Edwin Rosskam Service station, Connecticut Ave., Washington, DC Sep 1940

Saudi Arabia vs its former partners, but still with the US, in a long established protection racket.

• Low Oil Price Means High Anxiety For OPEC As US Flexes Its Muscles (Observer)

During a week of turmoil on the global stock markets, the energy sector played out a drama that could have even bigger consequences: a standoff between the US and the Opec oil-producing nations. While pension holders and investors watched aghast as billions of pounds were lost to market gyrations, a fossil-fuel glut and a slowing global economy have driven the oil price down to a level that could save the world $1.8bn a day on fuel costs. If this is some consolation for households everywhere after last week’s hit on stock market wealth, it means pain for the Opec cartel, composed mainly of Middle East producers. Opec’s 12-member group has largely controlled the global price of crude oil for the past 40 years, but the US’s discovery of shale oil and gas has dramatically shifted the balance of power, to the apparent benefit of consumers and the discomfort of petrostates from Venezuela to Russia.

The price of oil has plummeted by more than a quarter since June but will Opec, which holds 60% of the world’s reserves and 30% of supplies, cut its own production to try to lift prices? Or will the cartel allow a further slide from the current price – in the mid-$80s per barrel – in the hope of making it impossible for US drillers to make a profit from their wells, and so driving them out of business? Saudi Arabia – Opec powerhouse and traditional ally of Washington – and other rich Gulf nations have been building up their cash reserves and have shown themselves willing to slash prices in a bid to retain market share in China and the rest of Asia. The US, the world’s biggest oil consumer, has relied in the past on Saudi to keep Opec price rises relatively low. But now it has the complicating factor of protecting its own huge shale industry.

Even US oil producers see the political benefits of abundant shale resources and the resultant downward pressure on prices. Rex Tillerson, chief executive of Exxon Mobil, the biggest US oil company, said recently that his country had now entered a “new era of energy abundance” – meaning it is no longer dependent on the politically unstable Middle East. So there will be understandable tension next month when the ruling Opec body meets in Vienna and its member states fight over what to do. The cartel would like to reassert its authority over oil prices but some producing countries, such as Saudi, can withstand lower crude values for much longer than others, and the relative costs of production vary wildly between nations.

That’s what I’m hoping for.

• Germany’s Tough Medicine Risks Killing Off The European Project (Observer)

Beppe Grillo, the comedian-turned-rebel leader of Italian politics, must have laughed heartily. No sooner had he announced to supporters that the euro was “a total disaster” than the currency union was driven to the brink of catastrophe once again. Grillo launched a campaign in Rome last weekend for a 1 million-strong petition against the euro, saying: “We have to leave the euro as soon as possible and defend the sovereignty of the Italian people from the European Central Bank.” Hours later markets slumped on news that the 18-member eurozone was probably heading for recession. And there was worse to come. Greece, the trigger for the 2010 euro crisis, saw its borrowing rates soar, putting it back on the “at-risk register”. Investors, already digesting reports of slowing global growth, were also spooked by reports that a row in Brussels over spending caps on France and Italy had turned nasty.

With China’s growth rate continuing to slow, and US data showing the world’s largest economy was not as immune to the turmoil as many believed, it was time to head for the hills. Wall Street slumped and a month of falls saw the FTSE 100 lose 11% of its value. In the wake of the 2008 global financial crisis, voters backed austerity and the euro in expectation of a debt-reducing recovery. But as many Keynesian economists warned, this has proved impossible. More than five years later, there are now plenty of voters willing to call time on the experiment, Grillo among them. And there seems to be no end to austerity-driven low growth in sight. The increasingly hard line taken by Berlin over the need for further reforms in debtor nations such as Greece and Italy – by which it means wage cuts – has worked to turn a recovery into a near recession.

Given Europe’s size, they always were.

• Why The Eurozone’s Woes Have Become The World’s Problem (Observer)

Forget the economic threat posed by Ebola. Pay scant heed to the risk that the Chinese property bubble is about to be pricked. Take with a pinch of salt the risk that an imminent rise in US interest rates will trigger a wave of disruption across the fragile markets of the emerging world. In the end, the explanation for last week’s plunge on global financial markets comes down to one word: Europe. That’s not to say none of the other factors matter. Global pandemics, all the way back to the Black Death in the 14th century, have always been economically catastrophic. The knock-on effects of America starting to jack up the cost of borrowing are uncertain, but potentially problematical. The dangers facing policymakers in China as they seek to move the economy towards lower but better balanced growth are obvious. But it is the worsening condition of the eurozone that has spooked markets in the past couple of weeks.

The problem can be broken down into a number of parts. The first problem is that recovery in Europe appears to have been aborted. A tentative recovery began in the middle of 2013, but appears to have run into the sand. Technically, the eurozone has been in and out of recession since 2008. In reality, the story of the past six years has been of a deep slump followed by half a decade of flatlining. Until now, markets have been able to comfort themselves with the fact that the core of the eurozone – Germany – has been doing fine. Recent evidence has shown that the slow growth elsewhere in Europe, in countries such as France and Italy, is now having an effect on Germany. Exports and manufacturing output are suffering, not helped by the blow to confidence caused by the tension in Ukraine. That’s problem number two.

Until now, opposition from Berlin and the still influential Bundesbank in Frankfurt has made it impossible for the European Central Bank to fire its last big weapon: quantitative easing. The slowdown in Germany should make it easier for the ECB’s president, Mario Draghi, to begin cranking up the electronic printing presses, but are markets impressed? Not really. They are coming to the view that monetary policy – using interest rates and QE to regulate the price and quantity of money – is maxed out. The third facet of the problem is concern that Draghi’s intervention will be too little, too late, and that Europe is condemned to years of nugatory growth.

This is as crazy and disgraceful as the over 50% youth unemployment in southern Europe.

• Under-30s Being Priced Out Of The UK (Observer)

Britain is on the verge of becoming permanently divided between tribes of haves and have-nots as the young increasingly miss out on the opportunities enjoyed by their parents’ generation, the government’s social mobility tsar claim. The under-30s in particular are being priced out of owning their own homes, paid lower wages and left with diminishing job prospects, despite a strong economic recovery being enjoyed by some. Those without the benefits of wealthy parents are condemned to languish on “the wrong side of the divide that is opening up in British society”, according to Alan Milburn, the former Labour cabinet minister who chairs the government’s Commission on Social Mobility. In an illustration of how the less affluent young have been abandoned, Milburn notes that even the Saturday job has become a thing of the past. The proportion of 16- to 17-year-olds in full-time education who also work has fallen from 37% to 18% in a decade.

Milburn spoke out in an interview with the Observer as tens of thousands of people, including public sector workers such as teachers and nurses opposed to a below-inflation 1% pay offer from the government, protested in London, Glasgow and Belfast about pay and austerity on Saturday. The TUC, which organised the protests under the slogan “Britain Needs a Pay Rise”, said that between 80,000 and 90,000 people took part in the London march. Speaking on the eve of the publication of his final annual report on social mobility to ministers before the general election, Milburn demanded urgent action by the state and a change in direction by businesses. He said that only a radical change would save a generation of Britons buffeted by an economic downturn and condemned by a fundamental change in the labour market that left them without hope of better lives.

In a strikingly downbeat intervention, Milburn said: “It is depressing. The current generation of young people are educated better and for longer than any previous one. But young people are losing out on jobs, earnings and housing. “This recession has been particularly hard on young people. The ratio of youth to adult unemployment rates was just over two to one in 1996, compared to just under three to one today. On any definition we are nowhere near the chancellor’s objective of “full employment” for young people. Young people are the losers in the recovery to date.”

Britain as a mirror to the world.

• Britain’s Five Richest Families Worth More Than Poorest 20% (Guardian)

The scale of Britain’s growing inequality is revealed by a report from a leading charity showing that the country’s five richest families now own more wealth than the poorest 20% of the population. Oxfam urged the chancellor George Osborne to use Wednesday’s budget to make a fresh assault on tax avoidance and introduce a living wage in a report highlighting how a handful of the super-rich, headed by the Duke of Westminster, have more money and financial assets than 12.6 million Britons put together. The development charity, which has opened UK programmes to tackle poverty, said the government should explore the possibility of a wealth tax after revealing how income gains and the benefits of rising asset prices had disproportionately helped those at the top. Although Labour is seeking to make living standards central to the political debate in the run-up to next year’s general election, Osborne is determined not to abandon the deficit-reduction strategy that has been in place since 2010.

But he is likely to announce a fresh crackdown on tax avoidance and measures aimed at overseas owners of high-value London property in order to pay for modest tax cuts for working families. The early stages of the UK’s most severe post-war recession saw a fall in inequality as the least well-off were shielded by tax credits and benefits. But the trend has been reversed in recent years as a result of falling real wages, the rising cost of food and fuel, and by the exclusion of most poor families from home and share ownership. In a report, a Tale of Two Britains, Oxfam said the poorest 20% in the UK had wealth totalling £28.1bn – an average of £2,230 each. The latest rich list from Forbes magazine showed that the five top UK entries – the family of the Duke of Westminster, David and Simon Reuben, the Hinduja brothers, the Cadogan family, and Sports Direct retail boss Mike Ashley – between them had property, savings and other assets worth £28.2bn.

The most affluent family in Britain, headed by Major General Gerald Grosvenor, owns 77 hectares (190 acres) of prime real estate in Belgravia, London, and has been a beneficiary of the foreign money flooding in to the capital’s soaring property market in recent years. Oxfam said Grosvenor and his family had more wealth (£7.9bn) than the poorest 10% of the UK population (£7.8bn). Oxfam’s director of campaigns and policy, Ben Phillips, said: “Britain is becoming a deeply divided nation, with a wealthy elite who are seeing their incomes spiral up, while millions of families are struggling to make ends meet. “It’s deeply worrying that these extreme levels of wealth inequality exist in Britain today, where just a handful of people have more money than millions struggling to survive on the breadline.”

Chasing the last few suckers left.

• UK Mortgage Battle Hots Up As Banks Prepare To Slash Rates (Guardian)

The battle to tempt mortgage customers with attractive deals is heating up again as major lenders put more rate cuts into action. Barclays is preparing to offer what it said are some of its lowest ever rates, including a three-year fixed rate at 2.29%, a five-year fix at 2.85% and a 10-year fix at 3.49%. All of these deals are aimed at people with 40% deposits and come with a £999 fee. Barclays is also cutting the rate on its innovative family springboard mortgage, which helps people with only a 5% deposit get on the property ladder by allowing their parents to put some money into a savings account which is then linked to the mortgage. The savings money is later released back to their parents with interest, provided that the mortgage payments are kept up to date. The rate on a three-year fixed family springboard deal, which has no application fee, is to be slashed from 3.79% to 2.99%.

The bank is also cutting rates on deals aimed at people with deposits of 10%, 15%, 20% and 30% in what will be the seventh consecutive round of reductions to its range. Barclays said its “never seen before” rate cuts will come into place early this week and they are likely to be around for only a limited period. Meanwhile, a new 0.99% deal from HSBC will be launched on Monday. HSBC has said the product, which is available for borrowers with a 40% deposit, has the lowest rate it has ever offered. The 0.99% deal is in effect a 2.95% discount off HSBC’s 3.94% standard variable rate (SVR), which lasts for two years. In theory, HSBC could decide to increase its SVR within the two-year discount period, which would mean the rate would move above 0.99% but the borrower would still get a rate of 2.95% below whatever the new SVR rate was for the two years after initially taking out the deal.

Exactly what I’ve always said all the time about Abenomics. It should be held up as an example for all of our stimulus measures.

• Why Abenomics Failed: There Was A “Blind Spot From The Outset” (Zero Hedge)

Ever since Abenomics was announced in late 2012, we have explained very clearly that the whole “shock and awe” approach to stimulating the economy by sending inflation into borderline “hyper” mode in a country whose main problem has to do with an aging population demographic cliff and a global market that no longer thinks Walkmen and Sony Trinitrons are cool and instead can find all of Japan’s replacement products for cheaper and at a higher quality out of South Korea, was doomed to failure. Very serious sellsiders, economists and pundits disagreed and commended Abe on his second attempt at fixing the country by doing more of what has not only failed to work for 30 years, but made the problem worse and worse.

Well, nearly two years later, or roughly the usual delay before the rest of the world catches up to this website’s “conspiratorial ramblings”, the leader of the very serious economist crew, none other than Goldman Sachs, formally admits that Abenomics was a failure, and two weeks after Goldman also admitted that now Japan is informally (and soon officially) in a triple-drip recession, begins the scapegoating process when in a note by its Naohiko Baba, it says that Abenomics failed because all along it was based on two faulty “misconceptions and miscalculations.” Ironically, the same “misconceptions and miscalculations” that frame the Keynesian “recovery” debate in every insolvent developed world country which is devaluing its currency to boost its exports and economy, when in reality all it is doing is propping up its stock market, allowing the 1% of the population to cash out and leaving the 99% with the economic collapse that inevitably follows.

So what happened with Abenomics, and why did Goldman, initially a fervent supporter and huge fan – and beneficiary because those trillions in fungible BOJ liquidity injections made their way first and foremost into Goldman year end bonuses – change its tune so dramatically?

Bit of a loose argument, since Feynman never specifically talked about economics, but point taken.

• Richard Feynman On The Social Sciences (Tavares)

Looking back at his own experience, Feynman was keenly aware of how easy our experiments can deceive us and thus of the need to employ a rigorous scientific approach in order to find the truth. Because of this, he was highly critical of other sciences which did not adhere to the same principles. The social sciences are a broad group of academic disciplines concerned with the study of the social life of human groups and individuals, including anthropology, geography, political science, psychology and several others. Here is what he had to say about them in a BBC interview in 1981:

“Because of the success of science, there is a kind of a pseudo-science. Social science is an example of a science which is not a science. They follow the forms. You gather data, you do so and so and so forth, but they don’t get any laws, they haven’t found out anything. They haven’t got anywhere – yet. Maybe someday they will, but it’s not very well developed. “But what happens is, at an even more mundane level, we get experts on everything that sound like they are sort of scientific, expert. They are not scientists. They sit at a typewriter and they make up something like ‘a food grown with a fertilizer that’s organic is better for you than food grown with a fertilizer that is inorganic’. Maybe true, may not be true. But it hasn’t been demonstrated one way or the other. But they’ll sit there on the typewriter and make up all this stuff as if it’s science and then become experts on foods, organic foods and so on. There’s all kinds of myths and pseudo-science all over the place.

“Now, I might be quite wrong. Maybe they do know all these things. But I don’t think I’m wrong. See, I have the advantage of having found out how hard it is to get to really know something, how careful you have about checking your experiments, how easy it is to make mistakes and fool yourself. I know what it means to know something. “And therefore, I see how they get their information. And I can’t believe that they know when they haven’t done the work necessary, they haven’t done the checks necessary, they haven’t done the care necessary. I have a great suspicion that they don’t know and that they are intimidating people by it. I think so. I don’t know the world very well but that’s what I think.”

Amen. Word.

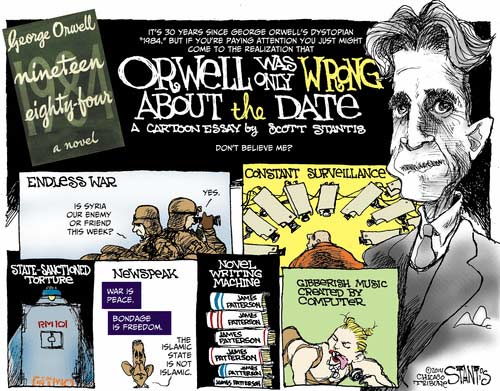

• Orwell Was Only Wrong About The Date (Scott Stantis)

Wildlife Photographer of the Year exhibition.

• Struggle Against Extinction: The Pictures That Capture The Story (Observer)

Toshiji Fukuda went to extraordinary lengths to photograph an Amur tiger, one of the world’s rarest mammals, in 2011. He built a tiny wooden hut overlooking a beach in Russia’s remote Lazovsky nature reserve, on the Sea of Japan, and spent the winter there. Fukuda was 63 at the time. “Older people have one advantage: time passes more quickly for us than the young,” he said later. Possession of such resilience was fortunate because Fukuda had to wait seven weeks for his only glimpse of an Amur tiger, which resulted in a single stunning image of the animal strolling imperiously along the beach below his hide. “It was as if the goddess of the Taiga had appeared before me,” he recalled.

In recognition of the photographer’s efforts, Fukuda was given a key award at the 2013 Wildlife Photographer of the Year exhibition, an annual event that has showcased the best images taken of the planet’s rarest animals and habitats and which has taken on an increasingly important role in recording their fates. This year’s exhibition, which opens on Friday, is the 50th such exhibition – to be held, as usual, at the Natural History Museum – and a recent study of past winning images has revealed the unexpected twists of fortune that have affected the world’s wildlife. Some animals, which appeared to be doing well, have plummeted towards extinction. Others, which seemed to be doomed, have bounced back. “It still seems to be very much a matter of hit or miss whether a threatened species recovers or instead continues to dwindle towards extinction,” said the museum’s curator of mammals, Roberto Portela Miguez.

” … a life-denying ideology, which enforces and celebrates our social isolation. The war of every man against every man – competition and individualism, in other words – is the religion of our time…”

• The Age Of Loneliness Is Killing Us (Monbiot)

What do we call this time? It’s not the information age: the collapse of popular education movements left a void filled by marketing and conspiracy theories. Like the stone age, iron age and space age, the digital age says plenty about our artefacts but little about society. The anthropocene, in which humans exert a major impact on the biosphere, fails to distinguish this century from the previous 20. What clear social change marks out our time from those that precede it? To me it’s obvious. This is the Age of Loneliness. When Thomas Hobbes claimed that in the state of nature, before authority arose to keep us in check, we were engaged in a war “of every man against every man”, he could not have been more wrong. We were social creatures from the start, mammalian bees, who depended entirely on each other. The hominins of east Africa could not have survived one night alone. We are shaped, to a greater extent than almost any other species, by contact with others. The age we are entering, in which we exist apart, is unlike any that has gone before.

Three months ago we read that loneliness has become an epidemic among young adults. Now we learn that it is just as great an affliction of older people. A study by Independent Age shows that severe loneliness in England blights the lives of 700,000 men and 1.1m women over 50, and is rising with astonishing speed. Ebola is unlikely ever to kill as many people as this disease strikes down. Social isolation is as potent a cause of early death as smoking 15 cigarettes a day; loneliness, research suggests, is twice as deadly as obesity. Dementia, high blood pressure, alcoholism and accidents – all these, like depression, paranoia, anxiety and suicide, become more prevalent when connections are cut. We cannot cope alone.

Yes, factories have closed, people travel by car instead of buses, use YouTube rather than the cinema. But these shifts alone fail to explain the speed of our social collapse. These structural changes have been accompanied by a life-denying ideology, which enforces and celebrates our social isolation. The war of every man against every man – competition and individualism, in other words – is the religion of our time, justified by a mythology of lone rangers, sole traders, self-starters, self-made men and women, going it alone. For the most social of creatures, who cannot prosper without love, there is no such thing as society, only heroic individualism. What counts is to win. The rest is collateral damage. British children no longer aspire to be train drivers or nurses – more than a fifth say they “just want to be rich”: wealth and fame are the sole ambitions of 40% of those surveyed.

Why anyone would want to do Guy McPherson the honor of talking about his loony tunes is beyond me, but here goes. Nicole gets mentioned.

• Human Extinction? Not So Much (Ecoshock)

The case against going extinct soon due to extreme climate change & human impacts.

The sadness is unspeakably deep.

• White Rhino Dies In Kenya: Only Six Animals Left Alive In The World (Observer)

An endangered northern white rhino has died in Kenya, a wildlife conservancy has said, meaning only six of the animals are left alive in the world. Suni, a 34-year-old northern white, and the first of his species to be born in captivity, was found dead on Friday by rangers at the Ol Pejeta Conservancy near Nairobi. While there are thousands of southern white rhinos in the plains of sub-Saharan Africa, decades of rampant poaching has meant the northern white rhino is close to extinction. Suni was one of the last two breeding males in the world as no northern white rhinos are believed to have survived in the wild. Though the conservancy said Suni was not poached, the cause of his death is currently unclear. Suni was born at the Dvur Kralove Zoo in Czech Republic in 1980. He was one of the four northern white rhinos brought from that zoo to the Ol Pejeta Conservancy in 2009 to take part in a breeding programme.

Wildlife experts had hoped the 90,000-acre private wildlife conservancy, framed on the equator and nestled between the snow capped Mount Kenya and the Aberdare mountain range, would offer a more favourable climate for breeding. The conservancy said in a statement: “The species now stands at the brink of complete extinction, a sorry testament to the greed of the human race. “We will continue to do what we can to work with the remaining three animals on Ol Pejeta in the hope that our efforts will one day result in the successful birth of a northern white rhino calf.” Suni’s father, Suit, died in 2006 of natural causes, also aged 34.

” … levels of the radioactive isotope cesium are now at 251,000 becquerels per liter, three times higher than previously-recorded levels.”

• Radiation Levels At Fukushima Rise To Record Highs After Typhoon (RT)

The amount of radioactive water near the Fukushima Daiichi nuclear plant has risen to record levels after a typhoon passed through Japan last week, state media outlet NHK reported on Wednesday. Specifically, levels of the radioactive isotope cesium are now at 251,000 becquerels per liter, three times higher than previously-recorded levels. Cesium, which is highly soluble and can spread easily, is known to be capable of causing cancer. Meanwhile, other measurements also show remarkably high levels of tritium – another radioactive isotope of hydrogen. Samples from October 9 indicate that there are 150,000 becquerels of tritium per liter in the groundwater near Fukushima, according to Japan’s JIJI agency. Compared to levels recorded last week, that’s an increase of more than 10 times.

Additionally, “materials that emit beta rays, such as strontium-90, which causes bone cancer, also shattered records with a reading of 1.2 million becquerels, the utility said of the sample,” JIJI reported. Officials blamed these increases on the recent typhoon, which resulted in large amounts of rainfall and injured dozens of people on Okinawa and Kyushu before moving westward towards Tokyo and Fukushima. While cesium is considered to be more dangerous than tritium, both are radioactive substances that authorities would like to keep from being discharged into the Pacific Ocean in high quantities. For now, extra measures to contain the issue are not on the table, since “additional measures have been ruled out since the depth and scope of the contaminated water leaks are unknown, and TEPCO already has in place several measures to control the problem, such as the pumping of groundwater or walls to retain underground water,” according to the IANS news service.

A shocking number: “There are some 3,700 Ebola orphans.”

• Oxfam Calls For Troops In Africa As Ebola Response Is Criticized (Observer)

Anger is growing over the “inadequate” response to the Ebola epidemic this weekend with the World Health Organisation’s Africa office accused of incompetence and world governments of having failed. Aid charities and the president of the World Bank are among the critics, declaring that the fight against the virus is in danger of being lost. On Saturday Oxfam took the unusual step of calling for troops to be sent to west Africa, along with funding and medical staff, to prevent the Ebola outbreak becoming the “definitive humanitarian disaster of our generation”. It accused countries that did not commit military personnel of “costing lives”. The charity said that there was less than a two-month window to curb the spread of the virus but there remained a crippling shortfall in logistical support. Several African countries have for the last decade been suffering severe shortages of homegrown medics thanks to a “brain drain” to countries such as Britain, which rely on foreign workers.

The executive director of frontline medical charity Médecins Sans Frontières, Vickie Hawkins, said national and global health systems had failed. “We are angry that the global response to this outbreak has been so slow and inadequate. “We have been amazed that for months the burden of the response could be carried by one single, private medical organisation, while pleading for more help and watching the situation get worse and worse. When the outbreak is under control, we must reflect on how health systems can have failed quite so badly. But the priority for now must remain the urgent fight against Ebola – we simply cannot afford to fail.” The worst outbreak on record has claimed 4,500 lives, out of 8,914 recorded cases since the start of the year, mostly in Liberia, Sierra Leone and Guinea. The true number is agreed to be higher. There are some 3,700 Ebola orphans.

There should be no doubt about this. Too many reasons for too many people to play it down.

• Ebola Deaths In Liberia ‘Far Higher Than Reported’ (Observer)

The true death toll from the Ebola epidemic is being masked by chaotic data collection and people’s reluctance to admit that their loved ones had the virus, according to one of west Africa’s most celebrated film-makers. Sorious Samura, who has just returned from making a documentary on the crisis in Liberia, said it is very clear on the ground that the true number of dead is far higher than the official figures being reported by the World Health Organisation. Liberia accounts for more than half of all the official Ebola deaths, with a total of 2,458. Overall, the number of dead across Liberia, Sierra Leone and Guinea has exceeded 4,500. Samura, a television journalist originally from Sierra Leone, said the Liberian authorities appeared to be deliberately downplaying the true number of cases, for fear of increasing alarm in the west African country.

“People are dying in greater numbers than we know, according to MSF [Médecins sans Frontières] and WHO officials. Certain departments are refusing to give them the figures – because the lower it is, the more peace of mind they can give people. The truth is that it is still not under control.” WHO has admitted that problems with data-gathering make it hard to track the evolution of the epidemic, with the number of cases in the capital, Monrovia, going under-reported. Efforts to count freshly dug graves had been abandoned. Local culture is also distorting the figures. Traditional burial rites involve relatives touching the body – a practice that can spread Ebola – so the Liberian government has ruled that Ebola victims must be cremated. “They don’t like this burning of bodies,” said Samura, whose programme will air on 12 November on Al Jazeera English. “Before the government gets there they will have buried their loved ones and broken all the rules.”