James McNeill Whistler Miss Ethel Philip Reading 1894

A useful summary fo many things we’ve said many times.

• Debt-Enabled Asset Bubbles On Crash Course With Demographics (Park)

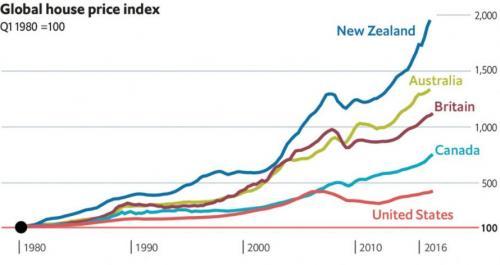

If finance had not been able to ‘securitize’ debts (turn them into assets) and sell them to speculators/investors over the past two decades, then debt creation could not have gone to such extremes and consumers would not have been able to borrow and spend themselves so far into financial ruin. If western consumers had not been able to borrow themselves so far into ruin, they would also not have been able to buy so many goods from Asia and other developing nations for a time.

Asia and developing nations would not then have been able to mint so many new millionaires and billionaires in their governments and businesses who then funneled capital into western property markets, and western property markets would not have appreciated so far beyond domestic income gains. If property prices had not increased so far beyond income gains, then households would not have had to borrow so much just to get a roof over their heads or a post-secondary education. If they had not been able to borrow so much, property prices, education and related services would never have been able to rise so much for so long, and become so unaffordable for the masses. But they did.

[..] The old need the young to drive productivity and innovation, pay taxes and support the social safety net. They also need the young to buy their assets (real estate, securities, businesses) when they wish to downsize and raise liquidity. If the young are broke: under-employed, over-indebted and under-saved, they cannot get a footing and the social contract is undone. Twenty years of central bank and government-enabled debt-driven asset bubbles, have broken long-standing laws of financial and social equilibrium. A secular global repricing cycle is necessary to break the impasse and reboot the system. The status quo is unraveling, as it must.

The same as above.

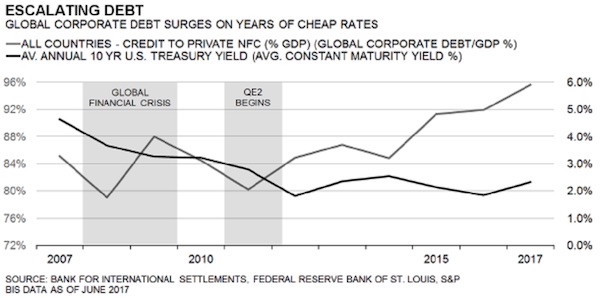

• ‘Grotesque’ Leverage and Rising Rates Already Causing Damage – SocGen (BBG)

The fear over 10-year U.S. Treasury yields breaking through 3 percent has been a long time coming, according to Societe Generale. “Interest rates are already doing damage, people just haven’t noticed,” Andrew Lapthorne, the firm’s global head of quantitative strategy, said in an interview Tuesday. “Leverage in the U.S. is grotesque for this stage of the cycle. At the moment you’ve got peak leverage at peak prices. It’s not like you have to dig deep to find a problem.” The number-one conversation Societe Generale’s having with clients right now is about the correlation between bonds and equities. But risks to corporate balance sheets is a bigger problem at the moment, particularly in the U.S. and China.

Lapthorne said he worries about volatility in debt because of the impact it can have on the economy, particularly how it weighs on businesses and the job market. Credit markets may get choppier due to triggers like high-profile bankruptcies, such as Toys ‘R’ Us, or if corporate buybacks drop, Lapthorne said. While Credit Suisse anticipates fewer share repurchases this year, they’re an outlier. JPMorgan Chase estimates they’ll rise to a record $800 billion from $530 billion last year. Bank of America said if the current pace continues there may be as much as $850 billion in 2018, while Goldman Sachs sees buybacks becoming “less constructive” in 2019. [..] He has further concerns about the direction of the markets as well. “Instead of the usual market driver of economic growth, this bull market has been driven by valuation growth,” Lapthorne said, adding that confidence in asset prices is deteriorating as volatility has risen.

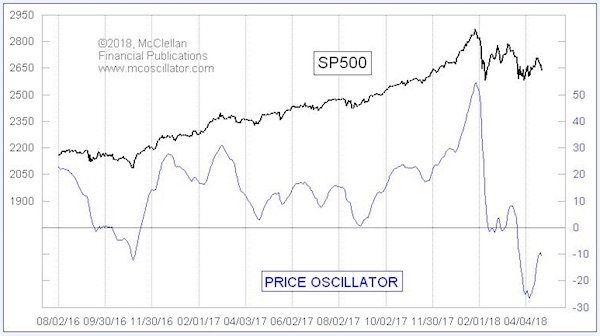

“..a technical indicator using exponential moving averages of closing price data..”

• ‘Big Bear Market’ For Stocks Appears To Have Begun (MW)

The “big bear market” for stocks that market timer Tom McClellan has been expecting appears to have begun, as Tuesday’s broad selloff turned a key technical indicator down from an already negative position to convey a “promise” of lower lows. McClellan, publisher of the McClellan Market Report, said there could be a pause in the downtrend this week, as his market-timing signals point to a minor top due on Friday. But with his “price oscillator” turning lower following the Dow Jones Industrial Average 425-point drop, and the S&P 500 1.3% slide on Tuesday, he turned bearish for short- and intermediate-term trading styles. He has been bearish for long-term trading styles since Feb. 28.

“I have been looking for a big downturn in late April….We appear to have gotten that downturn now,” McClellan wrote in a note to clients. He said it is possible that the big down move pauses briefly in honor of the minor top signal due Friday, “but it should be a lasting and painful downtrend, heading down toward a bottom due in late August.” His bearishness for all trading styles was a result of the McClellan Price Oscillator, a technical indicator using exponential moving averages of closing price data, turning down after it was already in negative territory, as the chart below shows. “Turning down a Price Oscillator while it is still below zero conveys the promise of a lower closing low on the ensuing move,” McClellan wrote. Since “promise” isn’t the same as a “guarantee,” he said the indication can get revoked if the Price Oscillator turns up right away.

Central bank control is an illusion. Naked emperors.

• Market Is Obsessed With 10-Year Yield, Should Be Watching The 2-Year (CNBC)

The government’s benchmark debt instrument saw its yield pass 3% Tuesday, a four-year high that ostensibly helped to trigger a violent stock market reversal that saw the Dow industrials close lower by about 425 points. The calculus behind fear of the 3% yield seems obvious: With the S&P 500 dividend yield at 1.9%, a risk-free investment like U.S. Treasurys yielding 3% makes more sense in a volatile environment. But that reasoning is weak. The play assumes holding the bond to duration and clipping coupons, and the stock market has never shown inflation-adjusted returns that low over a 10-year period. Absent a major crash and a deep recession it likely won’t over the next decade as well.

The next two years, though? That could be a different story. While everyone on Wall Street is pounding the table over the rising 10-year yield, the 2-year note rose above 2.5% Wednesday, a level it last closed at August 2008, just a month before the financial crisis imploded with the collapse of Lehman Brothers. A risk-free investment with a 2.5% yield over two years? That seems a little more reasonable. Investors who bought the 2-year in mid-2006 would have gotten it at 5%, ahead of a stock market that was about to drop 60%. “As much as every investor knows market timing is very difficult, that’s the sort of case study that resonates just now,” Nick Colas, co-founder of DataTrek Research, said in his daily note Wednesday.

Investors have been testing the waters over the past month, yanking $868 million out of U.S. equity ETFs while pouring $5.2 billion into funds that invest in fixed income with duration of less than three years, Colas said, citing XTF data. The iShares Short Treasury Bond fund, which focuses on fixed income with duration between one and 12 months, alone has pulled in $3.4 billion over the past month, according to FactSet.

This can’t be good. How much longer?

• Deutsche Bank Plans ‘Significant’ Job Cuts After Sharp Drop In Profits (CNBC)

Deutsche Bank posted first-quarter net profits of 120 million euros ($146 million) Thursday, a 79% fall from last year’s figure. The bank announced plans to significantly reduce its workforce through the rest of 2018, particularly in its corporate and investment bank and infrastructure functions. It also aims to scale back operations in bond sales and equities trading, particularly in the United States and Asia.

The net profit number was significantly lower than a Reuters poll prediction of 376 million euros. The Frankfurt-based lender has been under scrutiny from shareholders for posting three consecutive years of losses, including a 497 million euro loss for 2017. Revenues for the quarter were down by 5% on the prior year period at 7 billion euros, pressured by the appreciation of the euro against the dollar and lower corporate and investment bank revenues, which fell 13% year-on-year to 3.8 billion euros. Revenues for all businesses were lower year-on-year.

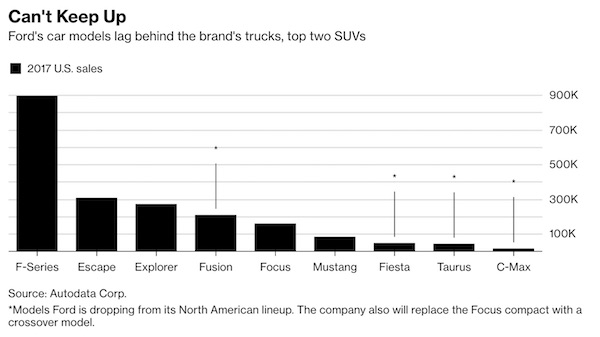

Oh, good, everyone will drive a truck. These things are 40x your weight, not just 20x.

• Ford Kills Most US Cars (BBG)

Ford Motor is sharpening its knives to cleave another $11.5 billion from spending plans and cut several sedans, including the Fusion and Taurus, from its lineup to more quickly reach an elusive profit target. The automaker expects to save $25.5 billion by 2022, Chief Financial Officer Bob Shanks told reporters Wednesday as Ford reported first-quarter earnings per share and revenue that beat estimates. The company now anticipates reaching an 8 percent profit margin by 2020, two years ahead of schedule. The cuts are aimed at kick-starting a turnaround effort almost one year after Ford’s board ousted its chief executive officer.

New CEO Jim Hackett has been trying to convince investors that betting on a rebound is a worthwhile wager by laying out plans to get rid of slow-selling, low-margin car models and refocusing the company around more lucrative sport utility vehicles and trucks. “We’re going to feed the healthy part of our business and deal decisively with areas that destroy value,” Hackett said on an earnings call Wednesday. “We aren’t just exploring partnerships; we’ve now done them. We aren’t just talking about ideas; we’ve made decisions.” Ford finds itself on a road similar to the route Fiat Chrysler followed to pass Ford in North American profitability. Fiat Chrysler CEO Sergio Marchionne now wants to eclipse General Motors before his retirement in 2019.

“..they have had virtually no role in real governance since the Gipper last nodded in their direction decades ago..”

• Yield Shock On Wall Street, Conservative Default In Washington (Stockman)

[..] capitalist prosperity depends upon keeping the state and its central banking branch at bay and out of the way. And once upon a time that pretty much happened because the conservative party in Washington adhered reasonably well to the pillars of sound money, fiscal rectitude, free markets at home and non-intervention abroad. In the last three decades, however, the GOP has either jettisoned these pillars of capitalist prosperity or relegated them to ritual incantation. Either way, they have had virtually no role in real governance since the Gipper last nodded in their direction decades ago. What has happened, instead, is that the neocons hijacked the GOP and turned it into the party of Empire—the very opposite of Robert Taft’s notion of homeland security and non-intervention.

Likewise, the supply siders spread the insidious lie that deficits don’t matter and that you can grow your way out of unfinanced tax cuts. So, too, the devotees of Alan Greenspan and the Wall Street lobbies buried the storied idea of sound money–supplanting it with the new ideology of monetary central planning and stock market bailouts. Stated differently, the GOP in Washington today is essentially useless because it has abandoned the pillars of prosperity and has become an opportunistic gang of neocons, social cons, tax cons and Wall Street hand maidens. As a result, we now have a financial system that is flying blind toward a monumental monetary/fiscal crack-up.

Makes too much sense.

• Democrats Have a Plan to Save the Post Office – and Kill Payday Lenders (NYMag)

Generally speaking, advancing economic justice is neither cheap nor easy. The Democratic Party has assembled a long list of worthwhile economic reforms — almost all of which, for all their considerable virtues, pose either a significant budgetary cost, or policy-design challenge, or political risk (universal child-care costs money; the federal job guarantee is complicated and untested; and Medicare-for-all is disruptive … and complicated, and costs money). But Kirsten Gillibrand’s new plan to establish a public option for banking is an exception to the rule: By requiring the post office to provide basic financial services, Gillibrand’s bill would significantly mitigate the economic exploitation of America’s most vulnerable people, punish predatory lenders — and increase federal revenue — all without requiring policy wonks to navigate uncharted territory, or even break a sweat.

The stagnation of working-class wages in the U.S. combined with the rising cost of housing, and declining value of welfare benefits have left millions of American families dependent on short-term loans to make ends meet. And payday lenders have mined their financial desperation for hefty profits. A parent with a gap in employment and a hungry child is liable to accept a loan no matter how usurious the interest rate. Thus, the average annualized interest rate on a payday loan is 390%. And the average American household that uses alternative forms of credit earns just $25,500 a year — and spends nearly 10% of that meager salary on interest and fees, according to a 2011 KPMG study.

But the post office — with its economies of scale, and freedom from avaricious shareholders — could offer America’s working class access to short-term credit at a fraction of the present cost. Under the current system, billions of dollars move from the pockets of the poor into the coffers of payday lenders each year. Postal banking could redirect those funds — saving low-income borrowers billions on fees and interest, while plowing the (non-usurious) interest payments they do still make into the post office’s trust fund. According to a 2014 study by the Postal Service Inspector General, if just 10% of the money that working Americans currently spend on high-risk financial products were instead spent on loans from the post office, the agency could offer said loans at 90% less than the current market cost — and gain nearly $9 billion in annual revenue in the process.

This, too, are the Democrats. A deeply troubled party. The power of email lists, reminiscent of Facebook.

• The Democratic Party Is Paying Millions For Hillary Clinton’s Email List (IC)

Heading Into The 2018 midterms, with Democrats hoping to take back the House of Representatives and even make a run at the Senate, the party has spent more than $2 million worth of campaign resources on payments to Hillary Clinton’s new group, Onward Together, according to Federal Election Commission filings and interviews with people familiar with the payments. The Democratic National Committee is paying $1.65 million for access to the email list, voter data, and software produced by Hillary for America during the 2016 presidential campaign, Xochitl Hinojosa, a spokesperson for the DNC, told The Intercept. The Democratic Congressional Campaign Committee has paid more than $700,000 to rent the same email list.

Clinton is legally entitled to rent her list to the party, rather than hand it over as a gift, but in 2015, Barack Obama gave his email list, valued at $1,942,640, to the DNC as an in-kind contribution. In 2013 and 2014, OFA had similarly made in-kind contributions exceeding $3.4 million for uses of the list that cycle. Obama’s list was at one point considered to be the most valuable in politics and raised more than twice as much money for the 2012 Obama campaign as Clinton’s did for hers in 2016. The DNC agreement with the Clinton campaign calls on the debt-ridden organization to fork the money over to an entity of Clinton’s choosing, which wound up being Onward Together, the operation she formed after her campaign ceased to exist.

Former DNC Chair Donna Brazile told The Intercept the deal was the result of “tough negotiations between the Clinton campaign and the DNC. I wanted to bring back our assets. I wanted to get as much from them as they got from us,” she said. “Under the terms I worked out, we had to pay quarterly for items that the DNC acquired. The final payment would have been in February of this year.” The DNC announced in April 2017 that Clinton had turned over her email list and related data and tools as an in-kind contribution to the party, with no suggestion that payments would later be made for it. “[P]utting the DNC on a strong footing is something that she’s been very focused on since the campaign, when she set out to leave the DNC in the black and did so,” said Clinton spokesman Nick Merrill at the time.

The biggest problem is people don’t understand the issue, as illustrated by the original headline, which said universal basic income. That’s not what Finland is doing.

• Finland Denies Claims Basic Income Experiment Has Fallen Flat (Ind.)

Finland has denied widespread claims its basic income experiment has fallen flat. A series of media reports said the Finnish government had decided not to expand its trial – a version of events which has been repudiated by officials. Miska Simanainen, a social affairs official, said the trial, where about 2,000 unemployed people aged 25-58 are being paid a tax-free €560 monthly income with no questions asked, was “proceeding as planned.” The €20m programme, which seeks to reform Finland’s social security system, ends in December, at which point Prime Minister Juha Sipila’s centre-right government will assess initial results.

Reports have said the government social affairs agency has requested up to €70m in extra funding this year, something Mr Simanainen says is false. Finland became the first country in Europe to start the basic income experiment in January 2017. Supporters of basic income argue it would help get unemployed people into temporary jobs, rather than forcing them to remain unemployed to qualify for benefits. They say it would provide a safety net, address insecurities associated with workers not having full-time staff contracts, and help boost mobility in the labour market as people would have a source of income between jobs.

Sheer insanity.

• NATO Think-Tank Expert: Russia Is ‘Comfortable’ Using Nuclear Weapons (RT)

Russia is more willing to run the risk of nuclear war than the West and NATO must pour more money into developing new capabilities to deter Moscow’s nuclear aggression, according to Atlantic Council analysts.

In a lengthy discussion on preparing for nuclear war with Russia, analysts from the neocon think tank lobbied for the US and NATO to spend more money on low-yield nuclear weapons and other methods of deterrence in order to dissuade Russia from using a limited nuke strike in order to “de-escalate” a conflict using the scare factor. The panel argued that Russia has adopted a policy of “escalate to de-escalate” which lowers the bar for nuclear weapons use.Under this policy, Russia would respond to a large-scale conventional military attack by employing a limited nuclear response in order to deter further aggression against itself. Matthew Kroenig, the deputy director for strategy at the Atlantic Council’s Scowcroft Center for Strategy and Security, went further by suggesting that Russia is simply “more comfortable using and threatening nuclear weapons” than the West. Russia’s so-called “escalate to de-escalate” policy was even referred to in the latest Nuclear Posture Review from the Trump administration. But while the Atlantic Council and White House are seemingly adamant that Russia is almost looking for excuses to use nuclear weapons, others have argued that the West has actually misunderstood Russia’s policy on nuclear use.

There is weak evidence that Russia has actually dropped its threshold for nuclear use at all. [..] Russia’s 2014 doctrine actually introduced the term “system of non-nuclear deterrence,” which is explained as a focus on preventing aggression “primarily through reliance on conventional (non-nuclear) forces.” It is more than likely that the Atlantic Council and its members are fully aware of this, which leads to the question: are they misleading people on Russia’s intentions in order to lobby for more military spending in Eastern Europe?

We sort of knew that already. But yeah, makes one wonder what Kin is giving up.

• North Korea Nuclear Test Site Has Collapsed Beyond Use – Chinese Study (G.)

North Korea’s main nuclear test site has partially collapsed under the stress of multiple explosions, possibly rendering it unsafe for further testing and leaving it vulnerable to radiation leaks, a study by Chinese geologists has shown. The findings could cast doubt on North Korea’s sincerity in announcing last weekend that it would stop testing nuclear weapons at the site ahead of Friday’s summit between the country’s leader, Kim Jong-un, and the South Korean president, Moon Jae-in. The test site at Punggye-ri, in a mountainous area in North Korea’s north-east, has been the location for all six of the regime’s nuclear tests since 2006.

The findings, by scientists at the University of Science and Technology of China, suggest the partial collapse of the mountain that contains the testing tunnels, as well as the risk of radiation leaks, have potentially rendered the site unusable. The study was published soon after Kim said his country would stop testing nuclear weapons and ballistic missiles, and close down Punggye-ri before his meeting with Moon just south of the countries’ heavily armed border. Nuclear explosions release enormous amounts of heat and energy, and the North’s largest test, in September last year, was believed early on to have rendered the site – a network of tunnels beneath Mount Mantap – unstable.

The Chinese scientists collected collected data for their study following the most powerful of the North’s six nuclear tests, on 3 September. The controlled explosion, which caused an initial magnitude-6.3 tremor, is believed to have triggered four more earthquakes over the following weeks. The study concluded that eight-and-a-half minutes after the test, there was “a near-vertical on-site collapse towards the nuclear test centre”.

Obvious. But he won’t be the only one.

• President Trump Will Personally Review Documents In Cohen Case (ABC)

In a filing Wednesday afternoon, attorneys for President Donald Trump told the federal judge overseeing the investigation of his personal attorney, Michael Cohen, that Trump would, as necessary, personally review documents to ensure that privileged information is not revealed accidentally to the FBI or prosecutors. “…Our client will make himself available, as needed, to aid in our privilege review on his behalf,” wrote attorneys Joanna Hendon, Christopher Dysard and Reed Keefe in their filing. The filing is part of the ongoing effort by Cohen and Trump to get the first crack at reviewing records seized earlier this month from Cohen’s home, hotel and office.

So far, US District Judge Kimba Wood has ruled against Cohen and Trump, though she has said she would be willing to consider their backup request to have an independent third-party review record before prosecutors and agents do. Trump’s attorneys made their submission late Wednesday in advance of a Thursday status meeting in US District Court in Manhattan. The issue of document review arose after the FBI raids and the subsequent public confirmation that Cohen has been under federal investigation for months. The probe is focused both on Cohen’s private business dealings as well as his work for and on behalf of Trump.

May and her government are behind this? And Windrush at the same time?

• UK Businesses Make World-First Pact To Ban Single-Use Plastics (Ind.)

More than 40 major businesses have pledged to eradicate single-use plastics from packaging in an effort to tackle the global pollution crisis. The launch of the UK Plastics Pact comes amid concerns over the impact such waste is having on the environment as it pervades the world’s land, oceans and waterways. With members across major food and non-food brands – including Sainsbury’s, Nestlé and Coca-Cola – the pact’s participants are collectively responsible for more than 80% of the UK’s supermarket plastic packaging. As the first initiative of its kind in the world, it is hoped the pact will serve as a template for other countries and spark a “global movement for change”.

The pact, which was welcomed by government ministers and environmental campaigners, consists of a series of targets that the industry as a whole will aim to meet by 2025. These include the complete elimination of “problematic or unnecessary” single-use plastic packaging by developing new designs and alternative delivery methods. Other targets include all plastic packaging being reusable, recyclable or compostable, and ensuring that at least 70% of packaging that is used actually makes it to recycling or composting facilities. There is also a commitment to ensuring 30% of the content of all plastic packaging comes from recycled sources by the target date.

Contact ourman in Kenya about this: “Yes it happened last year. About 300 factories were shut down, about 6 months notice was given. BUT there is still a black market for low quality black plastic bags amongst smaller vendors in rural areas and small towns. In the major supermarkets plastic has been entirely phased out, though please note that Kenya has a much lower number and density of supermarkets vs Europe. We’re looking at 120/150 major supermarkets country wide and 300-500 mini marts and mostly thousands of smaller kiosks.

Also plastic packaging has not been phased out yet. But they are targeting for the conversion of plastic to paper packaging in products. And also to phase out plastic water bottles if a national recycling scheme is not put in place. They’ve also banned forest logging as the tree cover of the nation is under 6-7%. So we will have to import trees and paper now instead of oil for plastic. [..] There’s been a large number of bans on all sorts of things since last year, we’re in a very weird phase politically. “

• Is The World’s Most Drastic Plastic Bag Ban Working? (G.)

Waterways are clearer, the food chain is less contaminated with plastic – and there are fewer “flying toilets”. A year after Kenya announced the world’s toughest ban on plastic bags, and eight months after it was introduced, the authorities are claiming victory – so much so that other east African nations Uganda, Tanzania, Burundi and South Sudan are considering following suit. But it is equally clear that there have been significant knock-on effects on businesses, consumers and even jobs as a result of removing a once-ubiquitous feature of Kenyan life. “Our streets are generally cleaner which has brought with it a general ‘feel-good’ factor,” said David Ong’are, the enforcement director of the National Environment Management Authority.

“You no longer see carrier bags flying around when its windy. Waterways are less obstructed. Fishermen on the coast and Lake Victoria are seeing few bags entangled in their nets.” Ong’are said abattoirs used to find plastic in the guts of roughly three out of every 10 animals taken to slaughter. This has gone down to one. The government is now conducting a proper analysis to measure the overall effect of the measure. The draconian ban came in on 28 August 2017, threatening up to four years’ imprisonment or fines of $40,000 (£31,000) for anyone producing, selling – or even just carrying – a plastic bag.