John Vachon General store and post office in Little Creek, Delaware Jul 1938

Boy, what a day so far; hard to keep up. tell me, is it just me, or has the US really started another round of regime change in Iraq?

Washington wants a new government in the capital, Baghdad, a national unity one, ostensibly to respond to the Islamist State threat.

PM Maliki doesn’t want to go, but also can’t lead such a government (nobody likes him). Iraqi President Fuad Masum then tells him off, so does a court. Maliki sends loyal troops into Baghdad, threatens to take the President to court, and the latter names deputy parliament speaker Haider Al-Abadi as new PM.

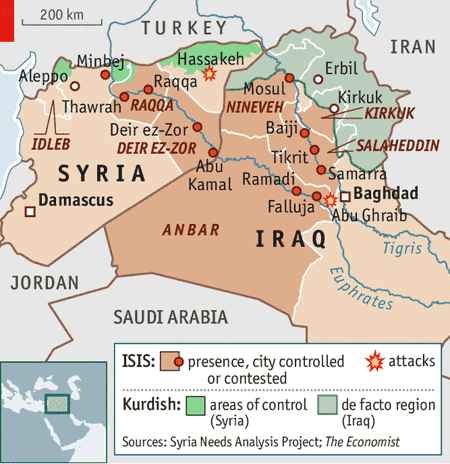

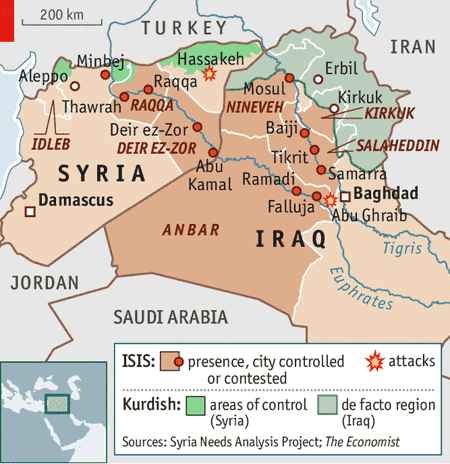

Meanwhile, the US pulls their support from Maliki, and the Islamist State conquers another city not far from the capital, and not anywhere near where the Americans are bombing them.

And most of that was before America had even woken up.

BTW, the President is Kurd, Maliki is Shi’ite, and the parliament chairman is Sunni. Lovely. National unity? You would need a nation first.

The US yesterday started directly arming the Kurds under siege where they are indeed bombing, and the Kurds took back some ground from the IS.

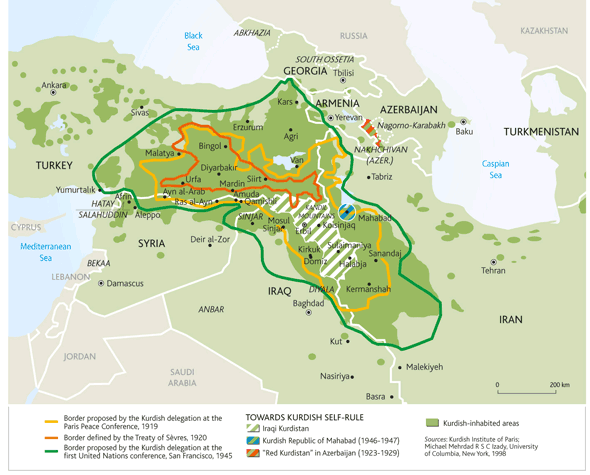

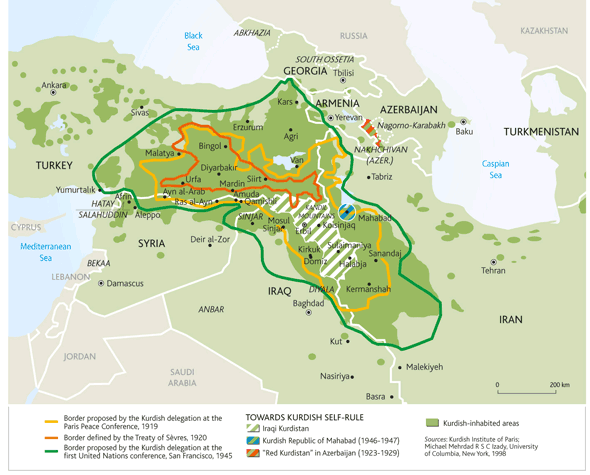

Wait a minute! The US is arming the Kurds? For real? Did they forget the longstanding fight between the Kurdish PKK and the Turks over Kurdistan? The Turks who yesterday elected Erdogan as their president?

That’s the same Erdogan who is hated by all his neighbors, Israel, Syria, Iraq, Iran, and who’s said some ugly things about America too, but who they need to keep the IS from moving north.

Erdogan might be at least a little bit nervous that these US arms may someday be used against him to make Kurdistan a sovereign nation after all.

Kurdistan, which for many decades has been a nation on paper only, stretches across Iraq and Turkey (where 18% are Kurds). And Iran, Syria, Armenia and Azerbaijan.

In the middle of the – clickable – map, you see Mosul (the dam the IS took), Erbil (the town the US is shelling) and Kirkuk, near which one of the world’s main mega oilfields is located.

And isn’t it interesting to know that the Kurds forcibly took control of that oilfield on July 11, 2014, from the Iraqi government? It all adds to the intrigue. Who shall we support today? If today is Monday …

Wikipedia on Kurdistan and its oil and gas reserves, in particular the Kirkuk field:

• Kurdistan Regional Government (KRG)-controlled parts of Iraqi Kurdistan are estimated to contain around 45 billion barrels of oil, making it the sixth largest reserve in the world. Extraction of these reserves began in 2007. Gas and associated gas reserves are in excess of 2,800 km3. Notable companies active in Kurdistan include Exxon, Total, Chevron, Talisman Energy, Genel Energy, Hunt Oil, Gulf Keystone Petroleum, and Marathon Oil. In July 2012, Turkey and the Kurdistan Regional Government signed an agreement by which Turkey will supply the KRG with refined petroleum products in exchange for crude oil.

• Kirkuk Field is an oilfield near Kirkuk, Iraq. It was discovered by the Turkish Petroleum Company at Baba Gurgur in 1927. The oilfield was brought into production by the Iraq Petroleum Company in 1934. It has ever since remained the most important part of northern Iraqi oil production with over 10 billion barrels of proven remaining oil reserves in 1998. After about seven decades of operation, Kirkuk still produces up to 1 million barrels per day, almost half of all Iraqi oil exports. Oil from the Kirkuk oilfield is now exported through the Kirkuk-Ceyhan Oil Pipeline, which runs to the Turkish port of Ceyhan on the Mediterranean Sea.

• On 11 July 2014 Kurdistan Regional Government forces seized control of the Kirkuk mega oilfield, together with the Bai Hassan field, prompting a condemnation from Baghdad and a threat of “dire consequences,” if the oilfields were not returned to Iraq’s control.

That’s right, Iraq lost – control over – about half of its oil exports one month ago. To an army that belongs to that part of the population the President belongs to!

And that takes us right back to why the US is meddling in Iraq. And Ukraine too, of course. Kirkuk is in Kurdish hands now, and it must be a nightmare for all of those oil companies active in Kurdistan to even ponder the IS conquering those parts of Kurdish Iraq that they are active in. A nightmare, but by no means impossible. They’re just about literally on the doorstep:

Oil and gas were always important, they’ve been the reason for the majority of all US and European wars and invasions of the past 150 years, But control over fossil fuels has gotten a lot more important recently, ever since everyone (well, everyone …) has acknowledged that conventional peak oil indeed happened in 2005, and that shale oil and gas won’t last long (less people understand this last bit, admittedly, but TPTB do).

The fight over oil has now literally become the fight for power, as I’ve said more than once recently. That is what we see develop here. The 2003 invasion of Iraq gave Big Oil access to a lot of oil and gas, but it also left behind an unparalleled chaos. And now they’re forced back in. I see Washington plan a lot of mayhem and chaos, but I doubt they wanted this at this particular point in time. This is not a powder keg, this is Pandora’s box.

But there’s no way back. The US doesn’t want Putin in control of Russian resources, even though, as I said yesterday, they’re going to need him dearly if they want to prevent Iraq from blowing up in their faces, and they don’t want the Islamist State in control of 45 billion+ barrels of oil in Kurdistan and the greater Iraq area.

By the by, when I read reports of children being buried alive etc., I think of patterns. These accusations are always used against new enemies. I don’t know how out there the IS is, but it does make me wonder.

In my view, America doesn’t sufficiently understand the region, and therefore chooses the Wrong Friends, Wrong Enemies, Wrong Fights . And I think that is due to pure American hubris and arrogance.

Washington thinks it has the by far best, most expensive, most advanced army, and that that alone will make it ultimately victorious no matter what happens. So why then pay too much attention to what happens? What that idea disregards is that the US hasn’t actually won a war or an invasion since 1945, though it had the numero uno army the whole time.

Creating chaos may be a tried and tested approach, but not if you yourself get confused and no longer oversee what is going on. Then you’re merely yet another part of the chaos.

The only way left to go then is ever heavier weapons, trying to spread ever more death and fear among the ‘enemy’. But Washington doesn’t even always now who the enemy is. And if you don’t know that, you can’t win.

Still, we’re in it for keeps. Here are two things from a few days ago that tell you why; they come on top of countless other examples The Automatic Earth has served you lately. BusinessWeek:

China’s 2020 Shale Gas Production Target Cut In Half

Tapping China’s vast shale-gas reserves has proved more difficult than government planners in Beijing once hoped. In 2012, China’s National Energy Administration projected that, by 2020, from 60 billion to 80 billion cubic meters (bcm) of domestic shale gas would be pumped annually. Earlier this week the country’s energy chief, Wu Xinxiong, slashed the goal in half, to 30 billion bcm by 2020.

In the US, the Monterey play was cut by 90-odd%. In Poland, no.1 EU shale prospect, close to nothing was ever found. China’s just getting started cutting expectations and targets.

And from the Wall Street Journal:

Statoil Fails to Make Commercial Discoveries in Arctic Drilling Campaign

Norwegian energy company Statoil said Thursday it was disappointed by the results of an Arctic drilling campaign in the Barents Sea after making no commercial discoveries of oil or gas. Statoil said it had ended its three-well drilling campaign in the Hoop area, and the Apollo, Atlantis and Mercury wells all contained noncommercial volumes of oil and gas.

Shell left the Arctic. Statoil now does. That leaves Exxon, in its recently announced sanction-busting deal with Russia.

Still, even that doesn’t leave much hope, as becomes clear – once again – in the following by Ambrose Evans Pritchard, who’s late to the game in reporting on the same EIA review we covered two weeks ago in Say Bye To The Bubble with help from Wolf Richter, information we expanded on last week in Debt and Energy, Shale and the Arctic.

But hey, it’s Ambrose, and he does numbers well.

Oil And Gas Company Debt Soars To Danger Levels To Cover Cash Shortfall

• The EIA said revenues from oil and gas sales have reached a plateau since 2011, stagnating at $568bn over the last year as oil hovers near $100 a barrel. Yet costs have continued to rise relentlessly.

• … the shortfall between cash earnings from operations and expenditure – mostly CAPEX and dividends – has widened from $18bn in 2010 to $110bn during the past three years. [..] .. to keep dividends steady and to buy back their own shares, spending an average of $39bn on repurchases since 2011.

• The agency, a branch of the US Energy Department, said the increase in debt is “not necessarily a negative indicator”

• … “continued declines in cash flow, particularly in the face of rising debt levels, could challenge future exploration and development”.[..] upstream costs of exploring and drilling have been surging, causing companies to raise long-term debt by 9pc in 2012, and 11pc last year. Upstream costs rose by 12pc a year from 2000 to 2012 due to rising rig rates, deeper water depths, and the costs of seismic technology.

• Global output of conventional oil peaked in 2005 despite huge investment.

• … the productivity of new capital spending has fallen by a factor of five since 2000. “The vast majority of public oil and gas companies require oil prices of over $100 to achieve positive free cash flow under current capex and dividend programmes. Nearly half of the industry needs more than $120 ..

• Analysts are split over the giant Petrobras project off the coast of Brazil, described by Citigroup as the “single-most important source of new low-cost world oil supply.” The ultra-deepwater fields lie below layers of salt, making seismic imaging very hard. They will operate at extreme pressure at up to three thousand meters, 50pc deeper than BP’s disaster in the Gulf of Mexico.

• Petrobras is committed to spending $102bn on development by 2018. It already has $112bn of debt. The company said its break-even cost on pre-salt drilling so far is $41 to $57 a barrel. Critics say some of the fields may in reality prove to be nearer $130. Petrobras’s share price has fallen by two-thirds since 2010.

• … global investment in fossil fuel supply rose from $400bn to $900bn during the boom from 2000 and 2008, doubling in real terms. It has since levelled off, reaching $950bn last year. [..] Not a single large oil project has come on stream at a break-even cost below $80 a barrel for almost three years.

• … companies are committing $1.1 trillion over the next decade to projects requiring prices above $95 to make money. Some of the Arctic and deepwater projects have a break-even cost near $120.

• The IEA says companies have booked assets that can never be burned if there is a deal limit to C02 levels to 450 (PPM), a serious political risk for the industry. Estimates vary but Mr Lewis said this could reach $19 trillion for the oil nexus, and $28 trillion for all forms of fossil fuel.

• “Exxon must be doing a lot of soul-searching as they get drawn deeper into this,” said one oil veteran with intimate experience of Russia. “We don’t think they ever make any money in the Arctic. It is just too expensive and too difficult.”

“It is just too expensive and too difficult.”. Or as we say where I come from: There Is No There There.

Oil companies already lose $110 billion a year (aka ‘the shortfall between cash earnings from operations and expenditure’). They’re now committing that exact same amount to new projects, money they’ll also have to borrow. What if interest rates go up to 5%? Will they still drill? Or are we going to take someone else’s oil by force?

As I said, hardly new for Automatic Earth readers, but this is so important in understanding what is happening geo-politically these days that it bears repeating. There is no way back. Oil has become ultimate power. And will lead to the ultimate fight. Having bigger and better guns and tanks won’t win that fight.

But Washington, by the look of things, doesn’t seem to understand that. Arrogance and hubris tend to be costly. In ultimate fighting, they can be deadly. America’s not exactly making a lot of friends these days, and the ones they do make are the wrong friends. Even the New York Times now reports on the fine folk gunning down the people of east Ukraine. Will Putin let them do as they please? And if not, what will “we” do?

• Oil And Gas Company Debt Soars To Danger Levels To Cover Cash Shortfall (AEP)

The world’s leading oil and gas companies are taking on debt and selling assets on an unprecedented scale to cover a shortfall in cash, calling into question the long-term viability of large parts of the industry. The US Energy Information Administration (EIA) said a review of 127 companies across the globe found that they had increased net debt by $106bn in the year to March, in order to cover the surging costs of machinery and exploration, while still paying generous dividends at the same time. They also sold off a net $73bn of assets. This is a major departure from historical trends. Such a shortfall typically happens only in or just after recessions. For it to occur five years into an economic expansion points to a deep structural malaise. The EIA said revenues from oil and gas sales have reached a plateau since 2011, stagnating at $568bn over the last year as oil hovers near $100 a barrel. Yet costs have continued to rise relentlessly.

Companies have exhausted the low-hanging fruit and are being forced to explore fields in ever more difficult regions. The EIA said the shortfall between cash earnings from operations and expenditure – mostly CAPEX and dividends – has widened from $18bn in 2010 to $110bn during the past three years. Companies appear to have been borrowing heavily both to keep dividends steady and to buy back their own shares, spending an average of $39bn on repurchases since 2011. The agency, a branch of the US Energy Department, said the increase in debt is “not necessarily a negative indicator” and may make sense for some if interest rates are low. Cheap capital has been a key reason why US companies have been able to boost output of shale gas and oil at an explosive rate, helping to lift the US economy out of the Great Recession.

The latest data shows that “tight oil” production has jumped to 3.7m barrels a day (b/d) from half a million in 2009. The Bakken field in North Dakota alone pumped 1m b/d in May, equivalent to Libya’s historic levels of supply. Shale gas output has risen from three billion cubic feet to 35 billion in just seven years. The EIA said America will increase its lead as the world’s largest producer of oil and gas combined this year, far ahead of Russia or Saudi Arabia. However, the administration warned in May that “continued declines in cash flow, particularly in the face of rising debt levels, could challenge future exploration and development”. It said that upstream costs of exploring and drilling have been surging, causing companies to raise long-term debt by 9pc in 2012, and 11pc last year. Upstream costs rose by 12pc a year from 2000 to 2012 due to rising rig rates, deeper water depths, and the costs of seismic technology.

Read more …

• China’s 2020 Shale Gas Production Target Cut In Half (BW)

Tapping China’s vast shale-gas reserves has proved more difficult than government planners in Beijing once hoped. In 2012, China’s National Energy Administration projected that, by 2020, from 60 billion to 80 billion cubic meters (bcm) of domestic shale gas would be pumped annually. Earlier this week the country’s energy chief, Wu Xinxiong, slashed the goal in half, to 30 billion bcm by 2020. According to the U.S. Energy Information Administration, China’s holds the world’s largest reserves of theoretically recoverable shale gas. But much of it is locked in mountainous regions in western China.

While China’s leaders – concerned about steeply rising energy demand accompanying rapid urbanization – dearly want to emulate the U.S.’s shale-gas boom, it turns out Americans have several practical advantages. For starters, the U.S. shale-gas revolution kicked off in fairly accessible regions: the flatlands of Texas, North Dakota, and Pennsylvania. So far, explorations in China have identified only one clearly promising shale play: Fuling shale gas field, near the western megalopolis of Chongqing. Sinopec, which controls the Fuling field, projects that its annual shale gas production will reach 5 bcm by 2015 and 10 bcm by 2017. With no other comparable sites yet identified, it’s not clear where the other 20 bcm may come from. While Sinopec is currently at the forefront of China’s shale-gas development, two foreign companies, Royal Dutch Shell and Hess, have secured production-sharing contracts for other potential sites.

Read more …

• Iraqi PM Maliki Digs In, Sends Loyal Forces Into Baghdad (Reuters)

Iraqi Prime Minister Nuri al-Maliki was battling to keep his job on Monday, deploying forces across Baghdad as some parliamentary allies sought a replacement and the United States warned him not to obstruct efforts to form a new government. Widely accused of a partisan obstinacy that has fuelled the communal violence tearing Iraq apart, the Shi’ite Muslim premier went on television late on Sunday to denounce the ethnic Kurdish president for delaying the constitutional process of naming a prime minister following a parliamentary election in late April. However, President Fouad Masoum won a rapid endorsement from Washington. With Sunni fighters from the Islamic State making new gains over Kurdish forces north of Baghdad, the United States renewed its call for Iraqis to form a consensus government to try and end bloodshed that has prompted the first U.S. air strikes since the U.S. occupation ended in 2011.

And in pointed remarks aimed at Maliki, Secretary of State John Kerry said: “The government formation process is critical in terms of sustaining stability and calm in Iraq, and our hope is that Mr. Maliki will not stir those waters. “There will be little international support of any kind whatsoever for anything that deviates from the legitimate constitution process that is in place and being worked on now.” Complicating efforts to propose a replacement from among fellow Shi’ites, who appear to have some support from both the country’s leading cleric and from the Shi’ite establishment of neighbouring Iran, the country’s highest court ruled that Maliki’s State of Law bloc is the biggest in the new parliament. That, a senior Iraqi official said, was “very problematic” for attempts to have President Masoud offer the premiership to an alternative candidate to Maliki – an alternative that one senior member of his party said had been close to being chosen.

Read more …

• US Begins Directly Arming Kurdish Forces In Iraq (IBT)

The administration of US president Barack Obama has begun directly providing weapons to Kurdish forces who have started to make gains against Islamic militants in Iraq. The US previously insisted on selling arms only to the Iraqi government. US officials say the administration is close to approving plans for the Pentagon to arm the Kurds. Recently the US military has been helping facilitate weapons deliveries from the Iraqis to the Kurds, who had been losing ground to the Islamic State militant group, formerly known as Isis. The move to directly aid the Kurds underscores the level of US concern about the Islamic State militants’ gains in the north, and reflects the persistent administration view that the Iraqis must take the necessary steps to solve their own security problems. A senior US state department official would only say that the Kurds are “getting arms from various sources. They are being rearmed”. To bolster that effort, the administration is also very close to approving plans for the Pentagon to arm the Kurds, a senior official said.

In recent days, the US military has been helping facilitate weapons deliveries from the Iraqis to the Kurds, providing logistic assistance and transportation to the north. The move comes as Iraqi prime minister Nuri al-Maliki is battling to keep his job today, deploying forces across Baghdad as some parliamentary allies sought a replacement and the United States warned him not to obstruct efforts to form a new government. Widely accused of a partisan obstinacy that has fuelled the communal violence tearing Iraq apart, the Shi’ite Muslim premier went on television late on yesterday to denounce the ethnic Kurdish president for delaying the constitutional process of naming a prime minister following a parliamentary election in late April. However, president Fouad Masoum won a rapid endorsement from Washington. With Sunni fighters from the Islamic State making new gains over Kurdish forces north of Baghdad, the United States renewed its call for Iraqis to form a consensus government to try and end bloodshed that has prompted the first US air strikes since the US occupation ended in 2011.

Read more …

• US Pulls Support for Iraqi PM Maliki as Militants Gain (Bloomberg)

U.S. Secretary of State John Kerry pulled support from Iraq’s Prime Minister Nouri al-Maliki today, telling him not to hinder the political process amid reports that Islamic State militants had seized a town northeast of Baghdad.Kerry said that the U.S. was backing Iraq’s President Fouad Masoum and that Maliki wasn’t even among the three candidates Iraqis wanted as the next prime minister.“We stand absolutely, squarely behind President” Fouad Masoum, Kerry said in Sydney. “He has the responsibility for upholding the constitution of Iraq, he is the elected president, at this moment Iraq has clearly made a statement that they are looking for change.”

Political haggling in Iraq is hurting government attempts to curb advances by an al-Qaeda breakaway group that ravaged the north of the country and drew U.S. air strikes. U.S. President Barack Obama has said that greater U.S. assistance in pushing back Islamic State forces would only come if a more inclusive government was formed that didn’t marginalize Sunni and other minorities.While U.S. strikes have slowed Islamic State advances in the north, the group still holds vast swaths of territory in Syria and Iraq, including key installations such as dams, military outposts and Iraq’s biggest northern city. Kurdish forces on Sunday were able to retake the towns of Makhmour and Gwer, south of Erbil, where militants retreated after U.S. airstrikes, according to the Kurdish news agency Rudaw, citing officials.

Read more …

Blowback coming right up.

• New York Times Discovers Ukraine’s Neo-Nazi Shock Troops In Action (Parry)

The New York Times reported almost in passing on Sunday that the Ukrainian government’s offensive against ethnic Russian rebels in the east has unleashed far-right paramilitary militias that have even raised a neo-Nazi banner over the conquered town of Marinka, just west of the rebel stronghold of Donetsk. That might seem like a big story – a U.S.-backed military operation, which has inflicted thousands of mostly civilian casualties, is being spearheaded by neo-Nazis. But the consistent pattern of the mainstream U.S. news media has been – since the start of the Ukraine crisis – to white-out the role of Ukraine’s brown-shirts. Only occasionally is the word “neo-Nazi” mentioned and usually in the context of dismissing this inconvenient truth as “Russian propaganda.” Yet the reality has been that neo-Nazis played a key role in the violent overthrow of elected President Viktor Yanukovych last February as well as in the subsequent coup regime holding power in Kiev and now in the eastern offensive. On Sunday, a NYT article by Andrew E. Kramer mentioned the emerging neo-Nazi paramilitary role in the final three paragraphs:

“The fighting for Donetsk has taken on a lethal pattern: The regular army bombards separatist positions from afar, followed by chaotic, violent assaults by some of the half-dozen or so paramilitary groups surrounding Donetsk who are willing to plunge into urban combat. “Officials in Kiev say the militias and the army coordinate their actions, but the militias, which count about 7,000 fighters, are angry and, at times, uncontrollable. One known as Azov, which took over the village of Marinka, flies a neo-Nazi symbol resembling a Swastika as its flag. “In pressing their advance, the fighters took their orders from a local army commander, rather than from Kiev. In the video of the attack, no restraint was evident. Gesturing toward a suspected pro-Russian position, one soldier screamed, ‘The bastards are right there!’ Then he opened fire.”

In other words, the neo-Nazi militias that surged to the front of anti-Yanukovych protests last February have now been organized as shock troops dispatched to kill ethnic Russians in the east – and they are operating so openly that they hoist a Swastika-like neo-Nazi flag over one conquered village with a population of about 10,000. Burying this information at the end of a long article is also typical of how the Times and other U.S. mainstream news outlets have dealt with the neo-Nazi problem in the past. When the reality gets mentioned, it usually requires a reader knowing much about Ukraine’s history and reading between the lines of a U.S. news account.

Read more …

Never a dull moment for Vladimir V.

• Putin in Push to Douse New Discord on Russia’s -Other- Doorstep (Bloomberg)

Russian President Vladimir Putin, staring down the deepening unrest in Ukraine, tried the role of peacemaker by brokering the first meeting in nine months between the leaders of Armenia and Azerbaijan following the deadliest clashes between the ex-Soviet republics in 20 years. The talks, which yielded little beyond a promise of more negotiations, showed Putin playing statesman with a war raging next door in Ukraine, where he’s faced accusations of stoking the conflict. Two days of meetings at his retreat in Sochi were marked by another fatality on the frontlines of the disputed region of Nagorno-Karabakh, with an Azeri soldier killed late on Aug. 9 by Armenian fire, according to the Defense Ministry in Baku. That brought the death toll to 24 since July 26.

“No way do they need a war in Karabakh,” Thomas de Waal, senior associate at the Carnegie Endowment for International Peace in Washington, said by e-mail yesterday. “Russia has a strong incentive in preventing a new conflict, as it would cause massive instability in its southern tier. It also has treaty obligations to defend Armenia militarily and would therefore also destroy its carefully developed relationship with Azerbaijan.” Failure to break the deadlock threatens to unleash war in a region where companies led by BP have invested more than $40 billion to develop Azerbaijan’s oil and gas fields. Russia’s role in Ukraine is complicating an effort by Putin to assert his sway in the former Soviet Union, according to Matthew Bryza, the U.S. ambassador to Azerbaijan in 2010-2011. The government in Moscow has repeatedly denied any involvement in the unrest in eastern Ukraine.

[..] The South Caucasus countries, which border Turkey and Iran, signed a cease-fire brokered by Russia in 1994 after more than 30,000 people were killed and more than 1.2 million were displaced. Armenians took over Nagorno-Karabakh and seven surrounding districts from Azerbaijan in a war after the Soviet breakup in 1991. The truce left 20,000 Armenian and Azeri troops, dug into World War I-style trenches sometimes only 100 meters (330 feet) apart, according to the Carnegie Endowment for International Peace. The conflict is part of the region’s “Soviet legacy,” Putin said as he opened negotiations yesterday. “We must show patience, wisdom and respect for each other to find a solution,” he said. The Azeri and Armenian leaders traded accusations in Putin’s presence, blaming each other for violating international agreements on Karabakh. Even so, both presidents said they support a peaceful solution to the conflict and praised Putin for his mediation efforts. About 700,000 Azeris were forced to leave the districts, 200,000 Azeris left Armenia and more than 360,000 Armenians fled Azerbaijan.

Read more …

Oh yes, it will.

• Brace For Japan GDP, It’s Going To Be Ugly (CNBC)

Japan’s economy is expected to have lost all the ground it gained earlier this year during the second quarter as the April consumption tax hike appears to have thrown the fragile recovery off its tracks. Asia’s second-largest economy, which is set to release gross domestic product (GDP) data on Wednesday, shrunk an annualized 7.1% in the April to June quarter, according to a Reuters poll, down sharply from a 6.7% gain in the previous three months. “The consumption tax hike that started in April will have a broad-based impact on demand components with consumption, residential investment and capex [capital expenditure] in particular expected to decline sharply,” Yoshiro Sato, economist at Credit Agricole wrote in a note. “That said, it is inevitable given the tax hike that the economy will contract following the robust growth thanks to the front-loaded increase in demand,” he said.

In April, Japan raised its consumption tax to 8% from 5%, the first increase in 17 years, as part of efforts to rein in mounting public debt. When Japan last lifted the sales tax to 5% from 3% in 1997, the economy fell into recession not too long afterwards. A raft of disappointing economic data in recent weeks has raised concerns that the April sales tax hike could prove more damaging than initially thought. Industrial output, for example, fell 3.3% on month in June – the fastest rate since the devastating earthquake and tsunami in March 2011 as companies scaled back production to offset a build-up in inventories.

Read more …

Costly, Angela?

• German Economy Backbone Bending From Lost Russia Sales (Bloomberg)

MWL Apparate Bau, based in the eastern German town of Grimma, has relied on strong ties with Russia to bolster business. Today, those links don’t mean much. The maker of equipment such as pressure vessels and hot water tanks for the chemical and petrochemical industries has seen a “significant” decline in orders in the last six months due to the crisis, sales chief Reinhard Weber said. The company has annual revenue of about €20 million ($27 million). “There are two contracts from Russia we didn’t get and we think that’s for political reasons,” Weber said in a telephone interview. “They’re afraid of sanctions being extended — that they will make an order and that we won’t be able to fulfill it because of political decisions in Germany or Europe.”

MWL is one of many businesses in Germany’s Mittelstand, the thousands of small- and medium-sized companies that form the backbone of Europe’s largest economy, that are already getting pinched as Russian customers put off purchases. With the crisis now intensifying through deeper European Union and U.S. sanctions and retaliatory measures from Russia banning EU and U.S. food imports, they’re preparing for an even bigger hit. Take Amandus Kahl. The maker of food processing and recycling machinery near Hamburg had expected to bring in about €10 million in revenue this year from Russia. Sales to the country “have pretty much evaporated because our clients can’t get financing,” Rochus Mecke, a Kahl’s sales director, said in an interview. “We still get inquiries, but it’s only inquiries.”

Read more …

Yup. No matter who you define it.

• Sanctions Will Deepen Euro Area Deflation (CNBC)

France’s powerful farm lobby asked last Friday for an immediate removal from the market of all EU fruits and vegetables that can no longer be exported to Russia. A similar action was urged with regard to milk, milk products, meat and fish. The fear is that excess supply would crush food prices and a heavily subsidized EU farm sector. The European media are abuzz about sanction effects. Dutch News.nl, for example, reported today (Sunday, August 10) that last Friday one kilogram (2.2 pounds) of spinach in the city of Zaltbommel was down to €0.30 from €1.1 when the sanctions hit the market on Wednesday, August 6. At this writing, an expert group is working at the EU Commission to assess the impact of this initial round of economic warfare with Russia. A broader group of national farm officials is expected to meet next Thursday, and Brussels is promising that “up to €400 million” could be paid out to compensate the sanctions-hit farmers.

Looking at all this, several things come to mind. First, this should have come as no news to the EU. Russia has been repeating for months that it would respond to Western sanctions. After the third wave of crippling measures directed at several sensitive sectors of Russian economy in mid-July, Moscow warned that it would target the EU farm business, and that further action will affect trade in automobile, aircraft and shipbuilding industries. Russia delivered on the first part of its counter-sanctions on August 6, 2014. In spite of all the warnings, the EU now seems totally surprised and indignant that Russia dared to respond. That is an unfortunate lack of EU preparedness to play this deadly serious sanctions game. As a result, a number of countries (Finland, Poland and some Baltic states) have already asked Brussels to compensate them for their trade losses.

Second, the compensation of “up to $400 million euros” promised by Brussels is wholly inadequate. Russia is the second-largest market for EU farm exports. It takes 10% of EU farm products representing annual sales of €12 billion. France alone accounts for about €1 billion of that export trade with Russia. No wonder the influential German and French media are now turning on their governments. Witnessing the sinking of their equity market (down 11% since its peak in late June), the Germans are reminding themselves of how much their government ignored the teachings of their own war strategist (General Carl von Clausewitz) about the management of hostilities. And in an apparent dig at Chancellor Merkel, her Foreign Minister Steinmeier complained recently that “sanctions alone are not a policy.” The raw nerve was apparently also touched by the news last Friday that the company Rheinmetall is now asking the government to use taxpayers’ money to compensate it for a €100 million contract it was forced to cancel with Russia.

Read more …

They’ll step out soon.

• Punishing Russia Provokes Finnish Dismay as Fallout Seen Unfair (Bloomberg)

After backing the European Union in expanding sanctions against Russia, Finland is now regrouping to consider what it describes as the disproportionate fallout of the crisis on its own economy. No other euro nation is as hard hit by the aftermath of the crisis in Ukraine as Finland, trade figures for the single currency bloc show. Prime Minister Alexander Stubb last week underscored the need for “solidarity” in the EU, making clear he expects any measures to “treat EU members similarly. If the impact isn’t equal, we’ll consider what kind of solutions we will seek.” The 28-nation EU has repeatedly struggled to speak with one voice, from how to handle the debt crisis and most recently with its economic response to the political turmoil at its eastern border.

Finland already has a proven track record of successfully carving out special rights within European accords. During the sovereign debt crisis, Finland was the only country to seek and obtain compensation for its contribution to bailouts in the form of collateral. “It creates an image of a country that engages in politics very much from its own perspective rather than a common European point of view,” Pasi Kuoppamaeki, chief economist at Danske Bank A/S in Helsinki, said by phone. “Of course, many others do that too.” In a counter-move to western sanctions, President Vladimir Putin slapped import bans on an array of foods last week, compounding the economic pain for Finland of faltering Russian demand and a weaker ruble. With 14% of Finland’s trade coming from Russia, those developments are exacerbating the Nordic country’s efforts to exit its second recession since 2008. “I hope the sanctions aren’t broadened,” Stubb told reporters on Friday. “This isn’t a trade war.”

Read more …

Europe? Where’s that?

• Europe’s Growth Engine Stutters as Spain Beats Germany (Bloomberg)

Germany probably underperformed Spain last quarter for the first time in more than five years as the euro-area recovery almost ground to a halt. After leading the currency bloc out of its longest-ever recession last year, Europe’s largest economy contracted in the three months through June, according to a Bloomberg News survey. The downturn in the region’s powerhouse highlights the fragility of a revival that European Central Bank President Mario Draghi has described as modest and uneven. The 18-nation euro area is struggling to boost growth and inflation even amid unprecedented ECB stimulus, with Draghi citing inadequate structural reforms as a key reason. While the German data is distorted by mild winter weather that front-loaded output earlier in the year, Bundesbank President Jens Weidmann has warned the country must also adjust or risk losing its role as a growth engine. This week’s reports “will probably underline that the problems in the euro zone have moved north,” said Ralph Solveen, an economist at Commerzbank AG in Frankfurt.

“The weak recovery will definitely provide the doves in the ECB Governing Council with a weighty argument to demand further expansionary measures.” German GDP shrank 0.1% in the three months through June, the first contraction since 2012, according to the median estimate in the Bloomberg survey. The economies of the euro area and France grew 0.1%, separate surveys show. The reports will be published on Aug. 14 along with those for the Netherlands, Austria and Portugal. Spain posted an expansion of 0.6% in the same period, the National Statistics Institute said last month. Italian GDP fell 0.2%, after a 0.1% decline in the previous quarter, taking the country into its third recession since 2008. Draghi took aim at Italy last week for lack of progress in reforms. “It’s pretty clear that the countries that have undertaken a convincing program of structural reforms are performing better, much better, than the countries that have not done so,” he said on Aug. 7 in Frankfurt after the ECB left interest rates unchanged at record lows.

Read more …

Sounds good, will look awful.

• PM Matteo Renzi Defends Pace Of Italian Reform (FT)

Matteo Renzi, Italy’s prime minister, says the eurozone’s third-largest economy is on track to hit its EU-mandated budget targets this year despite falling back into recession in the second quarter and, in a pugnacious interview with the Financial Times, defended the speed at which his reforms are moving. Mr Renzi, speaking in the prime minister’s office in Rome, rejected suggestions made by European Central Bank president Mario Draghi last week that the EU should intervene in countries where reforms were not being implemented fast enough to spur economic growth. “I agree with Draghi when he says that Italy needs to make reforms but how we are going to do them I will decide, not the Troika, not the ECB, not the European Commission,” he said. “I will do the reforms myself because Italy does not need someone else to explain what to do.” On Wednesday it was revealed that Italy unexpectedly fell back into recession in the second quarter for the third time since 2008.

The economy shrank 0.2% quarter-on-quarter between April and June, after contracting 0.1% in the first three months of the year, having only briefly emerged from two years of recession at the end of 2013. Economists have said the fall in gross domestic product may result in the general government budget deficit breaching the EU’s 3% of GDP threshold for 2014. Fabio Fois, an economist at Barclays in Milan, expects the deficit will pass the 3% limit unless the government cuts spending by between €1.2bn and €3.2bn. Mr Renzi, who took power in a party coup in February and whose centre-left democratic party won a landslide victory in the European elections in May with an unprecedented 40% of the vote, vowed to take personal control of Italy’s ongoing spending review to ensure compliance with the EU targets. “I have absolutely no intention of breaking the 3% ceiling. We hope to have better [growth] figures in the second half and as a result will be at 2.9% [of GDP].

Read more …

Struggling to make it all look rosy?

• ECB Struggling To Process Banks’ Stress-Test Data (MarketWatch)

The European Central Bank is having problems processing the large amount of data it receives from banks for the industry’s current health check of the industry, according to a report in the German media. The ECB has told Germany’s Bundesbank that it is “technically unable” to handle the adjusted data sets it had previously ordered banks to submit for the stress test, German weekly Euro am Sonntag reports, citing an email sent by the German central bank to domestic lenders. It added the ECB now wants banks to resubmit the data in a template format. A spokesman for the ECB said the “comprehensive assessment is on track to be concluded as planned, with results in the second half of October.” He added the ECB has been engaging with the banks and is refining its approach “to ensure we manage the process as effectively as is possible for all involved” where appropriate.

Read more …

Just step into the shadows.

• Chinese Banks Get Serious About Risk Of Bad Debts (Reuters)

Chinese banks are scrambling to get on top of bad debts they have downplayed for years, cutting off riskier borrowers, further tightening lending terms and, in one case, deploying teams of investigators to assess the risk of loan defaults. China’s banks keep reporting bad loan levels well below what most analysts consider realistic, but their recent actions suggest the slowing economy may be squeezing borrowers and lenders harder than thought only a few months ago. China’s fifth-largest lender, Bank of Communications, assembled research teams last month to look over the assets of troubled borrowers in Zhejiang province, according to bank sources and an internal document. The province is a hotbed of China’s credit stress. BoCom denied that special teams had been set up or that there was any surge in potential bad loans in an email to Reuters. The bank said it had always placed great importance in its risk control efforts.

Bankers from other major listed lenders said they were further cutting lending to riskier borrowers, in particular smaller private companies. “We’re lending almost exclusively to state-owned enterprises in our department at the moment, because it’s just seen as the least risky,” said a senior loan officer at the Bank of China. The banker, who would not be named because he is not authorized to speak to the media, added that the bank had also raised the bar for state-owned firms, in particular by demanding more collateral. Lawyers for banks say increasing numbers of transactions fall through because of lenders’ last-minute risk worries. A senior lawyer, who works for Industrial and Commercial Bank of China among others, said only a third of the financing deals she had been asked to work on were actually completed this year. This compares to 70% in the last two years, she said. [..]

In March, Reuters reported that Chinese banks had become unsettled by some highly publicized defaults and were toughening terms for highly indebted borrowers or those plagued by overcapacity. Now it appears that banks are moving one step further, effectively cutting off many private firms from financing. Regulators may welcome signs that banks have become more diligent in assessing risk, but it is bad news for policymakers and China’s near-term economic prospects. Beijing has been counting on consumption and a services sector dominated by private firms to take up the slack as it aims to cut industrial overcapacity and China’s over-reliance on large state-financed investment projects.

Read more …

Lots.

• China Property Defaults Seen as Financing Stresses Mount (Bloomberg)

China’s slumping property market is fueling speculation the industry is set for a shakeout as small developers face difficulty raising funds to pay off debt. Yield premiums on Chinese real-estate bonds denominated in dollars have jumped 35 basis points this month to 582 basis points over Treasuries, the sharpest increase among emerging Asian countries, according to Bank of America Merrill Lynch indexes. That compares with a 19 basis-point advance for Indonesian builders. Moody’s Investors Service and Standard & Poor’s said some smaller Chinese developers may default in the second half amid falling sales and shrinking access to credit. China’s real-estate industry poses the biggest near-term risk to growth in the world’s second-largest economy after new home prices dropped in the most cities in two years in June, according to JPMorgan Chase & Co. While government steps to ease property curbs helped builder bonds rally in July, they’re giving up those gains ahead of housing-price data due next week.

“The operating environment is still tough for Chinese developers,” said Franco Leung, a senior analyst in Hong Kong at Moody’s. “Banks in China have become more selective in lending to developers. Those weaker developers still face liquidity pressure.” “Given the fragmented nature of the property market in China and the sheer number of developers, it wouldn’t be surprising if there are news of developers being in financial difficulty or of outright defaults,” said Swee Ching Lim, a Singapore-based credit analyst at Western Asset Management Co. Home prices fell in 55 of 70 cities in June from May, the National Bureau of Statistics said on July 18, the most since January 2011 when the government changed the way it compiles the data. The inventory of unsold new homes in 20 large cities jumped to an average equivalent of more than 23 months of sales in June, according to Shenzhen World Union Properties Consultancy Inc. The floor space of unsold new apartments nationwide as of June 30 surged 25% from a year earlier, government data show.

Read more …

What can I say? Farrell!

• 100% Risk Of 50% Crash If Hillary Clinton Wins In 2016 (Paul B. Farrell)

OK, we get it. Everybody gets it. Big crash coming. Been trending all over the news. For months. Blogs. Cable. Networks. Social media. Hour after hour. Minute after minute. We get it. Crash ahead. Third big one of the century. Bet on it. But so what? Hillary? Jeb? Chris? Doesn’t matter. Markets don’t care who wins. Big crashes happen, about every eight years. Everybody knows it. Nobody really cares. Why? We love playing the game of musical chairs, in the race to the 2016 presidency. And everyone’s playing. 95 million Main Street investors. Millions of Wall Street pros. Super Rich billionaires, private-equity firms, hedge funds, pension managers. Every CEO, trader, adviser, broker, fund. Everybody loves playing with hundreds of trillions. Everybody. Yes, the market’s going to crash. Again. Crashes are part of the game. In fact, knowing a big crash is coming makes the game more exciting. We’re playing to squeeze out another point, maybe time our exit before the inevitable collapse.

The bull run is up over 250% since 2009. Maybe it’s time to get out. But the economy’s looking up, so we’ll risk going for more gains, more thrills, racing to the 2016 top. This new musical chairs game reminds us of that upbeat bank CEO in our favorite Robert Mankoff New Yorker cartoon: The CEO is at a podium motivating shareholders. Imagine Michael Douglas in Oliver Stone’s classic “Wall Street”: “While the end-of-the-world scenario will be rife with unimaginable horrors, we believe that the pre-end period will be filled with unprecedented opportunities for profit.” That’s the spirit driving another exciting game of musical chairs till 2016. Next crash: $10 trillion like dot-com 2000? Subprime 2008? Play the game .. How big a drop? Truth is, nobody really knows. But everybody has an opinion. First using this or that favorite theory, cycle, index, data, algorithm. Then they guess. And millions of investors pile in the trending herd, all chasing the same news media, alerts, opinions, guesses. As gigabytes of data endlessly overload us all day, every day, 24/7.

How big? Even the pros don’t really have a clue. They make consensus guesses. All over the map. This one up. Next down. A roller coaster. Not much help in today’s algorithm driven news business that’s more like a scattergun when we wish we had a sniper rifle. All that in a mess of contradictions hidden in a war zone of mental land mines. But we are absolutely certain something is coming. Bigger than the Silicon Valley’s dot-com crash after the 2000 millennium celebrations. That triggered a 30-month recession. Bigger than the 2008 Wall Street banks subprime credit collapse that put America in virtual bankruptcy. Does anyone really care, about the future? No, only today. What’s trending now? Our brains have lost the capacity to think long-term. We drift from trend to trend: The latest buzz. Rarely going deep, never into the future. Nor ask the moral questions, what’s the right thing to do? What counts: Today’s trends. That’s all. We’re playing the musical chairs game.

Read more …

Rat race to the bottom.

• Public Pensions Cannot Stop Chasing Performance (BW)

Two basic principles of investing hold up remarkably well: Past results really don’t predict future performance, and high fees eat away at your returns. Smart investors don’t chase performance (as much as they can help themselves) and keep costs to a minimum. Unfortunately for taxpayers, the experts who run public pension funds aren’t following these rules. What’s more, they have little incentive to start.First, the good news: Public pensions in California, Ohio, and New Jersey have been reducing their investments in hedge funds, noting high fees and poor performance, the Wall Street Journal reported. The Los Angeles Fire and Police fund invested $500 million in a hedge fund that returned less than 2% over the last seven years; the fund had comprised just 4% of Fire & Police’s portfolio but 17% of investment fees paid.

The pension plans reconsidering these high-fee, low-performance investments include those with allocations to hedge funds ranging from 1.6% to 15% of assets, according to the Journal. What they share, though, is dismal returns: The average hedge fund return for public pensions was 3.6% for the three years ended March 31, a period when returns from stocks were up more than 10%. But for all the griping about hedge funds’ high costs and lousy performance, it doesn’t appear pension funds have learned their lesson: They are maintaining their investment in private equity, in some cases, even expanding it. Private equity funds invest in non-publically traded assets; like hedge funds, they also promise higher returns—in exchange for high fees and often more risk. And historically, private equity has been a bust for pensions, too.

Research by economists Josh Lerner, Antoinette Schoar, and Wan Wong found public pensions underperformed in private equity relative to other institutional investors such as endowments, private pensions, and insurance companies. In the period they looked at (funds raised from 1991 to 2001), the pension funds’ private equity investments didn’t do much better than an equity index fund. So why the preference for private equity? It sure looks like performance chasing. According to the Journal, private equity investments returned more than 10% to large pension funds in the last three years. Accordingly, pension funds have dived in.

Read more …

Basic Income, citizens’ income. Sounds good to me.

• Would A Citizen’s Income Be Better Than Our Benefits System? (Guardian)

Photo: Fraser Gray/Rex Features

One radical suggestion is for everybody to receive a citizen’s income. Under this scheme, waged and unwaged, children and adults, the working aged and pensioner, rich and poor alike would receive the same basic income financed by the phasing out of virtually every tax relief and allowance. Those on benefits would not face high marginal tax rates if they took a job, but merely pay PAYE at the current standard rate of 20% on every pound they earned. Those working 20 hours a week on the minimum wage could work 40 hours a week without losing more than 50% of their extra earnings in lost tax credits. There would be other advantages from such a system. First, it would be universal and hence avoid the stigma attached to benefits. Secondly, people taking a job or starting a business would have the security of knowing that they would still have their citizen’s income if the venture did not work out.

Concerns that a citizen’s income would encourage the idle to sit at home all day watching daytime TV do not appear to be supported by evidence from pilot schemes in other countries. Even so, there would be cases where this did happen and they would doubtless be highlighted as an example of a something-for-nothing culture. Other drawbacks include the failure so far to construct a citizen’s income that obviates the need for housing benefit, and the political difficulty in persuading voters that a millionaire should be getting the same citizen’s income as a milkman. So far support for a citizen’s income is limited to the Green party, although the government’s switch to a flat-rate state pension is a step in that direction. The truth is that no tax and benefit system is perfect. But the one we have is costly, bureaucratic, ineffective – and ripe for reform.

Read more …

• Australia’s ‘Wait For The Dole’ For Under-30s ‘Deeply Disturbing’ (Guardian)

More than 100,000 young people will have to wait six months for unemployment benefits under the government’s proposed budget measure, with social services advocates warning they face “deeply disturbing” knock-on effects. Briefings given to various groups by the Department of Social Services show that 113,000 people a year aged under 30 will be denied the Newstart and Youth Allowance payments for six months. After this period young jobseekers will have to commit to 25 hours a week in a work-for-the-dole scheme. The government will also require those on unemployment benefits to apply for 40 jobs a month, double the current requirement. The government is facing difficulty in getting Senate support for its changes to the unemployment benefits system. Labor and the Greens are opposed to the changes while Clive Palmer, whose Palmer United party holds three crucial Senate seats, has said the proposals simply punish the jobless, with the majority of unemployed people “already trying desperately to find work”.

The Australian Council of Social Service said the scope of the measure would leave many young people suffering severe monetary and mental distress. “The human impact will be deeply disturbing, as this isn’t a small number of people,” Cassandra Goldie, chief executive of Acoss, told Guardian Australia. “When you look at other places that have experimented this, such as the UK, you see tragic examples of people in deep depression, overwhelmed by a lack of hope. “We should be proud of the social safety net we have in Australia. We shouldn’t be a country where if you can’t get a job you face the prospect of not being able to eat, turn on the light, or losing your housing altogether.” Goldie said the government was misguided if it thought young people were not trying hard enough to find jobs. “At the moment there are 165,000 jobs available out there and 800,000 people looking for work. The competition is very hard, especially for those who face barriers such as discrimination.

Read more …