Vincent van Gogh Peasant burning weeds 1883

“..the FANG trade is dead and the market is struggling to find a replacement.”

• Dow Plunges 600 Points As Apple Leads Tech Rout (CNBC)

The Dow Jones Industrial Average fell 602 points on Monday after a big decline in Apple shares, a rise in the U.S. dollar and lingering worries about global trade weighed on investor sentiment. Monday’s losses bring the Dow’s decline over the past two sessions to 804 points; it closed at 25,387.18. The tech-heavy Nasdaq Composite pulled back 2.8 percent to 7,200.87 and fell back into the correction territory it first entered during the October market rout. The S&P 500 dropped 2 percent to 2,726.22 as financials tanked, led by Goldman Sachs. In late-afternoon trading, the major indexes hit their lows of the day after Bloomberg News reported the White House was circulating a draft report on auto tariffs. Shares of General Motors turned negative following the report.

Apple shares tanked by 5 percent after Lumentum Holdings, which makes technology for the iPhone’s face-recognition function, cut its outlook for fiscal second quarter 2019. Lumentum CEO Alan Lowe said one of its largest customers asked the company to “materially reduce shipments” for its products. Shares of Lumentum plunged 33 percent. The decline in Apple pressured the broader technology sector. The Technology Select Sector SPDR dropped 3.5 percent. Alphabet and Amazon shares pulled back 2.7 percent and 4.3 percent, respectively. Amazon shares fell into bear-market territory, down about 20 percent from its 52-week high. [..] Peter Boockvar, chief investment officer at Bleakley Advisory Group, said “the FANG trade is dead and the market is struggling to find a replacement.”

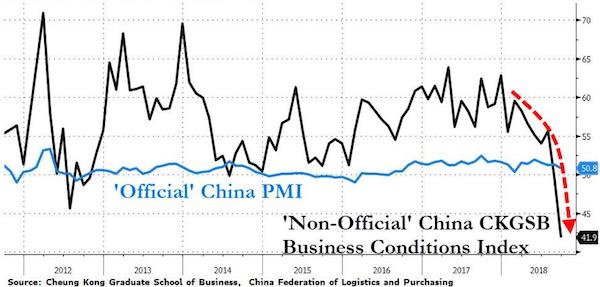

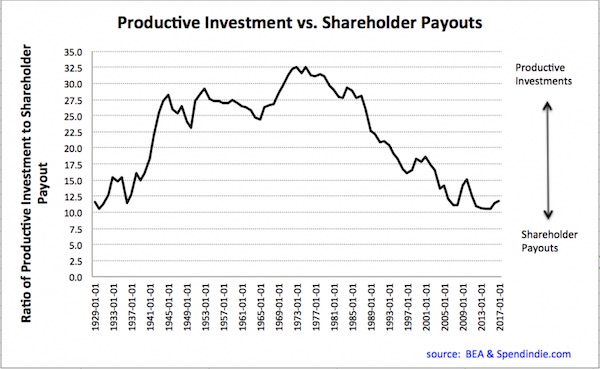

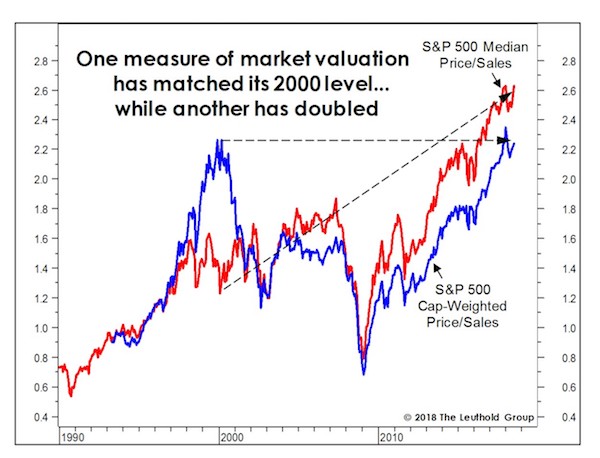

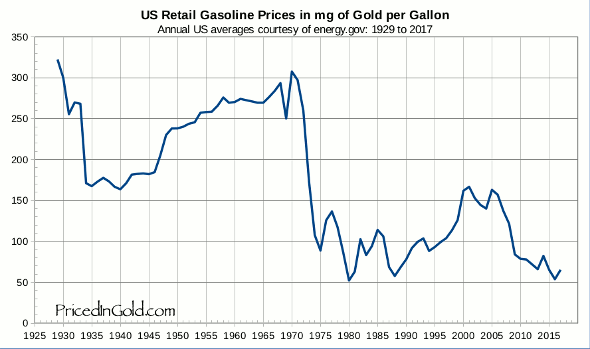

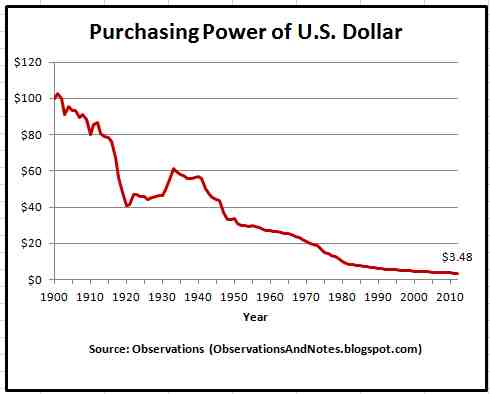

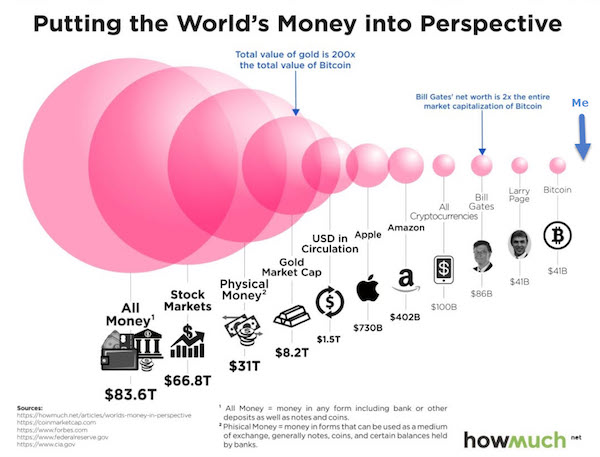

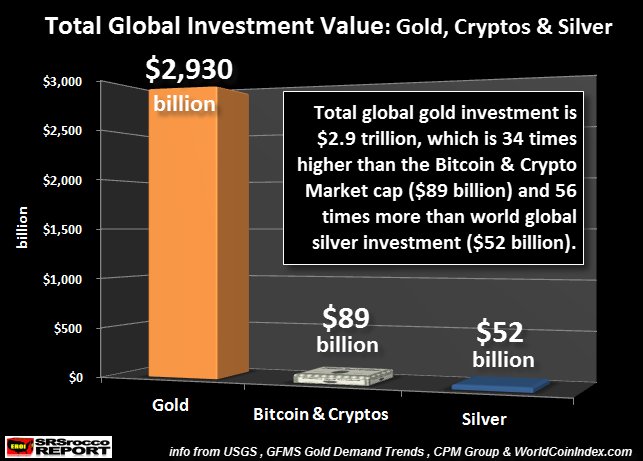

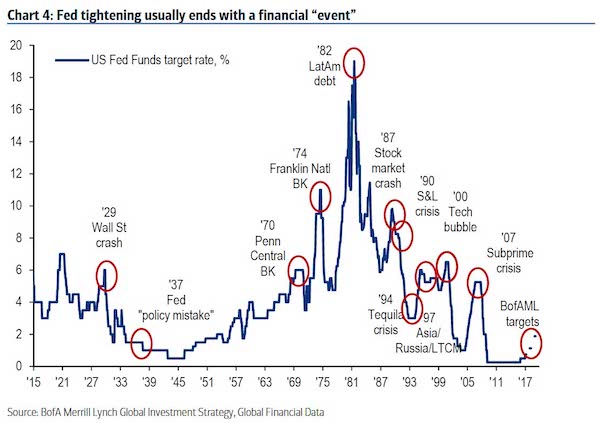

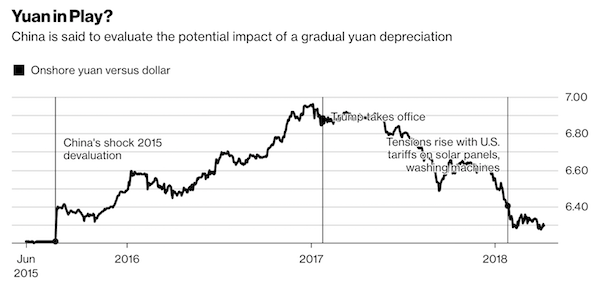

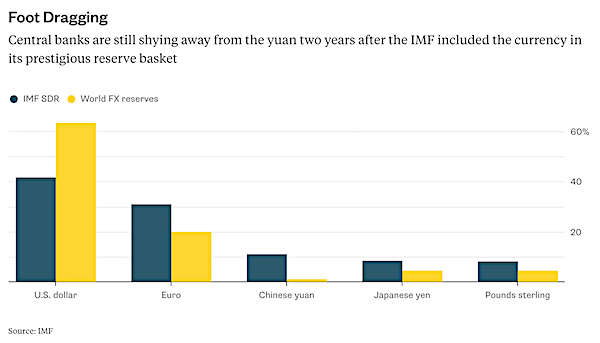

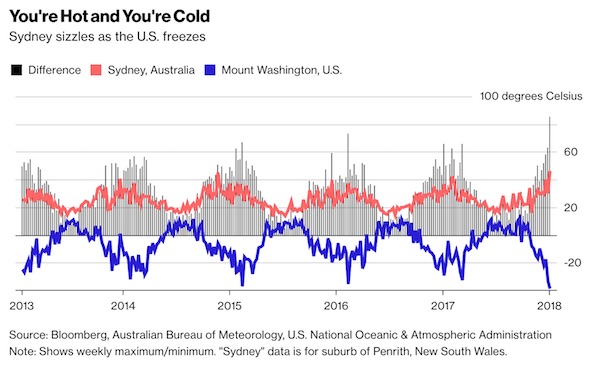

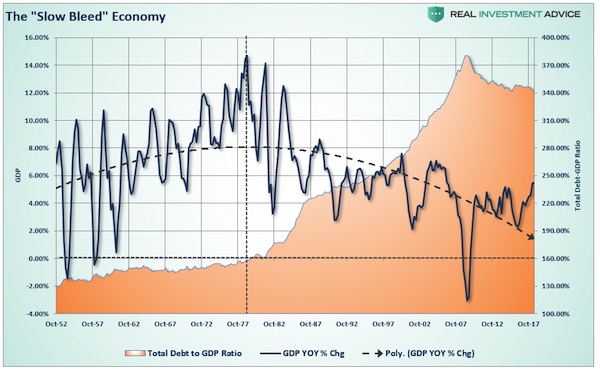

I’m partial to the last graph. It shows an undeniable long term trendline.

• The Economic Consequences Of Debt (Roberts)

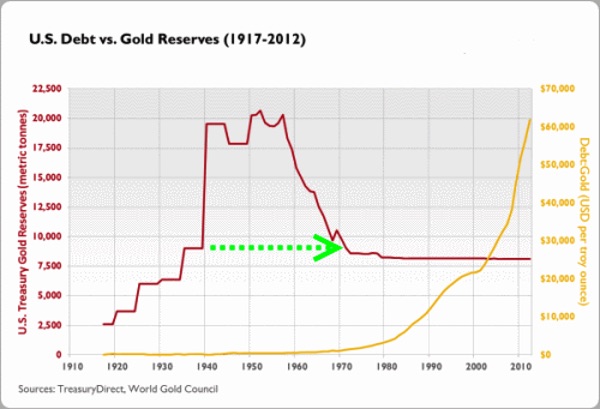

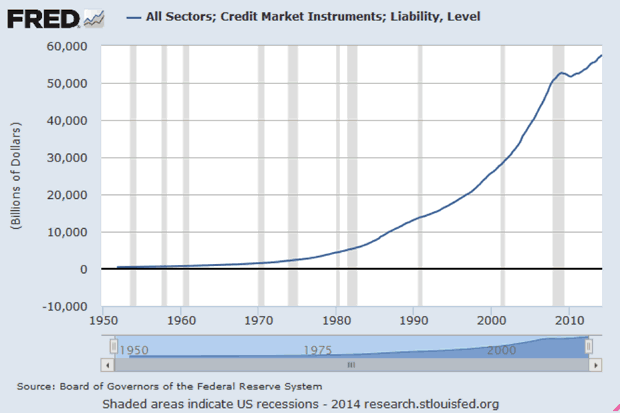

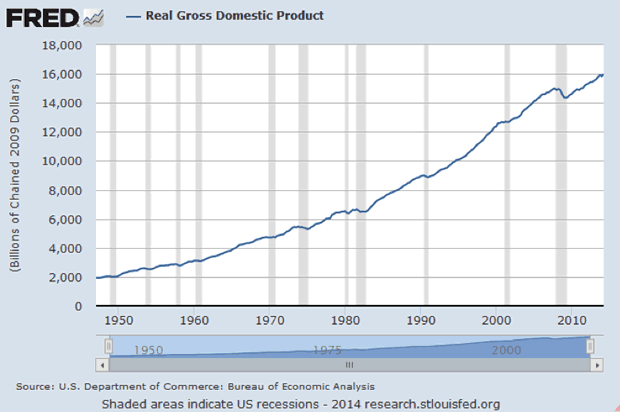

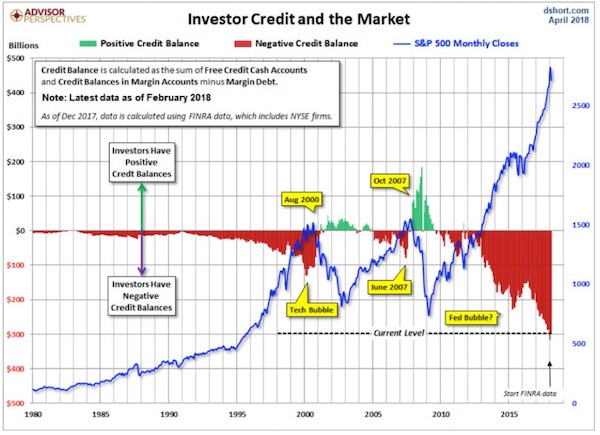

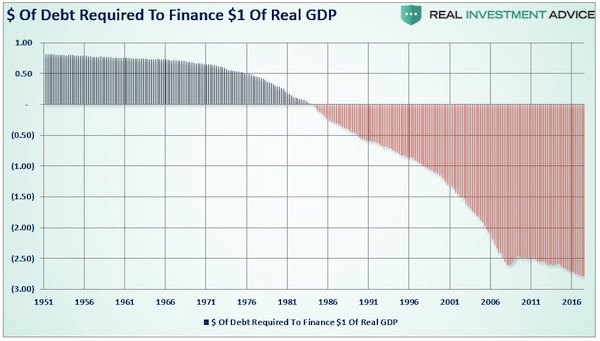

The relevance of debt growth versus economic growth is all too evident as shown below. Since 1980, the overall increase in debt has surged to levels that currently usurp the entirety of economic growth. With economic growth rates now at the lowest levels on record, the growth in debt continues to divert more tax dollars away from productive investments into the service of debt and social welfare. It now requires nearly $3.00 of debt to create $1 of economic growth.

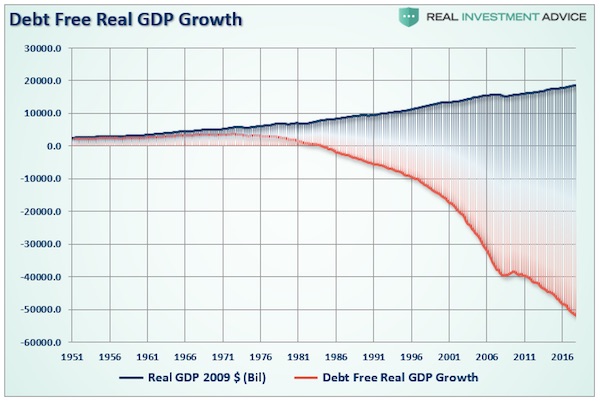

Another way to view the impact of debt on the economy is to look at what “debt-free” economic growth would be. In other words, without debt, there has actually been no organic economic growth.

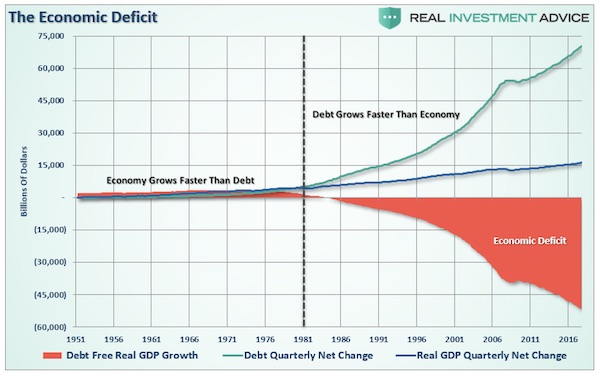

In fact, the economic deficit has never been greater. For the 30-year period from 1952 to 1982, the economic surplus fostered a rising economic growth rate which averaged roughly 8% during that period. Today, with the economy expected to grow at just 2% over the long-term, the economic deficit has never been greater.

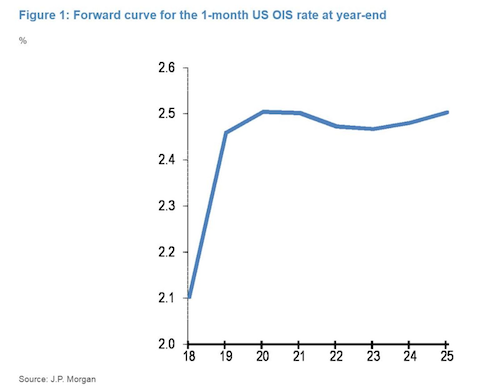

But it isn’t just Federal debt that is the problem. It is all debt. When it comes to households, which are responsible for roughly 2/3rds of economic growth through personal consumption expenditures, debt was used to sustain a standard of living well beyond what income and wage growth could support. This worked out as long as the ability to leverage indebtedness was an option. The problem is that when rising interest rates hit a point where additional leverage becomes problematic, further economic cannot be achieved. Given the massive increase in deficit spending by households to support consumption, the “bang point” between rates and the economy is likely closer than most believe.

The Fed must step back as wages rise.

• The Fed Supports Capital In Its Eternal War With Labor (Hunt)

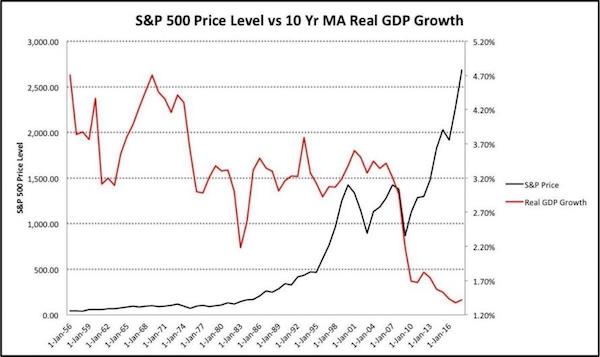

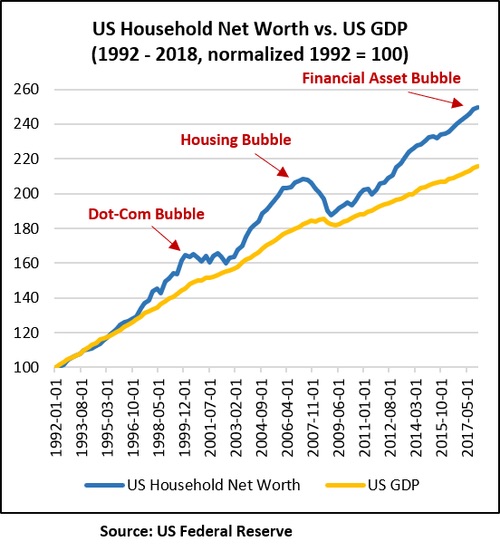

For 46 years, from 1951 to 1997, we were no more and no less rich than our economy grew. Which makes sense. That’s the neutral vision of monetary policy, where you’re not trying to pull forward future growth through leverage and easy money in order to create more wealth today. For the past 20 years, however, we have had a series of wealth bubbles – first the Dot-Com bubble, then the Housing Bubble, and today the Financial Asset Bubble – that have made us richer than our economy grows. Each of these bubbles was intentionally “blown” by the Fed through monetary policy. That’s the tried and true method of creating a wealth bubble in the modern age of fiat money – you artificially lower the cost of money to encourage borrowing and leverage, which in turn pulls future growth into the present. It’s a neat trick so long as you can keep it going.

But that’s the problem, of course. The Fed can’t keep it going, not if it wants to satisfy its raison d’etre, which is to keep inflation bottled up, particularly wage inflation. Once wage inflation starts to pick up, the Fed ALWAYS stops blowing bubbles. Why? Because the Fed, like every central bank, was created to support Capital in its eternal war with Labor. It’s in the name. They are bankers. I know that sounds all Marxist and conspiratorial and all that, but it’s really not. It’s very straightforward. It’s Alexander Hamilton, not Karl Marx. In case you haven’t noticed, wage inflation has started to pick up. The Fed has stopped blowing this Financial Asset Bubble. Then isn’t the inescapable conclusion that we are now inevitably heading back to that GDP growth line? And if that IS the conclusion, then how bad could it get for investors?

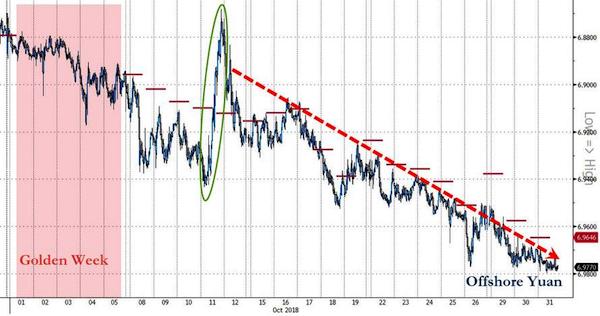

A very ominous sign.

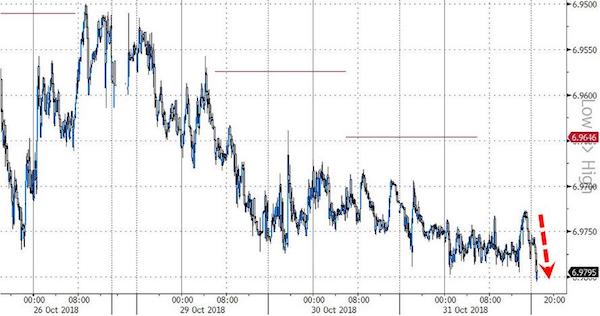

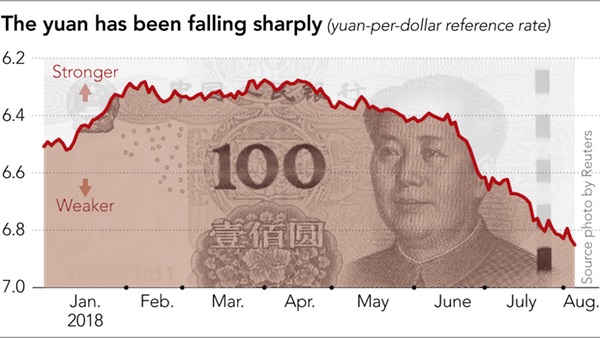

• China State Banks Selling Dollars In FX Market To Arrest Yuan Losses (R.)

Major state-owned Chinese banks were seen selling dollars at around 6.97 per dollar in the onshore spot foreign exchange market in early trade on Tuesday, three traders said, in an apparent attempt to arrest sharp losses in the local currency. The onshore spot market opened at 6.9681 per dollar, weakening to a low of 6.9703 at one point in early deals. “Big banks were selling (dollars) to defend the yuan,” said one of the traders. The move by the state-run banks helped the yuan recover to 6.9550. The onshore spot yuan was trading at 6.9645 as of 0237 GMT.

Traders attributed the sharp morning losses in the yuan to broad strength in the U.S. dollar, which hit 16-month highs against a basket of six other major currencies. They also suspect the authorities are keen to prevent the yuan from weakening too sharply before U.S. President Donald Trump and his Chinese counterpart President Xi Jinping’s meeting later this month. The two countries’ leaders plan to meet on the sidelines of a G20 summit, in Argentina at the end of November for a high-stakes talk.

The Squid got hungry.

• Goldman Sachs Down Most In 7 Years On 1MDB, ‘Fear Of The Unknown'(BBG)

Goldman Sachs Group’s reputation is facing one of its biggest crises of the decade – and now its shares are, too. Since prosecutors implicated a trio of Goldman Sachs bankers in a multi-billion-dollar Malaysian fraud early this month, investors have endured an almost daily drip of news on the firm’s ties to the scandal. The barrage culminated on Monday (Nov 12) as Malaysia’s finance minister demanded a “full refund”, tipping Goldman’s shares into their biggest drop since 2011. Across Wall Street, analysts expressed surprise over the dive, noting the bank – which hasn’t been charged with wrongdoing – can probably stomach any payment that might be extracted in the case. Instead, some said, the decline appeared to be due to a combination of concern over the persistently harsh spotlight and uncertainty about what’s to come.

It was also a generally bad day in US markets. “It’s not so much the dollar amount,” said Mr Gerard Cassidy at RBC Capital Markets. “It’s more that we don’t know all of the facts yet; we don’t know all of the important points to the story at this time. It’s the fear of the unknown.” On Nov 1, at least three senior Goldman Sachs bankers were publicly implicated by the US Department of Justice in a multi-year criminal enterprise that included bribing officials in Malaysia and elsewhere and laundering hundreds of millions of dollars. The firm has said it’s cooperating with the investigations and may face “significant” fines. [..] The Malaysia probe focuses on the country’s scandal-plagued state investment company, 1Malaysia Development Bhd and the US$6.5 billion it raised in 2012 and 2013. Goldman Sachs handled the deals, reaping almost US$600 million in fees.

“..technology will make the sector more “effective and more efficient.”

• Banking Consolidation In Europe Is ‘Inevitable’ – UBS Chief (CNBC)

The European banking system needs consolidation and “as time goes by, it will become more and more inevitable,” the head of one of the largest banks in Europe told CNBC on Tuesday. Often investors, policy-makers and other industry experts refer to fragmentation as one of the biggest hurdles to European banks. UBS chief Sergio Ermotti told CNBC that the issue is “not sustainable.” “That’s something that as time goes by will become more and more inevitable, is part of the solutions. For sure consolidation needs to happen, in particular in Europe, where we see a lot of fragmentation that it is not sustainable,” Ermotti told CNBC’s Joumanna Bercetche. He further added that technology will make the sector more “effective and more efficient.”

Self-media: social media not run by government.

• China Scours Social Media, Erases Thousands Of Accounts (R.)

China’s top cyber authority has scrubbed 9,800 social media accounts of independent news providers deemed to have posted sensational, vulgar or politically harmful content on the Internet, it said late on Monday. China’s strict online censorship rules have tightened in recent years with new legislation to restrict media outlets, surveillance measures for media sites and rolling campaigns to remove content deemed unacceptable. The Cyberspace Administration of China (CAC) said in a statement that the campaign, launched on Oct. 20, had erased the accounts for violations that included “spreading politically harmful information, maliciously falsifying (Chinese Communist) party history, slandering heroes and defaming the nation’s image.”

CAC also summoned social media giants, including Tencent’s Wechat and Sina-owned Weibo, warning them against failing to prevent “uncivilized growth” and “all kinds of chaos” among independent media on their platforms. “The chaos among self-media accounts has seriously trampled on the dignity of the law and damaged the interests of the masses,” CAC said. The term “self-media” is mostly used on Chinese social media to describe independent news accounts that produce original content but are not officially registered with the authorities.

Despair no more. Big Brother is here.

• Working to Protect the World from Bananas (Epsilon)

The main story is the increased pace and arc of the Chinese system overall, not the ‘play-by-play’. With technology, even totalitarian surveillance technology, there typically is no ‘big bang’, just a bunch of independent systems coming on line, getting adopted over time, then getting networked together, resulting in a series of subtle shifts in personal behavior, and then a tipping point. Having watched this system come on line for nearly 20 years, the deployment of the Chinese technology-driven domestic surveillance system was pretty limited even up until 2010, but has been absolutely rip-roaring and accelerating over the last five years thanks to the same driving forces of most other tech advances since 2010:

• Ubiquitous handheld connected device • App adoption • Cheap sensors (inc. cameras) • Cheap massive data storage • Sophisticated statistical algorithms • Leaps forward in compute power and cost. All of these advances are so powerful for surveillance with its inherent big, unstructured data characteristics that I think we are now really close to an inflection point where the system is starting to really work in a functional day-to-day way, which will then lead to a behavioral tipping point. I don’t think the main story is that controversial at this point, i.e., I don’t think anyone, even the Chinese government, denies this system is being built, the intention of it, or that it is starting to work in a practical way.

Therefore, I think the more interesting story in many ways is the sub-story of the willful ignorance of the main story by the West. I was at an event last week where a new fancy think tank on AI ethics based here in San Francisco was presenting and expounding their tenet of “Working to protect the privacy and security of individuals”, whilst simultaneously welcoming Baidu into their organization. I’m sorry, but that’s like “Working to protect the world from bananas” while signing up Del Monte as a member. Bananas. With hypocritical sprinkles. And a big ignorant cherry on top.

They’ve all heard the tapes, but not one of them talks about the content.

• Turkey, France Spar Over Khashoggi Killing (AFP)

Turkey on Monday lashed out at “unacceptable” and “impertinent” comments by the French foreign minister who accused President Recep Tayyip Erdogan of playing a “political game” over the murder of Jamal Khashoggi. Erdogan said on Saturday that Turkey had shared recordings linked to the Saudi journalist’s murder last month with Riyadh, the United States, France, Britain and other allies, without giving details of the tapes’ specific content. In an interview with France 2 television on Monday, French Foreign Minister Jean-Yves Le Drian said he “for the moment was not aware” of any information transmitted by Ankara. Asked if the Turkish president was lying, he said: “It means that he has a political game to play in these circumstances.”

His comments provoked fury in Ankara. “We find it unacceptable that he accused President Erdogan of ‘playing political games’,” the communications director at the Turkish presidency, Fahrettin Altun, told AFP in a written statement. “Let us not forget that this case would have been already covered up had it not been for Turkey’s determined efforts.” Turkish Foreign Minister Mevlut Cavusoglu responded even more sharply, saying that his French counterpart’s accusations amounted to “impertinence”. “It does not fit the seriousness of a foreign minister,” he said, accusing Le Drian of “exceeding his authority”.

[..] Altun said Ankara had shared evidence linked to the murder with officials from a large number of countries and that France was “no exception”. “I confirm that evidence pertaining to the Khashoggi murder has also been shared with the relevant agencies of the French government,” he said. A representative of French intelligence listened to the audio recording and examined detailed information including a transcript on October 24, he added.

The US is incapable of building a strong election system. How disgraceful is that?

• US Federal, State Elections Still In Flux (R.)

Democrats took control of the U.S. House of Representatives in the Nov. 6 elections and Republicans held onto a majority in the U.S. Senate, but more than a dozen races remain undecided nearly a week later. The outcomes of two Senate races, 13 House seats and two governorships had yet to be settled on Monday. The results of Arizona’s U.S. Senate race became clear on Monday, when Democratic candidate Kyrsten Sinema declared victory and Republican candidate Martha McSally conceded after multiple media outlets called the race for Sinema. Florida ordered a recount in the race where Democratic Senator Bill Nelson trailed his Republican challenger, Florida Governor Rick Scott.

Florida also ordered a recount for its gubernatorial race, while the winner of the governor’s race in Georgia remained uncertain, with a December runoff still possible. In one of Mississippi’s U.S. Senate races, Republican Senator Cindy Hyde-Smith and her Democratic challenger, Mike Espy, will contest a runoff on Nov. 27 after neither won a majority. Vote tallies continue to trickle in for the 13 U.S. House races that appear too close to call, and there is no consensus among media outlets and data provider DDHQ that a victor has emerged. Democrats held narrow leads in eight of those races, according to unfinished tallies compiled by DDHQ.

“.. C-Span will be livelier and more colorful than the WWE Wrestlemania round-robin, midget division.”

It warmed my heart to read in The Wall Street Journal that Hillary Clinton is preparing to re-enter the Washington DC swamp from her deluxe exile in the woods of Chappaqua, New York, and make another run for the White House — though it’s hard to calculate how many porters in sandals and loincloths will be required to lug all her baggage around the campaign trail. Will hubbie hit the hustings with her? That would be rich. I can just imagine the pussy-hatted legions shrieking #MeToo at every stop. Surely there is no better way to put the Democratic Party out of its misery. The post-election melodramas in Georgia and Florida grind on, despite the various rules and laws about deadlines for certifying ballots and accounting for their origin.

What is a ballot after all but a mere scrap of paper, easily reproducible, and interchangeable. Sometimes, they make strange journeys out of election headquarters in trucks and SUVs, seeking fun and excitement, and they have been known to mysteriously turn up by the hundredweight in broom closets where they retreat to caucus. Only one thing is certain: the ballot fiasco is a billable hours bonanza for DC lawyers arriving on the scene to sort things out — which they may not manage anyway. If the vote count somehow remains in favor of the provisional winners — Republicans Rick Scott, Ron DeSantis (Fla), and Brian Kemp (Ga) — you can be sure we’ll be in a frenzy of sore loserdom that will make the Medieval ergot outbreaks of yore look like episodes of Peewee’s Playhouse.

If the provisional votes get overturned, the attorneys billable hours will quickly exceed the national debt, and we’ll find ourselves in a new era where the free citizens of this republic can‘t be trusted to the simple task of counting ballots, or even holding elections in the first place. [..] Meanwhile, the new Democratic majority congress prepares to ramp up its longed-for multi-committee inquisition against Trump and Trumpism, and the Republican Senate will counter-punch with binders of criminal referrals against the superstars of the Resistance. C-Span will be livelier and more colorful than the WWE Wrestlemania round-robin, midget division.

The role of the MSM demands much more scrutiny.

• Crucifying Julian Assange (Chris Hedges)

Assange was once feted and courted by some of the largest media organizations in the world, including The New York Times and The Guardian, for the information he possessed. But once his trove of material documenting U.S. war crimes, much of it provided by Chelsea Manning, was published by these media outlets he was pushed aside and demonized. A leaked Pentagon document prepared by the Cyber Counterintelligence Assessments Branch dated March 8, 2008, exposed a black propaganda campaign to discredit WikiLeaks and Assange.

The document said the smear campaign should seek to destroy the “feeling of trust” that is WikiLeaks’ “center of gravity” and blacken Assange’s reputation. It largely has worked. Assange is especially vilified for publishing 70,000 hacked emails belonging to the Democratic National Committee (DNC) and senior Democratic officials. The Democrats and former FBI Director James Comey say the emails were copied from the accounts of John Podesta, Democratic candidate Hillary Clinton’s campaign chairman, by Russian government hackers. Comey has said the messages were probably delivered to WikiLeaks by an intermediary. Assange has said the emails were not provided by “state actors.”

The Democratic Party—seeking to blame its election defeat on Russian “interference” rather than the grotesque income inequality, the betrayal of the working class, the loss of civil liberties, the deindustrialization and the corporate coup d’état that the party helped orchestrate—attacks Assange as a traitor, although he is not a U.S. citizen. Nor is he a spy. He is not bound by any law I am aware of to keep U.S. government secrets. He has not committed a crime.

Enough controversy for ten.

• Stan Lee Leaves a Legacy as Complex as His Superheroes (DB)

He was born Stanley Martin Lieber in the Bronx. For nearly 22 years, beginning almost immediately after graduating from DeWitt Clinton High School, he labored in obscurity as a writer, editor, and art director in a publishing industry just one cultural rung above pornography: comic books. And then, in 1961, he became one of the pivotal 20th century figures who elevated comics into the first draft of American pop culture. Stan Lee, who died Monday, November 12 at age 95, is synonymous with Marvel Comics. Nearly every movie released by Hollywood upstart-turned-juggernaut Marvel Studios can trace part of its creative origins to Lee. (The exceptions are the Captain America, Guardians of the Galaxy, and forthcoming Captain Marvel franchises.)

Among people who shaped the legacy of the Disney company, which purchased Marvel in 2009 for $4 billion, Lee is probably second only to Walt Disney himself. George Lucas is third because of the debts Star Wars owes to the comics creations of Lee’s greatest creative partner and bitterest foe, Jack Kirby. Lee’s legacy at Marvel is immortal. But so too is the debate and controversy over what that legacy specifically is. In some quarters in comics, and especially to devotees of Kirby, Stan Lee is a supervillain–a man who stole credit, and corresponding fortunes, from the people who truly shaped Marvel creatively in the ’60s, relegating them to also-ran obscurity.

Aspects of that critique, uncomfortably, have merit. Lee had a maestro’s instincts for what we now call branding, and it cast a shadow long enough to keep his Marvel collaborators in darkness. In press interviews, his endless public appearances, and his own writing, Lee portrayed himself as the driver of the Marvel Universe, rendering artists like Kirby and Spider-Man co-creator Steve Ditko as afterthoughts.