said oil and gas companies had already started to make hundreds of redundancies, delay projects and scrap drilling contracts.

“It is not just the oil price that is a recipe for disaster, its the level of taxes. Reducing them by 2% [as in the autumn statement] is not scratching the surface given they have been earlier raised by 40%.“ Frank Doran, MP for Aberdeen North, agreed. “I think we have reached a stage in the (oil price) cycle where tax cuts have to be seriously looked at. The North Sea is one of the most expensive places in the world but it is not just about tax. I would want to see tax cuts tied to a reduction in costs through companies becoming more efficient.” The North Sea is regarded as a high tax and “mature” basin with few opportunities for making the kinds of major discoveries still available in newer areas such as Brazil, Angola or even the deep water US Gulf. The tax rate on a barrel of oil produced in the North Sea is between 60% and 80% – and the industry wants that burden reduced.

After all, there’s already $500 billion of it.

• It’s Not Easy Being Green: Fossil Fuel Subsidies Half A Trillion Dollars (CNBC)

For several years now, politicians have been pledging to cut fossil fuel subsidies and invest in green energy. Speaking at the UN Global Climate Summit in September, U.K. Prime Minister David Cameron said, “We need to give business the certainty it needs to invest in low carbon. That means fighting against the economically and environmentally perverse fossil fuel subsidies which distort free markets and rip off taxpayers.” And while politicians may be using emotive language to preach change, for some the reality is different. “Fossil fuel subsidies are enormous,” Dimitri Zenghelis, Principal Research Fellow at the London School of Economics’ Grantham Research Institute on Climate Change and the Environment, told CNBC’s Energy Future. “We’re talking about – according to both the OECD and the IEA – something like half a trillion dollars a year,” Zenghelis added.

In 2009, the G-20 group of nations made bold a commitment to “rationalize and phase out over the medium term inefficient fossil fuel subsidies that encourage wasteful consumption.” Five years down the line, are we on the way to seeing this pledge become a reality? According to the Overseas Development Institute think-tank, which this year released a report on the subject, not really. “What our report highlighted was, specifically, this perversity about fossil fuel subsidies and the objectives that these countries have on addressing climate change,” Shelagh Whitley, Research Fellow, Climate and Environment , told Energy Future. “What they’re doing is subsidizing fossil fuels to the tune of $88 billion a year, which means that they’re completely undermining their climate change targets,” she added. According to the ODI’s report, the United States is providing $5.1 billion, “in national fossil fuel exploration subsidies each year.” The report also states that in the U.K., the figure for fossil fuel exploration subsidies is up to $1.2 billion annually.

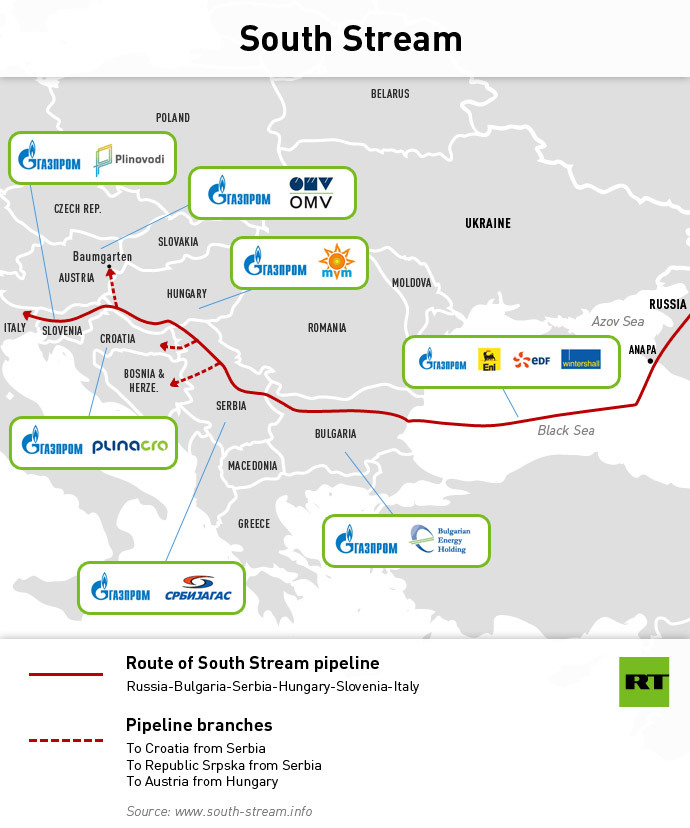

“if Gazprom stops the project, despite the permits, it will be considered guilty and not Bulgaria.”

• Bulgaria Ready To Issue South Stream Pipeline Permits (RT)

Bulgaria is ready to issue all the necessary permits for the construction of the South Stream pipeline, according to Prime Minister Boyko Borisov. He said it will up to Gazprom whether the pipeline is built or not. Borisov said he has the full support and understanding of the European Union and that Bulgaria is not in the wrong and should not suffer financial consequences for stopping the project, the Bulgarian news agency BGNES reports. Bulgaria was set to reap $600 million per year in transit fees, and investment on the Buglarian side was estimated at €3.5-4 billion. Russia was originally planning to build a pipeline to Southern Europe to directly export gas, but EU legislation was used to continually delay the project.

On December 1 during a visit to Turkey, Putin announced the pipeline would run through Turkey to Greece, instead of Bulgaria as originally proposed. “Thus, our country is now able to fulfill its obligations on the preparatory activities, particularly for the offshore part of the pipeline, and to issue a building permit,” Borisov said. The Prime Minister added that, “if Gazprom stops the project, despite the permits, it will be considered guilty and not Bulgaria.” A Bulgarian government delegation reportedly planned to fly to Moscow this week to clarify the situation over South Stream construction.

“.. oil-train traffic has grown to an amazing 42-times its 2009 level”

• The Oil Train Glut Shows How Little The Keystone XL Pipeline Matters (Reuters)

When it comes to moving petroleum through the United States, the Keystone XL pipeline is the rock star of transportation modes, garnering an extra large share of attention from politicians, activists and the press. Just this week, Senate Majority Leader-elect Mitch McConnell announced that passage of a bill approving the pipeline will be his first order of business when the 114th Congress convenes in January. Opponents, meanwhile, point to environmental and safety concerns, often citing the adverse impact that the pipeline would have on climate change and fossil fuel dependency. But while the Keystone XL would move an estimated 830,000 barrels a day of oil over its 1200 miles from Canada to the U.S. Gulf Coast, that’s not even a rounding error in the over 2.5 million miles of pipelines that weave their way throughout the country.

And even that isn’t enough to satisfy the pulsing demand for bubbling crude. On Monday, a Reuters report by Jarrett Renshaw highlighted the extent to which oil-carrying freight trains increasingly clog the nation’s rail lines, much to the concern of safety-minded local officials–especially after The devastating July train derailment in the Quebec town of Lac-Megantic–and sometimes at the expense of taxpayers. According to the report, oil-train traffic has grown to an amazing 42-times its 2009 level, and while the railroad industry spends $24 billion per year building infrastructure, $84.2 million in taxpayer money has been written into 10 federal and state grants that either have been approved or are seeking approval.

80HD

• 2014: The Year We Piled Up Risks Like A Global Game Of Tetris (David Collum)

Mavens in the US blamed bad weather for their complete inability to hit the dartboard. Oddly, German pundits blamed their joblessness on good weather, whereas Goldman suggested that the Germans actually have strong growth . . . because of the weather.Fed governor Plosser says the economy is great “despite the effects of severe weather.” The CEO of Walmart doubts the weather argument altogether, instead suggesting that everybody is unemployed and broke. Charles Dudley Warner insightfully noted, “Everybody complains about the weather, but nobody does anything about it.” I suspect the vital signs of the economy are stable, albeit with help from a high-capacity monetary respirator.

The weather is whacking California. One of our breadbaskets is going bone dry owing to a multiyear, high-sigma (500-year) drought. Analogies to the Dust Bowl are inescapable. Some towns are shipping in all water by truck. California will soon run out of Nevada and Oregon’s water. One orange grower bulldozed 400 acres of trees (why?), suggesting that “if this persists in the next year, the devastation . . . will be biblical.” California halted fracking because it may be contaminating aquifers. (I must confess that of all the risks of fracking, destroying a big aquifer tops the list.) Of course, housing is considered central to our economy. Maybe I have Assburger’s syndrome or 80HD, but I go nuts trying to figure out whether housing is strong or weak. Choose an indicator and make any case you want. Owens Corning reported a weakness in roofing materials: the corporate numbers don’t lie. Just kidding. Sure they do.)

Some plots show existing home sales rising; others show existing home purchases rising. Dudes: they’re the same numbers—a kind of housing velocity that may offer evidence that the market is loosening finally. That said, 20 million homeowners are still underwater, rendering them professionally immobile. A nice list of the riskiest real estate markets in country shows Hartford, Connecticut, leading the pack with a potential downside of 35%. (Canada and England now make us look like pikers, however, given that their busts remain prospective.) And remember that iconic plot of mortgage resets foreshadowing (to those paying attention) the ’08–’09 crisis? Well the resets are back – $200 billion worth of resetting home equity lines of credit (HELOCs). When the Fed finally normalizes rates, price discovery is gonna be a real bitch. The Fed never had an exit strategy.

So sad.

• Wall Street Firms Endure Lost Decade After Goldman Peak in 2007 (Bloomberg)

Wall Street firms have failed to keep up with a stock market that’s boomed for more than five years, losing ground to industries including technology and health care. There were just 32 U.S. financial firms among the world’s largest 500 companies by market capitalization when trading closed yesterday in New York. That compares with 41 at the end of 2006, the last full year before the credit crisis. Some companies that remain on the list, like Citigroup and AIG) have shrunk to a fraction of the size of tech giants like Apple and Google. Goldman Sachs has a lower market value than its peak in 2007. While Google and Cupertino, California-based Apple have been adding new products and customers since then, Wall Street lost trading revenue and spent much of that time repaying bailouts, settling government probes or divesting assets under pressure from federal watchdogs.

“The culture in the large banks needed to be corrected,” Charles Peabody, a banking analyst at Portales Partners in New York, said in a phone interview. “That is a good thing. The extent of this adjustment process has been a lot more drawn out than any of us anticipated, and that’s not been a good thing.” Goldman Sachs went public in 1999, the same year that President Bill Clinton signed into law the repeal of barriers between commercial and investment banking. Market capitalization as of Dec. 18 dropped about 21% from the peak in October 2007 of more than $105 billion. Financial firms that fell off the list include Lehman, which filed for bankruptcy protection in 2008, and Merrill Lynch, which struck a deal the same year to sell itself to Bank of America Corp. The U.S. group now makes up about 8.1% of the market value of the world’s largest 500 companies, compared with 9.7% at the end of 2006.

I think I’ve been missing Meredith.

• Meredith Whitney’s Hedge Fund Said to Be in Turmoil (Bloomberg)

The hedge fund Meredith Whitney started last year after she became one of Wall Street’s best-known analysts is in turmoil. Her biggest investor demanded his money back and two executives left in the past month, according to a person with knowledge of her firm. A fund connected to billionaire Michael Platt’s BlueCrest Capital Management asked to redeem its investment at least twice, according to the person, who asked for anonymity to describe the private exchanges. Her Kenbelle Capital LP started trading in November 2013 with about $50 million from BlueCrest partners and other investors, according to a fund presentation last year.

Stephen Schwartz, a co-founder and portfolio manager, left last month, his LinkedIn profile shows. Andrew Turchin, the chief financial officer, exited as well, the person with knowledge of the firm said. Chief Administrative Officer Brittani Caetano joined another hedge fund this month, according to LinkedIn. Whitney had aimed for returns of 12% to 17%, according to the fund presentation. Instead, her American Revival Fund LP lost 4.7% through the first half of the year, an investor letter this July showed. “Meredith is a brilliant woman and somebody who is indefatigable in her will to succeed and to win,” her attorney, Stanley Arkin, said today in a phone call. Colleagues left by “mutual agreement,” he added. BlueCrest’s redemption request violates their agreement and “had to do with the way the market is moving,” he said.

The sanctions cost Europe too much money; they can’t be maintained.

• France Risks EU Split Over Russian Sanctions Relief (Bloomberg)

French President Francois Hollande has floated the idea of rolling back EU sanctions against Russia, provided that Russia takes steps to remove troops from Crimea and Ukraine. Bloomberg’s Hans Nichols reports on “Bloomberg Surveillance.” Europe stumbled into a debate over the end of sanctions on the economically distressed Russia after French President Francois Hollande became the first major leader to dangle the prospect of easing the curbs. Hollande’s appeal at a European Union summit yesterday was a reminder that the bans on financing of major Russian banks and the export of energy-exploration equipment will lapse next July unless renewed unanimously by the 28 EU governments.

Hollande urged the EU to offer early “de-escalation” to reward expected peace overtures by Russian President Vladimir Putin in eastern Ukraine, while others including German Chancellor Angela Merkel put off sanctions relief until a settlement emerges. “It will be very difficult to retain that unity among member states” when the sanctions are up for renewal, said Steven Blockmans, an analyst at the Centre for European Policy Studies in Brussels. “We might find the sanctions fizzling out when it comes to summer next year.” European leaders papered over the controversy at the first summit chaired by new EU President Donald Tusk, who as Poland’s prime minister had spearheaded moves to punish Russia for meddling with Ukraine.

A communique said the bloc “will stay the course” and maintained the threat of “further steps if necessary.” As with the response to the euro-zone debt crisis, a consensus on how to deal with Russia’s annexation of Ukraine’s Crimean peninsula and military support for eastern Ukrainian separatists was slow to emerge. The EU halted trade and visa negotiations with Russia and blacklisted 18 members of Ukraine’s former pro-Russian regime in March. It took the downing of a Malaysian passenger jet over eastern Ukraine in July to prompt wider economic curbs. Those steps and another set of economic restrictions imposed in September will run out in July 2015. They are locked in by the EU’s unanimity principle: it would take all 28 governments to scrap them earlier or prolong them.

Huh, what? An arrest?

• First Arrest In UK Foreign Exchange Market Rigging Investigation (Guardian)

A City banker has been arrested by the Serious Fraud Office in connection with its investigation into the rigging of the £3.5 trillion-a-day foreign exchange markets. The banker is the first person to be detained in connection with the global foreign exchange rate-rigging scandal and was held following a dawn raid on his Essex home. “In connection with a Serious Fraud Office investigation, we can confirm one man was arrested in Billericay on 19 December,” an SFO spokesman said. “ Officers from the City of London Police assisted with the operation.” The arrest follows a record-breaking £2bn fine imposed on five global banks for their role in the scandal.

About 30 bankers have been sacked or suspended but until now no arrests have been made. Bankers were found by the UK’s City regulator, the Financial Conduct Authority (FCA), to have colluded to fix rates between 2008 and October 2013. Bankers using online chatrooms – where they called themselves the “A-Team” , “The Three Musketeers” and “The Players” – colluded to fix rates to make millions for their employers and collect big bonuses for themselves, according to transcripts released by the regulator. The conversations between the bankers, some of whom used the name “1 team, 1 dream”, recorded one saying: “How can I make free money with no fcking [sic] heads up.”

Another message, sent after Swiss bank UBS made £322,000 in a single deal, read: “He’s sat back in his chair, feet on desk, announcing, that’s why I got the bonus pool. Made most people’s year.” In other messages traders made remarks such as “nice job mate” and “yeah baby” as they discussed foreign exchange rates. The FCA said it had found a “free for all culture” on trading floors that allowed the market to be rigged for such a long time. The fines, which were far bigger than those handed out for Libor rigging, were imposed on Royal Bank of Scotland, HSBC, Citibank, JP Morgan and UBS.

And Cuba is now our friend. Folly of the day.

• Obama Authorizes ‘Economic Embargo’ On Russia’s Crimea (RT)

US President Barack Obama has authorized sanctions against individuals and entities operating in Russia’s Crimean peninsula, according to the White House statement. Obama has issued an executive order that “prohibits the export of goods, technology, or services to Crimea and prohibits the import of goods, technology, or services from Crimea, as well as new investments in Crimea,” according to the statement. The executive order also authorizes the Secretary of the Treasury to impose sanctions on “individuals and entities operating in Crimea.” The move comes just a day after the European Union introduced similar action against the Russian region of Crimea and Sevastopol, accepted into the Russian Federation following the referendum last March.

The United States did not recognize the reunification and has been calling on Russia to “end its occupation and attempted annexation of Crimea.” “We will continue to review and calibrate our sanctions, in close coordination with our international partners, to respond to Russia’s actions,” Obama’s statement reads. The bill that opened way for further sanctions against Russian economy – dubbed Ukraine Freedom Support Act of 2014 – was signed on Thursday. However Obama was hesitant to introduce any new measures until they are synchronized with European partners.

Should reveal a lot.

• Antarctic Photo Science Archive Unlocked (BBC)

Aerial photos from the 1940s and 1950s are being used to probe the climate history of the Antarctic Peninsula. UK scientists are comparing the images with newly acquired data sets to assess the changes that have occurred in some of the region’s 400-plus glaciers. The old and modern information has to be very carefully aligned if it is to show up any differences reliably. And that is a big challenge when snow and ice obscure ground features that might otherwise act as visual anchors. But the researchers from the British Antarctic Survey (BAS), Newcastle University and University of Gloucestershire believe they are cracking the problem. “We want to use these pictures to work out volume and mass-balance changes in the glaciers through time,” explained Dr Lucy Clarke from the University of Gloucestershire. “There are tens of thousands of these historical images, held by the British Antarctic Survey and the US Geological Survey.

“So, they’ve long been around, but it’s only now that we’ve had the capability to extract the 3D data from them.” Dr Clarke has been presenting the work at this week’s American Geophysical Union Fall Meeting in San Francisco. The Antarctic Peninsula – the northernmost extent of the White Continent which stretches up towards South America – has experienced quite dramatic warming in recent decades. The fronts of many of its glaciers have quite obviously retreated, and several of the marine-terminating ice streams have even seen their floating shelves disintegrate. But getting at the volume and mass changes in the glaciers has been a thorny issue. Satellites are used to track such trends today but their record spans only a few decades. The archive of aerial photos, on the other hand, goes back to the 1940s, and it represents an extraordinary account of the pioneering days of polar exploration.

“Europe today has twice as many wolves as the United States even though its territory is half the size of North America and its population twice as dense.”

• Wolves, Bears And Lynx ‘Now Plentiful In Europe’ (AFP)

After nearing extinction in Europe in the early 20th century because of hunting and shrinking habitats, large carnivores like the gray wolf, brown bear, lynx and wolverine are thriving once more. So say the results of a study carried out across the continent, except Russia and Belarus, by an international team whose report was published Thursday in the US journal Science. “The total area with a permanent presence of at least one large carnivore species in Europe covers 1,529,800 square kilometers (roughly one-third of mainland Europe), and the area of occasional presence is expanding,” the authors wrote. The study involved 76 scientists examining 26 countries. Brown bears were the most numerous of the four species, with nearly 17,000 specimens and a permanent presence in 22 countries. The gray wolf came next, with a population of more than 12,000 scattered across 28 countries, followed by the Eurasian lynx, 9,000 of which were to be found in 23 countries.

Wolverines were the scarcest of the four, with an estimated 1,250 of the cold-climate creatures found in three Nordic countries: Norway, Finland and Sweden. Although most populations of these large predators have been on the rise or stable in recent years, some are on the verge of extinction, such as the gray wolves of Spain’s Sierra Morena region, the Pyrenees bears or the lynx found in the Vosges region of France. All four species of carnivores live and reproduce mostly outside protected areas, such as national parks, in human-dominated landscapes. Their numbers suggest that they can coexist with humans in areas dominated by the latter, testifying to the success of European Union conservation policies, the authors wrote. For instance, Europe today has twice as many wolves as the United States even though its territory is half the size of North America and its population twice as dense.

“Our results are not the first to reveal that large carnivores can coexist with people but they show that the land-sharing model for large carnivores (coexistence model) can be successful on a continental scale,” the study stated. In the US, by contrast, protected species often live far from human-inhabited ones, such as wolves of Yellowstone National Park. The researchers said several factors explained the vitality of Europe’s populations of large carnivores, including the replenishing of stocks of prey such as deer and wild boars, which provides them with ample food. They also cited an exodus of people from rural areas in the 20th century, which allowed wolves, bears and lynxes to expand their territories. But the report mainly attributed the success to laws aimed at preserving species of wild animals and their habitats, such as the Berne convention of 1979.

Get a warbler.

• Birds ‘Heard Tornadoes Coming’ And Fled One Day Ahead (BBC)

US scientists say tracking data shows that five golden-winged warblers “evacuated” their nesting site one day before the April 2014 tornado outbreak. Geolocators showed the birds left the Appalachians and flew 700km (400 miles) south to the Gulf of Mexico. The next day, devastating storms swept across the south and central US. Writing in the journal Current Biology, ecologists suggest these birds – and others – may sense such extreme events with their keen low-frequency hearing. Remarkably, the warblers had completed their seasonal migration just days earlier, settling down to nest after a 5,000km (3,100 mile) journey from Colombia. Dr Henry Streby, from the University of California, Berkeley, said he initially set out to see if tracking the warblers was even possible.

“This was just a pilot season for a larger study that we’re about to start,” Dr Streby told the BBC.”These are very tiny songbirds – they weigh about nine grams. “The fact that they came back with the geolocators was supposed to be the great success of this season. Then this happened!” Working with colleagues from the Universities of Tennessee and Minnesota, Dr Streby tagged 20 golden-winged warblers in May 2013, in the Cumberland Mountains of north-eastern Tennessee. The birds nest and breed in this region every summer, and can be spotted around the Great Lakes and the Appalachian Mountains. After disappearing to Colombia for the winter, 10 of the tagged warblers returned in April 2014. The team was in the field observing them when they received advance warning of the tornadoes.

“We evacuated ourselves to the waffle house in Caryville, Tennessee, for the one day that the storm was really bad,” Dr Streby said. After the storm had blown over, the team recaptured five of the warblers and removed the geolocators. These are tiny devices weighing about half a gram, which measure light levels. Based on the timing and length of the days they record, these gadgets allow scientists to calculate and track the approximate location of migratory birds. In this case, all five indicated that the birds had taken unprecedented evasive action, beginning one to two days ahead of the storm’s arrival. “The warblers in our study flew at least 1,500km (932 miles) in total,” Dr Streby said. They escaped just south of the tornadoes’ path – and then went straight home again. By 2 May, all five were back in their nesting area.

Word.

• Dick Cheney Should Be In Prison, Not On ‘Meet The Press’: Greenwald (RT)

Journalist Glenn Greenwald said Dick Cheney is able to brag about the success of torture on weekend news shows because the Obama administration has decided to shield torturers rather than prosecute them. In a wide ranging interview about the CIA torture report, prospects for the 2016 presidential race, US-Cuba relations and the Sony hack, Greenwald told HuffPost Live that the discussion about the torture report is distorted since we are not hearing from the victims of torture themselves. In an interview on ‘Meet the Press,’ former Vice President Dick Cheney claimed that torture “worked” and announced he would “do it again in a minute” if given the opportunity. In response, Greenwald said that whether torture worked or not is completely irrelevant, and no one should be interested in that because everyone who tortures claims they do it for a good reason even though it has been banned under international treaties and laws. Greenwald said it was former Republican President Ronald Reagan who championed the idea that torture was never justifiable.

Reagan signed the international Convention against Torture in 1988, which became the primary international foundation of anti-torture law. Reagan said at the time the treaty would clearly express the United States’ opposition to torture, “an abhorrent practice unfortunately prevalent in the world today.” Greenwald said, “The reason why Dick Cheney is able to go on ‘Meet the Press’ instead of where he should be – which is in a dock in the Hague or in a federal prison – is because President Obama and his administration made the decision not to prosecute any of the people who implemented this torture regime despite the fact that it was illegal and criminal.” He added, “When you send the signal, like the Obama administration did, that torture is not a crime to be punished – it is just a policy dispute to argue about on Sunday shows – of course it emboldens torturers, like Dick Cheney, to go around on Sunday shows and say, ‘What I did was absolutely right.’”

The journalist said that when Obama was running for president in 2007/08, he was asked if there should be legal accountability for people who committed war crimes. He said it was something for the Attorney General to decide and affirm this principle, but even before Obama was inaugurated he began walking back the idea. Pointing to a 2009 New York Times article, Greenwald said one reason why was that presidents know if they protect their predecessor and shield them from legal accountability for their crimes, they, too, will be shielded by successive administrations. “Which is another way of saying the most powerful officials in the United States have exempted themselves from the rule of law,” he added. “They are able to commit not just ordinary crimes but the most egregious crimes with the assurance that unlike ordinary citizens they will not be held accountable under the law. That is about as tyrannical and dangers as a framework we could have.”

Deep.

• Will Religion Ever Disappear? (BBC)

A growing number of people, millions worldwide, say they believe that life definitively ends at death – that there is no God, no afterlife and no divine plan. And it’s an outlook that could be gaining momentum – despite its lack of cheer. In some countries, openly acknowledged atheism has never been more popular. “There’s absolutely more atheists around today than ever before, both in sheer numbers and as a%age of humanity,” says Phil Zuckerman, a professor of sociology and secular studies at Pitzer College in Claremont, California, and author of Living the Secular Life. According to a Gallup International survey of more than 50,000 people in 57 countries, the number of individuals claiming to be religious fell from 77% to 68% between 2005 and 2011, while those who self-identified as atheist rose by 3% – bringing the world’s estimated proportion of adamant non-believers to 13%.

While atheists certainly are not the majority, could it be that these figures are a harbinger of things to come? Assuming global trends continue might religion someday disappear entirely? It’s impossible to predict the future, but examining what we know about religion – including why it evolved in the first place, and why some people chose to believe in it and others abandon it – can hint at how our relationship with the divine might play out in decades or centuries to come. Scholars are still trying to tease out the complex factors that drive an individual or a nation toward atheism, but there are a few commonalities. Part of religion’s appeal is that it offers security in an uncertain world. So not surprisingly, nations that report the highest rates of atheism tend to be those that provide their citizens with relatively high economic, political and existential stability. “Security in society seems to diminish religious belief,” Zuckerman says.

Capitalism, access to technology and education also seems to correlate with a corrosion of religiosity in some populations, he adds. Japan, the UK, Canada, South Korea, the Netherlands, the Czech Republic, Estonia, Germany, France and Uruguay (where the majority of citizens have European roots) are all places where religion was important just a century or so ago, but that now report some of the lowest belief rates in the world. These countries feature strong educational and social security systems, low inequality and are all relatively wealthy. “Basically, people are less scared about what might befall them,” says Quentin Atkinson, a psychologist at the University of Auckland, New Zealand. Yet decline in belief seems to be occurring across the board, including in places that are still strongly religious, such as Brazil, Jamaica and Ireland. “Very few societies are more religious today than they were 40 or 50 years ago,” Zuckerman says. “The only exception might be Iran, but that’s tricky because secular people might be hiding their beliefs.”